-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Evergrande Makes Late Coupon Payment Ahead Of End Of Grace Period

EXECUTIVE SUMMARY

- CHINA EVERGRANDE MAKES OVERDUE INTEREST PAYMENT ON DOLLAR BONDS (WSJ)

- FED'S WILLIAMS: LONG-TERM INFLATION EXPECTATIONS IN LINE WITH 2% (BBG)

- WITH XI-BIDEN MEETING, U.S. AIMS TO SHOW RESPONSIBLE HANDLING OF CHINA TIES (RTRS)

- BOE CHIEF ECONOMIST WARNS UK INFLATION LIKELY TO HIT 5%, NOV MEETING "LIVE" (FT)

- BORIS JOHNSON READY TO COMPROMISE OVER ECJ FOR NI PROTOCOL (THE TIMES)

- RBA DEFENDS YCT MECHANISM FOR FIRST TIME SINCE FEB

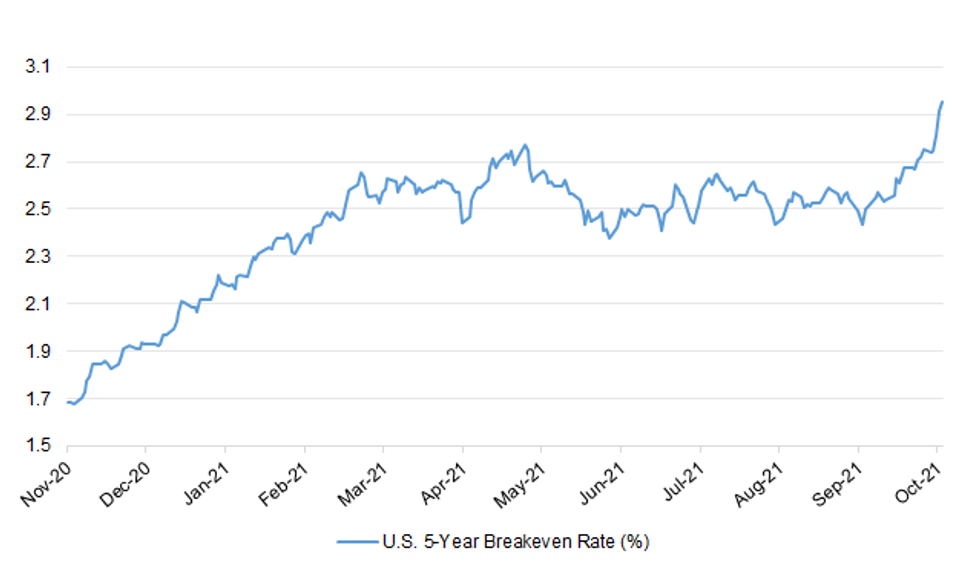

Fig. 1: U.S. 5-Year Breakeven Rate (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: UK inflation is likely to rise "close to or even slightly above 5 per cent" early next year, the Bank of England's new chief economist has warned, as he said the central bank would have a "live" decision on whether to raise interest rates at its November meeting. In his first interview in the role, Huw Pill declined to disclose how he would vote at the BoE Monetary Policy Committee's November 4 meeting, saying "it is finely balanced", but he added: "I think November is live." Although consumer price inflation dipped to 3.1 per cent in September, the BoE has previously forecast it to exceed 4 per cent by the end of the year. (FT)

BOE: The Bank of England will likely defy investors' expectations of a sudden interest-rate increase next month because it rarely shifts policy in such dramatic fashion, according to three former senior officials. Spurred on by comments from Governor Andrew Bailey and others, markets anticipate the BOE will start an aggressive cycle of hikes on Nov. 4, with the key rate rising to almost 1.25% by the end of 2022 from 0.1% now. (BBG)

CORONAVIRUS: Covid booster jabs could soon be opened up to millions more elderly people under plans being discussed by ministers and scientific advisers. Proposals to cut the waiting time for a third Covid jab from six months to five are under discussion in Whitehall, with the Joint Committee on Vaccination and Immunisation (JCVI) understood to be showing interest in the idea. It would mean the vast majority of over-65s could be vaccinated by early November rather than early December, and all over-70s jabbed now rather than by mid-November. (Telegraph)

BREXIT: Boris Johnson would be prepared to accept a limited role for the European Court of Justice in a bid to unlock a deal with Brussels over the Northern Ireland protocol, government figures say. In public Johnson and Lord Frost, the Brexit minister, have insisted that the EU must agree to drop any role for the court. But senior figures have privately raised the prospect of a compromise that would allow a limited role for the ECJ in interpreting the application of EU law in Northern Ireland. Under the plan, disputes would go to an independent arbitration panel, with the ECJ asked to interpret narrow matters of EU law as a last resort if dispute resolution failed. (The Times)

ECONOMY: MNI REALITY CHECK: UK Set For Modest Sales Lift, Downside Risk

- UK retail sales likely edged modestly higher in September from the previous month according to City forecasters, but disappointing accounts from industry insiders suggest a degree of downside risk to that outlook. Even a surprise to the upside is unlikely to prevent retailing from exerting a negative influence on overall third quarter output. After falling by 0.9% in August -- extending a 2.8% plunge in July -- sales must rise by an almost-unprecedented 12% in September to keep volumes in the black in the third quarter - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ROYALS: Britain's Queen Elizabeth II spent a night in a hospital for checks this week after canceling an official trip to Northern Ireland on medical advice, Buckingham Palace said Thursday. The palace said the 95-year-old British monarch went to the private King Edward VII's Hospital in London on Wednesday for "preliminary investigations." It said she returned to her Windsor Castle home at lunchtime on Thursday, "and remains in good spirits." (AP)

RATINGS: Rating reviews of note scheduled for after hours on Friday include:

- S&P on the United Kingdom (current rating: AA; Outlook Stable).

