-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: FOMC Taper Announcement Behind Us, BoE Next

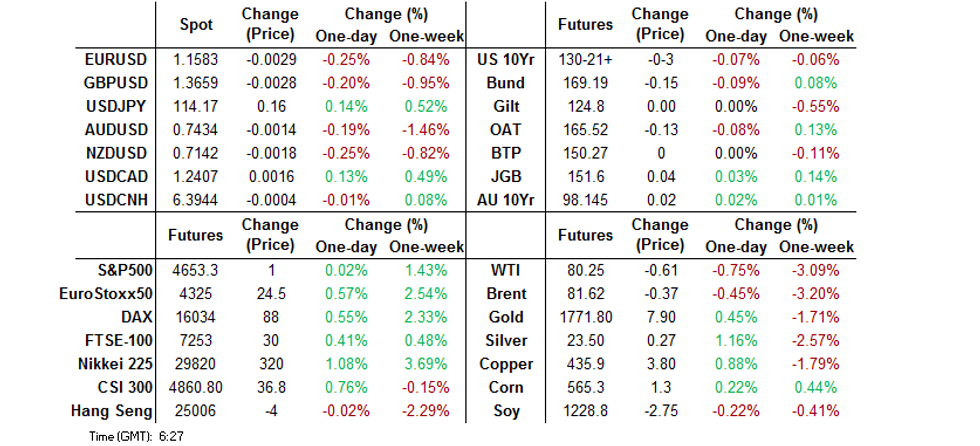

- The USD has ticked higher overnight, with the DXY unwinding the post-FOMC weakness, while U.S. Tsys were rangebound.

- The PBoC continued to tweak liquidity with eyes moving to this month's MLF dynamics.

- Today's MPC meeting will be the most watched since the Bank's aggressive easing at the beginning of the pandemic. Markets are fully pricing a 15bp hike, 14/23 analysts in our survey are looking for a hike but we have not heard from some of the centrist MPC members since the September meeting, who could act as kingmakers in this week's decision.

BOND SUMMARY: Stuck Between FOMC & NFPs

TYZ1 was hemmed in a 0-05 range overnight, last -0-03+ at 130-21, while cash Tsys are little changed across the curve (-/+0.5bp vs. settlement). There has been a couple of spurts of activity, but markets have failed to latch onto anything in an Asia-Pac session that has been bereft of headline flow and further hampered by lower liquidity on the back of the observance a national holiday in Singapore and the proximity to Friday's NFP. This came after the post-Fed bear steepening into the NY close. To recap, the FOMC confirmed its initial $15bn/month tapering plan ($10bn Tsys & $5bn MBS), which will get underway this month. The central bank stressed that "similar reductions in the pace of net asset purchases will likely be appropriate each month, but it is prepared to adjust the pace of purchases if warranted by changes in the economic outlook." Chair Powell was quick to reiterate that the Fed's tapering move does not put an imminent rate hike on the table, which facilitated the aforementioned steepening. On inflation, the Fed noted that "inflation is elevated, largely reflecting factors that are expected to be transitory," a tweak from the previously employed "inflation is elevated, largely reflecting transitory factors." Weekly jobless claims, challenger job cuts and unit labour cost data headline the local docket on Thursday. Note that House Majority Leader Hoyer has suggested that the House could vote on the well-documented fiscal spending initiatives as soon as Thursday.

- After unwinding the gains registered in the pre-holiday overnight session, JGB futures regained some poise as the Nikkei 225 pulled back from early highs, last +5, while the major cash benchmarks run little changed to ~1bp richer across the JGB curve. The proximity to the recent multi-year year highs for 10-Year breakevens promoted a smooth enough JGBi auction, with the cover ratio moving up from the multi-year low seen at the previous offering. Still, the fact that Japan continues to experience benign inflationary pressures (at best) will have provided a cap when it comes to broader demand. Elsewhere, discussions between PM Kishida & BoJ Governor Kuroda provided no fresh information.

- The Aussie bond curve was subjected to twist flattening pressure on Thursday, YM -6.0 and XM +2.0, with futures finishing off of worst levels after selling accelerated in the wake of a break of the overnight lows for both contracts (albeit with a lack of overt headline flow to drive the move).

FOREX: Risk-On Disposition Lingers Post-FOMC

The Asia-Pacific jumped on the risk-on bandwagon, set off by the Fed's declaration of patience on raising interest rates. The yen went offered as Japanese markets reopened after a public holiday, with demand for safe haven currencies reduced by post-FOMC impetus.

- AUD led high-beta FX higher, as the space drew support from risk-on flows. AUD/NZD moved away from a fresh five-week low printed yesterday.

