-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Friday, December 13

MNI US OPEN - UK Economy Contracts for Second Straight Month

MNI EUROPEAN OPEN: Russian Roulette

EXECUTIVE SUMMARY

- U.S. STATE DEPARTMENT ORDERS FAMILIES OF DIPLOMATS TO LEAVE UKRAINE

- BIDEN WEIGHS DEPLOYING THOUSANDS OF TROOPS TO EASTERN EUROPE AND BALTICS (NYT)

- U.S. HOLDS OFF ON RUSSIA SANCTIONS TO PRESERVE DETERRENCE, PREPARES SWEEPING EXPORT CONTROLS

- UK ACCUSES RUSSIA OF PLOTTING TO INSTALL PRO-KREMLIN LEADER IN UKRAINE

- PBOC CUTS RATE ON 14-DAY REVERSE REPO TO 2.25% FROM 2.35% (BBG)

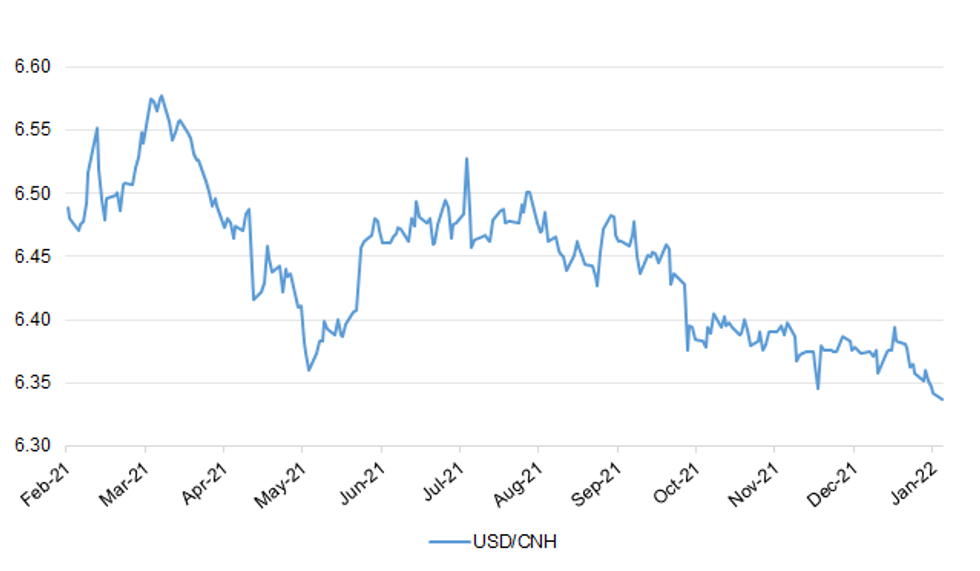

Fig. 1: USD/CNH

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Dominic Raab has refused to confirm that the Sue Gray report on alleged Downing Street parties will be published in full next week, saying the amount of detail released publicly will be a matter for Boris Johnson. In what appeared to be a scaling back of the government’s commitment to openness on the report, Raab, the justice secretary and deputy prime minister, promised there would be “full transparency”, but declined to give any specifics. (Guardian)

POLITICS: Officials working in No 10 claim they have held back information from Sue Gray’s investigation into the partygate scandal due to a “culture of fear” surrounding the probe. Three sources told The Independent they have not divulged messages and pictures on their phones after a senior member of staff told them to remove anything that could fuel speculation in the wake of the first party revelations. Messages in a WhatsApp group were said to contain photographs of people drinking and dancing, as well as references to how hungover people were the next day. (Independent)

POLITICS: Boris Johnson is “determined” to fight on and still does not believe that he broke any lockdown rules as he braces himself for Sue Gray’s imminent verdict on parties in Downing Street. It could prove decisive in determining the fate of Johnson’s faltering premiership, and he is drawing up plans to “own the narrative” afterwards. The vast majority of Britons have already made up their minds about the allegations, regardless of what the report says, polling for The Times has found. (Times)

POLITICS: A Muslim Conservative MP has accused one of Boris Johnson’s whips of telling her she was fired from her ministerial job because of her faith. Nusrat Ghani, 49, was sacked as a transport minister in a mini reshuffle early in 2020. She claimed she was told that her “Muslimness was raised as an issue” at a meeting in Downing Street and that her “Muslim woman minister status was making colleagues feel uncomfortable”. (Times)

UK/RUSSIA: Ministers have been warned that they will have to contend with record-breaking gas and petrol prices in the event of a Russian invasion of Ukraine. Senior government officials expect Russia to “weaponise” its natural resources by restricting supplies of gas to Europe if the West carries out its threat to impose sanctions. Ministers have been involved in top-level discussions to assess the impact that a reduced supply of gas from Russia would have on prices in Britain. The senior officials say that there is no direct risk of gas shortages, but the conflict would push prices from the present historic highs to new record levels. (The Times)

