-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: PBoC Liquidity Dynamic Eyed

EXECUTIVE SUMMARY

- BIDEN SAYS HE'LL ANNOUNCE FEDERAL RESERVE POSTS 'FAIRLY QUICKLY' (BBG)

- PBOC UPS GROSS OMO INJECTION, STILL CONDUCTS NET DRAIN AS MONTH-END PROVISIONS ARE REMOVED

- UK SEEKS NEW LEGAL ADVICE TO BACK POSSIBLE CHANGE TO N IRELAND PROTOCOL (FT)

- GOP'S YOUNGKIN PROJECTED TO WIN VIRGINIA GOVERNOR'S RACE

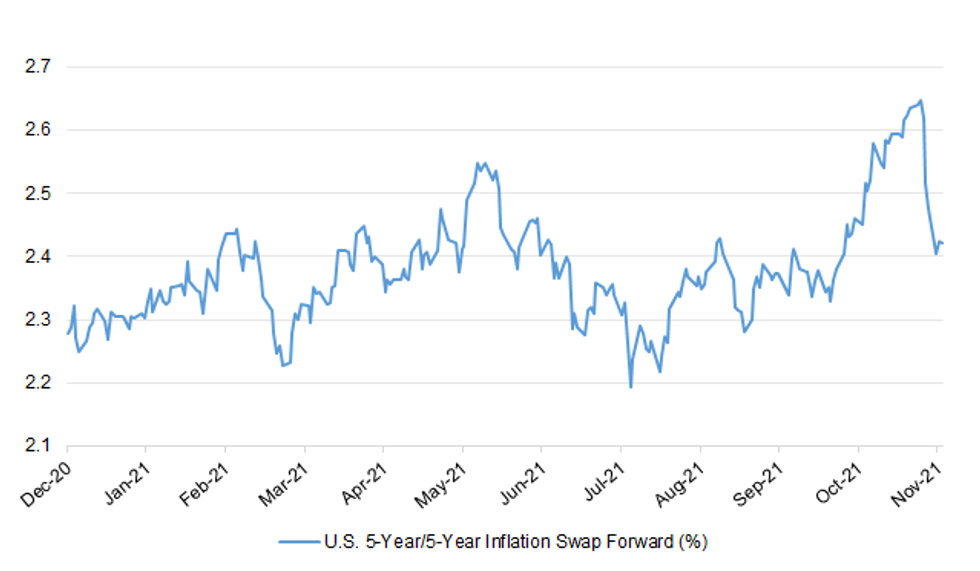

Fig. 1: U.S. 5-Year/5-Year Inflation Swap Forward (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: The UK government is seeking to appoint new external legal advisers in preparation for a possible overhaul of Northern Ireland's controversial post-Brexit trading arrangements. The move to find fresh legal advice will fuel expectations that ministers are preparing to use the Article 16 safeguard mechanism to try to fundamentally rewrite the deal, which has soured EU-UK relations since it came into force last January. Two people with knowledge of internal Whitehall discussions said the government was seeking the new legal advisers to enable Suella Braverman, the UK attorney-general, to provide legal opinions supporting the government's plans. (FT)

BREXIT: Boris Johnson downplayed the significance of a rift between the U.K. and France over post-Brexit fishing licenses, calling the issue "vanishingly unimportant" compared with efforts to limit global warming. The spat had threatened to overshadow the global climate summit hosted by Johnson until French President Emmanuel Macron withdrew a threat to punish the U.K. for restricting the access of French fishing boats to British waters, saying he would give negotiations more time to reach an agreement. Speaking to reporters in Glasgow, Scotland on Tuesday, Johnson said the U.K.'s position on licenses hasn't changed, though his officials have repeatedly said his government is seeking a "consensual" solution with France. (BBG)

CORONAVIRUS: One of Britain's top scientists has quit the government's pandemic advisory body, warning the COVID crisis is "a long way from over" and that the situation in the UK is "concerning". Sir Jeremy Farrar, director of the Wellcome Trust, quit the Scientific Advisory Group for Emergencies (SAGE) at the end of October. Sky News can reveal that Sir Jeremy is advocating for a "vaccine plus" strategy to curb the high levels of transmission seen in the UK. His plan calls for more mask wearing, ventilation and continued coronavirus testing to get the nation through what some experts predict will be a difficult winter. (Sky)

