-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN OPEN: New COVID Variant Results In Risk-Off Trade

EXECUTIVE SUMMARY

- WHO CALLS SPECIAL MEETING TO DISCUSS NEW COVID VARIANT FOUND IN SOUTH AFRICA WITH 'A LARGE NUMBER OF MUTATIONS' (CNBC)

- BAILEY SIGNALS BOE HAS ABANDONED HARD GUIDANCE FOR RATES POLICY (BBG)

- FRENCH FISHERMEN WILL BLOCKADE CHANNEL TUNNEL IN BREXIT PROTEST

- CHINA SAID TO ASK DIDI TO DELIST FROM U.S. ON SECURITY FEARS (BBG)

- RBNZ'S HAWKESBY: INFLATION EXPECTATIONS WILL BE KEY TO RATE-HIKE PACE (BBG)

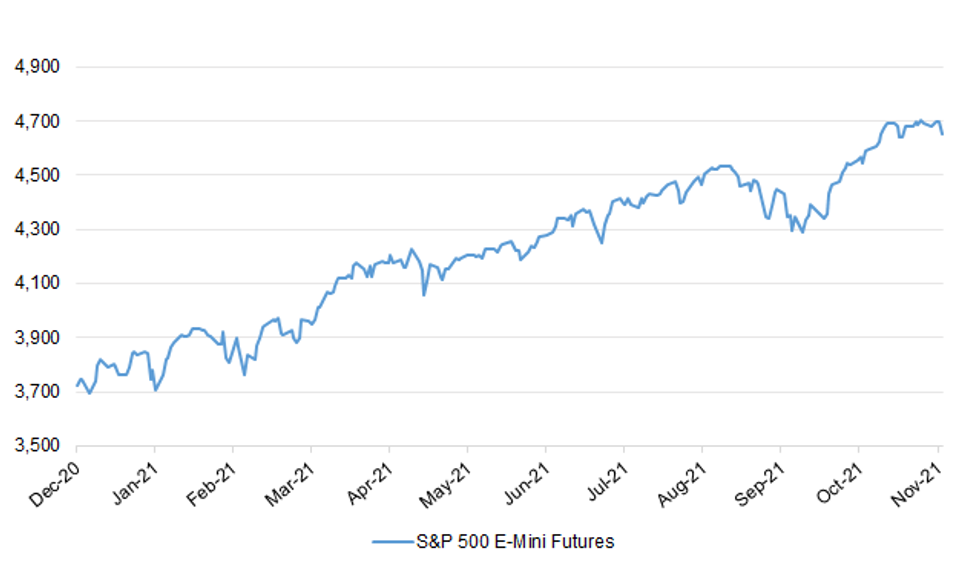

Fig. 1: S&P 500 E-Mini Futures (Continuation Chart)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: Bank of England Governor Andrew Bailey signaled that policy makers have effectively abandoned forward guidance as a way of guiding investors about the likely path of interest rates. Answering questions at Cambridge University, Bailey said there were three forms of forward guidance and the one that is currently in use is "not so much forward guidance as a reminder of where we are." Bailey said the system put in place in 2013 by his predecessor, Mark Carney, "is pretty hazardous (and) more hazardous in a more uncertain world." In 2013, Carney told markets that the BOE would consider raising interest rates when unemployment fell to 7%. In place of that "hard" form of guidance, the BOE has recently been using softer "evidence" based guidance to provide an anchor for policy "in this world of greater uncertainty," Bailey said. (BBG)

BREXIT: French fishermen have said they plan to blockade the channel tunnel in protest at Britain's refusal to issue them with work licences. The running dispute over the post-Brexit fishing rights is expected to boil over on Friday and cause even more disruption to UK supply chains. (Independent)

