-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Powell & Co. Outline Inflation Frustration

EXECUTIVE SUMMARY

- FED CHAIR POWELL CALLS INFLATION 'FRUSTRATING' AND SEES IT RUNNING INTO NEXT YEAR (RTRS)

- FED'S DALY SEES YEAR-END TAPER, 2022 RATE HIKE UNLIKELY (MNI)

- ECB'S LAGARDE FLAGS BOTTLENECKS, ENERGY AND VIRUS AS KEY RISKS (RTRS)

- BOE'S BAILEY SEES UK ECONOMY TAKING LONGER TO REGAIN PRE-PANDEMIC SIZE (RTRS)

- CHINESE M'FING PMIS VIRTUALLY INLINE, OFF'L NON M'FING FIRMER THAN EXP.

- EVERGRANDE RESUMES BUILDING OF ABOUT 20 GUANGDONG HOME PROJECTS (BBG)

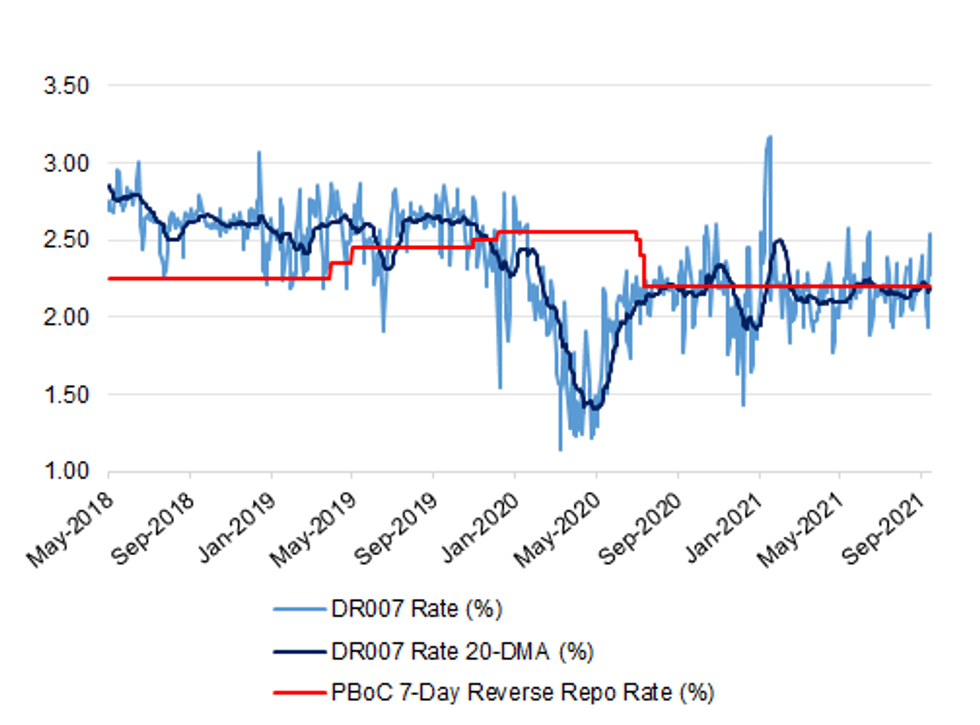

Fig. 1: China DR007 Rate Vs. PBoC 7-Day Reverse Repo Rate (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The benefits of giving children two doses of a coronavirus vaccine outweigh the risks and could prevent thousands of long Covid cases, scientists say. Children in the UK as young as 12 are now eligible for their first shot of the Pfizer vaccine but health experts are yet to advise on whether two doses should be given as standard. Two doses are being given to children aged 12 to 17 who have serious health problems, disabilities or are immunosuppressed. Double jabs are also advised for children living with someone who is immunosuppressed or teenagers about to have their 18th birthday. Researchers at Queen Mary University of London have carried out a study to assess the double dosing of children aged 12 to 17. (The Times)

FISCAL: Chancellor of the Exchequer Rishi Sunak is set to announce a new program of grants to help Britons struggling with the cost of living amid a surge in energy prices and as the U.K. government phases out more generous coronavirus support. The plan is worth as much as 500 million pounds ($672 million) and may be announced in coming days, according to a person familiar with the matter who requested anonymity discussing unannounced policy. It's designed to help poorer households cope with the cost of living over the winter, the person said. The Treasury declined to comment. (BBG)

BOE: Bank of England Governor Andrew Bailey said on Wednesday that he expected Britain's economy to recover its pre-pandemic level of output early next year, a little later than the central bank had predicted last month. (RTRS)

ENERGY: The fuel industry says there are signs the UK fuel crisis is easing - but Business Secretary Kwasi Kwarteng has warned he is "not guaranteeing anything" over whether the chaos will have an impact on Christmas. (Sky)

ECONOMY: The UK will not introduce visa schemes for any other sectors facing staff shortages, sources have told the BBC. On Sunday, the government set up temporary visa schemes for HGV drivers and poultry workers to limit disruption in the run-up to Christmas. Staff shortages in areas including hospitality and care have led to calls for a similar relaxation of post-Brexit immigration rules for other sectors. But government sources said firms should improve pay and conditions. (BBC)

ECONOMY: Financial services firms in the City of London are facing spiralling costs to bring in talented employees that threaten the competitiveness of the Square Mile, according to a report by industry body TheCityUK. The group has called for ministers to create a new short-term business visa to allow overseas staff to visit the UK. This would streamline the cost and time taken to move people around regional offices under current immigration rules. The report has been produced with the City of London Corporation, which governs the Square Mile, and EY. The UK ended freedom of movement between the UK and EU at the start of the year. TheCityUK said that nine months after Brexit financial and related professional services firms were seeing "significant cost increases" to securing the high-skilled talent that they need to compete on the global stage. (FT)

