-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: DXY Through Support, Even With Fedspeak Turning More Hawkish

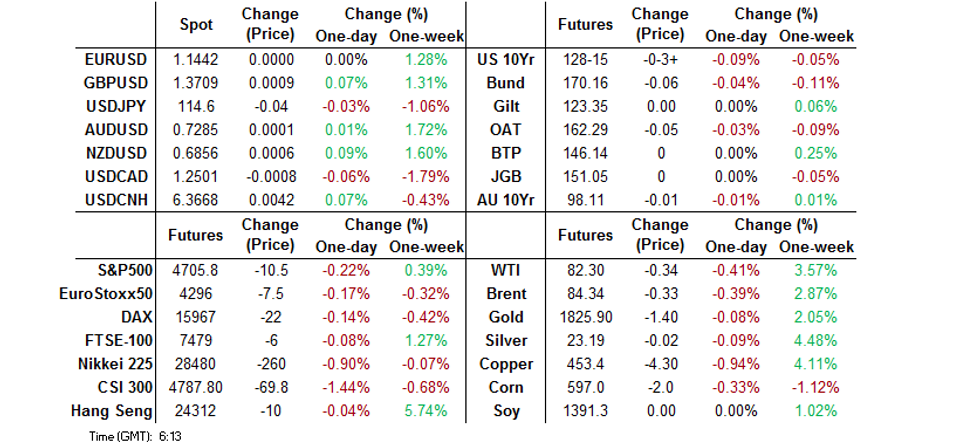

- Hawkish Fed utterances continued to file in overnight, with support for a March rate hike growing.

- Markets were generally limited, with the DXY consolidating below broken uptrend support.

- U.S. PPI and weekly jobless claims headline today's global data docket. Elsewhere, comments are due from Fed's Brainard, Barkin & Evans, ECB's de Guindos & Elderson, as well as BoE's Mann.

BOND SUMMARY: Core FI Coils In Asia

A lack of meaningful macro headline flow has made for a tight Asia-Pac session when it comes to core FI markets.

- TYH2 looked through Wednesday’s lows as Asia-Pac participants reacted to Wednesday’s hawkish Fedspeak, while Harker (’23 voter) & Daly (’24 voter) joined in during Asia hours, pointing to support for a March rate hike. TYH2 bounced from worst levels, operating at the top of the narrow-0-07 range observed ahead of London hours, last -0-04 at 128-14+. Cash Tsys sit ~1bp richer across the cruve. PPI and weekly jobless claims data headline the NY economic docket on Thursday. Elsewhere, Fedspeak will come from Brainard, Barkin & Evans, while Tsy supply comes in the form of 30-Year paper.

- The lack of domestic headline flow/overt macro market drivers left the cross-market impact from U.S. Tsys in the driving seat during Tokyo dealing. JGB futures were +1 at the bell, unwinding the early weakness, while operating within the confines of the recently observed range. Cash JGBs are little changed to 0.5bp richer across the curve. There wasn’t anything in the way of clear concession built ahead of tomorrow’s 20-Year JGB auction. Elsehwere on the issuance front, Hungary mandated for a potential round of multi-tranche samurai paper, which would include green bonds.

- Aussie bonds stuck to a narrow range given the lack of macro drivers, with YM -1.5 & XM -1.0 come the close.

FOREX: NZD Atop G10 Pile, CNH Slips On Wider Weak Bias In PBOC Fix

Major currency pairs held tight ranges as the dust settled after Wednesday's release of broadly in-line U.S. CPI data. The DXY stabilised after Wednesday's rout, while the NZD narrowly outperformed its G10 peers, with NZD/USD attacking its descending 50-DMA as a result.

- Offshore yuan slipped after the PBOC set their central yuan reference rate 60 pips above sell-side estimate, which represented the largest weak bias in a month. The soft fixing came after market reaction to U.S. CPI prompted spot USD/CNH to extend its uninterrupted pullback from Jan 6 multi-week high towards the CNH6.3600 mark. With many reading the divergence in today's fixing vs. expectations as a sign of the PBOC's discomfort with a stronger redback, the rate ticked away from that round figure, snapping a four-day losing streak.

- U.S. PPI and weekly jobless claims headline today's global data docket. Elsewhere, comments are due from Fed's Barkin & Evans, ECB's de Guindos & Elderson as well as BoE's Mann.

- Worth noting that the Senate Banking Committee will hold Lael Brainard's nomination hearing for Fed Vice Chair today. In her pre-prepared remarks, Brainard said that fighting high inflation will be the Fed's "most important task."

