-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Post-FOMC Meeting Minutes Moves Spill Into Asia

EXECUTIVE SUMMARY

- FED DISCUSSED FASTER RATE LIFTOFF ON INFLATION RISK

- BIDEN COULD NAME NEW FED OFFICIALS AS SOON AS THIS WEEK (RTRS SOURCE)

- BCC: U.K. INFLATION CONCERNS HIT THE HIGHEST ON RECORD FOR BUSINESSES (BBG)

- CHINA TO STRENGTHEN AUDITING OF FISCAL SPENDING, FINANCE (XINHUA)

- CHINA ADVISES CITIZENS TO CUT LONG-HAUL TRIPS IN LUNAR NEW YEAR (BBG)

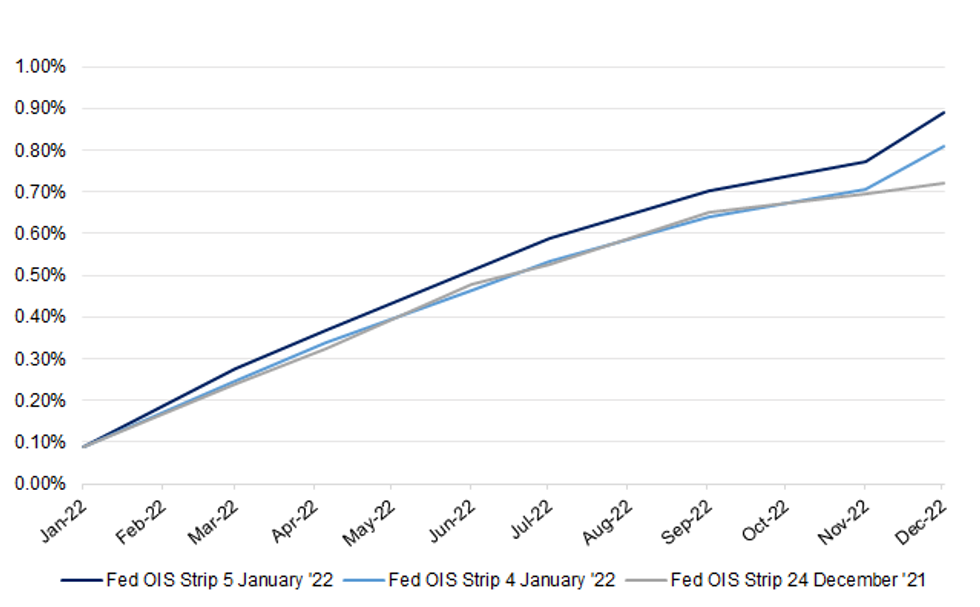

Fig. 1: Fed Meeting Dated OIS Strip Pricing

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

INFLATION: More U.K. businesses than ever before are worried about inflation, and a record number are planning to increase their own prices, according to a survey by the British Chambers of Commerce. The poll of almost 5,500 firms is the latest evidence that a wave of price gains is eating into confidence across the economy. Almost 60% of companies expect to boost prices in the next three months, according to the poll released by the BCC late Wednesday. Two-thirds cited inflation as a concern. The BCC said that indicates inflation, currently above 5%, will climb even further this year. (BBG)

FISCAL: Boris Johnson was urged yesterday to scrap a £12 billion rise in national insurance amid concerns that it cannot be justified when people are struggling with the cost of living. Jacob Rees-Mogg, the leader of the Commons, told the cabinet that the rise should be shelved as inflation and energy bills are rising significantly. He also questioned the productivity of civil servants who are working from home and suggested that significant savings could be made by reducing the number of officials, a source said. The 1.25 per cent rise in April is opposed by many Tory MPs. Rishi Sunak, the chancellor, stopped a major Tory rebellion over it by arguing that the Conservatives should not be adding to the Covid debt. (The Times)

