-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Japanese PM Kishida Outperforms, Familiar Matters Hamper Chinese Manufacturers

EXECUTIVE SUMMARY

- PMIS SHOW CHINESE MANUFACTURERS HAMPERED BY SURGING PRODUCER PRICES & ELECTRICITY LIMITS

- JOHNSON SET FOR MACRON COLLISION DURING KEY CLIMATE TALKS (BBG)

- JAPANESE PM KISHIDA RETAINS ABSOLUTE STABLE MAJORITY

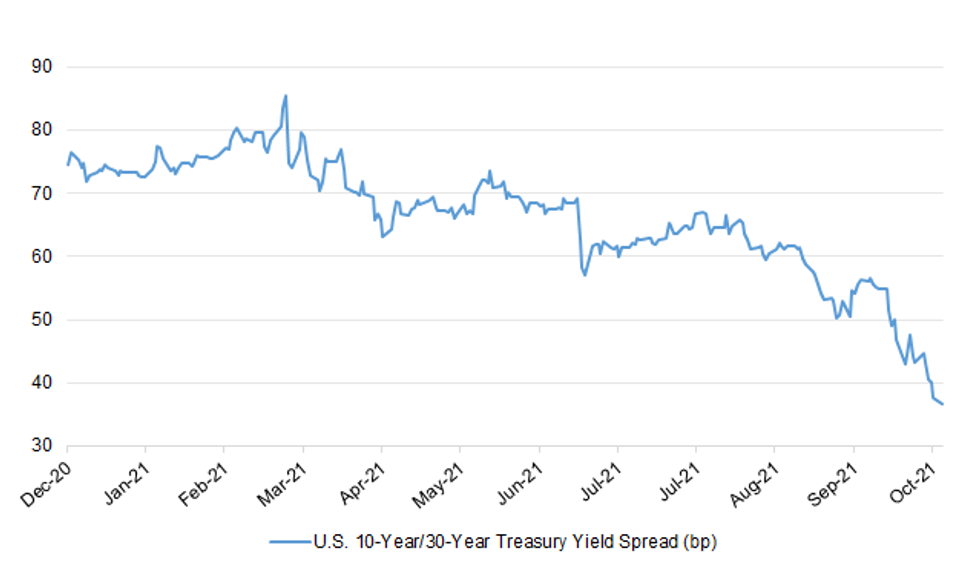

Fig. 1: U.S. 10-Year/30-Year Treasury Yield Spread (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Prime Minister Boris Johnson is adamant that the U.K. will have a Christmas without restrictions despite an alarming spike in Covid-19 cases. "I see no evidence whatever to think that any kind of lockdown is on the cards," Johnson told reporters en route to the Group of 20 summit in Rome. "Yes it's true that cases are high, but they do not currently constitute any reason to go to Plan B." (BBG)

BREXIT: The UK's Boris Johnson and France's Emmanuel Macron are heading for a full frontal collision in the next 48 hours that will bleed into the United Nations' climate summit. The French government on Tuesday is set to introduce additional controls on goods moving across its border with the UK and block British fishing boats from unloading their catches in France in retaliation for what it sees as unjustified restrictions on French trawlers. At a Sunday meeting in Rome aimed at defusing the clash, the two couldn't even agree on what they had said. Neither leader backed down in their own separate news conferences at the end of the Group of 20 summit. While a Macron aide briefed that the two leaders would work together to find a way to deliver licenses to French boats ahead of the deadline, Johnson's spokesman Max Blain said it was up to Paris to make the first move. Macron said the ball was in the UK's court, that a new methodology had been proposed and that France was poised to take retaliatory measures. It was a tit for tat. Johnson: "On fish, I've got to tell you the position is unchanged." Macron: "I hope tomorrow we get a response" from the British. (BBG)

BREXIT: Emmanuel Macron warned Boris Johnson on Friday that the international reputation of the UK is on trial in the Brexit disputes over fishing rights and Northern Ireland. In an interview with the Financial Times, the president of France said that for Johnson, the UK prime minister, and his government the issues represented "a test of their credibility". Although Macron said he was sure of "goodwill" on the British side, he warned that other nations were watching closely. (FT)

BREXIT: Lord Frost and his EU counterpart Maros Sefcovic will meet next week after the latest talks on the Northern Ireland Protocol failed to produce agreement. The UK wants fundamental changes to the protocol's operation and governance. The EU has proposed a more modest package of measures which would reduce its practical impact. A UK spokesman said: "While there is some overlap between our positions on a subset of issues, the gaps between us remain substantial." He added: "Our position remains that substantial changes to the protocol will be needed if we are to find a sustainable solution that works in the best interests of Northern Ireland." An EU spokesman said: "It is now essential to find common ground between the EU and UK's respective positions. "We owe it to the people of Northern Ireland to find stable solutions as soon as possible." (BBC)

BREXIT: Brexit minister Lord Frost has claimed the European Union has behaved "without regard to the huge political, economic and identity sensitivities" in Northern Ireland. (Sky)

BREXIT: Brussels has warned the UK not to "embark on a path of confrontation", amid tensions over Northern Ireland and post-Brexit fishing rights. Ahead of a crunch week for UK-EU relations, Marcos Sefcovic, a European Commission vice-president, urged Lord Frost, his British counterpart, to back down and reconsider the EU's proposals to reduce checks on British goods entering Northern Ireland under the protocol. Writing in The Telegraph, Mr Sefcovic said: "I am increasingly concerned that the UK Government will refuse to engage with this and embark on a path of confrontation." Mr Sefcovic's intervention comes after Boris Johnson accused France on Sunday of breaking the "spirit and letter" of the UK's Brexit settlement with the EU, as the cross-Channel spat over fishing grew increasingly bitter. (Telegraph)

