-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Biden-Xi Summit Avoids Worst Case Scenario

EXECUTIVE SUMMARY

- BIDEN & XI CALL FOR COOPERATION AS VIRTUAL SUMMIT WRAPS UP (BBG)

- FED'S KASHKARI: FED SHOULDN'T OVERREACT TO TEMPORARY INFLATION (BBG)

- U.S. SENATE BANKING CHAIR BROWN: BIDEN'S FED CHAIR PICK IS 'IMMINENT' (BBG)

- UK PM JOHNSON: 'LEGITIMATE' TO SUSPEND BREXIT DEAL OVER NORTHERN IRELAND (BBG)

- RBA MINUTES: DISTRIBUTION OF POSSIBLE INFLATION OUTCOMES HAS WIDENED (BBG)

- CHINESE DEVELOPER KAISA HAS YET TO PAY INTEREST DUE LAST WEEK (BBG)

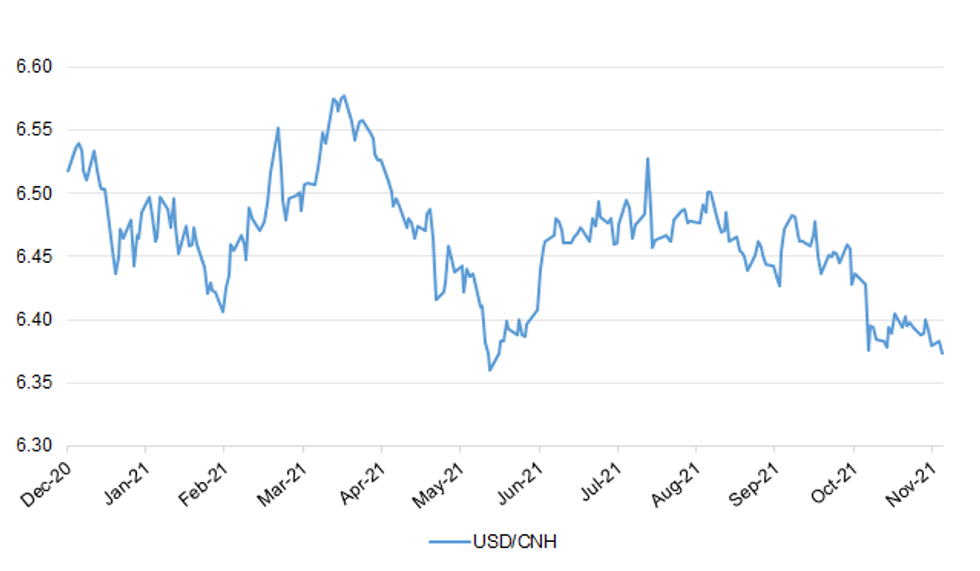

Fig.1: USD/CNH

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Asked if there could be another lockdown this Christmas, U.K. Prime Minister Boris Johnson warned: "Clearly, we cannot rule anything out." While saying that current data show no need for more restrictions, "history shows we cannot afford to be complacent," he said. Last month Johnson said there would be no curbs over the holidays. England Chief Medical Officer Chris Whitty said large parts of the National Health Service are under "very significant pressure" and are likely to remain so over the winter. (BBG)

BREXIT: Boris Johnson said it would be "perfectly legitimate" for the U.K. to suspend part of the Brexit deal with the European Union, though his government still wants to negotiate a solution to their escalating trade spat. The U.K. is demanding a major overhaul of the divorce agreement it signed with the bloc, arguing that its implementation is causing significant harm to businesses and communities in Northern Ireland. Johnson has repeatedly threatened to suspend parts of it by using Article 16 of the so-called Northern Ireland protocol, if the bloc doesn't agree to rewrite it. Yet doing so carries the risk of severe retaliation from the EU. On Monday, the bloc's top negotiator, Maros Sefcovic, told Irish lawmakers that any such move would call into question the EU's broader trade deal with the U.K., signed at the end of 2020 to ensure tariff-free commerce. But in a speech to business leaders and diplomats hours later in London, Johnson showed no indication is government is about to back down. (BBG)

