-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Frayed Nerves

EXECUTIVE SUMMARY

- TOP DIPLOMATS FOR U.S., RUSSIA MEET IN GENEVA ON SOARING UKRAINE TENSIONS (RTRS)

- U.S. ALLOWS BALTIC NATO MEMBERS TO SEND ARMS TO UKRAINE (WSJ)

- CHINA SET TO CUT INTEREST RATES ON STANDING LENDING FACILITY LOANS (RTRS)

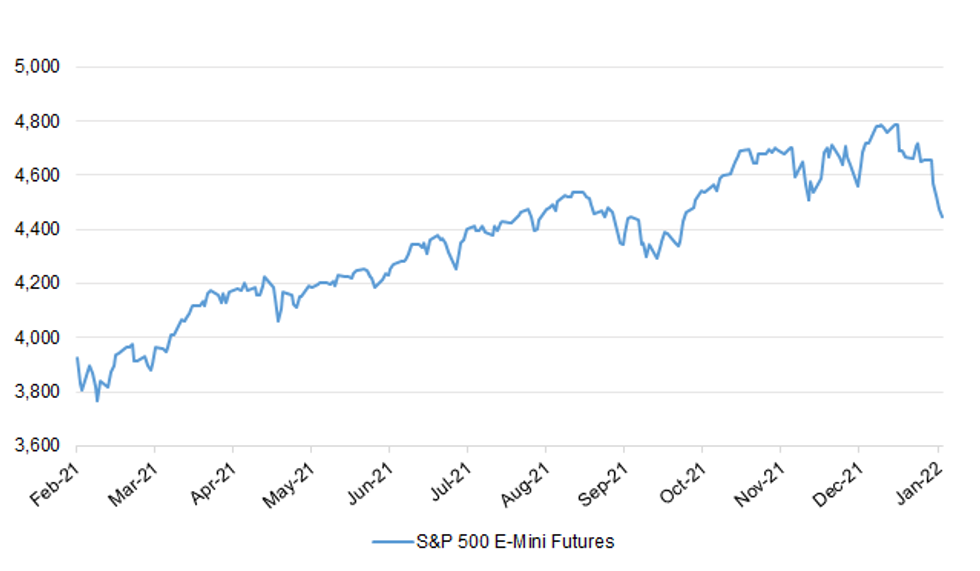

Fig. 1: S&P 500 E-Mini Futures

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Tory whips were accused on Thursday of using dirty tactics to intimidate rebels as Boris Johnson was said to be increasingly convinced he could see off a vote of no confidence. Though allies of Johnson believe a vote is almost inevitable after the inquiry into Downing Street parties is published next week, one cabinet minister said on Thursday there were now significant doubts among the rebels about whether they could defeat the prime minister. The Guardian has been told of at least five MPs who have expressed concerns about the government threatening funding for their constituency or encouraging damaging stories to be published in newspapers. (Guardian)

POLITICS: Mark Spencer, the government's chief whip, is under pressure to justify the tactics employed by his secretive cabal of "enforcers" after William Wragg, a Conservative backbencher, claimed colleagues considering putting in no confidence letters had been "threatened" with funding cuts and briefed against in the press. If it wasn't embarrassing enough that Mr Wragg then invited MPs to report any nefarious behaviour by the whips to the Speaker of the Commons and the commissioner of the Metropolitan Police, Mr Johnson was then forced into a denial of the allegations, saying he had "seen and heard no evidence" to support them. (Telegraph)

POLITICS: Tory MPs who want to oust Boris Johnson are considering publishing a secretly recorded conversation with the chief whip and text messages after they accused the government of blackmail and intimidation. (Independent)

POLITICS: Sue Gray, the civil servant leading the probe into Downing Street parties, has found an email that allegedly confirms concerns were raised over a lockdown garden drinks event at Downing Street before it took place. The message is said to have been sent by a senior Number 10 official after an invitation for “socially distanced drinks” on May 15 2020 was circulated to Downing Street staff. (Telegraph)