CORONAVIRUS: Britain is bringing in travel restrictions for six African countries due to a new COVID variant that UK experts have called the "worst one we've seen so far". Health Secretary Sajid Javid tweeted: "UKHSA (UK Health Security Agency) is investigating a new variant. More data is needed but we're taking precautions now. "Six African countries will be added to the red list, flights will be temporarily banned, and UK travellers must quarantine." (Sky)

FISCAL: Rishi Sunak's Treasury has made clear no new money will be spent on the relaunch of Boris Johnson's "levelling up" agenda next month, The Telegraph understands. Ministers and officials developing plans for the much-anticipated white paper are having to work with existing government projects and look at cost-neutral reforms. The refusal to consider more cash for Mr Johnson's flagship domestic reforms - which critics see as ill-defined - follows tensions between Number 10 and Number 11 over spending. (Telegraph)

ECONOMY: Ministers have no way of knowing whether a £2 billion flagship youth employment scheme is creating genuinely new jobs, government auditors have said. Rishi Sunak, the chancellor, has hailed the Kickstart programme, launched in September last year, as a critical component of the Treasury's recovery plan, claiming that it was "transforming" the lives of young people out of work because of the pandemic. (The Times)

ECONOMY: Car production slumped by 40 per cent in Britain last month as manufacturers grappled with a shortage of semiconductors on top of disruption caused by the Covid pandemic. It was the fourth monthly drop in a row and contributed to the weakest October output since 1956, according to the Society of Motor Manufacturers and Traders (SMMT). Mike Hawes, the organisation's chief executive, said: "These figures are extremely worrying and show how badly the global semiconductor shortage is hitting UK car manufacturers and their suppliers." He described carmakers as "resilient" but said they were battling a series of challenges. "With Covid resurgent across some of our largest markets and global supply chains stretched and even breaking, the immediate challenges in keeping the industry operational are immense." (The Times)

POLITICS: Senior figures in the 1922 Committee of backbench Conservative MPs have been seen entering Downing Street for a meeting with Boris Johnson. Their talks in Number 10 come after a difficult few weeks for the PM that has seen unrest within his party on a scale not seen thus far in his premiership. Sir Graham Brady, the committee's chairman, confirmed that its executive had met Mr Johnson, but declined to elaborate on what was talked about. (Sky)

CHANNEL: Boris Johnson has asked President Macron to allow Border Force staff and British security contractors to conduct joint patrols on French beaches from next week after 27 migrants drowned in the Channel. The prime minister has written to Macron, urging him to let British personnel patrol with gendarmes on beaches and nearby road networks. He has also asked the president to approve a bilateral agreement to allow for the immediate return of those who cross the Channel. Britain would accept unaccompanied children with links to the country. (The Times)

EUROPE

GERMANY: Germany reported a record 76,414 new Covid-19 cases compared with 75,961 the previous day, according to the country's public health authority RKI. Reported new deaths associated with the virus rose by 357, bringing the total to 100,476. The daily incidence rate also reached a new high of 438.2 per 100,000 people. (BBG)

GERMANY: Germany's new government under incoming Chancellor Olaf Scholz plans to channel 60 billion euros ($67 billion) into a climate fund to help finance the administration's climate goals over the next four years. The money will be earmarked via a supplementary budget from existing outlays, an official familiar with the decision said. The Greens, who will take control of the government's climate agenda, have projected 50 billion euros a year to finance climate protection over the next decade. (BBG)

FRANCE: France will strengthen rules for incoming travelers who aren't vaccinated or are coming from countries with high rates of Covid-19 or virus variants, Health Minister Olivier Veran said Thursday in a TF1 television interview. The government earlier announced booster shots would be made more widely available and masks mandatory. Veran also said health passes and testing would be required at ski resorts in a bid to keep them open this season after lifts were shut for part of last season. France has reported a surge in new daily cases in recent weeks, reaching 33,464 on Thursday. (BBG)