BREXIT: French far-right leader and presidential hopeful Marine Le Pen said incumbent Emmanuel Macron should be more forceful when confronting U.K. Prime Minister Boris Johnson over their countries' post-Brexit disputes. "We must raise our voice with the U.K.," Le Pen said, adding that Macron should demand the British government license French fishermen to work in U.K. waters as agreed under Brexit. (BBG)

PROPERTY: Rents are rising at the fastest pace since 2008 as people rush back to city centres, according to property website Zoopla. Private sector rents in the UK were 4.6% higher in September than a year before at £968 per month on average - the strongest growth seen in 13 years. Outside of London, rents were up by 6%, marking a 14-year high, it said. Zoopla said it was partly down to higher demand for city living amid limited supply. Rents are up most in the South West (9%) year-on-year, followed by Wales (7.7%) and the East Midlands (6.9%). (BBC)

EUROPE

ECB: The ECB says it decided to increase the upper limit of cash as collateral for the Eurosystem's securities lending programme from €75 billion to €150 billion. (RTRS)

FISCAL: MEPs have fought for and obtained better support for health, research, climate action, SMEs and the young in next year's EU budget, after talks with Council on Monday. On Monday evening, the negotiators from the European Parliament and the Council reached a provisional agreement on the 2022 EU Budget, shortly before the deadline of the conciliation period, ending on Monday 15 November at midnight. Parliament has obtained in total €479.1 million for its priorities on top of what the Commission has proposed in the Draft budget updated with the Letter of amendment. The preliminary figures are €169.5 billion in commitment appropriations and €170.6 billion in payment appropriations. Detailed figures will be available later. (European Parliament)

FISCAL: MNI: Italy Wants Permanent Lending Facility In EU Debt Talks

- Italy and other southern states are pressing for talks on a new fiscal regime for the European Union to include the creation of a permanent European Union lending facility along the lines of the Recovery and Resilience Facility implemented in the wake of the Covid pandemic, MNI understands - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

SPAIN: Spain's government has agreed with unions to raise social-security contributions by 0.6% between 2023 and 2032 to help pay for the pensions of an upcoming wave of retirees, the Social Security Ministry said on Monday. (RTRS)

U.S.

FED: It may take several more months at least for the Federal Reserve to understand if high inflation and labor shortages are offshoots of the pandemic that will eventually ease, or reflect more durable changes to the economy, Richmond Federal Reserve President Thomas Barkin said on Monday. Barkin said on Yahoo Finance the Fed will not hesitate to raise interest rates if it concludes high inflation threatens to persist, but "it is helpful for us to have a few more months to evaluate is inflation going to come back to a more normal level? Is the labor market going to open up? … I think it is helpful to have some time to see where reality is." (RTRS)

FED: The Federal Reserve shouldn't overreact to inflationary pressures that are likely to prove temporary, Federal Reserve Bank of Minneapolis President Neel Kashkari said. "We shouldn't overreact to what is likely going to be a temporary factor," Kashkari said Monday in a Bloomberg Television interview with Kathleen Hays. "If we overreact by saying, 'Let's just change the path of monetary policy to try to deal with a one-time effect,' that could lead to a worse long-term outcome for the economy." (BBG)

FED: Senate Banking Chairman Sherrod Brown said he was told by White House officials to expect an "imminent" announcement about President Joe Biden's pick to chair the Federal Reserve. "I hear it's imminent," Brown, an Ohio Democrat, said Monday in a brief interview at the Capitol. "I'm not going to speculate who I think it might be now. I assume the decision's been made and they haven't announced it, but I don't even know that," he said. Biden's choice has been expected before Thanksgiving. Current Chair Jerome Powell's term ends in February, and Biden interviewed both he and Fed Governor Lael Brainard for the top job earlier this month. Powell was elevated to the chairmanship by Donald Trump. Brainard, a Democrat, has won backing from progressive elements for her stronger stance on financial regulation. (BBG)

FISCAL: President Joe Biden signed into law a $1 trillion infrastructure bill at a White House ceremony on Monday that drew Democrats and Republicans who pushed the legislation through a deeply divided U.S. Congress. (RTRS)

FISCAL: The non-partisan Congressional Budget Office said its full cost estimate of President Joe Biden's signature tax and spending bill may not be ready until Friday, threatening to push a planned House vote on the legislation to the weekend or later. CBO director Phillip Swagel said in a blog post that the agency expects to release estimates on the agriculture and financial services portions of the bill Monday and the rest of the bill, including core healthcare, tax, climate and childcare elements by the end of the day Friday. (BBG)