ECONOMY: Shoppers have been warned to expect a "nightmare" Christmas with limited stock on the shelves and higher prices amid labour shortages and shipping problems. Many families will find they cannot get a turkey for Christmas Day and presents under the tree may not meet expectations, with delays to the import of toys, bikes and electrical items, according to analysts. Britain's biggest retailers predicted disruption to the festive season unless ministers took urgent action to allow more foreign workers into the country. Kwasi Kwarteng, the business secretary, admitted yesterday that the fuel crisis could affect Christmas as he announced the deployment of the government's reserve tanker fleet to help to deliver petrol to forecourts. (The Times)

ECONOMY: British car industry output declined for the second month in a row in August as the months-long shortage of computer chips hampered the sector's recovery effort. The number of cars built in UK factories fell by 27% year-on-year to 37,200 in August, according to lobby group the Society of Motor Manufacturers and Traders (SMMT). That was down from 51,000 in the same month in 2020, when carmakers were racing to make up for time lost to lockdowns. (Guardian)

POLITICS: Sir Keir Starmer has outperformed Boris Johnson in his first in-person conference speech as Labour leader, according to an exclusive poll for Sky News. The poll by Opinium, conducted after the speech, found 63% of respondents agreed with what Sir Keir had to say, 57% said he came across as strong, 62% say it showed him as competent and 68% said it shows he cares about ordinary people. Opinium surveyed 1,330 people online this afternoon, showing them excerpts of the speech before asking them to vote. (Sky)

EUROPE

ECB: The economic outlook for the euro zone is still fraught with uncertainty, stemming from supply bottlenecks, surging energy prices and new waves of the coronavirus pandemic, European Central Bank President Christine Lagarde said on Wednesday. (RTRS)

NETHERLANDS: Dutch political party leaders met Wednesday to force a breakthrough in deadlocked negotiations to form a new ruling coalition — efforts that came more than six months after a general election left a deeply divided parliament in the European Union nation. After hours of discussions, the leaders of smaller parties left, while the leaders of the three main parties that are expected to form the core of any new coalition government kept talking. (AP)

U.S.

FED: Federal Reserve Chairman Jerome Powell still expects inflation to ease eventually, but said Wednesday that he sees the current pressures running into 2022. Assessing the current economic situation, the Fed chief said during a panel discussion hosted by the European Central Bank that he was "frustrated" that getting people vaccinated and arresting the spread of the Covid delta variant "remains the most important economic policy that we have." "It's also frustrating to see the bottlenecks and supply chain problems not getting better — in fact at the margins apparently getting a little bit worse," he added. "We see that continuing into next year probably, and holding up inflation longer than we had thought." (CNBC)

FED: MNI: Fed's Daly Sees Year-End Taper, 2022 Rate Hike Unlikely

- San Francisco Fed President Mary Daly said Wednesday the economy will build the substantial progress needed to scale back asset purchases by the end of this year, while conditions for raising near-zero interest rates will likely remain out of reach through 2022. Tapering would just be "dialing back on the amount of accommodation we are adding to the economy," and the Fed would still be providing "tremendous support" to the recovery, she told reporters after a speech. Daly is an FOMC voter this year - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: The U.S. Treasury is likely to exhaust its ability to borrow as soon as late October, according to the Congressional Budget Office, in the latest warning to lawmakers following their failed efforts to address the debt ceiling this week. Barring an increase or suspension of the debt limit, the Treasury will run out of cash along with special measures to avoid a federal payments default by late October or early November, the nonpartisan CBO said in a report Wednesday. That echoes the calculation the CBO provided in July and compares with the Treasury's estimate of Oct. 18, released by Secretary Janet Yellen on Tuesday. (BBG)

FISCAL: Senate Majority Leader Chuck Schumer said Wednesday that senators have reached a deal on a stopgap government funding measure to prevent a shutdown. "We are ready to move forward," Schumer, D-N.Y., said on the Senate floor. "We have an agreement on ... the continuing resolution to prevent a government shutdown, and we should be voting on that tomorrow morning." If the bill is not enacted, the federal government would face a shutdown after the calendar turns to Friday. The deal announced by Schumer would keep the government open through Dec. 3. (CNN)

FISCAL: House Speaker Nancy Pelosi said she still plans to hold a vote on the infrastructure plan tomorrow — "that's the plan" she said, adding she's taking it "one hour at a time" Pelosi also told CNN she does not support going through the process known as "budget reconciliation" to raise the national debt ceiling on just Democratic votes. (Reconciliation bills cannot be filibustered and can pass with just 51 votes in the Senate.) Democrats have been resisting GOP calls to go this route over concerns over the unwieldy process on the floor that would open them to a flurry of politically charged amendments on the Senate floor. Democrats argue it would take too long to go through that process and stave off default; Republicans disagree. And Pelosi went further than she has before, making clear she won't go that route. "Yes," she said when asked if she's ruled out using that process. "I mean, I have." (CNN)

