-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Pentagon Puts Troops On High Alert

EXECUTIVE SUMMARY

- U.S. PUTS 8,500 TROOPS ON HIGH ALERT AS TENSIONS OVER UKRAINE RISE

- UK WARNS RUSSIA PLANS TO SEIZE KYIV IN "LIGHTNING WAR"

- BIDEN TOUTS “TOTAL UNANIMITY” ON UKRAINE WITH WITH EUROPEAN LEADERS

- AUSTRALIA CPI TRIMMED MEAN INFLATION PRINTS ABOVE RBA TARGET MID-POINT

- MAS RAISE POLICY BAND APPRECIATION RATE, CITE MOUNTING INFLATION PRESSURES

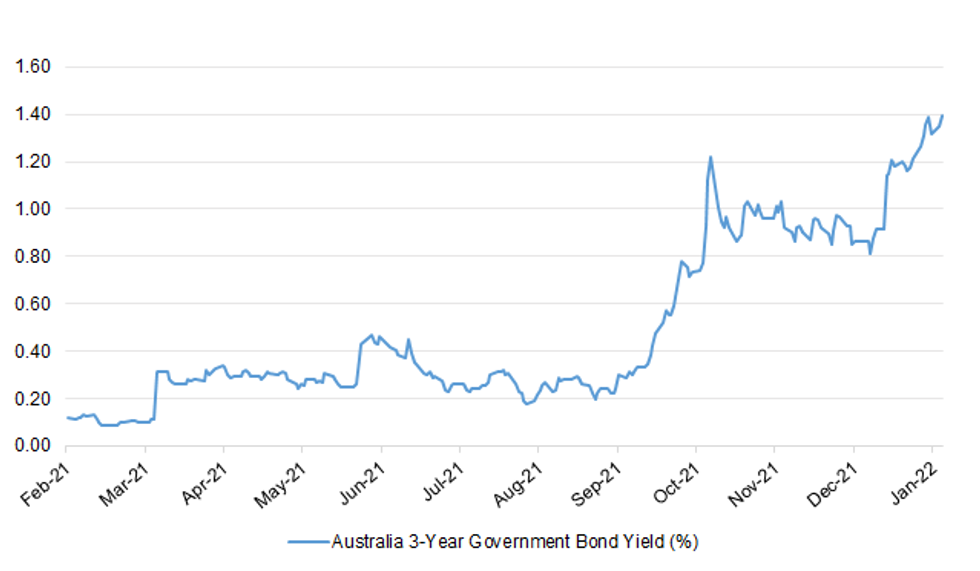

Fig. 1: Australia 3-Year Government Bond Yield (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: ITV News understands Boris Johnson had a birthday party during the first lockdown in 2020 despite the rules forbidding social gatherings indoors at the time. It's alleged that the prime minister's wife, Carrie Johnson, helped organise a surprise get-together for him on the afternoon of 19 June just after 2pm. Up to 30 people are said to have attended the event in the Cabinet Room after Boris Johnson returned from an official visit to a school in Hertfordshire. ITV News understands that the interior designer, Lulu Lytle - who was not a member of No 10 staff - also attended the gathering. At the time Ms Lytle was renovating Boris Johnson’s flat in Downing Street, which has been the subject of a separate controversy. (ITV)

POLITICS: Boris Johnson has reactivated his leadership campaign team to try and limit the fallout from Sue Gray’s report into Downing Street lockdown parties. Conservative MPs say they are being lobbied by the Prime Minister’s closest allies in a bid to ensure his position is safe even if the senior civil servant concludes that he did break the rules on one or more occasions. One ex-minister told i that “most people have made up their minds” about Mr Johnson even before the investigation concludes, adding: “The shadow whipping operation is about reassuring people regardless of Sue Gray.” (i)

POLITICS: A Conservative minister has resigned from his Cabinet Office and Treasury role over the Government’s “lamentable” handling of Covid fraud. Lord Agnew of Oulton made the decision to quit after £5 billion was thought to have been lost to fraudulent applications for emergency Bounce Back business loans during lockdown. (Telegraph)