EQUITIES: Elon Musk exercised options and sold more Tesla Inc. shares, continuing a streak of sales that helped tank the stock last week by the most since March 2020. The world's richest person offloaded more than 934,000 shares on Monday for about $930 million, regulatory filings unveiled. That adds to the $6.9 billion he already sold last week, just after he took an unusual Twitter poll asking whether he should dispose of 10% of his Tesla stake. The sales were to help pay taxes on the exercise of 2.1 million options. (BBG)

OTHER

U.S./CHINA: Joe Biden and Xi Jinping spoke of the need for cooperation in their first face-to-face virtual summit, with both sides aiming to stabilize the U.S.-China relationship while downplaying expectations for major breakthroughs. (BBG)

U.S./CHINA: The Senate will add an expansive plan to help the U.S. better compete with China and bolster the U.S semiconductor industry to Congress's annual defense authorization bill, Majority Leader Chuck Schumer said, jumpstarting action on legislation that's been stalled for months. Schumer said on the Senate floor Monday that he will move to attach the nearly $250 billion legislation to spur research and development as well as domestic chip manufacturing as an amendment to the National Defense Authorization Act because the "supply chain crisis needs attending to and we cannot wait." The New York Democrat set in motion procedures to begin Senate debate on the defense bill this week. If it passes there, the House and Senate would negotiate differences in the two measures. House Armed Services Chairman Adam Smith, a Washington State Democrat, said Monday that he was "wide open" to adding the China bill to the defense measure, a strong indication that the language would survive House-Senate negotiations and make it into the final defense bill. (BBG)

JAPAN: An economic stimulus package, expected to be released at the end of this week, has yet to be finalized, according to Japan's Finance Minister Shunichi Suzuki. Overall size will be decided as a result of accumulating requests from ministries, not the other way around starting with numbers, Suzuki tells reporters Tuesday. Stimulus is expected to start having a real impact on the economy in early 2022. Hope economy to stay in recovery mode in the current quarter with help of government measures. (BBG)

RBA: Australia's inflation outlook differs from many other advanced economies, the Reserve Bank said, while acknowledging that quicker consumer-price gains last quarter had altered the picture. "The risks to the inflation forecast had changed, with the distribution of possible outcomes shifting upwards," the RBA said in minutes of its November meeting Tuesday. Key uncertainties included the duration of global supply chain disruptions and how wages respond to very low unemployment, it said. The comment reinforces the tension between central banks and markets over the likely trajectory of inflation, with traders urging policy makers to begin tightening to head off faster price growth. Australia's central bank, like counterparts around the world, is grappling with whether a recent acceleration in inflation is temporary or more enduring. Governor Philip Lowe has kept interest rates at 0.1% and reiterated that they will not be lifted until inflation is "sustainably" within the RBA's 2-3% target, a goal he sees as unlikely to be met before 2024. (BBG)

RBA: Australian wages will need to grow at "3 point something" to sustain inflation around the middle of the central bank's 2-3% target, Governor Philip Lowe said, while adding that it will not be the sole determinant for price pressures and, in turn, policy. "Rather, we are using wages growth as one of the guideposts in assessing progress towards our goal and whether inflation is sustainably in the target range," Lowe said in the text of a speech Tuesday. "As we get closer to that goal, you could expect us to provide further guidance, including our projections for inflation." His comments come as markets challenge the Reserve Bank of Australia's dovish stance that rates are likely to remain at a record low of 0.1% for about two more years. The RBA chief, like counterparts around the world, is grappling with whether a recent acceleration in prices is temporary or more enduring. (BBG)

RBA: The Reserve Bank of Australia will launch a review of its yield curve target after a bond market revolt forced the central bank to prematurely dump the COVID-19 emergency policy setting earlier this month. Treasurer Josh Frydenberg signalled a possible review of the RBA after next year's federal election, but this would be a separate probe specifically focused on yield curve control in the context of the broader COVID-19 response. "This would be done in 2022 and in light of additional information on the effect of the overall policy package on the bank's goals," the minutes from the November board meeting said. The RBA was forced to dump its policy of suppressing the yield on the April-2024 Treasury bond to 0.1 per cent after a financial market sell off that forced the yield to 0.8 per cent, more than eight times the target rate. Board members discussed three potential options for the policy: continuing the target at 0.1 per cent consistent with the bank's central forecast for rates to remain at record lows until 2024; adjusting the target to an earlier bond line in 2023 or raising the yield target; or abandoning the policy altogether. (AFR)