EUROPE

ECB: The European Central Bank will supercharge its regular bond- buying program before pandemic purchases run out in March, according to economists surveyed by Bloomberg. Policy makers will increase the pace of their standard tool next year and make it more flexible to be able to better address market stress, respondents said. They also predict the ECB will start phasing out its emergency plan in December, and one in four say it could be followed by a new program. No policy shifts are expected at next week's Governing Council meeting. (BBG)

ECB: The European Central Bank will be one of the last major central banks to raise interest rates after the COVID-19 pandemic, according a Reuters poll of economists, who still say the risk is a rate rise comes sooner than their current prediction of 2024. (RTRS)

EU: The European Union is reassessing how aggressively to approach the rule-of-law crisis in Poland after leaders including Germany's Angela Merkel and France's Emmanuel Macron called for restraint. The European Commission is considering delaying a new mechanism designed to block budget payments to member states in breach of the EU's democratic standards, according to officials familiar with the discussions. Before the reassessment, the commission had been prepared to send letters to countries accused of violations as soon as this week. (BBG)

FRANCE: French Prime Minister Jean Castex announced a new subsidy program to help contain the impact of a severe spike in energy costs on millions of workers who rely on cars. "We need an exceptional response to an exceptional situation," Castex told national TF1 television in a live interview on Thursday. French workers earning less than 2,000 euros ($2,325) net a month will receive a one-off payment of 100 euros. Some people will start to get the payment in December, with a full roll-out over the weeks that follow. About 38 million people will qualify for the help, Castex said. (BBG)

ITALY/BTPS: Italy plans to sell up to EU2.25 billion ($2.62 billion) of 0% bonds due Jan. 30, 2024 in an auction on Oct. 26. Italy plans to sell up to EU750 million ($872.4 million) of 0.15% inflation-linked bonds due May 15, 2051 in an auction on Oct. 26. (BBG)

SWITZERLAND: A majority of Swiss back a law allowing the government to issue Covid-19 certificates for entry into theaters and restaurants ahead of a national vote. The passes are hotly opposed by some in Switzerland with regular -- and sometimes violent -- demonstrations in the capital of Bern. But a poll for broadcaster SRG had support for the law, which also covers financial pandemic relief, at 61%. The vote on the certificates, which show if someone has been vaccinated, tested or has recovered from the coronavirus, will be held on Nov. 28. (BBG)

RATINGS: Rating reviews of note scheduled for after hours on Friday include:

- Fitch on Austria (current rating: AA+; Outlook Stable), Finland (current rating: AA+; Outlook Stable) & the Netherlands (current rating: AAA; Outlook Stable).

- S&P on the European Financial Stability Facility (current rating: AA; Outlook Stable), Greece (current rating: BB; Outlook Positive) & Italy (current rating: BBB; Outlook Stable).

- DBRS Morningstar on Cyprus (current rating: BBB (low), Stable Trend).

BANKING: EU Commission won't meet banks' requests against stricter capital rules, Handelsblatt said on Thursday, mentioning a draft of the Commission's proposals dated from Oct. 20. So-called output floor, which limits the ability of banks to calculate their own risks and thus their capital requirements, won't be weakened in the proposals for Basel III banking reform. As a concession, the EU Commission will freeze certain individual capital buffers and require bank supervisors to check on additional capital surcharges. The EU Commission proposes long-term transitional rules for loans to companies without an external rating. (BBG)

U.S.

FED: Federal Reserve Bank of New York President John Williams says inflation has been through a "very unique set of circumstances" during the pandemic. Noting that longer-term inflation expectations have risen after being under the Fed's 2% target, Williams says they are now right at levels "consistent with that 2% goal." (BBG)

FED: Atlanta Federal Reserve President Raphael Bostic said Thursday that he sees an interest rate hike coming later in 2022 as he forecasts a growing economy and lasting inflation pressures. The central bank official told CNBC that he has "penciled in" a rate increase in "late third, maybe early fourth" quarter of 2022. The expectation puts him on the more hawkish side of Fed officials who are now about even on whether policy will tighten next year. "Our experience from the pandemic has really frankly surprised to the upside," he said in a live "Closing Bell" interview. "I've really adjusted my expectations moving forward." (CNBC)

FED: San Francisco Fed President Daly tweeted the following on Thursday: "{US} Fed's Daly tweets "The pandemic is mostly to blame for recent supply chain disruptions. But we could easily be discussing bottlenecks caused by extreme weather. Looking forward to meeting with @AEI and @MichaelRStrain to discuss climate risk and the economy." (MNI)

FED: MNI: Faster Fed Taper Possible, Rate Hike Room Limited

- The Federal Reserve could consider speeding up its tapering of bond purchases if inflation continues at a rapid pace, but the order of its exit plans may prevent rate rises from moving much earlier into 2022, former Federal Reserve staffers told MNI. While the base case remains for inflation to fall in 2022 towards the central bank's 2% target, consistent with a taper anticipated to run from late this year until June or July, the ex-staffers said there are heightened risks inflation could remain high - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: Responding to a growing controversy over investing practices, the Federal Reserve announced Thursday a wide-ranging ban on officials owning individual stocks and bonds and limits on other activities as well. The ban includes top policymakers such as those who sit on the Federal Open Market Committee, along with senior staff. Future investments will have to be confined to diversified assets such as mutual funds. (CNBC)