POLITICS: Sky News understands there is nervousness in Number 10 over what the top civil servant's report on the Downing Street Parties - which some MPs believe could be published as early as Monday - will reveal. According to sources, some in Downing Street fear the investigation has unearthed damaging evidence and they are now doubtful the report will clear the prime minister. (Sky)

POLITICS: Boris Johnson faces “checkmate” over claims of Downing Street parties, a senior Brexiteer has predicted as the government was accused of trying to blackmail and intimidate rebel MPs. Steve Baker, who played a key role in Theresa May’s downfall, said that allegations against the prime minister were “appalling and the public are rightly furious”. (Times)

POLITICS: UK Foreign Secretary Elizabeth Truss voiced on Friday her full support for embattled Prime Minister Boris Johnson, saying he was doing a fantastic job and there was no contest for the leadership. (RTRS)

EUROPE

EU: The European Union is ripping up the green investing playbook with plans to allow some gas and nuclear projects to be called sustainable. The bloc is poised to include these kinds of power generation with conditions in its rulebook for sustainable activities, or taxonomy. That’s divided the fund community, as some worry their holdings will no longer be in line with the rules, while others think it’s a necessary compromise to transition to a cleaner economy. (BBG)

GERMANY: Germany's new coalition government wants to attract 400,000 qualified workers from abroad each year to tackle both a demographic imbalance and labour shortages in key sectors that risk undermining the recovery from the coronavirus pandemic. "The shortage of skilled workers has become so serious by now that it is dramatically slowing down our economy," Christian Duerr, parliamentary leader of the co-governing Free Democrats (FDP), told business magazine WirtschaftsWoche. (RTRS)

FRANCE: French Prime Minister Jean Castex said Thursday that France will end audience capacity limits for concert halls, sporting matches and other events from February 2, part of a gradual lifting of Covid-19 restrictions made possible by a vaccine pass that will be required for most public areas starting Monday. Face masks will also no longer be required outside from February 2. Castex also justified the easing of restrictions with France's new Covid-19 vaccination pass that will come into effect on Monday, January 24, provided it gets approved by the Constitutional Council. (France24)

FRANCE: The French government is putting itself on a consultancy diet after the sector's involvement in its handling of the COVID crisis caused a public outcry. Public sector minister Amélie de Montchalin on Wednesday announced during a Senate hearing the imminent publication of new rules to regulate the use of outside consultants. The document, signed by the French prime minister and obtained by POLITICO, aims at stopping budgetary slippages by asking ministries to reduce by 15 percent their consultancy budgets for strategic management compared to 2021. It also previews new measures to avoid conflicts of interest, loss of state competencies or risks of data leaks. (Politico)

AUSTRIA: Austria's lower house of parliament passed a bill on Thursday making COVID-19 vaccinations compulsory for adults as of Feb. 1, bringing Austria closer to introducing the first such sweeping coronavirus vaccine mandate in the European Union. (RTRS)

POLAND: The European Commission has sent Poland a letter demanding that it pay €69 million in fines over failure to comply with a court order. A spokesperson for the European Commission confirmed Thursday that a call for payment was sent on Wednesday and that Poland now has 45 days to comply. (Politico)

BELARUS: U.S. prosecutors charged four Belarus officials with airline piracy over the diversion of a Ryanair flight last year that resulted in the arrest of a dissident journalist. Though U.S. authorities acknowledge the incident happened outside their jurisdiction, the presence of four Americans on board the plane made the diversion a violation of a U.S. law prohibiting aircraft piracy, according to the indictment. The law carries a minimum 20-year prison sentence. (BBG)

U.S.