POLITICS: Boris Johnson is meeting his Cabinet amid the growing threat of war with President Putin in eastern Europe and more humiliating Downing Street party allegations at home. Besides Ukraine, the regular Tuesday Cabinet meeting will also include discussions on the growing cost of living crisis and could also hear calls to scrap the national insurance hike to pay for the NHS and social care. (Sky)

CORONAVIRUS: COVID tests for fully vaccinated travellers arriving in England are being scrapped from 4am on 11 February, Grant Shapps has confirmed. Making a statement on the coronavirus rule change in the Commons, the transport secretary said those who have had two doses of an approved vaccination or one dose of a Janssen/J+J vaccine will no longer need to take a pre-departure or post-arrival test. (Sky)

CORONAVIRUS: Britain said on Tuesday it needed to recruit 6,000 more people onto a trial of Merck's COVID-19 antiviral pill molnupiravir to inform how the drug can be rolled out more widely. (RTRS)

ECONOMY: British workers will need pay rises of 8% on average this year to offset the living standards squeeze from higher energy bills, tax rises and broader inflation if the government does nothing to help. Analysis by the Tony Blair Institute for Global Change shows that the poorest fifth of U.K. workers will need a wage increase of more than 10% to compensate them for the hit to incomes. The work looked at the combined impact of the April hike in energy bills and taxes, alongside general inflationary pressures. (BBG)

EUROPE

EU/UKRAINE: The European Commission on Monday proposed more than €1 billion in potential new funding for Ukraine, urging the bloc to act swiftly on the package amid looming fears of a Russian invasion. The move is the latest attempt from European allies to show support for Ukraine as it faces down more than 100,000 Russian troops massed along its border, fueling warnings of Kremlin plots to destabilize or attack the country. And it comes as Ukraine has expressed frustration with EU countries like Germany for refusing to send weapons. Still, it is unclear how quickly the EU money could get to Ukraine. The funding needs to get the green light from EU countries and the European Parliament before it’s finalized. (Politico)

EU/UKRAINE: The European Union called on Russia on Monday to defuse tensions over Ukraine and reaffirmed that Moscow would face "massive" consequences if it attacked its neighbour. The EU's 27 foreign ministers, meeting in Brussels, said the bloc "condemns Russia's continued aggressive actions and threats against Ukraine and calls on Russia to de-escalate." "Notions of 'sphere of influence' have no place in the 21st century ... any further military aggression by Russia over Ukraine will have massive consequences and severe costs," they said in a statement, giving no details of the "consequences". (RTRS)

SPAIN: The Ukraine crisis has entered Spanish domestic politics, showcasing division within the coalition government over Spain’s participation in a North Atlantic Treaty Organization (NATO)-led effort to deter Russia from escalating the conflict further. Prime Minister Pedro Sánchez of the Socialist Party (PSOE) has run into open objections from his governing partners in the leftist Unidas Podemos, and is instead finding support in the main opposition Popular Party (PP). Spain will send four Air Force fighter jets to Bulgaria next month, according to NATO sources. The deployment of a Spanish Air Force contingent to a Bulgarian air base had been approved by the Cabinet on December 21 as part of a wider contribution to NATO, United Nations and EU missions in 2022, but recent events have added a new dimension to the contribution, said government sources. (El Pais)

GAS: Gas reserves in underground gas storages (UGS) of Europe and Ukraine are record low, Gazprom said on Monday. "The level of reserves in European UGS moved to the area of record minimums since January 11, 2002, throughout long-term observations. Reserves were 1.85 bln cubic meters lower than the minimal indicator as of this date on January 22," Gazprom said. (TASS)

U.S.

