-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Biden-Manchin Call Seemingly A Little More Positive Vs. Weekend Comments

EXECUTIVE SUMMARY

- BIDEN AND MANCHIN SPEAK (POLITICO)

- UK PM JOHNSON 'RESERVES POSSIBILITY' OF FURTHER RESTRICTIONS (SKY)

- ECB'S DE GUINDOS: EUROZONE INFLATION HIKE NOT AS TEMPORARY AS EXPECTED (RTRS)

- ANALYSTS EXPECT FURTHER CHINA LPR CUTS NEXT YEAR (BBG)

- NEW ZEALAND DELAYS PHASED BORDER REOPENING DUE TO OMICRON (BBG)

- ERDOGAN UNVEILS EXTRAORDINARY STEPS TO PROTECT LIRA, SAVINGS (BBG)

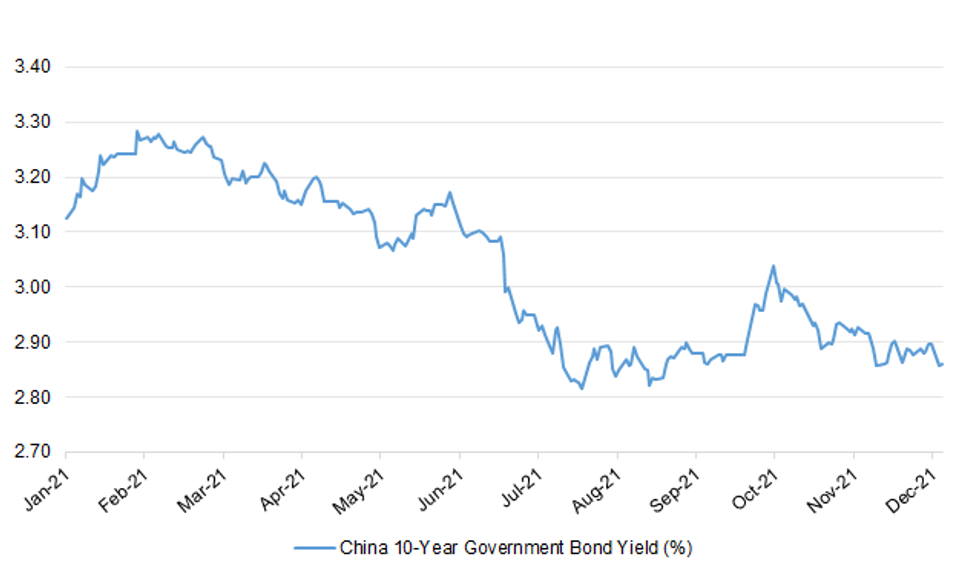

Fig. 1: China 10-Year Government Bond Yield (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Prime Minister Boris Johnson has not announced further restrictions today - but said he is following the data "hour by hour" and warned the rules could still be tightened in the days to come. The PM said the data is "under constant review", with the situation "extremely difficult" and the "arguments either way are very, very finely balanced" as Omicron cases surge across the country, with hospital admissions spiking in London. After a lengthy unscheduled cabinet meeting, Mr Johnson said: "Unfortunately, we will have to reserve the possibility of taking further action to protect the public, public health and our NHS." He added that ministers are not imposing any further restrictions yet but are looking at "all kinds of things to keep Omicron under control and we will rule nothing out". (Sky)

CORONAVIRUS: Boris Johnson on Monday faced a wave of cabinet opposition to new Covid-19 restrictions in England, forcing him to shelve decisions on a potential post-Christmas “circuit breaker” until ministers have seen new data. The UK prime minister said he would not “hesitate” to introduce restrictions if required to combat the spread of Omicron, despite deadlock between ministers on whether, how and when to act. The cabinet will meet again this week, and further data on the severity of the new variant is expected on Wednesday. One senior government insider said: “We are not planning to introduce new restrictions this side of Christmas.” Rishi Sunak, chancellor of the exchequer, led opposition to new Covid restrictions in England, which could include limits on social mixing and changes to rules for pubs and restaurants, before ministers had the chance to see new data. Sunak is drawing up plans to help the hospitality sector after it suffered a slump in bookings, and is willing to go further if the Covid data support the case for new social restrictions after Christmas. One person briefed on the cabinet said: “Rishi is not saying we can’t have more restrictions, but he said we should wait until we know more about the severity of Omicron before we make decisions which could have multibillion pound consequences.” (FT)

