-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Hawks Are Circling

EXECUTIVE SUMMARY

- MORE FED MEMBERS EYE FASTER, MORE AGGRESSIVE POLICY TIGHTENING

- BIDEN PICKS RASKIN TO BE FED’S BANK REGULATOR, COOK & JEFFERSON TO BE GOVS

- BOJ DEBATES MESSAGING ON EVENTUAL RATE HIKE AS INFLATION PERKS UP (RTRS)

- BOK DELIVER 25BP RATE HIKE, EXPECT 2022 CPI TO BE ABOVE MID-2%

- RUSSIA SAYS SECURITY TALKS WITH NATO HIT “DEAD END”

- NORTH KOREA FIRES UNIDENTIFIED PROJECTILE EASTWARD (Yonhap)

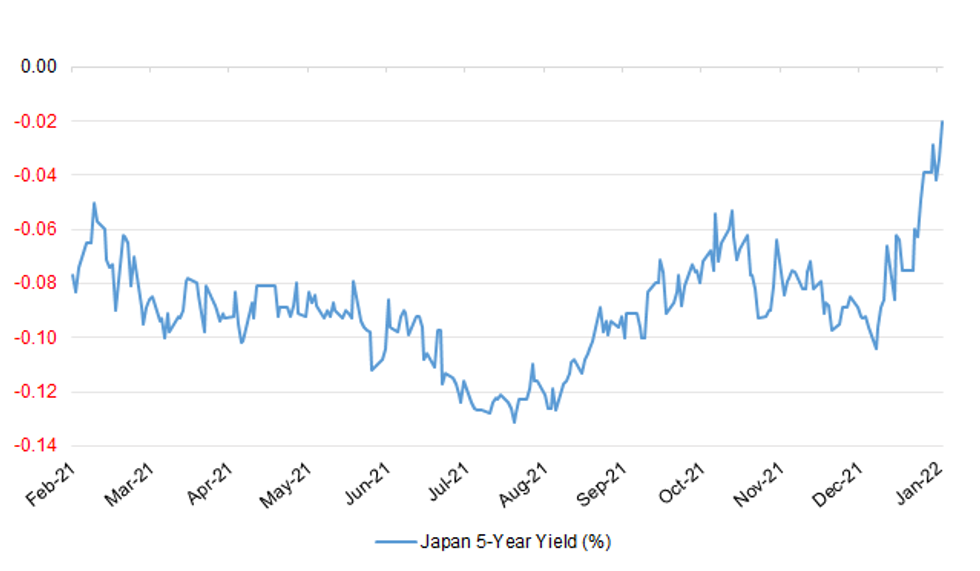

Fig. 1: Japan 5-Year Yield (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Boris Johnson is under intensifying pressure after reports Downing Street staff held two parties the night before the Queen was pictured sitting alone to mourn the death of her husband, Prince Philip. The Daily Telegraph reported that two leaving parties were held in Downing Street for staff on April 16 last year. Downing Street has not denied either event took place. (FT)

POLITICS: The rebellion by Scottish Tories over Boris Johnson’s leadership erupted into open warfare on Thursday after it emerged the prime minister was not expected to speak at the party’s spring conference. The unprecedented absence, confirmed by several sources, came after Jacob Rees-Mogg was bitterly criticised for attacking the character of the Scottish Tory leader, Douglas Ross, on Wednesday night. (Guardian)

CORONAVIRUS: Covid passes are to be abandoned this month after Sajid Javid effectively killed off the policy. The health secretary has concluded that Covid-19 certification is no longer needed as the Omicron wave eases. He told MPs that he shared their “instinctive discomfort” at the policy. With ministers keen to lift guidance on working from home when plan B measures are reviewed on January 26, it is increasingly likely that compulsory masks in enclosed spaces will be the only order remaining next month, if restrictions are not dropped entirely. (The Times)