ECONOMY: Britain is facing a renewed supply chain crisis fuelled by the world’s longest turnaround times for processing shipping containers and a growing threat to China’s manufacturing and logistical capacity from the Omicron variant. Data obtained by i shows the UK has been particularly badly hit by the logistics snarl up caused by factors from the pandemic to Brexit, with it taking almost two months for cargo boxes carrying goods from the Far East to be processed through the supply chain, from delays at ports to shortages of warehouse space and truckers. (i)

ECONOMY: Britain will compel airlines to use a greater proportion of takeoff and landing slots this summer, while making it easier for them opt out of flights when circumstances change. Carriers will be required to utilize 70% of airport slots or risk losing the rights, the Department for Transport said in a statement Monday. That’s below the pre-pandemic threshold of 80% but higher than required since the virus hit. (BBG)

NORTHERN IRELAND: British Foreign Secretary Liz Truss said there was a "deal to be done" on the Northern Ireland protocol that protects peace and works for all sides, ahead of a meeting with European Union Vice President Maros Sefcovic in Brussels on Monday. The two sides disagree over trading arrangements governed by the Northern Ireland protocol, which is designed to keep an open border between it and EU member Ireland. (RTRS)

EUROPE

ECB: The drivers of inflation in the euro zone will subside over the course of the year and inflation will hover around the European Central Bank's price stability target of 2% in the next two years, Finnish central bank chief Olli Rehn was quoted as saying on Sunday. In a pre-released interview with German business daily Handelsblatt, Rehn said the future pace of normalization of the ECB's loose monetary policy depended on the economic data. "Personally, I expect the economic data to remain relatively good despite being affected by the Omicron variant," Rehn said, adding he therefore viewed rate hikes in 2023 as a logical step, at least as long as there are no new economic shocks. (RTRS)

ECB: Inflation should slow in 2022 as supply-chain blockages and energy prices recede, though it’s likely to remain at more than 2% in the euro area for the rest of the year, according to European Central Bank Governing Council member Gabriel Makhlouf. Makhlouf said he doesn’t expect the ECB to raise interest rates in 2022, though policy makers will “have to keep a close eye.” The “big challenge” will be to watch for any second-round effects of inflation, such as wages rising without corresponding increases in productivity, he said in an interview with KCLR’s “The Bottom Line” for broadcast on Saturday. “If we see risks of those sort of second round effects happening then we will definitely be taking action at the European Central Bank to manage that,” he said. (BBG)

GERMANY: Germany's leader has urged Europe and the United States to think carefully when considering sanctions against Russia for any aggression against Ukraine in a crisis pitting Berlin's main gas supplier against its biggest security allies. "Prudence dictates choosing measures that will have the greatest effect on those who violate the jointly agreed principles," German Chancellor Olaf Scholz Scholz was quoted as saying by the Sueddeutsche Zeitung newspaper on Sunday. "At the same time, we have to consider the consequences this will have for us," Scholz added, saying nobody should think there was a measure available without consequences for Germany. According to a pre-release of the interview, Scholz also countered any impression that the United States and Europe could not agree on a joint set of sanctions. (RTRS)

GERMANY: Germany’s top naval officer quit after he infuriated Ukraine by dismissing the prospect of a Russian and invasion and suggested Berlin should team up with Moscow to counter China. The German government was forced to distance itself on Saturday from comments made by German Navy Chief Kay-Achim Schönbach, who told a think tank panel that concern about a Russian invasion was overblown and that “what Putin really wants is respect.” Schönbach, who said he was voicing his private opinion but was wearing his uniform, also said Crimea was “gone” and would “never come back” to Ukraine, and argued in favor of cooperating with Russia to contain China’s rise. (Politico)

FRANCE: French President Emmanuel Macron’s approval rating has stumbled less than three months before the first round of the country’s election. Macron’s approval rating fell to 37% in January from 41% a month earlier, while 60% disapproved, according to a poll by Ifop for the Journal du Dimanche published on Sunday. It was the biggest decline in the survey since March. Only 7% of respondents declared themselves very satisfied with Macron, against 30% who were very unsatisfied. Macron’s approval equaled levels from last spring. (BBG)