BREXIT: Liz Truss, the UK’s new Brexit negotiator, will be faced with exactly the same dilemma as her predecessor, Lord David Frost: compromise with Brussels or risk a trade war, diplomats in Brussels have said. Several welcomed Prime Minister Boris Johnson’s decision to hand his foreign secretary the role in the hope that she and her team would try to forge a broader, more positive relationship with the EU. But they warned that to achieve success would require a more emollient British approach. “It’s good the Foreign Office is getting involved again,” said one EU diplomat. “Let’s give her the benefit of the doubt but I fear more of the same.” (FT)

BREXIT: Boris Johnson was accused on Monday of “downgrading” Brexit by adding the task of leading the negotiations with the European Union to the Foreign Secretary's workload. (Telegraph)

EUROPE

ECB: Rising inflation in the Eurozone will not be as temporary as initially expected, European Central Bank vice president Luis de Guindos said on Monday. (RTRS)

BELGIUM: Belgium’s defense ministry said it shut down parts of its computer network because attackers triggered the vulnerability in the Log4j software that was disclosed earlier this month. A spokesman told Belgian broadcaster VRT on Monday that the ministry of defense detected the cyberattack last Thursday and isolated the parts of its network that were affected. “All weekend our teams have been mobilized to control the problem, continue our activities and warn our partners,” the spokesman said. (WSJ)

PORTUGAL: Portugal’s government will hold an extraordinary cabinet meeting on Tuesday to discuss new measures to contain the coronavirus pandemic, news agency Lusa reported on Monday. The new measures will be presented by Prime Minister Antonio Costa, Lusa said, citing an unidentified government spokesman. The government said in an emailed statement it would hold a cabinet meeting on Tuesday, without specifying the topic of the meeting. (BBG)

SWEDEN: Swedish residential property prices rose 0.3% on the month in November, according to the Nasdaq OMX Valueguard-KTH Housing Index. HOX Sweden index rose 0.5% in the 3 months through November and rose 11.0% y/y. Adjusted for seasonal effects, the index rose 1.0% m/m in November. (BBG)

U.S.

FISCAL: Sen. Joe Manchin III (D-W.Va.) last week made the White House a concrete counteroffer for its spending bill, saying he would accept a $1.8 trillion package that included universal prekindergarten for 10 years, an expansion of Obamacare, and hundreds of billions of dollars to combat climate change, three people familiar with the matter said. But Manchin's counteroffer excluded an extension of the expanded Child Tax Credit the administration has seen as a cornerstone of President Biden's economic legacy, the people said, an omission difficult for the White House to accept in the high-stakes negotiations. The people spoke on the condition of anonymity to discuss the closed-door deliberations. Manchin's private proposal to the White House — the details of which have not been previously reported — was made just days before a spectacular public collapse in negotiations between the White House and the West Virginia senator, marked by bitter and personal recriminations that left the status of the talks unclear. (Washington Post)

FISCAL: Sen. Joe Manchin (D-W.Va.) and President Joe Biden spoke Sunday night after a major blowup in negotiations around the president’s domestic agenda, three people familiar with the call told POLITICO. The conversation ended with a sense that negotiations would, in fact, resume around the Build Back Better Act in some form in the new year. The tone of conversation was cordial and it was agreed that they would speak again on legislative priorities. (POLITICO)

FISCAL: President Joe Biden hasn’t given up on his roughly $2 trillion Build Back Better economic plan after Senator Joe Manchin rejected it on Sunday, and will continue pushing the West Virginia Democrat, his press secretary said. “He’s no stranger to legislative challenges, so we’re going to continue to take steps, work like hell to get it done,” Press Secretary Jen Psaki told reporters in a briefing on Monday. Manchin dealt the president’s domestic agenda a blow over the weekend when he announced on Fox News Sunday that he wouldn’t support Build Back Better, squashing hopes for the president’s effort to address climate change, child care, health-care costs and other priorities. (BBG)

