-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Brexit Jabs Traded, No Sign Of Evergrande Coupon Payment

EXECUTIVE SUMMARY

- SOME EVERGRANDE UNIT OFFSHORE BONDHOLDERS HAVE NOT GOT INTEREST DUE NOV 6 (RTRS SOURCES)

- UK READY TO SCRAP NORTHERN IRELAND PROTOCOL'S CUSTOMS LAWS (TELEGRAPH)

- IRISH MINISTER WARNS EU COULD DITCH ENTIRE BREXIT DEAL (FT)

- PBOC CONDUCTS FIRST NET OMO INJECTION OF NOVEMBER

- CCP PLENARY SESSION GETS UNDERWAY

- BIDEN: U.S. HAS TOOLS TO RESPOND TO OPEC+ WITHHOLDING OIL SUPPLY (RTRS)

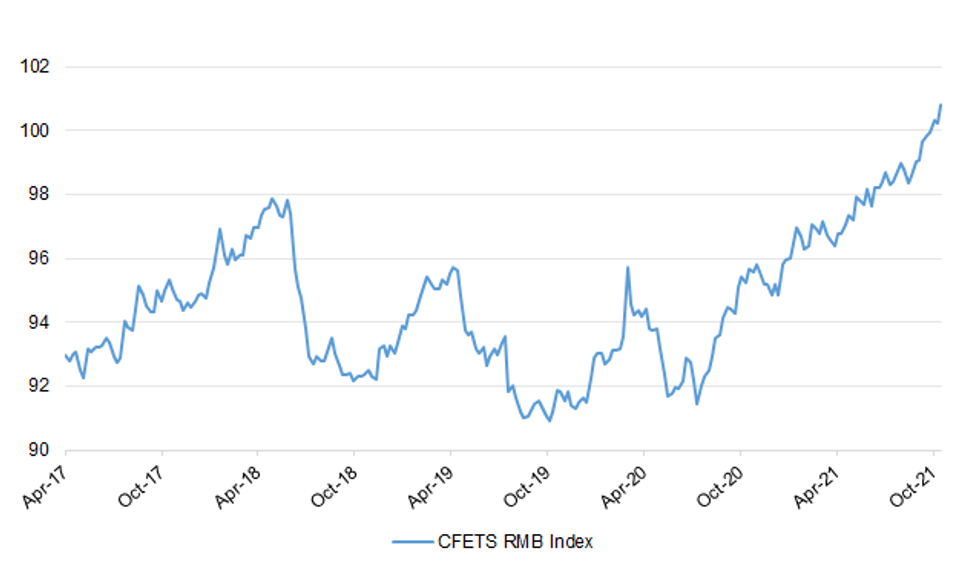

Fig. 1: CFETS RMB Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: Britain is prepared to trigger Article 16 and change laws to ditch customs checks required by the Northern Ireland Protocol before Christmas, The Telegraph has learned. In a move designed to show the EU that the UK is serious about altering the current trade arrangements, ministers are working on legal changes to customs regulations. A decision from the UK on whether to use Article 16 will be taken at the end of November. The move, widely expected both in Brussels and London, would lead to a month of formal talks. But The Telegraph understands that the UK plans to simultaneously lay secondary legislation before Parliament to slash customs checks and have the laws changed before Christmas. (Telegraph)

BREXIT: Britain is working on plans to withdraw from three major EU research programmes, which would see Brussels denied up to £15 billion funding. Amid deteriorating relations with Brussels, the Government has commenced work on domestic alternatives should the UK pull the plug on Horizon Europe, Copernicus and Euratom. They are the bloc's €90 billion (£77 billion) flagship scientific, satellite, and nuclear programmes, which the UK agreed to remain part of when it signed the Brexit trade deal last year. (Telegraph)

BREXIT: The EU could abandon the entire Brexit agreement with the UK if London goes through with its threat to suspend parts of the withdrawal deal, Ireland's foreign minister has warned. In some of the strongest public comments to date, which suggested a full blown trade war was coming closer, Simon Coveney told broadcaster RTE that the UK was deliberately pushing for a deal it knew it could not get. Retaliatory action from Brussels would go hand-in-hand with any action from London, he said. "One is contingent on the other. So that if one is being set aside, there is a danger that the other will also be set aside by the EU." (FT)

CORONAVIRUS: Professor Anne Johnson, president of Academy of Medical Sciences and a member of SAGE, told LBC radio that she understood a "Plan B" for lowdown restrictions is still on the cards, according to the Guardian. "If we want to avoid any restrictions in the future, or indeed reduce the damage, we need to think about all the things that we can do, which include not just vaccinating, which is very important, but also going to isolate when we're sick, get tested," the Guardian quoted her as saying. "All these things we can continue to do, and all those things are going to reduce the risk of having to go to plan B." (BBG)