NEW ZEALAND: New Zealand reduced the isolation period to 10 days from 14 for fully vaccinated people who get Covid-19 or are in close contact with someone who has it. The isolation period must include 72 hours symptom-free. (BBG)

RUSSIA: The U.S. Department of Defense said on Monday that it continued to see unusual military activity and a concentration of Russian forces near its border with Ukraine. (RTRS)

RUSSIA: French President Emmanuel Macron and Russian President Vladimir Putin agreed on the need for a de-escalation of the migrant crisis at the Belarus border, even if the two leaders disagreed on the origins of the crisis, a French official said on Monday. (RTRS)

RUSSIA: The U.S. and its European allies are discussing potential responses if Russian President Vladimir Putin takes military action against Ukraine, including fresh sanctions on Moscow and further security assistance for Kyiv. Senior U.S. officials have raised the idea of a package of measures in discussions with European counterparts over the past week, telling them the Biden administration is already working up a menu of options to counter possible moves by Russia, according to people familiar with the discussions. (BBG)

RUSSIA: The US has condemned Russia for conducting a "dangerous and irresponsible" missile test that it says endangered the crew aboard the International Space Station (ISS). The test blew up one of Russia's own satellites, creating debris that forced the ISS crew to shelter in capsules. The station currently has seven crew members on board - four Americans, a German and two Russians. (BBC)

IRAN: The Pentagon on Monday accused Iran of "unsafe and unprofessional" conduct by a naval helicopter that it said flew within about 25 yards of a U.S. Navy ship and circled it three times in the Gulf of Oman. Pentagon press secretary John Kirby said the Iranian helicopter circled the USS Essex, an amphibious assault ship, three times and at one point flew as low as 10 feet off the surface of the water. He said the incident on Nov. 11 had no effect on the Essex's operations. (AP)

ENERGY: European nations must choose between "mainlining" Russian gas and defending peace in Ukraine, Boris Johnson said on Monday amid escalating tensions with the Kremlin. (Telegraph)

OIL: Crude output at major U.S. shale plays seen at 8.316m b/d in December, according to EIA's monthly Drilling Productivity Report. EIA revises Nov. shale-oil forecast to 8.23m b/d from 8.22m b/d. (BBG)

OIL: The Trans Mountain pipeline has been shut down temporarily due to widespread rains and flooding in British Columbia. Trans Mountain Corp. spokeswoman Ali Hounsell says the precautionary move was taken due to the flooding situation in the area of Hope, B.C. In addition, Hounsell says construction on the Trans Mountain expansion project has been temporarily halted in the Lower Mainland, Hope, and Merritt regions due to prolonged rainstorms. The 1,500-km Trans Mountain pipeline is Canada's only pipeline system carrying oil from Alberta to the West Coast. The pipeline has a capacity for 300,000 barrels per day. (Coast Reporter)

CHINA

PBOC: PBOC's injection of 1t yuan through MLF on Monday, which matched the record amount maturing in November, shows government's intention to keep liquidity reasonably ample in the banking system in the medium and long term, Financial News reports, citing analysts. Liquidity will continue to be sufficient and money market rate will stabilize around PBOC's open market operation rate. China is also likely to keep LPR unchanged in November. Separately, China Business News cites an analyst as saying in a report that PBOC may still cut banks' reserve requirement ratio before the end of the year in order to support economic growth. (BBG)

PBOC: China may mainly use structural monetary tools to ensure liquidity, with Open Market Operations playing a significant role "smoothening" out short-term liquidity volatilities, the Economic Information Daily said. While cutting banks' reserve requirement may still be necessary, there needs to be a "catalyst" and the market shouldn't place high hopes on a rate cut, the Xinhua-owned newspaper said. The comment came after the PBOC on Monday conducted CNY1 trillion MLF and CNY10 billion reverse repo, net-injecting CNY910 billion, which was a pre-emptive measure ahead of maturing MLFs and tax remissions which drain liquidity. The central bank has increased reverse repo since Nov. 3 and ensured "loose-leaning" stable liquidity, said the newspaper. (MNI)