FISCAL: House Speaker Nancy Pelosi and West Virginia Sen. Joe Manchin are at a crossroads over President Joe Biden's agenda to transform the government's role in the country. The Democratic leader said Wednesday that the White House needs to sign off on a multi-trillion-dollar bill expanding the social safety net before House liberals vote for a roughly $1 trillion infrastructure bill on Thursday. Manchin, a pivotal vote in the 50-50 Senate, told CNN "that won't happen." "While I am hopeful that common ground can be found that would result in another historic investment in our nation, I cannot — and will not — support trillions in spending or an all or nothing approach that ignores the brutal fiscal reality our nation faces," added Manchin in a statement. "There is a better way and I believe we can find it if we are willing to continue to negotiate in good faith." (CNN)

CORONAVIRUS: The U.S. Centers for Disease Control and Prevention urged pregnant people to get vaccinated, saying the benefits of vaccination outweigh any potential risks. The agency had already recommended vaccination, but Wednesday it issued an "urgent health advisory" and cited low levels of immunization among pregnant populations. Only 31% of pregnant people have been vaccinated, with lower rates among Hispanic and Black people. (BBG)

CORONAVIRUS: As Covid-19 fuels another wave of hospitalizations, Colorado is reactivating a "Staffing Shortage Fusion Center" to help hospitals, nursing homes and other institutions fill short- term personnel gaps. "The fusion center only accepts staffing requests for assistance directly related to Covid-19 in which staff shortages are impacting patient care," according to the state's Emergency Operations Center. The original staffing center operated from November 2020 to March 2021. (BBG)

OTHER

GLOBAL TRADE: Finance ministers from the Group of Seven said they made some progress on Wednesday at reaching a joint position on a landmark global corporate tax deal, days before it needs to win over a wider international audience. (RTRS)

CORONAVIRUS: Transport and health ministers of the G-7 countries are due to meet virtually on Thursday to discuss ways to restart international travel, according to people familiar with the matter. The meeting is being organized by the U.K., which holds the presidency of the Group of Seven nations this year, said the people, who asked not to be identified ahead of any official statement. It's aimed at moving closer to a consensus on how to ease border restrictions, they said. (BBG)

CORONAVIRUS: AstraZeneca Plc's COVID-19 vaccine demonstrated 74% efficacy at preventing symptomatic disease, a figure that increased to 83.5% in people aged 65 and older, according to long-awaited results of the company's U.S. clinical trial published on Wednesday. (RTRS)

CORONAVIRUS: Regeneron Pharmaceuticals, Inc. (NASDAQ: REGN) today announced that the New England Journal of Medicine (NEJM) published positive detailed results from a Phase 3 trial that assessed the ability of REGEN-COV™ (casirivimab and imdevimab) to treat COVID-19 in infected high-risk non-hospitalized patients (outpatients). The trial met its primary and all secondary endpoints and showed treatment with REGEN-COV significantly reduced the risk of hospitalization or death, with a safety profile consistent with previously reported data. (PRNewswire)

JAPAN: Newly-elected president of Japan's ruling Liberal Democratic Party Fumio Kishida is planning to appoint former economy minister Akira Amari to the party's secretary-general, a No. 2 post in the LDP, the Yomiuri newspaper reports, without attribution. Amari would replace the longest-serving secretary-general and party heavyweight Toshihiro Nikai. Education Minister Koichi Hagiuda floated for chief cabinet secretary or other post. (BBG)

JAPAN: The Tokyo Metropolitan Government will lower the alert for coronavirus by one notch from the highest level for the first time in nearly 10 months as the number of daily cases found in the capital declines, public broadcaster NHK reports, citing an unidentified person. Decision will be made at a panel meeting Thurs. Tokyo will maintain the highest alert over the medical system given the numbers of Covid patients in hospitals and those with serious symptoms remain high. (BBG)

JAPAN: The Japanese government plans to sell about 1 trillion yen ($8.9 billion) shares in Japan Post Holdings Co. as soon as next month, marking the state's ongoing privatization of the postal and financial-services giant six years after its initial public offering. Government officials told bankers on Wednesday that it will announce the third round of the share sale on Oct. 6 and aims to complete the offering that month, according to people with knowledge of the matter who asked not to identified because the matter is private. The 1 trillion target is based on Tuesday's closing price, they said. With the offering, the state plans to cut its stake to one-third -- the minimum it's required to hold by law -- from about 61% currently, the people said. (BBG)

BOJ: Japan's economy will continue to recover and could reach levels seen before the coronavirus pandemic by the end of this year or early in 2022, Bank of Japan Governor Haruhiko Kuroda said on Thursday. (RTRS)

AUSTRALIA: Victoria, Australia's second-most populous state, reported a surge in cases to 1,438, a jump of 488 from the previous day, when it reported 950. The state also reported 5 deaths on Thursday. Local media reported case numbers are in line with projections and are expected to peak in about a month. Victoria earlier announced a funding package of up to A$2.27b ($1.63b) to support small and medium-sized businesses over the next six weeks. (BBG)

NEW ZEALAND: Prime Minister Jacinda Ardern has indicated the "high likelihood" that Auckland's boundary will remain in place even if the region moves to alert level 2 next week. Cabinet will meet on Monday, October 4, to review Auckland's Covid-19 alert level settings. By then, the region will have spent 48 days in lockdown. Amid "volatility" in case numbers over recent days, with just eight cases on Tuesday – the lowest in 40 days – to a sobering 45 cases on Wednesday, officials are giving "full consideration" to easing restrictions for Auckland next week, Ardern said in a press conference on Thursday. (Stuff NZ)

RBNZ: MNI BRIEF: RBNZ Seeks Public Comment On A Possible Digital NZD

- The Reserve Bank of New Zealand on Thursday asked for public comments on "the future of money," and said it is assessing the case for a central bank digital currency - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