CORONAVIRUS: The isolation period in England for those who test positive for COVID will be reduced from seven days to five, the health secretary has announced. Revealing the move in a Commons statement, Sajid Javid said data from the UK Health Security Agency shows that "around two-thirds of positive cases are no longer infectious by the end of day five" and "we want to use the testing capacity that we've built up to help these people leave isolation safely". (Sky)

UK/CHINA: An alleged Chinese agent closely linked to a Labour MP has been exposed by MI5, which has issued an alert warning other politicians of her activities. An “interference alert” from the security service names Christine Lee, a solicitor whose firm has donated tens of thousands of pounds to the Labour MP Barry Gardiner. She is judged by MI5 to “be involved in political interference activities” in the UK. (Times)

EUROPE

EU/POLAND: Brussels is poised to withhold more than €100m from Poland to cover unpaid fines imposed by the EU’s top court, the justice commissioner has warned, as he responds to “waves” of problems in the country’s judicial system. Didier Reynders told the Financial Times on Thursday that the commission will shortly send a letter to Warsaw demanding payment of €69m in accumulated daily fines that Poland has racked up between early November and the start of this week. If Warsaw does not comply within a 60-day period the commission will withhold the fines from EU payments due to be disbursed to Poland, with interest payments to be imposed on top, he said. (FT)

EU/RUSSIA: European ministers bemoaned on Thursday a perception that they had been left isolated after Russia held talks with the United States and NATO over the future of the continent and said that Washington had never coordinated as much with the EU as now. Consultations involving U.S. and Russian officials continued in Vienna on Thursday at the 57-nation Organization for Security and Cooperation in Europe after ministerial talks between Moscow and Washington in Geneva on Tuesday and between Russia and NATO in Brussels on Wednesday failed to yield clear progress. (RTRS)

FRANCE: The French government will ask Electricite de France SA to sell more power at a deep discount to protect households from surging wholesale electricity prices, a measure that will cost the state-controlled utility as much as 8.4 billion euros ($9.6 billion). The unprecedented move, announced by Finance Minister Bruno Le Maire in an interview with Le Parisien published Thursday, is the latest decision by President Emmanuel Macron to tackle inflation and gain support of voters ahead of April’s presidential election as an energy crisis threatens to create havoc across Europe. (BBG)

FRANCE/UK: France has lifted most of its restrictions on vaccinated travellers from the UK, which will pave the way for tourists to return starting on Friday. The French prime minister’s office said strict curbs on travel introduced in mid-December were no longer needed since their aim had been to slow the spread of the more transmissible Omicron variant — at the time more prevalent in the UK than France but now dominant in both. (FT)

ITALY: Prime Minister Mario Draghi is seeking new ways to claw back profit from energy companies which have benefitted from surging utility bills, as Rome looks to offset the impact of spiraling power costs on low-income Italians. New measures under discussion are focused on either changing the country’s tax code to target renewable energy producers, or on finding ways to require companies to guarantee lower bills for consumers, people familiar with the matter said. Draghi is personally reviewing the options and a decision could be made in the coming weeks, the people said, asking not to be named discussing confidential plans. (BBG)

NORWAY: The Norwegian government will partly reverse a ban on serving alcohol in bars and restaurants, one of several policy changes as it seeks to relax COVID-19 restrictions, the prime minister said on Thursday. "We can ease some restrictions, but not all," Jonas Gahr Stoere told a news conference. (RTRS)

GREECE: Greece will raise the minimum wage for a second time later this year, Prime Minister Kyriakos Mitsotakis said on Thursday, as rising inflation takes a toll on consumers' income. The government increased monthly gross minimum wage by about 2% at 663 euros from this month. A second raise will be implemented from May 1. (RTRS)

CZECHIA: Czech Prime Minister Petr Fiala's new centre-right government won a confidence vote in parliament on Thursday, sealing its authority as it takes over amid a spike in coronavirus cases, rising inflation, a deep fiscal gap and challenges posed by Europe's green transition. (RTRS)

UKRAINE: Several Ukraine government websites were down Friday, in what the Foreign Ministry said was a cyberattack. The websites of Ukraine’s foreign, agriculture and education ministries were among those that were down, some with their content replaced by messages in Russian, Polish and Ukrainian. (BBG)

U.S.

