-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Cautious End To Central Bank Marathon Week

EXECUTIVE SUMMARY

- EUROPEAN COUNCIL FAIL TO REACH AGREEMENT ON ENERGY CRISIS

- U.S. PUSHES EU TO READY RUSSIA SANCTIONS ON ENERGY AND BANKS (BBG)

- TORIES LOSE SAFE SEAT TO LIBDEMS IN NORTH SHROPSHIRE BY-ELECTION IN BLOW TO PM JOHNSON

- U.S. RATCHETS UP PRESSURE ON CHINA OVER TREATMENT OF UYGHURS

- BOJ LEAVE MAIN MONPOL SETTINGS UNCHANGED, WILL SLOW CORPORATE BOND PURCHASES

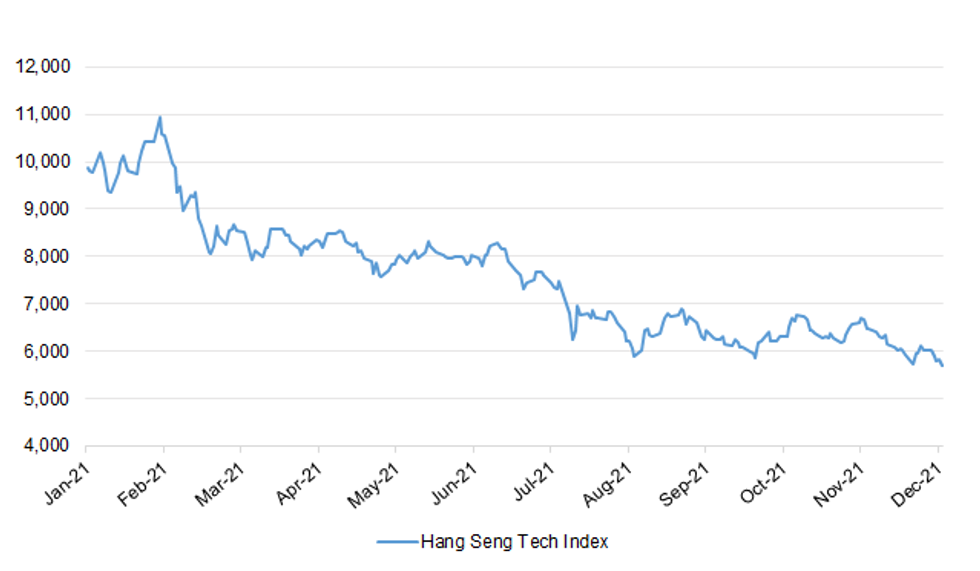

Fig. 1: Hang Seng Tech Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: The Liberal Democrats have won a stunning victory in the North Shropshire byelection, taking what had previously been a safe Conservative seat by a margin of nearly 6,000 votes, and capping a disastrous few weeks for Boris Johnson. Helen Morgan, the Lib Dem candidate, won 17,957 votes, ahead of the Conservatives’ Neil Shastri-Hurst, on 12,032, a majority of 5,925. Labour’s Ben Wood was third, with 3,686 votes. Turnout was 46.3%. The calamitous collapse in Conservative support – a 34% swing in a seat where they had a near-23,000 majority in 2019 – will prompt significant jitters among many Tory MPs, and is likely to raise questions about Johnson’s future. It was a swing even greater than the 25% seen last June when the Lib Dems won the Chesham and Amersham byelection. (Guardian)

POLITICS: Boris Johnson joined No 10 staff for a party in Downing Street during the first lockdown in May last year, sources have alleged, raising questions about whether there was a culture of flouting the rules over a number of months. The prime minister spent about 15 minutes with staff at the alleged social gathering on 15 May 2020, telling one aide inside No 10 that they deserved a drink for “beating back” coronavirus, a joint investigation by the Guardian and Independent was told. Sources claimed about 20 staff drank wine and spirits and ate pizza following a press conference on that day, some in offices inside No 10 and others going into the garden. Some staff stayed drinking until late into the evening, they alleged. (Guardian)

CORONAVIRUS: "Each six months will be better than the last six months", England's chief medical officer has said, as he predicted it could be "possibly 18 months" until a wide range of vaccines covers all variants of the coronavirus. Professor Chris Whitty said it is likely that COVID vaccines and anti-viral drugs will do "almost all of the heavy lifting" when it comes to tackling future strains - unless they are "extremely different". He told the Commons Health and Social Care Committee: "If I project forward, I would anticipate in a number of years - possibly 18 months, possibly slightly less, possibly slightly more - that we will have polyvalent vaccines, which will cover a much wider range, and we will probably have several antivirals." (Sky)