ECONOMY: Household incomes will rise at the slowest rate on record over the course of this parliament because of stagnating wages, higher taxes and falling employment, an analysis has found. The Resolution Foundation think tank concluded that disposable income — a household's spending power after taxes and other costs — would rise by only 0.1 per cent a year, the lowest over a parliament on record. The previous record was between 2015 and 2019 under David Cameron and Theresa May, when the annual rise was 0.3 per cent. Adam Corlett, principal economist at the foundation, said: "Last week the chancellor hailed his budget as marking a 'new age of optimism', but the economic reality facing families across Britain is far more sobering. (The Times)

FISCAL: The government has been defeated in the House of Lords over its one-year suspension of the "triple lock" formula to increase the state pension. Ministers plan to temporarily break the link between pensions and the rise in earnings, breaching a manifesto pledge. It followed concern that a post-pandemic rise in average wages would have meant pensions increasing by 8%. Peers voted to restore a link with earnings. But MPs could still go on to reject their amendment. The House of Lords backed an amendment by former Tory pensions minister Baroness Altmann to the law required to suspend the triple lock, by 220 votes to 178. It will set up a vote in the House of Commons, where the government will have to decide whether to order its MPs to oppose her plan. (BBC)

FISCAL: Two struggling councils have been warned they face government intervention unless they sell off publicly-owned assets, including town halls, public toilets, leisure centres and libraries, and push ahead with further cuts to services. (Guardian)

EUROPE

ITALY: Italy's budget deficit was EUR7.500b in October, according to The Italian Treasury. (BBG)

ITALY/BTPS: Italy's Finance Ministry says in a statement that on Nov. 4 a buyback auction of government bonds for a maximum of EU5B will take place at the Bank of Italy. The auction will include BTP 5.50% 1/11/2022, CCTeu 15/7/2023, BTP 0.00% 15/1/2024, BTP 1.85% 15/5/2024, BTP 1.75% 1/7/2024, BTP 2.50% 15/11/2025. (BBG)

NETHERLANDS: The Dutch government on Tuesday decided to re-impose measures, including the wearing of face masks, aimed at slowing the latest spike in COVID-19 infections, Prime Minister Mark Rutte said. The use of a "corona pass", showing proof of a COVID-19 vaccination or recent negative coronavirus test, would be broadened as of Nov. 6 to public places including museums, gyms and outdoor terraces, Rutte said. (RTRS)

GREECE: Unvaccinated people in Greece will only be allowed to enter local government agencies, banks, shops and hairdressers, among other places, with a negative coronavirus test starting from Saturday. They will also have to present a negative test at work twice a week and at their own expense. Essential shops, such as supermarkets and pharmacies, will remain accessible without a test, Greek Health Minister Thanos Plevris told state television on Tuesday evening. In addition, according to the minister, from Friday onwards all fully vaccinated citizens aged 18 and over will be able to receive a booster shot. (DPA)

IRELAND: The number of new cases in Ireland rose above 3,000 for the first time since January, with 3,726 confirmed infections reported. 493 Covid-19 patients are hospitalized, of whom 90 are in intensive care, the Department of Health said on its website. The 14-day incidence rate is 695 per 100,000, an increase of 18% over last week. (BBG)

IRELAND: Growth in Ireland's service sector eased slightly in October from the previous month but remained near historic highs as the COVID-19 recovery pushed growth in prices and work backlogs to their highest levels in 21 years, a survey found on Wednesday. (RTRS)

U.S.