FISCAL/ENERGY: Boris Johnson's government is set to announce new measures to help with rising energy bills within the next month. Ministers across government have now concluded that "something needs to be done" on energy bills ahead of a 1 April rise, although they have not yet determined what form this assistance will take. This means the Treasury has effectively accepted that additional funds will be needed, although they remain reluctant to shell out large amounts of cash on an ongoing basis after massive spending during the pandemic. The prime minister will personally take part in meetings on the energy crisis next week, Sky News has been told. (Sky)

ENERGY: Millions of low-income households could benefit from an increased discount on their energy bills, under plans being examined by the Government. Officials are drawing up options that could see the monetary value or eligibility of an existing support scheme extended to help alleviate a looming cost of living crisis, The Telegraph has learned. (Telegraph)

ECONOMY: The UK car industry says growing demand for electric cars was the only "bright spot" for the sector last year as a string of coronavirus crisis-related challenges combined to knock sales. The Society of Motor Manufacturers and Traders (SMMT) reported a rise of just 1% in overall new car sales during 2021 compared to the previous 12 months. Industry figures released later on Thursday are expected to show that 1.65 million vehicles were registered - up from 1.63 million in 2020 when COVID pandemic disruption first began, shuttering showrooms as drivers were forced to stay at home during lockdowns. (Sky)

EUROPE

FRANCE: A "supersonic" rise in French COVID-19 cases will continue in the coming days, an official said on Wednesday as the government decreed a health state of emergency in Guadeloupe, Guiana, Mayotte, Saint-Martin and Saint-Barthelemy. Government spokesman Gabriel Attal said that infections were reaching "stratospheric levels" in the Ile-de-France region around Paris and some other parts of France, adding that the situation in hospitals could worsen in coming weeks, with no end in sight to rising infections. (RTRS)

ITALY: Italy on Wednesday made COVID-19 vaccination mandatory for people from the age of 50, one of very few European countries to take similar steps, in an attempt to ease pressure on its health service and reduce fatalities. The measure is immediately effective and will run until June 15. (RTRS)

FINLAND: Finland’s Health Ministry may start the school term in remote learning mode after the holiday break, broadcaster YLE reported. (BBG)

U.S.

FED: MNI BRIEF: Fed Discussed Faster Rate Liftoff On Inflation Risk

- Federal Reserve officials agreed to speed up their taper of QE last month because policymakers would like to be ready to raise interest rates three times over the course of 2022, according to minutes from their December meeting - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: U.S. President Joe Biden could announce nominees for three top positions on the Federal Reserve Board as soon as this week, a person familiar with the process said on Wednesday. A final decision has not been made by the president, the source said, and the timing is still being decided. Topping the list of potential candidates for governor roles are Lisa Cook, an economics professor at Michigan State University, who would be the Fed's first Black woman governor; and Philip Jefferson, another Black economist who is vice president for academic affairs and dean of faculty at Davidson College in North Carolina. Former Fed Governor Sarah Bloom Raskin, a Harvard-trained lawyer who served on the Fed Board from 2010 to 2014, is viewed as a leading candidate to become the Fed's vice chair for supervision, the top U.S. banking regulatory role. (RTRS)

FED: Former Federal Reserve Governor Sarah Bloom Raskin is a leading contender to be President Joe Biden’s pick for the top regulatory post at the Fed, according to two people familiar with the matter, a move that would please senators demanding swift action on climate change. Senator Sheldon Whitehouse, who has been active on the climate issue, tweeted that a Raskin nomination as the Fed’s vice chair for supervision would be “good news.” (BBG)

INFLATION: The spread of the highly infectious omicron variant is likely to fuel more inflation, as Americans keep shopping instead of spending more outside of the home, according to the National Retail Federation’s chief economist, Jack Kleinhenz. The major retail trade group’s advisor said Wednesday in a news release, however, that he does not expect the latest wave of Covid cases to prompt an economic slowdown or a shutdown of businesses. (CNBC)