ITALY/BTPS: Italy plans to sell up to EU2 billion ($2.24 billion) of 0% bonds due Aug. 1, 2026 in an auction on Nov. 30. Italy plans to sell up to EU2.25 billion ($2.52 billion) of 0.95% bonds due June 1, 2032 in an auction on Nov. 30. Italy plans to sell up to EU1.5 billion ($1.68 billion) of floating bonds due April 15, 2029 in an auction on Nov. 30. (BBG)

SPAIN: Spain's government plans to extend by six months voluntary write-offs of state-backed loans as part of a debt restructuring plan to help companies cope with the COVID-19 pandemic, three sources with knowledge of the matter told Reuters. "The plan envisages prolonging haircuts on state-backed loans from end-2022 to June of 2023 among other measures, and in line with the recent extensions granted by the EU," a government source said, adding that those could be approved as soon as in the next cabinet meeting on Tuesday, although details were still being finalised. (RTRS)

PORTUGAL: The Portuguese government said remote working will be mandatory in the week of Jan. 2-9 as it tries to prevent a spike in coronavirus infections after the Christmas and New Year holiday break. Schools will reopen on Jan. 10, a week later than previously planned, Prime Minister Antonio Costa said on Thursday at a press conference in Lisbon. Until that first week of January, remote working will be recommended when possible. From December, the use of masks will become mandatory in closed spaces, digital certificates will be needed to access restaurants and negative tests will be required for nightclubs and bars. Masks are currently already required on public transport. (BBG)

AUSTRIA: Austrians have reduced time spent outside their homes since a nationwide lockdown kicked in on Monday, but the impact on movement has been far less than seen during the measures in the early days of the pandemic. The country was the first in Europe to respond to the latest surge in infections with a full lockdown. Visits to retail and recreation areas were down 56% on Monday compared with pre-pandemic levels, while train and bus stations saw a 35% decline, according to data compiled by Google. (BBG)

RATINGS: Potential sovereign rating reviews of note scheduled for Friday include:

- Moody's on Belgium (current rating: Aa3; Outlook Stable) & Switzerland (current rating: AAA; Outlook Stable)

- S&P on Ireland (current rating: AA-; Outlook Stable)

- DBRS Morningstar on Poland (current rating: A, Stable Trend)

OTHER

U.S./CHINA: Chinese regulators have asked Didi Global Inc.'s top executives to devise a plan to delist from U.S. bourses, people familiar with the matter said, an unprecedented request that's likely to revive fears about Beijing's intentions for its giant tech industry. The country's tech watchdog wants management to take the company off the New York Stock Exchange because of concerns about leakage of sensitive data, the people said, asking not to be identified discussing a sensitive matter. The Cyberspace Administration of China, the agency responsible for data security in the country, has directed Didi to work out precise details, subject to government approval, they said. Proposals under consideration include a straight-up privatization or a share float in Hong Kong followed by a delisting from the U.S., the people added. (BBG)

CORONAVIRUS: The World Health Organization is monitoring a new variant with numerous mutations to the spike protein, scheduling a special meeting Friday to discuss what it may mean for vaccines and treatments, officials said Thursday. The variant, called B.1.1.529, has been detected in South Africa in small numbers, according to the WHO. "We don't know very much about this yet. What we do know is that this variant has a large number of mutations. And the concern is that when you have so many mutations, it can have an impact on how the virus behaves," Dr. Maria Van Kerkhove, WHO's technical lead on Covid-19, said in a Q&A that was livestreamed on the organization's social media channels. (CNBC)

JAPAN: Japanese Prime Minister Fumio Kishida plans to ask the business community to raise wages by ~3% in spring negotiations, Kyodo reports, without attribution. Would be first time in 4 years a PM has set a numerical target. Government set to debate wages in panel meeting to be held Friday. (BBG)

BOJ: The Bank of Japan's newest board member said she's seeing a gradual emergence of upward price trends in the country that bears close watching, even as the bank holds its monetary stimulus in place. Japan's consumer prices "don't look like they will stay around zero forever," board member Junko Nakagawa said this week in her first interview with the foreign press since joining the bank in June. "The upward pressure is strengthening a little." (BBG)