BREXIT: The UK could respond in turn if France goes ahead with threats amid a row over post-Brexit fishing rights, Environment Secretary George Eustice has said, warning "two can play at that game". France said it could stop UK boats landing in its ports if the row over licences was not resolved by Tuesday. The UK government warned it could start "rigorous" checks on EU fishing activities in response. (BBC)

BREXIT: Sir Jeffrey Donaldson has denied backtracking on a threat to pull out of the executive if his Northern Ireland Protocol demands are not met by the end of October. The DUP leader also issued a new threat over any government move to legislate for Irish language at Westminster. Brexit Minister Lord Frost met his EU counterpart Maros Sefcovic on Friday as part of ongoing talks on the protocol. (BBC)

BREXIT: Britain is "actively considering" legal action against France as tensions escalate over post-Brexit fishing rights. Paris is threatening to block British boats from landing their catch at French ports while tightening checks on vessels. The UK has been given until Tuesday to grant more licences for small French boats to fish in British waters or face sanctions. (Sunday Times)

BREXIT: Almost twice as many voters now believe Brexit is having a negative effect on the UK economy as think it is benefiting the nation's finances, according to the latest Opinium poll for the Observer, carried out during budget week. The survey comes after Richard Hughes, the chairman of the Office for Budget Responsibility, said his organisation calculated that the negative impact on GDP caused by the UK's exit from the EU was expected to be twice as great as that resulting from the pandemic. Hughes said Brexit would reduce the UK's potential GDP by about 4% in the long term, while the pandemic would cut it "by a further 2%". "In the long term, it is the case that Brexit has a bigger impact than the pandemic," he said. (Observer)

POLITICS: While Opinium found evidence of clear anxiety about Brexit, this has yet to translate into a negative effect on support for the Tory party. The Conservatives are on 40%, down 1 point compared with a fortnight ago, while Labour is down 2 points on 35%. The Lib Dems are on 8%, the Green party 7%, the SNP 5% and Plaid Cymru 1%. (Observer)

EUROPE

ECB: Christian Lindner, the pro-business leader pushing to become Germany's next finance minister, warned the European Central Bank must resist the temptation to help out highly indebted euro countries as inflation accelerates. (BBG)

GERMANY: German Chancellor Angela Merkel warned in a newspaper interview that people should continue to take Covid-19 seriously as the latest wave of infections reached its highest level since May 3. Trends in hospitalization and death rates "worry me a lot," Merkel is quoted as saying in an interview with Frankfurter Allgemeine Sonntagszeitung. "They should worry us all." (BBG)

GERMANY: German Health Minister Jens Spahn called for a summit with state and federal leaders to discuss a uniform strategy on Covid-19 boosters, saying in a newspaper interview that the country must move quickly to halt another wave of infections. (BBG)

PORTUGAL: Portugal's president said on Sunday he would address the nation this week on the country's political crisis and is likely to announce his decision to dissolve parliament, triggering an election two years ahead of schedule. Parliament threw out the minority Socialist government's draft state budget for 2022 last week and while the rejection of the bill does not necessarily imply an election, the president warned he would have no option but to call it. (RTRS)

IRELAND: Growth in the Irish manufacturing sector further strengthened in October even with businesses adding capacity to meet demand and evidence that rising costs are being passed on to the rest of the economy. AIB's purchasing managers index (PMI) measures the strength of the sector based on a survey of hundreds of private sector managers. The latest data shows Ireland shrugging off an inflationary squeeze that has slowed output in China and clipped the pace of growth in Germany, at least for now. The price for that continued Irish expansion is output prices for manufactured goods rising at an unprecedented pace, a trend that will ultimately hurt competitiveness, if it is sustained. (Irish Independent)

RATINGS: Sovereign rating reviews of note from Friday include:

- Fitch affirmed Germany at AAA; Outlook Stable

- Fitch affirmed Slovakia at A; Outlook revised to Stable from Negative

- S&P affirmed the Czech Republic at AA-; Outlook Stable

- DBRS Morningstar confirmed Italy at BBB (high), Trend changed to Stable from Negative

U.S.

FED: The Trimmed Mean PCE inflation rate over the 12 months ending in September was 2.3 percent. According to the BEA, the overall PCE inflation rate was 4.4 percent on a 12-month basis, and the inflation rate for PCE excluding food and energy was 3.6 percent on a 12-month basis. (Dallas Fed)

CORONAVIRUS: The Food and Drug Administration on Friday authorized the use of Pfizer and BioNTech's Covid-19 vaccine for children ages 5 to 11, a move that will make the shots available to 28 million kids in the U.S. The Centers for Disease Control and Prevention must sign off before shots can be distributed. It's scheduled an advisory committee meeting to review the pediatric doses next week and is expected to swiftly clear them for public distribution immediately thereafter. (CNBC)

CORONAVIRUS: Moderna said the Food and Drug Administration will need more time to complete its assessment of the biotech company's Covid-19 vaccine for children ages 12 to 17. The agency is looking specifically at the risk of myocarditis in kids, Moderna said in a statement Sunday, and the review may not be completed before January 2022. Myocarditis is the inflammation of the heart muscle. (CNBC)

CORONAVIRUS: Delaying President Joe Biden's federal vaccine mandates until after Christmas would be "a big mistake," Secretary of Commerce Gina Raimondo said. (BBG)

CORONAVIRUS: President Joe Biden's administration is planning to encourage schools to set up regular Covid-19 testing for students and staff, ABC News reports. Biden had pledged $10 billion in March to help with the efforts, but some states rejected their slice of the funding and some schools have been slow to implement testing plans. Resources in the new initiative include sharing testing providers to make it easier to launch the screenings. The administration and The Rockefeller Foundation will also host webinars connecting experts and districts twice a week. (BBG)

