-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - House Takes Initiative After Budget Vote

MNI Eurozone Inflation Preview - February 2025

MNI US MARKETS ANALYSIS - Curve Nears Flattest Levels of 2025

MNI EUROPEAN OPEN: Cautious Optimism Evident In Asia

EXECUTIVE SUMMARY

- HEADLINE FLOW A LITTLE MIXED, BUT CAUTIOUS OPTIMISM CREEPING IN RE: MORTALITY THREAT OF OMICRON

- CHINA MAY LOWER RRR AS SOON AS THIS MONTH (SECURITIES DAILY)

- RRR REMARK BY CHINA’S LI DOESN’T MEAN POLICY CHANGE (ECO. DAILY)

- REPEAT CHINESE DEFAULTER SUNSHINE 100 MISSES ANOTHER PAYMENT (BBG)

- WILL EVEGRANDE MEET LATEST COUPON PAYMENT GRACE PERIOD DEADLINE?

- U.S. TENSION WITH BOTH RUSSIA AND IRAN EVIDENT

Fig. 1: U.S. 10- & 30-Year Yields (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Travellers heading to the UK will now have to take a Covid test before their departure in an effort to limit spread of the virus, the government has said. Health Secretary Sajid Javid said the tightened requirements would come into force from 04:00 GMT on Tuesday. Everyone aged 12 and over will be required to take a pre-departure test a maximum of 48 hours before leaving. Currently people only need to self-isolate until they test negative within two days of arriving. Nigeria will be added from Monday to the red list of countries from where people arriving must quarantine in a hotel for 10 days, Mr Javid also confirmed. (BBC)

CORONAVIRUS: The latest travel rule changes are "a case of shutting the stable door after the horse has bolted," a scientist advising the government has said. Prof Mark Woolhouse said the new rules had come "too late" to make a "material difference" to a potential wave of the Omicron variant in the UK. (BBC)

CORONAVIRUS: Dominic Raab, deputy prime minister, has predicted Britons will enjoy “a great Christmas” amid hopes in Downing Street that no new Covid-19 restrictions will be needed in England before the new year to deal with the Omicron variant. Ministers believe that new and existing anti-Covid measures — including the planned expansion of the vaccine booster programme and a fresh requirement for travellers to the UK to do a coronavirus test before departure — will be sufficient for now. Raab struck a bullish note on Sunday, saying this Christmas would be “totally different” to the last one and that people should plan with confidence to spend time with family and friends. “I think it’s going to be a great Christmas,” the justice secretary told the BBC. “I think people should enjoy Christmas, get their loved ones around them, celebrate it in a way we haven’t been able to do in the past.” (FT)

CORONAVIRUS: Deputy Prime Minister Dominic Raab, on Sky News, pushes back against mandatory vaccines but calls those who don’t get jabbed “irresponsible.” (BBG)

CORONAVIRUS: UK ministers have been warned they cannot wait for new research on the Omicron variant and must act now to prevent a potentially “very significant wave of infections” that risks overwhelming the NHS. A 75 further cases of the variant have been identified in England, the UK Health Security Agency (UKHSA) said on Friday night, bringing the total number of UK confirmed cases to 134. The head of the agency, Dr Jenny Harries, said: “We have started to see cases where there are no links to travel, suggesting that we have a small amount of community transmission.” The Guardian understands the government has been privately urged by some of its own scientific advisers to tell people to work from home until Christmas if they can, when more will be known about the dangers posed by the new variant. (Guardian)

CORONAVIRUS: Government officials and scientific advisers believe that the danger posed by the Omicron variant may not be clear until January, potentially allowing weeks of intense mixing while the variant spreads. Across Westminster, invitations to Christmas drinks are landing in embossed envelopes or on WhatsApp groups. Departmental staff parties are set to take place, as well as a reception for journalists with Rishi Sunak at No 11. Even Keir Starmer and Rachel Reeves are hosting a joint bash. However, minutes for the Scientific Advisory Group for Emergencies (Sage) suggest there is deep concern about the threat from the new variant, particularly its transmissibility. Though there is a wariness about overreacting, one government scientific adviser said Downing Street was “putting all its eggs in one basket” by focusing its efforts on the booster vaccine drive. “It should be a balance between social mixing and immunity. That will affect how quickly it spreads,” the adviser said. “At the moment we are not really doing anything to reduce mixing. It’s disruptive and it’s damaging to the economy, but at the very least we could encourage people to think about their contacts.” (Guardian)

CORONAVIRUS: The emergence of the Omicron variant shows that the world is “closer to the start of the pandemic than the end”, one of Britain’s most senior scientific figures has warned, as he lamented a lack of political leadership over Covid. Sir Jeremy Farrar, the director of the Wellcome Trust who stepped down as a government scientific adviser last month, said the progress in combatting Covid-19 since its emergence was “being squandered”. (Observer)

CORONAVIRUS: The first at-home treatment for Covid is to be offered to patients by Christmas as ministers roll out the antiviral pill to help protect the most vulnerable from the omicron variant. Sajid Javid, the Health Secretary, is preparing to announce the start of a national pilot of Lagevrio, also known as Molnupiravir – the "game-changing" pill that Britain became the first country to license last month. Under the plans, the NHS is expected to deliver courses of the tablet to clinically vulnerable and immunosuppressed patients within as little as 48 hours of them testing positive for Covid. (Telegraph)

FISCAL: Rishi Sunak is preparing to cut income tax by 2p in the pound or to slash VAT rates before the next election, The Times has learnt. The chancellor has told officials to draw up detailed plans to reduce the tax burden, with a third option to cut inheritance tax also under consideration. (The Times)

FISCAL: Boris Johnson and Rishi Sunak are to launch a war on waste, forming a "star chamber" to hold Cabinet ministers to account over government spending. (Telegraph)

FISCAL: Eighty business and charity leaders have urged Rishi Sunak to extend his Covid-19 bailout to Transport for London this week to avoid derailing the government’s levelling up agenda. The financial lifeline the chancellor threw to TfL during the pandemic ends on Saturday and, without a solution, London’s mayor Sadiq Khan has warned that one of the 11 Underground lines might have to be closed. (Sunday Times)

ECONOMY: Economic forecasters have slashed expectations for Britain’s recovery and said further pain could follow, depending on the severity of the Omicron variant of Covid-19 and government action to avoid a “cliff edge” for business investment. The Confederation of British Industry, the UK’s leading business lobby group, said in June that it expected the economy to expand by 8.2%. But on Monday it cut that prediction to 6.9% and revised down its 2022 forecast from 6.9% to 5.1%. It put the more pessimistic outlook down to weaker-than-expected output since its last forecast, with supply chain disruption among the factors that has placed a drag on the economy. The accounting firm KPMG issued an even gloomier prediction, saying it expects growth to reach 4.2% next year at best, even if the Omicron variant turns out to be a “false alarm”. (Guardian)

BOE/PROPERTY: The Bank of England is poised to loosen mortgage lending rules introduced in the wake of the financial crisis, in a move economists have warned risks sparking a housing bubble. Officials are understood to be considering softening affordability checks for borrowers as part of a review of the market restrictions that concludes next week. One of the measures being looked at is reducing the additional interest rate charge used to test borrowers’ ability to pay the reversion rate after an initial deal ends. This would benefit first-time buyers, as tight rules designed to protect them against a return to old fashioned high interest rates has made it harder for some would-be homeowners in an era of apparently permanently low borrowing costs. Tighter checks were brought in in 2014 to try to stop a repeat of the crisis. (Telegraph)