JAPAN/RATINGS: Moody's affirmed Japan at A1; Outlook Stable. (MNI)

RBNZ: New Zealand's central bank will be closely watching inflation expectations to determine whether it needs to raise interest rates at a faster pace, Assistant Governor Christian Hawkesby said. "Inflation expectations are going to be absolutely key for us," Hawkesby said in an interview with Bloomberg Television Friday in Wellington. "There are things that could make us go faster, and I think inflation expectations is one." (BBG)

NORTH KOREA: South Korea is monitoring North Korea's nuclear and missile activities in close cooperation with the United States, the unification ministry said Friday, following reports the North appears to be continuing the operation of a nuclear reactor at its mainstay Yongbyon complex. (Yonhap)

TURKEY: Central bank Governor Sahap Kavcioglu said he met chief executives of some commercial lenders to discuss the outlook for the economy and recent volatility in Turkish financial markets. Turkey's banks are resilient and will withstand recent "fluctuations" in the currency that were discussed with the sector's representatives in Istanbul, Kavcioglu said after the meeting Thursday. (BBG)

TURKEY: Turkey targets high job creation, high exports, low current account deficit and low foreign debt with a policy based on "low rates, high production volume," Deputy Treasury & Finance Minister Nurettin Nebati says in a series of tweets posted late Thursday. Revenue from export increase to be diverted to investments on energy, raw materials and intermediate goods, which will decrease. FX pressure on inflation and create jobs. Current account deficit is economy's biggest problem and it has kept. Turkey dependent on foreign debt. No problem in keeping policy rate below inflation; rates should be cut against supply-side inflation. Manipulative attacks won't seriously hurt Turkish lira. (BBG)

RUSSIA: The Arleigh Burke-class guided missile destroyer USS Arleigh Burke (DDG 51) entered the Black Sea "on a routine patrol" on Thursday, November 25, the U.S. Sixth Fleet reported. "While in the Black Sea, the ship will operate alongside NATO allies and partners in the region, working together to ensure security and stability in this vital international waterway," it said. "NATO allies and partners routinely operate in the region to ensure a safe, stable and secure maritime environment, and build partner capacity to improve effectiveness and interoperability," the Sixth Fleet said. The Russian military has begun to monitor the US missile destroyer The USS Arleigh Burke in the Black Sea, the National Defense Command Center told the media on Thursday. (TASS)

CHINA

FISCAL: China may reduce the issuance of local government special bonds next year, possibly to CNY3.2 trillion, compared with this year's issuance quota of CNY3.65 trillion, said the Securities Daily citing Luo Zhiheng deputy research head of Yuekai Securities. With less special bonds, the deficit-to-GDP ratio must be maintained at a relatively high level of about 3.5%, said Luo. Analysts expect the Finance Ministry to front-load some of next year's quota by the end of 2021, so to help local governments better prepare for the start of major projects, the newspaper said. (MNI)

YUAN: China should expand the digital yuan pilot program to more regions after ensuring the operations of the digital currency during the Beijing Winter Olympics, and formally launch it at the right time, said a commentary on the front page of the Economic Information Daily, penned by Dong Ximiao, chief analyst at Merchants Union Consumer Finance and a frequent contributor to state media. Digital yuan can help raise the international profile of the yuan and increase China's participation in global financial governance should the country strengthen exchanges in digital currency R&D, said Dong. Digital yuan will better protect information and financial security, said Dong, adding that less printing can also help to achieve the country's carbon neutrality goal. (MNI)