SOUTH KOREA: Finance Minister Hong Nam-ki said Thursday the government will seek to rein in household debt as much as possible but also plans to explore ways for people to take loans within their ability to repay debt. Hong made the remarks at a policy coordination meeting with the top central banker and financial regulators to discuss household debt and other economic issues. "We will discuss how to manage household debt on the consensus that households' indebtedness that has fast grown amid ample liquidity in the process of tackling the pandemic could pose a risk to the economy," Hong said. "The government will unveil additional measures to curb household debt in October," he said. (Yonhap)

NORTH KOREA: North Korean leader Kim Jong Un sent a fresh warning to the U.S., saying that he would boost the country's nuclear capabilities – just a day after Pyongyang claimed it had successfully tested a new "hypersonic missile" that could evade U.S. missile defenses. "As the actions of the past eight months of the new U.S. administration have clearly shown, the U.S. military threat and hostile policy toward North Korea has not changed at all," Kim said in a speech on the second day of a parliament meeting, the official Korea Central News Agency reported Thursday. Washington's North Korea policy is becoming "more cunning," he added, saying that he would step up new weapon developments to deter any possible "military provocations by hostile forces." (BBG)

NORTH KOREA: North Korea said Thursday leader Kim Jong Un had ordered officials to restore stalled communication lines with South Korea to promote peace in early October, while he shrugged off recent U.S. offers for dialogue by calling them "more cunning ways" to conceal its hostility against the North. Kim's comments carried in a state media report came a day after North Korea claimed to have performed it first hypersonic missile test in the latest in a series of its weapons tests this month. In recent days, North Korea has sought conditional talks with South Korea, in an apparent return to its pattern of mixing weapons displays with peace overtures to wrest outside concessions. (AP)

NORTH KOREA: North Korean leader Kim Jong Un's influential sister has been appointed to the country's top government body, the official KCNA news agency reported Thursday (Sept 30). Ms Kim Yo Jong, a key adviser to her brother, was promoted to a position on the State Affairs Commission, amid a raft of changes approved by the Supreme People's Assembly, the rubber-stamp Parliament. No fewer than nine members of the commission were dismissed, including one of its vice-presidents, Mr Pak Pong Ju, and diplomat Choe Son Hui, a rare senior woman in the North's hierarchy who has played a key role in negotiations with the United States. (AFP)

NORTH KOREA: The UN Security Council will meet Thursday to discuss the situation in North Korea, diplomats said, after Pyongyang said it tested a new hypersonic gliding missile – the latest apparent advance in the nuclear-armed nation's weapons technology. The meeting – organized at the request of the United States, Britain and France – is expected to take place Thursday morning behind closed doors, a diplomat told AFP, without saying if the talks were expected to result in the adoption of a joint statement. (AFP)

MEXICO: The chief economist for Mexico's central bank, Daniel Chiquiar, is leaving the position as of Thursday, according to one person with knowledge of the matter. Chiquiar, who also leads the central bank's economic research department, has been at his post for almost six years. His replacement has yet to be decided, according to the person, who asked not to be named as the information isn't public yet. The central bank, known as Banxico, is going through a leadership change, with Governor Alejandro Diaz de Leon finishing his term at the end of the year. Arturo Herrera, who was until recently Mexico's finance minister, was nominated by President Andres Manuel Lopez Obrador to replace Diaz de Leon. (BBG)

BRAZIL: Brazil President Jair Bolsonaro is putting pressure on state governors and lawmakers to reduce taxes on diesel and cooking gas in a bid to rein in rising energy prices that are hurting his popularity. "There is no reason for cooking gas to cost 50 reais ($9.21) at the refinery and then be sold to consumers for 130 reais," he said on Wednesday in an event in Brazil's northern state of Roraima. Inflation, running at an annual rate of more than 10%, has become one of Bolsonaro's biggest political headaches. (BBG)

BRAZIL: Brazil's court-ordered payments must respect the spending cap, Lower House speaker Arthur Lira said in a recorded interview alongside the chief of Senate, Rodrigo Pacheco, to Valor Economico newspaper. There are 5 or 6 hypotheses under development for the 50b reais that were left outside the spending ceiling to be paid in 2022, said Lira. Senate is committed to tax reform and discussion is still ongoing in Congress, according to Pacheco Income tax reform bill will go through the Economic Affairs Committee before the Senate floor. Discussion does not prevent a broader tax reform, the head of Senate added. Bill to create the so-called Refis, a tax debt renegotiation program, will be voted on in October. (BBG)

SOUTH AFRICA: South Africa's inflation target range of 3%-6% is too high and too wide relative to peer economies, Reserve Bank Governor Lesetja Kganyago says in an interview on PowerFM radio Wednesday. Inflation in South Africa, excluding administered prices such as electricity and water that are set by government entities, averages around 3.5% "I think the target should be closer to 3%." (BBG)

SOUTH AFRICA: Envoys from some of the world's richest nations met with South African cabinet ministers on Tuesday to discuss a climate deal that could channel almost $5 billion toward ending the country's dependence on coal. That funding would be comprised mainly of loans, along with some grants, according to a person familiar with the discussions, who asked not to be identified as the matter isn't yet public. The delegation is trying to hammer out an agreement that can be announced at the COP26 climate talks, which start in Glasgow, Scotland on Oct. 31. The discussions with South Africa – the world's 12th-biggest emitter of greenhouse gases – include representatives from the U.S., U.K., Germany, France and the European Union. The delegation was led by the U.K.'s COP26 envoy John Murton. (BBG)

