-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY68.6 Bln via OMO Thursday

POSCO (POHANG, Baa1/A-/NR) S.Korea to respond to U.S. tariffs

MNI EUROPEAN OPEN: RBA Pulls YCT, Ambiguous Cash Rate Guidance Adopted

EXECUTIVE SUMMARY

- RBA DROPS YCT, AMBIGUOUS FORWARD GUIDANCE TWEAK DEPLOYED

- PBOC'S LOWER INJECTION NOT SIGNAL OF TIGHTER LIQUIDITY (SEC NEWS)

- CHINESE DEVELOPERS REPAY BONDS EARLY AS CONTAGION SPREADS (BBG)

- FRANCE PULLS BACK IN BREXIT FISH ROW, GIVES TALKS MORE TIME (BBG)

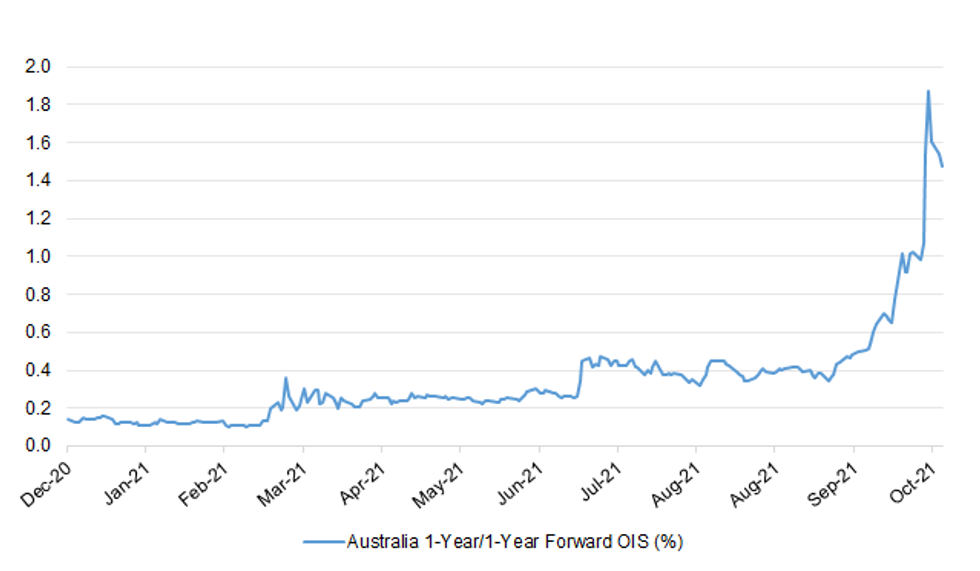

Fig. 1: Australia 1-Year/1-Year Forward OIS (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: France's president Emmanuel Macron backed away from his imminent threat to punish the U.K. for restricting the post-Brexit access of French fishing boats in British waters, saying he would give negotiations more time. "The British are going to come back to us tomorrow with further proposals. We'll see where we are at the end of the day," Macron told reporters in Glasgow, as a French deadline for retaliatory action approached. "We won't be bringing in sanctions while we're negotiating." Macron's decision followed a day of tense negotiations, with the U.K.-France fishing spat at risk of overshadowing the COP26 climate talks. France had threatened to introduce additional customs controls on goods entering from Britain and block its fishing boats from landing their catches in France, if progress wasn't made on issuing extra licenses by midnight on Monday. (BBG)

BREXIT: Brexit minister David Frost said he had accepted an offer from French Europe Minister Clement Beaune to meet. "I look forward to our talks in Paris on Thursday," Frost tweeted. Announcing the invitation to Frost to come for "in-depth discussions", Beaune tweeted that Britain had sent "the first signals... to accelerate exchanges". (France 24)

CORONAVIRUS: The pace of Britain's vaccine booster programme has slowed despite efforts to encourage people to protect themselves for the winter. A drop in Covid-19 cases and half-term holidays are thought to have reduced public urgency to have the jab. (The Times)