FED: President Joe Biden said he'll announce soon his choice of nominees for chair and other vacancies on the Federal Reserve, amid a scandal over stock trades by central bank officials. "We'll be making those announcements fairly quickly," he said Tuesday at a press conference at a climate summit in Glasgow, Scotland. The president faces the decision amid the Fed's internal investigation of stock trading by top regional officials in 2020 at the same time the bank was pumping money into the economy. Powell moved quickly to roll out new ethics rules guiding officials' trades, but the incident has given his critics fresh ammunition. (BBG)

FISCAL: Senate Majority Leader Chuck Schumer aims to put President Joe Biden's $1.75 trillion social safety net spending plan on the Senate floor by mid-November, setting up a potential clash with his most important swing vote, Joe Manchin, who has raised serious concerns about the proposal and called on Congress not to rush the process. "We hope the House to pass it soon and hope to begin debate on it on the 15th," Schumer said Tuesday, referring to the proposal to expand health care access, address the climate crisis, provide aid to families and deliver on other key liberal priorities. (CNN)

FISCAL: President Joe Biden said he expects Senator Joe Manchin to vote for his economic agenda, despite the West Virginia Democrat's public criticisms of the developing legislation. "I believe that Joe will be there," Biden said Tuesday at a news conference at a United Nations climate summit in Glasgow, Scotland. (BBG)

FISCAL: Sen. Joe Manchin said Tuesday that he has chief concerns that will need to be addressed in order to secure his vote for the $1.75 trillion economic package -- climate change, taxes, Medicare and immigration -- while also expressing new optimism that a deal could ultimately be reached that would win his support on President Joe Biden's domestic agenda. Manchin, who hours earlier had said it would take "quite a while" to get a deal, said Tuesday evening: "We have all next week. We're going to work into it next week -- as they are working. So if everyone works real hard, I've said, we can get it done before Thanksgiving. We're going to get something done." (CNN)

FISCAL: As Democrats iron out their $1.75 trillion social and climate spending package, the plan may still include relief for the $10,000 cap on the federal deduction for state and local taxes, known as SALT. The limit has been a pain point for high-tax states, such as New York, New Jersey and California, preventing Americans who itemize deductions from writing off more than $10,000 for property and state income taxes on their federal returns. While the measure wasn't addressed in President Joe Biden's framework, House Democrats on Tuesday inched closer to an agreement on SALT relief. (CNBC)

CORONAVIRUS: Children ages 5 to 11 will be able to get a Covid-19 vaccine after the CDC cleared Pfizer's doses for younger kids Tuesday night, allowing many parents across the U.S. to breathe a sigh of relief. CDC Director Dr. Rochelle Walensky, authorized the vaccine hours after a unanimous recommendation by the agency's Advisory Committee on Immunization Practices. Vaccinations for young kids are expected to begin immediately. (CNBC)

CORONAVIRUS: Colorado could come close to running out of hospital beds in late November or early December if infections accelerate, officials warned Tuesday. An estimated 1,900 of the state's roughly 2,000 beds could be occupied under a worst-case scenario, Rachel Herlihy, state epidemiologist, said during an online news briefing. At the current pace, hospitalizations are projected to peak at 1,500. An estimated 1-in-51 state residents are contagious, Governor Jared Polis said during the briefing, imploring people to get vaccinated. Polis said the delta variant is "like a laser-guided missile." (BBG)

POLITICS: Republican Glenn Youngkin has won the race for Virginia governor, NBC News projects, defeating Terry McAuliffe in a race that's been watched around the nation as a bellwether for the 2022 midterm elections. (NBC)

POLITICS: Democratic incumbent Phil Murphy is trying to fight off a stiff challenge from Republican Jack Ciattarelli in the race for New Jersey governor. As of 12:40 a.m. Wednesday, with nearly 95% of precincts reported, Ciattarelli leads 50-49, according to tabulation by The Associated Press. (CBS)

POLITICS: Democrat Eric Adams was elected mayor of New York on Tuesday as the nation's largest city faces concerns about an uptick in violent crime and economic recovery from the Covid-19 pandemic. (WSJ)

OTHER

GLOBAL TRADE: The Port of Los Angeles' decision to impose fines for lingering cargo containers was "a last resort," but it's already showing signs of having the desired effect, Gene Seroka, the port's executive director, told CNBC on Tuesday. The policy, which kicked in Monday, was announced Oct. 25 by the Port of Los Angeles and the adjoining Port of Long Beach as part of an effort to ease congestion due to the Covid pandemic. Ocean carriers will be charged $100 per day for each truck-bound container that's left for nine days or more. Fines for containers that will leave the facility by rail start accruing on their sixth day. (CNBC)

