-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Taps Sacks For White House Job

MNI US MARKETS ANALYSIS - NFP Followed by Ample Fedspeak

MNI EUROPEAN MARKETS ANALYSIS: Evergrande Still Dominating

- Questions swirl surrounding the possibility of a China Evergrande default, while the managed restructuring of the firm continues in the background.

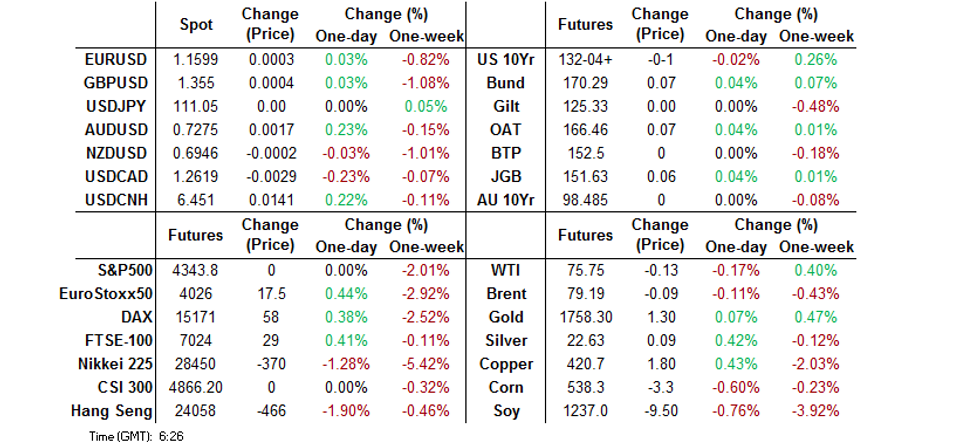

- Equities traded lower, while the major G10 FX crosses mostly hover around neutral levels into Europe.

- Central bank speak headlines Monday's broader docket, with an eye also set to fall on comments from U.S. Trade Rep Tai re: China.

BOND SUMMARY: Early Bid Cools A Little, Tight Ranges In Play

T-Notes held to a contained 0-05 range during overnight dealing, last trading -0-01+ at 132-04 after ticking back from early highs. There was no reaction to Chinese reports pointing to the latest round of details surrounding the continued reshuffle of troubled Chinese property developer Evergrande, while questions surrounding the company's debt obligations continued to swirl. Downside exposure headlined on the flow side, with a 5.0K screen lift of TYX1 130.50 puts seen overnight. Monday's U.S. docket will be headlined by Fedspeak from Bullard, with final durable goods data also due.

- The 7- to 10-Year sector of the JGB curve led the richening (~1.5bp firmer on the day) as the space played catch up to U.S. Tsys, while futures last deal 6 ticks above Tokyo settlement levels, a touch shy of their intraday peak. Local political headlines continue to dominate, with a recent Nikkei source report noting that "Fumio Kishida, president of Japan's ruling Liberal Democratic Party and soon to become prime minister, has decided to dissolve the lower house later this month to hold general elections on October 31." Elsewhere, outgoing Finance Minister Taro Aso has noted he had suggested that the BoJ lower its 2% inflation goal in previous rounds of discussion with BoJ Governor Kuroda. Today's BoJ Rinban operations drew the following offer/cover ratios: 1- to 3-Year: 2.57x (prev. 2.75x), 3- to 5-Year: 2.64x (prev. 1.99x), 10- to 25-Year: 3.03x (prev. 2.07). Focus now moves to tomorrow's 10-Year JGB auction.

- Aussie bond futures meandered to the beat of the broader tone, with NSW and the ACT out on holiday, resulting in the closure of cash ACGB trade. The local COVID situation once again failed to provide any real impetus for the space. YM & XM both -0.5 at typing.