FED: Ms. Warren, a Democratic Senator from Massachusetts, asked the Federal Reserve's Board of Governors to release an email sent to reserve banks. Senator Elizabeth Warren, Democrat of Massachusetts, asked Jerome H. Powell, the Federal Reserve chair, on Thursday to release an email the central bank's ethics office sent in March 2020 suggesting that officials might want to avoid unnecessary trading as they unrolled a sweeping market rescue. The email, the existence of which was first reported by The New York Times earlier Thursday, was sent to regional bank ethics officers from the Fed Board of Governor's ethics office on March 23, as the Fed announced a far-reaching market relief program, according to a person who saw it. It suggested that people with access to sensitive Fed information might want to stop unnecessary trading for a few months. (New York Times)

INFLATION: President Joe Biden said Thursday night that Americans should expect high gasoline prices to continue into next year because of policies by OPEC and other foreign oil producers. "My guess is you'll start to see gas prices come down as we get by and going into the winter -- excuse me, into next year, in 2022," the president said during a CNN town hall in Baltimore, responding to a question about rising inflation. "I don't see anything that's going to happen in the meantime that's going to significantly reduce gas prices." (BBG)

FISCAL: President Biden said he would consider deploying members of the National Guard to help with pandemic-related supply chain issues that have hampered several industries. Asked if National Guard members would be driving trucks, Biden said yes, but indicated there were ongoing efforts to increase truck drivers in other ways. The President also noted there was $16 billion included in his infrastructure plan to expand operations at U.S. ports, which has surfaced as another bottleneck in the supply chain. (Washington Post)

FISCAL: U.S. Senate Majority Leader Chuck Schumer said on Thursday that Democrats are working hard to agree on a framework for President Joe Biden's social legislation but that "outstanding issues" remain. (RTRS)

FISCAL: Moderate Democratic Senator Joe Manchin said that a deal on the framework of the budget reconciliation package "is not going to happen anytime soon," indicating that it was unlikely Democrats would meet their self-imposed Friday deadline to craft a spending agreement. "I believe that they're making good progress," Manchin told reporters Thursday, referring to those involved in negotiations. "There's a lot of details. Until you see the text and the fine print, it makes it pretty hard to make final decisions." (WAPO)

FISCAL: Sens. Joe Manchin (D-W.Va.) and Bernie Sanders (I-Vt.) squabbled behind closed doors Wednesday, with Manchin using a raised-fist goose egg to tell his colleague he can live without any of President Biden's social spending plan, Axios has learned. The disagreement, recounted to Axios by two senators in the room, underscores how far apart two key members remain as the Democratic Party tries to meet its deadline for reaching an agreement on a budget reconciliation framework by Friday. (Axios)

FISCAL: A CNN reporter tweeted the following on Thursday: "Sinema separately has backed provisions to raise revenue on the international side, domestic corporate, wealthy and tax enforcement, per person familiar, who says it's enough to fully pay for the package. Unclear whether that will pass muster." (MNI)

FISCAL: As Democrats wrestle over their spending package, key lawmakers are still fighting to change the $10,000 cap on the federal deduction for state and local taxes. The measure, known as SALT, is a priority among lawmakers in high-tax states, such as New York, New Jersey and California, jeopardizing the Democrats' multi trillion-dollar plan. The budget can pass without Republican support. However, Democrats need votes from nearly every member of the House and all Democratic senators. (CNBC)

FISCAL: White House officials have put forward a cost-cutting alternative of a new, roughly $100 billion plan that would offer four weeks of paid parental, family and sick leave beginning in 2024. The program would be smaller in size and shorter in duration than what House Democrats unveiled earlier this year, and it would not be authorized on a permanent basis. (Washington Post)

CORONAVIRUS: An influential Centers for Disease Control and Prevention advisory committee on Thursday unanimously recommended boosters of Moderna and Johnson & Johnson's Covid-19 vaccines, sending it to CDC Director Dr. Rochelle Walensky for final approval. The agency's Advisory Committee on Immunization Practices meeting recommended the Moderna booster for elderly people and at-risk adults six months after they complete their primary series of shots, bringing it in line with the distribution plan for Pfizer and BioNTech's booster. It also endorsed J&J boosters for everyone 18 and older who received the initial shot at least two months ago. (CNBC)

SOFR: The drop in the Secured Overnight Financing Rate, the Federal Reserve's preferred replacement for Libor, is raising concern about potential ructions in the final stretch of the transition. With a little more than two months until market participants are prohibited from entering into new agreements tied to the London interbank offered rate, SOFR slipped 2 basis points this week to 0.03%. This rate volatility will likely be a focus for bankers at the next gathering of the Alternative Reference Rates Committee, the Fed-backed body that's overseeing the transition away from Libor in the U.S., on Tuesday when it hosts a symposium. (BBG)

OTHER

GLOBAL TRADE: Suppliers to Chinese telecoms giant Huawei and China's top chipmaker SMIC got billions of dollars worth of licenses from November through April to sell them goods and technology despite their being on a U.S. trade blacklist, documents seen by Reuters showed on Thursday. (RTRS)

GLOBAL TRADE: Top U.S. trade negotiator Katherine Tai said on Thursday she was optimistic about resolving a dispute with the European Union over steel and aluminium tariffs, insisting that joint transatlantic efforts were needed to combat overcapacity in the global market. (RTRS)

GLOBAL TRADE: The United States reached a deal with Austria, France, Italy, Spain, and the United Kingdom on digital services taxes (DST) on Thursday, the U.S. Treasury Department and the U.S. Trade Representative said. Under the deal, "DST liability that U.S. companies accrue during the interim period will be creditable against future income taxes accrued under Pillar 1 under the OECD agreement," the USTR office said. (RTRS)