GLOBAL TRADE: The U.S. Trade Representative said on Tuesday she supported updating U.S. trade laws to combat circumvention of existing anti-dumping and anti-subsidy duties, including tools aimed at subsidized Chinese investment in steel production elsewhere in southeast Asia. Katherine Tai made the remarks in Washington to U.S. steel industry executives, who gave her a standing ovation after reaching a new metals quota deal with the European Union that ends a longstanding tariff dispute. (RTRS)

GLOBAL TRADE: The European Union's ambitious climate plan is in part a "trade weapon" to force major polluting economies to comply with the bloc's demanding standards, Belgian Prime Minister Alexander De Croo said. "We do this because we believe this is the way we gain economic and technological advantage," De Croo said in an interview with Bloomberg Television during the COP26 climate conference in Glasgow. (BBG)

U.S./CHINA: President Joe Biden said Tuesday that he is not concerned with the possibility of an armed conflict with China, adding that he's made clear to Chinese President Xi Jinping that this is "competition" not "conflict." "Am I worried about an armed conflict or something happening accidentally with China? No, I'm not," Biden told CNN's Phil Mattingly while speaking at his closing press conference at the COP26 Summit. Biden said that at his upcoming -- but not yet set--- virtual summit with Xi that he would continue to make clear, "This is competition. It does not have to be a conflict." (CNN)

U.S./CHINA: China "resolutely opposes" Washington's revocation of China Telecom Corp Inc's license to operate in the United States, the Ministry of Industry and Information Technology (MIIT) said in a statement on Wednesday. (CNA)

GEOPOLITICS: France's ambassador to Australia, Jean-Pierre Thebault, said on Wednesday that Australia acted with deceit when it abruptly cancelled a multi-billion deal with Paris to build a fleet of submarines. "The deceit was intentional," Thebault told media in Canberra on Wednesday. "And because there was far more at stake than providing submarines, because it was a common agreement on sovereignty, sealed with the transmission of highly classified data, the way it was handled was a stab in the back." Australia in September cancelled a deal with France's Naval Group, opting instead to build at least 12 nuclear-powered submarines after striking a deal with the United States and Britain. The decision has caused a major bilateral rift, with France recalling its ambassadors from Australia and the U.S. in protest. (RTRS)

GEOPOLITICS: Taiwan's deputy minister for environmental protection, Shen Chih-hsiu, will lead delegation to Glasgow, Scotland, for talks on the sidelines of the COP26 environmental summit this weekend, Foreign Ministry spokeswomen Joanne Ou says at briefing in Taipei. (BBG)

JAPAN: Japan will consider resuming issuance of long-term visas to foreign business travelers, Nikkei reports. Updated policies could be announced this week. (BBG)

RBNZ: New Zealand's transition to living with Covid-19 could lead to changes in consumer behavior that damp economic growth, the central bank said. "Businesses will need to adapt, and some businesses that have stayed afloat to date may not be viable as support schemes wind down," the Reserve Bank said in its semi-annual Financial Stability Report published Wednesday in Wellington. "These changes could drag on economic activity." After successfully eliminating Covid-19 from the community last year and holding it at bay for a long period, New Zealand is now battling an outbreak of the delta strain that has kept largest city Auckland in lockdown since mid-August. The government has conceded the virus is here to stay and plans to start lifting restrictions when vaccination rates reach 90%. (BBG)

SOUTH KOREA: Prime Minister Kim Boo-kyum said Wednesday the government cannot afford another round of universal COVID-19 relief grants as proposed by Lee Jae-myung, the presidential nominee of the ruling Democratic Party (DP). Kim made the remark during a radio interview, stressing that the most urgent task for now is to compensate the self-employed and small business owners suffering from the pandemic. "Our finance does not have enough capacity to do that," Kim said of Lee's proposal. (Yonhap)

RATINGS: The outlook for sovereign creditworthiness for the next 12-18 months has changed to stable from negative as the continuing economic recovery will improve revenues and allow governments to start unwinding some of the extraordinary stimulus they provided in response to the pandemic. (Moody's)