FOREX: Covid Headwinds Dent Kiwi

The kiwi went offered as New Zealand locked down parts of the Waikato district south of Auckland, including the nation's fourth-largest city of Hamilton. Officials detected two community cases of Covid-19 in the region but struggled to connect them to the Auckland outbreak. The news resulted in the trimming of hawkish RBNZ bets as participants prepare for Wednesday's monetary policy decision from the Reserve Bank. The move in implied odds of a hike to the OCR was modest but added to uncertainty ahead of the this week's MPC meeting. The OIS strip now prices an ~80% chance of a 25bp hike to the OCR this week, down from Friday's ~83%.

- The emergence of two mysterious cases outside of Auckland threw officials a curveball on the day when the Cabinet convened to review the Alert Level in New Zealand's largest city. Auckland remained at Alert Level 3 but PM Ardern outlined a plan for the gradual easing of restrictions.

- Geopolitical angst surrounding the largest-ever incursion by Chinese warplanes into Taiwan's air defence zone generated a mild risk-off impulse in early trade, which dissipated without much delay. Most major FX crosses oscillated within tight ranges, as market holidays in China, South Korea and Australia limited activity in the Asia-Pac region.

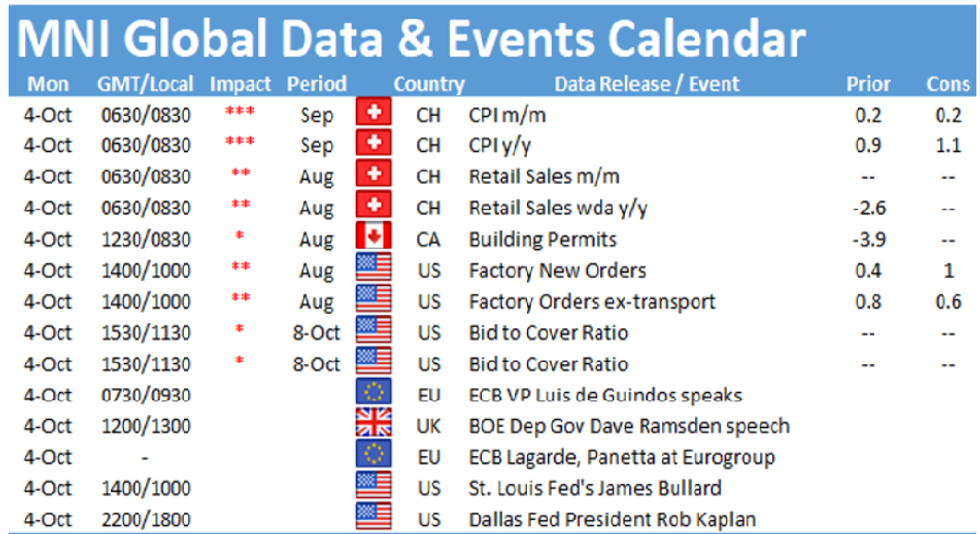

- U.S. factory orders & final durable goods orders as well as comments from Fed's Bullard, ECB's de Guindos & Makhlouf, BoE's Ramsden and Norges Bank's Olsen take focus from here.

FOREX OPTIONS: Expiries for Oct04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1500(E854mln), $1.1530-40(E801mln), $1.1560-75(E687mln), $1.1600(E884mln), $1.1650(E807mln), $1.1700-15(E2.2bln), $1.1740-55(E1.4bln)

- USD/JPY: Y111.25-30($710mln)

- AUD/USD: $0.7250(A$742mln)

ASIA FX: Rupiah Top Of The Pile, Baht Brings Up The Rear

Moves mixed in a holiday thinned session. Sentiment initially risk off after reports largest-ever incursion by Chinese warplanes into Taiwan's air defence zone, while sentiment was again dented after news that China Evergrande's Hong Kong equity listing, along with its property management unit's listing, will be suspended.

- CNH: Markets closed for holiday. Offshore yuan weaker, participants will return later this week after the National Day holiday.

- SGD: Singapore dollar is flat, having oscillated in a narrow range. Markets look ahead to PMI data after market.

- KRW: Market closed for holiday.

- TWD: Taiwan dollar is flat, shaking off reports of the reports largest-ever incursion by Chinese warplanes into Taiwan's air defence zone.

- MYR: Ringgit gained, PM Ismail Sabri told local reporters that broader relaxation of curbs on mobility is drawing nearer.