ITALY: Media tycoon Silvio Berlusconi has abandoned his long-shot bid to become Italy’s next president, just as the country is poised to choose a head of state of its notoriously fractious political system for the next seven years. In a widely anticipated withdrawal statement, Berlusconi, 85, insisted he had enough support to win the election to Italy’s highest office. But the four-time former prime minister, who was convicted of tax fraud in October 2012, said he had decided to pull his name from consideration so lawmakers from across the political spectrum can choose a less divisive candidate. (FT)

ITALY: Mario Draghi should continue in his hands-on role as Italy’s prime minister, even as lawmakers begin selecting a candidate for the more ceremonial position of president, League party leader Matteo Salvini said. (BBG)

UKRAINE/GERMANY: Ukrainian Foreign Minister Dmytro Kuleba has accused Germany of "undermining unity" and "encouraging Vladimir Putin" by refusing to supply weapons to Kyiv amid heightened fears of a possible Russian invasion. Kuleba wrote on Twitter on January 22 that "recent statements by Germany about the impossibility of transferring defense weapons to Ukraine...do not correspond to the level of our relations and the current security situation." On January 22, German Defense Minister Christine Lambrecht said in a newspaper interview that Berlin will send a field hospital to Ukraine in February, but rejects the delivery of arms. Ukraine has requested that Germany provide 100,000 helmets and protective vests while also asking Berlin to rethink its position on arms deliveries. Ukraine's ambassador to Germany, Andriy Melnyk, told the Handelsblatt business newspaper on January 22 that Kyiv would "not rest in convincing the German government...to deliver defensive weapons to Ukraine." In a separate development, the Ukrainian Foreign Ministry on January 22 summoned Germany's ambassador regarding comments made by a German military leader that appeared to express empathy for Russian President Putin. (RFE/RL)

UKRAINE: Foreign Minister Dmitry Kuleba said that Russia's possible recognition of the DNR and LNR groups would mean its complete withdrawal from the Minsk agreements. Kuleba stressed that Russia is a party to the conflict and must implement part of the Minsk agreements, starting with the security part. (Ukrayinska Pravda)

UKRAINE: Ukrainian Defence Minister Oleksii Reznikov tweeted the following on Sunday: “The second bird in Kyiv! More than 80 tons of weapons to strengthen Ukraine's defense capabilities from our friends in the USA! And this is not the end.” (MNI)

U.S.

POLITICS/ECONOMY: Senator Bernie Sanders said it’s time for Democrats to change course on Joe Biden’s agenda and have senators vote on portions of the president’s key economic bill, then seek to pass what remains as a package. After six months of “so-called negotiating” with Democratic senators Joe Manchin and Kyrsten Sinema, “we need to start voting,” Sanders said on CNN’s “State of the Union” on Sunday. “We need to bring important pieces of legislation that impact the lives of working families right on to the floor of the Senate.” (BBG)

POLITICS: Are Democrats or Republicans better positioned to address voter concerns in this year's congressional elections? Depends on the issue. A Fox News national survey asks voters which party would do a better job on 14 issues. Voters split the list between Democrats and Republicans. They believe Democrats can better handle climate change (+22 points), racism (+20), health care (+16), bringing the country together (+9), coronavirus (+9) and education (+7). Republicans are preferred on national security (+16 points), border security (+16), crime (+15), the economy (+15), immigration (+15), the federal deficit (+13) and taxes (+11). There is no clear party advantage on protecting American democracy (Democrats +2). That all leads to a split matchup: By a one-point margin, voters favor the Republican candidate in their congressional district over the Democratic candidate (44-43%). Last month, Republicans were favored by four points. (Fox)

CORONAVIRUS: Anthony Fauci said Sunday he is "as confident as you can be" that most states in the U.S. will reach a peak in omicron infections over the next several weeks. "You never want to be overconfident when you're dealing with this virus," Fauci said during an appearance on ABC's "This Week." "But if you look at the patterns that we've seen in South Africa in the U.K. and Israel ... they've peaked and starting to come down rather sharply." (Hill)

OTHER

GEOPOLITICS: President Biden is considering deploying several thousand U.S. troops, as well as warships and aircraft, to NATO allies in the Baltics and Eastern Europe, an expansion of American military involvement amid mounting fears of a Russian incursion into Ukraine, according to administration officials. In a meeting on Saturday at Camp David, the presidential retreat in Maryland, senior Pentagon officials presented Mr. Biden with several options that would shift American military assets much closer to Mr. Putin’s doorstep, the administration officials said. The officials spoke on the condition of anonymity because they were not authorized to talk publicly about internal deliberations. Mr. Biden is expected to make a decision as early as this week, they said. (NYT)

GEOPOLITICS: The U.S. ordered family members at its embassy in Kyiv to leave Ukraine “due to the continued threat of Russian military action,” the State Department said Sunday. The advisory also urged U.S. citizens in Ukraine to consider leaving the country now using commercial or other private travel options. (BBG)