OIL: U.S. President Joe Biden kept up the pressure on OPEC+ to combat high oil prices, blaming it for inflationary pressure at home just two days before Saudi Arabia, Russia and the rest of the cartel meet to discuss oil policy. "If you take a look at gas prices, and you take a look at oil prices, that is a consequence of, thus far, the refusal of Russia or the OPEC nations to pump more oil," Biden told reporters at a news conference at the United Nations climate summit in Glasgow. "And we'll see what happens on that score sooner than later." (BBG)

OIL: Mexico is in the process of locking in its income from next year's oil production, people familiar with the matter said, in what's one of the most closely watched deals among the world's energy traders. The country has been purchasing put options, which grant the right to sell at a predetermined price, at a price range of about $60 to $65 a barrel, the people said, asking not to be identified because the trade is private. (BBG)

OIL: China's coastal province of Shandong is expected to shutter refineries with daily capacity of more than half a million barrels by the end of 2022 to make way for a new petrochemical complex, a provincial official and industry sources said. The clean-up of 10 plants, accounting for about 3% of refining capacity in the world's largest importer of crude, is part of efforts to streamline a bloated oil refining sector that brought fuel shortages in some regions recently. (RTRS)

FOREX: The dollar's performance against major currencies will be mixed as investors are expected to favour those carrying higher interest rates in both the short and medium-term, a Reuters poll of FX strategists found. Calls for tighter monetary policy to tame inflation running at multi year highs in the United States and elsewhere have prompted money markets to bring forward rate hike expectations, and are now at odds with central banks' own projections. Those expectations have pushed yields on U.S. Treasuries and other sovereign debt higher, especially at the shorter end of the curve, to the highest in more than a year. That is set to continue. But while rising Treasury yields have helped the dollar to maintain its gains so far this year, rate hike speculation elsewhere looks set to restrain the greenback from strengthening any further. (RTRS)

CHINA

ECONOMY: China's economy faces new downward pressure, Premier Li Keqiang said, calling for the formulation of new "phased, coordinated" policies lowering business taxes and fees to address the production and operational difficulties for small and proprietary businesses, Xinhua News Agency said. Li, who chaired a meeting with market regulators on Monday, also urged financial institutions to transfer a reasonable portion of profits to the real economy, according to the official news agency. Authorities should also ensure stable supplies and prices of electricity and coal and use unemployment insurance to support workers, said Xinhua citing Li. (MNI)

PROPERTY: China's property loans increased significantly in October, an indication that the crackdown on real estate lending has been eased, the Shanghai Securities Journal reported. Top policymakers and regulators have "corrected some misunderstandings" about the property financing rules which barred some loans for legitimate projects, and banks have been given the permissions to orderly provide credit, the newspaper said. Real estate loans slowed in the first three quarters as the Evergrande Group's debt crisis made lenders more averse to the sector, the newspaper said. However, with the changing regulatory environment, real estate loans are likely to resume the pace of growth, and property project reserves will be increased to ensure the steady development of the sector, the newspaper said, citing analysts. (MNI)

PROPERTY: Property developers in China looking to raise badly needed cash by selling assets are finding it hard to strike deals as potential buyers in the sector hoard funds after home sales plunged and Beijing stepped up its borrowing crackdown. (BBG)

POLICY: China remains confident in achieving carbon peak and neutrality goals as it shifts its economy to high-quality development, and westerners should not think that the country is returning to coal-based development after experiencing the current power crunch, the Economic Daily said in a commentary. The coal shortages seen in China were due to insufficient supply, as the country had closed many mines and withdrawn a billion-ton production capacity during supply-side reform since 2016, the newspaper said. The recent power crunch in more than 20 provinces reminded the authorities that low-carbon transition must be done orderly, and a stable energy supply ensures development, the newspaper said. (MNI)