ECONOMY: U.S. Treasury Secretary Janet Yellen said she continues to forecast inflation falling close to 2% by the end of 2022. “I expect inflation throughout much of the year -- 12-month changes -- to remain above 2%,” Yellen said Thursday in an interview with CNBC television. “But if we’re successful in controlling the pandemic I expect inflation to diminish over the course of the year and hopefully to revert to normal levels by the end of the year, around 2%.” (BBG)

ECONOMY: Speaker Nancy Pelosi said the House is close to finishing legislation to bolster U.S. competition with China and aid the U.S. semiconductor industry that can be merged with a similar Senate-passed bill, a crucial step toward eventual passage by Congress. The House’s package is “very close to being ready to go,” Pelosi said Thursday at her weekly press conference. The legislation, which has bipartisan support, is a major priority for the Biden administration, particularly the nearly $52 billion in grants and incentives for the semiconductor industry amid a global chip shortage. But progress has been stalled since the Senate passed its version last June as two House committees approved bills with similar elements but were not packaged together. (BBG)

POLITICS: President Joe Biden ends his first year in the White House with a clear majority of Americans for the first time disapproving of his handling of the presidency in the face of an unrelenting pandemic and roaring inflation, according to a new poll from The Associated Press-NORC Center for Public Affairs Research. More Americans disapprove than approve of how Biden is handling his job as president, 56% to 43%. As of now, just 28% of Americans say they want Biden to run for reelection in 2024, including only 48% of Democrats. (AP)

POLITICS: Biden told Democratic National Committee members during a virtual grassroots event Thursday that Democrats broadly have to offer a clearer contrast with Republicans going forward. He said the contrast he hopes to paint is between Democrats’ agenda and the lack thereof from the Republican Party, which he said was “completely controlled by one man, that’s focused on relitigating the past” — a veiled reference to former President Donald Trump and his continued false claims that he won the 2020 election. “That’s the choice we have to present before voters: Between the plans we have to improve the lives of the American people, and no plan, none at all,” Biden said. (AP)

POLITICS: The Supreme Court on Thursday rebuffed abortion providers’ latest legal maneuver in their challenge to Texas’s 6-week ban, which has sharply reduced abortion access in the state since taking effect nearly five months ago. The order, issued without comment, was unsigned but appeared to divide the court along ideological lines, with the court’s three liberal justices writing in dissent. (Hill)

POLITICS: The House committee investigating the U.S. Capitol insurrection is asking Ivanka Trump, daughter of former President Donald Trump, to voluntarily cooperate as lawmakers make their first public attempt to arrange an interview with a Trump family member. (AP)

POLITICS: Senate Minority Leader Mitch McConnell is backing efforts to rework a law on certifying electoral votes as a bipartisan group of senators considers changes aimed a preventing maneuvers deployed by some Republicans last year to challenge the 2020 election results. McConnell told reporters the process for counting Electoral College votes that certified President Joe Biden’s victory over former President Donald Trump needs changes, giving further weight to the nascent talks to alter the nearly 150-year-old law. (BBG)

EQUITIES: Netflix warned subscriber growth would slow substantially in the first quarter, sending its stock price down by nearly 20 per cent in late trading on Thursday in the latest instance of investors dumping shares in companies that thrived during the pandemic. (FT)

EQUITIES: Peloton stock fell by as much as 25% on Thursday, following a CNBC report that the connected fitness company will temporarily halt production on its bikes and treadmills. Why it matters: Peloton is viewed by many as a proxy for consumer behavior in the pandemic era, as its popularity surged when gyms closed and people wanted to exercise at home. (Axios)

OTHER

GLOBAL TRADE: The Biden administration is monitoring real-time data obtained from businesses operating in China to determine whether outbreaks of the omicron variant of coronavirus pose a risk to U.S. supply chains, an administration official said. It’s too early to tell whether there will be any impact on the American economy from the variant’s spread in China or from aggressive efforts by officials there to stamp it out, the official said. (BBG)

CORONAVIRUS: A small preliminary laboratory study has shown that levels of Omicron-neutralising antibodies of people vaccinated with Russia's Sputnik V vaccine did not decline as much as of those who had Pfizer shots. The joint Russian-Italian study - funded by the Russian Direct Investment Fund, which markets Sputnik V abroad - compared the blood serum of people who had received the different vaccines. (RTRS)