POLITICS: Former President Trump dominates the field of potential contenders for the 2024 Republican presidential nod, but Florida Gov. Ron DeSantis is an early favorite for the nomination in the event that Trump doesn’t run again, according to a new Harvard CAPS/Harris poll shared exclusively with The Hill. In a hypothetical eight-person GOP presidential primary, Trump holds a clear edge, garnering 57 percent support among Republican voters. DeSantis and former Vice President Mike Pence are nearly deadlocked at 12 percent and 11 percent, respectively. No other would-be candidate tested in the poll registers double-digit support. (Hill)

CORONAVIRUS: A New York judge struck down the state's mask mandate on Monday, ruling that it was unconstitutional and a violation of state law, according to the court decision. Judge Thomas Rademaker, of New York State Supreme Court on Long Island, wrote in his decision, which apparently takes effect immediately, that the state legislature last year curbed any governor's ability to issue decrees, such as a mask mandate, amid a declared state of emergency. New York Governor Kathy Hochul said in a statement, "We strongly disagree with this ruling, and we are pursuing every option to reverse this immediately." (RTRS)

EQUITIES: The new head of the Justice Department Antitrust Division, Jonathan Kanter, said on Monday the government should seek to stop proposed mergers which pose anticompetitive concerns rather than striking deals for asset sales or other concessions that would allow the transaction to close. "In my view, when the division concludes that a merger is likely to lessen competition or tend to create a monopoly, in most situations, we should seek a simple injunction to block the transaction," said Kanter, who was confirmed in November and is one of three progressives named to top U.S. antitrust posts. Kanter took the reins of the division at a time of rising inflation, including in key industries like meat production, and growing concern that there are a range of sectors of the economy where a handful of companies have become too powerful. (RTRS)

OTHER

GEOPOLITICS: NATO Allies are putting forces on standby and sending additional ships and fighter jets to NATO deployments in eastern Europe, reinforcing Allied deterrence and defence as Russia continues its military build-up in and around Ukraine. (NATO)

GEOPOLITICS: Defense Secretary Lloyd Austin has placed 8,500 U.S. troops on "heightened preparedness to deploy" to eastern Europe in case NATO activates its rapid-response force over tensions with Russia, the Pentagon announced Monday. (Axios)

GEOPOLITICS: President Biden said Monday he and European leaders are in agreement following a call to discuss strategy in response to Russia’s military build-up along the Ukrainian border. "I had a very, very, very good meeting. Total unanimity with all the European leaders. We’ll talk about it later,” Biden said after a previously planned meeting with administration officials to discuss lowering prices. Biden met for 80 minutes earlier Monday with European Commission President Ursula von der Leyen, European Council President Charles Michel, French President Emmanuel Macron, British Prime Minister Boris Johnson, German Chancellor Olaf Scholz, Italian Prime Minister Mario Draghi, NATO Secretary General Jens Stoltenberg and Polish President Andrzej Duda. (Hill)

GEOPOLITICS: Boris Johnson said that Russia had massed enough troops close to Ukraine for a “lightning war” in which it would try to seize Kyiv. Johnson said there were 60 Russian battle groups on the borders of Ukraine, which he described as evidence of a “plan for a lightning war that could take out Kyiv”. “That would be a disastrous step,” he said. For Moscow, any invasion is “going to be a painful, violent and bloody business. I think it’s very important that people in Russia understand that this could be a new Chechnya”. (FT)

GEOPOLITICS: Eight senators from both parties met Monday evening to hammer out a Russia sanctions bill that would bolster U.S. efforts to deter Vladimir Putin from invading Ukraine, multiple people familiar with the discussion told POLITICO. The preliminary talks between the four Democrats and four Republicans revolved around Senate Foreign Relations Chair Bob Menendez’s (D-N.J.) “mother of all sanctions” legislation, which as written authorizes a slate of harsh financial penalties that would kick in only after any Russian invasion of Ukraine. The bill mirrors the Biden administration’s approach thus far to the worsening crisis facing Ukraine and its western allies. (POLITICO)

GEOPOLITICS: Ukrainian Foreign Minister Dmytro Kuleba supported the proposal to hold a meeting of EU foreign ministers in Kyiv. Kuleba wrote about this on Twitter on Monday night. The Foreign Minister commented on the post of his Romanian counterpart Bohdan Aurescu, who said that he had proposed such a meeting in Kyiv at a meeting of EU Foreign Ministers on Monday. (European Pravda)