FED: Federal Reserve governor Lael Brainard, the White House nominee to serve as the central bank’s No. 2 official, told Congress that efforts to reduce inflation are the central bank’s “most important task.” Ms. Brainard, who joined the Fed in 2014, was a forceful advocate last year for ensuring that the central bank didn’t prematurely curtail stimulus as part of a focus on spurring a robust labor-market recovery. (WSJ)

FED: Federal Reserve Governor Christopher Waller said that three interest-rate increases this year was a “good baseline” but there may be fewer or even as many as five moves, depending on inflation. “Three hikes is still a good baseline; we will have to wait and see what inflation looks like in the second half of the year,” Waller said in an interview Thursday on Bloomberg Television with Kathleen Hays. “If it continues to be high, the case will be made for four, maybe five, hikes,” he said, but added that if inflation abated -- as many forecasters including him expect it will -- “then you could actually pause and not even go the full three.” (BBG)

FED: Chicago Federal Reserve Bank President Charles Evans on Thursday said monetary policy as it stands is "not well-positioned" for high inflation and that interest rates need to rise this year. "We need to be adjusting monetary policy to something close to neutral," Evans said at an event hosted by the Milwaukee Business Journal, adding that Fed policymakers "strongly" believe rates will need to rise two, three, or four times this year. (RTRS)

FED: US president Joe Biden has tapped Sarah Bloom Raskin, the former deputy treasury secretary, to be the Federal Reserve’s top banking supervisor, as he moved to complete his roster of appointments to the US central bank. According to a source familiar with the matter, Biden on Thursday night sent Raskin’s nomination as the Fed’s vice-chair for supervision to the Senate, where she will have to be confirmed for the post. Biden has also chosen Lisa Cook, a professor of economics and international relations at Michigan State University, and Philip Jefferson, a professor of economics at Davidson College, to fill two remaining vacancies on the Fed’s board of governors. (FT)

CORONAVIRUS: The Supreme Court on Thursday blocked the Biden administration's COVID-19 vaccine-or-test requirement for large employers, but it will allow a similar mandate to continue for workers at federally funded health care facilities. (Axios)

POLITICS: President Joe Biden’s long-shot bid to get the Senate to change its rules to pass voting rights legislation is headed to almost certain failure after Democrat Kyrsten Sinema said Thursday she continues to oppose the effort. Just before Biden arrived at the Capitol to huddle with all 50 Senate Democrats, the Arizona senator said on the Senate floor that the filibuster, which requires 60 votes for most legislation to advance, protects the country “from wild reversals on federal policy” when control of Congress changes hands. At issue is the fate of two Democrat-drafted voting rights measures that were combined into a single bill passed by the House earlier Thursday. Senate Majority Leader Chuck Schumer has set up the legislation as a test of the Senate rules that give the minority party broad power over what bills can get a vote. “While I continue to support these bills, I will not support separate actions that worsen the underlying disease of division infecting our country,” Sinema said. “The debate over the 60-vote threshold shines a light on our broader challenges.” (BBG)

POLITICS: Majority Leader Charles Schumer (D-N.Y.) announced on Thursday night that the Senate will take up voting rights legislation on Tuesday, missing his self-imposed deadline to hold a vote on changing the filibuster by Monday, Jan. 17. The change in the Senate schedule comes after Sen. Brian Schatz (D-Hawaii) announced he was isolating after testing positive for COVID-19 in a breakthrough case, leaving Democrats one vote short on their ability to start debate on the voting rights bill. Senators are also worried about the potential for another snowstorm in Washington, D.C., on Sunday into Monday. (Hill)