GEOPOLITICS: The top diplomats of Russia and the United States were to meet in Switzerland on Friday to discuss soaring tensions over Ukraine after a flurry of meetings between officials on both sides in the last week produced no breakthroughs. U.S. Secretary of State Antony Blinken arrived in Geneva for talks with Russian Foreign Minister Sergei Lavrov following a swing through Europe to shore up U.S. allies’ commitments to hit Russia with sanctions if it goes ahead with an invasion of Ukraine. (RTRS)

GEOPOLITICS: The U.S. has given approval for three Baltic NATO members to send American made weapons to Ukraine, U.S. officials said. The decision will enable Estonia, Lithuania and Latvia to send Javelin antitank weapons and Stinger air-defense systems for Ukraine's forces. The Biden administration has also notified Congress that it intends to provide Ukraine with five Mi-17 transport helicopters, U.S. officials said. The Russian-made helicopters had been intended for Afghanistan's military and were being repaired in Ukraine. "The United States and its allies and partners are standing together to expedite security assistance to Ukraine," said a State Department spokesman, who declined to discuss details of the shipments from the Baltic states. (BBG)

GEOPOLITICS: The US has alleged that Russian intelligence is recruiting current and former Ukrainian government officials to take over the government in Kyiv and cooperate with a Russian occupying force. The US Treasury on Thursday imposed sanctions on two Ukrainian members of parliament and two former officials it said were involved in the alleged conspiracy, which involved discrediting the current government of the president, Volodymyr Zelenskiy. Online researchers have identified Russian troops and military vehicles within just ten miles of Ukraine’s borders, increasing the risk that Vladimir Putin could launch a military offensive on short notice. (Guardian)

GEOPOLITICS: Both Russia and Ukraine are open to the idea of Turkey playing a role to ease tensions between the two countries, as proposed by Ankara in November, Turkish diplomatic sources said on Thursday. Turkey is also holding talks on hosting the next meeting of the OSCE Minsk Group, at which Ukraine's eastern Donbass region will be discussed, the sources told reporters on condition of anonymity. No date has been set for an Istanbul meeting but representatives from Russia, Ukraine, the OSCE Minsk group and from Donbass were expected to attend, they said, adding the group would meet "frequently". (RTRS)

GEOPOLITICS: China and the US are in talks to prepare for a potential crunch meeting between Chinese top diplomat Yang Jiechi and US national security adviser Jake Sullivan on core national security concerns. But the two sides remain deeply divided on protocol and agenda items, according to sources familiar with the matter. (SCMP)

JAPAN: Japanese Prime Minister Fumio Kishida said the ruling party’s tax committee would continue debating revisions of the capital gains tax, without offering details of the discussions. Kishida was speaking in parliament Friday, answering questions from lawmakers. (BBG)

JAPAN/US: The leaders of the United States and Japan will contend with China's growing might, North Korea's missiles and Russia's aims in Ukraine when they hold their first substantial talks since Fumio Kishida became Japanese prime minister in October. The online meeting between U.S. President Joe Biden and Kishida, scheduled for Friday Washington time, will build on this month's so-called "two-plus-two" discussions when their defense and foreign ministers pledged to work together against efforts to destabilize the Indo-Pacific region. (RTRS)

JAPAN/US: The United States and Japan will initiate a new "2 plus 2" dialogue that will cover economic and diplomatic issues, Kyodo reported, citing a Japan government official. The agreement is expected to be confirmed during the teleconference summit to be held between U.S. President Joe Biden and Japan Prime Minister Fumio Kishida on Friday, the report added. (RTRS)

AUSTRALIA: Covid-19 hospital admissions have eased for two days straight in Australia’s most-populous state, New South Wales, the first time that’s happened in more than a month. The dip in hospitalizations, as well as intensive care admissions, comes as health authorities say the current wave of cases, fueled by the dominant omicron strain, could be nearing its peak in some parts of the country. Still, daily deaths continue to edge higher, with 46 reported in the state on Friday. (BBG)