- In light of the observance of a national holiday in Singapore, liquidity in the region may have been thinner today.

- The yuan defied PBOC signalling and traded on a marginally firmer footing, despite another softer than anticipated fixing of the central USD/CNY mid-point.

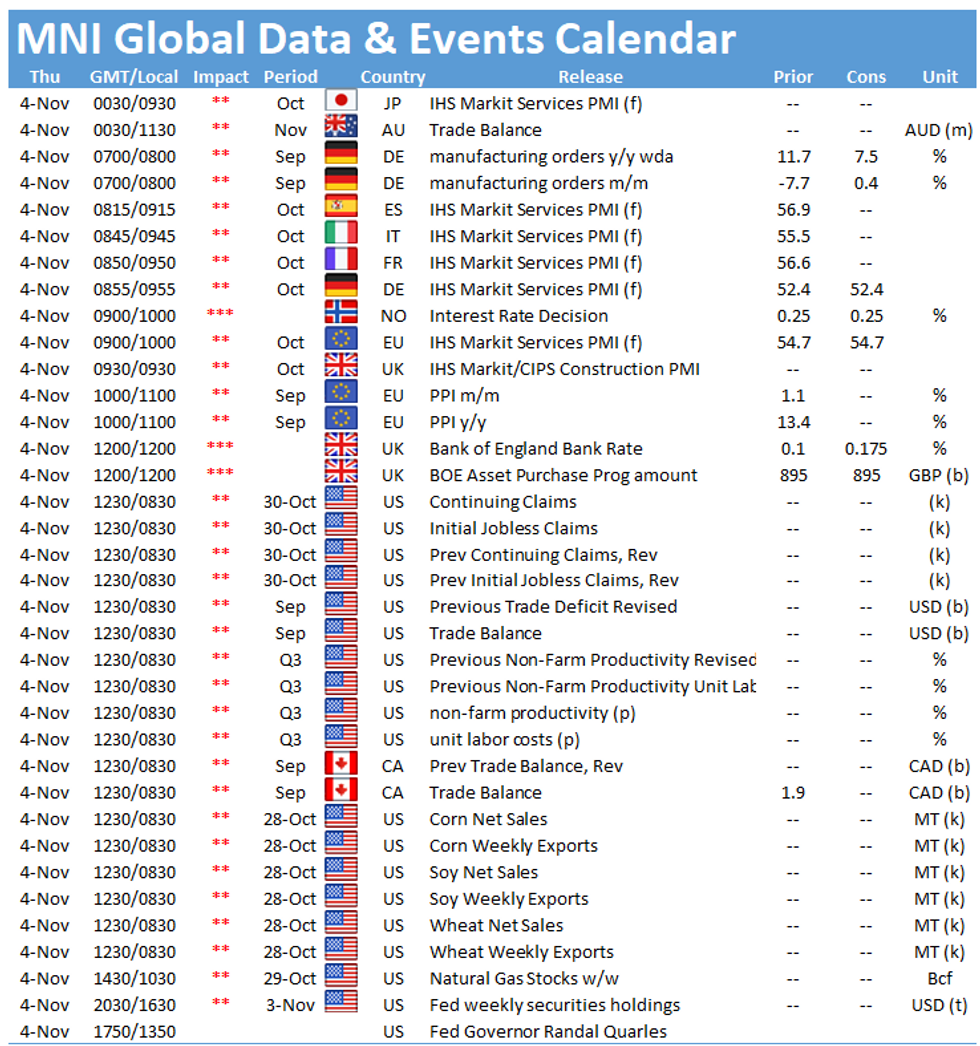

- Central bank activity picks up today, with the BoE and Norges Bank set to deliver monetary policy decisions. This will be complemented by speeches from BoE's Cunliffe, Norges Bank's Bach & several ECB members including Pres Lagarde.

- Data highlights include U.S. trade balance & weekly jobless claims, German factory orders, Canadian trade balance & a suite of Services PMIs from across the globe.

ASIA FX: Post-FOMC Flows In Play, Yuan Defies Another Weaker PBOC Fix

USD/Asia crosses traded mixed, regional players digested FOMC MonPol decision. The yuan proved resilient, despite the PBOC's apparent discomfort with its current level.

- CNH: Offshore yuan traded on a marginally firmer footing, unfazed by another softer than expected PBOC fix. China's central USD/CNY mid-point was set 17 pips above sell-side estimate, bringing the sum of misses this week to 62 pips.