FISCAL: House Speaker Nancy Pelosi projected confidence Monday, vowing Democrats will not give up on passing the Build Back Better Act, despite Sen. Joe Manchin saying he will not vote for the package in its current form. At a news conference in San Francisco, the Democrat from California said she believes that Manchin will come around so Democrats can take up the legislation that would enhance the social safety net as well as fight the climate crisis. "We will not let this opportunity pass," Pelosi said. "And we will make that case and I have confidence that Senator Manchin cares about our country and that at some point, very soon, we can take up the legislation. I'm not deterred at all." (CNN)

CORONAVIRUS: Omicron has raced ahead of other variants and is now the dominant version of the coronavirus in the U.S., accounting for 73% of new infections last week, federal health officials said Monday. The Centers for Disease Control and Prevention numbers showed nearly a six-fold increase in omicron’s share of infections in only one week. In much of the country, it’s even higher. Omicron is responsible for an estimated 90% or more of new infections in the New York area, the Southeast, the industrial Midwest and the Pacific Northwest. The national rate suggests that more than 650,000 omicron infections occurred in the U.S. last week. (AP)

CORONAVIRUS: U.S. President Biden to speak about status of COVID-19 fight at 2:30pm Tuesday. (BBG)

CORONAVIRUS: U.S. President Biden tweeted the following on Monday: “Folks, Omicron cases are on the rise in the United States. I want to give you all a sense of where we are and what we know.

- We know that vaccines are working. If you are boosted with Pfizer or Moderna, you have a high degree of protection against severe illness with Omicron. If you’re an adult choosing to be unvaccinated, you will face an extremely difficult winter for your family and community.

- Omicron cases will increase in the coming days—even among fully vaccinated individuals. If you’re vaccinated and boosted, you may still get a breakthrough case but doctors say you will likely have no symptoms or mild ones.

- We still need to take precautions and remain vigilant. Listen to the advice from doctors: even if you’re fully vaccinated, you should wear a mask when indoors in a public setting. It will help protect you and others—especially kids under 5 who can’t get vaccinated yet.

- To our frontline workers, I am in awe of your sacrifices. Thank you for the work you are putting in on this wave after a painful and difficult two years. We owe you a tremendous debt. I am once again asking for your strength, and I’ll never forget it.

- We are working around the clock to increase testing capacity, vaccine availability, and support for our hospitals. I'll have more to say on this tomorrow. In the meantime: Get vaccinated, get boosted, wear a mask. And keep the faith. We’ll get through this together.” (MNI)

CORONAVIRUS: White House press secretary Jen Psaki said that President Biden's planned Tuesday address is 'not a speech about locking the country down,' but will focus on a drive for vaccinations. 'This is not a speech about locking the country down. This is a speech outlining and being direct and clear with the American people about the benefits of being vaccinated, the steps we're going to take to increase access and to increase testing, and the risks posed to being unvaccinated.' 'He'll talk about what to expect as we head into the winter months and detail additional steps that we will be taking,' Psaki said. (Daily Mail)

CORONAVIRUS: D.C. Mayor Bowser (D) declared a state of emergency on Monday and announced a number of new policies aimed at stopping the spread of COVID-19, including the reinstatement of the city's indoor mask mandate and a booster requirement for D.C. government employees. (Axios)

CORONAVIRUS: The Wisconsin Department of Health Services on Monday issued a public health advisory as a surge in Covid-19 infections threatens to overwhelm the state’s health care system. (BBG)

CORONAVIRUS: The Biden administration is pushing back the date by which large businesses must comply with its Covid-19 vaccine mandate as legal uncertainty continues to hang over the requirement. Following a federal appeals court ruling reinstating the administration’s vaccination rules, the Labor Department said Friday night it would give employers until Feb. 9 to comply with the rule’s testing requirements and until Jan. 10 to comply with the rest of it. (WSJ)