BREXIT: The UK government is to begin trials next year of a “smart” customs border involving cutting-edge technologies that it hopes will reduce trade frictions for British importers. UK companies will this week be asked to submit bids to pilot the new system, with the aim of starting trials at a port in May, according to senior officials in Whitehall. The announcement of the plans, described as building a “Rolls-Royce system for moving goods”, come as the government prepares to begin implementing full customs checks on EU imports from January. Last week the Federation of Small Businesses, a trade body, warned that only a quarter of companies were ready to handle the new paperwork, including real-time customs declarations and pre-notification to UK authorities of imports of animal and plant products. (FT)

BREXIT/CHANNEL: UK prime minister Boris Johnson has ordered his team to de-escalate tensions with French president Emmanuel Macron, telling colleagues not to retaliate against what London regards as recent provocation from Paris. Johnson is convinced that Macron is going to win a second term, according to allies, and wants to prepare the ground for better relations after next April’s presidential elections, possibly via a new Anglo-French treaty. With Macron reportedly labelling Johnson a “clown” — amid a bitter row over how to respond to the deaths of 27 migrants who last month tried to reach the UK by crossing the English Channel in a small boat — the idea of any post-election “entente cordiale” seems far-fetched to some diplomats. (FT)

POLICY: The government's white paper on "levelling up" all regions of the UK is likely to be delayed until next year, it has been confirmed. The document, focusing on industry, skills and transport, had been expected to be published before Christmas. It is understood the need to deal with the spread of the Omicron Covid variant was among the reasons for this being pushed back. Labour accused ministers of being in "disarray" over levelling-up plans. It said they had failed to come up with a "single idea" for effectively reducing regional inequality. But government sources dismissed the claim, telling the BBC recently appointed Levelling Up Secretary Michael Gove was determined to address the issue and a committee he was chairing had already met several times, with "very good engagement" from fellow cabinet ministers. (BBC)

POLITICS: The Metropolitan Police has said it does not routinely probe "retrospective breaches" of Covid laws amid calls for an investigation of a No 10 Christmas party held during 2020's restrictions. The party took place on 18 December, with a source telling the BBC that "several dozen" people attended. However, Covid restrictions in place at the time banned such events. The PM, who was not at the party, said no Covid rules were broken but No 10 has not said how party-goers complied. A source who attended the event told the BBC that party games were played, food and drink were served, and the party went on past midnight. (BBC)

EUROPE

CORONAVIRUS: Protests broke out in several European cities against tightening Covid-19 rules, including 40,000 people in Vienna by a police estimate despite a nationwide lockdown. In the Dutch city of Utrecht, marchers protested a partial lockdown, in which most public venues must close at 5 p.m., the Associated Press reported. Violent clashes broke out two weeks ago in Covid-related protests in Rotterdam. (BBG)

GERMANY: German Chancellor Angela Merkel pleaded with unvaccinated Germans to come forward and get shots, warning the country faced difficult weeks ahead as deaths and hospitalizations from coronavirus rise. “Go and get vaccinated,” Merkel said in her last weekly podcast as chancellor. “Whether it’s your first vaccination or a booster, every vaccination helps.” (BBG)

GERMANY: Two out of the three parties that will form Germany's next government have now approved the agreement. After the FDP and Social Democrats, the result of the Green Party's vote will be known Monday. The neoliberal Free Democratic Party (FDP) on Sunday backed the coalition agreement negotiated with the center-left Social Democrats (SPD) and the Green Party. Two out of the three parties that will form Germany's next government have now approved the agreement. After the FDP and Social Democrats, the result of the Green Party's vote will be known Monday. The neoliberal Free Democratic Party (FDP) on Sunday backed the coalition agreement negotiated with the center-left Social Democrats (SPD) and the Green Party. (Deutsche Welle)

GERMANY: Some 63% of people in Germany support mandatory vaccinations, according to a YouGov poll for DPA, with 30% opposed. That’s a reversal of a December 2020 survey when only 33% backed mandatory vaccinations. A separate poll by INSA for Bild am Sonntag showed 63% of unvaccinated don’t intend to get a jab, while 20% plan to do so. Germany’s parliament is set to vote on mandatory vaccinations in the coming weeks with both outgoing Chancellor Angela Merkel and her successor Olaf Scholz backing such a measure. (BBG)

FRANCE: The French government announced details of tougher testing requirements for visitors from outside the EU. From Saturday, anyone coming from a non-European country, whether or not they are vaccinated, must show a negative antigen test less than 24 hours old, or a negative PCR test less than 48 hours old. Unvaccinated EU visitors need a negative antigen or PCR test less than 24 hours old to enter France. (BBG)

FRANCE: France's conservative party on Saturday chose Valérie Pécresse, the moderate chief of the Paris region, to challenge President Emmanuel Macron next year, a choice that will likely have major influence on the shape of the campaign. (AFP)

FRANCE: France will try to avoid any new health rules including a lockdown in the face of rising coronavirus cases and the spread of the omicron variant, according to Finance Minister Bruno Le Maire. “We should do the maximum to avoid any new health restrictions,” he said Sunday in an interview with Europe 1, Les Echos and CNews. Unlike some European countries, the government isn’t in favor of making vaccines mandatory, he said. (BBG)

ITALY: Italy is cracking down on the small minority that has so far refused the shot. As of Monday, a “green pass” -- proof of vaccination, recovery or a recent negative test -- will be required for buses, metro, local trains and hotels. It’s already compulsory for working, long-distance travel and most indoor venues. The new “reinforced” green pass will also be needed for many leisure activities, including eating inside restaurants, going to theaters, cinemas, sporting and other public events. (BBG)

BELGIUM: Belgian police used tear gas to disperse a protest in Brussels on Sunday afternoon. The gathering turned violent when a few dozen rioters hurdled firecrackers and flares toward the police barricade that kept the protesters from occupying the Schuman roundabout in the capital’s European Quarter. (BBG)

IRELAND: Ireland moved to tighten restrictions, as it seeks to head off a possible renewed surge driven by the omicron variant. The government will close nightclubs from Dec. 7 to Jan. 9. Bars and restaurants will be restricted to table service only while a maximum of four households can mix in private homes. “The potential for a very serious crisis is obvious” if omicron takes hold, Irish prime minister Micheal Martin said in a national address. (BBG)

RATINGS: Sovereign rating reviews of note from Friday included:

- Fitch upgraded Italy to BBB; Outlook Stable

- Fitch affirmed Slovenia at A; Outlook Stable

- Fitch affirmed Sweden at AAA; Outlook Stable

- DBRS Morningstar confirmed Germany at AAA, Stable Trend

BANKING: European banks improved their capital buffers, liquidity positions and profitability in the year after the onset of the coronavirus pandemic, according to the latest risk assessment of the sector by the European Banking Authority. But the regulator warned that banks would need to be prepared for a potential deterioration in the economy and for inflationary pressure leading to rising interest rates. The EBA also raised concerns about banks that had lent to industries worst-affected by the pandemic and relying on government support schemes. Banks played a crucial role in the first year of the pandemic, serving as the “transmission mechanism” through which trillions of dollars of government and central bank aid was distributed to companies and consumers in an effort to save the global economy from collapse. While the banks’ non-performing loans fell from 2.9 per cent to 2.3 per cent of their lending books over the year to June, the EBA warned that the proportion of non-performing loans exposed to sectors most affected by the pandemic was increasing. (FT)

U.S.