GEOPOLITICS: The Council of the State Duma will consider the appeal of the Communist Party caucus to Vladimir Putin on the recognition of the self-proclaimed DPR and LPR in February, Nikolai Kolomeitsev, the first deputy head of the Communist parliamentary group, told RIA Novosti. (Ria Novosti)

GEOPOLITICS: Foreign Minister Dmitry Kuleba believes that deputies of the State Duma of the Russian Federation will not support the bill on the recognition of Russian illegal entities in the occupied territory of Donbass. “So far, we do not see any intention to make this decision, to recognize "DNR" and "LNR" in Russia. This is part of a "big game" to destabilise the situation.” (Pravda)

GEOPOLITICS: French President Emmanuel Macron intends to hold telephone talks on the situation around Ukraine with Russian and Ukrainian leaders Vladimir Putin and Vladimir Zelensky in the coming days. This was announced at the Elysee Palace following a video conference between Macron and the leaders of the United States and NATO. (TASS)

GEOPOLITICS: Ukrainian Defense Minister Alexey Reznikov said early on Tuesday he had received no information so far indicating the possibility of Russia’s invasion of his country in the near future. "As of today, the armed forces of Russia created no strike groups, indicating they were ready to launch an offensive tomorrow," he told Ukraine’s ICTV television channel, adding that a scenario of a Russian attack in the near future was also unlikely. When asked about the likelihood of Russia attacking Ukraine on February 20, the final day of the Olympic Games in Beijing, the minister said the probability was "low." (TASS)

U.S./CHINA: The US-China relationship is becoming increasingly adversarial, according to US Secretary of State Antony Blinken who on Monday criticised what he described as a Chinese government that was more assertive and aggressive than was seen in previous decades. During a virtual discussion hosted by the Ahavath Achim synagogue in Atlanta, Blinken reiterated that there were both competitive and cooperative components to the China policy that United States President Joe Biden’s administration had adopted in its first year. (SCMP)

RUSSIA/CHINA: Russia and China conducted a joint naval exercise in the western part of the Arabian Sea, Interfaxcites the Russian Defense Ministry as saying Tuesday. (BBG)

CORONAVIRUS: The head of the World Health Organization (WHO) warned on Monday that it was dangerous to assume the Omicron variant would herald the end of COVID-19's acutest phase, exhorting nations to stay focused to beat the pandemic. "It’s dangerous to assume that Omicron will be the last variant and that we are in the end game," Tedros Adhanom Ghebreyesus told a WHO executive board meeting of the two-year pandemic that has killed nearly 6 million people. (RTRS)

CORONAVIRUS: A new study shows high levels of coronavirus antibodies that fight the omicron variant four months after a third dose of the Pfizer vaccine, a positive sign for the durability of a booster shot’s effectiveness. The study from researchers at Pfizer, BioNTech and the University of Texas Medical Branch shows virus-fighting antibodies enduring four months after the third dose, helping answer the key question of how long protection from the booster shot lasts. (Hill)

JAPAN: A moderate decline in the yen is positive for the economy, Bank of Japan Governor Haruhiko Kuroda tells members of parliament. Higher commodity prices are having a bigger impact on inflation than the yen’s current weakness. Prime Minister Fumio Kishida, also speaking in parliament, says it’s hard to draw a line between good and bad price gains. (BBG)

JAPAN: A Japanese advisory panel is set to approve the expansion of tougher measures against COVID-19 to 18 additional regions on Tuesday, putting more than 70% of the country under restrictions. The western prefectures of Osaka and Kyoto are among the areas covered by the measures, taken in response to a surge of infections and hospitalisation driven by the Omicron variant. (RTRS)

JAPAN: A Covid test may not be needed to be counted as infected in Japan, as an omicron surge quickly overtakes the country’s health-care resources and forces the government to find workarounds. People who have close contact with a Covid patient and later became symptomatic can be considered infected, according to a statement on the government’s website. (BBG)