CORONAVIRUS: The health secretary has urged elderly and vulnerable people to get their COVID-19 booster jabs "as soon as you can" to help avoid restrictions being imposed over Christmas. Around 30% of people aged over 80 and 40% of over-50s in England are yet to receive a top-up jab of the coronavirus vaccine, according to the Department of Health. (Sky)

ECONOMY: The UK's statistical agency will face a communications conundrum this week when it publishes two sets of official figures for the size of the economy that paint contradictory pictures of the recovery from coronavirus. The problem is set to arise on Thursday when the Office for National Statistics releases both its quarterly and monthly figures for gross domestic product. The quarterly figures will show the UK economy still some distance short of its pre-pandemic size, while the monthly figures are likely to show that the economy is within a hair's breadth of reaching that benchmark. The discrepancy arises because the ONS uses different techniques to measure gross domestic product on a monthly basis compared with a quarterly basis and these estimates are currently far apart, even though they are attempting to measure the same thing. Economists say the discrepancy will create difficult problems for the statistical agency, the Office for Budget Responsibility and the Bank of England. (FT)

POLITICS: Boris Johnson's personal approval rating has slumped to its lowest level on record after his botched attempt to scrap Westminster's standards system and spare a Tory MP from being suspended. According to a new Opinium poll for the Observer, the prime minister's personal ratings have now fallen to -20, down from -16 last week. It surpasses the previous low of -18 that Johnson recorded a month ago, suggesting he was already experiencing a low point in his popularity in recent weeks. The Tory lead has also fallen to a single point in the past week, according to the poll that is the first to be conducted entirely after the resignation of Owen Paterson. The former Tory cabinet minister quit as an MP after No 10 ordered an embarrassing U-turn over its attempt to spare him from a 30-day Commons suspension for breaching lobbying rules. (Observer)

POLITICS: Boris Johnson has been reported to the House of Commons standards watchdog after refusing to declare the cost of his holiday at a villa in Marbella. (Telegraph)

POLITICS: No 10 was at the centre of further controversy last night after a cabinet minister wrongly claimed that Boris Johnson could not be investigated by parliament's standards commissioner. George Eustice claimed that it was not for Kathryn Stone to carry out an inquiry into whether the prime minister had properly declared how a recent refurbishment of his Downing Street flat was financed. The environment secretary said the matter was a "ministerial issue, not a members of parliament issue". However, critics said Eustice was incorrect to suggest that the prime minister had "special privileges". As an MP, Johnson is subject to the same parliamentary standards as all other members. (The Times)

POLITICS: Prime Minister Boris Johnson must apologise to the country for his handling of the Owen Paterson sleaze row, Sir Keir Starmer has said. The Labour leader said Mr Johnson must also confirm that Mr Paterson, a former cabinet minister, will not be nominated for a peerage. Ahead of an emergency Commons debate on standards at Westminster, Sir Keir said Mr Johnson needed to act to clean up politics. (Sky)

POLITICS: Boris Johnson needs to stop campaigning and begin "governing" to deliver his manifesto pledges or risk betraying the voters who supported him, a former cabinet minister warns today. In a shot across the bows of Downing Street, Robert Buckland, the former justice secretary, said if Johnson wanted his government to be "sustainable" then he needed to show "seriousness of purpose". In an article for The Times Red Box Buckland implies that unless Johnson changes the way he runs the government he risks squandering the 80-seat majority he won in 2019 and delivering very little for those who voted for him. (The Times)

EUROPE

GERMANY: Germany's economic growth will boost tax revenue by 160 billion euros ($185 billion) more than previously expected through 2025, Handelsblatt reported, citing forecasts from unnamed government officials. The revenue forecast for federal, state and municipal taxes tallies 29 billion euros more this year than a May estimate -- and 33 billion euros next year, the newspaper reported. The finalized figures, which are subject to adjustment, will be unveiled Thursday. The increased revenue would give a new government led by Social Democrat Olaf Scholz, who is negotiating with the Greens and the Free Democrats to form a coalition, between 10 and 15 billion euros in extra funds to distribute, the newspaper said. That would still leave party negotiators to seek other avenues to finance an ambitious agenda that addresses climate change and Germany's digital infrastructure, while adhering to Germany's constitutional debt restrictions. (BBG)

GERMANY: The German parties currently in talks to form the next government under Social Democrat Olaf Scholz will introduce draft legislation in the lower house of parliament on Monday to address the country's surge in new COVID infections. The SPD, Green party and the Free Democrats will propose a bill for an "appropriate and decisive" measure to fight the country's fourth wave, FDP parliamentary whip Marco Buschmann tweeted on Sunday. (BBG)

FRANCE: Budget Minister Dussopt and Health Minister Olivier Veran will present the budget to the Senate on Monday, Dussopt said in a radio interview. If the current increase in Covid cases causes a short-term hospital crisis, the government will act further, Dussopt said. "Each time it's been necessary to respond to the crisis, we've released emergency funds, and if it's necessary, we'll do it again," he said. (BBG)

