-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: EC Head Confirms Nat'l Escape Clause Activation

MNI Eurozone Inflation Insight – Feb 2024

MNI EUROPEAN OPEN: European COVID Restrictions Deepen

EXECUTIVE SUMMARY

- FED'S BOSTIC: COULD START NORMALIZING INTEREST RATES NEXT SUMMER (RTRS)

- TOP BIDEN LABOR ECONOMIST WANTS FED TO RUN IT HOT TO BOOST JOBS (BBG)

- MANCHIN SEEKS MEETING WITH FED'S BRAINARD, FOLLOW-UP WITH POWELL (BBG)

- CBO & WHITE HOUSE AT LOGGERHEADS RE: "PAID FOR" STATUS OF BIDEN'S BBB PLAN

- GERMANY RESTRICTS ACCESS FOR UNVACCINATED TO STEM COVID RISE (BBG)

- IRISH PM: SERIOUS EU INTENT TO FIX N IRELAND BORDER ROW (BBC)

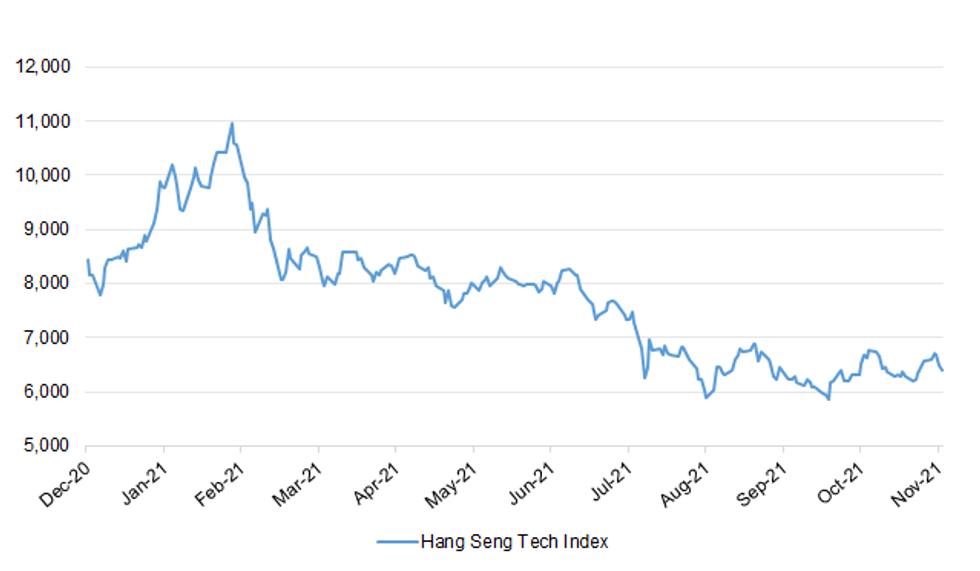

Fig. 1: Hang Seng Tech Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: There is "serious intent" in the EU to solve post-Brexit difficulties over the Northern Ireland border, Irish Prime Minister Micheál Martin has said. Speaking to the BBC, he said the "mood music" surrounding EU-UK negotiations had improved in recent weeks. But he admitted feeling "frustrated" that the issue had hindered the "full flowering" of the two sides' alliance. And he warned the UK against acting unilaterally, saying it would "undermine" relationships. The Taoiseach's comments come ahead of a meeting between the UK's Brexit Minister Lord Frost and the EU Commission Vice-President Maros Šefčovič in Brussels on Friday aimed at resolving problems arising from the Northern Ireland Protocol. (BBC)

BREXIT: The European Union will get a fresh chance on Friday to see whether the U.K. stance in their post-Brexit negotiations over Northern Ireland is wavering, where a potential deal on medicines may signal a path to a broader compromise that could avert a trade war. European Commission Vice-President Maros Sefcovic and U.K. Brexit Minister David Frost meet in Brussels on Friday to take stock of a week of intensive talks focused on easing the flow of medicines between mainland Britain and Northern Ireland, along with a broader range of customs and food inspection issues. A deal on medicines would give fresh impetus to the wider talks and temper fears that the U.K. might imminently quit the negotiations. (BBG)