FOREX OPTIONS: Expiries for Jan13 NY cut 1000ET (Source DTCC)

- USD/JPY: Y115.00($612mln), Y115.50($1.07bln), Y116.00($960mln)

- USD/CAD: C$1.2650($531mln)

USD: DXY Through Uptrend Support

Note that the DXY index closed below uptrend support drawn off its May ’21 lows on Wednesday.

- The DXY topped out in late November and has faltered even against the backdrop of the well-documented hawkish Fed re-pricing.

- This would suggest that positioning and the relative impact that Fed expectations have on broader market expectations re: other central banks may be inhibiting the USD at present.

- On the former, cumulative net USD longs remain elevated (based on CFTC CoT data), sitting at levels not witnessed since late ‘18/early ’19, even with cumulative net USD length pulling back since late November (if we exclude the recent peak).

Fig. 1: USD Index (DXY)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

ASIA FX: KRW In Demand With U.S. CPI In Books, CNH Slips After PBOC Fix

The PBOC fix took focus in Asia as the impulse generated by Wednesday's release of the U.S. CPI data, which showed little deviation from expectations, gradually dissipated.

- CNH: Spot USD/CNH edged higher, snapping a four-day losing streak, as the PBOC set their central USD/CNY mid-point 60 pips above average sell-side estimate. The divergence was widest in a month, which some interpreted as a sign of the PBOC's discomfort with redback appreciation. Note that spot USD/CNH retreated towards CNH6.3600 on Wednesday, after the latest U.S. CPI report delivered a blow to the greenback.

- KRW: Spot USD/KRW trimmed losses after a softer re-open, with post-U.S. CPI dynamics in play. Participants were preparing for the next monetary policy decision from the BoK, due to be announced on Friday.

- IDR: Spot USD/IDR wavered within yesterday's range, with matters surrounding Indonesia's policies on key commodity exports dominating the domestic news flow.

- MYR: Spot USD/MYR recouped some of its initial losses after a failure to penetrate its 200-DMA.

- PHP: Spot USD/PHP moved away from early lows but still operated in negative territory, even as the Philippines raised Covid-19 Alert Level in more areas. Elsewhere, Health Sec Duque said he would recommend keeping the Alert Level in Metro Manila as it is, barring a larger spike in hospitalisations.

- THB: The baht traded on a firmer footing, as Thailand's consumer confidence rose to a 9-month high, bolstered by support measures extended by the government. Elsewhere, PM Prayuth asked ministers to tackle rising consumer good prices, possibly through caps on the prices of certain goods.

EQUITIES: Mixed In Asia

Asia-Pac hours saw a lack of coherence when it came to the direction of travel for the major regional equity indices. The Nikkei 225 fell afoul of Wednesday’s downtick in the USD/JPY FX cross, while Chinese property developers struggled on the back of increasing focus on the bond payment hurdles that some of the major names in the space face during the current week. Elsewhere, the ASX 200 and Hang Seng nudged higher. U.S. e-mini futures were little changed to ~0.2% lower.

GOLD: Gold Flat In Asia

Spot gold operates within the confines of the recently observed range, dealing just above $1,825/oz, with familiar technical parameters in play. The pullback in the USD has supported bullion over the last 24 hours or so, with hawkish Fed rhetoric offering little impetus for participants.

OIL: Holding Onto Most Of Wednesday’s Gains

WTI & Brent crude futures sit ~$0.15 below Wednesday’ settlement levels, with yesterday’s closing levels representing the highest levels observed since early November. Recent sessions have seen crude latch onto support from reduced Omicron worry, questions re: the ability of OPEC+ to meet heightened production quotas (without tweaking the county by country splits observed within the group’s production pact) and shrinking U.S. crude inventories.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/01/2022 | 0101/0101 | ** |  | UK | IHS Markit/REC Jobs Report |

| 13/01/2022 | 0845/0845 |  | UK | BOE Mann at EIB Conference | |

| 13/01/2022 | 0900/1000 | * |  | IT | industrial orders |

| 13/01/2022 | 1030/1130 |  | EU | ECB de Guindos at UBS Q&A | |

| 13/01/2022 | 1300/0800 |  | US | Philadelphia Fed's Patrick Harker | |

| 13/01/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 13/01/2022 | 1330/0830 | *** |  | US | PPI |

| 13/01/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 13/01/2022 | 1430/1530 |  | EU | ECB Elderson at Climate Change Seminar | |

| 13/01/2022 | 1500/1000 |  | US | Fed Brainard's Senate Nomination Hearing | |

| 13/01/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 13/01/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 13/01/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 13/01/2022 | 1700/1200 |  | US | Richmond Fed's Tom Barkin | |

| 13/01/2022 | 1800/1300 |  | US | Chicago Fed's Charles Evans | |

| 13/01/2022 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.