FISCAL: New York Gov. Kathy Hochul on Wednesday proposed a faster phase-in of $1.2 billion in middle-class tax cuts and more tax relief targeting small businesses to help the state’s pandemic-scarred economy. In her first State of the State address, Hochul (D) said a gradual reduction of personal income tax rates should be accelerated to fully take effect in 2023. “That original timeline did not take into account the economic devastation brought on by the pandemic, and the many people who need help now in the face of rising inflation,” according to the governor’s briefing book. (BBG)

CORONAVIRUS: The Centers for Disease Control and Prevention’s independent panel of vaccine experts endorsed Pfizer and BioNTech’s Covid booster shots for children ages 12 to 15 on Wednesday, as kids return to school amid an unprecedented surge of infections across the U.S. The CDC’s Advisory Committee on Immunization Practices, in a 13 to 1 vote, recommended Pfizer boosters for kids 12 to 15 at least five months after their second dose. CDC Director Rochelle Walensky is expected to quickly sign off on the committee’s endorsement, making third shots available to adolescents as soon as this week. (CNBC)

CORONAVIRUS: New York City Health Commissioner Dave Chokshi said Covid data suggests the city hasn’t yet hit a peak in the omicron-fueled spike of coronavirus cases in recent weeks. (BBG)

POLITICS: President Joe Biden will mark the one-year anniversary of the deadly Jan. 6 assault on the U.S. Capitol by Donald Trump's followers with a speech on Thursday warning of the threats to democracy, while Trump abandoned plans for a news conference that day as he reprised his attacks on Democrats and the media. The White House said Biden would push back against Trump's false claims, adopted by many of his followers, that his election defeat was the result of widespread fraud, as well as attempts to downplay the violence of the worst assault on the Capitol since the War of 1812. (RTRS)

POLITICS: U.S. Attorney General Merrick Garland on Wednesday vowed to hold accountable anyone involved in last year's deadly Capitol attack by former President Donald Trump's supporters and said the Justice Department's work on the matter is far from done. In a speech a day before the one-year anniversary of the violence, Garland appeared to address criticism by some Democrats who want his department to act more aggressively against those responsible for the attack on Jan. 6, 2021, that sought to overturn Trump's 2020 election loss. The department has charged more than 725 people with crimes arising from the riot ranging from disorderly conduct to assaulting police to conspiracy. Of those people, about 165 have pleaded guilty and at least 70 have been sentenced. (RTRS)

EQUITIES: The White House said on Wednesday that strong anti-trust laws are good for the technology industry. White House press secretary Jen Psaki told reporters that over the past 10 years the largest tech platforms have been getting an unfair advantage over smaller competitors. (RTRS)

OTHER

GLOBAL TRADE: The rapidly spreading omicron coronavirus variant is increasing worker shortages along the global supply chain but has yet to substantially disrupt port operations, a Biden administration official said Wednesday. "As we stand here today, the ports and the supply chain are operating at record levels," said John Porcari, the port envoy for the White House's supply chain disruptions task force. But Porcari would not say that the worst of pandemic-related supply chain pressures are over. "It's hard to tell if the supply chain pressures have peaked," he said. The cost of shipping a standard container from Asia to the U.S. West Coast decreased 14% from last week to $12,524, down from a delta-variant-fueled peak surpassing $20,000 in September. But the latest figure represents a 218% increase over this time last year, data from online marketplace Freightos shows. (Nikkei)

CORONAVIRUS: A new study raises significant doubts about whether at-home rapid antigen tests can detect the Omicron variant before infected people can transmit the virus to others. The study looks at 30 people from settings including Broadway theaters and offices in New York and San Francisco where some workers were not only being tested daily but were, because of rules at their workplaces, receiving both the antigen tests and a daily test that used the polymerase chain reaction, or PCR, which is believed to be more reliable. (STAT News)

BOJ: MNI BRIEF: BOJ Sees Spending Recovery Confirmed By Data

- Bank of Japan officials judged that the recovery of private consumption is confirmed by hard economic data and they expect the recovery trend to be boosted by pent-up demand, MNI understands - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