CORONAVIRUS: China may not relax restrictions on foreign visitors soon even as it prepares for the limited opening of its borders with Hong Kong, the Global Times reported citing an anonymous Beijing-based immunologist. A quarantine-free opening to foreign visitors in the short term would have an incalculable negative impact on China, and previous outbreaks abroad have repeatedly demonstrated that cold temperatures in winter tend to cause a strong rebound in the epidemic, the expert was cited as saying. China's "zero policy" will not be adjusted even after the resumption of quarantine-free travel between the Chinese mainland and Hong Kong, and Chinese experts have not yet discussed future adjustments in China's policy, the newspaper said citing an expert from China's Center for Disease Control and Prevention who requested anonymity. (MNI)

CORONAVIRUS: More than 30% of flights from Shanghai Pudong International Airport have been cancelled as of 10am Friday, state broadcaster CCTV reports, after the city reported 3 local confirmed Covid cases Thursday. (BBG)

OVERNIGHT DATA

JAPAN NOV TOKYO CPI +0.5% Y/Y; MEDIAN +0.4%; OCT +0.1%

JAPAN NOV TOKYO CORE CPI +0.3% Y/Y; MEDIAN +0.3%; OCT +0.1%

JAPAN NOV TOKYO CORE-CORE CPI -0.3% Y/Y; MEDIAN -0.3%; OCT -0.4%

AUSTRALIA OCT RETAIL SALES +4.9% M/M; MEDIAN +2.2%; SEP +1.3%

NEW ZEALAND NOV ANZ CONSUMER CONFIDENCE INDEX 96.6; OCT 98.0

NEW ZEALAND NOV ANZ CONSUMER CONFIDENCE -1.4% M/M; OCT -6.2%

Households' response to whether it was a good time to buy a major household remains subdued everywhere outside the South Island outside of Canterbury. Auckland and Wellington are the most pessimistic. Those 50+ are the most comfortable spending, which isn't unusual. Households' real discretionary income has taken quite a hit recently. Although jobs are plentiful, most people have experienced a real wage fall, given CPI inflation is near 5% and rising. Those with mortgages are now either paying significantly more interest, or at least seeing it coming down the pipe at the next rate rollover. House price inflation expectations are easing, and anecdotally, enthusiasm for purchasing is dropping away as higher mortgage rates, stretched affordability, macroprudential restrictions bite and FOMO (fear of missing out) wanes. The days of your house paying for your new car are probably behind us for a while. Indeed, just as the RBNZ over-achieved on stimulating the housing market on the way up, there is a real risk that they may over-achieve in cooling it down, hitting consumer confidence. (ANZ)

CHINA MARKETS

PBOC NET INJECTS CNY50BN VIA OMOS FRIDAY

The People's Bank of China (PBOC) injected CNY100 billion via 7-day reverse repos with the rates unchanged at 2.2% on Friday. The operation has led to a net injection of CNY50 billion after offsetting the maturity of CNY50billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.2385% at 09:25 am local time from the close of 2.2461% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 45 on Thursday vs 43 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3936 FRI VS 6.3980

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3936 on Friday, compared with 6.3980 set on Thursday.

MARKETS

SNAPSHOT: New COVID Variant Results In Risk-Off Trade

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 799.43 points at 28699.63

- ASX 200 down 127.991 points at 7279.3

- Shanghai Comp. down 22.866 points at 3561.313

- JGB 10-Yr future up 16 ticks at 151.7, yield down 1.1bp at 0.075%

- Aussie 10-Yr future up 13.5 ticks at 98.25, yield down 13.2bp at 1.737%

- U.S. 10-Yr future +0-25 at 130-19+, yield down 8.77bp at 1.546%

- WTI crude down $2.41 at $75.98, Gold up $8.97 at $1797.82

- USD/JPY down 69 pips at Y114.67

- WHO CALLS SPECIAL MEETING TO DISCUSS NEW COVID VARIANT FOUND IN SOUTH AFRICA WITH 'A LARGE NUMBER OF MUTATIONS' (CNBC)

- BAILEY SIGNALS BOE HAS ABANDONED HARD GUIDANCE FOR RATES POLICY (BBG)