CORONAVIRUS: More than a dozen states sued President Joe Biden over his vaccine mandate for federal contractors, arguing the initiative forces Americans to choose between their jobs and their constitutional rights. The U.S. constitution doesn't give the federal government the right to dictate "any and every facet of its citizens' lives," Texas Attorney General Ken Paxton said in one of the complaints, filed Friday night in federal court in Galveston, Texas. (BBG)

CORONAVIRUS: The state of Colorado, where the Covid-19 vaccination rate is one of the highest in the U.S., will allow overwhelmed hospitals to turn away new patients, the governor's office announced Sunday. (BBG)

CORONAVIRUS: The Chicago city council Friday voted to keep Mayor Lori Lightfoot's vaccination policy in place. The city's policy requires that employees reported vaccine status by Oct. 15 or be subject to weekly testing through the end of the year, when all employees without medical or religious exemptions get vaccinations. The policy has faced pushback among some police and firefighters. (BBG)

CORONAVIRUS: Vaccination rates among New York City's police, fire and sanitation departments rose as workers faced possible suspension on Monday. The city is bracing for gaps in public health and safety, with tens of thousands of essential public workers still not vaccinated under the mandate imposed by Mayor Bill de Blasio. The New York Police Department said its vaccination rate had risen to 84%, from 79% on Thursday. The Fire Department's numbers rose to 77% from 69% the day before. (BBG)

CORONAVIRUS: White House Press Secretary Jen Psaki has been diagnosed with Covid-19, sidelining President Joe Biden's top spokesperson. "While I have not had close contact in person with the president or senior members of the White House staff since Wednesday – and tested negative for four days after that last contact -- I am disclosing today's positive test out of an abundance of transparency," she said in a statement. "I last saw the president on Tuesday, when we sat outside more than six-feet apart, and wore masks." She bowed out of Biden's trip with the White House citing a family emergency. (BBG)

POLITICS: Virginia gubernatorial candidates Terry McAuliffe and Glenn Youngkin remain neck-and-neck in polls ahead of next week's highly competitive race for governor, but Democrats lead in early voting. McAuliffe, the former Democratic governor who is seeking a comeback, leads his Republican opponent Youngkin by one percentage point in a Washington Post-Schar School poll released Friday. (CNBC)

FISCAL: House Democratic leaders are telling lawmakers they plan to pass both a $1.2 trillion infrastructure bill and a $1.75 trillion social spending bill as early as Tuesday, two sources familiar with the conversations tell Axios. It's a very ambitious timeline, but leadership is eager to deliver a win to President Biden while he meets with world leaders in Europe. (Axios)

OTHER

GLOBAL TRADE: The U.S. and the European Union have concluded a trade truce on steel and aluminum that will allow the allies to remove tariffs on more than $10 billion of their exports each year. Negotiators reached an agreement Saturday as they worked to balance market demands and climate change, said National Security Adviser Jake Sullivan, speaking on the sidelines of a Group of 20 summit in Rome. Bloomberg reported earlier that the two sides were on the brink of a deal. (BBG)

GLOBAL TRADE: President Joe Biden convened a summit on Sunday during the annual gathering of G-20 leaders to address supply-chain challenges and other disruptions affecting global commerce. "Supply chains are something that most of our citizens never think twice about until something goes wrong. And during this pandemic, we've seen delays and backlogs of goods from automobiles to electronics, from shoes to furniture," Biden said in his debut at the G-20 since becoming president. "Ending the pandemic is the ultimate key to unlocking the disruptions we're all contending with. But, we have to take action now, together with our partners in the private sector, to reduce the backlogs that we're facing," he said. "Now that we have seen how vulnerable these lines of global commerce can be, we cannot go back to business as usual." (CNBC)

GLOBAL TRADE: Leaders of the world's 20 major economies have approved a global agreement that will see the profits of large businesses taxed at least 15%. It follows concern that multinational companies are re-routing their profits through low tax jurisdictions. The pact was agreed by all the leaders attending the G20 summit in Rome. Climate change and Covid are also on the agenda of the summit, which is the leaders' first in-person gathering since the start of the pandemic. (BBC)

U.S./CHINA/TAIWAN: U.S. Secretary of State Antony Blinken and Chinese Foreign Minister Wang Yi locked horns over Taiwan on the sidelines of a Group of 20 summit on Sunday, trading warnings against moves that could further escalate tensions across the Taiwan Strait. In an hour-long meeting in Rome, Blinken made "crystal clear" that Washington opposes any unilateral changes by Beijing to the status quo around Taiwan,a senior State Department official said. A recent increase in Chinese military exercises in Taiwan's air defence identification zone, including what Taipei said were eight such flights on Sunday, is part of what it views as stepped-up military harassment by Beijing. (RTRS)

CORONAVIRUS: A US intelligence agency has spelt out for the first time how and why it thinks the virus that causes Covid-19 first jumped from animals to humans via an accident at the Wuhan Institute of Virology. According to the report, analysts at the unnamed agency believe the dangerous nature of the science being carried out at the Wuhan lab and the lack of safety precautions make it most likely that it is the source of the pandemic. However, the same report says several other agencies do not hold that view, though they were less confident in their own conclusions. (FT)

CORONAVIRUS: China said the U.S. report on virus orgins is "a lie." It also urged the U.S. to stop attacking and smearing the Asian nation, China's foreign ministry spokesman Wang Wenbin said in a statement Sunday. (BBG)

JAPAN: State broadcaster NHK reports that the ruling Liberal Democratic Party secured 261 seats and retained a single-party majority in the House of Representatives. Despite reducing its representation from the pre-election 276 seats, the LDP managed to reach the crucial threshold of "absolute stable majority," just.

- While only 233 seats are required to form a simple majority in Japan's lower house, commanding an "absolute stable majority" allows to dominate all 17 standing committees and nominate their chairpersons, smoothing the passage of legislation.