YUAN: Yuan exchange rate will be supported by strong settlement demand amid seasonal factors and deviate from the dollar index to have its own independent market, Shanghai Securities News reports, citing analysts from China Merchants Bank and Citic Securities' research institute. Driven by higher-than-expected inflation data and increasing expectations for the Fed to raise interest rates in advance, the dollar index continued to strengthen. However yuan exchange rate has not been dragged down by the strengthening of the dollar index and the trend is stable, mainly due to strong exports and relatively high settlement demand from customers. (BBG)

ECONOMY: China's GDP growth in the fourth quarter faces a number of uncertainties, including recurring cases of Covid-19, which have been more particularly widespread in November, the 21st Century Business Herald reported citing Zhang Yongjun, an economist with China Center for Economic Exchanges. Exports in November and December this year may be weaker than usual given that the global shipping bottleneck prompted buyers to prepare orders five months ahead of normal timeline, the newspaper said citing analyst Zhang Yu of Huachuang Securities. GDP may slow to between 4% and 4.5% from 4.9% in Q3, the newspaper said. (MNI)

ECONOMY: MNI: Green Targets Seen Limiting China Factories, GDP, In Q4

- Chinese factories are likely to face renewed constraints on energy supplies in the fourth quarter as authorities stick to green targets after allowing a boost to domestic coal production in response to September's power shortages which fed producer price inflation, advisors told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CREDIT: At least some of Chinese developer Kaisa Group Holdings Ltd.'s creditors haven't received bond interest that was due last week, according to people with knowledge of the matter, starting the clock on a 30-day grace period before a default. As of 6 a.m. in New York on Nov. 15, investors in Kaisa's dollar bonds had yet to receive their payments, said the people, who asked not to be named discussing a private matter. The developer had coupon payments totaling $88.4 million due on Nov. 11 and Nov. 12. A representative for Kaisa didn't immediately respond to a request for comment after normal business hours. (BBG)

CORONAVIRUS: China's "dynamic zero-Covid policy" will not weaken the society's "political enthusiasm and rationality" for opening up to the outside world, even as some in the west laugh at China's isolation and say it will increase China's suspicion of everything in the west, the Global Times said in an editorial. The ideas of closing the doors to develop alone and completely part ways with the West are not advocated in China, it said. While the U.S. and other western nations are opening the doors faster, China's insistence on the dynamic zero-COVID policy is to adhere to scientific epidemic prevention and control, in line with China's huge population, urban-rural gap, and insufficient medical resources, the officially-run newspaper said. (MNI)

CORONAVIRUS: China's daily Covid infections have been dropping sharply for a second day. Only 13 infections were reported on Tuesday, including two asymptomatic ones, compared to close to 100 daily last week. Authorities are working on extinguishing flareups in the northern border town of Heihe and an outbreak in the port city of Dalian in the northeast where tens of thousands of university students were put under lockdown. (BBG)

OVERNIGHT DATA

JAPAN SEP TERTIARY INDUSTRY INDEX +0.5% M/M; MEDIAN +0.8%; AUG -1.1%

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE 106.0; PREV 109.0

Consumer confidence dropped 2.8% last week, possibly influenced by the weaker-than-expected employment data for October. Elevated inflation expectations may also be dragging sentiment down, particularly given the headlines about global inflation pressures following the rise in the US CPI. Both weekly inflation expectations and its four-week moving average rose 0.1ppt to 5.0%. The drop in confidence about 'current financial conditions' may reflect concerns about rising prices, though this subindex is higher than it was this time last year despite the sharp rise in inflation expectations since then. (ANZ)

NEW ZEALAND OCT NON-RESIDENT BOND HOLDINGS 56.1%; SEP 54.2%

CHINA MARKETS

PBOC NET DRAINED CNY50BN VIA OMOS TUES

The People's Bank of China (PBOC) injected CNY50 billion via 7-day reverse repos with the rates unchanged at 2.2%, respectively, on Tuesday. The operation has led a net drain of CNY50 billion after offsetting the maturity of CNY100billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1707% at 09:25 am local time from the close of 2.0705% on Monday.