CORONAVIRUS: New York City officials defended a move to shut down Covid-19 testing sites right before the omicron surge because of a lack of demand, pledging to ramp up testing again over the coming week. (BBG)

CORONAVIRUS: Just 40% of New Jerseyans eligible for boosters have received the shots, Governor Phil Murphy said. Among 116 Covid-related New Jersey deaths from Nov. 29 through Dec. 5, none was a breakthrough case, he said. While the virus is spreading, boosters are protecting against serious illness, Murphy said at a Trenton news conference on Monday. Plenty of vaccine is available. (BBG)

CORONAVIRUS: Rationing of hospital care is ending in Idaho after conditions improved in the northern part of the state, where anti-vaccination sentiment has been widespread. “While the number of Covid-19 patients remains high and continues to stress healthcare systems, the surge is currently no longer exceeding the healthcare resources available,” according to a statement Monday by the Idaho Department of Health and Welfare. (BBG)

CORONAVIRUS/POLITICS: President Joe Biden tested negative for Covid on Monday, days after he was in close contact with an aide who would eventually test positive for the virus, the White House said. He will be tested again Wednesday, press secretary Jen Psaki said in a release. (CNBC)

OTHER

GLOBAL TRADE: United Microelectronics Corp. told clients it will raise wafer prices by 5% to 10% from March, Taipei-based Economic Daily News reports, citing unidentified customers of co. Co. declines to comment on pricing, but stresses that 2022 sales will outpace the industry’s average growth of 12%. (BBG)

GLOBAL TRADE: Dongxing city in Chinese southern Guangxi province suspends people and goods customs clearance from Dec. 21 due to Covid control requirements, CCTV reports. The city reported one person tested positive for Covid on Dec. 20. (BBG)

CORONAVIRUS: The protection afforded by two doses of the Oxford/AstraZeneca coronavirus shots, including against severe disease, begins to wane three months after the second shot, according to a new study that highlights the importance of booster programmes. Researchers analysed data for 2m people in Scotland and 42m people in Brazil who had received two shots of the vaccine. Their findings were published in a new peer-reviewed paper in The Lancet late on Monday. The Omicron variant was not circulating during the study. (FT)

JAPAN: Japan is considering raising its forecast for fiscal 2022 real gross domestic product (GDP) growth to 3.0% or more after taking into account the impact of a record $317 billion extra budget, the Yomiuri newspaper reported. The projection would be an upgrade from a forecast for 2.2% real GDP growth for the fiscal year starting in April 2022 released at a mid-year review in July. The cabinet was set to approve the new forecast, which comes after parliament on Monday approved the 36 trillion yen ($316.73 billion) extra budget for the current fiscal year, on Thursday, Yomiuri said. (RTRS)

JAPAN: MNI: Japan Govt Ups Overall Econ View As Jobs, Spending Noted

- Japan's government upgraded its main economic assessment for the first time since July 2020 and also upgraded its views on private spending and employment, the Cabinet Office said on Tuesday - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

RBA: MNI BRIEF: RBA Watching Fresh Data For Feb QE Decision

- Fourth quarter inflation data and labour market data for December and January are likely to influence the Reserve Bank of Australia when it next meets in February to review its bond buying program - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA: South Australia has dumped COVID-19 testing on arrival requirements for people travelling from interstate after a blowout in wait times at testing centres. Some people have been forced to wait for up to eight hours to be tested in Adelaide amid rising virus infections. Premier Steven Marshall says people travelling to SA from NSW, Victoria and the ACT will no longer be required to have a swab on arrival unless they have symptoms. (7 News)

NEW ZEALAND: New Zealand is pushing back the phased reopening of its border until the end of February due to the threat of the omicron variant. “Waiting till the end of February will increase New Zealand’s overall protection and slow Omicron’s eventual spread,” Covid-19 Response Minister Chris Hipkins said Tuesday in Wellington. Previously, the government said vaccinated New Zealand citizens could return from Australia without undergoing managed isolation from Jan. 17. “There’s no doubt this is disappointing and will upset many holiday plans, but it’s important to set these changes out clearly today so they can have time to consider those plans,” Hipkins said. (BBG)