GEOPOLITICS: Secretary of State Antony Blinken amplified his warning against a Russian invasion of Ukraine, saying "a single additional Russian force" entering Ukraine "in an aggressive way" would result in a severe response by the US and its allies. "If a single additional Russian force goes into Ukraine in an aggressive way, as I said, that would trigger a swift, a severe and a united response from us and from Europe," Blinken told CNN's Dana Bash on "State of the Union" on Sunday. (CNN)

GEOPOLITICS: U.S. Secretary of State Antony Blinken on Sunday rebuffed calls to immediately impose economic sanctions on Russia, saying that doing so would undercut the West's ability to deter potential Russian aggression against Ukraine. "When it comes to sanctions, the purpose of those sanctions is to deter Russian aggression. And so if they are triggered now, you lose the deterrent effect," Blinken told CNN in an interview. (RTRS)

GEOPOLITICS: The Biden administration is threatening to use a novel export control to damage strategic Russian industries, from artificial intelligence and quantum computing to civilian aerospace, if Moscow invades Ukraine, administration officials say. The administration may also decide to apply the control more broadly in a way that would potentially deprive Russian citizens of some smartphones, tablets and video game consoles, said the officials. Such moves would expand the reach of U.S. sanctions beyond financial targets to the deployment of a weapon used only once before — to nearly cripple the Chinese tech giant Huawei. (WSJ)

GEOPOLITICS: The U.S. is threatening to use sweeping export controls against key Russian industries if Moscow invades Ukraine, a senior administration official confirmed to The Hill. “No final decisions have been made, but we would start high and stay high and maximize the pain to the Kremlin,” the official said, adding that that the US is in discussion with allies on these actions. (Hill)

GEOPOLITICS: Russian lawmakers have scheduled a hearing this week on whether to recognize the independence of two pro-Russian separatist regions of Ukraine, Russia's parliament speaker said Friday as pro-Kremlin lawmakers suggested the move would trigger full-scale war between Moscow and Kyiv. “Following the results, we must consider the issue at the Council of the State Duma,” he wrote on the Telegram messaging app, noting that major party leaders had already voiced support for the Communists’ proposal. (Moscow Times)

GEOPOLITICS: Britain accused Russia of plotting to install a puppet leader in Kyiv, as Boris Johnson warned European Union leaders against “naivety” over Vladimir Putin’s demands over Ukraine and described the crisis as “gravely dangerous”. In a highly unusual move, Liz Truss, the Foreign Secretary, publicly released specially declassified intelligence naming Yevhen Murayev, a former Ukrainian MP, as the Kremlin’s preferred candidate to take over the country following an invasion. Officials also named four former Ukrainian ministers alleged to be colluding with Russian intelligence officers, including spies involved in planning an attack. (Telegraph)

GEOPOLITICS: Britain is understood to be considering a “nuclear” option of backing the suspension of Russia from the Swift international payment scheme. Mr Johnson believes possible sanctions “cannot exclude” Nordstream II, the controversial gas pipeline between Russia and the EU, and is due to hold calls with G7 leaders to finalise a “sanction coalition” to take targeted measures against oligarchs supporting the Russian president. Sources close to the Prime Minister said that he “fears some world leaders may not appreciate the deteriorating picture on the Ukrainian border, or fully comprehend the risks posed by a bullying Russia”. (Telegraph)

GEOPOLITICS: Dominic Raab has said it is “extremely unlikely” that troops will be sent into Ukraine in the event of a Russian invasion – but stressed there will be “severe economic consequences” for the Kremlin. The deputy prime minister also assessed the threat of an incursion by Russian forces as “very significant”, as he urged the Russian president, Vladimir Putin, to “step back from the brink”. (Independent)

GEOPOLITICS: British foreign minister Liz Truss could visit Moscow under plans being examined by authorities, a Russian foreign ministry spokeswoman said on Sunday, according to TASS news agency, at a time of high tensions between Russia and the West over Ukraine. "Such a query was received from the British side, the possibility of such a visit is being considered," Maria Zakharova, a spokeswoman for the Russian ministry, was quoted as saying by TASS, without giving a possible timeframe for the trip. (RTRS)

GEOPOLITICS: Russian Defense Minister Sergei Shoigu has accepted an invitation to meet his British counterpart Ben Wallace to discuss the crisis on the Russia-Ukraine border, a senior U.K. defense source said Saturday. "The Defence Secretary is glad that Russia has accepted the invitation to talk with his counterpart," the source said. "Given the last defense bilateral between our two countries took place in London in 2013, Russian Defence Minister Sergei Shoigu has offered to meet in Moscow instead," added the source. (AFP)