FED: MNI: March Fed Meeting Seen Live For Liftoff, Ex-Officials Say

- Faster tapering of asset purchases next month is all but a done deal, leaving the Federal Reserve with an option to lift interest rates from near zero as soon as March to calm frothy inflation, former officials said in interviews - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: Former Treasury Secretary Lawrence Summers said that Federal Reserve Chair Jerome Powell ought to signal the possibility of raising interest rates four times next year, in order to restore what he argues is the central bank’s lost credibility on fighting inflation. “I’d be signaling four rate increases next year -- with two-sided uncertainty, depending on how the inflation figures of work out,” Summer said on Bloomberg Television’s “Wall Street Week” with David Westin. “That will be a jolt. But a jolt is what is required to restore credibility.” (BBG)

ECONOMY: Holiday sales could exceed even the rosiest expectations for the major shopping season, according to the National Retail Federation. The major trade group’s economist, Jack Kleinhenz, said Friday that spending in November and December could grow as much as 11.5% compared with the same period a year ago — higher than many retail analysts and NRF itself had predicted. The NRF had already called for a record holiday season, projecting in late October that sales would rise between 8.5% and 10.5% from last year. The group said it expected sales in November and December would hit an all-time high of between $834.4 billion and $859 billion. The sales forecast excludes spending at automobile dealers, gas stations and restaurants. (CNBC)

ECONOMY: U.S. inflation is poised to exceed the Federal Reserve’s target rate for at least another two years, according to a survey of business economists released Monday. Some 71% of respondents in the latest National Association for Business Economics survey say the annualized core personal consumption expenditures price index, which excludes food and energy, won’t reach or fall below the central bank’s 2% goal until the second half of 2023 at the earliest. Supply-chain bottlenecks, strong demand and rising wages are key drivers of higher prices, according to the report. While shipping and transportation disruptions may ease soon, economic demand and higher worker pay will keep inflation elevated over the next three years, the panelists expect. Forty-three percent of panelists expect that supply chains will start to normalize in the second quarter of 2022, while 22% believe the process has already started. (BBG)

FISCAL: President Joe Biden signed a short-term government funding bill on Friday, snuffing out one looming crisis as Congress turns its gaze toward two other big-ticket items. Biden’s signature prevents a shutdown hours before an end of Friday deadline. The measure — which the House and Senate passed Thursday — will keep the government running through Feb. 18. (CNBC)

FISCAL: Asked if Biden had spoken to McConnell about the debt limit, White House Press Secretary Jen Psaki on Friday afternoon said: ‘We are encouraged by the conversations that are happening between Leader Schumer and Senator McConnell about how to address a range of issues that are in front of Congress, including the debt limit.’ She said she did not have further updates to provide on the matter. (Metro)

CORONAVIRUS: At least 15 states have detected the omicron coronavirus variant and that number is expected to rise, Centers for Disease Control and Prevention Director Dr. Rochelle Walensky told ABC News on Sunday. “We know we have several dozen cases and we’re following them closely. And we are every day hearing about more and more probable cases so that number is likely to rise,” Walensky said on “This Week." (CNBC)

CORONAVIRUS: Early signals about the severity of the new Omicron coronavirus variant that has spread globally are “encouraging”, according to a top US health official, with booster jabs potentially offering a “considerable degree” of protection. Anthony Fauci, chief medical adviser to President Joe Biden, acknowledged on Sunday that it was too early to know the full consequences of the new strain, but was optimistic about the initial data. Omicron has generated significant alarm since its emergence less than two weeks ago in South Africa and Botswana. “We really gotta be careful before we make any determinations that it is less severe or really doesn’t cause any severe illness comparable to Delta, but thus far the signals are a bit encouraging,” he said in an interview with CNN. “It does not look like there’s a great degree of severity to it.” (FT)

CORONAVIRUS: Anthony Fauci, the director of the National Institute of Allergy and Infectious Diseases, said on Sunday that the United States is reevaluating the travel restrictions from south African countries "on a daily basis." (Axios)

EQUITIES: Biotech stocks have fallen to earth with a thud in 2021 after soaring last year amid excitement over the development of Covid-19 vaccines, dealing big losses to some hedge funds. The sector is being buffeted by concerns Congress will move to put a lid on drug pricing and a surfeit of early-stage biotech shares as the IPO market booms. (WSJ)

OTHER

GLOBAL TRADE: U.K. Trade Secretary Anne-Marie Trevelyan will press U.S. Commerce Secretary Gina Raimondo on Tuesday to remove Trump-era tariffs on British steel and aluminum after the U.S. struck a deal with the European Union in October to remove their levies. “We’ve already made strong progress; from getting British beef and lamb back on U.S. plates, to lowering the cost of Scotch whisky exports by addressing the long-running Airbus-Boeing issue,” Trevelyan said in a statement. “Now is the time to hit the ground running and get on with boosting ties with our closest ally.” (BBG)

GLOBAL TRADE: Some Lithuanian and other foreign media outlets have reported that Lithuanian products have been removed from China's customs systems, with some painting the move as "economic coercion" by China, after China downgraded diplomatic ties with Lithuania over the latter's mistake on the Taiwan question. However, a Global Times investigations into such claims, which included interviews with several sources close to Chinese customs and industry insiders, found that Lithuanian products are still listed in official customs systems as of Sunday, contrary to what some media reports suggested. But in light of growing risks, Chinese traders and industry insiders are diversifying their import sources after reducing or halting trading with Lithuania to fend off potential risks posed by political tensions. (Global Times)

U.S./CHINA: U.S. President Joe Biden’s planned democracy summit next week will be a “joke” and the American political system doesn’t represent a real democracy, senior Chinese officials said on Saturday. “Under the American democratic system, U.S. politicians are the agents of interest groups, and don’t represent interests of majority voters nor national interest,” Tian Peiyan, deputy director of the Policy Research Office of the Communist Party’s central committee, said at a press conference in Beijing on Saturday for the release of a white paper on democracy. U.S. politicians would promise anything just to get elected and rarely delivered on their commitments, he said. “This is not real democracy, Chinese people don’t like and don’t want such a democracy,” Tian said. The “revolving door” phenomenon in the U.S. system means that politicians are swayed by interest groups and lobbyists, said Xu Lin, deputy head of the Publicity Department in the party’s central committee. (BBG)

U.S./CHINA: President Joe Biden's administration is not lobbying against a U.S. bill that would ban some Chinese imports over concern about forced labor among Uyghurs, which Republicans have accused Democrats of stalling, the White House said on Friday. (RTRS)

U.S./CHINA: The Biden administration is expected to announce this week that no US government officials will attend the 2022 Beijing Olympics, implementing a diplomatic boycott of the games, according to several sources. The move would allow the US to send a message on the world stage to China without preventing US athletes from competing. The National Security Council, which has been privately discussing the boycott, declined to comment. President Joe Biden told reporters last month that he was weighing a diplomatic boycott as Democratic and Republican lawmakers, including House Speaker Nancy Pelosi, advocated for one in protest of China's human rights abuses. A full boycott is not expected, meaning US athletes will still be allowed to compete. The last time the US fully boycotted the Olympics was in 1980 when former President Jimmy Carter was in office. (CNN)