BREXIT: A compromise over the European Court of Justice could be within reach in the Northern Ireland Protocol talks, which now appear set to stretch into the new year, sources said on Thursday. (Telegraph)

POLITICS: Boris Johnson hit back at claims that he was ruining his own levelling-up programme after the government's rail plan provoked a revolt by Tory MPs. The prime minister said his government was making the "biggest investment in rail in the history of the country", but critics attacked a decision to cancel the eastern leg of HS2 and downgrade Northern Powerhouse rail. MPs from across the Commons accused the government of breaking promises and betraying the north. Grant Shapps, the transport secretary, presented the long-awaited £96 billion Integrated Rail Plan, which he called an "ambitious and unparalleled programme" to overhaul links across the north and Midlands, but it caused an immediate backlash. (The Times)

EUROPE

GERMANY: Germany will restrict access to restaurants, bars and public events for unvaccinated people in regions that exceed a threshold of Covid-19 hospital admissions, while stopping short of a nationwide lockdown, Chancellor Angela Merkel said. Merkel and German regional leaders agreed on catalog of measures, with restrictions increasing by region as hospitals fill up with patients, in response to what she called the fourth wave of the pandemic to strike Germany. Only people who are vaccinated or have recovered from Covid-19 infections will have access to leisure, cultural and sports events, gastronomy, hospitality and services such as gyms, according to the agreement presented on Thursday. The measures kick in above a certain level of hospitalizations as a share of a region's population. (BBG)

FRANCE: President Emmanuel Macron said France didn't need to single out unvaccinated people for restrictions, as in several European countries including Austria and Germany, because of the national health pass that documents a person's vaccination status. "Countries locking down non vaccinated people are those that didn't put in place the health pass," Macron told La Voix du Nord late Thursday, referring to the obligation of being showing proof of immunization or vaccination to access public venues such as bars or restaurants. France's outbreak has worsened recently but not as badly as many other countries in Europe. Almost 80% of the population has received at least one dose of vaccine, according to the Bloomberg Vaccine Tracker. (BBG)

PORTUGAL: The Portuguese island of Madeira will impose new restrictions on unvaccinated residents and visitors amid a surge in cases across Europe. People who have not been vaccinated will be banned from attending public events such as concerts from Saturday, Miguel Albuquerque, the president of Madeira's regional government, said on Thursday. Unvaccinated people are allowed to attend mass or go to the supermarket as long as they show a negative Covid-19 test. (BBG)

GREECE: Greece joined several other European countries on Thursday in imposing more restrictions on those unvaccinated against COVID-19 following a surge in infections in recent weeks. From next Monday, unvaccinated people will be barred from indoor spaces including restaurants, cinemas, museums and gyms, even if they test negative for COVID-19, Prime Minister Kyriakos Mitsotakis. (RTRS)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on Malta (current rating: A+; Outlook Stable) & Switzerland (current rating: AAA; Outlook Stable)

- Moody's on Greece (current rating: Ba3; Outlook Stable)

- S&P on Slovakia (current rating: A+; Outlook Stable)

- DBRS Morningstar on Latvia (current rating: A (low), Positive Trend ) & Lithuania (current rating: A, Positive Trend)

U.S.

FED: Atlanta Federal Reserve President Raphael Bostic on Thursday said he believes the Fed could start raising interest rates in the middle of next year, when the U.S. economy will have regained the vibrant labor market it had before the pandemic hit. "Right now, our projections suggest that by the summertime of next year, the number of jobs that we have in the economy will be pretty much where we were pre-pandemic," Bostic said in an interview with NPR's Marketplace. "And at that point, I think it's appropriate for us to try to normalize our interest rate policy." (RTRS)