- Initial exit polls and early results suggested that the LDP could lose its single-party majority. It regained poise as the vote count progressed, eventually achieving a result which means it will not rely on coalition partner Komeito to pass bills. Komeito won 32 seats, up from 29 held before the election.

- The main opposition Constitutional Democratic Party of Japan's seat count stands at 96, down from the 109 seats it had before the election. It is an underwhelming result in the light of the pact formed by five opposition parties, whereby they fielded joint candidates in some 70% of single-seat districts.

- The right-leaning Nippon Ishin no Kai increased its representation by almost four times and secured 41 seats. This means that Nippon Ishin will replace Komeito as the third-largest party in the House of Representatives.

- Despite the party's generally solid performance, some veteran LDP lawmakers lost in their home constituencies. Secretary General Amari and faction chief Ishihara suffered most high-profile defeats. (MNI)

BOJ: MNI INSIGHT: BOJ May Consider 10-Yr Yield If Yen Hits 125 Fast

- A problematic weakening of the yen which begins to undermine corporate profits and economic momentum could prompt the Bank of Japan to consider raising its 10-year yield curve control target from around zero percent, with a rapid move to JPY125 seen as a possible threshold for economic pain, MNI understands - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA/NEW ZEALAND: Australia has further loosened its tight border controls, with fully vaccinated tourists arriving from New Zealand permitted to fly there without quarantining starting from late Sunday evening. Quarantine-free travel will initially be limited to those arriving in New South Wales and Victoria, the two jurisdictions that have scrapped the isolation requirement for vaccinated international travelers. (BBG)

NEW ZEALAND: Retailers in Auckland, New Zealand's largest city, will be allowed to reopen next week after being closed for almost three months during a lockdown. Prime Minister Jacinda Ardern said shops in the city can begin operating from midnight on Nov. 9. Public facilities will also reopen and the number of people who can gather outdoors will increase to 25. However, Auckland will remain at Alert Level 3, meaning many lockdown restrictions will stay in place, as the delta variant of Covid-19 continues to spread. (BBG)

BOC: Bank of Canada Governor Tiff Macklem, speaking in an interview with Radio-Canada, said the central bank is prepared to adjust policy if needed to bring inflation back to its 2% target. (BBG)

TURKEY: President Joe Biden and Turkish President Recep Tayyip Erdogan sought to defuse tensions over Turkey's failed bid to buy fighter jets from the U.S. at a meeting on Sunday in Rome, focusing instead on their broader defense interests as NATO allies. "I've seen a positive approach from Mr. Biden," Erdogan told reporters later, saying he urged the U.S. leader to convince Congress to permit the sale of F-16 fighter jets to Turkey. They also discussed a dispute over $1.4 billion that Turkey paid for F-35 warplanes that it was subsequently barred from receiving, the Turkish leader said. (BBG)

MEXICO: The Biden administration on Friday announced its second attempt to terminate a Trump-era border policy that forces asylum seekers to stay in Mexico until their U.S. immigration court date. This comes two weeks after the administration complied with a Texas federal judge's order to reinstate the policy, known as "Remain in Mexico," by mid-November. (CNBC)

BRAZIL: Brazil's sale of power utility Eletrobras in 2022 is unlikely to happen, with concerns over a shortfall in revenue and an election skewing the government's timeline, said a person familiar with the talks. The country's audit court, which needs to green-light the operation, considers that the government has underestimated in at least 10 billion reais ($1.8 billion) the revenue it expects to obtain from the privatized company once it renews licenses for the operation of hydro power plants and transmission lines, the person said, asking not to be named because the matter isn't public. (BBG)

BRAZIL: Brazil's Treasury works closely with the central bank, and if necessary, the two institutions will act together, Treasury Secretary Paulo Valle said during a press conference. (BBG)

RUSSIA: Russia's unemployment rate fell to a two-year low in August and retail sales beat analyst forecasts, but real wages grew slower than expected in July, indicating Russia's economic rebound may not be entirely smooth, data showed on Friday. (RTRS)

IRAN: Iran's foreign minister said on Sunday that if the United States was serious about rejoining Tehran's 2015 nuclear deal with world powers, President Joe Biden could just issue an "executive order", the state-owned Iran newspaper reported. (RTRS)

IRAN: U.S. Secretary of State Antony Blinken said on Sunday that the United States was "absolutely in lock step" with Britain, Germany and France on getting Iran back into a nuclear deal, but added it was unclear if Tehran was willing to rejoin the talks in a "meaningful way." Blinken's remarks in an interview with CNN on Sunday come a day after the United States, Germany, France and Britain urged Iran to resume compliance with a 2015 nuclear deal in order to "avoid a dangerous escalation." (RTRS)

IRAN: U.S. President Joe Biden and the leaders of Germany, France, and the U.K. said they still see a chance to revive a deal with Iran over its nuclear program, but that Tehran must change course before any relief on sanctions. "We are convinced that it remains possible to quickly reach and implement an understanding on return to full compliance to ensure for the long term that Iran's nuclear program is exclusively for peaceful purposes, and to provide sanctions lifting with long-lasting implications for Iran's economic growth," the leaders said in a joint statement after meeting during the Group of 20 summit in Rome. "This will only be possible if Iran changes course." (BBG)

IRAN: The Iranian Foreign Ministry said on Friday new US sanctions imposed against Tehran's military drone program contradicted Washington's claim to seek a return to the 2015 Iran nuclear deal, state media reported. "The imposition of new sanctions reflects the completely contradictory behavior of the White House (which) speaks of its intention to return to the nuclear accord and continues to impose sanctions," Foreign Ministry spokesman Saeed Khatibzadeh told state media. (Jerusalem Times)

ENERGY: Gazprom PJSC said it's meeting European demand in full after German data showed natural-gas flows through a key transit route reversed direction. Shipments from the Yamal-Europe pipeline toward Germany's Mallnow station went to zero early Saturday, according to data from the grid operator Gascade. Instead, it reported so-called reverse flows, with gas going eastward through the station from Germany toward Poland. (BBG)