FRANCE: French President Emmanuel Macron would get 25% or more of the votes in the first round of the election if voting were held today, according to a poll done by Ifop-Fiducial for LCI television and Le Figaro. Far-right commentator Eric Zemmour would win 16.5% to 18% of the first-round vote, depending on who else was running, line with Marine Le Pen of the National Rally party at 16% to 18%, the poll shows. (BBG)

ITALY: Health Minister Speranza says that if hospitalizations remain under control, the country won't face any additional restrictions during the Christmas holidays. Italy is working to persuade the roughly 12% of population that opposes the vaccine to get a shot, the minister said. (BBG)

ITALY/BTPS: Italy plans to sell up to EU5 billion ($5.78 billion) of bills due Nov. 14, 2022 in an auction on Nov. 10. (BBG)

PORTUGAL: Portuguese Prime Minister Antonio Costa's Socialists led center-right opposition party PSD by a wider margin of 14.1 percentage points in a survey of voter intentions. Costa, who is halfway through a second four-year term, will face an early election on Jan. 30 after parliament rejected his minority Socialist government's 2022 budget last week. The Socialists took 36% of the vote in the 2019 election. The survey indicated 38.5% support for the Socialists, an increase of 0.9 percentage point from the previous poll carried out in July. It indicates 24.4% backing for PSD, a drop of 0.8 percentage point. (BBG)

AUSTRIA: Unvaccinated people in Austria who also haven't had Covid-19 will no longer be allowed to enter restaurants, hotels and hair salons or attend public events with more than 25 people under new rules that take effect Monday, according to the Associated Press. (BBG)

RATINGS: Sovereign rating reviews of note from Friday included:

- Fitch affirmed France at AA; Outlook Negative

U.S.

ECONOMY: Most truckers are not covered by President Joe Biden's Covid vaccine and testing requirements for private businesses, according to Labor Secretary Marty Walsh, a win for an industry that had warned of potential walkouts that would disrupt already strained supply chains. (CNBC)

CORONAVIRUS: The U.S. crossed the milestone of 70% of people 18 and older fully vaccinated, according data from the Centers for Disease Control and Prevention. (BBG)

FISCAL: The House voted 221 - 213 to clear a procedural hurdle for President Joe Biden's $1.75 trillion safety net package after a chaotic day that included passage of a separate infrastructure bill. The vote came after weeks of missed deadlines and then hours of wrangling between Democrats that ended in a pact between progressives and centrists. Progressives agreed to pass the bipartisan physical infrastructure bill and centrists promised to vote for the Build Back Better bill after an estimate about the bill's price is completed. While a date for a vote on the $1.75 trillion bill hasn't been set yet, Biden said he felt confident it would happen over the next two weeks. "I am confident that during the week of November 15, the House will pass the Build Back Better Act," Biden said in a statement before the vote. (NBC)

CORONAVIRUS: President Joe Biden's requirement for employees at companies with more than 100 workers to get Covid-19 vaccinations or regular testing is on solid legal ground, presidential adviser Cedric Richmond said. "We're very confident we're on statutory and legal grounds," Richmond said on CBS's "Face the Nation" on Sunday. A federal appeals court in New Orleans temporarily halted the mandate's nationwide rollout on Friday and gave the Biden administration until Monday to respond. Republican state attorney-generals and companies have been challenging the U.S. Occupational Safety and Health Administration's rule, which sets a Jan. 4 deadline. (BBG)

CORONAVIRUS: Pfizer Inc. is aiming to submit data from its experimental Covid-19 pill to U.S. regulators by Thanksgiving, potentially clearing the way for an emergency-use authorization, Chief Executive Officer Albert Bourla said. (BBG)

CORONAVIRUS: U.S. regulators cleared a new over-the-counter Covid-19 test Friday that could add millions of tests per month to the market for rapid Covid diagnostics that have sometimes been in short supply, according to federal health authorities. (BBG)

EQUITIES: Elon Musk's social media followers have spoken: The Tesla Inc. chief should sell 10% of his stake in the electric-car maker. A majority of 3.5 million Twitter users -- 58% -- said they'd support such a sale in a Twitter poll that Musk launched Saturday and closed shortly after 2:15 p.m. Sunday in New York. The stake would be valued at about $21 billion based on 170.5 million Tesla shares he holds. "I was prepared to accept either outcome," Musk said in a tweet after the poll closed. A cryptocurrency version of Tesla's shares trading on FTX suggests Musk's tweeting may cause the shares to fall when Wall Street wakes up Monday. They were fetching $1,137.60 as of about 5:20 p.m. Sunday in New York, 6.9% lower than Friday's close for the real stock. (BBG)