FED: MNI BRIEF: Fed's Evans Open to 2022 Hike If Inflation

- Chicago Federal Reserve President Charles Evans suggested Thursday he's becoming more open to the prospect of raising interest rates next year because of creeping doubts that elevated inflation will linger. Evans said his main forecast is for supply chains to be fixed up next year as the job market makes gains, and that current price pressures tend to be a handful of prominent items. He also said he can't overlook recent evidence and he's become a bit nervous about sustained price gains. "As long as there continues to be uncertainty about the Covid risks, and other things, it might be a gentle increase," he said. "It could begin next year after we finish our asset purchasing program or it could be as long as in 2023" - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FED: A high number of job postings and a low unemployment rate do not automatically mean that all people who want to work are able to land a job and some people need more support, San Francisco Federal Reserve President Mary Daly said on Thursday. "Just saying that the labor market has a low unemployment rate is not saying that everyone who wants a job can get one because some of the barriers are not about job openings but about the network of things to support work," Daly said during a virtual event focused on the role of care work. "Dependent care is an essential ingredient to supporting work." (RTRS)

FED: Democratic Senator Joe Manchin is looking to meet with Federal Reserve Governor Lael Brainard and have a follow-up conversation with current Fed Chair Jerome Powell, according to a person familiar with the matter, as President Joe Biden prepares to decide who will lead the central bank. Manchin remains undecided about whether Powell or Brainard -- the two contenders under consideration by Biden -- would be best for the job, according to the person, who described the senator's thinking on condition of anonymity. The West Virginia lawmaker has repeatedly questioned the Fed's bond-buying program this year amid a surge in inflation. Powell spoke with Manchin by phone on Wednesday, and the central bank chief discussed his assessment of inflation, the person said. The senator's staff is now working on setting up another meeting with Powell along with a meeting with Brainard. Biden is expected to announce a Fed decision before the Thanksgiving holiday. (BBG)

FED: Sen. Joe Manchin (D-W.Va.) told The Hill that he was "looking very favorably," but hadn't made a final decision, on supporting Federal Reserve Chair Jerome Powell if he's renominated as chairman, after the two spoke on Wednesday. "Well we're looking very favorably towards that, because I needed that conversation with him. But I have not made up my mind yet. But I'm just saying that it helped an awful lot having him clear up a lot of the concerns I had," Manchin told The Hill. The two spoke by phone on Wednesday with Manchin telling reporters earlier this week that he was trying to set up a meeting to talk about his concerns with inflation and quantitative easing. (The Hill)

FED: President Joe Biden's top labor economist has a message for the Federal Reserve: run the economy hot. Inflation remains largely transitory and linked to supply-chain and Covid-related issues, said Janelle Jones, the chief economist at the Department of Labor. But raising interest rates or reducing economic support for the economy too soon -- which many economists are urging to tame rampant inflation -- could spell disaster for the nascent jobs recovery, she said. "I don't really want to -- and I think the folks at the Federal Reserve would agree -- I don't want to slow the economy down, because we're not recovered," Jones said in a telephone interview Wednesday. (BBG)

ECONOMY: MNI INTERVIEW: Consumers Fear Policy Inaction on US Inflation

- Americans are increasingly worried inflation will stick around longer than Washington policymakers have maintained, and the strains could intensify as workers push to catch up with bigger wage increases, the head of the University of Michigan's Survey of Consumers told MNI - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FISCAL: The Democratic-controlled U.S. House of Representatives voted on Thursday to advance President Joe Biden's $1.75 trillion social-policy and climate-change legislation toward final debate and passage. (RTRS)

FISCAL: The White House said on Thursday that its social spending package, known as the "Build Back Better" Act, would reduce the deficit by $112 billion over the next decade according to a new analysis. The statement came out just after the non-partisan Congressional Budget Office, charged with evaluating the cost of legislation, found that the bill would raise the federal deficit by $367 billion over the next decade. (RTRS)

FISCAL: U.S. Treasury Secretary Janet Yellen said a combination of estimates done by the Congressional Budget Office, the Joint Committee on Taxation, and Treasury showed that a $1.75 trillion social and climate spending bill would be "fully paid for." (RTRS)