FISCAL: Rishi Sunak has denied he raised taxes in the autumn Budget so that he can cut them again ahead of the next general election in order to win more votes - but insisted he will aim to bring the tax burden down before then. The chancellor said the rises announced in his budget last month must be seen in the context of the public services being delivered following the coronavirus pandemic and told MPs that people's quality of life can be boosted by higher taxes. (Sky)

FISCAL: Train companies, the London Underground and other public transport services may need to be subsidised permanently by the taxpayer because too many people are working from home to make them financially viable, the head of the UK's spending watchdog has said. (Telegraph)

EUROPE

GREECE: Greece recorded a new daily high of cases Monday with 5,449 positive tests in 24 hours. It's the second day in a row that the country hit a daily record. The authorities will discuss the imposition of further restrictive measures in areas with high levels of infections on Wednesday. (BBG)

U.S.

ECONOMY: U.S. Treasury Secretary Janet Yellen on Monday said she expects to see some revival of labor force participation over time but that she was uncertain about the degree to which the current drop is transitory or permanent. "Although there's quite a bit of demand for workers now, many workers are remaining outside of the workforce in the U.S. It's a good question, is it transitory or is it permanent, I must say I'm uncertain," Yellen told an event in Dublin. (RTRS)

ECONOMY: MNI INTERVIEW: US Mfg Price Bounce Dents Buyer Demand - ISM

- A second month of rising U.S. manufacturing price pressures appears to have held back new order demand in October, and suggests inflation will remain higher for longer, the Institute for Supply Management chair Tim Fiore told MNI Monday - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: Centrist Sen. Joe Manchin on Monday demanded more time to evaluate the projected impact of President Joe Biden's $1.75 trillion social spending bill, refusing to endorse the framework that Biden had told House Democrats was a done deal in the Senate late last week. Manchin's statement was the latest blow to Democrats, who had hoped to have the bill finalized this week and ready for a vote in the House. Speaking to reporters in the Capitol, Manchin accused House progressives of playing "political games" by refusing to pass a Senate approved infrastructure bill until every Democrat in the Senate endorsed the companion social spending bill. "Holding this [infrastructure] bill hostage is not going to work in getting my support for the reconciliation bill," said Manchin, who represents West Virginia. (CNBC)

FISCAL: White House officials on Monday sought to stay the course in getting an infrastructure bill and larger economic and social spending bill to President Biden's desk after Sen. Joe Manchin (D-W.Va.) threatened to upend plans to hold a vote as early as this week. (The Hill)

FISCAL: Congressional Progressive Caucus Chair Pramila Jayapal on Monday said her caucus is ready to move forward on two bills key to President Joe Biden's agenda "as soon as tomorrow," a significant concession after previously seeking direct assurances from Democratic Sens. Joe Manchin and Kyrsten Sinema on the legislation. Speaking with CNN's Victor Blackwell on "CNN Newsroom," Jayapal said that after spending the weekend reviewing the legislative text and conferring with the progressive caucus, she is ready to pass the $1 trillion bipartisan infrastructure bill as well as the $1.75 trillion social safety net expansion bill once a few details in the latter are finalized. Progressives, who have so far held up the bipartisan measure by demanding a concurrent vote on the larger package, trust that Biden can get all Democratic senators on board with the social safety net legislation, she said. (CNN)

FISCAL: Top Democrat, Rules Committee Chairman Jim McGovern, said his panel would likely meet Wednesday to set the parameters for floor debate on the tax and spending measure. (BBG)

FISCAL/TSYS: MNI BRIEF: US Treasury Raises Q4 Borrowing Estimate by USD312B

- The U.S. Treasury Department on Monday announced it expects to borrow USD1.015 trillion in privately-held net marketable debt in the fourth quarter, USD312 billion more than previously announced in August. Treasury is assuming a cash balance of approximately USD650 billion at the end of December, down USD150 billion from the assumption made in August. For the first quarter in 2022, Treasury plans to borrow USD476 billion, assuming an end-of-March cash balance of USD650 billion. The Treasury's quarterly refunding, which is expected to show coupon cuts, will be released at 8:30 a.m. November 3 - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CORONAVIRUS: The U.S. was set to surpass a new milestone in its vaccination effort on Monday, with 80% of adults having received at least one dose of a vaccine, said Jeff Zients, President Joe Biden's Covid-19 response coordinator. The U.S. entered the day at 79.9% of those 18 and up having one shot. Biden once set a goal of having 70% of adults with at least one shot, and met that in August, a month behind schedule. (BBG)