NEW ZEALAND: New Zealand will proceed with plans to start a phased reopening of the border from the end of February even as the infectious omicron variant starts to take hold in the community. The initial phase will allow New Zealanders living in Australia to return home and undertake self-isolation rather than a lengthy stay in a managed isolation hotel. In December, the government pushed out the original start date of Jan. 17 citing the need for more people to be boosted to combat omicron. (BBG)

SOUTH KOREA: Korea said Tuesday it plans to improve the foreign exchange market system to better ensure foreign investors' market access as it seeks to win developed market status from Morgan Stanley Capital International (MSCI). To this end, the government is considering extending the FX market operating hours and permitting foreign financial institutions to directly take part in the interbank FX market. It is also mulling easing regulations on offshore transactions of the Korean won. (Korea Times)

NORTH KOREA: North Korea seems to have test-fired at least two cruise missiles from an inland area, a South Korean official said, in what would be Pyongyang's fifth known round of missile launches this year. "We still need to conduct a detailed analysis (on the launches)," the military official told reporters on condition of anonymity. "But I want to say that should such a missile be launched southward, our detection and interception systems have no problem countering it." The official stopped short of providing details, including the exact location of the launch. (Yonhap)

NORTH KOREA: South Korea has detected no signs of North Korea trying to restore underground tunnels at its purportedly demolished Punggye-ri nuclear test site despite indications of maintenance work there, a Seoul official said Tuesday. The official's assessment came after Olli Heinonen, a former deputy director-general at the International Atomic Energy Agency, told the Voice of America (VOA) earlier this week that the North is maintaining the site as evidenced by "trails of the cars and cleaning of snow." (Yonhap)

TAIWAN: Taiwan Vice President William Lai left on Tuesday to shore up a shaky relationship with Honduras and attend the swearing in of its new leader, an event U.S. Vice President Kamala Harris is also going to, potentially giving the two a chance to meet. (RTRS)

CANADA: Canada's foreign affairs department was hit with a cyberattack last week, according to the Treasury Board of Canada. The hack of Global Affairs Canada, the government entity responsible for diplomatic and global relations, occurred on Wednesday, according to a statement provided by the Treasury Board to ABC News. The statement does not identify who carried out the cyberattack. (ABC)

IRAN: Iran is ready to consider direct talks with the United States if it feels it can get a good deal with guarantees, its foreign minister said on Monday, adding no decision had yet been made. Indirect talks between Iran and the United States on reviving the 2015 nuclear deal resumed almost two months ago. Western diplomats have indicated they were hoping to have a breakthrough over the next few weeks, but sharp differences remain. Iran has rejected any deadline imposed by Western powers. (RTRS)

IRAN: A senior member of the U.S. team negotiating with Iran has left the role amid a report of differences of opinion on the way forward, as the urgency to salvage the 2015 Iran nuclear deal intensifies. The official did not give a reason for the change but said personnel moves were 'very common' a year into an administration. The departure comes at a critical time as the United States and its European allies last week said there were just weeks to salvage the 2015 Iran nuclear deal, formally called the Joint Comprehensive Plan of Action (JCPOA). (RTRS)

TURKEY: The suspension of flight operations at Turkey's Istanbul Airport was extended on Tuesday due to heavy snowfall, while winter weather snarled transport across the city, home to about 16 million people. "The suspension of flight operations have been extended until 1000 GMT on Jan 25 due to adverse weather conditions," the Istanbul Airport said on its website. (RTRS)

ISRAEL: Opposition leader Benjamin Netanyahu publicly declared Monday that he had not agreed to a charge of moral turpitude as part of a plea bargain in his corruption trial, indicating that he has no intention to do so or to leave politics, since reports said he had released the statement in response to the collapse of plea deal talks with Attorney General Avichai Mandelblit. The former prime minister vowed to remain the leader of his Likud party and of the right-wing political camp, and to eventually return to power and lead the country. (Times of Israel)