FISCAL: Chuck Schumer and Mitch McConnell clobbered each other incessantly during October's debt ceiling standoff. Now, as a new December deadline approaches, they're taking a slightly more conciliatory approach. "We had a good discussion about several different issues that are all extent here as we move toward the end of the session, and we agreed to keep talking and working together," McConnell said after meeting with Schumer. (POLITICO)

EQUITIES: Apple Inc. is pushing to accelerate development of its electric car and is refocusing the project around full self-driving capabilities, according to people familiar with the matter, aiming to solve a technical challenge that has bedeviled the auto industry. For the past several years, Apple's car team had explored two simultaneous paths: creating a model with limited self-driving capabilities focused on steering and acceleration -- similar to many current cars -- or a version with full self-driving ability that doesn't require human intervention. (BBG)

EQUITIES: Robinhood Markets Inc. scored a victory as a federal judge dismissed a lawsuit accusing the brokerage of colluding with electronic trading firm Citadel Securities to stop investors from buying GameStop Corp. and other meme stocks in January. The lawsuit had been filed on behalf of investors who lost money when Robinhood and other brokerages imposed trading restrictions in GameStop, AMC Entertainment Holdings Inc. and several other stocks on Jan. 28. (WSJ)

OTHER

GLOBAL TRADE: One of China's biggest chipmakers has warned it may have to drop orders from foreign clients next year to prioritize domestic demand, Nikkei Asia has learned, as the country pushes to build a "secure and controllable" tech supply chain. Hua Hong Semiconductor, China's No. 2 contract chipmaker, told several of its non-Chinese clients -- including Taiwan's Holtek, a key developer of microcontroller chips -- that it will not be able to provide them with as much capacity as they may need, sources briefed on the matter told Nikkei Asia. Hua Hong warned it may even have to drop some orders from non-Chinese chip developers due to the supply constraints, the sources added. (Nikkei)

USMCA: Mexican President Andrés Manuel López Obrador urged U.S. President Joe Biden to reduce North America's imports of goods from overseas and to loosen immigration restrictions in order to ease labor shortages. Biden didn't respond in front of reporters observing the beginning of a three-way summit on Thursday between him, the Mexican president known as AMLO and Canadian Prime Minister Justin Trudeau at the White House. AMLO said through a translator that Pacific ports are "saturated with merchandise coming from Asia" and that Mexico, the U.S. and Canada should seek to build up their industrial bases to produce more goods domestically. He repeatedly promoted the idea of North American economic "integration," without elaborating. (BBG)

U.S./CHINA: President Joe Biden said he's weighing a diplomatic boycott of the upcoming Winter Olympics in Beijing, meaning the U.S. would decline to send a delegation of government officials. It's "something we're considering," Biden said in response to a question during a meeting with Canadian Prime Minister Justin Trudeau on Thursday. (BBG)

U.S./CHINA: An American who had been blocked for years from leaving China has returned to the United States, the U.S. government told Reuters, his release coming just hours before the two countries' leaders met this week. Daniel Hsu's return also coincided with the United States' deportation of seven Chinese nationals convicted of crimes, including at least one who was sought by Beijing to face fraud charges. A U.S. government official denied the individuals were part of an exchange. The U.S. official, authorized to speak to Reuters on the condition of anonymity, confirmed that Hsu - who had never been convicted of a crime in China and had been under an exit ban for more than four years - had been allowed by Chinese authorities to leave the country last weekend. (RTRS)

JAPAN: Prime Minister Fumio Kishida confirmed details of a bigger-than-expected stimulus package Friday as he looks to make a bold move early in his premiership to shore up a sputtering economy and launch his new vision of capitalism. Kishida said the measures will have an overall scale of around 79 trillion yen (about $690 billion) and record fiscal support of 56 trillion yen. The package will be unveiled after gaining Cabinet approval later Friday. "We've been able to put together a strong package of economic measures to develop a new society after Covid," Kishida said. "It's one that will create a virtuous cycle of growth and distribution by launching a new form of capitalism." (BBG)