CORONAVIRUS: The federal Covid-19 vaccine distribution program for children ages 5 to 11 will be "fully up and running" next week if the Centers for Disease Control and Prevention approves Pfizer and BioNTech's doses for that age group, White House coronavirus response coordinator Jeff Zients said Monday. (CNBC)

CORONAVIRUS: An Illinois judge paused a Dec. 31 deadline for Chicago's police officers to be vaccinated, saying the union needed more time to negotiate with the city over the mandate. The union had sued last month to block the mandate. The judge upheld Chicago's separate requirement that every municipal employee report their vaccination status. (BBG)

POLITICS: Early voting hit a record high in Virginia's dead heat governor's race between former Democratic Gov. Terry McAuliffe and Republican Glenn Youngkin. Saturday marked the last day for early voting before the commonwealth's Election Day on Tuesday. (CNBC)

OTHER

GLOBAL TRADE: Apple has cut back sharply on iPad production to allocate more components to the iPhone 13, multiple sources told Nikkei Asia, a sign the global chip supply crunch is hitting the company even harder than it previously indicated. Production of the iPad was down 50% from Apple's original plans for the past two months, sources briefed on the matter said, adding that parts intended for older iPhones were also being moved to the iPhone 13. (Nikkei)

CORONAVIRUS: Novavax Inc.'s top executive said the company's Covid-19 vaccine could be a good booster option for people who have received other shots, as the drugmaker looks to ramp up output and gain approvals around the world. "Our vaccine is ideal for boosting," Chief Executive Officer Stanley Erck said in an interview on Monday with Bloomberg Television. (BBG)

JAPAN: Japanese Finance Minister Shunichi Suzuki said on Tuesday that he would keep an eye on the foreign exchange market, describing the yen as "weakening" recently and stressing the importance of stability in the market. Suzuki told reporters after a cabinet meeting that he would refrain from commenting on whether the yen was weak or strong to avoid influencing market moves. "Currency stability is important," he added. (RTRS)

JAPAN: Japan looks to let foreigners visit the country for short business trips, study abroad and technical training in an easing of its strict coronavirus-related entry rules, Nikkei has learned. Tourists are not included in this round. The government is expected to announce the policy changes as early as this week, with implementation to begin this month. (Nikkei)

JAPAN: The leader of Japan's main opposition party will step down from his post after his group suffered a stinging setback in a national election Sunday. Yukio Edano said in a statement Tuesday he will resign as leader of the Constitutional Democratic Party, the left-leaning party he's run since its formation in 2017. He added he would stay on until after a special parliamentary session expected for this month. (BBG)

RBA: The Reserve Bank of Australia bowed to market pressure Tuesday, abandoning a bond-yield target after an acceleration in inflation spurred traders to price in higher borrowing costs. The decision to scrap the 0.1% yield target on the April 2024 security comes after a bond market selloff last week and amid an improving domestic outlook underpinned by high vaccination rates. The RBA kept its cash rate at a record low 0.1%, as expected. "Given that other market interest rates have moved in response to the increased likelihood of higher inflation and lower unemployment, the effectiveness of the yield target in holding down the general structure of interest rates in Australia has diminished," Governor Philip Lowe said in a post-meeting statement. The currency dropped after Lowe said it was still "likely to take some time" for inflation to sustainably return to its target. Short-end sovereign bonds also erased losses as the RBA damped bets for an aggressive tightening from here. Australia is now caught up in the global inflation debate that's seen bond markets press policy makers worldwide to act promptly to counter rising price pressures. Data last Wednesday showed Australia's core consumer prices jumped back inside the RBA's 2-3% target for the first time in six years, sending yields surging. While it is possible that interest rates may not change until 2024, it is now plausible that the cash rate may be lifted in 2023, Lowe said in a Q&A session by webinar after the policy announcement. (BBG)