GEOPOLITICS: The EU will be ready to launch sanctions against Russia within days of a military attack on Ukraine, a senior official has said, as the volatile security crisis enters a critical phase. EU foreign ministers meeting in Brussels on Monday are expected to issue a further warning to Moscow amid simmering tensions over Russia’s buildup of 100,000 troops and heavy weapons along its border with Ukraine. EU sources are pessimistic about the Kremlin climbing down from maximalist demands that would in effect give Russia a sphere of influence in eastern Europe. Ministers meeting on Monday, however, will not discuss specific sanctions. Instead they are expected to echo earlier EU warnings of “massive consequences” without going into specifics. “If such a very serious development [Russian troops crossing the border] happens, the reaction will be very quick, the reaction will be extremely clear. And again it will be a question of days … not a question of weeks,” a senior EU official said. (Guardian)

GEOPOLITICS: Estonia, Latvia, and Lithuania have announced they will provide anti-armor and antiaircraft missiles to Ukraine to help the country in the event of a possible Russian invasion. The three Baltic states and NATO members announced the plan in a joint statement on January 21. (RFE/RL)

US/IRAN: The United States is unlikely to strike an agreement with Iran to save the 2015 Iran nuclear deal unless Tehran releases four U.S. citizens Washington says it is holding hostage, the lead U.S. nuclear negotiator told Reuters on Sunday. The official, U.S. Special Envoy for Iran Robert Malley, repeated the long-held U.S. position that the issue of the four people held in Iran is separate from the nuclear negotiations. He moved a step closer, however, to saying that their release was a precondition for a nuclear agreement. (RTRS)

JAPAN: The Japanese government is planning to expand a quasi-state of emergency to Osaka, Kyoto and other prefectures amid a resurgence of coronavirus infections. (NHK)

AUSTRALIA/CHINA: The popular Chinese messaging application WeChat appears to have blocked access to Australian Prime Minister Scott Morrison’s account, leading one senator to call for a parliament-wide boycott of the service. Senator James Paterson, chair of the Parliamentary Joint Committee on Intelligence and Security, said on Monday the prime minister’s team had been having trouble accessing the WeChat account for months. It was finally taken out of the government’s control in early January despite formal representations from Morrison’s office, he told radio station 4BC. (BBG)

NEW ZEALAND: The Government will shift the entire country into the red traffic light setting at 11.59pm on Sunday night, the Prime Minister has announced. The uptick in settings comes after the Government discovered nine linked cases of Omicron in the community without a link to the border, indicating community transmission in Auckland and possibly Motueka. (Stuff)

SOUTH KOREA: Main opposition presidential candidate Yoon Suk-yeol is leading his ruling party rival Lee Jae-myung with 42 percent public support against Lee's 36.8 percent, a survey showed Monday. Yoon of the People Power Party (PPP) gained 1.4 percentage points from the previous week, while Lee of the Democratic Party edged up 0.1 point, according to the Realmeter survey conducted on 3,046 adults from Jan. 16 to 21. (Yonhap)

SOUTH KOREA: South Korea's public institutions plan to hire more than 26,000 new regular workers this year in an effort to help buttress job creation, the finance minster said Monday. He said the public firms also plan to hire around 22,000 interns to help them build work experience. (Yonhap)

TAIWAN: Taiwan on Sunday reported the largest incursion since October by China's air force in its air defence zone, with the island's defence ministry saying Taiwanese fighters scrambled to warn away 39 aircraft in the latest uptick in tensions. (RTRS)

MALAYSIA: Malaysia’s southernmost state Johor will head to the polls in 60 days after its legislature was dissolved on Saturday (Jan 22) evening. “Sultan Ibrahim Iskandar has assented to signing the proclamation of dissolution for the Johor state assembly to pave way for a state election,” said the monarch’s Facebook page. (Straits Times)

THAILAND/SAUDI ARABIA: Prime Minister Prayut Chan-o-cha will visit Saudi Arabia from Tuesday to Wednesday as a guest of Crown Prince Mohammad bin Salman, Government House announced on Sunday. It will be the first high-level meeting between the two countries since a diplomatic row over a jewellery theft nearly three decades ago. (Bangkok Post)

BRAZIL: Brazil President Jair Bolsonaro said he vetoed 2.8 billion reais ($514 million) from this year’s budget, newspaper O Estado de Sao Paulo reported, citing remarks to reporters in the town of Eldorado. Bolsonaro is working to have congress approve a constitutional amendment that would allow fuel tax reductions. If that bill passes, then he will eliminate federal diesel tax. (BBG)