U.S./CHINA: White House officials are gearing up for a virtual meeting between President Joe Biden and Chinese leader Xi Jinping they hope will show the world Washington can responsibly manage relations between the rival superpowers, people familiar with the matter say. (RTRS)

U.S./CHINA: China needs not to give the incoming U.S. Ambassador to China Nicolas Burns any other courtesies except diplomatic etiquette, given his "toughest and most arrogant" confirmation hearing statements toward China in the Senate on Wednesday, the Global Times said. Burns will inevitably suffer from setbacks after he comes to China, and the U.S. lacks the means to pressure China to submit, the state-run newspaper said. Burns's systematic attack on China, including criticizing its Xinjiang and Hong Kong policies and willingness to sell more arms to Taiwan, demonstrated the U.S. political elites' overall hostility toward China, the Times said. However, Burns's statements seemed hollow as he didn't suggest new moves for the U.S. to deal with China, said the newspaper. (MNI)

U.S./CHINA/TAIWAN: President Joe Biden says the U.S. has a commitment to protect Taiwan and would come to its defense if attacked by China. "China knows the U.S. has the most powerful military in the world," Biden says, adding what he worries about is China engaging in activities where they may make a serious mistake. (BBG)

GEOPOLITICS: The U.S. Navy and Army tested hypersonic weapon component prototypes on Wednesday that will inform development of new weapons, the Pentagon said, calling the three tests successful. The tests occurred the same day that U.S. President Joe Biden said he was concerned about Chinese hypersonic weapons. (RTRS)

CORONAVIRUS: The White House on Thursday called on all World Trade Organization members to support an intellectual property waiver for COVID-19 vaccines. "We ... need every WTO member to step up as well and support an intellectual property waiver, and every company must act ambitiously and urgently to expand manufacturing now," White House spokesperson Karine Jean-Pierre told reporters. (RTRS)

JAPAN: One option to help improve the fiscal position could be a capital gains tax, International Monetary Fund mission chief for Japan Ranil Salgado says in interview with Bloomberg TV Friday. IMF isn't focused on the specific date when the primary balance is reached. Says IMF thinks BOJ-government statement should stay as it is; important they cooperate toward achieving 2% inflation target. Due to positive developments on vaccination and reduction in Covid cases, "we expect somewhat of a shift from manufacturing to services as Japanese consumers feel more comfortable to spend substantial savings that they have built up." (BBG)

RBA: Reserve Bank Governor Philip Lowe highlighted the benefits of Australia's monetary regime for a small, open economy during a panel discussion in Chile focused on central independence, mandates and policies. Chile's Constitutional Assembly on Monday began the process of debating the content of a new charter, almost two years after the start of social unrest in 2019. Participants on the panel hosted by the University of Chile included central bank officials from the U.S., South Africa and Israel among others. "There is no right answer to the questions that Chile is grappling with," Lowe said via video-conference from his office in Sydney. "But Australia's experience is that the combination of a freely floating exchange rate, a flexible medium-term inflation target and a broad mandate for the central bank can work well for a small open economy." Lowe didn't address monetary policy or the outlook for Australia's economy in his opening remarks. (BBG)

AUSTRALIA: The RBA has now concluded "it would be in the public interest and consistent with its mandate to promote competition and efficiency in the Australian payments system for BNPL providers to remove their no-surcharge rules, so that merchants can apply a surcharge to those payments if they wish." The RBA pointed to "the adverse implications for competitive neutrality in an environment where designated card schemes and some other payment services have been required to remove their no-surcharge rules". It also said that while BNPL "still accounts for a relatively low share of overall transactions in the economy, there are indications that its use is now widespread in certain retail segments". (Australian Financial Review)

AUSTRALIA: Victoria will scrap quarantine requirements for double-vaccinated travellers arriving from overseas as early as next month, following the lead of NSW and no longer expecting travellers to isolate either at home or in hotels if they are fully vaccinated and test negative to COVID-19 on arrival. The change is expected to come into effect as soon as November 1, the same day as NSW takes the step. People who are not double-dosed can travel into Victoria but are required to isolate until they return a negative test. (The Age)

AUSTRALIA: Qantas Airways expects to get back to flying 100% of its pre-COVID-19 domestic capacity by January as Australian state borders open up due to surging vaccination rates. It will progressively in the first week of November go back to nearly 15 flights a day and by Christmas get back to closer to 30 to 40 flights per day. The airline will resume international passenger flights from Sydney to London and Los Angeles on Nov. 1 after New South Wales announced permitted entry of fully vaccinated travellers without the need for quarantine, though only citizens and permanent residents will be allowed back in. (RTRS)

NEW ZEALAND: New Zealand Prime Minister Jacinda Ardern set one of the world's highest vaccination targets for pandemic restrictions to be eased as she presented a roadmap for the country to abandon lockdowns and gradually reopen. Once 90% of the eligible population aged 12 and over is fully vaccinated, the government will begin to ease restrictions and introduce a new traffic-light system to gauge the level of risk in each region. The government will measure vaccination rates for each District Health Board around the country. (BBG)

NEW ZEALAND: Wellington and nearby areas were shaken by a 5.9 magnitude earthquake with the epicentre 35 km south-west of Taumarunui in central North Island. While the shaking was felt widely there were no reports of damages or injuries. (RTRS)