NORTH KOREA: North Korea said Thursday that it has successfully conducted a test-firing of what it called a "hypersonic" missile a day earlier, three months after it first showcased the new weapons system. On Wednesday, South Korea's military said the North fired what appeared to be a ballistic missile toward the East Sea from the northern province of Jagang. South Korea's Joint Chiefs of Staff said the new missile appears to be in the early stages of development and would require "considerable time for actual deployment." (Yonhap)

RUSSIA: Secretary of State Antony Blinken said the U.S. is taking steps toward boosting security assistance to help Ukraine counter Russia’s “aggressive” and “destabilizing” actions. “We are actively looking at strengthening even further our security cooperation and security assistance,” Blinken told reporters following a meeting with Thursday with Ukraine president Volodymyr Zelenskiy in Kyiv without offering specific details. Blinken called on Russia to cease its “aggressive” attempts to push more forces to Ukraine’s border. (BBG)

RUSSIA: Secretary of State Antony Blinken on Wednesday said the Russian-owned Nord Stream 2 pipeline meant to bring gas to Germany provides Europe with "leverage" against Moscow's military provocations. The secretary made his remarks standing alongside German Foreign Minister Annalena Baerbock, following a bilateral meeting where Russian threats on Ukraine's border were at the top of the agenda. "This pipeline does not have gas flowing through it at present and if Russia renews its aggression toward Ukraine, it would certainly be difficult to see gas flowing through it in the future," Blinken said. "So some may see Nord Stream Two as leverage that Russia can use against Europe. In fact, it's leverage for Europe to use against Russia." (The Hill)

RUSSIA: Russia wants to see results from high-stakes talks with the U.S. and its allies over security in Europe in as little as a matter of weeks, despite the seemingly wide gap that currently divides the parties, Moscow’s top negotiator said. “The president said the result is needed immediately and that’s not a figure of speech,” Deputy Foreign Minister Sergei Ryabkov said Wednesday in a telephone interview ahead of meetings with the U.S. set for Jan. 9-10 in Geneva. “We can’t even talk about months here, let alone years,” he added, declining to specify a deadline. (BBG)

RUSSIA: The EU’s top diplomat has warned Russia and the US against creating “spheres of influence” in Europe ahead of talks between the two countries next week regarding proposals from Moscow that would reshape the continent’s defence and security architecture. (FT)

RUSSIA: A Russia-led security alliance of ex-Soviet states will send peacekeeping forces to Kazakhstan, Armenia's prime minister said on Thursday, after the Kazakh president appealed for their help in quelling violent and deadly protests. Armenian Prime Minister Nikol Pashinyan said on Facebook that an unspecified number of peacekeepers would go to Kazakhstan for a limited period to stabilise the situation after state buildings were torched and the Almaty international airport was seized. (RTRS)

SOUTH AFRICA: South African excess deaths fell for the first week in three, adding to evidence that the omicron-driven wave of coronavirus infections has been shorter and less severe than those caused by previous variants. (BBG)

MIDDLE EAST: The Saudi-led coalition fighting in Yemen received a distress signal from an oil tanker after it had been subjected to "armed harassment" off Yemen's Hodeidah port, Saudi state TV reported on Wednesday, citing the coalition. (RTRS)

IRAN: The head of Israeli military intelligence told ministers during a Security Cabinet meeting on Sunday that Israel will be better off if the Iran nuclear talks lead to a deal rather than collapsing without one, two Cabinet ministers who attended the meeting tell me. (Axios)

IRAQ: Katyusha rockets hit Iraqi military bases hosting U.S. forces near Baghdad's international airport and west of Baghdad on Wednesday, Iraqi military sources said. Five rockets landed near Iraq's Ain al-Asad air base, which hosts U.S. and other international forces west of Baghdad, leaving no casualties, a coalition official told Reuters on Wednesday. U.S. officials have warned in recent weeks they expected an uptick in attacks against U.S. forces in Iraq and Syria, in part because of the second anniversary of the killing of top Iranian general Qassem Soleimani. (RTRS)