CANADA: Quebec is closing schools, gyms and bars and making work-from-home arrangements mandatory to stem a wave of coronavirus infections that has reached record levels. The province recorded 4,571 new infections in 24 hours, far above the levels of last winter, when the provincial government imposed a curfew and closed all restaurants. Nearly 400 people are in the hospital with Covid-19, an increase of 76% in two weeks. (BBG)

TURKEY: President Recep Tayyip Erdogan’s government announced extraordinary measures to bolster the Turkish lira, including the introduction of a new program that will protect savings from fluctuations in the local currency. The government will make up for losses incurred by holders of lira deposits should the lira’s declines against hard currencies exceed interest rates promised by banks, Erdogan said after chairing a cabinet meeting in Ankara. The lira trimmed its drop -- which had extended to as much as 10.6% -- after Erdogan’s announcement and was trading down 5.9% at 17.4240 per dollar at 8:45 p.m. in Istanbul. “From now on, none of our citizens will need to switch their deposits from the Turkish lira to foreign currencies because of their concerns that the exchange rate” fluctuations might wipe out gains from interest payments, Erdogan said. (BBG)

TURKEY: Around $1 billion was sold in markets after Turkish President Tayyip Erdogan unveiled a series of measures to prevent further dollarisation, the head of the Turkish Banks Association (TBB) said on Monday, as the lira mounted a massive turnaround from record lows. (RTRS)

TURKEY: Turkey cancels gasoline and diesel price hikes that were planned to go into effect as of Tuesday, energy market regulator EPDK says in statement. (BBG)

RUSSIA: Nato allies are resigned to the need to negotiate with Russia despite the impossibility of many of Moscow’s demands regarding the US-led alliance in Europe, as pressure mounts to find a diplomatic solution to rising military tension over Ukraine. Western defence officials want to avoid an outright rejection of the Kremlin’s proposals in an attempt to find areas of mutual agreement and calm a situation in which more than 100,000 Russian troops have assembled on Kyiv’s border. Russia laid out its “red lines” to Nato and the US last week, which included forthright demands for the western alliance to deny membership to Ukraine, seek consent from Moscow to deploy troops in former communist countries in Europe and avoid military deployments or exercises close to Russia’s borders. Western officials have in private rejected almost all of the demands as implausible, not credible and in contradiction to post-cold war treaties guaranteeing sovereign states’ rights to choose their defence policies. But they admit that closing the door on Moscow’s initial diplomatic offer could make the situation worse. They think the proposals are a chance for dialogue alongside threats of sanctions should Moscow take steps to endanger Ukraine. (FT)

RUSSIA: White House national security adviser Jake Sullivan encouraged Russia to de-escalate its troop buildup on the border with Ukraine in a phone call with his Russian counterpart on Monday. Sullivan spoke with Yuri Ushakov, Russian President Vladimir Putin’s foreign policy adviser, and “indicated U.S. readiness to engage in diplomacy through multiple channels, including bilateral engagement, the NATO-Russia Council, and the OSCE [Organization for Security and Cooperation in Europe],” according to a White House statement on the phone call. “[Sullivan] made clear that any dialogue must be based on reciprocity and address our concerns about Russia’s actions, and take place in full coordination with our European Allies and partners,” the White House continued. “He also noted that substantive progress can only occur in an environment of de-escalation rather than escalation.” (The Hill)

SOUTH AFRICA: South Africa’s daily coronavirus cases almost halved amid a fourth wave of infections fueled by the omicron variant. The country recorded 8,515 new infections in the past 24 hours, data from the National Institute for Communicable Diseases showed Monday. That’s a 44% drop from a day earlier and the lowest number of daily infections since Dec. 6. (BBG)

MIDDLE EAST: The Saudi-led coalition fighting in Yemen on Monday carried out air strikes on the international airport of the Houthi-controlled Yemeni capital Sanaa after asking civilians to immediately evacuate, state media reported. (RTRS)