MEXICO: Mexico’s Energy Minister Rocio Nahle took to Twitter on Saturday, responding to media reports that the flagship Dos Bocas refinery project was over budget and won’t be finished on time. Without specifying the costs of the project, Nahle said “Dos Bocas is being built in record time. Opinions around the world are very positive.” She said reports to the contrary are “speculative, alarmist and tendentious.” (BBG)

TURKEY: Turkey’s banking regulator has advised commercial lenders not to distribute dividends from profits in 2021, when a currency crash eroded banks’ cash buffers, people with direct knowledge of the matter said. The regulator, known as BDDK, passed its recommendation to the lenders via Turkey’s banking association, but has yet to send a formal, written notice banning dividend payments, according to the people, who asked not to be named due to the sensitivity of the matter. (BBG)

ISRAEL: Eight days before they expire, the Health Ministry is reportedly considering canceling the Green Pass rules that have for many months been limiting entry to most public spaces only to those who have either been vaccinated or recovered from COVID-19 in the past six months, or have taken a negative test in the past 72 hours. The development comes as more and more leading experts say the mass infections caused by the Omicron variant, including among the recently vaccinated, render the Green Pass rules increasingly obsolete. (Times of Israel)

UAE: The United Arab Emirates intercepted two ballistic missiles targeting Abu Dhabi early Monday, its state-run news agency reported, the latest attack to target the Emirati capital. The attack on Abu Dhabi, after another last week killed three people and wounded six, further escalates tensions across the Persian Gulf as Yemen's yearslong civil war grinds on. The state-run WAM news agency said that missile fragments fell harmlessly over the capital, Abu Dhabi. (ABC)

OIL: Iraq said its oil exports would stay steady this month and rise slightly in February. Crude shipments will probably average 3.2 million barrels a day in January from fields controlled by the central government, Ali Nizar, deputy director-general of state marketing company Somo, told reporters on Sunday in Baghdad. The figure will rise to 3.3 million next month, he said. (BBG)

CHINA

PBOC: Looser monetary policy in China won’t be sufficient to stabilize the economy and a faster increase in government spending is needed, according to a former adviser to the central bank. “Under the current economic situation, the role the PBOC can play is limited,” said Yu Yongding, a member of the monetary policy committee of the People’s Bank of China in the mid 2000s, adding that he would “emphasize the importance of fiscal policy.” (BBG)

ECONOMY: China may lower its budget deficit-to-GDP ratio to about 2.8-3% in 2022 from the “about 3.2%” set last year, retreating to the 3% red line as the economy gradually normalizes, the Securities Times reported citing Wu Chaoming, the chief economist at Chasing Securities. The high government deposits, due to higher surplus funds carried over from the previous two years, will be a strong support to expand fiscal spending, the newspaper cited Wu as saying. Some analysts expect another issuance of special China treasury bonds this year as a follow-up to CNY1 trillion issued in 2020 immediately following the Covid-19 outbreak, which is not included in the fiscal deficit. About CNY950 billion special treasury bonds are maturing this year, the newspaper said. (MNI)

CORONAVIRUS: China won’t bow to the IMF’s opposition to its zero-COVID policy as it sees the strict measures guarantee the smooth operation of the economy, Lu Xiang, a researcher at the Chinese Academy of Social Sciences, wrote in a commentary for the government-run Global Times. The IMF Managing Director Kristalina Georgieva said on Friday that China's policy is putting more at risk as a supply source for the rest of the world, Lu wrote. China has joint prevention and control mechanism and will never give it up, while Western countries lack the ability, Lu wrote. (MNI)

CORONAVIRUS: Beijing's city government on Sunday introduced new measures to contain a recent outbreak of COVID-19, as China's capital continued to report new local cases of the virus less than two weeks before it hosts the Winter Olympic Games. (RTRS)

PROPERTY: Local governments in China will be more flexible in relaxing housing regulations this year as they prioritize development and meet the reasonable needs of homebuyers, the China Securities Journal reported. Banks will quicken mortgage approvals to boost transactions and stabilize overall prices, the newspaper said citing Xu Xiaole, chief analyst with Beike Research Institute. Authorities will also promote large-scale construction of affordable housing this year to help stabilize real estate investment, the newspaper said citing analysts. (MNI)

PROPERTY: Shares of China Evergrande Group jumped more than 13% on Monday, a day after the embattled developer said it would appoint an official from a unit of state asset manager China Cinda Asset Management to its board. Evergrande's assets are expected to be taken over by state-owned firms in a restructuring led by the Guangdong provincial government, where the developer is based, and the appointment could signal the restructuring is moving forward. (RTRS)