METALS: Fortescue Metals Group has temporarily suspended operations at its Solomon Hub iron ore mine following a significant incident involving one of its employees this morning. The company said it was working closely with the WA Police and the WA Department of Mines, Industry Regulation and Safety. (ABC)

OIL: OPEC+ is likely to stick to an existing deal to add 400,000 barrels per day (bpd) to its output for November when it meets next week, sources said, despite oil hitting a three-year high above $80 a barrel and pressure from consumers for more supply. (RTRS)

CHINA

POLICY: China's ministries are ramping up efforts to introduce a new round of policies to support businesses in the operating environment, fund-raising and innovation, the Economic Information Daily said. Authorities are to further lower barriers of market entry and shorten the so-called negative list that restricts private capital, including setting up pilot areas in Shenzhen, Shanghai and other cities, said the newspaper run by Xinhua News Agency. The government will make financial information more accessible, including taxation and social security payments, helping businesses utilizing credit and capital-raising platforms, said the daily. Some ministries are also promoting innovative SMEs mainly through funding the so-called "little giants" of innovation program, said the daily. (MNI)

PBOC: The People's Bank of China may implement another across-the-board cut to the banks' required reserve ratios in Q4 to further loosen up credit and inject long-term capital to help banks' boost lending, the 21st Century Business Herald reported citing analyst Wang Qing with Golden Credit Rating International. Wang commented after the central bank conducted CNY100 billion 14-day reverse repo purchases on Tuesday, the eighth straight day injection to ease concerns about shortage due to the week-long national day holiday starting Oct. 1 and the expected increase in local government bond sales, said the newspaper. The Q3 monetary policy committee meeting held Sept. 24 called for "strengthening the consistency in credit growth," a sign that policymakers want a stronger foundation for economic growth from yearend to early next year, Wang was cited as saying. (MNI)

PROPERTY: Evergrande's onshore real estate unit resumed construction at about 20 real estate projects in Guangzhou, Foshan, Shantou and other cities in Guangdong province, according to a company statement posted on WeChat account Tuesday. Evergrande Real Estate Group also started to deliver homes to buyers from July in Guangdong. (BBG)

PROPERTY: China's policies on curbing bubbles in the real estate market will be steady and consistent, and the market should not expect authorities to loosen measures for the sake of stimulating growth, nor that the restrictions on fundraising by developers are be lifted, the Economic Daily said. The official newspaper commented after the central bank's monetary policy committee mentioned "protecting housing consumers' legal rights" following its recent Q3 meeting, raising speculations that authorities may ease controls on the sector given capital shortages have forced many developers to halt projects. The PBOC is sticking to its prudent monetary stance, and the financial system overall can withstand risks, said the newspaper. Relevant regulators should set up systems to monitor property industry risks and properly guide market expectations, said the newspaper. (MNI)

PROPERTY: MNI: China May Loosen Mortgage Rules In Property Slump-Advisors

- China could marginally relax home lending quotas amid a softer-than-expected high season for sales and avoid, for now, new short-term regulation targeting the real estate sector as current tight controls are acting as a drag on the economy, policy advisors told MNI. A chill has swept through China's property markets since August as regulators have tightened rules on banks' lending to developers and for some mortgage products in the past year with the debt crisis at China Evergrande Group adding more downward pressure - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ENERGY: Provinces including Inner Mongolia, Ningxia, Shanghai, Shandong and Guangdong start to allow transaction prices of market-oriented electricity to rise 10% from the benchmark, Caixin reports. Market-oriented power prices had never risen before in practice. Only about 30% of the electricity in China is allowed to float within a certain range. Electricity market buyers who benefited from electricity price reductions showed willingness to exit the markets; they are also unlikely to sign long-term electricity contracts for 2022. (BBG)

EQUITIES: Norges Bank said it decided to exclude four companies from the Government Pension Fund Global and revoke the exclusion of one company. To exclude China Traditional Chinese Medicine Holdings, Beijing Tong Ren Tang Chinese Medicine, Tong Ren Tang Technologies and China Grand Pharmaceutical and Healthcare Holdings. Cites unacceptable risk that the companies contribute to serious environmental damage. To revoke the exclusion of Hanwha, which has been excluded since 2008 due to production of cluster munitions. (BBG)

CORONAVIRUS: Tickets for the 2022 Winter Olympics in Beijing will only be sold to residents of mainland China to limit the spread of Covid-19. The International Olympic Committee and organizers of the games are still discussing ticketing details and other restrictions. Athletes "who are not fully vaccinated" will be subject to a 21-day quarantine when they reach Beijing. The Summer Olympics in Tokyo were held without any spectators. (BBG)

BONDS: The Ministry of Finance will sell 3-year, 5-year, 10-year and 30-year sovereign bonds worth a total of $4b in Hong Kong to global institutional investors, according to a ministry statement. Specifics of the bond sale will be announced later. (BBG)