AUSTRALIA/CHINA: Informal negotiations over Australia’s anti-dumping tariffs on Chinese goods have fallen through, with China on Thursday calling for a World Trade Organization panel to arbitrate the dispute. (SCMP)

AUSTRALIA/UK: Britain’s top foreign and defense officials will meet their Australian counterparts in Sydney on Friday to advance a security pact involving nuclear-powered submarines and share notes on countering China’s growing clout. U.K. Foreign Secretary Elizabeth Truss and Secretary of State for Defense Ben Wallace are meeting Australian Minister for Foreign Affairs Marise Payne and Minister for Defense Peter Dutton for the first time since Canberra signed the deal in September. (BBG)

SOUTH KOREA: A South Korean foreign-exchange panel will discuss ways to “effectively ease” inconveniences pointed out by foreign investors trading the won, said Kim Dong-ick, director of the finance ministry’s international finance bureau. The meeting follows a survey of foreign investors conducted by the finance ministry through November-December to find out issues faced by foreigners in trading won. Global funds pointed out inconveniences and disadvantages in exchanging dollar-won outside local trading hours, according to the survey. A global investor based in the U.K. said it was a problem not being able to trade the won around 4pm London time when fund fixings usually take place as Korean markets are closed around that hour. (BBG)

SOUTH KOREA: The Cabinet on Friday approved a 14 trillion won (US$11.8 billion) extra budget plan aimed at supporting small merchants hit by the pandemic. The proposal passed an extraordinary Cabinet session presided over by Prime Minister Kim Boo-kyum and is expected to be submitted to the National Assembly next Monday for approval. The request includes an additional 3 million won in relief payments for 3.2 million merchants following the extension of the government's antivirus curbs, including a cap on the size of private gatherings and business curfews. (Yonhap)

TAIWAN: The United States is looking for ways to potentially accelerate delivery of Taiwan's next generation of new-build F-16 fighter jets, U.S. officials said, bolstering the Taiwanese air force's ability to respond to what Washington and Taipei see as increasing intimidation by China's military. The officials, speaking on condition of anonymity, said they have not yet come up with a solution on how to speed delivery of Block 70 F-16s, manufactured by Lockheed Martin and equipped with new capabilities. The aircraft are currently slated to be delivered by the end of 2026. (RTRS)

RUSSIA: Russia announced on Thursday its navy wouldstage a sweeping set of exercises involving all its fleets this month and next from the Pacific to the Atlantic, the latest show of strength in a surge of military activity during a standoff with the West. The drills will take place in the seas directly adjacent to Russia and also feature manoeuvres in the Mediterranean, the North Sea, the Sea of Okhotsk, the northeast Atlantic Ocean and the Pacific, it said. (RTRS)

BRAZIL: Candidates expected to run in Brazil’s October presidential election are seeking alliances with centrist parties, likely helping to reduce volatility in the currency market, according to central bank chief Roberto Campos Neto. “We already have a very polarized situation and from what I read the candidates are trying to move to the center,” he said Thursday at a video conference organize by Banco Santander SA, adding that such a move is already having a positive impact on markets. (BBG)

SOUTH AFRICA: The World Bank has approved a loan of $750 million to South Africa linked to COVID-19, aiming to help protect the poor and support economic recovery from the pandemic, the National Treasury said on Friday. (RTRS)

IRAN/OIL: China has offloaded nearly four million barrels of Iranian crude oil into state reserve tanks in the southern port city of Zhanjiang over the past few weeks, a trade source and ship tracking specialist Vortexa Analytics said on Thursday. The move comes as world powers are locked in tough negotiations with Iran to revive a 2015 nuclear deal that will include the lifting of U.S. sanctions on Iranian oil. The former Trump administration pulled out of the deal and re-imposed sanctions. (RTRS)