AUSTRALIA: Cases have continued to fall in Australia's two most populous states, as the country starts to reopen following more than 19 months of harsh restrictions. Victoria state on Tuesday reported 989 new cases, the first time below 1,000 since Sept. 29. New South Wales state recorded 173 new cases and the lowest seven-day average since Aug. 5. (BBG)

AUSTRALIA: Australia's New South Wales state pushed back the date when Covid-19 restrictions will be eased for unvaccinated people. Instead of Dec. 1, those curbs will be eased on Dec. 15 or whenever the state reaches 95% double-dose coverage for people aged 16 and above, Premier Dominic Perrottet said Tuesday. (BBG)

RBNZ: House prices should ease in New Zealand in the medium term once the supply of new dwellings exceeds demand, the central bank governor said. Fast-rising house prices have largely been driven by the inability of housing supply to respond to population growth and low interest rates, Reserve Bank of New Zealand Gov. Adrian Orr said in a speech on Tuesday. "Houses have been scarce at a time that demand was strong. The reverse is now evolving -- with housing building at record levels at a time that population growth is static," he said. Interest rates do affect demand for housing, but it's not the central bank's mandate to target house prices using monetary policy, Mr. Orr said. (Dow Jones)

NEW ZEALAND: New Zealand put the north of its Northland region back into lockdown as the source of two new cases in the area remains unknown. The area moves back to Level 3 lockdown at midnight, initially through midnight Nov. 8. The rest of Northland stays at Level 2. Northland's vaccination rate is lower than the rest of the country at just 79% for first doses, increasing the risk for 11,000 unvaccinated Maori in the region, said Covid-19 Response Minister Chris Hipkins. (BBG)

SOUTH KOREA: South Korea will buy back 2t won of bonds in an emergency move to cap bond market volatility, finance ministry says in a statement. (BBG)

BOK: Bank of Korea says 2021 inflation may be above Aug. forecast of 2.1%. BOK closely monitoring possibility of prolonged raw material price increase. To pay attention to possibility that global supply bottleneck would increase price pressure in S. Korea. (BBG)

BOC: MNI INTERVIEW: Pitfalls Seen in BOC Apr Rate Hike - Ex Staffer

- The Bank of Canada will wait until July before raising the record low 0.25% interest rate because moving sooner as the market expects would risk undoing a recovery strained by unemployment and consumer debt, former central bank and finance department economist Charles St-Arnaud told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CANADA: The Ontario government will raise the province's minimum wage to $15 an hour on Jan. 1, 2022. Currently, the minimum wage in Ontario is $14.35. The government will also hike the $12.55 minimum wage for workers who serve alcohol and receive tips to $15. Following these increases, the minimum wage will increase every October according to the inflation rate. (CBC)

RUSSIA: The Russian central bank sees inflationary risks stemming from rising food prices that could keep inflation expectations at an elevated level as well as from high oil prices, the bank said in a report on its monetary policy on Monday. The central bank, which is expected to raise rates for the seventh time next month as it struggles to rein in high inflation, said growth in investment activity in Russia slowed in the third quarter and is expected to slow further this year. (RTRS)

RUSSIA: New commercial satellite photos taken on Monday confirm recent reports that Russia is once again massing troops and military equipment on the border with Ukraine after a major buildup this spring. The new images taken by Maxar Technologies and shared with POLITICO show a buildup of armored units, tanks and self-propelled artillery along with ground troops massing near the Russian town of Yelnya close to the border of Belarus. The units, which began moving in late September from other areas of Russia where they are normally based, include the elite 1st Guards Tank Army. (POLITICO)

CHINA

FISCAL: MNI: Falling Land Sales To Sap China Infrastructure Spending

- Local governments in China face lower revenues from land sales that squeeze budgets and limit the ability to invest in infrastructure projects that are key to rebound from an expected slowdown in growth in Q4 and next year, advisors told MNI - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