OVERNIGHT DATA

CHINA SEP M'FING PMI 49.6; MEDIAN 50.0; AUG 50.1

CHINA SEP NON-M'FING PMI 53.2; MEDIAN 49.8; AUG 47.5

CHINA SEP COMPOSITE PMI 51.7; AUG 48.9

CHINA SEP CAIXIN M'FING PMI 50.0; MEDIAN 49.5; AUG 49.2

Overall, conditions in the manufacturing sector picked up in September from the previous month, though the improvement was limited. The Caixin China manufacturing PMI came in at 50, indicating the downward pressure on the economy was still high. On the one hand, the epidemic continued to impact demand, supply, and circulation in the manufacturing sector. The state of the epidemic overseas and the shortage of shipping capacity also dragged down total demand. Epidemic control measures have clearly impacted the logistics industry. Domestic demand varied based on different types of goods. The demand for intermediate goods and investment goods was relatively high, while the demand for consumer goods was weak, reflecting consumers' lack of purchasing power. On the other hand, constraints to the supply side were strong as raw material prices remained high and some policy measures restricted production, squeezing employment and eventually weakening demand. In view of this, in the coming months, the government should focus on improving epidemic prevention and control and alleviating supply-side pressure. It should also find a balance among multiple objectives, such as promoting employment, maintaining the stability of raw material prices, ensuring a stable and orderly supply, and meeting targets for controlling energy consumption. (Caixin)

JAPAN AUG, P INDUSTRIAL OUTPUT +9.3% Y/Y; MEDIAN +12.1%; JUL +11.6%

JAPAN AUG, P INDUSTRIAL OUTPUT -3.2% M/M; MEDIAN -0.5%; JUL -1.5%

JAPAN AUG RETAIL SALES -3.2% Y/Y; MEDIAN -1.0%; JUL +2.4%

JAPAN AUG RETAIL SALES -4.1% M/M; MEDIAN -1.7%; JUL +1.0%

JAPAN AUG DEPT STORE,SUPERMARKET SALES -4.7% Y/Y; MEDIAN -1.4%; JUL +1.3%

JAPAN AUG HOUSING STARTS +7.5% Y/Y; MEDIAN +9.5%; JUL +9.9%

JAPAN AUG ANNUALISED HOUSING STARTS 0.855MN; MEDIAN 0.884MN; JUL 0.926MN

AUSTRALIA AUG BUILDING APPROVALS +6.8% M/M; MEDIAN -5.0%; JUL -8.6%

AUSTRALIA AUG PRIVATE SECTOR HOUSES +3.5% M/M; JUL -5.5%

AUSTRALIA AUG PRIVATE SECTOR CREDIT +4.7% Y/Y; MEDIAN +4.6%; JUL +4.1%

AUSTRALIA AUG PRIVATE SECTOR CREDIT +0.6% M/M; MEDIAN +0.5%; JUL +0.7%

AUSTRALIA AUG JOB VACANCIES -9.8% Q/Q; JUL +28.0%

NEW ZEALAND SEP, F ANZ BUSINESS CONFIDENCE -7.2; FLASH -6.8

NEW ZEALAND SEP, F ANZ ACTIVITY OUTLOOK 18.2; FLASH 18.2

Overall, while current activity is being crimped by lockdown restrictions, medium-term indicators are broadly robust. However, the slippage in profit expectations and investment intentions in the face of relentless cost pressure highlights that business conditions are anything but easy at present. In terms of the levels, expected costs and pricing intentions remain extreme. Employment intentions are robust so far (levels are still above average), though the monthly fall in experienced employment across all sectors suggests some jobs have been lost during lockdown. Own activity, business confidence and export intentions remain strong relative to history. (ANZ)

NEW ZEALAND AUG BUILDING PERMITS +3.8% M/M; JUL +2.2%

SOUTH KOREA AUG INDUSTRIAL OUTPUT +9.6% Y/Y; MEDIAN +8.0%; JUL +7.7%

SOUTH KOREA AUG INDUSTRIAL OUTPUT -0.7% M/M; MEDIAN +0.3%; JUL +0.2%

SOUTH KOREA AUG CYCLICAL LEADING INDEX CHANGE -0.3; JUL -0.1

SOUTH KOREA OCT BUSINESS SURVEY M'FING 93; SEP 96

SOUTH KOREA OCT BUSINESS SURVEY NON-M'FING 81; SEP 81

UK SEP LLOYDS BUSINESS BAROMETER 46; AUG 36

CHINA MARKETS

PBOC INJECTS NET CNY40BN VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY100 billion via 14-day reverse repos with the rate unchanged at 2.35% on Thursday. The operations lead to a net injection of CNY40 billion after offsetting the maturity of CNY60billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity stable by the end of the quarter, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2343% at 09:26 am local time from the close of 2.5459% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 40 on Wednesday vs 46 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4854 THURS VS 6.4662

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4854 on Thursday, compared with the 6.4662 set on Wednesday.

MARKETS

SNAPSHOT: Powell & Co. Outline Inflation Frustration

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 28.57 points at 29574.13

- ASX 200 up 124.685 points at 7321.4

- Shanghai Comp. up 13.164 points at 3549.458

- JGB 10-Yr future down 6 ticks at 151.36, yield down 0.7bp at 0.071%

- Aussie 10-Yr future up 1.0 tick at 98.500, yield down 1bp at 1.475%

- U.S. 10-Yr future +0-05+ at 131-20+, yield unch. at 1.517%

- WTI crude down $0.09 at $74.74, Gold up $6.21 at $1732.58

- USD/JPY down 2 pips at Y111.94

- FED CHAIR POWELL CALLS INFLATION 'FRUSTRATING' AND SEES IT RUNNING INTO NEXT YEAR (RTRS)

- FED'S DALY SEES YEAR-END TAPER, 2022 RATE HIKE UNLIKELY (MNI)

- ECB'S LAGARDE FLAGS BOTTLENECKS, ENERGY AND VIRUS AS KEY RISKS (RTRS)

- BOE'S BAILEY SEES UK ECONOMY TAKING LONGER TO REGAIN PRE-PANDEMIC SIZE (RTRS)

- CHINESE M'FING PMIS VIRTUALLY INLINE, OFF'L NON M'FING FIRMER THAN EXP.