CHINA

PBOC: China’s central bank will cut interest rates on its standing lending facility loans for all tenors on Friday, three sources with direct knowledge of the matter said, following similar reductions in other liquidity tools. The borrowing cost on overnight, seven-day and one-month loans will be lowered by 10 basis points to 2.95%, 3.10% and 3.45%, respectively, according to the sources. (RTRS)

CORONAVIRUS: China reported on Friday the lowest daily tally of local confirmed COVID-19 cases in nearly two months, after a national strategy to quickly curb flare-ups forced worst-hit cities to lock down affected communities and cut business activity. China reported 23 domestically transmitted infections with confirmed symptoms for Thursday, official data showed, down from 43 a day earlier. This marks the fourth consecutive day of decline in local symptomatic cases, with the lowest daily case load since Nov. 29. (RTRS)

ENERGY: China will encourage the purchase of light, small-sized and low-emission gasoline passenger vehicles while also promoting new-energy-powered automobiles amid the country’s push to reach carbon neutrality, a top central government planning commission said Friday. Beijing will “reasonably guide” consumers to buy those type of gasoline vehicles while “vigorously promoting” new-energy vehicles and gradually eliminating restrictions on NEV purchases, according to guidelines on boosting green consumption issued by the National Development and Reform Commission and other agencies. (BBG)

PROPERTY: A key group of China Evergrande's international creditors said on Thursday they were ready to take "all necessary actions" to defend their rights if the property developer did not show more urgency to resolve a default. Evergrande is the world's most indebted property company, with more than $300 billion in total liabilities, which include nearly $20 billion of international bonds all deemed to be in default after a run of missed payments late last year. The creditor group, represented by law firm Kirkland & Ellis and investment bank Moelis, said in a statement it had to "seriously consider" enforcement action after a lack of engagement by the firm at the heart of China's property crisis. (RTRS)

PROPERTY: China Evergrande Group said on Friday that it was hiring more financial and legal advisers to help it with demands from creditors, after a key group of its international creditors threatened to take legal action if it did not show more urgency. The company said in a stock market statement that it was proposing to engage China International Capital Corp Ltd and BOCI Asia Ltd as financial advisers, and Zhong Lun Law Firm LLP as legal adviser. (RTRS)

OVERNIGHT DATA

CHINA DEC FX NET SETTLEMENT - CLIENTS CNY +CNY329.1BN; NOV +CNY173.9BN

JAPAN DEC CPI +0.8% Y/Y; MEDIAN +0.9%; NOV +0.6%

JAPAN DEC CORE CPI +0.5% Y/Y; MEDIAN +0.6%; NOV +0.5%

JAPAN DEC CORE-CORE CPI -0.7% Y/Y; MEDIAN -0.6%; NOV -0.6%

NEW ZEALAND DEC BUSINESSNZ M’FING PMI 53.7; NOV 51.2

The Performance of Manufacturing Index (PMI) improved in December after underwhelming in November. It lifted to 53.7 from 51.2. This continues the PMI’s recent oscillation around its long-term average, of 53.1, following the heavy knock it took in August last year when it fell to 39.9 (as Delta appeared in the community along with associated restrictions). Production lifted to 56.4 and new orders rose to 57.5, both their strongest readings since July (pre-Delta). Employment rose to 52.0, after a strange-looking drop in November, while stocks bounced from a dip in the previous month. Deliveries of raw materials remains a clear outlier among the sub-components. While this indicator did lift to 50.0 in December from a very weak 43.9 in November, it remains below its long-term average of 52.9. Today’s PMI was generally a bit more upbeat than the NZIER’s latest Quarterly Survey of Business Opinion (QSBO) was for manufacturers regards the likes of activity, employment, and new orders. Some of this may reflect timing. (BNZ)