U.S./CHINA/TAIWAN: Any move by China to invade Taiwan would have "terrible consequences," U.S. Secretary of State Antony Blinken said on Friday, adding that he hoped Chinese leaders would think very carefully about "not precipitating a crisis" across the Taiwan Strait. Blinken, speaking at the Reuters Next conference, said China had been trying to change the status quo over self-ruled Taiwan, which Beijing claims as its territory, and that the United States is "resolutely committed" to making sure the island has the means to defend itself. "But here again, I hope that China's leaders think very carefully about this and about not precipitating a crisis that would have, I think, terrible consequences for lots of people, and one that's in no one's interest, starting with China," Blinken said. (RTRS)

U.S./CHINA/TAIWAN: Austin said on Saturday that "China is not 10 feet tall," while "America is a Pacific power." Frankly, China may not be that tall and strong, especially when it is in the deep Pacific Ocean, Indian Ocean, or the Caribbean Sea. But we are going to measure who is "taller" in the Taiwan Straits, where we are sure to show the US that in some parts of the world where it is not supposed to be, the US really is a dwarf. (Global Times)

GEOPOLITICS: The U.S. has seen a reversal of fortunes since last year, when China closed the gap on American influence in Asia, according to a new report by the Lowy Institute. This year marks the first gain for the U.S. since the Australian think tank began publishing its annual Asia Power Index in 2018. Washington bucked the downtrend seen in most of the 26 ranked countries. The annual index awards points for military capability and defense networks; economic, diplomatic and cultural influence; resilience; and future resources. The U.S. scored 82.2 points, up from 81.6 in 2020. Aside from the U.S., Brunei, Sri Lanka and Bangladesh were the only countries to gain points this year. China received 74.6 points, its score falling for the first time since 2018, "with no clear path to undisputed primacy in the Indo-Pacific," the report says. It surpassed the U.S. only in economic capability and relationships, but it also gained ground in terms of military capability and resilience. (Nikkei)

GEOPOLITICS: Classified American intelligence reports suggest China intends to establish a military installation in this tiny Central African country, a move that would give Beijing its first permanent naval presence on the Atlantic Ocean, according to U.S. officials. The officials declined to describe details of the secret intelligence findings. But they said the reports raise the prospect that Chinese warships would be able to rearm and refit opposite the East Coast of the U.S.—a threat that is setting off alarm bells at the White House and Pentagon. (WSJ)

CORONAVIRUS: Initial data from a major hospital complex in South Africa’s omicron epicenter show that while Covid-19 case numbers have surged, patients need less medical intervention. The Steve Biko and Tshwane District Hospital Complex in Pretoria had 166 new admissions between Nov. 14 and Nov. 29, with 42 patients currently in the Covid wards, according to a report showing the early experience of patients at the hospital group. Most originally sought treatment for ailments unrelated to the coronavirus and were discovered to have it in testing required for admission. The omicron variant “is more transmissible, it seems, than others,” President Cyril Ramaphosa said on Saturday, according to the Sunday Times. “Our hospital admissions are not increasing at an alarming rate, meaning that whilst people may be testing positive, they are not in large numbers being admitted into hospitals.” (BBG)

CORONAVIRUS: As fears of another global surge of Covid-19 cases send jitters through global markets, spur a new round of travel bans and cause Americans to rethink their holiday plans, scientists studying the omicron variant are getting the first hints of what’s in store for the months to come. The new variant’s mutations suggest that it is likely to evade the protections of vaccines to at least some extent, but that it is unlikely to cause more severe illness than previous versions of the coronavirus. These early hypotheses appear in line with real-world observations from places like South Africa, where infections have included the vaccinated and previously ill but appear so far largely mild. That data, however, is thus far extremely limited, so much current evidence has come from computer modeling and comparing omicron’s physical structure to past variants. (BBG)

CORONAVIRUS: The speed at which the omicron variant appears to have accumulated its unusual pattern of mutations is a concern, according to Sikhulile Moyo, the scientist who first detected the new strain that has quickly spread across the world. The velocity of the mutations also raises questions about how the variant evolved and adds to the puzzle of how transmissible the variant may be. (BBG)

CORONAVIRUS: Moderna Inc. President Stephen Hoge said there’s a clear risk that existing Covid-19 vaccines will be less effective against the omicron variant, though it’s too early to say by how much. An updated formulation would be probably be needed if effectiveness is shown to drop by something like half, Hoge said on ABC’s “This Week” on Sunday. “I think that there’s a real risk that we’re going to see a decrease in the effectiveness of the vaccines,” Hoge said. “What I don’t know is how substantial that is.” (BBG)

CORONAVIRUS: Johnson & Johnson says preliminary results from an independent study showed that a booster shot of its Covid-19 vaccine administered six months after a two-dose primary regimen of Pfizer-BioNTech’s vaccine raised both antibody and T-cell responses. Study was conducted by Beth Israel Deaconess Medical Center but included a subset of participants from a study sponsored by its subsidiary Janssen. Johnson & Johnson says findings reinforce a study published in The Lancet showing showing a mix-and-match booster. (BBG)

JAPAN: The Japanese government is considering raising its economic growth forecast for fiscal 2022 to take into account the effects of its record $490 billion stimulus package, public broadcaster NHK reported on Monday. (RTRS)

JAPAN: Japanese Prime Minister Fumio Kishida’s cabinet approval rating rose 6 ppts to 62% in a Yomiuri poll taken over the weekend. Disapproval rating fell 7 ppts to 22%. Asked if they approve of the government’s efforts to strengthen border controls amid the spread of the omicron variant, 89% of respondents said they approve while 8% said they disapprove. (BBG)

AUSTRALIA: Australia will upgrade its economic forecasts for next year at the mid-year budget update, Treasurer Josh Frydenberg said. “The market is coming back strongly,” Frydenberg said on the national broadcaster’s “Insiders” program Sunday. “That comes as a result of the fact that we now have one of the highest vaccination rates in the world, one of the lowest mortality rates in the world.” Frydenberg pointed to data including job growth and retail sales for the improved outlook. He wasn’t specific on whether the upgrade was for the next calendar year or fiscal year, which starts in July. Frydenberg will deliver the Mid-Year Economic and Fiscal Outlook in the coming weeks just as the nation’s economy shows signs of resilience following the months-long lockdowns of the two most populous cities combat a surge of the delta variant. The economy posted a smaller-than- forecast contraction in the September quarter while multiple data and surveys ranging from business confidence to retail sales, job vacancies and mobility pointed to a strong pick-up in activity. (BBG)

AUSTRALIA: Australia’s Queensland state will reopen its border to the rest of the nation ahead of schedule next Monday as more than 80% of the eligible population will be fully vaccinated later this week, Premier Annastasia Palaszczuk told reporters Monday. Fully vaccinated travelers will need to have received a negative test within the 72 hours prior to arriving, while those that haven’t been inoculated must arrive by air and spend 14 days in hotel quarantine. The border was due to reopen on Dec. 17. (BBG)