PROPERTY: Chinese developer Yuzhou Group Holdings Co. said it won’t pay off two dollar bonds due this week, meaning some events of default will occur, as builders continue to struggle meeting debt payments. The company earlier this month offered to swap the notes for new debt, and investors exchanged most of their holdings. There’s $104.9 million of combined principal remaining, Yuzhou said in a Monday stock exchange filing, and it’s opting not to pay that while planning to relaunch the exchange offer this week. “Certain events of default will occur in respect of” the two dollar bonds, the company said, but that won’t be the case for its other such debt. Yuzhou has $5.7 billion of dollar notes outstanding, according to data compiled by Bloomberg. (BBG)

OVERNIGHT DATA

JAPAN JAN, P JIBUN BANK M’FING PMI 54.6; DEC 54.3

JAPAN JAN, P JIBUN BANK SERVICES PMI 46.6; DEC 52.1

JAPAN JAN, P JIBUN BANK COMPOSITE PMI 48.8; DEC 52.5

Flash PMI data indicated that activity at Japanese private sector businesses dipped into contraction territory for the first time in four months at the start of 2022. The pace of decline was modest, and led by the sharpest fall in services activity since August, while manufacturers commented on a slight quickening in output growth. Private sector firms reported that the surge in COVID-19 cases from the more transmissible Omicron variant had hindered client confidence, most notably in customer-facing industries across the service sector as restrictions were re-introduced across various prefectures including the capital Tokyo. Disruption was also reported in the labour market, where employment levels fell for the first time in a year. Positively, it appeared that price pressures may have peaked at the end of last year, as firms noted a softening in input price inflation for the first time in five months. Finally, firms remained confident regarding the year-ahead outlook for activity in Japan, though optimism waned to the weakest since January 2021. (IHS Markit)

AUSTRALIA JAN, P MARKIT M’FING PMI 55.3; DEC 57.7

AUSTRALIA JAN, P MARKIT SERVICES PMI 45.0; DEC 55.1

AUSTRALIA JAN, P MARKIT COMPOSITE PMI 45.3; DEC 54.9

The Australian economy had slipped from a state of strong recovery in end-2021 to being affected by the surge in COVID-19 infections at the start of 2022 according to the IHS Markit Flash Australia Composite PMI. Supply issues meanwhile remained prevalent, with lengthening of lead times, reports of supply shortages and labour constraints persisting and made worse by the latest surge in COVID-19 cases. This had led to input price inflation worsening which may well lead to further selling price pressures, especially when demand later recovers. Employment levels were unchanged in January, affected by both COVID-19 disruptions and difficulties in hiring. That said, there have been some early positive signs of COVID-19 infections peaking in Australia which may offer some hopes for a turnaround in the situation absent any further restrictions imposed. (IHS Markit)

CHINA MARKETS

PBOC CUTS 14-DAY REVERSE REPO RATE, NET INJECTS CNY50BN

The People's Bank of China (PBOC) pumped in CNY150 billion via 14-day reverse repos with the rate lowering to 2.25% from the previous 2.35% on Monday. The operation led to a net injection of CNY50 billion after offsetting CNY100 billion maturing reverse repos, according to Wind Information. The 14-day rate cut followed a 10-bp cut to the rate of 7-day reverse repos last Monday, as well as that of 1-year MLF.

- The operation aims to keep liquidity stable before the Spring Festival holiday, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.2200% at 09:27 am local time from the close of 2.1057% on Friday.

- The CFETS-NEX money-market sentiment index closed at 41 on Friday vs 58 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3411 MON VS 6.3492

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3411 on Monday, compared with 6.3492 set on Friday.

MARKETS

SNAPSHOT: Russian Roulette

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 63.04 points at 27586.26

- ASX 200 down 36.314 points at 7139.5

- Shanghai Comp. up 4.897 points at 3526.616

- JGB 10-Yr future down 5 ticks at 150.92, yield up 0.4bp at 0.141%

- Aussie 10-Yr future down 1.5 ticks at 98.04, yield up 2bp at 1.938%

- U.S. 10-Yr future -0-07+ at 128-02+, yield up 1.6bp at 1.7741%

- WTI crude up $0.75 at $85.89, Gold up $1.66 at $1837.07

- USD/JPY up 25 pips at Y113.93

- U.S. STATE DEPARTMENT ORDERS FAMILIES OF DIPLOMATS TO LEAVE UKRAINE

- BIDEN WEIGHS DEPLOYING THOUSANDS OF TROOPS TO EASTERN EUROPE AND BALTICS (NYT)