PBOC: The PBOC will flexibly use the medium-term lending facilities, open market operations and other tools to inject liquidity with different maturities to ensure the CNY2 trillion gaps in November are "smoothened over," the Securities Times said. A total of CNY1 trillion reverse repos are maturing this week, and another CNY1 trillion MLF will come due in the second half of November, the official securities newspaper said, noting that the overall scale of local government bond issuance is close to CNY900 billion in November. Though the PBOC is less likely to cut RRR, it may roll over maturing MLF and increase reverse repos, the newspaper said. Increased fiscal spending by year end is expected to release CNY1.89 trillion and CNY3.81 trillion to the inter-bank market in November and December, respectively, which can fully cover the impact of government bond issuance, the newspaper said. (MNI)

PBOC: The Chinese central bank's slower injection into the banking system at beginning of November is normal practice and should not be taken as liquidity tightening, Shanghai Securities News reports, citing multiple analysts. The open market operations on Monday is a normal seasonal phenomenon, according to Zhang Xu, chief fixed-income analyst at Everbright Securities. PBOC will continue to use monetary policy tools including the medium-term lending facilities and open market operations in a flexible way to keep liquidity reasonably ample, the report says. (BBG)

PBOC: China's fiscal policy will provide the main support to economic growth next year while significant monetary easing is unlikely, according to a former adviser to China's central bank. "The economy overall really is still okay and we will see average growth this year at around 8%," Huang Yiping, a former member of the People's Bank of China's monetary policy committee, said in an interview with Bloomberg TV. "So the need for aggressive easing is quite limited." (BBG)

ECONOMY: The Chinese government has told families to keep daily necessities in stock in case of emergencies after unusually heavy rains caused vegetable prices to surge and raised concerns about supply shortages. A Commerce Ministry statement late on Monday urged local authorities to do a good job in ensuring supply and stable prices, and to give early warnings of any supply problems. (RTRS)

ECONOMY: The biggest shopping event in the world, Singles Day, is underway but China's e-commerce giants will have to deal with economic growth potentially slowing as well as continued scrutiny from domestic regulators. Singles Day — also known as Double 11 — takes place on Nov. 11 in China and is widely believed to have begun in the 1990s in universities as men celebrated being single. In 2009, Chinese e-commerce giant Alibaba launched the first shopping event on that day, offering heavy discounts on its Tmall shopping platform. Many of China's online shopping companies have since jumped on the bandwagon, making Singles Day bigger than Black Friday and Cyber Monday in the U.S. combined. (CNBC)

BONDS: China's issuance of local government special bonds to fund infrastructure projects may surge in November to over CNY700 billion, the Economic Information Daily reported citing industry estimates. Funds raised from new local government special bonds have mostly supported new projects since H2, with over 40% invested in transportation and urban amenities, which helps drive investments and stabilize the economy, the daily said. The stimulus impact may register in Q4 or early next year, the newspaper said citing analysts. (MNI)

BONDS: China needs to increase economic and financial supervision and risk-prevention capacities to better manage the expected investments in its bonds, the Economic Daily said in an editorial. The inclusion of China's sovereigns into the FTSE World Government Bond Index concluded China's acceptance by all top three global bond indices, a recognition of its reform measures, said the official newspaper. The WGBI is followed by larger and more influential funds, so more capital is expected to flow into China, it said. China should enhance monetary policy coordination and macroprudential framework, including the supervision of its foreign exchange markets, the daily said. (MNI)

CORONAVIRUS: Residents in Beijing are told by the authorities not to leave the city unless necessary and those traveling should postpone returning after new Covid-19 cases are reported, the Global Times reported citing the Beijing Health Commission. New cases have been reported by at least 16 provincial areas in China so far, the newspaper said. Some analysts believe that the measures are also timed ensure the safety of the 2022 Winter Olympics, the newspaper added. (MNI)

CORONAVIRUS: The Chinese capital suspended classes at 18 primary and middle schools in Chaoyang district after a school teacher became infected with Covid-19, according to a local government briefing. A key Communist Party meeting, a central committee plenary session, will be held next week in Beijing. The city reported four new local coronavirus cases on Tuesday morning.