CHINA

PBOC: The People’s Bank of China urged banks to prioritize credit growth with an "all-out" effort to achieve a good start in Q1, support the reasonable financing needs of real estate developers and better meet home purchase demand, the Shanghai Securities News reported citing a conference held by the central bank in Beijing. Maintaining stability is the biggest progress before the downward economic pressure is fundamentally relieved, the meeting said, emphasizing that finance should play a keep role in underpinning the economy. (MNI)

ECONOMY: Most provinces in China set their annual economic growth targets this year lower than their actual growth rate in 2021 amid increased downward pressure, Caixin reported. Economically developed provinces in China such as Guangdong, Jiangsu, Shandong, Shanghai and Beijing mostly set the 2022 growth target between 5% and 5.5%, which are references for understanding the national GDP target, the newspaper said citing Guo Lei, chief economist of GF Securities. The city of Beijing sets a 2022 target of “more than 5%”, the lowest among 30 provinces that have released targets, the newspaper said. (MNI)

ECONOMY: The number of jobs available per applicant among fresh university graduates fell to 0.88 in the fourth quarter of 2021, according to the survey conducted by the China Institute for Employment Research (CIER) at Renmin University of China and job search website Zhaopin. This was only slightly higher than the reading of 0.79 in the second quarter of 2020, when China’s economy was hit hard by the initial coronavirus outbreak, and down significantly from 1.52 in the second quarter of last year. “At present, the employment market for college graduates remains stable and under pressure, while structural contradictions still exist,” the report said, referring to the mismatch of supply and demand in the job market. (SCMP)

PROPERTY: China Evergrande Group on Monday asked for more time from its overseas creditors to work on a "comprehensive, detailed and effective" debt restructuring plan, according to a statement on the company's website. The company called on bondholders to refrain from taking any “radical legal actions” that may affect its current hard-won stability. The company will communicate with its creditors after further studies and evaluation, citing the complexity due to the group's large size, its many businesses and stakeholders involved, the statement said. (MNI)

PROPERTY: Chinese property developer Shimao Group joined smaller peer Agile Group to sell its stake in a Guangzhou complex to state-owned partner China Overseas Land & Investment in a push to reduce its debt. Shimao, which held a 26.7% stake in the Guangzhou Asian Games City, the same as Agile, said late on Monday it sold its holdings to joint venture partner COLI for 1.84 billion yuan ($290.65 million). Agile made a similar announcement earlier in the day. (RTRS)

PROPERTY: Shimao Group Holdings Ltd. has put 34 projects across China up for sale, as the embattled developer seeks to raise billions of dollars amid mounting debt repayment pressures, Caixin reported Tuesday. The company is among Chinese real-estate companies that are selling assets to pay bills during a liquidity crunch following a government crackdown on excessive borrowing and speculation in the housing market. Regulators see asset sales as key to easing the crisis that’s impeding an economic recovery. (BBG)

EQUITIES: Tencent Holdings, China's biggest social media and video games company, on Tuesday said it fired nearly 70 staff over bribery and embezzlement incidents last year and named 13 companies it had blacklisted from future contracts. Tencent said in a social media post that it had also reported more than 10 people to authorities over their actions. As the Chinese government has intensified a crackdown on corruption in recent years, tech companies have doubled down on their own investigations into irregularities as their valuations and profiles have soared following the country's tech boom. Tencent started its anti-graft campaign in 2019 and has been regularly reporting the results of its probes. (RTRS)