- U.S. HOLDS OFF ON RUSSIA SANCTIONS TO PRESERVE DETERRENCE, PREPARES SWEEPING EXPORT CONTROLS

- UK ACCUSES RUSSIA OF PLOTTING TO INSTALL PRO-KREMLIN LEADER IN UKRAINE

- PBOC CUTS RATE ON 14-DAY REVERSE REPO TO 2.25% FROM 2.35% (BBG)

BOND SUMMARY: Core FI Lose Ground Amid Bounce In U.S. E-Minis, U.S. Tsy Curve Flattens

Light selling pressure hit core FI at the start to the week, in spite of bubbling geopolitical tensions over Russia's military build-up near the Ukrainian border. Participants eyed Wednesday's monetary policy decision from the Fed, which should shed some more light on the policy outlook. U.S. e-mini futures caught a bid, which coincided with weakness in core bond markets.

- T-Notes meandered within a fairly tight range overnight, they last change hands -0-07 at 128-03. Eurodollar futures trade 1.5-4.5 ticks lower through the reds. The Tsy curve bear flattened as cash trading got under way, with yields last seen 1.8-3.1bp higher. Flash Markit PMIs & 2-Year Tsy auction headline the local docket today.

- JGB futures sold off in the morning session to stabilise after the Tokyo lunch break. JBH2 operates at 150.95 at typing, 2 ticks shy of last settlement. Cash JGB yields are little changed across the curve. The space shrugged off domestic PMI data & Covid-19 headline flow, with JGBs happy to move in tandem with peers.

- Cash ACGB yields crept higher and last trade 0.7-2.7bp across the curve. Aussie bond futures slipped in sync with cash ACGBs, with YM last -2.0 & XM -2.0. Bills last sit 1-3 ticks lower through the reds. There was no material follow-through from the release of local PMI figures or today's round of ACGB Sep '26 supply, which drew bid/cover ratio of 4.09x (prev. 6.08x).

JGBS AUCTION: Japanese MOF sells Y2.8155tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y2.8155tn 6-Month Bills:

- Average Yield -0.0907% (prev. -0.1068%)

- Average Price 100.045 (prev. 100.053)

- High Yield: -0.0866% (prev. -0.0987%)

- Low Price 100.043 (prev. 100.049)

- % Allotted At High Yield: 28.7513% (prev. 2.0426%)

- Bid/Cover: 4.416x (prev. 3.733x)

AUSSIE BONDS: The AOFM sells A$1.0bn of the 0.50% 21 Sep ‘26 Bond, issue #TB164:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 0.50% 21 September 2026 Bond, issue #TB164:

- Average Yield: 1.5720% (prev. 0.6810%)

- High Yield: 1.5750% (prev. 0.6825%)

- Bid/Cover: 4.0900x (prev. 6.0830x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 48.4% (prev. 20.8%)

- Bidders 40 (prev. 57), successful 14 (prev. 23), allocated in full 8 (prev. 8)

FOREX: Safe Havens Ignore Geopol Risks; Crude Rises & Oil-Tied FX Hitch Ride

The Japanese yen and Swiss franc brought up the rear in G10 FX space. A recovery in U.S. e-mini futures sapped strength from safe haven currencies, with participants eyeing Wednesday's monetary policy decision from the Fed. Further escalation in geopolitical tensions over Ukraine failed to generate any significant safe haven bid.

- USD/JPY climbed over the Tokyo fix and held the bulk of its initial gains, as U.S. Tsy yields rose across the curve in cash trade.

- Firmer oil prices supported CAD and NOK. The combination of enthusiasm about a potential recovery in demand as Omicron countermeasures are lifted and a failed missile strike on the UAE helped keep crude buoyant.

- Spot USD/CNH hovered just above support from Dec 8 cycle low of CNH6.3305, the rate's lowest point since 2018. However, the yuan reference rate virtually matched average estimate, suggesting that the PBOC are comfortable with redback appreciation. The central bank also lowered the interest rate applied to 14-Day Reverse Repo operations by 10bp, adding to a suite of rate cuts delivered last week.

- A suite of PMI figures from across the globe will keep hitting the wires today, while the central bank speaker slate is virtually empty.

FOREX OPTIONS: Expiries for Jan24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1230-35(E875mln)

- USDJPY: Y113.95-05($795mln), Y114.85-00($634mln)

- AUDUSD: $0.7200(A$761mln), $0.7235(A$1.6bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/01/2022 | 0815/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 24/01/2022 | 0815/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 24/01/2022 | 0830/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 24/01/2022 | 0830/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 24/01/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 24/01/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 24/01/2022 | 0900/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 24/01/2022 | 0930/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 24/01/2022 | 0930/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 24/01/2022 | 0930/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 24/01/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/01/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 24/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 24/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 24/01/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.