- FRENCH FISHERMEN WILL BLOCKADE CHANNEL TUNNEL IN BREXIT PROTEST

- CHINA SAID TO ASK DIDI TO DELIST FROM U.S. ON SECURITY FEARS (BBG)

- RBNZ'S HAWKESBY: INFLATION EXPECTATIONS WILL BE KEY TO RATE-HIKE PACE (BBG)

BOND SUMMARY: Core FI Bid On New COVID Variant

Core FI markets have been underpinned by the broader risk-off dynamic in the wake of the discovery of a new, aggressive COVID variant in Africa, with TYZ1 sitting at fresh session highs at typing, +0-24+ at 130-19. Cash Tsy trade sees outperformance in the belly, with 5s richening by ~9.0bp. This comes as some of the recent hawkish Fed repricing gets wound out of markets on the COVID news, as Eurodollar futures trade as much as 13.0 ticks higher on the day, with the reds outperforming. This dynamic has allowed the 2-/5-/10-Year butterfly to move back from recent highs (a reminder that the belly is the most susceptible part of the curve when it comes to Fed repricing and speculation surrounding tapering matters), while the 5-/30-Year spread has ticked away from the YtD, post-COVID vol. flats registered on Wednesday. A reminder that U.S. exchanges will observe altered trading hours on Friday, with early closures surrounding the Thanksgiving holiday weekend.

- JGB futures +16, while cash JGBs have richened by 0.5-2.0bp, with 7s (pointing to a futures-driven bid) and 40s (perhaps on a continued wind back in worry re: issuance requirements to finance the impending fiscal stimulus package) outperforming on the curve. On the issuance front, Uruguay will conduct a 3-/5-/7-/10-/15-Year multi-tranche round of JPY issuance, which is set to price on Thursday 2 Dec, while a multi-tranche round of corporate issuance from Rakuten priced this morning. There hasn't been much attention afforded to news reports pointing to PM Kishida pushing for a 3% rise in corporate wages across Japan, given the broader risk-off dynamic. Participants still await formal details re: the issuance program surrounding the impending fiscal stimulus package, which should cross at some point today.

- Aussie bond futures shunted higher at the close, registering fresh session highs, potentially pointing to a closing of shorts to limit risk over the weekend. YM finished +11.5, with XM +13.5. There was no reaction in the space to the much firmer than expected domestic retail sales data, with focus squarely on the broader risk-off dynamic. Pricing at the latest round of ACGB Nov-25 supply was firm, with the weighted average yield printing 0.88bp through prevailing mids (per Yieldbroker), although the cover ratio slid below 2.50x. Note that the uptick in issuance size muddies the direct comparability of the latter a little, but looking back at the previous auction results, the 12 Nov auction of the line drew nearly A$3.0bn more in bids, it would seem that the recent issuance dynamic may have limited bidding amounts. AOFM issuance remains brisk next week (vs. recent norms), with a A$300mn dip in ACGB supply vs. this week's levels, while Note issuance remains at A$5bn.

JGBS AUCTION: Japanese MOF sells Y3.4981tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y3.4981tn 3-Month Bills:

- Average Yield -0.1518% (prev. -0.1388%)

- Average Price 100.0408 (prev. 100.0373)

- High Yield: -0.1470% (prev. -0.1377%)

- Low Price 100.0395 (prev. 100.0370)

- % Allotted At High Yield: 89.2176% (prev. 76.3172%)

- Bid/Cover: 4.131x (prev. 4.915x)

AUSSIE BONDS: The AOFM sells A$1.5bn of the 0.25% 21 Nov ‘25 Bond, issue #TB161:

The Australian Office of Financial Management (AOFM) sells A$1.5bn of the 0.25% 21 November 2025 Bond, issue #TB161:

- Average Yield: 1.3087% (prev. 1.3045%)

- High Yield: 1.3150% (prev. 1.3075%)

- Bid/Cover: 2.4567x (prev. 6.4900x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 36.4% (prev. 40.9%)

- Bidders 41 (prev. 45), successful 28 (prev. 14), allocated in full 23 (prev. 10)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Wednesday 1 December it plans to sell A$1.0bn of the 4.50% 21 April 2033 Bond.