CHINA

PBOC: China’s banks are expected to further lower their loan prime rates next year following a cut for the first time in 20 months Monday, according to reports by China Securities Journal and Shanghai Securities News,citing analysts. To stabilize the economy, China is likely to reduce banks’ reserve requirement ratio in the first half of next year or even lower medium-term lending facility rate, and that would mean further downside for LPR, Shanghai Securities News cites Wang Qing, chief analyst at Golden Credit Rating International Co., as saying. His view is shared by other analysts including Lu Zhengwei, a Shanghai-based economist at Industrial Bank, who said further LPR cut is needed to lower enterprises’ fund-raising costs. China Securities Journal carried a similar analysis Tuesday, saying China’s loan prime rates may see a small drop as early as the first quarter, likely following a cut in MLF rate. (BBG)

ECONOMY: There is “little doubt” that China’s economy can grow above 5% in 2022 and gradually return to normal, in line with political targets, Lian Ping, the former chief economist of Bank of Communications and a sometime advisor to the government, wrote on Yicai.com. Housing investments may continue to weigh on the economy, slowing to 4.2% y/y growth as the government maintains its tightening efforts, while spending may gradually recover to the pre-pandemic level given China’s successful anti-pandemic measures and policies stimulating public spending, Lian said. Chinese exports may regain double-digit growth in H2 of 2022 as global logistics improve, said Lian. CPI may average 2.4% next year while slowing commodity prices may push PPI to negative by H2, said Lian. (MNI)

POLICY: After China's year of unprecedented crackdowns, roiling markets and halting deals, bankers and lawyers expect tighter scrutiny to continue in 2022 but say clearer rules will give investors some certainty about the regulatory environment. (RTRS)

PROPERTY: China’s regulators have met with large developers to encourage those in good standing to buy the assets of competitors in financial trouble, as a way to diffuse the risks in the real estate sector hard hit by regulatory tightening, the PBOC-run Financial News reported. The central bank and the banking regulator CBIRC are also asking banks to push for the acquisitions of loans, and not to cut off funding to large developers facing risks and cash crunch, said the newspaper. China recently introduced a series of measures to ease tensions and restore normal real estate sales and financing, said the newspaper. Developers sold CNY47.3 billion bonds in November, up 55.6% from October, while individual mortgages rose for two months, it said. (MNI)

CORONAVIRUS: China’s local Covid-19 outbreak is growing, with the epicenter now in the central city of Xi’An, which had 42 cases on Tuesday, according to the National Health Commission. Only eight cases were found in the eastern coastal province of Zhejiang, which had previously detected over 300 cases. With the winter Olympics about two months away, Beijing has temporarily suspended road passenger transportation to the city for people who traveled from cities or counties with one or more cases within 14 days, a transport ministry official said at a press conference on Monday. (BBG)

OVERNIGHT DATA

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 108.4; PREV 108.0

Consumer confidence increased 0.4% last week as sentiment improved sharply in NSW (+4.5%) and Victoria (+1.1%) despite the rising number of Omicron cases in both states. The much lower hospitalisation rate compared to the Delta wave probably helped. Confidence in Queensland dropped 0.5%, Western Australia saw a drop of 3.7% and confidence in South Australia dropped 3.4%. Though all these states have stronger confidence than two weeks ago. The outlook about personal financial conditions improved, mostly due to a sharp increase in ‘finances compared to a year ago’. Household inflation expectations rose to a recent high of 5.0%. (ANZ)

NEW ZEALAND NOV CREDIT CARD SPENDING +4.5% M/M; DEC +8.4%

NEW ZEALAND NOV CREDIT CARD SPENDING -0.1% Y/Y; DEC -5.6%

SOUTH KOREA NOV PPI +9.6% Y/Y; OCT +9.1%

SOUTH KOREA DEC FIRST 20 DAYS EXPORTS +20.0% Y/Y

SOUTH KOREA DEC FIRST 20 DAYS IMPORTS +42.1% Y/Y

UK DEC LLOYDS BUSINESS BAROMETER +40; NOV +40

CHINA MARKETS

PBOC INJECTS NET CNY10 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos and CNY10 billion via 14-day reverse repo with the rate unchanged at 2.2% and 2.35% respectively on Tuesday. This operation has injected net CNY10 billion after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to maintain the liquidity stable towards year end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1864% at 09:35 am local time from the close of 2.1025% on Monday.