SOUTH KOREA: South Korea plans to temporarily cut fuel taxes in a bid to ease upward pressure on inflation amid surging oil prices, a senior government official said Friday. First Vice Finance Minister Lee Eog-weon also said the government plans to additionally cut import tariffs on liquid natural gas (LNG), currently at 2 percent, as part of efforts to ease people's burdens on a hike in energy costs. "The government will unveil details about fuel tax cuts, including the timing and the scope, next week," Lee said at a government meeting. (Korea Herald)

SOUTH KOREA: South Korea is considering lifting restrictions on operating hours at restaurants and coffee shops from early Nov., a health ministry official told a daily briefing. The country, which will on Oct. 29 announce plans for a "gradual return to normal life," is also mulling requiring vaccine certificates for people entering high risk and adult entertainment venues. (BBG)

TURKEY: An international watchdog downgraded Turkey to a so-called grey list on Thursday for failing to head off money laundering and terrorist financing, a decision that could further erode foreign investment after a years-long exodus. (RTRS)

TURKEY/RATINGS: Rating reviews of note scheduled for after hours on Friday include:

- S&P on Turkey (current rating: B+; Outlook Stable).

MEXICO: Mexico's central bank Governor Alejandro Diaz de Leon said that the shocks being experienced during the pandemic are transitory, but risks are increased, during a conference hosted by the Universidad de Chile. The supply shocks being experienced during the pandemic are not "traditional." There are "bottleneck issues," as well as a shift in household expenditure to durable goods. Important to to avoid having inflation expectations being contaminated. (BBG)

BRAZIL: Brazil's govt will pay 400 reais per month to 750,000 self- employed truck drivers and the amount for Auxilio Brasil, a separate social program for needy families, will be within the spending cap, President Jair Bolsonaro said during weekly remarks via webcast. (BBG)

BRAZIL: Jair Bolsonaro's administration was plunged into crisis as four top economic aides and a key energy official resigned hours after the Brazilian president unveiled spending plans that unnerved investors and threatened to add to a surge in inflation. Four members of the team that reports to Economy Minister Paulo Guedes stepped down on Thursday, including Treasury Secretary Jeferson Bittencourt and Special Treasury and Budget Secretary Bruno Funchal. All of them cited personal reasons for leaving, but the timing of their resignations sent a clear message that they disapproved of the controversial spending plan. (BBG)

BRAZIL: President Jair Bolsonaro said that Economy Minister Paulo Guedes remains in government, despite the departure of members of his team. The stampede was motivated by the dissatisfaction of members of the Economy with the government's insistence on keeping the value of Auxílio Brasil at R$400, which would not fit within the spending ceiling. (CNN)

BRAZIL: Lower House Special Committee approved the bill on court-ordered payments, known as "precatorios," which includes changes in the rules governing the spending cap. Committee rejected all proposed amendments from the opposition. Bill will be voted on the lower house floor next week, lawmaker and govt house leader Ricardo Barros said. (BBG)

RUSSIA: President Vladimir Putin said on Thursday that the Western-backed military development of Ukraine posed a serious threat to Russia, two days after the U.S. defense secretary staged a show of support for Kyiv and encouraged its aspiration to join NATO. Putin told a group of journalists and Russia experts that Tuesday's visit to Ukraine by Lloyd Austin, in which he said no third country had the right to veto its hoped-for NATO membership, had effectively paved the way for Kyiv to join. Whether it did or not, Putin said, Russia's interests were targeted. (RTRS)

ENERGY: Russia can increase gas supplies to Europe as soon as Germany approves the new Nord Stream 2 pipeline, President Vladimir Putin said, underlining Moscow's conditions for help to resolve the continent's energy crisis. Putin said Gazprom, the Kremlin's gas monopoly, could increase flows by an extra 17.5bn cubic metres via the new pipeline "the day after tomorrow" if regulators approved it "tomorrow." The amount, equal to roughly 10 per cent of the gas Russia shipped to Europe and Turkey in 2020, would provide significant additional supplies at a time of record prices in Europe, even before the pipe's second line is fully filled in December. (FT)

ENERGY: Several European Union leaders warned against hasty intervention to address the unprecedented energy crisis, suggesting that pleas for immediate actions from some of the bloc's poorer countries would go unheeded. Record power and gas prices are the first topic for EU leaders in their two-day summit that started on Thursday in Brussels, but the bloc's ability to act is extremely limited. While most countries have already cut taxes or approved subsidies to help households and companies, some want new measures on emissions, power and gas or seek scaling down ambitious climate reforms. "We need to distinguish significantly from the challenge we face in the fight on climate," German Chancellor Angela Merkel told reporters before the meeting. "I think that we should react in a level-headed way." (BBG)

OIL: Not all OPEC+ producers are able to quickly increase crude production due to declining investment in oil development, Russian President Vladimir Putin said Oct. 21. "OPEC + countries are increasing production volumes, even more than they agreed to do. But not everyone can do this, not all oil-producing countries are able to quickly increase production," Putin said during a meeting of the Valdai discussion club. "From 2012-2016, investment in oil production totaled around $400 billion/year, and in recent years, even before the pandemic, this decreased by 40%, and now it amounts to $260 billion," he added. Putin said that while political cycles in leading economies are four-five years, investment cycles for energy projects are 15-30 years. (Platts)

CHINA

EVERGRANDE: China Evergrande Group made an overdue interest payment to international bondholders, the state-owned Securities Times reported Friday, an unexpected move that allows the struggling property giant to stave off a default. The Chinese real-estate developer on Thursday sent $83.5 million to the trustee for the dollar bonds, and that financial institution will in turn pay bondholders, the Securities Times reported. The financial paper is run by the Communist Party's flagship People's Daily newspaper. Evergrande was nearing the end of a 30-day grace period before bondholders could send a notice of default to the company, after it failed to make the interest payment on about $2.03 billion of dollar bonds on Sept. 23. (WSJ)