- On Thursday 2 December it plans to sell A$2.0bn of the 11 February 2022 Note & A$3.0bn of the 11 March 2022 Note.

- On Friday 3 December it plans to sell A$1.5bn of the 2.75% 21 April 2024 Bond.

EQUITIES: New COVID Variant Weighs

It has been pretty much one-way traffic during Asia-Pac trade, with equity markets pressured by the discovery of a new, aggressive COVID variant in Africa. The S&P 500 e-mini contract has found a bit of a base at 4,650, after shedding 1%. Our technical analyst has flagged the formation of a bearish shooting star pattern in the wake of Monday's price action. Tuesday's low is located just below today's base, providing the initial point of technical support. Those of a bullish disposition need to see fresh all-time highs in the contract, which would negate the significance of Monday's technical formation.

- A quick reminder that U.S. markets will be subjected to a shortened trading session on Friday, owing to the Thanksgiving weekend. This will thin out broader liquidity.

- In terms of the regional backdrop, all of the major equity indices are comfortably lower on the day, with the Nikkei leading the way, shedding ~3%. The Hang Seng Tech Index has seen extra pressure creep in on the back of a BBG source report which suggested that "Chinese regulators have asked Didi Global Inc.'s top executives to devise a plan to delist from U.S. bourses." The sources noted that "the country's tech watchdog wants management to take the company off the New York Stock Exchange because of concerns about leakage of sensitive data." Still, the sources highlighted that no final decision re: the matter has been made. With the possibility for some backtracking evident.

OIL: Hit By COVID Worry

WTI & Brent crude oil futures have been battered by the discovery of the new COVID variant in Africa, with broader risk appetite and worries over any related hit to crude demand weighing. WTI is $2.00 lower vs. Wednesday's settlement, while Brent is ~$1.60 worse off. This of course builds on the demand-side worries generated by the imposition of tighter COVID restrictions across several European nations in recent days. A quick reminder that the OPEC+ group will meet next week, with plenty of speculation already doing the rounds re: the potential for a tweak in the group's oil output policy in the wake of the recent coordinated inventory release from some of the large oil consuming nations (some source reports have pointed to the likelihood of no change in production, while others have suggested that the group will continue to lift oil output, as planned).

GOLD: Bid On Broader Risk-Off Theme

Gold has benefitted from the broader safe haven bid witnessed in Asia-Pac trade, adding the best part of $10/oz, to trade just shy of $1,800/oz at typing. The wider market reaction to the discovery of an aggressive new COVID strain in Africa will be the headline market driver ahead of the weekend, although shortened trading hours in the U.S. will continue to limit broader market liquidity. From a technical perspective, bulls need to reclaim the 20-day EMA to begin to reassert control. Conversely, to the downside, key support is located at the Nov 3 low ($1,759.0.oz).

FOREX: "Variant Of Serious Concern" Inspires Flight To Safety

The discovery of a heavily mutated variant of Covid-19 in South Africa inspired a rush into safe haven currencies. Scientists are still working to shed some light on the likely consequences, but there is concern that the new variant could dodge immunity and a leading South African researcher called it "clearly very different" from previous strains.

- The JPY caught a bid and comfortably outperformed its G10 peers, closely followed by its safe haven peer CHF. USD/JPY retreated below the Y115.00 figure, while the Japanese government assured that no cases of the new variant have been found in Japan.

- High-beta currencies went offered as Covid jitters resurfaced. AUD/USD plunged through support from Sep 29 low of $0.7170 and printed its worst levels in three months, as the AUD lagged all of its G10 peers. Across the Tasman, the NZD faltered for the sixth day in a row.