ENERGY: President Emmanuel Macron has warned that an energy crisis threatens the world's post-pandemic recovery. (FT)

OIL: King Salman said on Saturday Saudi Arabia will continue supporting the stability and balance of oil markets, and also backs efforts to supply clean energy to the world. (RTRS)

OIL: A daily increase of 400,000 barrels in oil output would be enough to meet demand, according to Iraqi Minister Ihsan Abdul Jabbar. (BBG)

OIL: U.S. President Joe Biden on Saturday urged major G20 energy producing countries with spare capacity to boost production to ensure a stronger global economic recovery as part of a broad effort to pressure OPEC and its partners to increase oil supply. (RTRS)

OIL: The Biden administration's senior energy official on Sunday blamed the Opec oil "cartel" for soaring petrol prices in the US, putting more pressure on the group to increase crude output ahead of a meeting later this week. "Gas prices of course are based on a global oil market. That oil market is controlled by a cartel. That cartel is Opec," said Jennifer Granholm, the US energy secretary, on NBC's Meet the Press. "So that cartel has more say about what is going on." (FT)

OIL: For the past year, oil consuming countries have become increasingly anxious at crude's resurgence: first to $50 a barrel, then $75 and now to more than $85. And when Vladimir Putin, one of the leaders of the OPEC+ cartel, warned that $100 a barrel was a distinct possibility, the alarm bells really started ringing. Now, as quickening inflation pushes some central banks toward earlier-than-expected interest rate hikes, the U.S. India, Japan and other consuming countries are putting the strongest diplomatic pressure on the cartel in years. Behind closed doors, an intense campaign is being waged to persuade OPEC+ to speed up its output increases, according to multiple diplomats and industry insiders involved in the contacts. The cartel, which meets virtually on Nov. 4 to review policy, is currently boosting output at a rate of 400,000 barrels a day each month. The private efforts come on top of recent public appeals. The Biden administration is increasingly alarmed by rising gasoline prices that have reached a 7-year high, and has been calling on OPEC+ for weeks to pump more oil. Japan, the world's fourth-largest oil consumer, took the rare step of adding its voice to those calls in late October -- a first for Tokyo since 2008. India, the third-largest consumer, has also asked for more crude. China has been silent in public, but is equally vocal in private, diplomats said. (BBG)

OIL: China will release state oil product reserves to the domestic market to offset a supply shortage and stabilize prices in certain regions, the country's National Food and Strategic Reserves Administration said on Oct. 31. With the approvals from National Development and Reform Commission and the Ministry of Finance, the NFSRA has started its annual state oil product reserves rotation. The release from this annual rotation aims to increase gasoil and gasoline supplies in the domestic market to offset shortages, serving its role to adjust market fundamentals, the administration announced on its website. (Platts)

CHINA

PROPERTY: China's indebted developers are struggling to meet Beijing's tighter financing rules. Two-thirds of the top 30 Chinese property firms by sales ranked by the China Real Estate Info Corp. have breached at least one of the metrics known as the "three red lines," Bloomberg-compiled data showed as of Oct. 29. (BBG)

PROPERTY: Who will survive in China's property sector is becoming a key question for investors as the country's credit market undergoes its biggest shakeout in years. A surge in Chinese junk dollar bond yields in October, briefly reaching 20%, has made it all but impossible for stressed developers to refinance their maturing debt. Such firms have just over $2 billion of onshore and dollar-bond payments due in November, according to data compiled by Bloomberg. At least four builders defaulted last month, while China Evergrande Group twice averted that fate by paying overdue coupons at the 11th hour. (BBG)

YUAN: Offshore yuan deposits are expected to further increase due to the currency's recent appreciation and China maintaining interest rates, the 21st Century Business Herald reported citing Lin Junhong, a research head at the Shanghai Commercial Bank. In September, yuan deposits in Hong Kong increased by 1.6% m/m to CNY855.9 billion, the highest in six years. The further deepening of cross-border linkages such as those for stocks and bonds also drove demand for offshore yuan, though it is only the first stage of yuan internationalization as funds are still under closed-loop management, the newspaper said citing Ba Shusong, the chief China economist of the Hong Kong Stock Exchange. Ba suggested more cross-border transactions in yuan or keeping the funds after assets get sold in Hong Kong in the future, according to the newspaper. (MNI)

YUAN: The Chinese yuan may still be under depreciation pressure given the U.S. dollar is likely to strengthen as the Federal Reserve starts to reduce debt purchases, said the Financial News, a newspaper of the People's Bank of China, citing an unidentified expert. The dollar is due for a technical rebound, as it has fallen a lot after the U.S. Q3 GDP data was announced last week, the newspaper said. (MNI)

POLICY: Promoting more infrastructure investment will be significant for China countering the economic slowdown and improving economic efficiency, the official newspaper Economic Daily said in an editorial. As more projects get approved, infrastructure spending is expected to provide a more significant boost to the economy in the fourth quarter, the newspaper said. Authorities should properly use local government special bonds, REITs and other policy tools to create more funding for infrastructure, said the newspaper. Separately, the newspaper said China has accelerated the issuances of local government bonds, with Q3 local debt amounting to CNY1.4 trillion, providing funding for "strategic projects" such as transportation and social programs, and many local governments have begun to plan applications for special-purpose bonds next year. (MNI)

EQUITIES: China published a set of rules for the newly established Beijing Stock Exchange on Saturday, moving a step closer toward the official launch of a market designed to fund innovative startups. The exchange was set up last month in the Chinese capital, complementing two other bourses in the business hub of Shanghai and the southern city of Shenzhen. Establishing the Beijing Stock Exchange is part of President Xi Jinping's strategic scheme to develop China's capital markets, and will support innovation and small- and medium-sized enterprises (SMEs), the China Securities Regulatory Commission (CSRC) said on Saturday. (RTRS)