- The CFETS-NEX money-market sentiment index closed at 48 on Monday, compared with the close of 43 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3924 TUES 6.3896

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3924 on Tuesday, compared with the 6.3924 set on Monday.

MARKETS

SNAPSHOT: Biden-Xi Summit Avoids Worst Case Scenario

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 31.32 points at 29808.12

- ASX 200 down 49.711 points at 7420.4

- Shanghai Comp. down 3.214 points at 3530.088

- JGB 10-Yr future down 10 ticks at 151.67, yield up 1bp at 0.076%

- Aussie 10-Yr future down 6.5 ticks at 98.145, yield up 6.7bp at 1.832%

- U.S. 10-Yr future +0-04+ at 130-14, yield down 1.89bp at 1.596%

- WTI crude up $0.55 at $81.43, Gold up $4.17 at $1867.02

- USD/JPY up 1 pip at Y114.13

- BIDEN & XI CALL FOR COOPERATION AS VIRTUAL SUMMIT WRAPS UP (BBG)

- FED'S KASHKARI: FED SHOULDN'T OVERREACT TO TEMPORARY INFLATION (BBG)

- U.S. SENATE BANKING CHAIR BROWN: BIDEN'S FED CHAIR PICK IS 'IMMINENT' (BBG)

- UK PM JOHNSON: 'LEGITIMATE' TO SUSPEND BREXIT DEAL OVER NORTHERN IRELAND (BBG)

- RBA MINUTES: DISTRIBUTION OF POSSIBLE INFLATION OUTCOMES HAS WIDENED (BBG)

- CHINESE DEVELOPER KAISA HAS YET TO PAY INTEREST DUE LAST WEEK (BBG)

BOND SUMMARY: Worst-Case Averted

The light bid in U.S. Tsys that was apparent ahead of the Xi-Biden phone call faded from extremes, with the opening salvos ahead of the call seemingly a little bit more open vs. some expectations. While the meeting itself seemingly failed to herald any meaningful progress re: Sino-U.S. relations (as was exp.), the lack of overt conflict re: matters such as Taiwan meant that the call avoided the worst-case scenario for risk assets. TYZ1 +0-05 at 130-14+, back from session highs of 130-17, as cash Tsys run flat to 2bp richer across the curve, with 10s outperfroming. Flow was headlined by a 5K screen buyer of the TYZ1 130.00 puts. Tuesday's domestic docket is retail sales-centric, with industrial production, business inventories & NAHB housing data also due. Tuesday will also bring a deluge of Fedspeak, with Bullard, Barkin, Bostic, George & Daly all set to make addresses.

- The JGB curve was subjected to some twist steepening, with the belly representing the weak point (cheapening by ~1bp) in the wake of the weakness in futures overnight. The move in futures extended during the Tokyo morning as local participants reacted to overnight developments and set up for this afternoon's 5-Year JGB supply. The auction was solid, with the low price meeting broader expectations (taken from the BBG dealer survey), while the tail width held steady when compared to the previous auction as the cover ratio moved higher, topping the 6-auction average as it hit the highest level witnessed at a 5-Year JGB auction since April. Value vs. futures and the ability to set relative value steepener plays ahead of the impending outline of the well-discussed fiscal support package (which may weigh on the super long end on an increased issuance burden) were the most likely supporting factors for takedown (outlined ahead in our preview of supply). Futures are still lower on the day, -11 ahead of the close.

- While there was little in the way of fresh meaningful substance in the RBA's November meeting minutes, some light pressure crept into the front end of the ACGB curve post-release. That likely came on the back of the sentence which noted that "while a range of outcomes for global inflation in 2022 were possible, risks to inflation forecasts were tilted to the upside." A reminder that the market has been pricing an early RBA liftoff (when compared with Bank forward guidance) for some time, which limited the move. The Bank's overview on inflation remained relatively well balanced, with the minutes reiterating the idea that "members agreed that the distribution of possible outcomes for inflation had widened." The minutes then fleshed out upside and downside scenarios for the path of inflation. YM made new session lows on the release, with the same holding true for XM, although the contracts edged away from worst levels, with a subsequent address from RBA Governor Lowe reaffirming the well-known dovish stance at the centre of the central bank. YM -5.0 & XM -6.5 at the close.