RBNZ: New Zealand’s runaway house prices could be brought back to earth by low net migration if the coronavirus pandemic keeps the country’s borders closed, according to the central bank’s deputy governor. Geoff Bascand told the Financial Times that if house prices cooled down faster than expected, it could affect the Reserve Bank of New Zealand’s forecast for rapid interest rate rises next year. If New Zealand was slow to reopen its borders and more of its residents moved abroad, that could put a check on population growth and reduce demand for housing, he added. (FT)

TURKEY: Turkish police found an explosive device under a vehicle that belongs to a police officer who was supposed to be on duty at a rally for President Recep Tayyip Erdoğan Saturday morning, according to state-run TRT Haber. The improvised explosive under the police officer’s personal vehicle was found in Mardin, a province in the southeast that’s more 125 miles (200 kilometers) away from the rally held in Siirt, the outlet said. The explosive was discovered before the police officer traveled to Siirt and was defused by bomb squads. (BBG)

TURKEY: The Banks Association of Turkey is working on how to strengthen state bank capital in order to help boost loans as President Recep Tayyip Erdogan presses for looser monetary policy to spur growth and create jobs, according to Alpaslan Cakar, the head of the association. The Turkish banking industry is “strong and solid” in terms of capital adequacy and non-performing loans ratio, the association’s head Alpaslan Cakar said in an interview with a local TV channel. He said lenders will “take responsibility in some way” to support Erdogan’s economic model, which relies on banks giving out loans that will eventually transform into investments and employment. Banks need to “finance the new economic model,” Cakar said. “We will all contribute in proportion to our scale, we can not grow independently from the economy.” (BBG)

TURKEY/RATINGS: Sovereign rating reviews of note from Friday included:

- Moody's affirmed Turkey at B2; Outlook Negative

RUSSIA: U.S. President Joe Biden and Russian President Vladimir Putin will hold a video call on Tuesday, with the two leaders set to discuss the tense situation in Ukraine. "Biden will underscore U.S. concerns with Russian military activities on the border with Ukraine and reaffirm the United States' support for the sovereignty and territorial integrity of Ukraine," White House spokesperson Jen Psaki said in a statement. She said other topics would include "strategic stability, cyber and regional issues." (RTRS)

RUSSIA: U.S. President Joe Biden will tell Russian President Vladimir Putin in their meeting that the United States is determined to stand resolutely against any reckless or aggressive actions that Russia may pursue and to defend the territorial integrity of Ukraine, Secretary of State Antony Blinken said on Friday. Blinken told the Reuters Next conference that when the two leaders speak, Biden will also lay out to Putin the U.S. desire for greater predictability and stability in ties with Russia. (RTRS)

RUSSIA: The US believes Russia is planning to invade Ukraine “as soon as early 2022” with an estimated 175,000 troops — in a sign of escalating alarm in Washington about Moscow’s intentions towards its neighbour. A Biden administration official said on Friday night that Moscow’s plans “call for a military offensive against Ukraine as soon as early 2022 with a scale of forces twice what we saw this past spring during Russia’s rapid military build-up near Ukraine’s borders”. This included “extensive movement of 100 battalion tactical groups with an estimated 175,000 personnel, along with armour, artillery and equipment”. According to the administration official, half the units were already near Ukraine’s border, having arrived in the past month. Russia had already moved to established a “ready reserve of contract reservists” to prepare for the offensive. Before heading to the presidential retreat at Camp David on Friday evening, Joe Biden said: “We’ve been aware of Russia’s actions for a long time and my expectation is we’re going to have a long discussion.” (FT)

RUSSIA: EU and Nato allies have swung behind the Biden administration’s assessment that Russia may be poised to invade Ukraine, following unprecedented sharing of US intelligence on Moscow’s military preparations. Weeks of sustained US diplomatic engagement with European governments, backed by a sharing of intelligence normally reserved for its closest allies, have helped convince some previously sceptical capitals, including Berlin, that the Kremlin could soon order its troops into Ukraine. The effort has galvanised support for the need for robust sanctions threats to deter the Kremlin. (FT)

RUSSIA: U.S. Secretary of State Antony Blinken and Russian Foreign Minister Sergei Lavrov had a testy exchange over Ukraine at a dinner with dozens of their colleagues this week, according to people familiar with the discussions. The verbal tension erupted as the U.S. and its European allies seek ways -- including possible sanctions -- to counter the threat of a Russian invasion of Ukraine after President Vladimir Putin’s troop buildup on the neighboring country’s border. (BBG)

RUSSIA: The Biden administration is prepared to impose sanctions or other measures against Russia if it decides to invade Ukraine, White House spokeswoman Jen Psaki said on Friday. Psaki said Russian President Vladimir Putin is taking steps that would allow him to invade the neighboring country. "That is why we want to be prepared and in an area we have expressed serious concern about," Psaki said. (RTRS)

RUSSIA/RATINGS: Sovereign rating reviews of note from Friday included:

- Fitch affirmed Russia at BBB; Outlook Stable

SOUTH AFRICA: South African hospitals are bracing for a surge in admissions as the new omicron variant drives a sharp rise in coronavirus infections and as more evidence emerges about the severity of the illness caused by the strain. The seven-day moving average of daily new cases in the country rose to 10,055 last week, from less than 300 three weeks earlier. Hospitalizations also picked up but remain relatively low, with admissions standing at 3,268 on Sunday. Whether there will be a deluge of new patients is the biggest question. Severe symptoms in patients who contracted earlier variants typically developed between one and three weeks after they were diagnosed, according to the National Institute for Communicable Diseases. (BBG)

SOUTH AFRICA: Eskom has announced it will be suspending load shedding much sooner than it had anticipated: The power utility says the electricity cuts will come to an end on Sunday, 5 December 2021 at 21:00. Eskom implemented stage 2 load shedding on Saturday until Monday morning at 05:00, citing several factors, including the fact that generation units at Kusile, Medupi and Arnot power stations failed to return to service. Added to that is the delay of a unit returning to service at Tutuka power station. That’s not all: Eskom had also said at that time, that the failure of the coal conveyors at Medupi led to reduced output at the station. While this had been rectified, the embattled parastatal had claimed it would still take time to recover the full operations. Now Eskom says emergency generation reserves have adequately recovered. (The South African)

IRAN: U.S. Secretary of State Antony Blinken on Friday said that the latest round of Iran nuclear talks ended because Iran right now does not seem to be serious about doing what is necessary to return to compliance with a 2015 deal. Blinken, speaking at the Reuters Next conference, said that the United States would not let Iran drag out the process while continuing to advance its program and that Washington will pursue other options if diplomacy fails. "What we've seen in the last couple of days is that Iran right now does not seem to be serious about doing what's necessary to return to compliance, which is why we ended this round of talks in Vienna," Blinken said. (RTRS)

IRAN: Iran didn’t show seriousness in the latest talks to rejoin a 2015 accord restraining its nuclear program, and the U.S. is preparing for a scenario where restoring the deal won’t be possible, a senior U.S. official said Saturday. It was the most pessimistic American assessment of the negotiations yet. (BBG)