- EM FX space drew attention in light of idiosyncratic developments. USD/ZAR surged to its highest point in a year, as the spread of the new variant inspired speculation that South Africa could be hit by another deadly wave of infections.

- Separately, USD/MXN extended gains and showed at a one-year low, after Pres Obrador tapped a little-known Finance Ministry official with no experience in monetary policy to be the next Banxico chief.

- Thursday's Thanksgiving holiday may have limited liquidity across the broader FX space.

- The data economic docket is rather thin today, while central bank speaker slate features ECB's Lagarde, de Guindos, Lane, Visco, Schnabel, Centeno & Panetta, BoE's Pill & Riksbank's Ohlsson.

FOREX OPTIONS: Expiries for Nov26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1150-60(E503mln), $1.1275-80(E612mln), $1.1380-1405(E598mln), $1.1500-14(E1.1bln)

- USD/JPY: Y113.65-80($1.3bln), Y115.50($582mln)

- GBP/USD: $1.3400(Gbp963mln)

- AUD/USD: $0.7200(A$524mln), $0.7240-50(A$597mln)

- USD/CAD: C$1.2520-25($1.8bln), C$1.2545-55($2.9bln)

- USD/CNY: Cny6.3750-60($500mln), Cny6.4000($650mln), Cny6.4550-55($1.2bln)

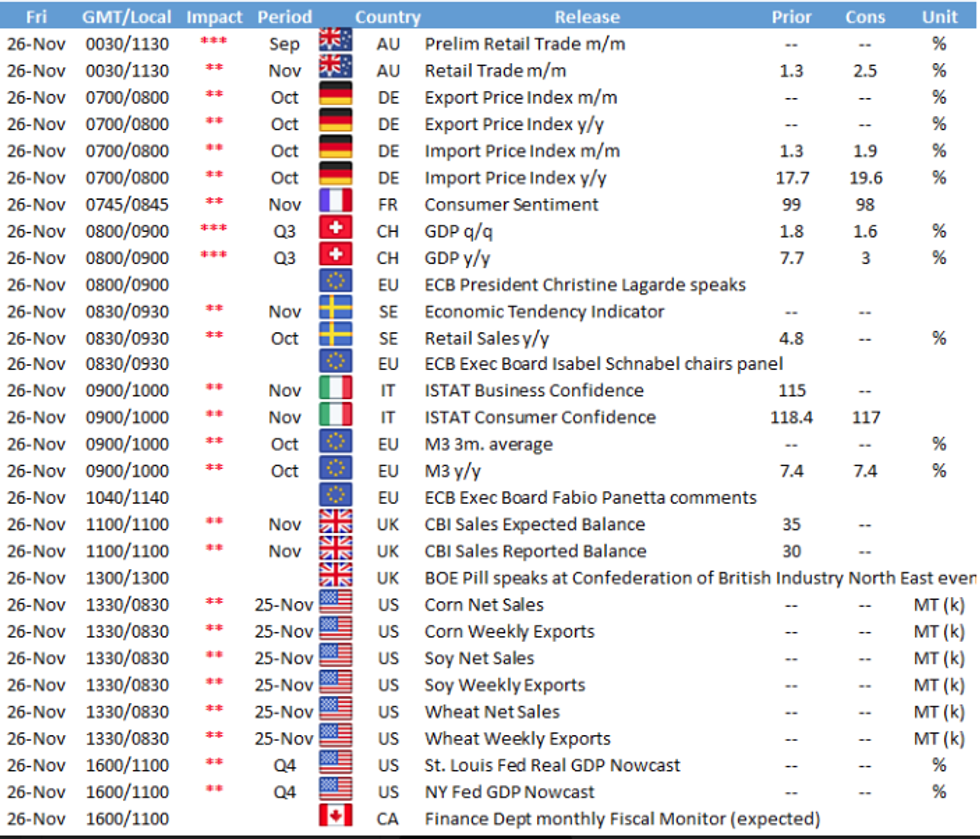

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.