- EVERGRANDE RESUMES BUILDING OF ABOUT 20 GUANGDONG HOME PROJECTS (BBG)

BOND SUMMARY: Contained Core FI In Asia

Core fixed income markets struggled for anything in the way of meaningful direction in Asia-Pac dealing, with the latest round of Chinese manufacturing PMI data providing little to no impetus, although a firmer than expected official non-manufacturing PMI print may have provided a cap for core FI markets overnight (note that the better-than-expected print was seemingly driven by price increases and business expectations). A reminder that China is set to start a week-long holiday on Friday, while Hong Kong markets will also be closed on Friday, but return on Monday.

- An uptick in e-minis has seen T-Notes move off highs to last trade +0-05 at 131-20, sticking within a narrow 0-04 range. Cash Tsys run little changed to 0.5bp cheaper across the curve. Senate Majority Leader Schumer pointed to a bipartisan deal to keep the government funded until December 3, although the hurdles to increased fiscal spending and debt ceiling worries remain evident. A raft of Fedspeak headlines during NY hours, with weekly claims data and the latest MNI Chicago PMI print also due.

- JGBs ticked higher at the re-open, playing catch up to the late NY uptick in Tsys, but faded through the afternoon, with the contract last dealing -8, potentially hampered by worry surrounding the spending plans of a Kishida government. Cash trade sees yields run little changed to ~1.0bp richer, with 5s outperforming on the curve. There is some speculation that the Q4 Rinban plan (released after hours today) may see the BoJ cut the size of its Rinban purchases covering JGBs out to 10s. The latest 2-Year JGB auction was easily digested, with the BoJ's monetary policy settings underscoring takedown despite the headwinds outlined ahead of the auction, as we suggested would be the case. There was a marginal shortening of the price tail, with the cover ratio nudging lower but holding above the 6-auction average.

- ACGBs looked to the broader impetus, but stuck to contained ranges, with YM -1.0 and XM +0.5 at typing. Australian Treasurer Frydenberg outlined a ~A$27bn narrowing of the commonwealth fiscal deficit for FY20/21 when compared to projections made in the May budget. Elsewhere, Victoria's COVID case numbers continued to surge.

JGBS AUCTION: Japanese MOF sells Y2.4903tn 2-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.4903tn 2-Year JGBs:

- Average Yield -0.115% (prev. -0.129%)

- Average Price 100.242 (prev. 100.269)

- High Yield: -0.114% (prev. -0.127%)

- Low Price 100.240 (prev. 100.265)

- % Allotted At High Yield: 77.0964% (prev. 43.1236%)

- Bid/Cover: 4.244x (prev. 4.504x)

EQUITIES: Mixed Session Ahead Of China Holiday

A mixed day for equity markets in the Asia-Pac time zone; as a reminder China will observe a weeklong holiday starting tomorrow, with mainland markets returning on Friday Oct 8. Hong Kong returns on Monday Oct 4. Markets in Hong Kong came under pressure, shedding over 1%, tech shares were out of favour after a negative lead from the Nasdaq. Markets in mainland China are higher, data earlier showed official manufacturing PMI slipped to contraction for the first time since May 2020, but official non-manufacturing PMI and Caixin manufacturing PMI both rose. Markets in Japan lost ground, a reshuffle of the Nikkei and uncertainty ahead of new leadership kept investors on the sidelines; former foreign minister Fumio Kishida was appointed as new leader of the LDP. Markets in Australia topped the performance tables, mining stocks getting a boost as iron ore rallies with Chinese steel mills stocking up ahead of the holiday. In the US futures are higher, e-mini Nasdaq leading the way higher after the index declined yesterday. Central bank speaker events remain frantic, with Fed's Powell appearing again in front of lawmakers as well as speeches from Williams, Bostic, Harker, Evans and Bullard.

OIL: Lower, But On Track For Monthly Gain

Crude futures slightly lower in Asia-Pac trade on Thursday, but sticking to Wednesday's range so far. A particularly solid session for the greenback worked against commodity markets yesterday, USD strength kept a lid on the still-bullish energy contracts, resulting in Brent and WTI circling just below recent cycle bests. Despite the edge off highs for oil, dips are considered corrective and a bullish theme remains intact. Last week's break of $73.58, the Jul 6 high and bull trigger confirmed a resumption of the uptrend. The focus is on $78.24 next, a Fibonacci projection with scope seen for a climb towards $80.00 further out. Both benchmarks still on track for monthly gains, thanks I part to disruptions in the Gulf of Mexico from Hurricane Ida. Inventory data yesterday showed headline crude tockpiles rose by 4.6m bbls, the first increase since the week ending July 30. Gasoline and distillate stockpiles increased last week

GOLD: Bears In Control

Our weighted U.S. real yield monitor has stabilised and sits a little shy of Wednesday's highs, with the DXY trading ever so slightly softer after Wednesday's rally saw it tap a ~1-Year peak. This has allowed spot gold to add ~$5/oz, operating just above $1,730/oz. Gold bottomed out at $1,721.7/oz, which now acts as initial support. A break below there would open the way to the Mar 31 low ($1,678.0/oz).