POLITICS: The Senate on Thursday failed to pass a bill sanctioning the Nord Stream 2 pipeline, after the Biden administration aggressively lobbied Democrats to defeat Sen. Ted Cruz's effort to target the Putin-backed project. Why it matters: The 55-44 vote is the culmination of Cruz's months-long push to force Democrats into an uncomfortable vote on Nord Stream 2, which the Ukrainian government has said is "no less an existential threat to our security" than the tens of thousands of Russian troops massing on its border. The bill needed 60 votes to pass. (Axios)

OTHER

NATO/RUSSIA: Poland's foreign minister said on Thursday that Europe was at risk of plunging into war as Russia said it was not yet calling time on diplomacy but that military experts were preparing options in case tensions over Ukraine could not be defused. U.S. Ambassador Michael Carpenter said after talks with Russia in Vienna that the West should prepare for a possible escalation in tensions with Moscow. "The drumbeat of war is sounding loud, and the rhetoric has gotten rather shrill," he told reporters. Russia said dialogue was continuing but was hitting a dead end as it tried to persuade the West to bar Ukraine from joining NATO and roll back decades of alliance expansion in Europe - demands that the United States has called "non-starters". (RTRS)

NATO/RUSSIA: Russia has refused to rule out a military deployment to Cuba and Venezuela if talks with the west on European security and Ukraine fail to go its way, while warning the latest discussions with Nato were hitting a dead end. (Guardian)

NATO/RUSSIA: NATO is ready to negotiate with Russia on not granting Ukraine and Georgia admission to the Western-led bloc, but will not agree to bind this agreement legally, says Ruslan Bortnik, who heads the Ukrainian Institute of Politics, commenting on the Russia-NATO Council meeting in Brussels. (TASS)

U.S./RUSSIA: The U.S. is putting pressure on European allies to agree on potential sanctions against Russia, worried about slow progress despite weeks of talks and heightened concerns that President Vladimir Putin could soon invade Ukraine, said people familiar with discussions that have taken place this week. The Biden administration has also discussed the range of possible actions by Moscow it believes should trigger retaliation, the people said. Aside from sending troops into Ukraine, it could include any effort to engineer a coup against Ukrainian president Volodymyr Zelenskiy or other acts to destabilize his government. (BBG)

BOJ: Bank of Japan policymakers are debating how soon they can start telegraphing an eventual interest rate hike, which could come even before inflation hits the bank's 2% target, sources say, emboldened by broadening price rises and a more hawkish Federal Reserve. While an actual rate hike is hardly imminent and the BOJ is on course to maintain ultra-loose policy at least for the rest of this year, financial markets may be under-estimating its readiness to gradually phase out its once-radical stimulus programme. Notably, the BOJ's carefully worded promises to keep monetary policy accommodative apply only to steadily pumping cash into markets – not to keeping rates at current low levels. (RTRS)

JAPAN: Japan can balance its budget a year earlier than previously forecast, according to the latest highgrowth scenario from the government that assumes a fast economic expansion and continued record tax revenues. The budget balance, excluding debt payments, could be achieved in the year ending March 2027 under a scenario in which real gross domestic product grows around 2% in the medium- and long-term and tax revenues keep topping record levels, the Cabinet Office said Friday. Tax revenues hit a record 60.8 trillion yen ($534 billion) in fiscal 2020 and are projected to keep rising non-stop in the forecast period through fiscal 2031, according to the optimistic scenario. (BBG)

SOUTH KOREA: South Korea plans to propose another extra budget of some 14 trillion won (US$11.8 billion) in a bid to support small merchants as they are suffering COVID-19 caused losses amid extended tighter virus curbs, the country's finance minister said Friday. The country plans to create the extra budget, given that the government is estimated to have an additional 10 trillion won in excess tax revenue last year, according to Finance Minister Hong Nam-ki. The planned budget will be first financed with debt sale, as excess tax revenue can be used only after the government settles last year's state accounts in April. (Yonhap)