ECONOMY: Rishi Sunak, chancellor, has cut short a visit to California to confront the Covid-related crisis in Britain’s hospitality industry, as executives expressed frustration that he has failed to offer the sector new financial support. Sunak was accused by Labour on Thursday of “going missing” as pubs and hotels saw their Christmas bookings plummet, while one restaurant boss claimed the chancellor had gone into “hiding”. Sunak held video talks with three hospitality bosses on Thursday from San Francisco but did not attend a roundtable discussion with the sector, to the disappointment of some attendees. (FT)

EUROPE

ECB: The European Central Bank’s decision to lengthen the reinvestment time frame of its emergencybond-purchase program to combat market stress drew pushback from a significant number of policy makers,according to officials familiar with the matter.The plan to extend that horizon to the end of 2024 was approved only because it was presented by the ExecutiveBoard as part of the wider package to exit pandemic stimulus, but many Governing Council members argued that itdidn’t conform to that aim, said the officials, who declined to be identified because such discussions are private. (BBG)

EU: European Union leaders failed to reach a deal on how to react to the unprecedented gas crisis that sent energy prices to record levels after Poland and the Czech Republic demanded stronger action to cap the costs of pollution. After two rounds of heated talks at a summit Thursday in Brussels, the heads of government dropped plans to adopt a statement on the energy crunch. The differences in their assessments of the spike in power, natural gas and emissions costs proved insurmountable, according to two diplomats with knowledge of the talks. A planned regulation by the EU’s executive arm on how to classify nuclear energy and gas in the bloc’s green rulebook was also a contentious issue. Most countries in the 27-nation bloc have already taken national measures to blunt the impact of the crisis on businesses and consumers, including tax cuts and direct support for the most vulnerable households. With no signs of easing, the rally is stoking concerns about inflation and risks to the economic recovery as gas shipments from Russia, the EU’s biggest supplier, remain limited. (BBG)

EU: The European Union is ready to impose sanctions with a "massive cost" for Russia if the Russian military invades Ukraine, European Commission President Ursula von der Leyen said on Friday. "Let there be no doubt. If Russia were to move against Ukraine, the Union will be in a position to take sanctions that could extract a massive cost. We have done our work in that respect," von der Leyen told a news conference following a summit of EU leaders in Brussels. (RTRS)

EU: Croatia expects formal decision on Euro entry in mid-2022, says PM Plenkovic. (BBG)

GERMANY: Germany's newly inaugurated Chancellor Olaf Scholz met other European Union leaders at his first Brussels summit on Thursday. Russian antagonism on the Ukraine border dominated the agenda after Ukrainian President Volodymyr Zelenskyy met with Scholz and French President Emmanuel Macron, as well as European Council President Charles Michel on Wednesday. Scholz held talks with NATO Secretary General Jens Stoltenberg Thursday. "We will underscore again that the inviolability of borders is an important basis for peace in Europe, and that together we will do everything that this inviolability endures," Scholz said prior to the summit. (Deutsche Welle)

GERMANY/RUSSIA: The German energy regulator's eagerly-awaited decision on fully certifying the Nord Stream 2 gas pipeline won't come in the first half of next year, it said on Thursday, in a setback for the Russian project that has sparked global political tensions. "There will be no decisions in the first half (of 2022)," Bundesnetzagentur (BNetzA) President Jochen Homann said with regard to the certification process. (RTRS)

FRANCE/UK: France will ban non-essential travel to and from Britain from the weekend to slow the spread of the Omicron Covid-19 variant that is causing record numbers of cases on the other side of the Channel, the government said Thursday. From midnight Saturday (2300 GMT Friday) there will be a "requirement to have an essential reason to travel to, or come from, the UK, both for the unvaccinated and vaccinated... People cannot travel for touristic or professional reasons," the government said in a statement. (France24)

DENMARK: Denmark, one of the countries with the highest number of omicron cases, is raising its growth forecast, predicting that the new virus variant won’t prevent the Nordic economy from booming, according to government documents seen by Bloomberg News. (BBG)