AUSTRALIA: Almost all eligible citizens in Australia's "Bush Capital" have had at least one dose of Covid-19 vaccine and it is expected to reach full inoculation next month, a milestone that shows just how fast the nation has overcome a slow start to its vaccination rollout. Canberra, one of a number of highly vaccinated cities in the Asia-Pacific region, achieved the feat by relying on education and access to get its citizens to embrace the rollout, according to Andrew Barr, the chief minister of the Australian Capital Territory which oversees the city. Data show the city's vaccination rate is at 96.8% for eligible people aged 12 and over. (BBG)

AUSTRALIA: Comparing the wage price index with property values for the past two decades shows that nominal dwelling value growth has vastly outstripped the total change in wages and salaries. While wages increased 81.7% in the past 20 years, Australian home values have grown 193.1%. This has been further exacerbated by the recent upswing in national housing values, which has seen Australian dwelling values rise 22.0% in the past 13 months. (CoreLogic)

AUSTRALIA: The Australian Prudential Regulation Authority (APRA) has issued a discussion paper seeking information from superannuation trustees on their plans to maintain the financial resilience needed to protect members' best financial interests. (APRA)

RBNZ: MNI INTERVIEW: RBNZ "Shadow Board" Member Sees 25bps Rise

- A member of a "shadow board' of the Reserve Bank of New Zealand expects a rate hike of 25 basis points next week and that within 12 months official rates in NZ will be at 2%.

CANADA: Canada's health regulator is expected to authorize Pfizer-BioNTech's COVID-19 vaccine for kids between the ages of 5 and 11 – bringing a welcome sigh of relief to families across the country. Three sources told The Globe and Mail on Thursday the decision from Health Canada is expected on Friday. The Globe is not identifying the individuals because they were not permitted to disclose the internal plans. (Globe & Mail)

MEXICO: Mexico's inflation is becoming a "very serious problem" as it reaches levels unseen in the past two decades, according to central bank deputy Governor Jonathan Heath. Annual inflation will most likely accelerate to above 7% this month to finish the year between 7.1% and 7.3%, Heath said at a conference Thursday, expressing greater alarm about price increases than the majority of fellow board members at the central bank. A combination of supply and demand shocks, including semiconductor shortages, explain the jump in prices, he added. (BBG)

BRAZIL: Brazil's govt signaled a series of changes in the court-ordered payments bill known as precatorios, in order to ease senators' reluctance to the text, O Globo newspaper reports without saying how it obtained the information. Agreement between Senate, govt and lower house may include slicing up the proposal as well as commitments outside the main theme of the bill. (BBG)

SOUTH AFRICA/RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Moody's on South Africa (current rating: Ba2; Outlook Negative)

- S&P on South Africa (current rating: BB-; Outlook Stable)

IRAN: The United States has not changed its approach to sanctions on Iran ahead of nuclear talks, White House spokesperson Jen Psaki said on Thursday. (RTRS)

OIL: The United States has discussed with China and a wide range of other countries the possibility of a joint release of oil reserves, White House spokesperson Jen Psaki said on Thursday. (RTRS)

CHINA

ECONOMY: Comparing the wage price index with property values for the past two decades shows that nominal dwelling value growth has vastly outstripped the total change in wages and salaries. While wages increased 81.7% in the past 20 years, Australian home values have grown 193.1% (figure 2). This has been further exacerbated by the recent upswing in national housing values, which has seen Australian dwelling values rise 22.0% in the past 13 months. (BBG)

FISCAL: China is expected to release a more forceful package to cut taxes and administrative fees by 500b yuan, Securities Daily reports, citing Zhang Yiqun, a researcher at China's Society of Public Finance. Such a move would help boost the vitality of small and medium-sized companies, report cites Zhang as saying. He Daixin, a researcher at Chinese Academy of Social Sciences, forecasts a new round of fee, tax cut could reach hundreds of billions of yuan and recommends more tax reductions for manufacturing companies. (BBG)