CHINA

YUAN: The Chinese yuan will face depreciation pressure in 2022 if the Federal Reserve hikes rates more than expected, and the U.S. economy recovers, while a likely reduction in export orders as other manufacturing bases recover also weakens yuan, the PBOC-run Financial News said in a commentary. The Fed is expected to hike rates as much as four times, which would push up U.S. Treasury yields and drive capital out of China, the newspaper said. Potential volatilities in the global financial markets due to the Fed’s rate hikes or valuation correction can worsen investors’ outlook, with risks spilling over to China through capital flows from emerging economies and increasing yuan uncertainty, the newspaper said. (MNI)

ECONOMY/INFRASTRUCTURE: China’s growth in 2022 will be driven by accelerated infrastructure investment, technology-focused manufacturing investment, a gradual recovery in consumption and resilient exports, the China Securities Journal reported citing analysts. Traditional infrastructure investment in electricity, transportation, water conservancy and rural revitalization will be the main driver, the newspaper said. Investments in new infrastructure for new energy and information network may reach up to CNY3 trillion this year, the newspaper said citing analysts. (MNI)

FISCAL: China will promptly implement new and greater tax and fee reductions to ensure a stable economic start in Q1, as renewed downward pressure requires greater cross-cycle policies, Xinhua News Agency reported citing Premier Li Keqiang, who spoke in a meeting touting tax and fee cuts. Deduction for R&D expenses and value-added tax rebates should be increased to promote the upgrade of manufacturing enterprises, while targeted measures should be given to the service industries hurt by the pandemic to stabilize employment, Xinhua said. The central government will continue to increase transfer payments to local governments to ensure tax and fee cuts, the newspaper said. (MNI)

FISCAL: China will deepen auditing over fiscal spending, tax and fee cuts and financial support to the real economy, official Xinhua News Agency reports, citing chief auditor Hou Kai as saying at a national conference. Xinhua doesn’t give more details. (BBG)

CORONAVIRUS: Traveling to neighboring regions and surrounding areas should be preferred, while long-distance trips should be reduced during the upcoming Lunar New Year holiday, according to a notice released by the National Development and Reform Commission on preparation work for holiday transportation. This year’s Lunar New Year holiday starts from the end of this month, but holiday transportation rush is expected to run from Jan. 17 through Feb. 25, according to the notice. Notice also urges stronger virus prevention efforts at transportation hubs. (BBG)

CORONAVIRUS: The northwestern Chinese city of Xi’an suspended all international passenger flights from Jan. 5 at its airport until further notice, the official news agency Xinhua said on Thursday. The Xi’an Xianyang International Airport has also halted all domestic passenger flights, Xinhua reported. (RTRS)

CORONAVIRUS: China’s race to develop its own messenger RNA vaccine has gained greater urgency as Beijing struggles to rein in an outbreak of the Omicron coronavirus variant that is threatening its zero-Covid policy. Beijing’s pandemic strategy, in which authorities implement strict lockdown measures on communities with local cases to quash any outbreak, has, according to China’s official statistics, proved effective at preventing the large number of deaths suffered in some western countries. (FT)

OVERNIGHT DATA

CHINA DEC CAIXIN SERVICES PMI 53.1; MEDIAN 51.7; NOV 52.1

CHINA DEC CAIXIN COMPOSITE PMI 53.0; NOV 51.2

The Caixin China General Services Business Activity Index rose to 53.1 in December from 52.1 the previous month, indicating continuous recovery of the services sector. Supply and demand both improved. As new products helped lift the market sentiment, business activity and total new business both expanded for the fourth consecutive month. But surveyed enterprises were concerned about the disruptions caused by scattered Covid-19 flare-ups. Overseas demand was stable with little change in the gauge for new export business from the previous month. The job market for services improved as the measure for employment stayed in expansionary territory for the fourth consecutive month. But employment expanded at a significantly slower pace than business activity and total new business, resulting in an increase in outstanding work at the fastest pace since February 2020. Service costs rose at a slower rate. The measures for input costs and the prices charged by service providers both dropped from the previous month, indicating lower inflationary pressure. But raw material and labor costs were still high as input costs have risen for 18 months in a row. The gauge for input costs was higher than that for prices charged by service providers for the 15th consecutive month, reflecting the pressure on service providers. Businesses were less optimistic due to worries about the pandemic’s fallout. Although the measure for business expectations remained in positive territory, it fell to the lowest since September 2020 and was remarkably lower than the long-term average. (Caixin)