- The CFETS-NEX money-market sentiment index closed at 49 on Monday vs 43 on Friday.

CHINA SETS YUAN CENTRAL PARITY AT 6.3729 TUES VS 6.3933 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3729 on Tuesday, compared with 6.3933 set on Monday.

MARKETS

SNAPSHOT: Biden-Manchin Call Seemingly A Little More +ve Vs. Weekend Comments

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 579.78 points at 28517.59

- ASX 200 up 62.84 points at 7355

- Shanghai Comp. up 23.731 points at 3617.333

- JGB 10-Yr future down 16 ticks at 152.08, yield up 1bp at 0.051%

- Aussie 10-Yr future down 6.0 ticks at 98.345, yield up 5.9bp at 1.599%

- U.S. 10-Yr future down -0-02+ at 131-02+, yield up 0.68bp at 1.4293%

- WTI crude up $0.90 at $69.50, Gold up $1.24 at $1792.18

- USD/JPY up 13 pips at Y113.74

- BIDEN AND MANCHIN SPEAK (POLITICO)

- UK PM JOHNSON 'RESERVES POSSIBILITY' OF FURTHER RESTRICTIONS (SKY)

- ECB'S DE GUINDOS: EUROZONE INFLATION HIKE NOT AS TEMPORARY AS EXPECTED (RTRS)

- ANALYSTS EXPECT FURTHER CHINA LPR CUTS NEXT YEAR (BBG)

- NEW ZEALAND DELAYS PHASED BORDER REOPENING DUE TO OMICRON (BBG)

- ERDOGAN UNVEILS EXTRAORDINARY STEPS TO PROTECT LIRA, SAVINGS (BBG)

BONDS: Core FI Under Modest Pressure Overnight

An e-mini bid linked to fiscal hope re: U.S. President Biden’s BBG plan (per source reports, pointing to Biden & Senator Manchin conducting discussions on the matter in early ‘22) applied some modest pressure to Tsys overnight, with TYH2 last -0-03 at 131-02, just off the base of the contract’s 0-06 overnight range. Cash Tsys run flat to 0.5bp cheaper across the curve. 20-Year U.S. Tsy supply will provide the focal point of the U.S. docket on Tuesday. Participants also await President Biden’s Tuesday address. White House press secretary Psaki has noted that the speech is 'not about locking the country down,' but it will focus on the vaccination drive.

- A relatively lacklustre morning saw JGB futures edge away from their overnight low, before the broader impetus (which included a ~2% rally in the Nikkei 225) and the Japanese cabinet office’s first upgrade to its main economic assessment since July ’20 applied some pressure during the Tokyo afternoon. Re: the latter, this came after press reports pointed to the potential for a government upgrade re: its FY22 real GDP growth view to 3.0%+ (currently 2.2%), owing to the impact of the well-documented fiscal support package that has been outlined and in recent weeks (formally enacted on Monday). Futures finished -16. Cash JGB trade saw the major benchmarks print little changed to ~1bp cheaper on the day (the 7- to 20-Year zone led the weakness). The latest round of BoJ Rinban operations (covering 1- to 10-Year JGBs) drew offer/cover ratios of 2.7-3.0x times. This didn’t provide any notable impetus for the space

- Aussie bond futures drifted lower in the wake of the release of December’s RBA meeting minutes, with CBA now expecting for the RBA to end its bond purchase scheme in February, as they look for firmer than expected Q4 CPI and labour market data (at least when compared to RBA projections) ahead of the Bank’s February meeting. The uptick in e-minis has also helped apply some pressure to ACGBs. YM -1.0 & XM -6.0 at the bell.