OTHER

GLOBAL TRADE: U.S. TR Tai is set to meet with EU trade ministers on Thursday. (BBG)

GLOBAL TRADE: South Korea said its technology firms will provide some semiconductor data to the U.S., following a request by the Commerce Department for companies in the supply chain to provide information on inventory and sales of chips. South Korean firms are preparing for a "voluntary submission" of relevant information, the finance ministry said in a statement on Sunday, adding that its tech giants have been negotiating with the U.S. on the extent of data to be submitted. It didn't elaborate. (BBG)

GLOBAL TRADE: China says it's ready to reduce tariffs when the Asia-Pacific trade deal Regional Comprehensive Economic Partnership Agreement, or the RCEP, comes into force next year. China expects the deal to significantly improve East Asia's economic integration and wants full implementation as soon as possible, according to a statement of China Ministry of Commerce on Saturday. RCEP could fuel regional recovery, consolidate supply chains and promote economic development, it added. (BBG)

U.S./CHINA: China's official news agency issued a lengthy commentary accusing the U.S. of "vicious slanders" against Beijing over the origins of the Covid-19 pandemic. Among them, the Xinhua News Agency piece cited the notion that the earliest cluster arose in Wuhan in December 2019. However, there was a "growing number of clues, reports and studies" indicating that cases had emerged in many places around the world as early as the second half of 2019, it said. (BBG)

GEOPOLITICS: China will hold those who support "Taiwan independence" criminally liable for life, it said on Friday, provoking anger and ridicule from the democratic island at a time of heightened tension across the sensitive Taiwan Strait. (RTRS)

JAPAN: Japan reported zero Covid-19 deaths for the first time in 15 months on Sunday, a day before the country eases border control measures. The country reported 157 new infections on Sunday, down from a peak of about 25,000 during the summer. With Japan's outbreak easing and a vaccination campaign that's inoculated more than 70% of the population, the government is seeking to reopen the economy. Effective Monday, Japan will shorten quarantine for short-term business travelers and Japanese nationals or foreign residents returning from abroad if they have received an approved vaccine. Japan will also decide whether to change the way it categorizes the severity of the Covid situation based on the burden on its health-care system in five different stages, the NHK reported. (BBG)

JAPAN: Several government sources told Jiji that Japan is considering revising its National Security Strategy at the end of 2022. The focus is on whether the controversial proposal to build capabilities to strike enemy military bases will be included in the revised document. Jiji reported that officials are planning to call for boosting economic security, amid China's growing assertiveness. The National Security Strategy was last reviewed in 2013 by the second Abe Cabinet. (MNI)

JAPAN: Japanese Prime Minister Fumio Kishida's government will distribute 100,000 yen ($880) in cash, vouchers or a combination of both to those 18 years or younger and make it a pillar of an economic stimulus package planned to be created by the end of the month. The payment is expected to be made by spring 2022. Komeito insists that all children should be eligible for handouts, regardless of their parents' income. But the idea of excluding wealthier households still remains within the government. (Nikkei)

JAPAN: Japanese Cabinet approvals ratings rose by 4 ppt to 45% in the latest poll conducted by the Asahi Shimbun. (BBG)

BOJ: MNI BRIEF: BOJ Oct Opinions: Board Sees Higher Inflation Rate

- Bank of Japan board members see higher inflationary pressure in Japan and they are vigilant against the impact of higher inflation rates on economic activities at the October 27-28 meeting, the summary of opinions released Monday showed - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA: Australia hit its target of having 80% of people aged 16 and older fully vaccinated against Covid-19, Prime Minister Scott Morrison said, as the country shifts from a strict containment policy toward living with the virus as endemic. (BBG)

AUSTRALIA: Prime Minister Scott Morrison plans to open the border to foreign workers before Christmas and said the nation must fix supply chain port blockages if it is to make the most of a post-lockdown economic rebound. (AFR)

NEW ZEALAND: Aucklanders will get a few more freedoms when the city moves to alert level 3, step 2, from Wednesday. Prime Minister Jacinda Ardern announced the decision on Monday, and also confirmed Auckland would likely leave lockdown and move into the new 'Covid-19 Protection Framework, also known as the traffic light system, from November 29. Under this stepped approach, retail will be able to open in Auckland as well as public amenities such as museums and zoos. Upper Northland, which was put into level 3 in the middle of last week, will also come down to alert level 2 on Friday. (Stuff.co.nz)

SOUTH KOREA: South Korea's economic recovery momentum has weakened due to the slowdown in the manufacturing sector amid a global supply chain shortage and energy crisis, a state-run think tank said Sunday."The recovery in manufacturing weakens as global supply chains remain clogged, since an improvement of external conditions lost steam," the Korea Development Institute (KDI) said in a monthly economic assessment report.The manufacturing firms' shipments have fallen, while the inventory-to-shipment ratio has risen recently, the institute said, noting supply chain disruptions and rising prices of raw materials put increasing downward pressure on the global economy. (Yonhap)

SOUTH KOREA: Latest polling shows that clouds are gathering over South Korea's ruling Democratic Party ahead of the 2022 presidential race.

