-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

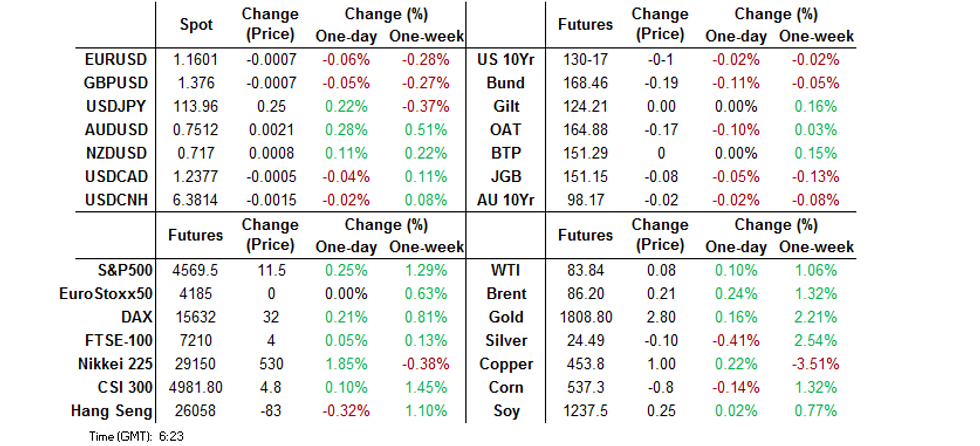

Free AccessMNI EUROPEAN MARKETS ANALYSIS: A Yellen-Liu He Call & Deeper Buyback Chest For Facebook Supports Risk

- A call between Messrs Yellen & Liu He, in addition to U.S. tech giant Facebook boosting the size of its share buyback scheme, provided a modest boost for risk appetite during Asia-Pac dealing, even with some grievances being aired in the former.

- Still, the market moves were relatively modest in the broader scheme of things, with JPY underperforming in the G10 FX space, as you would expect in such an environemnt.

- There isn't much in the way of tier 1 risk events on Tuesday's docket.

BOND SUMMARY: Core FI Biased A Touch Lower Overnight

Core fixed income markets saw some modest cheapening in Asia-Pac hours, with a phone call between U.S. Tsy Sec Yellen & Chinese Vice Premier Liu He pointing to loose agreements re: the need for a certain degree of coordination between Sino & U.S. economic and political policy albeit with the U.S. airing some grievances) resulting in very modest risk-on price action. Elsewhere, Facebook's $50bn boost to its share buyback scheme supported the e-mini space in the early rounds of dealing.

- TYZ1 is -0-02 at 130-16 as a result, while cash Tsys run up to ~1.5bp cheaper across the curve, with the belly leading the downtick. Tuesday's NY dealing will be headlined by 2-Year Tsy supply. Elsewhere, new home sales data, the latest Richmond Fed m'fing survey and conference board consumer confidence print will hit. We also note that the fiscal back and forth within the Democratic Party continues, although progress in the matter has been touted by several quarters.

- The JGB curve saw some light twist flattening during the Tokyo morning, while futures shed 8 ticks on the modest risk positive price action witnessed elsewhere. Local news flow remains relatively light, headlined by PM Kishida noting that he plans to draw up his economic policy proposals in November (there is the small issue of the upcoming lower house elections to contend with, which will be held over the coming weekend). Kishida's comments pointed to focus on social security, digital garden cities and public sector pay.

- Sydney trade sees YM -4.0 & XM -3.0, with pressure building in the space ahead of the bell and the modest overnight gains now completely unwound. The move has gathered steam as futures move through their respective overnight lows. Perhaps a degree of position squaring ahead of tomorrow's local Q3 CPI print is exacerbating the move.

FOREX: Liu/Yellen Talks Boost Sentiment

Risk appetite received a boost after news wires ran headlines pointing to a phone call between Chinese Vice Premier Liu and U.S. Tsy Sec Yellen, who had a "pragmatic, candid and constructive" conversation and agreed to keep communications. While there was little substance in official communique surrounding the call, its general tone was positive, which buoyed market sentiment.

- The yuan caught a bid in reaction to news about Sino-U.S. talks. USD/CNH bottomed out at CNH6.3755 and trimmed losses, but remained in negative territory.

- The Antipodeans led gains in G10 FX space, while the yen was the main underperformer. JPY crosses were bought over the Tokyo fix, with another uptick driven by the risk-on impetus provoked by the Liu/Yellen call.

- The global data docket is fairly thin today, while speeches are due from ECB's Villeroy & de Cos. The Fed are in their policy blackout.

FOREX EXPIRIES: Expiries for Oct26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1600-10(E1.4bln), $1.1720-30(E849mln)

- USD/JPY: Y114.00($590mln), Y114.50($1.1bln)

- AUD/USD: $0.7400(A$561mln)

- USD/CAD: C$1.2400($670mln)

ASIA FX: Won Leads Gains In Asia, Sino-U.S. Talks Take Focus

Chinese Vice Premier Liu held a "pragmatic, candid and constructive" talks with U.S. Tsy Sec Yellen. Relatively positive language of official communique supported risk appetite and left participants assessing the state of Sino-U.S. relations.

- CNH: USD/CNH dipped in reaction to headlines surrounding talks between Liu & Yellen. The pair printed an intraday low of CNH6.3755 before trimming losses. Elsewhere, the PBOC fix fell 11 pips above sell-side estimate.