IRAN: Iran said world powers can’t expect it to stop expanding its nuclear work until they reach an agreement with Tehran on how U.S. sanctions will be lifted from the Islamic Republic’s economy, according to a statement by the country’s foreign ministry. The statement, which quotes an anonymous “senior official” in the foreign ministry without explaining why they can’t be named, added that draft texts presented to European interlocutors on Dec. 1, before the latest round of talks ended on Friday, also included Iran’s proposals for how it returns to full compliance with the 2015 nuclear deal. (BBG)

IRAN: The United States is "making decisions" and preparing "for a world in which there is no return" to the Iran nuclear deal, a senior State Department official said over the weekend, following last week's disappointing negotiations over resuming the 2015 accord. "We've been waiting patiently for five and a half months" since Tehran suspended talks in June, the official said. "The Iranian government said it needed time to get ready." "What we've seen over the last week or so is what getting ready meant for them . . . it meant continuing to accelerate their nuclear program in particularly provocative ways" to gain leverage in extracting unreasonable concessions far beyond the scope of the original agreement, the official said Saturday. (Washington Post)

IMF: Global economic growth projections from the International Monetary Fund will likely be downgraded due to the emergence of the Omicron variant of the coronavirus, IMF Managing Director Kristalina Georgieva said on Friday. "A new variant that may spread very rapidly can dent confidence, and in that sense, we are likely to see some downgrades of our October projections for global growth," Georgieva said during the Reuters Next conference. The IMF said in October it expected the global economy to grow 5.9% this year and 4.9% next year, pointing then to the threat of new coronavirus variants as increasing uncertainty about the timeline for overcoming the pandemic. (RTRS)

OIL: The Organization of the Petroleum Exporting Countries (OPEC) will continue with its supply adjustments for the oil market, the OPEC Secretary General said on Saturday. "We will continue to do what we know best to ensure we attain stability in the oil market on a sustainable basis," Mohammad Barkindo said in a webinar organised by Italian think-tank ISPI. (RTRS)

OIL: Saudi Arabia’s state oil producer Aramco raised its January official selling price (OSP) to Asia for its flagship Arab Light crude to $3.30 a barrel versus Oman/Dubai crude, up $0.60 from December, the company said on Sunday. The company set the Arab Light OSP to Northwestern Europe at minus $1.30 per barrel versus ICE Brent and to the United States at plus $2.15 per barrel over ASCI (Argus Sour Crude Index). (RTRS)

OIL: The Alaska state agency that holds oil leases in the Arctic National Wildlife Refuge (ANWR) has committed to spending more money to develop those tracts, even though prospects are dim for any oil activities there in the near future. (RTRS)

CHINA

PBOC: China may cut the amount of cash banks have to keep in reserve this month to free funds to repay medium-term policy loans coming due, Securities Daily reports, citing Li Chao, chief economist at Zheshang Securities. (BBG)

PBOC: The People’s Bank of China may cut banks’ reserve requirement ratios as early as mid-December to promote credit expansion and better support the economy, China Securities Journal reported following Premier Li Keqiang’s speech on Friday calling for an RRR cut in due course. About CNY950 billion medium-term lending facilities are maturing on Dec. 15, which may be the window for RRR cut, the newspaper said citing analysts. The cut is likely to be 50-bps to roll over part of the maturing MLF, so to help reduce banks’ debt cost and avoid excessive liquidity, the newspaper said citing Wang Yifeng, chief banking analyst of China Everbright Securities. (MNI)

PBOC: Premier Li Keqiang’s mention of an RRR cut to help small companies and the separate relaxing of rules on land sales and rising property loans doesn’t indicate China will ease monetary policy, Economic Daily says in a commentary. Nation will continue implementing a stable monetary policy while making it more targeted and effective, the commentary adds. Monetary, fiscal and industrial policies will be better coordinated to improve structure of economy and growth momentum. (BBG)

ECONOMY: With 2021 rapidly drawing to an end, China's policymakers are expected to convene an important economic meeting in Beijing in middle December to craft the course of accelerating structural reforms while overcoming a raft of challenges in 2022. Investors worldwide are closely watching for clues on next year's policy and reform agenda as China has become the leading engine of the global economy. In considering the country's customary plan choreographing an annual growth rate for the coming year, Chinese policymakers are expected to set the GDP growth target at "above 5 percent" for 2022. The International Monetary Fund (IMF) has predicted China is likely to achieve 5.6 percent economic growth next year. It is necessary to strive for relatively fast 5.5-6 percent growth in order to create sufficient jobs and maintain economic and social stability. Thanks to lower levels of inflation in the country, the People's Bank of China, the central bank, is expected to take more aggressive counter-cyclical financial tools to support Chinese enterprises to speed up technological transformation and expand production in 2022, and at the same time, stimulate the country's vast middle-class to keep shopping by browsing and clicking on numerous e-commerce platforms on their mobile phones. Expanding household consumption will always remain the decision-makers' top agenda in boosting GDP growth. (Global Times)

PROPERTY: China’s real estate market may become more stable with market sentiment normalizing as the impact of the Evergrande risks become clearer, and developers will enjoy smoother financing channels amid policy correction, the PBOC-run newspaper Financial News reported citing analysts. Some Chinese developers have begun to repurchase overseas bonds, and some investors have also begun to buy dollar bonds issued by Chinese developers as domestic home sales, land purchases and financing of developers normalize, according to a statement on the PBOC’s website Friday responding to possible Evergrande defaults on its dollar bonds. Loans to developers continue to rise in November based on the sharp rebound in October, and domestic real estate bond issuance also rose 84% from the previous month, the newspaper said, noting that the pessimism on real estate has been relieved as financing policy eased. (MNI)

PROPERTY: Loans from Chinese lenders to the real estate sector rose both sequentially and from a year earlier in November, reported a newspaper backed by the country’s central bank. New property loans increased about 200 billion yuan ($31.4 billion) from November 2020, Financial News said on Sunday, citing preliminary data from Chinese financial regulators and banks. The People’s Bank of China had said growth in mortgage loans outstanding accelerated in October. However, policies to ease mortgage controls and improve financing for builders haven’t translated into an ebbing of sharp declines in new-home sales. Contracted deals continued to slump last month, according to preliminary data from the China Real Estate Information Corp. (BBG)

EVERGRANDE: A quick reminder that troubled Chinese property developer, China Evergrande, faces its latest liquidity test today, with the 30-day grace period on ~$82.5mn of coupon payments covering offshore bonds issued by Evergrande business unit Scenery Journey Ltd set to come to an end.

- Could the end game of this saga be upon us? Friday saw Evergrande note that the company plans to “actively engage” with offshore creditors re: a restructuring plan. This was followed up by a flurry of communique from various wings of the Chinese policymaking sphere:

- The PBoC pointed to “poor management” and “reckless expansion” when it came to issues at the core of the company’s troubles. The central bank also stressed that the case will not impact regular middle- and long-term financing in the market.

- Meanwhile, the government of Guangdong summoned Evergrande founder Hui to flag concern over the previously highlighted company notice, while noting that it will dispatch a team to ensure “normal” operations within the company.

- We also saw Chinese Premier Li alert watchers to a RRR cut at “an appropriate time,” with heightened speculation that such a move could be imminent.

- This could be one leg to the government’s engineering of a soft-landing restructure for Evergrande, at least when it comes to limiting the broader impact within the property sector (which has an outsized contribution to Chinese GDP, at least in a global sense, accounting for somewhere in the region of 25% of the Chinese economic output, based on a wide range of estimates).