- Yoon Seok-youl, the candidate of the main opposition People Power Party, was backed by 45.8% of respondents in a survey conducted by PNR on Friday and Saturday. Support for the Democratic Party's Lee Jae-myung stood at 30.3%.

- The weekly Realmeter survey showed that the approval rating of President Moon Jae-in fell 4.5pp to 34.2% last week, nearing record lows. Approval of the People Power Party rose 3.4pp to a new high of 46%. (MNI)

NORTH KOREA: North Korea conducted an artillery fire drill Saturday that could target its rival Korea's heavily populated capital, after Washington and Seoul kicked off joint military aerial exercises on Monday despite Pyongyang's rebuke. North Korea's mechanized troops held an "artillery fire competition" to boost the country's "mobile artillery combat capabilities," state-run Korean Central News Agency said Sunday. The country's leader, Kim Jong Un, didn't watch the drill, although Pak Jong Chon, a member of the Presidium of the Political Bureau, inspected the fire competition, the state media reported. (BBG)

BOC: Canada's high inflation rate is a temporary problem, but that doesn't mean it will be resolved quickly, Bank of Canada Gov. Tiff Macklem says. Speaking in an interview with CTV Network's Sunday politics show, "Question Period," Mr. Macklem said high inflation continues to be a top concern for the central bank. The bank has repeatedly described the situation as transitory, saying the factors pushing up inflation -- such as supply-chain disruptions and elevated energy prices -- are largely tied to the circumstances of the pandemic. "Transitory to economists means sort of not permanent," Mr. Macklem said in the interview. "I think to a lot of people transitory means it's going to be over quickly. And you know, maybe, I don't know exactly what the right word is. But it's probably something like, you know, transitory but not short-lived." (Dow Jones)

CANADA: MNI INTERVIEW: Supply Price Pressure Seen Lingering For a Year

- Global supply chain pressures are likely to keep inflation elevated for a year or more, though there's little evidence yet of a spiral of higher price demands, the head of Canada's Ivey PMI told MNI Friday. "It's not just manufacturers having problems, it's constraints in the delivery system, so it's ships, the ports, the trucks, the trains and the associated Covid problems that we are slowly working our way out of, but also labor shortages," said Fraser Johnson, who compiles the Ivey index - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BRAZIL: Brazilian President Jair Bolsonaro lamented on Saturday that state-run oil company Petrobras sets domestic fuel prices independent of government interference and repeated his desire to privatize the firm. (RTRS)

RUSSIA: The United States is keeping a close watch on Russian troop movements near the country's border with Ukraine, describing the activity as "unusual." "We continue to monitor this closely," Pentagon press secretary John Kirby told reporters Friday, while calling on Moscow to publicly explain its intentions. (Voice of America)

SOUTH AFRICA: Eskom announced Stage 2 power cuts will continue through the week from 5 am on Monday until 5 am on Saturday. The power cuts are a result of needing to use emergency generating reserves. The utility warned the system remains volatile and unpredictable and higher stages of power cuts could be required. (ENCA)

IRAN: Russia and Iran's foreign ministers called for the nuclear accord with Tehran to be restored, with Iran saying it was ready to comply if the U.S. doesn't add additional demands. Sergei Lavrov and Hossein Amir Abdollahian discussed the Joint Comprehensive Plan of Action by telephone on Saturday, the Russian Foreign Ministry said in a statement, before the latest round of negotiations kick off later this month. (BBG)

IRAN: Iran's military began its annual war games in a coastal area of the Gulf of Oman, state TV reported Sunday, less than a month before upcoming nuclear talks with the West. The report said navy and air force units as well as ground forces were participating in a more than 1 million square-kilometer (386,100 square-mile) area east of the strategic Strait of Hormuz. (ABC)

MIDDLE EAST: Iraq's prime minister has survived an attempted assassination by a drone armed with explosives. The government said the drone targeted Iraqi Prime Minister Mustafa al Kadhimi's home in Baghdad's Green Zone early on Sunday. By early afternoon, it was reported that troops were being deployed across the city. State news agency INA quoted an interior ministry spokesman as saying that three drones were used in the attack, including two that were intercepted by security forces. The third drone hit the prime minister's residence. (Sky)

ENERGY: Russian President Vladimir Putin promised Europe more gas starting on Monday. So far, there are no signs the continent will get any relief. German gas orders via a key Russian pipeline signaled a very small increase in shipments on Monday, while no extra capacity to send additional supplies to Europe was booked in auctions on Sunday. (BBG)