FISCAL: The Saihan district of China's Hohhot city in Inner Mongolia province was found to have misused CNY125 million urban renewal funding to pay its hidden debt, the 21st Century Business Herald reported citing an audit by the central government. The case reflects the growing fiscal pressure of local authorities in China, the newspaper said. Saihan's budget report disclosed CNY3.3 billion outstanding debt at the end of 2020, though it didn't disclose the amount of hidden debt, the newspaper said. Local authorities are pressured by declining revenue as the central government implements tax-reduction policies, and due to heavy reliance on incomes from land sales, the Herald said. (MNI)

BONDS: Chinese insurers will be allowed to invest in bonds issued by financial companies that don't have external credit ratings, according to a notice from the banking and insurance regulator. CBIRC also scraps a so-called white list system restricting insurers' financial bond investment targets. An insurer's total investment in a bond issuer rated BBB or lower by domestic agencies is capped at 20% of the issuer's net asset value in the recent accounting year. (BBG)

EVERGRANDE: Debt-laden real estate developer China Evergrande has resumed construction of 63 projects in the southern Pearl River delta, a regional subsidiary said on Friday. The projects span 15 sites from the city of Guangzhou to locations in Foshan, Qingyuan, Yangjiang and Zhaoqing, the subsidiary said on its account on social media app WeChat. The company will "speed up and conquer difficulties" in the next stage, to ensure the projects are delivered on time and in line with standards of quality, it added. (RTRS)

PROPERTY: Developers' limited funding access, slowing contracted sales and weakened controls over project-level cash are dampening cash flow and liquidity, Moody's Investors Service says in a new report. More developers expected to meet the three red lines requirement as debt growth declines. (BBG)

ENERGY: China should boost lending to clean energy, lower the cost for green bond issuance and develop green insurance products, the Economic Daily reported. Outstanding clean-energy loans totaled CNY3.79 trillion by Sept. 30, less than 27% of total green lending, the Daily said. Financial support for green building, clean transportation and renewable energy should be further increased so to promote the green transformation of key industries, the newspaper said citing PBOC Deputy Governor Liu Guiping. Green insurance products urgently need to be developed, and the relatively small scale of green bonds has kept the issuance rates high, the newspaper said. (MNI)

OVERNIGHT DATA

JAPAN OCT CPI +0.1% Y/Y; MEDIAN +0.2%; SEP +0.2%

JAPAN OCT CORE CPI +0.1% Y/Y; MEDIAN +0.1%; SEP +0.1%

JAPAN OCT CORE-CORE CPI -0.7% Y/Y; MEDIAN -0.7%; SEP -0.5%

NEW ZEALAND OCT CREDIT CARD SPENDING -5.6% Y/Y; SEP -12.8%

NEW ZEALAND OCT CREDIT CARD SPENDING +8.4% M/M; SEP -3.3%

SOUTH KOREA OCT PPI +8.9% Y/Y; SEP +7.6%

UK NOV GFK CONSUMER CONFIDENCE -14; MEDIAN -18; OCT -17

CHINA MARKETS

PBOC NET DRAINS CNY50BN VIA OMOS FRIDAY

The People's Bank of China (PBOC) injected CNY50 billion via 7-day reverse repos with the rates unchanged at 2.2% on Friday. The operation has led to a net drain of CNY50 billion after offsetting the maturity of CNY100 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1635% at 09:39 am local time from the close of 2.1524% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 48 on Thursday vs 41 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3825 FRI VS 6.3803

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3825 on Friday, compared with 6.3803 set on Thursday.