JAPAN DEC, F JIBUN BANK SERVICES PMI 52.1; FLASH 51.1

JAPAN DEC, F JIBUN BANK COMPOSITE PMI 52.5; FLASH 51.8

Japanese service sector businesses signalled a sustained expansion in business conditions at the end of 2021, as activity rose for the third consecutive month. The easing of COVID-19 restrictions allowed customer-facing businesses to operate more freely throughout the final quarter of the year and also led to a further rise in incoming business as client confidence grew throughout December. That said, firms continued to cite shortages in both labour and raw materials, with employment levels dipping further. Moreover, business optimism eased to the lowest since September. Overall private sector activity improved moderately at the end of 2021, following sustained expansions in both manufacturing and services. Private sector firms also commented on a further solid rise in incoming business, the first full quarter of growth reported since 2019 Q3. Cost burdens among Japanese private sector firms continued to intensify at the end of the year, pushing input price inflation to the sharpest in nearly 13-and-a-half years amid sustained material shortages and supply chain delays. Concerns that disruption would extend into the new year were elevated, as business optimism dipped to a four month low. These were exacerbated by the potential impact of new COVID-19variants, such as the Omicron strain. Nonetheless, IHS Markit continues to forecast a modest expansion in Japan, estimating the economy will grow 3.5% in 2022. (IHS Markit)

AUSTRALIA DEC, F MARKIT SERVICES PMI 55.1; FLASH 55.1

AUSTRALIA DEC, F MARKIT COMPOSITE PMI 549; FLASH 54.9

Despite growth momentum easing in the Australia service sector, overall demand continued to improve at a faster rate, which was a positive sign. This signalled that economic conditions remained robust even as concerns over the new COVID-19 Omicron variant emerged. Price pressures meanwhile continued to heighten with input price inflation printing a new survey record while output prices similarly rose rapidly as firms continued to pass these on to consumers. Issues of labour constraints likewise persisted. With the COVID-19 Omicron uncertainties, it will be worth watching if these trends continue. Overall business confidence dropped a notch as Australian service providers expressed some concerns over growth slowing into 2022 and with lingering COVID-19 concerns. IHS Markit forecasts for Australia’s GDP to expand by 2.7% in 2022 following a 4.0% growth in 2021. (IHS Markit)

CHINA MARKETS

PBOC NET DRAINS CNY100BN VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY10 billion via seven-day reverse repos with the rate unchanged at 2.2% on Thursday. This operation has drained net CNY100 billion after offsetting the maturity of CNY110 billion reverse repos, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The seven-day weighted average interbank repo rate for depository institutions rose to 2.1357% at 09:32 am local time from the close of 2.0163% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 39 on Wednesday vs 43 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3728 THURS 6.3779

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3728 on Thursday, compared with 6.3779 set on Wednesday.

MARKETS

SNAPSHOT: Post-FOMC Meeting Minutes Moves Spill Into Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 733.5 points at 28598.66

- ASX 200 down 207.544 points at 7358.3

- Shanghai Comp. down 2.296 points at 3592.88

- JGB 10-Yr future down 23 ticks at 151.19, yield up 2.9bp at 0.115%

- Aussie 10-Yr future down 8 ticks at 98.105, yield up 8bp at 1.865%

- U.S. 10-Yr future -0-06+ at 128-20+, yield up 1.93bp at 1.725%

- WTI crude down $0.85 at $77.01, Gold down $6.86 at $1803.55

- USD/JPY down 26 pips at Y115.85

- FED DISCUSSED FASTER RATE LIFTOFF ON INFLATION RISK

- BIDEN COULD NAME NEW FED OFFICIALS AS SOON AS THIS WEEK (RTRS SOURCE)