OIL: Saudi Arabia's larger-than-expected rise in oil prices is a signal it will continue resisting U.S. pressure to pump faster, according to Vitol Group. Saudi Aramco hiked December prices for customers in Asia, the U.S. and Europe on Friday, a day after OPEC+ stuck to its plan to boost output only at a gradual pace. The state producer's month-on-month increase in the official selling price, or OSP, for its main Asian grade was the third-largest this century, according to data compiled by Bloomberg. "They are unlikely to change stance," Mike Muller, the head of Asia for Vitol, the world's biggest independent oil trader, told Bloomberg on Sunday. (BBG)

OIL: U.S. President Joe Biden said on Saturday that his administration has ways to deal with high oil prices after OPEC and its allies rebuffed U.S. pleas for the producers to pump more crude. (RTRS)

OIL: Energy Secretary Jennifer Granholm on Sunday said that President Biden is "looking at" tapping into the nation's Strategic Petroleum Reserve to address rising oil prices. (Axios)

OIL: China National Petroleum Corp. will halt product exports for the rest of the year, according to Vice President Ren Lixin. Co. will coordinate refining and exports with the government. (BBG)

CHINA

EVERGRANDE: Some holders of U.S. dollar bonds issued by China Evergrande Group's unit Scenery Journey Ltd have not received interest payments due on Saturday by Monday morning in Asia, two people familiar with the matter said. The company was due to make semi-annual coupon payments on Saturday worth a combined $82.49 million on its 13% November 2022 and 13.75% November 2023 bonds. Non-payment of interest by Nov. 6 would have kicked off a 30-day grace period for payment. The company has narrowly averted defaults by paying previous coupons just before the expiration of their grace periods. One such period expires on Wednesday, Nov. 10, for more than $148 million in coupon payments that had been due on Oct. 11. A spokesperson for Evergrande did not immediately respond to a request for comment. The sources could not be named as they were not authorized to speak to the media. (RTRS)

PBOC: The PBOC is unlikely to cut banks' reserve requirement ratios or interest rates soon given growing expectations for higher inflations both within the country and globally, but will continue to reduce the financing costs of the real economy through structural monetary policy tools, the Shanghai Securities Journal reported citing Yan Se, an associate professor at Guanghua School of Management, Peking University. The PBOC will smoothen the liquidity gap by increasing reverse repos and MLFs towards year-end, the newspaper said citing analysts. MLFs valued at CNY1 trillion and CNY950 billion are to mature in November and December, respectively, along with increased maturity of reverse repos and the largest monthly sales of local government special bonds totaling CNY900 billion throughout this month, the newspaper said. (MNI)

ECONOMY: China needs to increase policies to support businesses beset by "dire" economic conditions including the pandemic, flooding and rising costs of raw materials, the Economic Daily said in an editorial. The government should steadily "pump blood" to help companies survive, stabilize expectations with the key measure being cutting taxes and fees, the official newspaper said. Numbered over 150 million, small businesses, or the so-called market entities, employ over 700 million, and are the backbone of the economy, said the newspaper. The authorities should continue to prod financial institutions to apportion more profits to businesses and lower their capital costs, said the daily. (MNI)

POWER: State Grid Corp. of China said power supply and demand in its areas of operation have returned to normal and the electricity gap has been significantly reduced, Xinhua reported. The thermal coal inventory in the company's operating area has rebounded to 99.3 million tons and the available days of thermal coal supply has climbed to 20, the report said, citing spokesperson Meng Haijun. State Grid Corp. of China supplies power to 1.1 billion people with a service area that covers 88% of Chinese territory, the company said on its website, adding that it's the world's largest utility. Power is still being curtailed for some high-consuming, high-polluting industries in selected provinces. The grid will face an "overall tight balance with partial gaps" this winter and in spring, the company said in the Xinhua report. (BBG)

ENERGY: Average daily coal output between Nov. 1-5 reached 11.7m tons, an increase of 1.2m tons from end-Sept., National Development and Reform Commission says in a statement. Maximum daily output during the period reached 11.9m tons, highest in recent years. Coal prices are expected to keep falling steadily due to output increases and a drop in power plant purchases. (BBG)

CORONAVIRUS: China said it will continue with stringent curbs to disrupt the coronavirus's domestic transmission, suggesting the nation won't break away from its Covid-Zero strategy anytime soon. (BBG)

CORONAVIRUS: China will see community transmission set off by imported Covid-19 infections as a "new normal" and that requires its response to change from total suppression to mitigation, according to Gao Fu, director of the Chinese Center for Disease Control and Prevention. "With frequent community spread caused by imported infections becoming the new normal, we need to be more targeted in suppressing the virus" Gao said at a forum in Shanghai on Saturday, "Everybody should be prepared." (BBG)