NORTH KOREA: North Korea fired an unidentified projectile eastward on Friday, South Korea's military said, the third launch in a little over a week. The Joint Chiefs of Staff (JCS) announced the launch without elaborating further. The North fired what it claims to be hypersonic missiles on Wednesday last week and Tuesday, in an apparent quest for new, advanced weapons amid a deadlock in nuclear talks with the United States. (Yonhap)

NORTH KOREA: North Korea hit back at U.S. sanctions in response to recent hypersonic missile tests that raised new security concerns, vowing a “stronger and certain reaction” to Washington’s attempt to halt its weapons programs. The pursuit of the advanced hypersonic missiles system, which are designed to evade existing defenses, is North Korea’s “legitimate right,” the country’s Foreign Ministry said in a statement. Washington’s move to slap sanctions on North Koreans who advanced its nuclear and ballistic weapons programs was a dangerous escalation, the ministry added in a statement released Friday through the state’s official Korean Central News Agency. (BBG)

HONG KONG: Hong Kong’s ban on evening dine-in services will be extended for two more weeks, through the Lunar New Year holiday, according to a government source. Chief Executive Carrie Lam Cheng Yuet-ngor is expected to announce the extension of the ban and other coronavirus-related social-distancing measures at a press conference on Friday evening, while also fleshing out the details of a fifth round of pandemic relief funding. The extension would put a damper on Hongkongers’ traditional festive dinners out, requiring them to instead celebrate at home until at least the fourth day of the Lunar New Year – one day after the public holiday ends. Large-scale events, such as the Lunar New Year Fair, would also be affected. (SCMP)

TURKEY: Turkey’s newly appointed finance chief said the country’s inflation will peak months earlier and at a level far lower than predicted by top Wall Street banks. After a run on the lira touched off the fastest inflation in nearly two decades, Treasury and Finance Minister Nureddin Nebati laid out an agenda that puts the spotlight on prices and takes some of the political heat off the central bank. Consumer-price growth won’t accelerate after this month -- and should remain largely flat until a seasonal improvement in the cost of food leads to a general slowdown in the summer, Nebati said in an interview Thursday. (BBG)

CHINA

ECONOMY: China’s infrastructure investment may grow 8% this year on strong policy support and early issuances of local government debt, the Shanghai Securities News said citing economist Lian Ping of Zhixin Investment. Many major projects across the country have begun as the central government urged quick use of the funds from CNY1.2 trillion special-purpose bonds issued in Q4, the newspaper said. The year 2022 will be a period of fiscal expansion, with increasing government spending and debt, the newspaper said citing Feng Xiaolin, a researcher at the Development Research Center of the State Council. (MNI)

BONDS: Chinese local governments are facing increased bond repayment pressure amid falling revenues from land sales due to slumping property markets, while implicit debts piled up in recent years threaten their ability to borrow more, Yicai.com reported citing Ma Guangrong, deputy director of Institute of Public Finance and Taxation at the Renmin University. Local governments are highly dependent on selling land to repay special bonds, with the ratio of such income to general budget revenue rising to 74% from 33% between 2008 to 2020, said Ma. During this period, the debt sustainability index measuring legal and implicit debts fell to 60.1 from 87.7, indicating local governments face persistently rising debt risks and pressure to fiscal sustainability, Ma was reported as saying. Local authorities rely on raising debt to pay for public service and infrastructure investment, the newspaper cited Ma as saying. (MNI)

CORONAVIRUS: Volkswagen and Toyota's factories in China’s Tianjin city have been shut since Monday as employees undergo Covid tests amid a new outbreak confronting the port city, the Global Times said. Production lines in other parts of China will try to make up for the potential capacity losses, the newspaper said citing unidentified sources within the industry. Tianjin reported 41 domestically transmitted infections with confirmed symptoms on Wednesday, up from 33 on Tuesday, adding the total to 256 confirmed cases. The outbreak in Tianjin has spread to at least two other cities - Anyang in central Henan province and Dalian, a port city in northeast Liaoning. (MNI)