NEW ZEALAND NOV NET MIGRATION +130; OCT +814

SOUTH KOREA JAN 1-20 EXPORTS +22.0% Y/Y; DEC +20.0%

SOUTH KOREA JAN 1-20 IMPORTS +38.4% Y/Y; DEC +42.1%

UK JAN GFK CONSUMER CONFIDENCE -19; MEDIAN -15; DEC -15

The UK’s financial pulse weakened further this January driven by concerns over personal finances and the general economic situation. All five measures are down in January and the picture on the economy is especially bad with an eight-point decrease in how we see the past year and the year to come. Despite some good news about the easing of Covid restrictions, consumers are clearly bracing themselves for surging inflation, rising fuel bills and the prospect of interest rate rises. The four-point fall in the major purchase index certainly suggests people are ready to tighten their belts. Will the mood brighten when the latest wave of the pandemic subsides and Covid numbers improve? It seems unlikely because it’s the cost-of-living squeeze that’s worrying us now and this will affect us for months to come. (GfK)

CHINA MARKETS

PBOC INJECTS CNY90BN VIA OMOS FRIDAY

The People's Bank of China (PBOC) injected CNY100 billion via 7-day reverse repos with the rate unchanged at 2.1% on Friday. The operation has led to a net injection of CNY90 billion after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.1000% at 09:56 am local time from the close of 2.1104% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 58 on Thursday vs 51 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3492 FRI VS 6.3485

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3492 on Friday, compared with 6.3485 set on Thursday.

MARKETS

SNAPSHOT: Frayed Nerves

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 321.26 points at 27451.67

- ASX 200 down 166.585 points at 7175.8

- Shanghai Comp. down 31.053 points at 3524.01

- JGB 10-Yr future up 14 ticks at 150.98, yield down 1.1bp at 0.136%

- Aussie 10-Yr future up 7.5 ticks at 98.055, yield down 7.4bp at 1.918%

- U.S. 10-Yr future +0-16 at 128-06+, yield down 2.85bp at 1.776%

- WTI crude down $1.43 at $84.1, Gold up $1.99 at $1841.2

- USD/JPY down 25 pips at Y113.86

- TOP DIPLOMATS FOR U.S., RUSSIA MEET IN GENEVA ON SOARING UKRAINE TENSIONS (RTRS)

- U.S. ALLOWS BALTIC NATO MEMBERS TO SEND ARMS TO UKRAINE (WSJ)

- CHINA SET TO CUT INTEREST RATES ON STANDING LENDING FACILITY LOANS (RTRS)

BOND SUMMARY: Geopolitical Anxiety Adds Fuel To Bond Rally

Core bond markets received a fillip from continued risk-off flows, as lacklustre Asia-Pac headline flow failed to add much to the existing narrative. Geopolitical frictions frayed nerves amid the lingering risk of a potential Russian military strike on Ukraine, which provoked Western retaliation threats over the recent days. The spectre of aggressive Fed tightening kept appetite for riskier assets in check, while Thursday's weakness in key U.S. stock indices infected their Asia-Pacific peers.

- T-Notes surged to a session high of 128-10, their best level in a week, before stabilising below there. TYH2 changes hands +0-15 at 128-05+ as we type. Eurodollar futures run 1.5-6.5 ticks higher through the reds. Tsys faltered in cash trade, with the belly leading declines. Yields last sit 1.4-3.9bp lower across the curve, with 10-year yield now back below 1.80%. The U.S. economic docket is fairly empty ahead of the weekend, which leaves the main focus on geopolitical matters.

- JGB futures extended gains after a firmer re-open, but trimmed gains after the Tokyo lunch break. JBH2 trades at 150.99, 15 ticks above last settlement and 10 ticks shy of session highs. Cash JGBs tracked moves in U.S. Tsys as the yield curve shifted lower, with belly outperforming. Japanese CPI data failed to elicit any volatility, even as a marginal miss in core inflation underscored the BoJ's message that policy normalisation will not be happening anytime soon. Likewise, there was no reaction to domestic debt supply, with global market impetus in the driving seat.

- Australia's yield curve bull flattened as ACGBs turned their tails in cash Sydney trade. Yields last sit 5.0-9.0bp lower across the curve. Aussie bond futures were in demand, with YM last +8.0 & XM +9.0, both stabilising near session highs. Bills trade unch. to +9 ticks through the reds. The space showed no reaction to a fairly standard issuance slate for next week, the supply of ACGB Apr '25 also came and went.