NBP: Polish central bank will “most likely” need to raise interest rates further to bring inflation toward the upper limit of its inflation range, around 3.5%, Monetary Policy Council member Cezary Kochalski tells PAP newswire in an interview. Most recently the Council “has been increasing rates in around 50 basis-point increments, that is relatively forcefully.” “Looking into the near future, the scenario of a stronger move or moves, but less frequent, seems in my opinion more likely.” (BBG)

US

ECONOMY: President Biden on Thursday signed a bill raising the debt ceiling by $2.5 trillion, narrowly averting default on the nation’s debt. (Hill)

ECONOMY: Democrats on Thursday began to concede that they may not be able to adopt a roughly $2 trillion package to overhaul the country’s health care, education, climate, immigration and tax laws before the end of this year, threatening a major political setback for the final piece of President Biden’s economic agenda. The acknowledgment on Capitol Hill after months of negotiations — some even involving Biden personally — generated fresh frustration among a party struggling to overcome its own divisions and finalize a measure that has bedeviled them now for nearly a year. And it raised the odds that a key federal program that provides monthly payments to approximately 35 million families could expire in a matter of days. Biden, however, sought to manage expectations late Thursday. In a statement, he said discussions remain ongoing with Sen. Joe Manchin III (D-W.Va.), a key swing vote in the chamber who has expressed sustained concern about the size and scope of the economic package. But he appeared to leave open the door that the debate could easily drag into 2022. “We will advance this work together over the days and weeks ahead,” Biden said, noting that he and Senate Majority Leader Charles E. Schumer (D-N.Y.) are “determined to see the bill successfully on the floor as early as possible.” (WaPo)

ECONOMY/POLITICS: Democrats’ plan to use President Joe Biden’s $2 trillion economic package to alter U.S. immigration laws was rejected by the Senate parliamentarian for the third time, likely dealing the effort a knockout blow. Senate Parliamentarian Elizabeth MacDonough told lawmakers Thursday that a provision providing temporary deportation protections for some unauthorized immigrants doesn’t comply with strict Senate rules enabling the broader package to clear with only Democratic support. Those rules require each item in a so-called reconciliation bill to be largely budgetary in nature. (BBG)

POLITICS: Vice President Kamala Harris said that she and President Biden have never discussed whether he plans to run for re-election and that it isn’t a topic she thinks about as they near the end of their first year in office. Ms. Harris, the nation’s first female vice president, has been in the national spotlight as a potential future leader of the Democratic Party, particularly since she took office as Mr. Biden’s second in command. (WSJ)

CORONAVIRUS: Dr. Anthony Fauci, President Joe Biden’s top medical advisor, said Thursday that omicron will become the dominant Covid-19 variant in the United States within a few weeks, urging people to get vaccines and booster shots to fight it off. “It is the most transmissible virus of Covid that we had to deal with those far. It will soon become dominant here. That’s one thing we know,” Fauci told a virtual U.S. Chamber of Commerce Foundation audience. (CNBC)

CORONAVIRUS: President Joe Biden warned that unvaccinated Americans face “a winter of severe illness and death” as he urged initial doses and booster shots amid a surge of coronavirus cases and the emergence of the omicron variant. “It’s past time” to get shots, the president said Thursday following a briefing with his coronavirus team at the White House. “We’re going to protect our economic recovery if we do this. We’re going to keep our school and businesses open if we do this.” (BBG)

CORONAVIRUS: Most Americans should be given the Pfizer or Moderna vaccines instead of the Johnson & Johnson shot that can cause rare but serious blood clots, U.S. health officials said Thursday. The strange clotting problem has caused nine confirmed deaths after J&J vaccinations — while the Pfizer and Moderna vaccines don’t come with that risk and also appear more effective, said advisers to the Centers for Disease Control and Prevention. The panel recommended the unusual move of giving preference to the Pfizer and Moderna vaccines, and late Thursday the CDC’s director, Dr. Rochelle Walensky, accepted the panel’s advice. (AP)

OTHER

GEOPOLITICS: The Biden administration is pushing European Union allies to finalize a broad package of sanctions against Russian banks and energy companies that could be imposed jointly with the U.S. if the Kremlin attacked Ukraine, according to people familiar with the discussions. Adding to the urgency is the fact that Vladimir Putin has shown no sign of pulling back the thousands of troops he’s amassed near his neighbor’s borders. The U.S. believes agreeing on specific sanctions options would send a firm signal to the Russian president. It’s been more than a week since he and Joe Biden discussed the crisis. These are the measures under consideration, according to people familiar with discussions. They are based on multiple conversations that have taken place between the U.S., U.K., Germany, France and Italy, as well as with the EU. (BBG)