EVERGRANDE: China Evergrande rival Hopson Development Holdings Limited, which had sought to buy half of the embattled developer's property management unit, still considers the purchase agreement "legally binding" despite Evergrande rescinding the sale on October 12, according to a company filing with the Hong Kong stock exchange. "Having sought legal advice, the company considers the agreement legally binding and the acquisition is not subject to the fulfilment of any conditions precedent," Hopson said in a late filing on Thursday. The filing by Hopson complicates an increasingly messy restructuring saga for Evergrande, the world's most indebted developer. (SCMP)

PBOC: The PBOC should consider cutting RRRs by another 0.5% to release lower-cost market liquidity, lower real interest rate and promote credit growth in the future, the 21st Century Business Herald reported citing Lian Ping, chairman of China Chief Economist Forum. He noted that the current weighted average level of the RRR is close to 9%, leaving room for another cut following the 0.5% reduction in July. The central bank should also roll over the MLFs maturing in Q4, and lower the real market interest rate by 15-25 bps by unleashing the potential of LPR reform, Lian was cited as saying. Monetary policy should be appropriately looser amid weak demand and slowing economic growth, said Lian, adding that the spillover effect of possible monetary tightening by the Fed is controllable by China. (MNI)

YUAN: China's banks saw a net forex settlement surplus of 180 billion U.S. dollars in the first three quarters, the country's forex regulator said Friday. Forex purchases by banks stood at around 1.86 trillion dollars, while sales reached nearly 1.68 trillion dollars, data from the State Administration of Foreign Exchange (SAFE) showed. The surplus in forex settlement indicated that China's stable recovery has underpinned the stable operation of the forex market, said Wang Chunying, spokesperson with the SAFE. (Xinhua)

PROPERTY: China's credit supply for residential housing is expected to rebound steadily in Q4, as the real estate credit environment is improving with mortgage interest rates in 90 cities in China falling in October from September by 1 bp, Yicai.com reported citing a report by Beike Research Institute. The average interest rate for first-time buyers in 90 cities was 5.73% while that for second-time buyers was 5.99%, both lowered by 1 bp from the previous month. Though a major easing is unlikely, recent comments by top policymakers indicate that the tightest moment of credit supply has passed, as the credit tightening since Q2 has led to sharp declines in home sales, land sales and many overseas debt defaults by developers, the newspaper said. (MNI)

ENERGY: China continues to pull out the stops to make sure its winter heating needs are met. Thermal coal futures tumbled again as traders took fright at the government's attempts to tame prices. The National Development and Reform Commission said it has told coal miners to set reasonable prices after a meeting on Friday morning. It follows a statement from the NDRC on Thursday that said it's studying concrete measures to intervene in the market. China's top planning agency is also looking to boost energy conservation in some of the most power-hungry industries, including steel, aluminum and cement. Meanwhile, the national gas distributor, PipeChina, said it aims to secure enough winter supply by the end of October and has put more pipelines into operation to help ease the energy crisis. (BBG)

ENERGY: China will suspend tax collection from coal mines and heating companies in 4Q, in order to ensure power supply during the winter and spring, the state TV network reports, citing the taxation authority. (BBG)

CORONAVIRUS: Beijing plans to test 34,700 people in residential compounds linked to 4 Covid-19 cases reported Friday and is preparing to expand testing if necessary, Tong Lizhi, vice governor of Changping district, says at a briefing. A residential compound in the district has been classified as medium-risk area, Tong says. The city asks residents to avoid outbound trips unless necessary, says Tian Wei, an official with the municipal government. (BBG)

OVERNIGHT DATA

CHINA SEP FX NET SETTLEMENT - CLIENTS CNY 173.7BN; AUG 116.9BN

JAPAN SEP CPI +0.2% Y/Y; MEDIAN +0.2%; AUG -0.4%

JAPAN SEP CORE CPI +0.1% Y/Y; MEDIAN +0.1%; AUG 0.0%

JAPAN SEP CORE-CORE CPI -0.5% Y/Y; MEDIAN -0.4%; AUG -0.5%

JAPAN OCT, P JIBUN BANK M'FING PMI 53.0; SEP 51.5

JAPAN OCT, P JIBUN BANK SERVICES PMI 50.7; SEP 47.8

JAPAN OCT, P JIBUN BANK COMPOSITE PMI 50.7; SEP 47.9

Activity at Japanese private sector businesses returned to expansion territory at the start of the fourth quarter of 2021, according to the latest flash PMI data. The rise was the first in six months and came as the dominant service sector registered an increase in activity for the first time since January 2020. Moreover, manufacturers reversed the slight decline seen in September to indicate growth for the eighth time in nine months. Panel members commonly associated the slight recovery to a reduction in COVID-19 cases and looser pandemic restrictions. Private sector businesses also noted an increase in aggregate new business for the first time since April, assisted by a quicker rise in export orders. That said, firms continued to highlight sustained supply chain pressures and material shortages. As a result, input prices rose at the fastest rate in over 13 years. This contributed to the sharpest rise in output charges since July 2018. Looking forward, companies were optimistic that business activity would improve in the year ahead. Optimism stemmed from hopes that the pandemic would end and provide a broadbased boost to demand. (IHS Markit)