JGBS AUCTION: Japanese MOF sells Y4.0667tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.0667tn 3-Month Bills:

- Average Yield -0.0918% (prev. -0.0970%)

- Average Price 100.0229 (prev. 100.0242)

- High Yield: -0.0882% (prev. -0.0922%)

- Low Price 100.0220 (prev. 100.0230)

- % Allotted At High Yield: 63.4443% (prev. 40.8089%)

- Bid/Cover: 3.364x (prev. 2.957x)

JGBS AUCTION: Japanese MOF sells Y499.3bn of 5-15.5 Year JGBs in liquidity enhancement auction

The Japanese Ministry of Finance (MOF) sells Y499.3bn of 5-15.5 Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.020% (prev. -0.012%)

- High Spread: -0.017% (prev. -0.012%)

- % Allotted At High Spread: 10.1289% (prev. 86.2785%)

- Bid/Cover: 3.516x (prev. 3.503x)

AUSSIE BONDS: The AOFM sells A$1.5bn of the 3.25% 21 Apr ‘25 Bond, issue #TB139:

The Australian Office of Financial Management (AOFM) sells A$1.5bn of the 3.25% 21 April 2025 Bond, issue #TB139:

- Average Yield: 1.3298% (prev. 1.0468%)

- High Yield: 1.3300% (prev. 1.0500%)

- Bid/Cover: 2.9433x (prev. 3.2500x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 77.8% (prev. 37.2%)

- Bidders 45 (prev. 30), successful 9 (prev. 16), allocated in full 1 (prev. 11)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Monday 24 January it plans to sell A$1.0bn of the 0.50% 21 September 2026 Bond.

- On Thursday 27 January it plans to sell A$1.0bn of the 22 April 2022 Note & A$1.0bn of the 13 May 2022 Note.

- On Friday 28 January it plans to sell A$1.0bn of the 1.25% 21 May 2032 Bond.

FOREX: Flight To Safety

Risk-off flows intensified in Asia, with regional equity benchmarks retreating after a sharp reversal in key U.S. stock indices during Thursday's NY session. Looming Fed's policy tightening and underwhelming earnings reports wreaked havoc on Wall Street, while Asia-Pac headline flow offered no consolation. The escalating geopolitical risk surrounding Russia's military activity near the Ukrainian border helped undermine market sentiment.

- Participants rushed into safe havens, generating heavy demand for the yen. USD/JPY retreated past the Y114.00 mark to a fresh one-week low, with talk of JPY purchases against AUD and EUR doing the rounds. The main well-known risk barometer AUD/JPY tumbled below Y82.00 for the first time in a month.

- The yen was unfazed by domestic CPI report, which failed to provide evidence of rising inflation pressures. The key gauge of underlying inflation targeted by the BoJ stayed unchanged, marginally missing expectations.

- The Aussie was the worst performer in G10 FX space, as AUD/USD sank through the $0.7200 figure to erase all of its gains registered in the wake of Thursday's release of strong jobs data out of Australia.

- Weakness in crude oil futures applied additional pressure to commodity-tied FX, after the EIA reported a surprise build-up in U.S. stockpiles.

- UK retail sales & advance EZ consumer confidence headlines today's data docket, with comments coming up from ECB's Lagarde & BoE's Mann.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/01/2022 | 0700/0700 | *** |  | UK | Retail Sales |

| 21/01/2022 | 1230/1330 |  | EU | ECB Lagarde on Global Economic Outlook at WEF | |

| 21/01/2022 | 1300/1300 |  | UK | BOE Mann speaks at OMFIF | |

| 21/01/2022 | 1330/0830 | ** |  | CA | Retail Trade |

| 21/01/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 21/01/2022 | 1500/1600 | ** |  | EU | consumer confidence indicator (p) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.