EQUITIES: FTSE Russell is considering major changes to the index underpinning a widely used China futures contract in Singapore, including potentially doubling the benchmark's constituents, after Hong Kong's stock exchange broke its rival's monopoly on the highly popular trade. Arne Staal, chief executive of FTSE Russell, said the company may tweak its FTSE China A50 index — a critical tool for international traders seeking to hedge their exposure to Chinese shares — in response to investor feedback. Traded volumes on the Singapore Exchange's (SGX's) A50 index futures have risen 20 per cent year-on-year to 9.3m contracts, according to FTSE Russell and SGX. (FT)

BONDS: China should expand the issuance of yuan-denominated treasury bonds as "safe-haven assets" for foreign investors to raise the country's status in the global financial system, the China Daily reported citing Zhang Ping, the deputy director of the National Institution for Finance and Development. To promote yuan usage, China should allow more foreign investors to hold yuan assets, either under the capital account or through the opened yuan-denominated financial product trading, the newspaper said citing Zhou Chengjun, director of the PBOC's Financial Research Institute. China's internationalization of the RMB is not to challenge the U.S. dollar but to reduce yuan volatility, the newspaper cited Zhou as saying. (MNI)

CORONAVIRUS: China's latest COVID-19 outbreak is developing rapidly, a health official said, as the authorities demanded high vigilance at ports of entry amid growing infections in a northeastern border city caused by the virus arriving from abroad. (RTRS)

CORONAVIRUS: More than 33,000 visitors to Shanghai Disneyland and Disneytown tested negative for Covid-19 after the parks temporarily suspended visitor entries on Sunday to cooperate with a coronavirus investigation. Guests were required to undergo nucleic-acid testing before leaving the resort and a second test is required after 24 hours, Shanghai Disney Resort said in a statement on Weibo on Sunday. Government and Disney officials didn't say what triggered the suspension. Earlier on Sunday, Hangzhou city in eastern China reported that a person who tested positive for Covid-19 had taken a train from Shanghai. (BBG)

OVERNIGHT DATA

CHINA OCT M'FING PMI 49.2; MEDIAN 49.7; SEP 49.6

CHINA OCT NON-MFING PMI 52.4; MEDIAN 53.0; SEP 53.2

CHINA OCT COMPOSITE PMI 50.8; SEP 51.7

CHINA OCT CAIXIN M'FING PMI 50.6; MEDIAN 50.0; SEP 50.0

To sum up, manufacturing recovered slightly in October from the previous month. But downward pressure on economic growth continued. We noticed that the pandemic's impact on manufacturing faded from late September to mid-October as the number of new Covid-19 cases dropped, which boosted demand. However, supply strains became the paramount factor affecting the economy. Shortages of raw materials and soaring commodity prices, combined with electricity supply problems, created strong constraints for manufacturers and disrupted supply chains. Input costs for manufacturers have risen much faster than output prices for several months, putting a lot of pressure on downstream enterprises. (Caixin)

JAPAN OCT, F JIBUN BANK M'FING PMI 53.2; FLASH 53.0

October PMI data pointed to a stronger expansion in the Japanese manufacturing sector at the start of the fourth quarter. The rate of growth quickened from September amid renewed expansions in both production and new orders. Overall, the headline Manufacturing PMI was at its highest reading since April and the second-highest in the year to date. Manufacturers continued to note concern regarding significant supply chain disruption which dampened output and demand in the latest survey period. Moreover, material shortages and delivery delays induced sharp rises in input prices, as average cost burdens rose at the sharpest pace since August 2008. This contributed to higher charges for clients in attempts to cover margins, with factory gate inflation quickening to a 13-year high. That said, Japanese manufacturers commented that the degree of optimism regarding the outlook strengthened in October. Confidence about the outlook reached the highest level since the series began in July 2012, as hopes that the end of the pandemic would stimulate a broad market recovery gathered pace. This is broadly in line with the IHS Markit forecast for industrial production to grow 7.1% this year and 4.3% in 2022. (IHS Markit)

JAPAN OCT VEHICLE SALES -30.2% Y/Y; SEP -30.0%

AUSTRALIA OCT, F MARKIT M'FING PMI 58.2; FLASH 57.3

The easing of COVID-19 restrictions triggered an improvement in manufacturing sector conditions in October according to the latest IHS Markit Australia Manufacturing PMI. The gradual normalisation of economic conditions from a state of widespread lockdowns in Australia had inspired better confidence among manufacturers, as evident across their hiring and purchasing activity, and also measured through the Future Output index which reflects business sentiment. That said, supply constraints remained severe while price pressures and labour issues persisted which remain issues worth monitoring. As demand eases following the post-lockdown surge, the demand-supply imbalance is expected to improve. Until then, the Backlogs of Work Index may remain a good indication to the extent at which capacity constraints are accumulating in the Australian manufacturing sector. (IHS Markit)

AUSTRALIA OCT ANZ JOB ADVERTISEMENTS +6.2% M/M; SEP -2.8%

With Sydney, Melbourne and Canberra emerging from their prolonged lockdowns, ANZ Job Ads rose 6.2% m/m in October. This put it back on par with the June peak prior to the Delta lockdowns. (ANZ)