PROPERTY: Shares of Country Garden Holdings Co. fell a third day after the nation’s largest developer failed to get enough interest for a $300 million convertible bond. The stock is on track for its worst week since October, while a dollar bond due in 2024 is also set for a record low. China Evergrande Group shares gained after it avoided what would have been its first default on a public onshore bond. The stock gained as much as 2.5% following three days of declines. An Evergrande unit said it got investor backing to delay early repayment of a 4.5 billion yuan ($707 million) note. (BBG)

OVERNIGHT DATA

CHINA DEC TRADE BALANCE +$94.46BN; MEDIAN +$73.95BN; NOV +$71.72BN

CHINA DEC EXPORTS +20.9% Y/Y; MEDIAN +20.0%; NOV +22.0%

CHINA DEC IMPORTS +19.5% Y/Y; MEDIAN +27.8%; NOV +31.7%

CHINA DEC TRADE BALANCE +CNY604.68BN; MEDIAN +CNY453.70BN; NOV +CNY460.68BN

CHINA DEC EXPORTS CNY +17.3% Y/Y; MEDIAN +16.3%; NOV +16.6%

CHINA DEC IMPORTS CNY +16.0% Y/Y; MEDIAN +23.6%; NOV +26.0%

JAPAN DEC PPI +8.5% Y/Y; MEDIAN +8.8%; NOV +9.2%

JAPAN DEC PPI -0.2% M/M; MEDIAN +0.3%; NOV +0.7%

AUSTRALIA NOV HOME LOANS VALUE +6.3% M/M; MEDIAN +0.4%; OCT -2.5%

AUSTRALIA OWNER-OCCUPIER LOANS VALUE +7.6% M/M; MEDIAN +3.0%; OCT -4.1%

AUSTRALIA INVESTOR LOAN VALUE +3.8% M/M; MEDIAN +8.0%; OCT +1.1%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.2018% at 09:43 am local time from the close of 2.1913% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 42 on Thursday vs 55 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3677 FRI VS 6.3542

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3677 on Friday, compared with 6.3542 set on Thursday.

MARKETS

SNAPSHOT: Hawks Are Circling

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 399.7 points at 28089.43

- ASX 200 down 80.458 points at 7393.9

- Shanghai Comp. down 18.223 points at 3537.036

- JGB 10-Yr future down 21 ticks at 150.85, yield up 1.9bp at 0.151%

- Aussie 10-Yr future up 1 tick at 98.12, yield down 0.9bp at 1.851%

- U.S. 10-Yr future -0-03 at 128-20, yield up 1.76bp at 1.722%

- WTI crude down $0.18 at $81.94, Gold up $5.27 at $1827.79

- USD/JPY down 48 pips at Y113.72

- MORE FED MEMBERS EYE FASTER, MORE AGGRESSIVE POLICY TIGHTENING

- BIDEN PICKS RASKIN TO BE FED’S BANK REGULATOR, COOK & JEFFERSON TO BE GOVS

- BOJ DEBATES MESSAGING ON EVENTUAL RATE HIKE AS INFLATION PERKS UP (RTRS)

- BOK DELIVER 25BP RATE HIKE, EXPECT 2022 CPI TO BE ABOVE MID-2%

- RUSSIA SAYS SECURITY TALKS WITH NATO HIT “DEAD END”

- NORTH KOREA FIRES UNINDENTIFIED PROJECTILE EASTWARD (Yonhap)

BOND SUMMARY: JGBs Lead Core FI Lower On Talk Of BoJ Considering Rate Hikes Amid Global Tightening

The growing expectation of an earlier/more aggressive policy tightening from the Fed and many of its peers across the globe applied pressure to core FI space, after Thursday saw several voices join the choir of hawkish Fed members. An article suggesting that the BoJ might hike rates before meeting inflation target played into this narrative. So did the BoK's decision to hike their policy rate by 25bp (a non-negligible minority of analysts expected them to stand pat) to the pre-pandemic level of 1.25%, while signalling that they see inflation above mid-2% "for a considerable time."