GEOPOLITICS: The Kremlin said Thursday that Russia submitted draft documents outlining security arrangements it wants to negotiate with the United States and its NATO allies amid spiraling tensions over Ukraine. Kremlin spokesman Dmitry Peskov said a senior Russian envoy stood ready to immediately depart for talks in a neutral country on the proposal. Peskov told reporters that Russian President Vladimir Putin may have another call with U.S. President Joe Biden before the year's end to discuss the security issue, but he said it hasn't been agreed to yet. (AP)

U.S./CHINA: The Biden administration said Thursday it imposed trade restrictions on more than 30 Chinese research institutes and entities over human rights violations and the alleged development of technologies, such as brain-control weapons, that undermine U.S. national security. The Commerce Department accused China’s Academy of Military Medical Sciences and 11 of its research institutes of using biotechnology “to support Chinese military end uses and end users, to include purported brain-control weaponry,” according to a notice in the Federal Register. The notice does not elaborate further on the alleged brain-control weaponry. (CNBC)

U.S./CHINA: Senators gave final congressional approval Thursday to a bill barring imports from China’s Xinjiang region unless businesses can prove they were produced without forced labor, overcoming initial hesitation from the White House and what supporters said was opposition from corporations. The Senate vote sends the bill to President Joe Biden. Press secretary Jen Psaki said this week that Biden supported the measure, after months of the White House declining to take a public stand on an earlier version of the legislation. (AP)

JAPAN: The Japanese government is making preparations for an initial fiscal 2022 general account budget in the high 107t yen range, NHK reports, citing an unidentified person. (BBG)

JAPAN: The Japanese government has decided to keep government bond issuance in the 30t yen range for fiscal 2022 budget, down from this year’s initial plan of ~43.6t yen, the Sankei newspaper reports, without attribution. (BBG)

JAPAN: Japan's defense expenditures for the next fiscal year are expected to grow for the 10th consecutive year to a record high. The Defense Ministry has been arranging with the Finance Ministry for a budget of more than 5.4 trillion yen, or roughly 48 billion dollars, for fiscal 2022, starting in April. The final decision will be made later this month. (NHK)

AUSTRALIA: Australian authorities on Friday rushed to track down hundreds who attended a Taylor Swift album party in Sydney last week that has become a super-spreading event as cases in the country hit a new pandemic high for the second straight day. COVID-19 infections, including the new, more transmissible Omicron variant, have been spreading in pubs and nightclubs as social distancing curbs ease after higher vaccination levels. Despite the surge in cases, Prime Minister Scott Morrison said Australia had entered "a different phase of the pandemic" and ruled out lockdowns to contain the spread of the virus. "Case numbers are no longer the metric ... the real measure is what does it mean for serious illness, (intensive care), hospitalisation, pressures on the hospital system," Morrison said during a media briefing on Friday. (RTRS)

AUSTRALIA: WA has tightened its border restrictions with Queensland and Tasmania right before Christmas, as COVID-19 cases in the eastern states continue to grow. It will reintroduce its hard border with Queensland – where 16 local cases were recorded today – from 12.01am on Monday. (AFR)

AUSTRALIA/CHINA: Australian Treasurer Josh Frydenberg on Friday said Australia had been subject to "economic coercion" by China through various trade disputes, but argued the Asian giant would continue to need its resource exports. Speaking at a Reuters Breakingviews event, Frydenberg said China would find it especially hard to replace Australia's iron ore exports which fuel its massive steel industry. (RTRS)

NEW ZEALAND: New Zealand policy makers are alert to a potential economic hit from the omicron variant of coronavirus, while sticking for now to their plans to progressively relax border restrictions from early 2022. “The large-scale spread of omicron around countries we are seeing at the moment has that potential to ripple through to New Zealand,” Finance Minister Grant Robertson said in a Bloomberg Television interview Friday in Wellington. “While it’s disruptive, and deeply concerning from a health perspective, we remain confident the New Zealand economy will be resilient.” “We will continue to monitor the spread of omicron and its severity as well, but for now we are sticking to the decisions we made,” Robertson said. “We’ve got some reviews in place, one of them in early January, before we begin that process.” (BBG)