- KRW: The won outperformed in the region, as risk-on flows outweighed a miss in South Korea's Q3 GDP. Director-General at the BoK's statistics dept told reporters that the GDP outturn "is not something to worry much about," as the imminent transition to living with Covid-19 and fuel tax cut will support consumption in Q4. Elsewhere, FinMin announced a record 20% reduction to fuel taxes and the suspension of LNG import tariff for 6 months.

- THB: USD/THB printed worst levels since mid-Sep but then moved away from there, ahead of the release of Thailand's Customs trade data.

- SGD: In Singapore, participants awaited monthly industrial output data. The Singdollar was rangebound.

- PHP: The peso held a narrow range. Questions surrounding the potential for Davao Mayor Sara Duterte replacing one of the current presidential candidates did the round.

- MYR: USD/MYR slid to a six-week low amid chatter of strong stock inflows on Monday.

- IDR: The rupiah lost ground amid limited local headline flow.

EQUITIES: Tech Tailwinds

Early risk positive flows saw a light extension on the back of headlines pointing to a call between U.S. Tsy Secretary Yellen and Chinese Vice Premier Liu He re: economic, bilateral and global cooperation, with Chinese media noting that the two agreed that coordination between Sino & U.S. policy is important. Meanwhile, the U.S. Tsy noted that Yellen "frankly raised issues of concern. Secretary Yellen noted that she looks forward to future discussions with Vice Premier Liu."

- The initial bid came on the back of after-hours reports revealing a mixed round of earnings & guidance from tech giant Facebook, although it was the company's announcement of a potential $50bn boost to its share buyback scheme dominated matters and has led to NASDAQ 100 outperformance in the e-mini space. This built on Monday's Tesla-driven outperformance for the tech space.

- The move moderated a little, leaving the Nikkei 225 to outperform, while the Hang Seng & CSI 300 operated around neutral levels come the lunch bell.

- Note that Monday saw a sharp reversal in the early net selling when it came to northbound Hong Kong- China Stock Connect flows, with the measure reverting to marginal positive come the bell, recording a 5th straight day of net buying in the process.

GOLD: Back Above $1,800/oz

To recap, the widening of U.S. breakevens outstripped movements in nominal yields on Monday (with the Tsy curve seeing some light twist steepening), resulting in a downtick for our weighted U.S. real yield monitor, ultimately supporting gold prices, with spot closing above $1,800/oz. The risk positive price action surrounding the recently revealed Yellen-Liu call (with both the ensuing market reaction and details re: the call proving to be limited) and post-earnings dynamics surrounding tech giant Facebook have applied some light pressure, but spot hasn't really tested the $1,800/oz, printing a touch above the round number, a handful of dollars softer on the day. The technical backdrop remains as it was this time yesterday.

OIL: Stable In Asia After Pullback From Cycle Highs

WTI & Brent crude futures sit ~$0.20 & ~$0.30 above their respective settlement levels, with the mild risk positive backdrop (outlined elsewhere) providing light support for the space in Asia-Pac hours. This comes after a sharp pullback from fresh cycle highs on Monday, following news that Iran and the EU will meet in Brussels on Wednesday, with the goal of the meeting being to open the way to a wider push to revive the 2015 Iranian nuclear accord. This applied pressure to the space after the latest leg of bullish price action came on the back of OPEC+ rhetoric that we outlined previously (Russia added to that particular line of mood music on Monday). The benchmark futures curves remain in a deep state of backwardation. API crude inventory estimates headline on Tuesday.

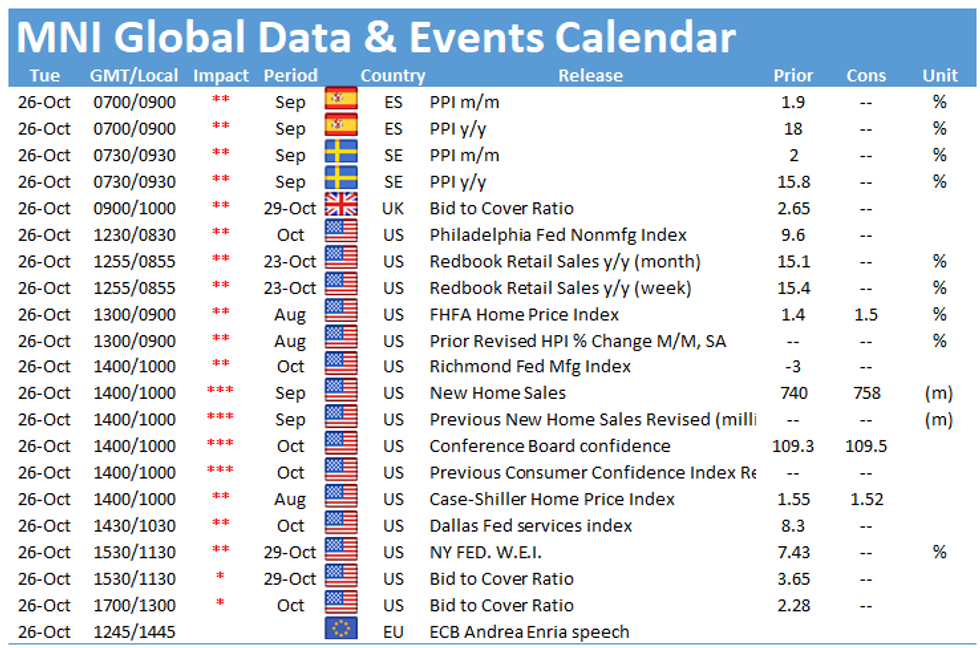

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.