- T-Notes went offered and extended their pullback from Thursday's high of 128-27 before stabilising in the later part of the Asia-Pac session. TYH2 last changes hands -0-03+ at 128-19+ after bottoming out at 128-17+. Cash U.S. Tsy yields have crept higher, they last sit 1.4-2.1bp higher, as the belly underperforms. Eurodollar futures trade unch. to -3.5 ticks through the reds. Fed's Williams will address the Council on Foreign Relations today, while key data releases include industrial output, retail sales & flash U. of Mich Sentiment.

- Reuters circulated a widely cited source report which added to the general hawkish central bank narrative by noting that BoJ "policymakers are debating how soon they can start telegraphing an eventual interest rate hike, which could come even before inflation hits the bank's 2% target," albeit not imminently. The report knocked JGBs on their head, with futures losing ground in early trade. The contract has edged away from lows after the Tokyo lunch break and now trades at 150.79, 27 ticks shy of last settlement. Cash JGB yields sit higher across the curve, the belly underperforms. The yield on 5-Year Note showed at its highest level since the BoJ adopted their negative interest rate policy in Jan 2016. On the supply front, the lowest bid at today's 20-Year JGB auction topped dealer expectations (which was 90.300 per the BBG dealer poll), which may have provided some incremental relief to the space in the Tokyo afternoon.

- Aussie bonds were driven by offshore impetus, tracking moves in U.S. Tsys & JGBs. Futures have just edged away from session lows but remain below neutral levels (YM -2.5 & XM +0.5). Cash ACGB curve twist flattened a tad, with yields last seen +3.3bp to -1.3bp. Bills run 1-3 ticks lower through the reds. Little to write home about the local headline flow, with ACGBs unfazed by today's offering of ACGB 0.25% 21 Nov '25 and the AOFM's weekly issuance slate.

JGBS AUCTION: Japanese MOF sells Y975.8bn 20-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y975.8bn 20-Year JGBs:

- Average Yield 0.532% (prev. 0.452%)

- Average Price 99.41 (prev. 100.86)

- High Yield: 0.536% (prev. 0.455%)

- Low Price 99.35 (prev. 100.80)

- % Allotted At High Yield: 94.8003% (prev. 73.0359%)

- Bid/Cover: 3.179x (prev. 3.658x)

JGBS AUCTION: Japanese MOF sells Y4.0663tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.0663tn 3-Month Bills:

- Average Yield -0.0970% (prev. -0.1054%)

- Average Price 100.0242 (prev. 100.0260)

- High Yield: -0.0922% (prev. -0.0993%)

- Low Price 100.0230 (prev. 100.0245)

- % Allotted At High Yield: 40.8089% (prev. 56.7007%)

- Bid/Cover: 2.957x (prev. 2.937x)

AUSSIE BONDS: The AOFM sells A$1.0bn of the 0.25% 21 Nov ‘25 Bond, issue #TB161:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 0.25% 21 November 2025 Bond, issue #TB161:

- Average Yield: 1.3250% (prev. 1.3087%)

- High Yield: 1.3275% (prev. 1.3150%)

- Bid/Cover: 5.2800x (prev. 2.4567x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 40.5% (prev. 36.4%)

- Bidders 44 (prev. 41), successful 17 (prev. 28), allocated in full 11 (prev. 23)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Wednesday 19 January it plans to sell A$500mn of the 2.75% 21 June 2035 Bond.

- On Thursday 20 January it plans to sell A$1.0bn of the 22 July 2022 Note.

- On Friday 21 January it plans to sell A$1.5bn of the 3.25% 21 April 2025 Bond.