JGBS AUCTION: Japanese MOF sells Y2.0231tn 5-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.0231tn 5-Year JGBs:

- Average Yield -0.077% (prev. -0.079%)

- Average Price 100.40 (prev. 100.42)

- High Yield: -0.075% (prev. -0.077%)

- Low Price 100.39 (prev. 100.41)

- % Allotted At High Yield: 39.9856% (prev. 98.5189%)

- Bid/Cover: 4.537x (prev. 3.861x)

EQUITIES: Stocks Generally Higher In Asia

A lack of outright hostility in the opening salvos ahead of the Biden-Xi phone call facilitated a warmer risk tone in Asia-Pac hours, with most of the major regional indices moving higher. The concluding comments also pointed to a lack of confrontation re: Taiwan, which would have aided risk appetite further. Casino names listed on the Hang Seng benefited from optimism surrounding regulatory review in Macau, while several Chinese tech names moved higher on the back of a press report which pointed to the Chinese powers that be potentially resuming online game approvals in the near future. Elsewhere, reports surrounding a continued lack of payment of bond coupons on the part of Chinese property developer Kaisa reminded us of the fragile state of affairs that particular sector is facing at present. The ASX 200 was the broader exception to the rule, registering modest losses as material names led the way lower. U.S. e-mini futures are little changed, with Tesla CEO Musk once again headlining in that particular sphere. Musk confirmed the sale of yet more of his equity holdings in the company (~$930mn worth) after he exercised options (the move is essentially tax-related).

OIL: A Little Firmer In Asia

WTI & Brent crude futures sit ~$0.50 & ~$0.60 above their respective settlement levels in Asia, after the benchmarks were essentially flat on Monday.

- A lack of imminent action from the U.S. re: the release of inventories from its SPR to combat the recent, well-documented rise in gasoline prices has supported crude. White House Press Secretary Psaki once again pointed to the consideration of all of the options available to the Biden administration re: the matter, with markets seemingly tiring of that line of dialect.

- On the broader supply front, a weather-related closure of Canada's Trans-Mountain pipeline has been noted.

- A quick reminder that Monday saw marginal upward revisions to the EIA's U.S. shale production estimates for the month of December.

- The latest round of weekly API crude inventory estimates is due to be released on Tuesday, as is the IEA monthly oil market report.

GOLD: DXY Caps Gold, ETFs Not Participating In Latest Rally

Spot gold trades a handful of dollars higher at $1,868/oz at typing. A fresh YtD high for the DXY capped gold on Monday. Our weighted U.S. real yield monitor was ultimately little changed come the close, although underlying worry re: inflation continues to support bullion. Resistance remains intact at the June 14 high ($1,877.7/oz). A break there would expose the June 8 high ($1,903.8/oz). Initial support is seen at the Nov 10 low ($1,822.4/oz).

- It is interesting to note that ETF holdings of gold are essentially unchanged in net terms over the last 6 sessions, after hitting the lowest level witnessed since mid-May '20 in the middle of last week. Still, the rebound from the trough in that metric hasn't been steep. On net, the dynamic in known ETF holdings of gold points to a lack of participation in the latest leg of the gold rally on the part of ETFs, with a steady weekly net liquidation of ETF holdings of gold seen up until last week.

FOREX: Virtual Summit Aids Redback, Dents Safe Havens

The first face-to-face virtual summit between U.S. Pres Biden and China's Pres Xi inspired some cautious optimism, sapping strength from safe havens USD and JPY in Asia-Pac hours.

- Note that $1.6bn worth of USD/JPY options with strikes at Y114.30 will roll off at today's NY cut, with a further $1.3bn of options due to expire at Y113.40-50. Spot USD/JPY last trades at Y114.17.

- AUD garnered some strength as the minutes from the RBA's most recent monetary policy meeting showed that the Reserve Bank sees risks to inflation shifting upwards. Its Antipodean cousin NZD traded on a softer footing, with AUD/NZD showing above the 38.2% recovery of its Oct 13 - Nov 9 sell-off.

- Offshore yuan went bid and printed its best levels since Jun 1, while spot USD/CNH plunged through support from ascending trendline/Oct 19 low in the process, as headlines surrounding Biden/Xi talks stole the limelight.

- U.S. retail sales & industrial output, UK labour market data and flash EZ GDP take focus on the data front, while central bank speaker slate features Fed's Bullard, Barkin, Bostic, George & Daly, ECB's Lagarde, BoC's Schembri & Riksbank's Breman.