- Wider visibility re: the spill over impact remains limited, at best, given the various entities that have issued bonds, along with the general opaque nature of such matters in China. (MNI)

CREDIT: Chinese developer and repeat defaulter Sunshine 100 China Holdings Ltd. has missed payment on $179 million of debt and interest payments due Sunday, as higher borrowing costs hit indebted companies across the sector. Sunshine 100 said in a filing that it won’t be able to repay the $170 million of principal and more than $8.9 million of interest on its 10.5% senior notes due 2021. The company said in August that it wasn’t able to repay the principal, premium and accrued interest of its 2021 bonds. Its default will also trigger provisions under some other debt instruments. The firm has struggled to meet debt obligations this year as authorities cracked down on excessive leverage in the property industry. It conducted a distressed repurchase that S&P Global Ratings said was “tantamount” to default in March and failed to repay a dollar bond due August 11. Sunshine 100 has $385 million of outstanding dollar notes including those with missed payments across three bonds, Bloomberg-compiled data show. (BBG)

MARKETS/POLICY: China’s securities regulator said it is open to companies choosing to be listed in the U.S. and a few companies are actively working with regulators for U.S. listings. Reports that the Chinese authorities are forbidding those so-called variable interest entities (VIE) seeking U.S. listings are untrue, the China Securities Regulatory Commission said in a statement on Sunday. The reports came after a new U.S. SEC law forced some Chinese companies to delist from the U.S. These practices are by some U.S. political forces and shouldn’t be a responsible policy choice, said the Chinese watchdog. (MNI)

CORONAVIRUS: Schools were closed in the Zhenhai district of Ningbo city in China’s eastern province of Zhejiang on Monday after three people tested positive for Covid-19, state broadcaster CCTV reported. The new cases come as China -- one of the world’s last Covid Zero holdouts -- uses strict measures to try and stamp out an outbreak of the virus that spread to various spots across the country. (BBG)

CORONAVIRUS: China’s top health expert identified two conditions for the country to return to “normality” and maintained that it should stick to a Covid Zero policy in battling omicron, the state- backed Global Times reported. Prerequisites for getting back to normal include Covid fatalities needing to fall to a rate of 0.1% similar to the flu’s, said Zhong Nanshan, who heads China’s Covid task force, according to the paper. The virus’s reproduction rate -- a measure of how many people one patient can transmit the virus to -- also needs to remain within a range of 1 to 1.5, according to Zhong. (BBG)

OVERNIGHT DATA

AUSTRALIA NOV MELBOURNE INSTITUTE INFLATION +3.1% Y/Y; OCT +3.1%

AUSTRALIA NOV MELBOURNE INSTITUTE INFLATION +0.3% M/M; OCT +0.2%

AUSTRALIA NOV ANZ JOB ADVERTISEMENTS +7.4% M/M; OCT +7.5%

ANZ Australian Job Ads rose 7.4%m/m in November, as restrictions eased further after the lockdowns were lifted in October. National employment fell in October against expectations of a rise, but this ANZ Job Ads result signals a strong rebound is imminent. (ANZ)

NEW ZEALAND Q3 VOLUME OF ALL BUILDINGS -8.6% Q/Q; MEDIAN -13.0%; Q2 +2.0%

NEW ZEALAND NOV ANZ COMMODITY PRICE INDEX +2.8% M/M; OCT +2.2%

CHINA MARKETS

PBOC NET DRAINS CNY90BN VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rates unchanged at 2.2% on Monday. The operation has led to a net drain of CNY90 billion after offsetting the maturity of CNY100 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.2000% at 09:26 am local time from the close of 2.0470% on Friday.

- The CFETS-NEX money-market sentiment index closed at 43 on Friday vs 40 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3702 MON VS 6.3738

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3702 on Monday, compared with 6.3738 set on Friday.

MARKET

SNAPSHOT: Cautious Optimism Evident In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 86.37 points at 27943.22

- ASX 200 up 3.935 points at 7245.1

- Shanghai Comp. up 5.546 points at 3612.978

- JGB 10-Yr future up 13 ticks at 152.24, yield down 1.3bp at 0.040%

- Aussie 10-Yr future up 3.0 ticks at 98.410, yield down 2.7bp at 1.582%

- U.S. 10-Yr future -0-13+ at 131-01, yield up 4.21bp at 1.385%

- WTI crude up $1.46 at $67.72, Gold down $0.33 at $1782.95

- USD/JPY up 23 pips at Y113.03

- HEADLINE FLOW A LITTLE MIXED, BUT CAUTIOUS OPTIMISM CREEPING IN RE: MORTALITY THREAT OF OMICRON

- CHINA MAY LOWER RRR AS SOON AS THIS MONTH (SECURITIES DAILY)

- RRR REMARK BY CHINA’S LI DOESN’T MEAN POLICY CHANGE (ECO. DAILY)

- REPEAT CHINESE DEFAULTER SUNSHINE 100 MISSES ANOTHER PAYMENT (BBG)

- WILL EVEGRANDE MEET LATEST COUPON PAYMENT GRACE PERIOD DEADLINE?

- U.S. TENSION WITH BOTH RUSSIA AND IRAN EVIDENT

BOND SUMMARY: U.S. Tsys Pressured, JGBs Firm

T-Notes pulled lower at the re-open, moving further away from Friday’s NY. News out of South Africa re: the omicron COVID variant remains mixed, although the severity of the COVID strain appears to remain a little more limited than some had feared (at least from a mortality perspective). Meanwhile, over in the U.S., Dr Fauci pointed to “encouraging” early signs, with booster jabs potentially offering a “considerable degree” of protection vs. the strain, although he cautioned against drawing hasty conclusions. This cautious degree of optimism pressured T-Notes early this week, with second round effects coming from an uptick in crude oil prices. Increased speculation re: the chances of a fairly imminent RRR cut from the PBoC (in lieu of Friday’s Guidance from Chinese Premier Li) helped the space find a bit of a base early on, before a 6K FV block sale and selling flow in TY futures in the same window applied fresh pressure to the space. TYH2 -0-14 at 131-00+, 0-01 off lows, Tsys run 3.0-4.0bp cheaper across the curve, with the 7- to 10-Year zone leading the weakness. From a technical perspective, cash 10s have respected uptrend support (in yield terms) drawn off the Aug ’20 lows, bouncing from that particular area of support on Friday. There is nothing of note on the domestic docket on Monday.

- JGB futures hit the bell 14 ticks above Friday’s settlement, hovering around late overnight levels for the duration of the Tokyo session, insulated from the broader cheapening pressures that kicked into wider core global fixed income markets. Cash JGBs see outperformance for 7s, which richened by a little over 2bp during the morning (pointing to a futures-driven bid), while the remainder of the curve was flat to ~1bp richer. Domestic news flow remains relatively light, outside of speculation in the local press re: the potential for an upgrade in the government’s view on economic growth covering FY22, owing to the impact of its well-documented fiscal spending package. Elsewhere, PM Kishida pointed to a willingness to provide the required support if the omicron outbreak depends/poses a threat to the economy.