CORONAVIRUS: More provinces in China are fighting Covid-19 than at any time since the deadly pathogen first emerged in Wuhan in 2019. The highly-infectious delta variant is hurtling across the country despite the increasingly aggressive measures that local officials have enacted in a bid to thwart it. Local infections have been found in 19 of 31 provinces in the world's second-largest economy. China reported 93 new local cases on Wednesday, and 11 asymptomatic infections. Three more provinces detected cases, central Chongqing and Henan and Jiangsu on the eastern coast. Meanwhile Changzhou, in Jiangsu province, has closed schools after three Covid infections were found. (BBG)

ENERGY: China targets updating at least 350m kilowatts of coal-fired power generation units through 2025 to make them less polluting, according to a statement by the economic planning agency NDRC. (BBG)

OVERNIGHT DATA

CHINA OCT CAIXIN SERVICES PMI 53.8; MEDIAN 53.1; SEP 53.4

CHINA OCT CAIXIN COMPOSITE PMI 51.5; SEP 51.4

Supply and demand both recovered as disruptions from local Covid-19 outbreaks faded by the middle of October. The gauges for business activity and total new business both reached the highest level in three months. Overseas demand also rebounded as the measure for new export business moved into expansionary territory. Prices in the services sector kept rising. Input costs increased for the 16th month in a row and rose at a faster pace than the previous month due to rising labor and raw material costs. Solid demand allowed businesses to pass part of this rise in costs downstream, leading the gauge for prices charged by service providers to reach the highest in three months. Businesses remained relatively optimistic, though the measure for business expectations fell to the lowest point in four months. Some surveyed firms were worried about rising costs and the stability of supply chains. (Caixin)

AUSTRALIA SEP BUILDING APPROVALS -4.3% M/M; MEDIAN -2.0%; AUG +7.6%

AUSTRALIA OCT, F MARKIT SERVICES PMI 51.8; FLASH 52.0

AUSTRALIA OCT, F MARKIT COMPOSITE PMI 52.1; FLASH 52.2

The latest IHS Markit Australia Services PMI captured the initial positive effects of the easing of COVID-19 lockdowns upon the Australian economy. Demand and business activity both returned to growth in the month, which were very positive signs. Price pressures, however, persisted for services providers as a result of supply constraints while some anecdotal evidence of labour constraints was also reported in the latest survey, though these have yet to send backlogged work into overdrive. Broadly, Australian service providers maintained a positive outlook and saw business confidence rising in October. With the gradual easing of restrictions, we may continue to find the service sector recovering from the latest COVID-19 Delta wave. (IHS Markit)

NEW ZEALAND Q3 UNEMPLOYMENT RATE 3.4%; MEDIAN 3.9%; Q2 4.0%

NEW ZEALAND Q3 EMPLOYMENT CHANGE +4.2% Y/Y; MEDIAN +2.7%; Q2 +1.6%

NEW ZEALAND Q3 EMPLOYMENT CHANGE +2.0% Q/Q; MEDIAN +0.4%; Q2 +1.1%

NEW ZEALAND Q3 PARTICIPATION RATE 71.2%; MEDIAN 70.5%; Q2 70.5%

NEW ZEALAND Q3 AVERAGE HOURLY EARNINGS +1.2% Q/Q; MEDIAN +1.5%; Q2 +0.7%

NEW ZEALAND Q3 PVT WAGES EX-OVERTIME +0.7% Q/Q; MEDIAN +0.8%; Q2 +0.9%

NEW ZEALAND Q3 PVT WAGES INC-OVERTIME +0.7% Q/Q; MEDIAN +0.8%; Q2 +0.9%

SOUTH KOREA OCT FOREIGN RESERVES $469.21BN; SEP $463.97BN

CHINA MARKETS

PBOC NET DRAINS CNY150BN VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY50 billion via 7-day reverse repos with the rates unchanged at 2.2% on Wednesday. The operation led to a net drain of CNY150 billion after offsetting the maturity of CNY200 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.2000% at 09:29 am local time from the close of 2.1586% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 42 on Tuesday vs 51 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4079 WEDS VS 6.4009

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4079 on Wednesday, compared with the 6.4009 set on Tuesday.