- IDR: Rupiah rose, The Jakarta Post pointed to the escalating infighting within Pres Widodo's PDI-P party, which struggles to unite in pursuit of post-Jokowi presidency.

- PHP: Peso is higher, Philippine President Rodrigo Duterte took many off guard as he announced his plan to retire from politics and resign from seeking to become Vice President once his current term expires in 2022.

- THB: Baht declined, PM Prayuth launches Covid-19 vaccine rollout targeting students aged 12 to 18 today.

ASIA RATES: Indecisive

- INDIA: Yields mixed in early trade, a reminder that liquidity is expected to be thinned today by market holidays in China and South Korea and widespread holiday's in Australia. Data on Friday showed that goods exports rose 21% in September, imports rose by around 85%. Markets look ahead to PMI data tomorrow and later in the week the RBI rate announcement, the Central Banks is expected to hold rates and maintain is accommodative stance.

- SOUTH KOREA: Market closed for holiday

- CHINA: Market closed for holiday

- INDONESIA: Yields mixed, curve twist flattens. The Jakarta Post pointed to the escalating infighting within Pres Widodo's PDI-P party, which struggles to unite in pursuit of post-Jokowi presidency. Central Java Gov Pranowo and House of Representatives Speaker Maharani both set their sights on joining the race to succeed Widodo when his term expires in 2024. On the coronavirus front there were added 58 deaths on Sunday, the fewest since August 2020, there are reports that movement restrictions could be eased later today. Participants look to the release of the official consumer confidence gauge on Friday, with Danareksa Consumer Confidence also due at some point this week.

EQUITIES: Evergrande Dents Sentiment

Equity indices in the Asia-Pac time zone are in the red, giving back early gains and then some after sentiment took a hit following Evergrande headlines. There were reports that China Evergrande's Hong Kong equity listing, along with its property management unit's listing, will be suspended. There were also reports that Evergrande is a guarantor of a US$-denominated bond issued by Jumbo Fortune Enterprises. This $260mn bond matured yesterday (October 3), with the payment falling due today. The Hang Seng led the move lower, shedding ~2%, and other bourses in the region dropped into negative territory. U.S. e-mini futures gave up their early gains and now trade ~0.2% softer on the session.

- Liquidity was thinned today by market holidays in China and South Korea and widespread holiday's in Australia. Looking ahead Monday's U.S. docket will be headlined by Fedspeak from Bullard, with final durable goods data also due. Further ahead focus in the coming week turns to the nonfarm payrolls release for September, which could seal the Fed's intentions to taper asset purchases ahead of the end of 2021. Rate decisions from the Australian and Indian central banks are also due.

GOLD: Early Uptick Unwound

Spot had a limited look through last week's high in early Asia-Pac dealing before pulling back to trade little changed around the $1,760/oz mark at typing, with our weighted U.S. real yield monitor and the DXY moving away from their respective early Asia lows. Meaningful technical resistance is located at the Sep 22 high ($1,787.4/oz), while initial support is seen at the Sep 29 low ($1,721.7/oz). U.S. labour market matters headline the broader docket this week, with ADP due Wednesday and NFPs slated for Friday.

OIL: Softens Ahead Of OPEC+ Meeting

Crude futures have come off Friday's closing highs in a holiday thinned Asia-Pac session. WTI remains below Tuesday's high of $76.67. Dips are considered corrective and a bullish theme remains intact. The recent break of resistance at $73.58,the Jul 6 high and bull trigger confirmed a resumption of the uptrend. The focus is on $78.24 next, a Fibonacci projection with scope seen for a climb towards the psychological $80.00 level further out. On the downside, firm support is seen at $73.58. As a reminder JPMorgan joined other sell-side outfits looking for further resilience in energy prices over the winter months as they upped their year-end Brent forecast to $84/bbl from $78/bbl previously. Markets look ahead to the OPEC+ meeting today, the group is expected the ratify the 400k bpd output boost agreed in July, though the upbeat assessment of demand given previously could result in a higher addition.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.