FOREX OPTIONS: Expiries for Nov16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1450(E695mln), $1.1539-50(E892mln), $1.1600-25(E1.4bln)

- USD/JPY: Y113.40-50($1.3bln), Y114.30($1.6bln)

- GBP/USD: $1.3495-00(Gbp500mln)

- EUR/GBP: Gbp0.8525(E791mln)

- AUD/USD: $0.7300-15(A$757mln)

- USD/CAD: C$1.2370-90($830mln)

- USD/CNY: Cny6.4000($2.3bln); Cny6.4390-00($1.3bln)

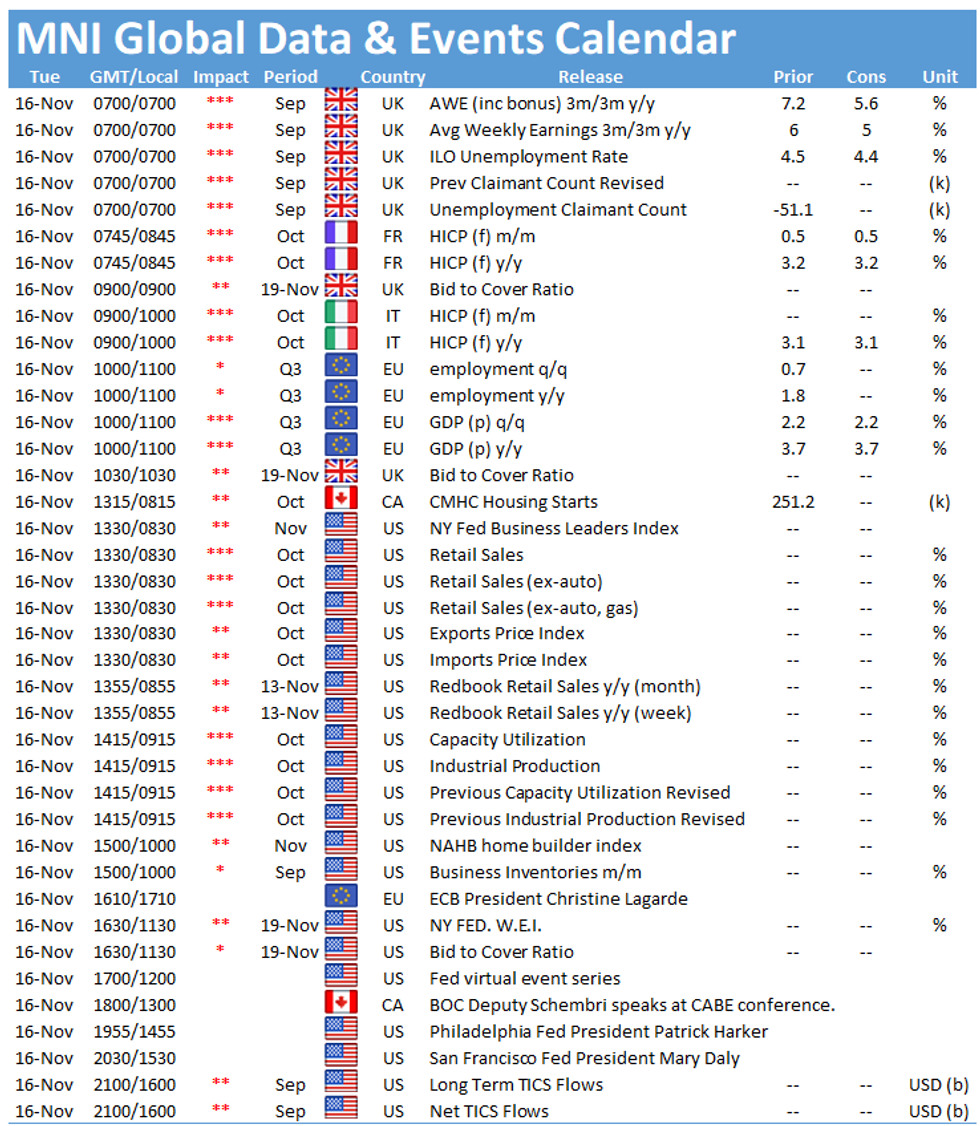

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.