MARKETS

SNAPSHOT: European COVID Restrictions Deepen

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 157.84 points at 29761.31

- ASX 200 up 17.297 points at 7396.5

- Shanghai Comp. up 22.805 points at 3543.025

- JGB 10-Yr future up 11 ticks at 151.64, yield down 0.3bp at 0.076%

- Aussie 10-Yr future down 1.5 ticks at 98.170, yield up 1.5bp at 1.810%

- U.S. 10-Yr future -0-02 at 130-16+, yield up 0.69bp at 1.592%

- WTI crude up $0.49 at $79.50, Gold up $2.27 at $1861.22

- USD/JPY up 9 pips at Y114.35

- FED'S BOSTIC: COULD START NORMALIZING INTEREST RATES NEXT SUMMER (RTRS)

- TOP BIDEN LABOR ECONOMIST WANTS FED TO RUN IT HOT TO BOOST JOBS (BBG)

- MANCHIN SEEKS MEETING WITH FED'S BRAINARD, FOLLOW-UP WITH POWELL (BBG)

- CBO & WHITE HOUSE AT LOGGERHEADS RE: "PAID FOR" STATUS OF BIDEN'S BBB PLAN

- GERMANY RESTRICTS ACCESS FOR UNVACCINATED TO STEM COVID RISE (BBG)

- IRISH PM: SERIOUS EU INTENT TO FIX N IRELAND BORDER ROW (BBC)

BOND SUMMARY: Core FI Mixed In Asia

Fresh record highs for both the S&P 500 & NASDAQ 100 e-mini contracts applied some very modest pressure to the Tsy space, although tight ranges were in play in the space overnight. T-Notes last -0-01+ at 130-17, sticking to a narrow 0-04 range. Cash Tsys are ~1.0-1.5bp cheaper across the curve. Macro headline flow remains very light. NY hours will be headlined by Fedspeak from Vice Chair Clarida & Governor Waller. We will also see the House vote on President Biden's BBB Bill. A note that the CBO & the White House are at loggerheads re: the "paid for" status of the BBB scheme.

- JGB futures extended their overnight uptick, +11 into the bell. Confirmation of the rumoured Y55.7tn fiscal spending package (with total support meeting the expected Y79tn watermark) via Japanese PM Kishida seemingly applied some modest pressure in the morning, with the need for swift compilation (by year end) and disbursement highlighted. A fresh bid came in during the Tokyo afternoon. Cash JGBs run flat to 1.5bp richer across the curve, with 30+-Year paper seeing some light outperformance on the lessening of issuance concerns re: the fiscal package (surplus holdings and unused funds from previous stimulus schemes may be able to do a fair chunk of the heavy lifting).

- Aussie bond futures looked through the release of next week's AOFM issuance slate, even with another A$300mn added to nominal coupon issuance (which now sits at A$2.8bn vs. this week's A$2.5bn), via ACGB Jun-51 supply on Monday. The AOFM has departed from the recent norms in terms of the number of ACGB auctions (2), with 3 rounds of coupon supply due next week. We will also see a notable uptick in Note issuance, which rises to A$5bn from the typical A$2bn. It looks like the AOFM is looking to rebuild its cash buffers. YM unch. & XM -1.5 at the close, with tight trade in play on Friday. Elsewhere, the latest round of ACGB Nov-24 supply passed smoothly, with relative and outright plays likely facilitating strong pricing as the weighted average yield printed 0.87bp through prevailing mids (per Yieldbroker). A reminder that heavy borrowing via the RBA's SLF also pointed to the potential for a strong auction. The cover ratio eased a bit vs. the prev. auction of the line, but that metric was particularly strong last time out and still printed comfortably above 4.50x this time around.

JGBS AUCTION: Japanese MOF sells Y3.4981tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y3.4981tn 3-Month Bills:

- Average Yield -0.1388% (prev. -0.1239%)

- Average Price 100.0373 (prev. 100.0333)

- High Yield: -0.1377% (prev. -0.1210%)

- Low Price 100.0370 (prev. 100.0325)

- % Allotted At High Yield: 76.3172% (prev. 51.3350%)

- Bid/Cover: 4.915x (prev. 4.975x)

AUSSIE BONDS: The AOFM sells A$1.0bn of the 0.25% 21 Nov ‘24 Bond, issue #TB159:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 0.25% 21 November 2024 Bond, issue #TB159:

- Average Yield: 0.9588% (prev. 0.7229%)

- High Yield: 0.9600% (prev. 0.7250%)

- Bid/Cover: 4.7400x (prev. 6.6150x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 93.5% (prev. 40.0%)

- Bidders 37 (prev. 40), successful 7 (prev. 15), allocated in full 3 (prev. 6)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Monday 22 November it plans to sell A$300mn of the 1.75% 21 June 2051 Bond.