MARKETS

SNAPSHOT: PBoC Liquidity Dynamic Eyed

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 is closed

- ASX 200 up 68.377 points at 7392.7

- Shanghai Comp. down 22.67 points at 3482.889

- JGBs are closed

- Aussie 10-Yr future up 4.0 ticks at 98.125, yield down 3.8bp at 1.852%

- U.S. 10-Yr future +0-00+ at 131-31+, cash Tsys are closed

- WTI crude down $1.23 at $82.70, Gold down $5.36 at $1782.37

- USD/JPY down 10 pips at Y113.86

- BIDEN SAYS HE'LL ANNOUNCE FEDERAL RESERVE POSTS 'FAIRLY QUICKLY' (BBG)

- PBOC UPS GROSS OMO INJECTION, STILL CONDUCTS NET DRAIN AS MONTH-END PROVISIONS ARE REMOVED

- UK SEEKS NEW LEGAL ADVICE TO BACK POSSIBLE CHANGE TO N IRELAND PROTOCOL (FT)

- GOP'S YOUNGKIN PROJECTED TO WIN VIRGINIA GOVERNOR'S RACE

BOND SUMMARY: Off Asia Lows, Japanese Holiday Limits Price Action & Volumes

The cocktail of a Japanese holiday and proximity to Wednesday's FOMC decision has made for light Tsy trade in Asia, with a little over 40K TYZ1 contracts changing hands thus far. That particular contract last deals +0-00+ at 130-31+, with a downtick in oil & bid in ACGBs helping the move away from early session lows, while TYZ1 proved resilient to the pullback seen in ACGBs late in the Sydney day. A reminder that the Japanese holiday means that cash Tsys will not open for trade until London hours. Looking ahead to the NY session, ADP employment data is due to hit (ahead of Friday's NFP print). Elsewhere, the latest FOMC decision is expected to result in a $15bn/month tapering announcement, while most of the attention is set to fall on the Fed's communication surrounding inflation dynamics and any further signals on the rate hike outlook. The final point of note comes in the form of the Treasury's quarterly refunding announcement.

- It didn't take long for a bid in ACGBs to come back into play, as the follow through from yesterday's RBA decision continues to be observed, reversing the early Sydney trans-Tasman driven softening, which came on the back of the larger than expected downtick in NZ unemployment. The internals surrounding the latest round of ACGB Nov-31 supply weren't the strongest in recent memory (as fleshed out in an earlier bullet), but the auction still passed smoothly enough in the grander scheme of things, which provided another likely aid for the bid. YM +2.5 & XM +4.0 at the close, after fading back from best levels and failing to test their respective overnight highs. 10s led the rally in the cash ACGB space. The IR strip settled unchanged to 15bp richer through the reds, with IRZ2 leading the bid there.

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.00% 21 Nov ‘31 Bond, issue #TB163:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.00% 21 November 2031 Bond, issue #TB163:

- Average Yield: 1.8390% (prev. 1.4956%)

- High Yield: 1.8425% (prev. 1.4975%)

- Bid/Cover: 3.2750x (prev. 5.3400x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 27.8% (prev. 21.6%)

- Bidders 57 (prev. 45), successful 22 (prev. 19), allocated in full 17 (prev. 8)

EQUITIES: Equities Marginally Mixed In Asia

Chinese & Hong Kong equities continued to soften on Wednesday, although losses in the benchmark indices were limited. Focus remains on the net draining of the month-end liquidity provisions deployed by the PBoC, although today's net drain was a little smaller than that seen on Monday & Tuesday, as the central bank upped its gross intraday OMO injection via reverse repos.

- The fallout from Tuesday's dovish RBA decision and an uptick in iron ore supported the ASX 200.

- U.S. e-mini futures are little changed after another round of record highs were lodged on Tuesday.

OIL: Headline API Inventory Build Weighs

A larger than expected headline crude stock build in the weekly API inventory estimates has applied pressure to crude in post-settlement and overnight dealing, leaving WTI & Brent futures over $1.00 softer at typing. The headline build was accompanied by a surprise, albeit modest, uptick in distillate stocks and a shallower than expected drawdown in gasoline stocks. There was also a marginal drawdown in stocks at the Cushing hub.

- This comes after the benchmark contracts finished little changed on Tuesday.