AUSTRALIA OCT CORELOGIC HOUSE PRICE INDEX +1.4% M/M; SEP +1.5%

AUSTRALIA OCT MELBOURNE INSTITUTE INFLATION +3.1% Y/Y; SEP +2.7%

AUSTRALIA OCT MELBOURNE INSTITUTE INFLATION +0.2% M/M; SEP +0.3%

AUSTRALIA SEP HOME LOANS VALUE -1.4% M/M; MEDIAN -2.0%; AUG -4.3%

AUSTRALIA SEP OWNER-OCCUPIER LOAN VALUE -2.7% M/M; MEDIAN -4.3%; AUG -6.6%

AUSTRALIA SEP INVESTOR LOAN VALUE +1.4% M/M; MEDIAN -4.0%; AUG +1.5%

AUSTRALIA OCT COMMODITY INDEX AUD 129.8; SEP 126.6

AUSTRALIA OCT COMMODITY INDEX SDR +40.7% Y/Y; SEP +36.8%

SOUTH KOREA OCT TRADE BALANCE +$1.690BN; MEDIAN +$2.100BN; SEP +$4.205BN

SOUTH KOREA OCT EXPORTS +24.0% Y/Y; MEDIAN +28.5%; SEP +16.7%

SOUTH KOREA OCT IMPORTS +37.8% Y/Y; MEDIAN +43.0%; SEP +31.0%

SOUTH KOREA OCT MARKIT M'FING PMI 50.2; SEP 52.4

October data provided proof that ongoing raw material shortages and supply chain issues began to bite in the South Korean manufacturing sector at the start of the fourth quarter of 2021. The latest Manufacturing PMI reading slowed significantly from the previous month and pointed to a broad stagnation in operating conditions. The slowdown came amid a renewed contraction in output, and one that was the sharpest since July 2020. Moreover, total new order growth eased to a marginal pace, amid a stagnation in foreign demand. The latest data provided the first indication that sustained supply chain disruption had directly impacted activity. The impact of shortages has also been clear in rising raw material prices, with inflation accelerating to the quickest for three months. In an effort to protect margins, firms passed higher costs on to clients, with factory gate charges rising at the sharpest pace since July. South Korean manufacturers noted that ongoing shortages and disruptions impacted the outlook for output over the coming 12 months. The degree of confidence dipped in October, and was the softest signalled since September 2020. This is broadly in line with current IHS Markit estimates for industrial production to grow just 0.2% in 2022 following a 6.2% increase in 2021. (IHS Markit)

UK OCT LLOYDS BUSINESS BAROMETER 43; SEP 46

CHINA MARKETS

PBOC NET DRAINS CNY190BN VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rates unchanged at 2.2% on Monday. The operation led to a net drain of CNY190 billion after offsetting the maturity of CNY200 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.2000% at 09:26 am local time from the close of 2.3400% on Friday.

- The CFETS-NEX money-market sentiment index closed at 37 on Friday vs 50 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4192 MON VS 6.3907

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4192 on Monday, compared with the 6.3907 set on Friday.

MARKETS

SNAPSHOT: Japanese PM Kishida Outperforms, Familiar Matters Hamper Chinese Manufacturers

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 749.44 points at 29641.34

- ASX 200 up 47.064 points at 7370.8

- Shanghai Comp. up 4.683 points at 3551.735

- JGB 10-Yr future up 14 ticks at 151.46, yield down 0.4bp at 0.095%

- Aussie 10-Yr future up 18.5 ticks at 98.070, yield down 18.3bp at 1.905%

- U.S. 10-Yr future -0-02+ at 130-20, yield up 0.36bp at 1.556%

- WTI crude down $0.40 at $83.17, Gold up $2.68 at $1786.13

- USD/JPY up 30 pips at Y114.25

- PMIS SHOW CHINESE MANUFACTURERS HAMPERED BY SURGING PRODUCER PRICES & ELECTRICITY LIMITS

- JOHNSON SET FOR MACRON COLLISION DURING KEY CLIMATE TALKS (BBG)

- JAPANESE PM KISHIDA RETAINS ABSOLUTE STABLE MAJORITY

BOND SUMMARY: Early Weakness Unwound

The ability of Japanese PM Kishida to hold onto his legislative majority in the weekend's lower house elections removed some political uncertainty and increased the likelihood of notable fiscal support in the coming months, applying pressure to core fixed income markets in Asia, before a recovery later in the overnight session. This outweighed softer than expected official PMI data out of China (which pointed to manufacturers hampered by electricity limitations and surging input prices).

- TYZ1 is a touch lower as a result, -0-03 at 130-19+, 0-05 clear of lows. Bear flattening has been at the fore with yields running little changed to 2.5bp higher across the curve, as the belly leads the weakness. The latest ISM m'fing survey headlines the U.S. docket on Monday, although more focus is on Wednesday's FOMC decision (where a taper announcement is expected) and Friday's NFP print.

- JGB futures ran lower on the aforementioned local political developments, before recovering to last print +10, with yields little changed to ~1bp lower across most of the curve. Domestic equities outperform. PM Kishida failed to offer much new in his post-election address. The outright cheapening and carry and rolldown on offer allowed the cover ratio to tick higher at today's 10-Year JGB auction, after last month's soft offering saw the metric register a multi-year low. Still, the tail saw a slight widening in length vs. the prev. auction, with the low price missing broader dealer exp. (which stood at 99.90, per the BBG dealer poll), as some worry re: the global monetary policy/inflation dynamic & domestic fiscal situation remain evident.

- Aussie bond futures recovered from the early Sydney weakness, YM leading the bid after last week's aggressive bear flattening, with some pre-RBA position squaring/adjustment evident after the dramatic moves witnessed last week and as local participants adjusted to Friday's after-hours recovery from session lows. YM +21.5, XM +18.5 at the close.

JGBS AUCTION: Japanese MOF sells Y2.1205tn 10-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.1205tn 10-Year JGBs:

- Average Yield 0.107% (prev. 0.049%)

- Average Price 99.93 (prev. 100.50)

- High Yield: 0.112% (prev. 0.052%)

- Low Price: 99.88 (prev. 100.47)

- % Allotted At High Yield: 60.6167% (prev. 78.6986%)

- Bid/Cover: 3.137x (prev. 2.452x)

EQUITIES: Japan Outperforms, Hong Kong & China Struggle

A lower degree of political uncertainty and increased scope for the deployment of a notable fiscal package (at least vs. pre-election exp.) in Japan supported local equity markets, which outperformed their major Asia-Pac counterparts in the wake of the weekend's Lower House elections. Elsewhere, soft official PMI data out of China applied pressure to both the Hang Seng & CSI 300, with a net liquidity drain from the PBoC (as it started to unwind its month end provisions) adding further pressure. U.S. e-mini futures have ticked higher, aided by the dynamic in Japan, but sit off the fresh all-time highs registered in the early part of Monday's Asia-Pac session.