OVERNIGHT DATA

JAPAN DEC TOKYO CONDOMINIUMS FOR SALE -9.7% Y/Y; NOV +95.4%

JAPAN DEC NATIONWIDE DEPT STORE SALES +8.8% Y/Y; NOV +8.1%

JAPAN DEC TOKYO DEPT STORE SALES +11.1% Y/Y; NOV +10.0%

AUSTRALIA Q4 CPI +3.5% Y/Y; MEDIAN +3.2%; Q3 +3.0%

AUSTRALIA Q4 CPI +1.3% Q/Q; MEDIAN +1.0%; Q3 +0.8%

AUSTRALIA Q4 CPI TRIMMED MEAN +2.6% Y/Y; MEDIAN +2.3%; Q3 +2.1%

AUSTRALIA Q4 CPI TRIMMED MEAN +1.0% Q/Q; MEDIAN +0.7%; Q3 +0.7%

AUSTRALIA Q4 CPI WEIGHTED MEDIAN +2.7% Y/Y; MEDIAN +2.3%; Q3 +2.2%

AUSTRALIA Q4 CPI WEIGHTED MEDIAN +0.9% Q/Q; MEDIAN +0.7%; Q3 +0.8%

AUSTRALIA DEC NAB BUSINESS CONDITIONS +8; NOV +11

AUSTRALIA DEC NAB BUSINESS CONFIDENCE -12; NOV +12

Business confidence fell sharply in December as the spread of the Omicron variant threatened to dampen the economy’s post-lockdown momentum. The fall in business conditions was driven by the employment component, which fell despite strong jobs growth reported in official data, reflecting the complexity of the labour market situation as businesses faced growing worker shortages and the prospect of a ‘shadow lockdown’ through the summer. Still, the profitability and trading components of conditions held up in the month. In terms of confidence, the aggregate index fell sharply to be well into negative territory – below the level seen during the Delta wave – signalling the depth of concern among firms about the trajectory of the outbreak. Capacity utilisation and forward orders both fell back. Price pressures also continued in December, with both reported labour and purchase cost growth near record levels. Final products price growth also edged up from an already high rate and retail price growth printed at 2% in quarterly terms. With significant disruption to supply chains and labour markets, price pressures are to be expected and the key question will be how quickly (if at all) these pressures abate over coming months. (NAB)

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 100.1; 16 JAN 97.9

Consumer confidence increased 2.2% last week, rising above the neutral level of 100. The recovery came in the same week that the unemployment rate was reported as dropping to its lowest in more than 13 years. COVID cases appear to have peaked, though deaths unfortunately made new highs. Confidence was driven by rises of 7.7% in Victoria, 8.8% in WA and 3.7% in Queensland. But it dropped in NSW (-2.4%) and SA (-2.6%). The live entertainment of the Australian Open tennis and great weather might have added to Victoria’s positive outlook. Ahead of the Q4 2021 CPI data, inflation expectations recorded a 0.1ppt rise to match the recent high of 5% reached in December. (ANZ)

NEW ZEALAND DEC PERFORMANCE SERVICES INDEX 49.7; NOV 47.2

Four months on from Delta’s big hit in August, the Performance of Services Index (PSI) has still not quite shaken its contractive tone. Still, it did improve to 49.7 during December, from the disappointing 47.2 it posted for November. Then again, last week’s Quarterly Survey of Business Opinion (QSBO) showed service-related firms reporting extreme difficulty in finding staff to begin with (notwithstanding an abidingly strong intention to increase employment levels, nevertheless). While the PSI was about flat for December, overall, it was full of positives and negatives in its details. By industry, for instance, there was a significant acceleration in Cultural, Recreation & Personal – to an unadjusted 72.8, from 30.0 in November and 18.1 in October. This is consistent with the country moving into the traffic light system of COVID management in December. As it turned out, December’s PSI couldn’t match the reasonable expansion that the PMI registered for the month (with its 53.7). As such, the PSI and PMI combined leaves us cautious as to what to expect for the bounce in GDP for Q4, and momentum into the start of 2022. (BNZ)

SOUTH KOREA Q4, P GDP +4.1% Y/Y; MEDIAN +3.9%; Q3 +4.0%

SOUTH KOREA Q4, P GDP +1.1% Q/Q; MEDIAN +1.1%; Q3 +0.3%

SOUTH KOREA 2021 GDP +4.0% Y/Y; MEDIAN +4.0%; 2020 -0.9%

CHINA MARKETS

PBOC INJECTS NET CNY50BN VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY150 billion via 14-day reverse repos with the rate unchanged at 2.25% on Tuesday. The operation has led to a net injection of CNY50 billion after offsetting the maturity of CNY100 billion repos today, according to Wind Information.