CORONAVIRUS: China aims to fully vaccinate those aged 3 to 11-years-old by the end of this year, according to CCTV.com. So far, more than 3.53 million doses have been given to children in this age group, the state-owned station reported on its website, citing data from the National Health Commission. Asia's largest economy has been battling a series of delta variant outbreaks. (BBG)

CORONAVIRUS: Merck & Co. is working with Chinese regulators to explore bringing its Covid-19 pill to China. The company, responding in an email to questions from Bloomberg News, didn't give further details. The drug, molnupiravir, received its first approval in the U.K. earlier this week after studies showed that it prevented hospitalization by half among mild and moderate patients. (BBG)

OVERNIGHT DATA

CHINA OCT TRADE BALANCE +$84.54BN; MEDIAN +$64.03BN; SEP +$66.76BN

CHINA OCT EXPORTS +27.1% Y/Y; MEDIAN +22.8%; SEP +28.1%

CHINA OCT IMPORTS +20.6% Y/Y; MEDIAN +26.2%; SEP +17.6%

CHINA OCT FOREIGN RESERVES $3.2176TN; MEDIAN +$3.2000TN; SEP +$3.2006TN

JAPAN SEP LEADING INDEX CI 99.7; MEDIAN 99.8; AUG 101.3

JAPAN SEP COINCIDENT INDEX 87.5; MEDIAN 87.5; AUG 91.3

CHINA MARKETS

PBOC NET INJECTS CNY90BN VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY100 billion via 7-day reverse repos with the rates unchanged at 2.2% on Monday. The operation led to a net injection of CNY90 billion after offsetting the maturity of CNY10 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1917% at 09:25 am local time from the close of 2.1240% on Friday.

- The CFETS-NEX money-market sentiment index closed at 51 on Friday vs 48 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3959 MON VS 6.3980

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3959 on Monday, compared with the 6.3980 set on Friday.

MARKETS

SNAPSHOT: Brexit Jabs Traded, No Sign Of Evergrande Coupon Payment

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 72.5 points at 29539.7

- ASX 200 down 4.737 points at 7452.2

- Shanghai Comp. up 10.811 points at 3501.547

- JGB 10-Yr future up 1 tick at 151.84, yield up 0.1bp at 0.061%

- Aussie 10-Yr future up 6.0 ticks at 98.225, yield down 6bp at 1.753%

- U.S. 10-Yr future -0-05 at 131-21+, yield up 1.39bp at 1.465%

- WTI crude up $0.97 at $82.25, Gold up $1.51 at $1820

- USD/JPY up 16 pips at Y113.57

- SOME EVERGRANDE UNIT OFFSHORE BONDHOLDERS HAVE NOT GOT INTEREST DUE NOV 6 (RTRS SOURCES)

- UK READY TO SCRAP NORTHERN IRELAND PROTOCOL'S CUSTOMS LAWS (TELEGRAPH)

- IRISH MINISTER WARNS EU COULD DITCH ENTIRE BREXIT DEAL (FT)

- PBOC CONDUCTS FIRST NET OMO INJECTION OF NOVEMBER

- CCP PLENARY SESSION GETS UNDERWAY

- BIDEN: U.S. HAS TOOLS TO RESPOND TO OPEC+ WITHHOLDING OIL SUPPLY (RTRS)

BOND SUMMARY: Core FI Back From Friday Highs

Asia-Pac hours saw core fixed income markets pressured by the trifecta of higher oil prices, a wider than expected Chinese trade surplus (firmer than exp. exports & softer than exp. imports), as well as the passage of the Build Back Better and infrastructure spending plans in the U.S. on Friday.

- A round of TYZ1 lifts (4K block and ~3K subsequently on screen) helped the Tsy space find a bit of a base mid-way through the Asia-Pac session. TYZ1 runs -0-04+ at 131-22 at typing, off lows and within the confines of 0-06+ overnight range, while the major cash Tsy benchmarks sit 0.5-1.5bp cheaper across the curve. A raft of Fedspeak, headlined by Chair Powell & Vice Chair Clarida, in addition to 3-Year note supply from the Tsy, headline the local docket on Monday.

- JGB futures sit at unchanged levels after giving back their overnight gains on the aforementioned dynamics, while the domestic fiscal burden continues to dominate headline flow. Cash JGBs run 0.5bp richer to 1.0bp cheaper across the curve, with 20s providing the weak point on the day. 30-Year JGB supply headlines the local docket on Tuesday.

- ACGBs lacked any meaningful local catalysts, leaving the space to track broader gyrations, with YM +7.0 & XM +6.0 come the bell. The weekend saw news that Australia hit its target of having 80% of 16+-Year olds fully vaccinated against COVID, with PM Morrison also noting that the border will open to foreign workers before Christmas. Issuance provided some points of interest; TCV launched a syndicated benchmark sized tap of its Nov '34 line, which is set to price on Tuesday, while Westpac mandated for a 5-tranche round of US$-denominated issuance.