PROPERTY: As stress among Chinese developers mounts, some firms are telegraphing their ability to meet debt obligations. On Monday, Zhenro Properties Group Ltd. said it informed a bond trustee it will redeem its 5.95% dollar notes early in full on Nov. 16. Central China Real Estate Ltd. on Tuesday said it has remitted funds to a trustee for payment of its 6.75% dollar bonds, which are due Nov. 8. "Central China Real Estate becomes one of a string of developers publicly setting aside money to redeem offshore bonds in apparent attempts to set themselves apart from weaker firms," said Daniel Fan, an analyst at Bloomberg Intelligence. (BBG)

OVERNIGHT DATA

JAPAN OCT MONETARY BASE +9.9% Y/Y; SEP +11.7%

JAPAN OCT MONETARY BASE END OF PERIOD Y664.0TN; SEP Y663.5TN

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 108.4; PREV. 106.8

Weekly inflation expectations' is still close to its recent high, dropping just 0.1ppt to 4.9%. The sharp quarterly rise in fuel costs of 7.1% in Australia's Q3 CPI likely had a significant impact on householders' inflationary outlook during these past few months. The close relationship between ABS's Wage Price Index and inflation expectations means it is a key indicator. Critically, however, inflation expectations point to wages growth that is still below the level the RBA has said is needed to ensure inflation will sustainably be in the target band. Consumer confidence jumped 1.5% last week, as all cities came out of lockdown. Confidence was up in NSW (2.0%) and Victoria (5.5%), which more than offset the falls in Queensland (-0.6%), South Australia (-4.3%) and Western Australia (-5.6%). (ANZ)

NEW ZEALAND SEP BUILDING APPROVALS -1.9% M/M; AUG +3.8%

NEW ZEALAND OCT CORELOGIC HOUSE PRICE INDEX +28.8% Y/Y; SEP +27.8%

SOUTH KOREA OCT CPI +3.2% Y/Y; MEDIAN +3.3%; SEP +2.5%

SOUTH KOREA OCT CORE CPI +2.8% Y/Y; MEDIAN +2.6%; SEP +1.9%

SOUTH KOREA OCT CPI +0.1% M/M; MEDIAN +0.2%; SEP +0.5%

CHINA MARKETS

PBOC NET DRAINS CNY190BN VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rates unchanged at 2.2% on Tuesday. The operation led to a net drain of CNY190 billion after offsetting the maturity of CNY200 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1984% at 09:26 am local time from the close of 2.1146% on Monday.

- The CFETS-NEX money-market sentiment index closed at 51 on Monday vs 37 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4009 TUES VS 6.4192

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4009 on Tuesday, compared with the 6.4192 set on Monday.

MARKETS

SNAPSHOT: RBA Pulls YCT, Ambiguous Cash Rate Guidance Adopted

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 126.18 points at 29520.9

- ASX 200 down 46.475 points at 7324.3

- Shanghai Comp. down 53.818 points at 3490.643

- JGB 10-Yr future up 8 ticks at 151.56, yield down 1.5bp at 0.081%

- Aussie 10-Yr future up 1.5 ticks at 98.085, yield down 1.5bp at 1.890%

- U.S. 10-Yr future +0-07+ at 130-28+, yield down 1.04bp at 1.547%

- WTI crude up $0.07 at $84.13, Gold up $0.44 at $1793.77

- USD/JPY down 31 pips at Y113.69

- RBA DROPS YCT, AMBIGUOUS FORWARD GUIDANCE TWEAK DEPLOYED

- PBOC'S LOWER INJECTION NOT SIGNAL OF TIGHTER LIQUIDITY (SEC NEWS)

- CHINESE DEVELOPERS REPAY BONDS EARLY AS CONTAGION SPREADS (BBG)

- FRANCE PULLS BACK IN BREXIT FISH ROW, GIVES TALKS MORE TIME (BBG)