- On Tuesday 23 November it plans to sell A$150mn of the 0.25% 21 November 2032 Indexed Bond.

- On Wednesday 24 November it plans to sell A$1.0bn of the 1.75% 21 November 2032 Bond.

- On Thursday 25 November it plans to sell A$2.0bn of the 21 January 2022 Note, A$1.5bn of the 25 February 2022 Note & A$1.5bn of the 25 March 2022 Note.

- On Friday 26 November it plans to sell A$1.5bn of the 0.25% 21 November 2025 Bond.

EQUITIES: Hang Seng Struggles On Alibaba Guidance

Equity trade was mixed during Asia-Pac hours.

- Chinese tech names struggled in the wake of a downward revision in Alibaba's '22 outlook. This resulted in underperformance for the Hang Seng, which shed the best part of 2% vs. Thursday's closing levels.

- Elsewhere, the likes of the Nikkei 225, CSI 300 and ASX 200 posted modest gains, aided by an uptick in U.S. e-mini futures, as the S&P 500 and NASDAQ 100 contracts registered yet another round of fresh all-time highs. There wasn't a clear catalyst for the uptick in U.S. e-minis during the Asia-Pac session, with some desks pointing to spill over support from news that tech heavyweight Apple is pushing for the release of a fully autonomous car by 2025.

OIL: Crude Marginally Firmer Alongside E-Minis

WTI & Brent crude futures firmed during the final Asia-Pac session of the week, adding circa $0.50 vs. settlement levels, aided by an uptick in U.S. e-minis. This comes after the benchmarks printed at the lowest levels seen since early October on Thursday, with Brent showing below $80 in the process, before recovering.

- A potential coordinated stockpile release from the U.S. & China continues to dominate news flow in the space. However, Goldman Sachs note that any such move "would 1) only provide a short-term fix to a structural deficit, 2) is now fully priced-in following the $6/bbl move lower in recent weeks (pricing in a release of more than 100mn bbl into OECD stocks), and 3) would not help the slow global supply response that only higher oil prices can overcome. In fact, if such a release is confirmed and manages to keep oil prices depressed in the context of low trading activity into year-end, it would create clear upside risks to our 2022 price forecast."

GOLD: As You Were

Little to really flag for gold, with spot a handful of dollars higher on the day, just shy of $1,865/oz. Our weighted U.S. real yield monitor is essentially unchanged over the last 24 hours, hovering just above the all-time low, with the DXY sitting a touch lower over the same horizon. Nothing has changed from a technical perspective, while the broader inflationary dynamic provides the fundamental focal point.

FOREX: USD Edges Higher In Quiet Asia-Pac Trade

The DXY edged higher from the off amid an uptick in U.S. Tsy yields, correlated with fresh record highs for both the S&P 500 & NASDAQ 100 e-minis.

- Firmer crude oil prices lent support to CAD and NOK. AUD followed suit but its Antipodean cousin NZD faltered.

- The kiwi slipped as BBG trader source pointed to fast money trimming longs amid lack of new catalysts after Thursday's inflation expectations data.

- All in all, major crosses held narrow ranges as broader headline flow was relatively thin.

- UK & Canadian retail sales as well as Norwegian GDP take focus going forward. Comments are due from Fed's Waller & Clarida, ECB's Lagarde & Weidmann as well as BoE's Pill.

FOREX OPTIONS: Expiries for Nov19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1375-00(E1.4bln), $1.1445-50(E581mln), $1.1500(E1.6bln)

- USD/JPY: Y114.75-76($637mln)

- EUR/GBP: Gbp0.8590-00(E1.1bln)

- USD/CAD: C$1.2650($526mln), C$1.2800-20($1.1bln)

- USD/CNY: Cny6.3700($1.1bln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.