- Speculation re: OPEC+'s ability to a continue to lift crude production in line with its plans (+400K bpd/month) seems to have intensified in recent days.

- Elsewhere, Tuesday saw Iran flag a significant improvement in oil sales, with the country's exports of oil by-products set to resume in the coming weeks.

- DoE inventory data headlines on Wednesday.

GOLD: Rangebound Ahead Of Key Event Risk

Spot remains anchored within the recently observed range ahead of Wednesday's key FOMC (the first of several major macro risk events slated for the week), last dealing liltte changed around the $1,785/oz mark. Initial support comes in at the Oct 29/18 lows ($1,772.0/1,760.4/oz), while resistance is seen at the Oct 22 high ($1,813.8/oz).

FOREX: Kiwi Bolstered By NZ Jobs Data, Pre-FOMC Flows Aid Yen

New Zealand's jobs report for Q3 exceeded expectations, cementing the case for tighter monetary policy. The data reflected an increasingly tight labour market, as the unemployment rate plunged past the level forecast by the RBNZ in their latest MPS and landed close to the all-time low. The unexpected uptick in participation was easily absorbed by a surge in hiring, with employment growth surpassing estimates. NZD crosses trimmed some gains, as some of the post-data hawkish RBNZ repricing got unwound, but remained the best performer in G10 FX space.

- The DXY conceded some ground with today's monetary policy decision from the FOMC looming large. U.S. policymakers are widely expected to start scaling back pandemic-era stimulus.

- The yen gained on defensive flows ahead of the FOMC announcement. Japanese markets were shut in observance of a local public holiday.

- Today's data highlights include U.S. ADP employment change, factory orders & durable goods orders and a suite of Services PMIs from across the globe. Speeches are due from BoE's Bailey, RBA's Debelle & a suite of ECB members.

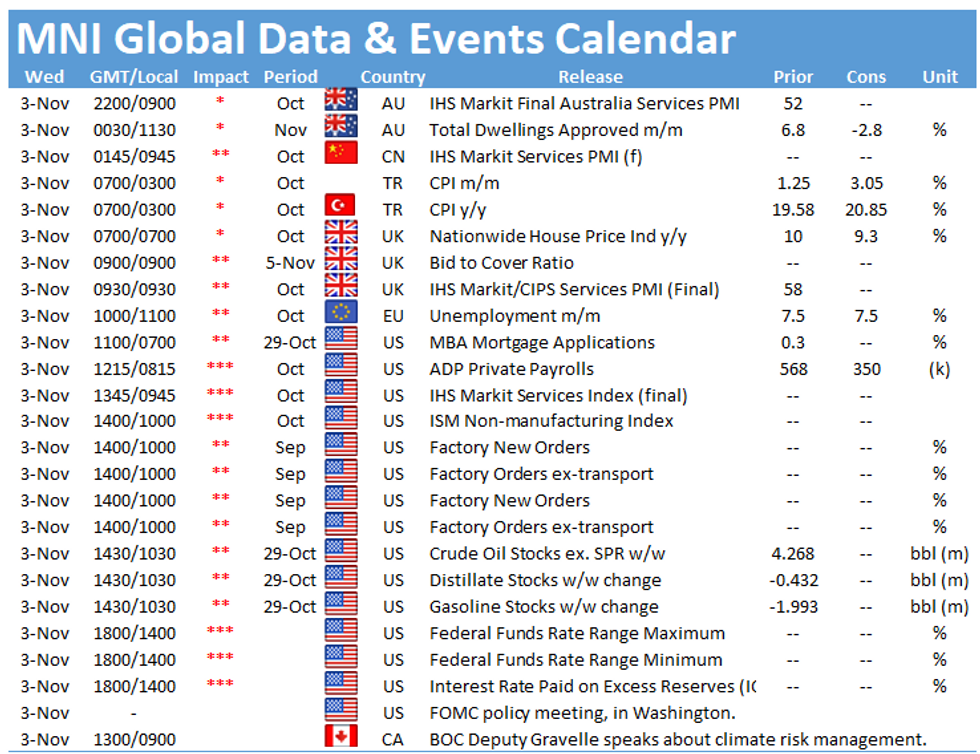

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.