BOND SUMMARY: RBA At The Fore In Asia

There hasn't been much in the way of domestic headline flow for U.S. Tsys to absorb, outside of the Chairman of the House Rules Committee, McGovern, noting that a House panel is likely to meet on Wednesday re: discussions surrounding President Biden's spending plan. More widely, the post-RBA bid in ACGBs has provided a bid for the space, while the lockdown of just under 20 schools in the Chinese capital of Beijing may have exposed some nerves. TYZ1 has hit fresh session highs in recent trade, before easing back a touch, last trading +0-07 at 130-28, while cash Tsys run little changed to 2.0bp richer across the curve, unwinding the early, modest cheapening and more, with bull steepening in play as the front end leads the rally. Flow was headlined by a block buy of TYZ1 (+1,250), while the short end saw a screen lift of the 0EZ1 99.625/99.375/99.125 put fly (+7.5K). There is nothing in the way of notable domestic releases scheduled on Tuesday, which will allow participants to zero in on Wednesday's FOMC meeting.

- The JGB curve has seen some twist steepening, with paper out to 20s little changed to 2.0bp richer as the belly outperforms, while 30s and 40s have seen cheapening of 0.5-1.0bp, perhaps pointing to some worry re: the impact of the impending supplementary budget on long end issuance. Technical steepener interest may also be present, after the likes of the 10-/30-Year yield spread tagged a multi-month low in recent sessions. The space has firmed a little in afternoon trade after BoJ Rinban ops covering 1- to 5- & 10- to 25-Year paper revealed a downtick in cover ratios vs. the prev. ops, while the broader bid in core FI market post-RBA likely provided further support. This allowed futures to firm, last +7 on the day.

- The RBA dropped its YCT mechanism, as expected, adopting a more open-ended round of forward guidance re: the cash rate alongside that move, with a subsequent press conference from Governor Lowe pointing to optionality when it came to a '23/'24 rate hike. This provided a disappointment vs. hawkish market pricing, which was already well in advance of the prior RBA guidance. Wage growth remains at the fore of the Bank's thought process, even with underlying inflation now seen within the target band over the entirety of the Bank's forecast horizon. The front end led the bid that eventually took hold after the initial post-RBA vol. (which was aided by thinned liquidity surrounding the Melbourne Cup). That left YM +6.5 and XM +1.5 come the close, with the early bear steepening morphing into bull steepening.

BOJ: BoJ Makes Rinban Purchase Offers

The BoJ offers to buy a total of Y1.050tn of JGBs from the markets:

- Y450bn worth of JGBs with 1-3 Years until maturity

- Y450bn worth of JGBs with 3-5 Years until maturity

- Y150bn worth of JGBs with 10-25 Years until maturity

EQUITIES: Stocks Generally Softer In Asia Hours

Tuesday's Asia-Pac session was much more sedate than Monday's offering, with most of the major regional benchmark indices ticking lower.

- The Nikkei 225 lost some steam after yesterday's politically-inspired bid, while mainland Chinese equities struggled as the PBoC continued to withdraw month end liquidity provisions. Some noted that the impact surrounding the recent Chinese PMI releases continues to be felt. Finally, COVID-related lockdowns have been imposed on just under 20 schools in Beijing, which may represent another source of pressure.

- The Hang Seng was the exception to the broader rule, with the tech space rallying as participants looked to pick up beaten down Chinese names. Some also suggested that the unwind of shorts in the sector helped fuel gains.

- E-mini futures sit around 0.2% lower after the space backed away from fresh record highs as we moved through Monday trade.

OIL: Modest Gains For Crude In Asia, OPEC+ Dynamic Eyed

WTI & Brent futures sit ~$0.25 above their respective settlement levels, building on Monday's uptick, with focus on the upcoming OPEC+ summit (scheduled to take place on Thursday). Monday saw Kuwait become the latest participating nation to back the current policy implemented by the group of crude producers. The unanimity when it comes to OPEC+ will have supported crude prices on Monday, as would have a softer USD and fresh record highs for U.S. equities, although the major Wall St. indices did pull back from best levels of the day, which allowed crude to pare some of its own intraday gains. Meanwhile, the latest RTRS survey noted that "the increase in OPEC's oil output in October fell short of the rise planned under a deal with allies, as involuntary outages in some smaller producers offset higher supplies from Saudi Arabia and Iraq." OPEC crude production rose by ~190K bpd per the survey (vs. the 254K increase allotted to the group within the 400K bpd rise agreed by OPEC+ nations). Tuesday's focus will fall on the latest round of API inventory estimates.