FOREX: Greenback Gets Winded After Climbing To Cycle High

The greenback turned its tail and the DXY ticked away from a new one-year high registered in the course of Wednesday's upswing, which resulted in a failed attack at the 38.2% retracement of the 2020 - 2021 sell-off.

- AUD caught a bid amid a jump in iron ore prices and improvement in broader risk tone evidenced by upticks in all three main U.S. e-mini futures. The rest of major commodity-tied currencies (NZD, CAD, NOK) followed suit and generally firmed a tad.

- Offshore yuan gained some ground against the greenback following the release of China's PMI data. Official figures showed that the m'fing sector slipped into contraction for the first time since Feb 2020 but the non-m'fing sector unexpectedly returned into expansion, while Caixin M'fing PMI recovered more than forecast, returning to the breakeven 50 level.

- European data highlights include final UK GDP as well as EZ & German jobs market reports, while in NY hours focus will turn to the third reading of U.S. GDP, weekly jobless claims and MNI Chicago PMI.

- There is plenty of central bank rhetoric coming up today. The speaker slate is headlined by Fed Chair Powell, who will appear along Tsy Sec Yellen in front of the House Financial Services Committee.

FOREX OPTIONS: Expiries for Sep30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1600(E511mln), $1.1650-54(E621mln), $1.1700(E1.8bln)

- USD/JPY: Y110.00($1.3bln), Y110.30-40($1.5bln), Y111.00($775mln)

- GBP/USD: $1.3640-50(Gbp1.2bln)

- AUD/USD: $0.7200-10(A$643mln)

- USD/CAD: C$1.2675($520mln), C$1.2740-55($2.2bln)

- USD/CNY: Cny6.4490($826mln)

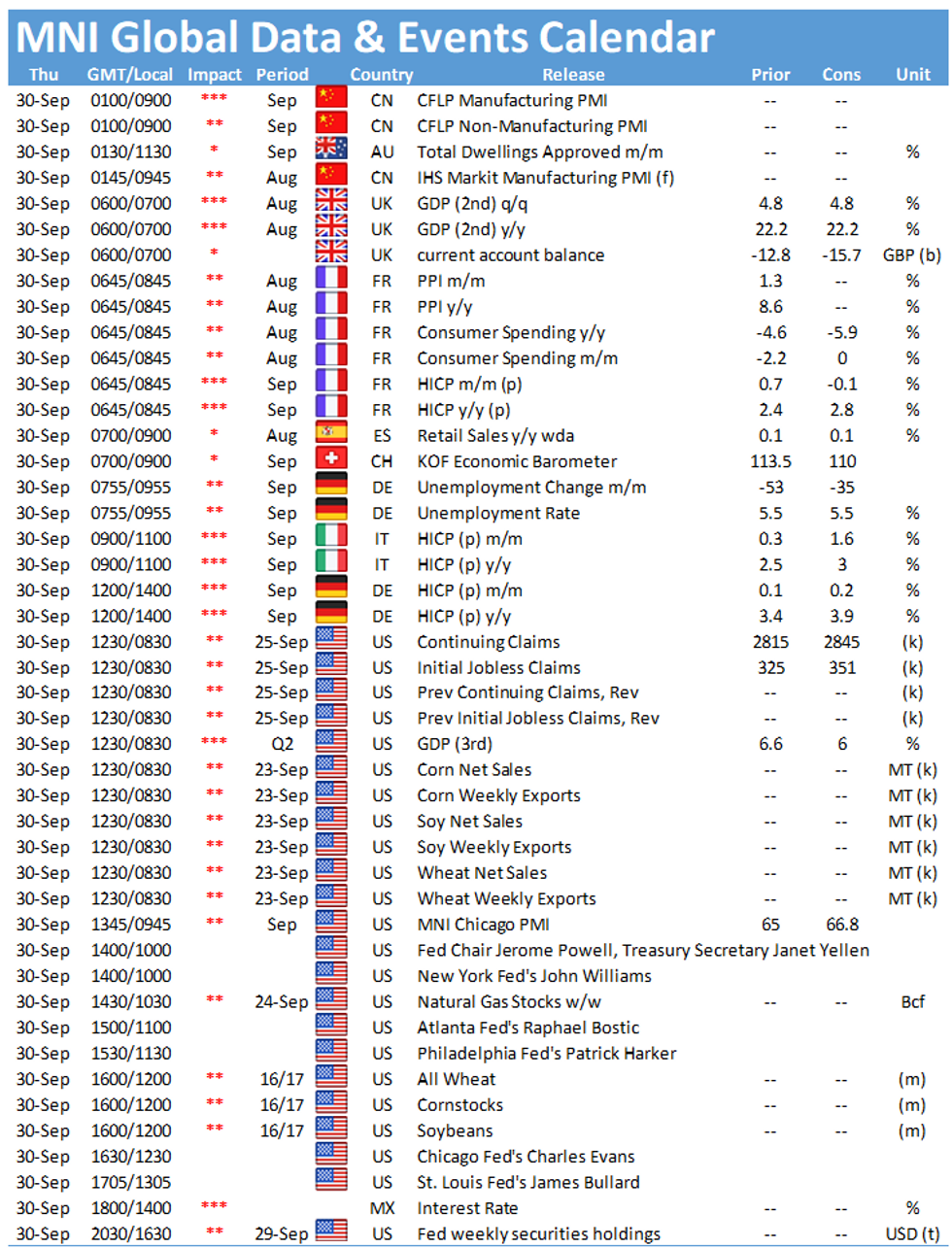

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.