EQUITIES: Tesla Steals The Limelight, Again

The major regional equity indices traded little changed to marginally softer during the first Asia-Pac session of the week. Participants looked for leaks surrounding the latest Chinese policymaker gathering in Beijing, although they were not forthcoming. Elsewhere, a net liquidity injection via PBoC OMOs (the first since the turn of the month), did little to boost broader risk appetite. Meanwhile, U.S. e-mini futures edged lower, with the NASDAQ 100 contract leading the way after Tesla CEO Musk ran a Twitter poll over the weekend, effectively asking if he should shed 10% of his equity holding in the company. The poll answered in the affirmative, after he noted that he "will abide by the results of this poll, whichever way it goes." Musk used the recent tax debate as his reasoning for launching the poll and it remains unclear if/when he will shed any of his holdings.

OIL: Friday's Rally Extends

WTI & Brent sit the best part of $1.00 above their respective settlement levels, albeit a little shy of their Asia-Pac peaks. Early trade saw regional participants adjust to Friday's news flow and price action, after a softer USD, news that Saudi Aramco has hiked its OSPs to all buyers and an uptick for the major equity indices on Wall St. combined to support crude at the backend of last week. The benchmarks still sit someway shy of their recent highs, with participants now assessing the chances of the deployment of U.S. SPR stock to fight off the upward momentum in crude, with President Biden stressing that the country has the capability to act after OPEC+ failed to comply with his request re: larger increases in supply last week.

GOLD: Little Changed After Post-NFP Move Higher

The post-NFP move lower in U.S. real yields and the DXY has mostly held during Monday's Asia-Pac session (at least if we use our weighted U.S. real yield monitor for the former), leaving gold little changed, just shy of $1,820/oz in spot dealing, after Friday's uptick. Bulls are squarely focused on the Sep 3 high/bull trigger ($1,834.0/oz), while bears need to take out the Nov 3 low ($1,759.0/oz) to reassert themselves. The upcoming raft of Fedspeak (including Chair Powell & Vice Chair Clarida on Monday) provides the immediate area of focus, with Wednesday's U.S. CPI release also eyed.

FOREX: Yen, Sterling Lose Ground

The yen went offered despite the absence of any major headline catalysts, with broader awareness of policy outlook divergence between the BoJ and its major peers lingering in the background. BBG trader sources pointed to leveraged short-covering in USD/JPY amid an uptick in U.S. Tsy yields. The rate extended gains over the Tokyo fix.

- Sterling showed some weakness amid continued escalation in the UK-EU stand-off over the Northern Ireland protocol.

- Commodity-tied FX found some poise as crude oil traded on a firmer footing. The NZD led gains as New Zealand eased restrictions in Auckland and confirmed that its largest city is on track to exit lockdown by month-end.

- USD/CNH operates on a slightly firmer footing, even as China's trade surplus surged to a record amid robust overseas demand for Chinese goods. Imports growth was slower than expected.

- A dearth of notable data releases today will be compensated by central bank rhetoric from Fed's Powell, Clarity, Harker, Bowman & Evans, ECB's Lane & Makhlouf as well as BoE's Bailey.

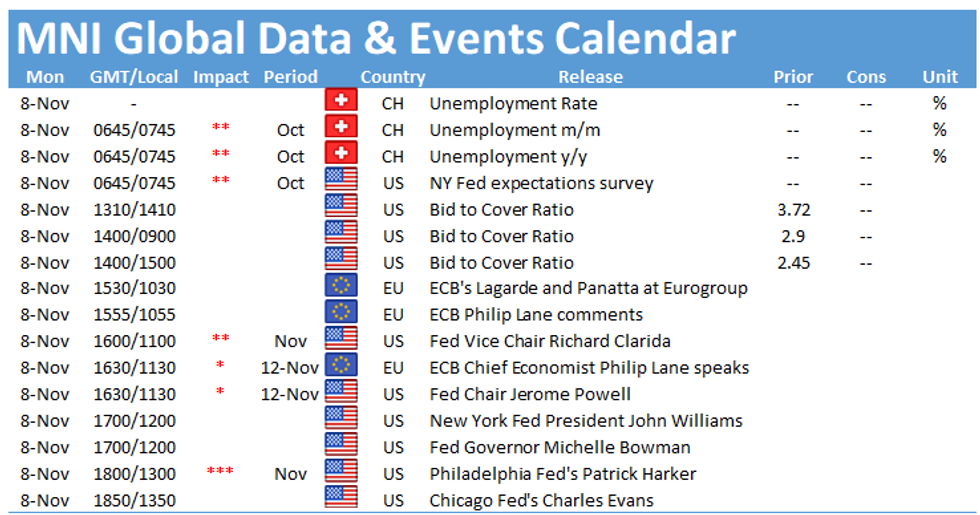

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.