GOLD: Familiar Levels

Gold continues to oscillate within the boundaries of the recently observed range, struggling for a real sense of direction ahead of this week's notable event risk. Spot is last little changed at $1,790/oz after drawing support from a weaker USD on Monday, which outweighed the impulse from a downtick in our weighted U.S real yield monitor. The technical picture remains unchanged.

FOREX: AUD Takes Drubbing After RBA Statement

The RBA's monetary policy decision rattled AUD, as policymakers left the cash rate unchanged but scrapped their ACGB Apr '24 yield target. The Reserve Bank said that they are "prepared to be patient," as inflation "remains low in underlying terms."

- AUD/USD went offered but yesterday's low of $0.7486 provided a durable layer of resistance. AUD/NZD plunged to a one-week low, approaching its 50-DMA.

- The yen outperformed amid heightened demand for safe haven currencies, as U.S. e-mini futures lost ground.

- Japan's FinMin Suzuki stressed the importance of currency stability and noted that officials will continue to monitor FX markets.

- Swiss CPI and a suite of m'fing PMIs from several Eurozone countries headline the global data docket today. Speeches are due from ECB's Enria, Elderson & de Cos.

FOREX OPTIONS: Expiries for Nov2 NY cut 1000ET (Source DTCC)

EUR/USD: $1.1570-85(E529mln), $1.1750(E574mln), $1.1795-00(E838mln), $1.1815-20($980mln)

USD/JPY: Y104.85-00($618mln)

GBP/USD: $1.3100(Gbp1.2bln), $1.3150(Gbp911mln)

EUR/GBP: Gbp0.8900(E2.2bln-EUR puts), Gbp0.9000(E1.5bln)

AUD/USD: $0.7140-45(A$1.9bln)

USD/CAD: C$1.3300($662mln)

USD/CNY: Cny6.65($770mln)

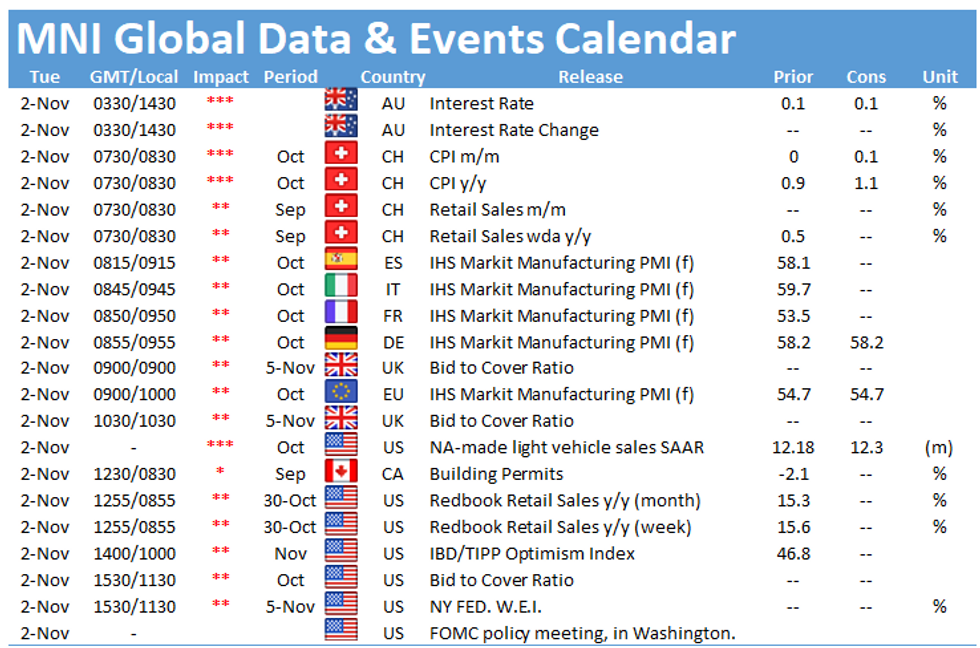

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.