- BCC: U.K. INFLATION CONCERNS HIT THE HIGHEST ON RECORD FOR BUSINESSES (BBG)

- CHINA TO STRENGTHEN AUDITING OF FISCAL SPENDING, FINANCE (XINHUA)

- CHINA ADVISES CITIZENS TO CUT LONG-HAUL TRIPS IN LUNAR NEW YEAR (BBG)

BOND SUMMARY: Tsys Drag Core FI Lower As Post-FOMC Mins Move Extends

Tsys extended on their post-Dec FOMC meeting minute weakness during Asia-Pac hours as the curve bear flattened, with the major cash Tsy benchmarks running 1.5-3.0bp cheaper into European hours. All of the major U.S. Tsy yield benchmarks have moved above their respective Wednesday peaks. Headline flow remained light, with regional follow through from the release of the FOMC minutes outweighing early dip buying & support from lower equity markets (with the resumption of the cheapening move in Tsys eventually fuelling further equity weakness). Regional COVID worry failed to facilitate meaningful support (participants are more at ease, given the apparent diminished severity that the Omicron strain offers), while stronger than expected Caixin services PMI data didn’t seem to provide any notable market reaction. On the flow side, a burst of TY screen selling added to the broader weakness, while downside exposure was sought via a block buy of TYG2 128.50 puts (+5K). The ISM services survey tops the NY docket. Thursday’s Fedspeak will consist of addresses from St. Louis Fed President Bullard (’22 voter) & San Francisco Fed President Daly (’24 voter).

- The second burst of Tsy weakness weighed on JGB futures, after the weakness in the Nikkei 225 provided some relief. That allowed the contract to take out its early Tokyo lows, ending the day at worst levels, -30. The major cash JGB benchmarks are flat to ~2bp cheaper at typing, with the 7- to 20-Year zone leading the weakness. Cash 10-Year JGB yields have moved above 0.10%, printing at the highest level since early November in the process (0.121% provides the next point of technical resistance on that front). The BoJ continued to administer JGB repo operations as it looks to manage cash and collateral levels in the system. The latest round of BoJ Rinban operations drew the following offer/cover ratios: 1- to 3-Year: 2.41x (prev. 3.01x), 3- to 5-Year: 3.28x (prev. 2.10x), 10- to 25-Year: 3.19x (prev. 3.27x).

- The Aussie bond space remained happy to track broader gyrations, with a lack of meaningful domestic news flow evident. YM was 5.5 cheaper, with XM 8.0 worse off come the bell. The 7- to 12-Year zone provided the weak point on the cash ACGB curve.

JGBS AUCTION: Japanese MOF sells Y2.8068tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y2.8068tn 6-Month Bills:

- Average Yield -0.1068% (prev. -0.1082%)

- Average Price 100.053 (prev. 100.054)

- High Yield: -0.0987% (prev. -0.1062%)

- Low Price 100.049 (prev. 100.053)

- % Allotted At High Yield: 2.0426% (prev. 6.7449%)

- Bid/Cover: 3.733x (prev. 4.562x)

EQUITIES: Higher U.S. Yields Weigh In Asia

The continuation of the recent uptick in U.S. Tsy yields, with the latest leg stemming from the release of the FOMC’s Dec meeting minutes, weighed on the major regional equities and e-mini futures during Asia-Pac dealing, after Wall St. provided a negative lead.

- Tech names continue to come under pressure, with a higher U.S. real yield environment and the increased regulatory burden for the Chinese tech sphere headlining on that front in recent days.

- Firmer than expected Caixin services PMI data did little to nothing for broader risk appetite, with Chinese government guidance to limit travel over the upcoming lunar new year period garnering more attention.

- It was the ASX 200 that spearheaded losses amongst the major regional equity indices, as it shed ~2.75%. U.S. e-minis sit 0.2-0.6% below settlement levels, with the NASDAQ 100 leading losses there.