SOUTH KOREA: South Korea's domestic demand is feared to lose steam amid the latest upsurge in COVID-19 cases and tighter antivirus measures, the finance ministry said Friday. Amid global inflation risks and supply chain disruptions, Asia's fourth-largest economy faces persisting uncertainty due to the spread of the omicron variant and major economies' move to accelerate monetary policy shifts, the ministry said in its monthly economic assessment report, called the Green Book. "The country's exports remain robust and the job market has extended its recovery, but the latest spike in COVID-19 patients and stricter quarantine measures are feared to affect domestic demand, including in-person service segments," the report showed. (Yonhap)

SOUTH KOREA: South Korea's finance minister said on Friday the government will prepare a new 4.3 trillion won ($3.6 billion) stimulus package to help support small-sized and self-employed businesses hurt by the reimposition of tougher COVID-19 curbs. Of the total package, some 3.2 trillion won would be allocated to provide 1 million won each to 3.2 million small business owners that experienced a decrease in sales. (RTRS)

CANADA: The Omicron variant of COVID-19 is spreading rapidly in Ontario, Canada's most populous province, and could overwhelm intensive care units early next month without prompt intervention, a panel of experts said on Thursday. "This will likely be the hardest wave of the pandemic," said Steini Brown, head of the Ontario COVID-19 Science Advisory Table. The panel released modeling which said increased vaccination alone would not be enough to fight Omicron. Instead, it called for public health measures to cut peoples' contacts by 50% and ensure the rapid roll-out of booster doses. (RTRS)

CANADA: Amid escalating trade tensions with the United States, Prime Minister Justin Trudeau on Thursday directed his Cabinet to address rising fears about President Joe Biden’s America-first policies. The marching orders make it clear Biden’s problematic trade agenda is top of Trudeau’s mind. The new policy priorities were revealed in a fresh set of ministerial mandate letters, which indicate the prime minister wants to lead a team approach to managing the U.S.-Canada relationship. (Politico)

BCB: As Brazil launches a new round of fiscal stimulus, its central bank forecast it will need even higher interest rates to fulfill its pledge to fight inflation with a “significantly restrictive” monetary policy. “Scenarios with higher fiscal risk include a higher neutral interest rate,” Fabio Kanczuk, the central bank’s outgoing economic policy director, said in a news conference after the new estimates were released. “As the central bank changes its opinion on the implicit probability of the alternative scenarios, so does the neutral rate change.” (BBG)

BRAZIL: President Jair Bolsonaro has been warned by close political advisers that further boosting Brazil’s social spending could actually jeopardize his re-election chances next year. The government is always looking for opportunities to expand and strengthen social policies -- including Bolsonaro’s flagship Brazil Aid program that will pay 400 reais ($70.32) a month to some 17 million families -- but that can’t be done without fiscal responsibility, according to Citizenship Minister Joao Roma. “The social and the economic areas are two sides of the same coin,” Roma, who oversees the nation’s social policies, said Tuesday during an interview in his Brasilia office. “Social improvements have to come with fiscal responsibility, otherwise you’ll be giving with one hand and taking away with the other.” (BBG)

PERU: Peru's prime minister Mirtha Vasquez said on Thursday that declaring a state of emergency would be a "last resort" to defuse a road blockade that led miner MMG Ltd to suspend operations at its Las Bambas copper mine for the first time. "We are trying to reach an understanding... but when all dialogue options are exhausted we will probably have to evaluate how we will restore the rule of law," Vasquez said. Under a state of emergency, civil liberties are suspended. (RTRS)

CHINA

PBOC: The PBOC is expected to continue to release low-cost liquidity via RRR cuts and structural monetary tools in the first half of next year, taking the favorable window for marginal monetary easing before the Federal Reserve’s likely interest rate hike starting mid-2022, said the Securities Times in a commentary. The PBOC may take the opportunity to increase total credit growth with liquidity boost and lower lending interest rate, the newspaper said, noting that the benchmark Loan Prime Rate could be announced lower next Monday. Though the divergence of monetary policies between China and the U.S. was made due to changes in domestic economic situations respectively, the spillover effects brought about by the shift of the world’s two largest economies cannot be ignored, the newspaper added. (MNI)

ECONOMY: China has revised down the size of its economy and growth rate for 2020 with Beijing increasingly worried about mounting headwinds and a further slowdown in economic activities. Authorities revised down China’s 2020 gross domestic product (GDP) growth rate to 2.2 per cent year on year, down from 2.3 per cent previously, the National Bureau of Statistics said on Friday. (SCMP)