FOREX: Hawkish Central Bank Musings Spoil Sentiment, BoJ Chatter Supports Yen

The growing prominence of hawkish overtones in recent comments from Fed members continued to undermine appetite for risk assets, with Asia-Pac equity benchmarks taking their cue from Thursday's tech-driven rout on Wall Street. Expectations of global policy tightening were fuelled by a back-to-back rate hike from the BoK, who signalled that their policy rate remains below its neutral (i.e. neither expansionary nor contractionary) level. Elsewhere, Reuters reported that the BoJ are debating how to begin messaging an eventual interest rate hike, which could be delivered before the Bank meets its inflation target (albeit not imminently).

- The yen caught a bid on the back of broader risk aversion and hawkish BoJ musings. This allowed USD/JPY to extend this week's losses past the Y114.00 mark, which provided a layer of support on Thursday. Recall that the BoJ hold a monetary policy meeting next week and may modestly upgrade their FY2022 inflation forecast.

- The Antipodeans landed at the bottom of the G10 pile amid reduced appetite for risk proxies. The USD also traded on a softer footing, but the dollar index (DXY) struggled to break below its 100-DMA. This occurs ahead of a long weekend in the U.S. which may thin out liquidity on Monday.

- Yuan bulls breathed a sigh of relief after the PBOC set their central USD/CNY mid-point just 15 pips above average estimate (as per Bloomberg survey of analysts), a moderation from yesterday's 60-pips bias. A solid round of Chinese data, which showed that monthly trade surplus topped expectations and hit an all-time high, failed to move the redback.

- UK economic activity indicators as well as U.S. industrial output & retail sales take focus from here. The central bank speaker slate features Fed's Williams, ECB's Lagarde & Riksbank's Ingves.

FOREX OPTIONS: Expiries for Jan14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1235-50(E1.2bln), $1.1280-00(E3.9bln), $1.1320(E503mln), $1.1365-75(E1.5bln), $1.1395-05(E1.4bln), $1.1415-25(E2.5bln), $1.1460-70(E1.2bln)

- USD/JPY: Y110.75-00($1.8bln), Y111.80-00($560mln), Y113.35-50($1.6bln), Y113.65-80($1.1bln), Y114.45-55($835mln), Y114.90-10($1.7bln), Y116.00($1.5bln)

- GBP/USD: $1.3385-10(Gbp1.0bln)

- EUR/GBP: Gbp0.8350(E682mln)

- AUD/USD: $0.7125-40(A$1.3bln)

- NZD/USD: $0.6845-50(N$536mln)

- USD/CAD: C$1.2485($1.3bln), C$1.2500-10($2.0bln), C$1.2520-30($1.7bln), C$1.2540-50($929mln)

- USD/CNY: Cny6.35($620mln), Cny6.3750($555mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/01/2022 | 0700/0700 | *** |  | UK | Index of Production |

| 14/01/2022 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 14/01/2022 | 0700/0700 | ** |  | UK | Index of Services |

| 14/01/2022 | 0700/0700 | ** |  | UK | UK monthly GDP |

| 14/01/2022 | 0700/0700 | ** |  | UK | Trade Balance |

| 14/01/2022 | 0745/0845 | *** |  | FR | HICP (f) |

| 14/01/2022 | 0800/0900 | *** |  | ES | HICP (f) |

| 14/01/2022 | 0830/0930 | *** |  | SE | Inflation report |

| 14/01/2022 | 1000/1100 | * |  | EU | trade balance |

| 14/01/2022 | 1315/1415 |  | EU | ECB Lagarde speech at COSAC | |

| 14/01/2022 | 1330/0830 | *** |  | US | Retail Sales |

| 14/01/2022 | 1330/0830 | ** |  | US | import/export price index |

| 14/01/2022 | 1415/0915 | *** |  | US | Industrial Production |

| 14/01/2022 | 1500/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 14/01/2022 | 1500/1000 | * |  | US | business inventories |

| 14/01/2022 | 1500/1000 |  | US | Philadelphia Fed's Patrick Harker | |

| 14/01/2022 | 1600/1100 |  | US | New York Fed's John Williams | |

| 14/01/2022 | 1700/1200 |  | CA | BOC releases climate risk paper |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.