BOJ: BoJ Makes Rinban Purchase Offers

The BoJ offers to buy a total of Y1.325tn of JGBs from the market:

- Y450bn worth of JGBs with 1-3 Years until maturity

- Y450bn worth of JGBs with 3-5 Years until maturity

- Y425bn worth of JGBs with 5-10 Years until maturity

EQUITIES: Equities Off To A Better Start On Tuesday

Risk appetite rebounded a little during Asia-Pac trade, with suggestion’s that President Biden’s BBB plan may not be dead and supportive Chinese policy re: property builders generating most of the attention. The Nikkei 225 led the way higher when it came to the major regional indices, adding ~2% (unwinding yesterday’s underperformance), while e-minis added 0.6-1.0%, with the NASDAQ 100 outperforming.

GOLD: Back Below $1,800/oz

Our weighted U.S. real yield monitor unwound the pressure witnessed during the early part of Monday’s session (on hope that U.S. President Biden’s BBB plan may be rekindled in the early part of ’22), which pushed spot gold back below $1,800/oz. Subsequent Asia-Pac trade has been tight, with consolidation around the $1,790/oz mark, leaving well defined technical lines in the sand in play.

OIL: Crude Edges Further Away From Monday’s Trough

E-minis have nudged higher during Asia-Pac hours, supporting crude futures. WTI & Brent have added $0.60-0.70 vs. their respective settlement levels after a volatile Monday session ultimately saw the benchmarks shed ~$2.00, but finish well off their respective session lows. A reminder that Monday saw risk appetite dented by omicron worry (centring on Europe & the UK) and U.S. Senator Manchin putting President Biden’s BBB plan in jeopardy (note that subsequent reports have suggested that Biden & Manchin will pick up discussions re: that matter in the new year, which has supported risk appetite in Asia). The broader risk dynamic dominated on Monday, with idiosyncratic news flow headlined by RTRS sources flagging an uptick in OPEC+ overcompliance when it comes to the group’s production pact, in addition to Libyan supply headaches. The usual round of weekly API crude inventory estimates will cross later on Tuesday.

FOREX: Tight Asia Session For G10 FX

The major USD crosses are essentially unchanged on the day at typing, with a lack of meaningful headline flow apparent since the Asia open. U.S. e-mini futures and crude oil ticked higher, aided by source reports pointing to U.S. President Biden & Senator Manchin restarting BBB plan discussions in the new year (these reports hit during late NY hours).

- CAD saw some marginal outperformance in the G10 FX space on the modest uptick In oil, although USD/CAD is only 15 pips lower on the day at typing.

- A weaker than expected PBoC USD/CNY mid-point fixing provided a negligible, short-lived reaction in USD/CNH, although the move was tiny in the broader scheme of things. USD/CNH sits at unchanged levels at typing.

- AUD looked through the release of the RBA’s December meeting minutes.

- The NZD blipped lower on news that omicron has resulted in a delay to the re-opening of New Zealand’s borders, but the kiwi was ultimately aided by an uptick in e-minis. NZD/USD last trades ~10 pips higher on the day. Note that NZD/USD’s YtD low ($0.6702) remained intact after a test of the level on Monday.

- Canadian retail sales data headlines the broader economic docket on Tuesday. Participants also await U.S. President Biden’s Tuesday address. White House press secretary Psaki has noted that the speech is “not about locking the country down,” but it will focus on the vaccination drive.

FX OPTIONS: Expiries for Dec21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1150(E532mln), $1.1200-20(E676mln), $1.1250-70(E889mln), $1.1275-95(E780mln), $1.1315(E527mln), $1.1350(E742mln), $1.1500(E864mln)

- USD/JPY: Y112.70($562mln)

- USD/CAD: C$1.2800-10($524mln)

- USD/CNY: Cny6.40($650mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/12/2021 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 21/12/2021 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 21/12/2021 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 21/12/2021 | 1330/0830 | * |  | US | Current Account Balance |

| 21/12/2021 | 1330/0830 | ** |  | CA | Retail Trade |

| 21/12/2021 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 21/12/2021 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 21/12/2021 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 21/12/2021 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.