OIL: A Touch Weaker

Pressure on the broader equity sphere (in the wake of the release of the FOMC’s Dec meeting minutes) has applied pressure to crude since Wednesday’s settlement, leaving WTI & Brent futures ~$1.00 softer on the day at typing.

- A reminder that firmer than expected U.S. ADP employment data had provided some support for crude in early NY trade on Wednesday, while the latest round of weekly DoE inventory data failed to meaningfully impact the space. The DoE data was broadly inline with the picture sketched out by the weekly API inventory estimate (drawdown in headline crude stocks, alongside a notable build in distillates & gasoline, with the latter potentially driven by the Omicron effect). Rocket launches on a U.S. military installation in Iraq also provided some support for crude, before the benchmarks pulled away from best levels into yesterday’s settlement in the wake of the aforementioned release of the FOMC’s Dec meeting minutes.

GOLD: Fed Minutes Facilitate Pullback After Test Of Resistance, Tight Asia Trade Observed

Gold has stuck to a narrow range during Asia-Pac hours, with spot hovering just above $1,805/oz, a handful of dollars softer on the day. A reminder that the minutes from the FOMC’s Dec meeting provided a hawkish market reaction (with the potential for a faster rate liftoff and swifter, more aggressive round of balance sheet normalisation at the fore). This supported the DXY and U.S. real yields, which allowed bullion to fully unwind the gains registered in pre-Fed minute dealing, moving into negative territory come the bell. Familiar technical parameters remain in play after the early Wednesday rally failed to break key near-term resistance ($1,831.9/oz).

FOREX: Market Sentiment Sours As FOMC Minutes Send Reverberations Through Asia

Risk appetite turned sour as the Asia-Pacific woke up to the relatively hawkish FOMC minutes released Wednesday, which fuelled expectations of an earlier, faster policy tightening by the Fed. The defensive feel was reflected in price action across G10 FX space.

- Risk aversion was a boon for the yen which topped the G10 pile. USD/JPY moved away from a cycle high printed on Tuesday. Reports suggesting that the BoJ might raise their FY2022 inflation outlook at their monetary policy meeting this month were doing the rounds, while BBG noted that policymakers could debate ditching the view that price risks are skewed downward.

- The Antipodeans led commodity-tied currencies lower, with both AUD/USD and NZD/USD printing two-week lows. Weaker oil prices added pressure to the space.

- China's services sector unexpectedly expanded at a faster pace in December, according to the latest Caixin PMI report, but the yuan was unfazed. Broader USD strength drove spot USD/CNH above its 50-DMA.

- On the data front, focus turns to German factory orders as well as U.S. ISM Services, trade balance & weekly jobless claims. Speeches are due from Fed's Bullard & Daly.

FOREX OPTIONS: Expiries for Jan06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1210-25(E2.1bln), $1.1265-75(E1.9bln), $1.1300(E1.4bln), $1.1330-50(E1.0bln), $1.1425(E598mln)

- USD/JPY: Y113.45-55($1.8bln), Y114.75-00($1.3bln), Y115.50-65($1.1bln)

- AUD/USD: $0.7200-20(A$639mln)

- USD/CAD: C$1.2780-90($796mln)

- USD/CNY: Cny6.40($651mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/01/2022 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 06/01/2022 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/01/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 06/01/2022 | 1000/1100 | ** |  | EU | PPI |

| 06/01/2022 | 1300/1400 | *** |  | DE | HICP (p) |

| 06/01/2022 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 06/01/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 06/01/2022 | 1330/0830 | ** |  | US | Trade Balance |

| 06/01/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 06/01/2022 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 06/01/2022 | 1500/1000 | ** |  | US | Factory New Orders |

| 06/01/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 06/01/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 06/01/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 06/01/2022 | 1630/1130 |  | US | San Francisco Fed's Mary Daly | |

| 06/01/2022 | 1815/1315 |  | US | St. Louis Fed's James Bullard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.