- The weakness in U.S. Tsys allowed Aussie bond futures to unwind the overnight/early bull flattening impetus, leaving YM & XM +3.0 come the bell. The collateral scarcity/RBA SLF borrowing story that we flagged in our auction preview resulted in the strong pricing at the latest ACGB Nov-24 auction, with the weighted average yield printing 1.37bp through prevailing mids (per Yieldbroker), while the cover ratio wasn’t anything out of the ordinary, printing comfortably on the 3x handle. Overall, it was another smooth auction for the AOFM. Elsewhere, the weekend saw Treasurer Frydenberg point to an upgrade in the government’s growth outlook in the upcoming mid-year budget update. This comes as no real surprise in the wake of the firmer than expected Q3 GDP data, which provides a better starting point for the economy. On the COVID front, we saw that Australia’s Queensland state will re-open its borders to the rest of the country ahead of schedule (next Monday) owing to vaccination progress within the state.

AUSSIE BONDS: The AOFM sells A$1.5bn of the 0.25% 21 Nov ‘24 Bond, issue #TB159:

The Australian Office of Financial Management (AOFM) sells A$1.5bn of the 0.25% 21 November 2024 Bond, issue #TB159:

- Average Yield: 0.8779% (prev. 0.9588%)

- High Yield: 0.8825% (prev. 0.9600%)

- Bid/Cover: 3.3633x (prev. 4.7400x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 52.7% (prev. 93.5%)

- Bidders 40 (prev. 37), successful 14 (prev. 7), allocated in full 8 (prev. 3)

EQUITIES: CSI 300 Outperforms In Asia, E-minis Nudge Higher

When it comes to the major regional indices, Monday’s Asia-Pac session saw the ASX 200 edge higher, while the Nikkei 225 ticked lower in the wake of a negative lead from Wall St., although the latter managed to move off of early Tokyo lows.

- Elsewhere, losses in the Hang Seng were more pronounced, with Chinese tech names struggling after Friday’s pressure on U.S. listed Chinese names. The pressure stemmed from worries in the wake of Didi Global’s U.S. delisting as higher levels of U.S. regulatory oversight re: Chinese firms listed in the U.S. near (note that increased Chinese scrutiny of such names is also evident). This drove the Hang Seng Tech index to the lowest levels in its short life.

- Chinese equities nudged higher, with the broader property sphere continuing to balance worries surrounding Evergrande and credit defaults within the sector, against policymaker rhetoric re: the isolated nature of the Evergrande situation.

- We also saw U.S. e-mini futures push higher, with tentative optimism re: the ultimate risks posed by the omicron COVID variant and a bid in oil prices supporting the space. The S&P 500 and DJIA contracts added a little over 0.5%, while the NASDAQ 100 underperformed as U.S. Tsy yields ticked higher.

OIL: Tentative Hope Re: The Threat Posed By Omicron Supports Crude In Asia

WTI and Brent crude futures have added ~$1.50 to their respective settlement levels, with tentative optimism re: the ultimate risks posed by the omicron COVID variant supporting oil prices since the re-open, which has allowed some fears on the demand front to recede.

- In idiosyncratic news, the weekend saw Saudi Aramco issued wider differentials when it comes to crude pricing for the U.S. & Asia during the month of January, even with Omicron uncertainty lingering and OPEC+ choosing to plough ahead with its previously outlined production hike in January.

- Elsewhere, the verbal jousting between the U.S. & Iran seems to have intensified a little over the weekend.

GOLD: U.S. CPI On The Horizon

A flat start for gold this week, consolidating Friday’s uptick, even with U.S. Tsy yields nudging higher and the DXY trading on the front foot (although the USD trades in more of a mixed fashion within G10 FX on a more granular level). This comes after Friday’s post-NFP pullback in our weighted U.S. real yield monitor, coupled with the DXY pulling back from best levels, supported gold. Spot last deals around the $1,785/oz mark, with a familiar technical overlay remaining in play. Looking ahead, Friday’s U.S. CPI print provides the notable fundamental risk event for participants over the coming days. A reminder that the Fed is now in its pre-meeting blackout period, so we won’t get anything more from the central bank until next Wednesday’s monetary policy decision. Further afield, Chinese monetary policy matters continue to garner attention, with speculation rife re: the prospect of a fairly imminent RRR cut from the PBoC in the wake of Friday’s guidance from Chinese Premier Li.

FOREX: Risk-Sensitive FX Gain Ground On Waning Omicron Fear

The perception of risks associated with the new coronavirus variant remained the main driver of market sentiment, with early data reinforcing the view that the symptoms caused by Omicron could be less severe than initially feared. The expectation that patients infected with the new variant could require less medical intervention inspired risk-on flows across G10 FX space.

- Chief U.S. medical advisor Fauci pointed to "encouraging signals" on the severity of symptoms caused by the new variant, while expressing hope that border restrictions would be lifted "within a quite reasonable period of time." Separately, data from South Africa has not shown any upsurge in hospitalisations linked to the spread of Omicron.

- High-beta currencies drew support from a revival in risk sentiment. The AUD was comfortably the best performer in this space, as federal Treasurer Frydenberg signalled that the upcoming mid-year budget review will feature an upgrade to the government's 2022 growth forecast.

- Its Antipodean cousin NZD lost some altitude early on but managed to recoup those losses on the back of broader risk-on feel. AUD/NZD moved away from a two-week low and remained buoyant through the Asia-Pac session.

- Safe haven currencies fell out of favour, as better mood music left CHF and JPY bringing up the rear in the G10 basket. USD/JPY stabilised around the Y113.00 mark.

- The yuan strengthened a tad, even as speculation was rife that Beijing could deliver a fairly imminent cut to the RRR, in the wake of Friday's comments from Chinese Premier Li. The prospect of policy easing in China likely lent additional support to broader risk sentiment overnight.

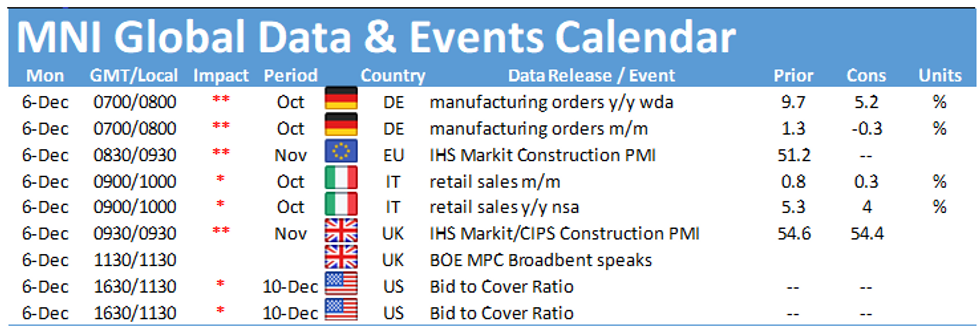

- Monday brings a slow start to the week, with the global data docket providing little of real note. BoE's Broadbent and Riksbank's Skingsley are set to speak.

FOREX OPTIONS: Expiries for Dec06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1200(E720mln), $1.1250(E609mln) $1.1550-60(E1.5bln)

- USD/JPY: Y113.70-80($707mln), Y113.95-05($683mln), Y115.00-10($1.4bln)

- GBP/USD: $1.3490-00(Gbp536mln)

- AUD/USD: $0.7400-10(A$1.3bln)

- USD/CAD: C$1.2765-75($510mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.