OIL: Crude A Touch Lower To Start The Week

WTI & Brent crude futures sit ~$0.25 and ~$0.35 below their respective settlement levels, after China pointed to a release from its strategic petroleum reserves, while the U.S. remains the most vocal of the oil consuming nations when it comes to calling on OPEC to open the supply taps.

- Continued solidarity within the OPEC+ group was noted over the weekend, and cushioned the early losses seen in crude, with Iraq & Angola pointing to a need to maintain the status quo when it comes to the envisaged loosening of production constraints ahead of the group's gathering later this week i.e. 400K bpd of permitted additional cumulative production across participating countries on a M/M basis.

- A reminder that the OPEC+ JTC downgraded its view re: the current tightness of the global oil markets on Friday, indicating less of a need to open the taps.

- Elsewhere, Goldman Sachs reaffirmed its bullish view on crude.

GOLD: Narrow In Asia, Event Risk Later This Week Eyed

Spot gold deals little changed around the $1,785/oz mark after a stronger USD weighed on bullion on Friday, with a light uptick in Tsy yields helping to keep a lid on gold during Asia-Pac hours. The technical picture hasn't really changed since our previous outline on Friday. Participants remain focused on Wednesday's FOMC decision (a tapering announcement is expected) & Friday's U.S. NFP print.

FOREX: JPY Goes Offered As Election Outcome Boosts Bets For Ramped-Up Stimulus

In defiance of forecasts based on pre-election surveys, betting markets and initial exit polls, Japan's ruling Liberal Democratic Party managed to retain a sole "absolute stable majority" in the House of Representatives. This means that the LDP will be able to dominate all standing committees in the lower house without relying on support from its junior coalition partner Komeito. The outcome of the election raised the prospect of a stable political environment and a smooth passage of fiscal stimulus measures promised by PM Kishida. The Nikkei 225 welcomed the news, while the yen headed in the opposite direction, landing at the bottom of the G10 pile.

- Some mild selling pressure hit the AUD amid speculation surrounding tomorrow's RBA monetary policy decision. AUD/USD implied volatilities kept rising across the curve, with 1-week tenor touching best levels since Mar 25.

- Spot USD/CNH stuck to a very tight range, looking through China's PMI data and a slightly softer than estimated PBOC fix. The official m'fing gauge slipped deeper into contractionary territory but the Caixin index unexpectedly improved.

- The greenback caught a bid in afternoon trade, becoming the best G10 performer. The DXY approached its one-month high printed on Friday.

- Manufacturing PMI readings abound today, dominating the global data docket. Looking further afield, it is worth noting that Wednesday's FOMC policy announcement provides the main risk event this week.

FOREX OPTIONS: Expiries for Nov01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1620-30(E985mln), $1.1695-00(E652mln)

- USD/JPY: Y111.00($935mln)

- AUD/USD: $0.7600(A$500mln)

- USD/CAD: C$1.2350($692mln)

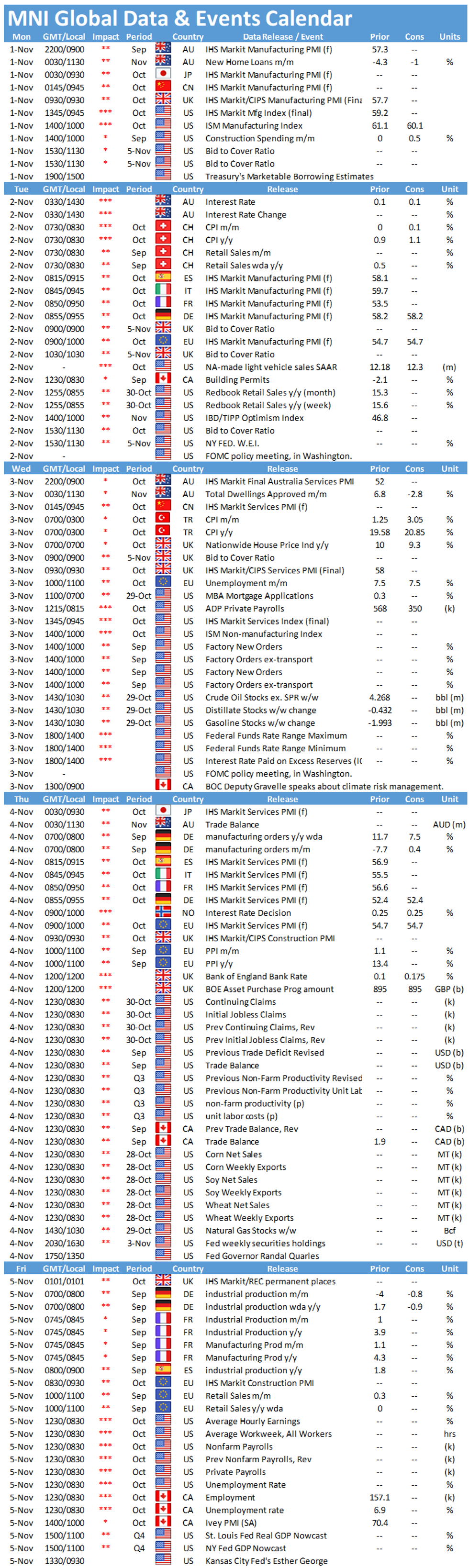

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.