ECONOMY: China's banking system should further lower businesses' financing costs, strengthening the growth of credit and loans and optimizing the lending structure, PBOC Governor Yi Gang said at a meeting with banking financial institutions on Thursday, according to a statement on its website. The central bank will also step up the "cross-cycle adjustment" efforts and "comprehensively" plan for the economy's transition into next year amid the current slowdown, said Yi. The PBOC will strive to improve financial services for the real economy, Yi said. (MNI)

ECONOMY: China should extend lower mortgage rates to single-home owners, including those who purchased their houses in the last 10 years, so to ease repayment pressure and help boost consumption, said the 21st Century Business Herald in an editorial. Developers should focus on developing long-term rental homes and promote affordable housing construction, so to meet the needs of increasing number of low-income earners and college graduates, the newspaper said. The real estate industry should abandon huge expansion with massive sales targets and turn to meet segmented demand, the newspaper said. (MNI)

OVERNIGHT DATA

NEW ZEALAND DEC ANZ BUSINESS CONFIDENCE -23.2; NOV -16.4

NEW ZEALAND DEC ANZ ACTIVITY OUTLOOK 11.8; NOV 15.0

The December ANZBO showed activity indicators generally slipping further, but they remain at respectable levels. Expected own activity, export intentions, investment intentions, commercial construction intentions, employment intentions, and profit expectations all fall into that bucket. Slipping more markedly are overall business confidence, residential construction intentions, and ease of credit. Inflation expectations are still rising, while cost expectations and pricing intentions bounce about at very high levels. (ANZ)

UK DEC GFK CONSUMER CONFIDENCE -15; MEDIAN -17; NOV -14

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.1707% at 09:44 am local time from the close of 2.1884% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 45 on Thursday vs 46 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3651 FRI VS 6.3637

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3651 on Friday, compared with 6.3637 set on Thursday.

MARKETS

SNAPSHOT: Cautious End To Central Bank Marathon Week

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 558.76 points at 28507.56

- ASX 200 up 8.34 points at 7304

- Shanghai Comp. down 31.452 points at 3643.564

- JGB 10-Yr future down 1 tick at 152.11, yield down 0.1bp at 0.046%

- Aussie 10-Yr future down 1.5 ticks at 98.36, yield up 2bp at 1.586%

- U.S. 10-Yr future +0-00+ at 131-03+, yield up 0.33bp at 1.414%

- WTI crude down $0.75 at $71.63, Gold up $5.43 at $1804.79

- USD/JPY down 10 pips at Y113.57

- EUROPEAN COUNCIL FAIL TO REACH AGREEMENT ON ENERGY CRISIS

- U.S. PUSHES EU TO READY RUSSIA SANCTIONS ON ENERGY AND BANKS (BBG)

- TORIES LOSE SAFE SEAT TO LIBDEMS IN NORTH SHROPSHIRE BY-ELECTION IN BLOW TO PM JOHNSON

- U.S. RATCHETS UP PRESSURE ON CHINA OVER TREATMENT OF UYGHURS

- BOJ LEAVE MAIN MONPOL SETTINGS UNCHANGED, WILL SLOW CORPORATE BOND PURCHASES

BOND SUMMARY: Initial Selling Pressure Peters Out, Risk Aversion Takes Hold

Initial headwinds for core FI dissipated later in the session, giving the space some reprieve. The return of a defensive mood music likely played a role here, as concerns over Omicron, geopolitics and the implications of global monetary policy tightening resurfaced.

- Following an early sell-off to a session low of 130-30+, T-Notes clawed back losses and last trade +0-00+ at 130-03+. Their recovery coincided with a pullback in U.S. e-mini futures, which entered negative territory. Cash Tsy curve flattened at the margin, with yields sitting up to 1.0bp higher. Eurodollars last seen up to half a tick either side of neutral levels. A speech on the economic outlook from Fed's Waller will take focus in the U.S. amid an empty data docket.