- KRW: Post-FOMC impetus allowed USD/KRW to nudge lower at the reopen, but the rate trimmed losses thereafter. Officials declared that they will continue to monitor market developments and may intervene to curb volatility in the bond market if needed. Vice FinMin Lee noted that South Korea will conduct an emergency bond buyback tomorrow, focusing on 5-10 year bonds.

- IDR: Spot USD/IDR extended its recent gains, approaching resistance from 100-DMA/Sep 30 high at IDR14,332/14,333.

- PHP: USD/PHP eased off despite an uptick in the Philippines' unemployment rate in Sep. Econ Planning Sec Chua sought to downplay the release, noting that the jobs market is expected to have improved in Oct. Elsewhere, the nation's daily Covid-19 case count fell to the lowest level since Feb on Weds.

- THB: USD/THB more than erased initial losses, despite upbeat consumer confidence data released out of Thailand. The University of the Thai Chamber of Commerce's gauge rose to a five-month high amid relaxation of Covid-19 restrictions.

- Markets in Singapore, Malaysia and India were closed in observance of local holidays, reducing liquidity in the region.

STIRS: IRZ1/Z2/Z3 Fly Shows RBA Rate Hike Premium Still Frontloaded

As we have noted in recent sessions, the repricing in the front end of AUD rates curves has been relatively aggressive, although we are nowhere near a full retrace when it comes to the hike premium embedded into the markets over the last month or so.

- A quick look at the IRZ1/Z2/Z3 butterfly shows that tightening expectations (at least when measured through this metric) remain front loaded, with the IRZ1/Z2 spread continuing to drive the direction of the structure. Note that a modest amount of the hike premium that was previously embedded into that area of the curve has rolled into IRZ2/Z3 this week.

- The market continues to doubt the RBA's view when it comes to '22 rate hikes. A reminder that RBA Governor Lowe explicitly pushed back on market pricing surrounding an early '22 rate hike earlier this week, calling that particular move an overreaction to the firmer than expected underlying Q321 CPI print. The RBA's new forward guidance on the cash rate was purposefully ambiguous, with the follow up address from the Governor pointing to scenarios that may lead to lift off in either '23 or '24.

- Both the 3- & 6-month BBSW fixings have retraced from last week's highs (both hit the highest levels seen since '20), with stability in the local fixed income space, aided by the RBA delivering a relatively dovish outcome come the end of Tuesday's meeting, helping the fixings away from highs.

Fig. 1: IRZ1/Z2/Z3 Butterfly

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EQUITIES: Regional Equity Benchmarks Higher On Thursday

The major regional equity indices ticked higher during Thursday's Asia-Pac session, following the positive lead from Wall St. and no surprises from the Federal Reserve as it outlined its initial tapering plans re: asset purchases. The Nikkei 225 benefitted from the recent uptick in USD/JPY as Tokyo markets returned from their mid-week holiday, while the continued withdrawal of month-end liquidity provisions from the PBoC limited Chinese markets once again (note the PBoC has introduced higher gross reverse repo injections over the last couple of sessions). E-minis trade either side of unchanged, with the NASDAQ 100 contract experiencing some light outperformance.

GOLD: Nowhere Near Challenging Key Technical Parameters In Wake Of FOMC

Spot gold last deals a handful of dollars higher on the day at $1,775/oz.

- A lack of meaningful net movement in the DXY and our weighted U.S. real yield monitor leaves gold little changed over the last 24 hours, with the brief show lower witnessed on Wednesday mostly unwound given that both of the aforementioned metrics operate off of their respective Wednesday highs.

- Wednesday's FOMC decision provided no real surprises for markets, delivering the expected tapering plan, stressing that interest rate hikes are some way off and providing general reassurance re: patience when it comes to unwinding the stimulus that it employed in the wake of the COVID outbreak.

- From a technical perspective, bullion made a very brief and limited showing below its Oct 8 low on Wednesday but got nowhere near challenging medium-term support in the form of the October 6 low ($1,746.0/oz).

OIL: Softer Ahead Of OPEC+

WTI & Brent crude futures trade ~$0.70 & ~$0.50 lower on the day at typing, a touch off their respective Asia-Pac lows, after both contracts threatened to make a clean break below Wednesday's trough.

- Spill over from Wednesday's U.S. DoE inventory release, which revealed a larger than expected build in headline crude stocks, alongside a surprise build in distillate stocks and a larger than expected uptick in refinery run rates, was evident.

- The formal announcement that Iran is set to resume talks with the U.S. re: the revival of the Iran nuclear deal at the end of the month provided another source of pressure.

- Thursday will be headlined by the latest OPEC+ gathering, with the group set to lift production by another 400K bpd in December, even with questions surrounding the ability of some participants when it comes to meeting the upper limit of higher permitted production quotas.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.