AUSTRALIA OCT, P MARKIT M'FING PMI 57.3; SEP 56.8

AUSTRALIA OCT, P MARKIT SERVICES PMI 52.0; SEP 45.5

AUSTRALIA OCT, P MARKIT COMPOSITE PMI 52.2; SEP 46.0

Following the turnaround in September, the IHS Markit Flash Australia Composite PMI indicated that the Australian economy is back in expansion in October as the easing of COVID-19 restrictions and plans for further opening up of the Australian economy restored confidence and rejuvenated economic activity in the country. The return to growth for demand and backlogged work likewise reflected the improvement in overall confidence, with business sentiment rising to the highest level since February. Higher demand however translated to greater strains on the supply chain as we saw vendor performance deteriorate and price pressures further accumulate in October. Meanwhile employment levels rose at a slower rate with reports of constraints when trying to hire staff. These are issues that may persist in the short- to mediumterm for firms as they take their time to clear. (IHS Markit)

UK OCT GFK CONSUMER CONFIDENCE -17; MEDIAN -16; SEP -13

CHINA MARKETS

PBOC INJECTS NET CNY90BN VIA OMOS FRIDAY

The People's Bank of China (PBOC) injected CNY100 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday. The operations lead to a net injection of CNY90 billion after offsetting the maturity of CNY10 billion reverse repos today, according to Wind Information.

- The operation aims to offset the impact of tax season and the issuance of government bonds, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:25 am local time from the close of 2.0266% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 42 on Thursday vs 39 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4032 FRI VS 6.3890

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4032 on Friday, compared with the 6.3890 set on Thursday.

MARKETS

SNAPSHOT: Evergrande Makes Late Coupon Payment Ahead Of End Of Grace Period

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 119.01 points at 28828.81

- ASX 200 down 2.671 points at 7412.7

- Shanghai Comp. up 3.398 points at 3598.181

- JGB 10-Yr future down 11 ticks at 151.26, yield up 0.5bp at 0.096%

- Aussie 10-Yr future down 2.0 ticks at 98.165, yield up 1.5bp at 1.805%

- U.S. 10-Yr future -0-02 at 130-04, yield down 1.77bp at 1.683%

- WTI crude down $0.34 at $82.16, Gold up $4.06 at $1786.96

- USD/JPY up 4 pips at Y114.04

- CHINA EVERGRANDE MAKES OVERDUE INTEREST PAYMENT ON DOLLAR BONDS (WSJ)

- FED'S WILLIAMS: LONG-TERM INFLATION EXPECTATIONS IN LINE WITH 2% (BBG)

- WITH XI-BIDEN MEETING, U.S. AIMS TO SHOW RESPONSIBLE HANDLING OF CHINA TIES (RTRS)

- BOE CHIEF ECONOMIST WARNS UK INFLATION LIKELY TO HIT 5%, NOV MEETING "LIVE" (FT)

- BORIS JOHNSON READY TO COMPROMISE OVER ECJ FOR NI PROTOCOL (THE TIMES)

- RBA DEFENDS YCT MECHANISM FOR FIRST TIME SINCE FEB

BOND SUMMARY: Not Much Relief From Evergrande Making Late Coupon Payment, RBA Enforces YCT

TYZ1 trades -0-02 at 130-04, shy of the peak of its 0-06 Asia range, while cash Tsys firmed by 0.5-2.5bp, bull flattening in the process. The move represented a pullback from the late NY lows which were inspired by breakeven dynamics (Asia hours saw NY Fed President Williams stress that long-term inflation expectations are "in line with 2%") and another round of FOMC hike repricing, which saw 10-Year yields top out just ahead of their mid-May highs. The previously outlined repayment of a missed coupon on a US$ bond issued by China Evergrande within the 30-day grace period provided some very modest & brief pressure for Tsys, although markets quickly switched focus to a similar missed payment that needs to be fulfilled late next week. Flash PMIs from Europe & the UK will headline ahead of Friday's NY session. Elsewhere, we will hear from Fed's Powell & Daly ahead of the Fed's pre-meeting blackout period.

- JGB futures sit 9 ticks lower on the day, following the broader ebb & flow of core FI markets. The cash curve has been subjected to some twist steepening pressure, while swap rates have pulled back from their early peaks. Y300bn of multi-tranche green issuance from NTT finance headlined the corporate issuance slate.

- YM & XM sit 2.0 & 3.0 below yesterday's settlement levels, in the top half of their respective ranges, but shy of their Sydney peaks. Action in the ACGB space saw the RBA defend the 0.10% yield target on ACGB Apr-24 for the first time since Feb, buying $A1.0bn of the line after hiking repo costs (the cost of shorting) back on Monday failed to weigh on yields. The line last yields ~0.12% after challenging 0.18% early on.

JGBS AUCTION: Japanese MOF sells Y4.0613tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.0613tn 3-Month Bills:

- Average Yield -0.1098% (prev. -0.1172%)

- Average Price 100.0295 (prev. 100.0315)

- High Yield: -0.1061% (prev. -0.1117%)

- Low Price 100.0285 (prev. 100.0300)

- % Allotted At High Yield: 89.6278% (prev. 61.6980%)

- Bid/Cover: 4.534x (prev. 5.100x)

EQUITIES: Evergrande Makes Delayed Coupon Payment, Light Rally, Next Hurdle Eyed

The major regional equity indices trade little changed to marginally firmer in Asia, with news that China Evergrande has deployed the funds to prevent an official default on the initial missed coupon payment on one of its US$ bonds providing light support. Note that the relief rally was only limited, with the payment not changing the long-term dynamic surrounding the troubled firm. A similar payment needs to be made come the end of next Friday to avoid default on another missed coupon payment.

- Questions surrounding the fiscal impasse in Washington DC & President Biden reaffirming support for Taiwan in any instances re: Chinese aggression also limited any rally.