- JGB futures sold off as trading re-opened in Tokyo before stabilising into the lunch break. The contract meandered after the BoJ announced their monetary policy decision and last deals at 152.14, 2 ticks above previous settlement. Cash JGB yields are mostly lower, by narrow margins. The BoJ kept their core policy settings unchanged but implemented tweaks to emergency Covid-19 support programmes. The central bank extended the duration of a special aid scheme targeting smaller companies, while pledging to slow down purchases of corporate bonds and commercial paper from Apr '22. Elsewhere, there was little market follow-through from press reports noting that the gov't is preparing to compile a budget in the high Y107tn range (NHK) and is set to keep JGB issuance in the Y30tn range (Sankei).

- Cash ACGB curve reversed some of yesterday's steepening, with yields last seen -0.2bp to +6.2bp across the flattened curve. The initial rise in yields lost steam later in the session, albeit they refused to give away earlier gains. Likewise, light selling pressure hit Aussie bond futures in early Sydney trade, but they stabilised later on. YM last operates -0.5 & XM -3.5, with YMXM +3.5 as we type. Bills trade 1-5 ticks lower through the reds. The AOFM slashed its planned bond issuance for FY2021-22 to A$105bn from their July forecast of A$130bn.

FOREX: Defensive Feel Drives Price Action

Market sentiment soured towards the end of a week which saw a marathon of monetary policy decisions, prompting participants to reflect on the outlook for global policy tightening. Meanwhile, the risks from the rapidly spreading Omicron coronavirus variant and simmering Sino-U.S. tensions sapped appetite for riskier assets.

- The Antipodeans led commodity-tied FX lower amid weakness in crude oil prices. Australia's Covid-19 situation provided a source of concern as NSW daily case count hit an all-time high for the second day in a row. New Zealand's ANZ Business Confidence deteriorated in December, with firms reporting troubles with freight disruptions and finding labour.

- The yen topped the G10 scoreboard as participants flocked into the traditional safe haven currency. USD/JPY extended losses after yesterday's rout, showing little in the way of immediate reaction to the BoJ monetary policy decision. Japanese policymakers kept key parameters unchanged, extended emergency aid for small firms and scaled back support for larger companies.

- Final EZ CPI, German Ifo Survey, UK retail sales & Norwegian unemployment are on today's data docket. Comments are due from Fed's Waller & ECB's Rehn.

FOREX OPTIONS: Expiries for Dec17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1200(E2.4bln), $1.1300(E2.5bln), $1.1340-50(E1.4bln), $1.1380-00(E4.4bln), $1.1415-25(E1.37bln), $1.1450(E2.1bln), $1.1500(E1.2bln)

- USD/JPY: Y113.00($1.8bln), Y113.50-75($3.0bln), Y113.90-05($1.9bln), Y114.50($1.3bln)

- GBP/USD: $1.3200-10(Gbp1.1bln), $1.3250(Gbp1.5bln), $1.3300-20(Gbp1.1bln), $1.3350(Gbp1.1bln)

- EUR/GBP: Gbp0.8400(E2.0bln), Gbp0.8540-50(E1.1bln)

- USD/CAD: C$1.2730-50($1.0bln), C$1.2850($826mln), C$1.2900($785mln)

- USD/CNY: Cny6.3700($675mln), Cny6.4000($1.4bln)

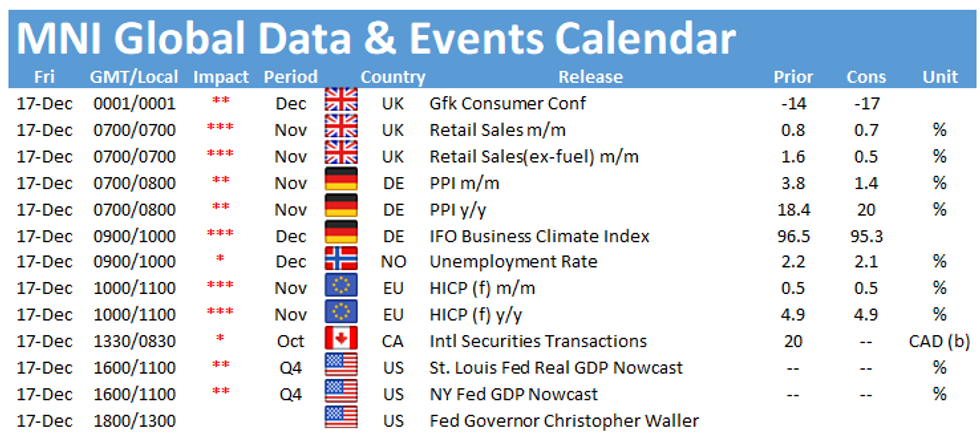

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.