- E-minis were mixed. They generally recovered from worst levels on the back of the aforementioned Evergrande news. The DJIA was a touch firmer, while the S&P 500 hovers around neutral levels. Meanwhile, the NASDAQ 100 trades nearly 0.5% lower on the day. The underperformance for that contract stemmed from guidance from Intel after the company warned that margins are set to be lower than current levels for 2-3 years (although gross margin is set to hold above 50%).

OIL: Crude Nudges Lower

WTI & Brent futures sit ~$0.30 below their respective settlement levels after Thursday saw the benchmarks shed ~$0.90 & ~$1.20 apiece. Both metrics operate comfortably above their respective Thursday lows.

- To recap, the initial cooling in the bid in U.S. equities allowed crude to ease from best levels on Thursday, before a firmer USD came to the fore, adding fresh pressure even as equities recovered from lows. Most attributed at least some of the move to a little bit of exhaustion after the recent rally to fresh cycle highs. Note that the move in U.S. breakevens may have aided crude's recovery from lows late in the day.

GOLD: Stuck Between The Lines In The Sand

Gold coiled on Thursday, with the impact from the downtick in our weighted U.S. real yield monitor nullified by the uptick in the USD, although the former, coupled with some subsequent richening for U.S. Tsys may have provided light support for bullion in Asia-Pac hours. Spot gold last deals a handful of dollars higher just below $1,790/oz, with the technical pattern that we have outlined on several occasions this week still in play.

FOREX: Temporary Respite For Evergrande Received With Optimism

The mood music turned optimistic after Chinese state media reported that Evergrande had paid a missed coupon on its Mar '22 dollar bond. The real-estate giant wired the payment just days ahead of the expiration of a 30-day grace period and thus averted a formal default. The news was received with a sigh of relief, even as the payment does not solve the firm's longer-term troubles.

- Spot USD/CNH went offered in response to headlines surrounding the Evergrande situation but quickly recouped losses. The rate oscillates around neutral levels as we type.

- Antipodean currencies led commodity-tied FX higher but trimmed gains thereafter. AUD/USD and NZD/USD remained within the confines of their Thursday ranges.

- For the record, the RBA stepped in to defend its yield target for the first time since Feb but the Aussie dollar was unfazed.

- JPY underperformed at the margin amid limited demand for safe haven currencies. Japan's core CPI rose for the first time in 18 months, albeit its growth rate registered at a modest level of +0.1% Y/Y. Still, BBG noted that core inflation would be closer to +1.4% Y/Y if the impact of trimmed mobile phone fees was discounted.

- PMI reports from across the globe take focus from here alongside UK & Canadian retail sales data. Speeches are due from Fed's Powell, Williams & Daly, ECB's Villeroy & Riksbank's Ohlsson.

FOREX OPTIONS: Expiries for Oct22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1600(E788mln), $1.1650(E648mln)

- USD/JPY: Y113.50($500mln), Y114.25-45($1.6bln)

- GBP/USD: $1.3700(Gbp558mln)

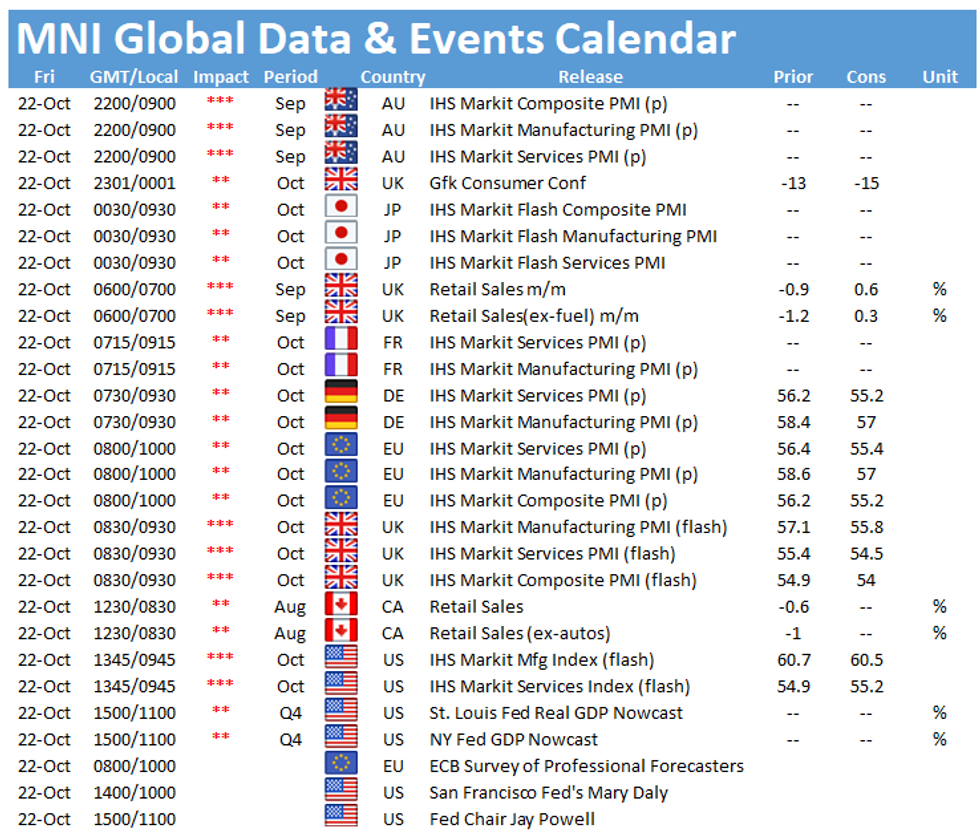

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.