- The operation aims to keep liquidity stable before the Spring Festival, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1750% at 09:36 am local time from the close of 2.0499% on Monday.

- The CFETS-NEX money-market sentiment index closed at 50 on Monday vs 41 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3418 TUES VS 6.3411

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3418 on Tuesday, compared with 6.3411 set on Monday.

MARKETS

SNAPSHOT: Pentagon Puts Troops On High Alert

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 484.42 points at 27106.3

- ASX 200 down 177.945 points at 6961.6

- Shanghai Comp. down 58.314 points at 3464.923

- JGB 10-Yr future up 3 ticks at 150.96, yield down 0.6bp at 0.136%

- Aussie 10-Yr future down 0.5 ticks at 98.035, yield up 0.7bp at 1.945%

- U.S. 10-Yr future -0-08+ at 128-08, yield down 1.06bp at 1.760%

- WTI crude up $0.42 at $83.73, Gold down $1.7 at $1841.37

- USD/JPY down 13 pips at Y113.82

- U.S. PUTS 8,500 TROOPS ON HIGH ALERT AS TENSIONS OVER UKRAINE RISE

- UK WARNS RUSSIA PLANS TO SEIZE KYIV IN "LIGHTNING WAR"

- BIDEN TOUTS “TOTAL UNANIMITY” ON UKRAINE WITH WITH EUROPEAN LEADERS

- AUSTRALIA CPI TRIMMED MEAN INFLATION PRINTS ABOVE RBA TARGET MID-POINT

- MAS RAISE POLICY BAND APPRECIATION RATE, CITE MOUNTING INFLATION PRESSURES

BOND SUMMARY: Risk Aversion Aids Core FI But ACGBs Take Hit From Strong Inflation Data

Australia's above-forecast Q4 CPI data delivered a blow to ACGBs but continued risk rout provided support to the core FI space, underpinning partial recovery in Aussie bonds. The prospect of a Russian military strike on Ukraine and uncertainty ahead of Wednesday's monetary policy announcement from the increasingly hawkish Fed cumulated into an unabating sense of anxiety.

- Consumer prices down under grew 3.5% Y/Y in the final quarter of 2021, while the RBA's preferred metric of underlying inflation printed at +2.6%, crossing above the mid-point of the +2.0%-3.0% target range for the first time since 2014. The data inspired more sell-side desks to revise their RBA rate-hike calls, with market participants adding hawkish central bank bets. ACGBs took a hit after the release of inflation figures, with 3-year yield hitting its highest point since Apr 2019 amid a growing choir of voices expecting the RBA to scrap their QE programme as soon as next week. Risk-off flows brought the space some reprieve, but bear flattening remains evident in cash Sydney trade. ACGB yields last sit 1.5-7.0bp higher across the curve. Aussie bond futures have ticked away from post-CPI lows, YM last -4.0 & XM -1.5. Bills trade 1-4 ticks lower through the reds.

- T-Notes crept higher, retracing part of their sharp pullback from Monday's NY hours. The contract last operates -0-07 at 128-09+, just shy of best levels of the session. Eurodollar futures trade 1.0-5.0 ticks lower through the reds. Tsy curve has steepened in cash Tokyo trade, with yields last seen +0.6bp to -2.0bp. Conf. Board Consumer Confidence & 5-Year Tsy auction will take focus in the U.S. today.

- JGB futures advanced after an initial spell of mild weakness, which seemed like a follow-through from the move in U.S. Tsys observed in the NY session. JBH2 printed new session highs after the Tokyo lunch break and last sits at 150.99, 6 ticks above previous settlement. The yield curve steepened in cash trade, with the super-long end slipping. Japan's MOF sold Y598.8bn of 40-Year JGBs, with high yield matching the forecast based on BBG dealer poll. Comments from BoJ Gov Kuroda and PM Kishida were shrugged off, as both officials failed to offer much in the way of fresh insights.

JGBS AUCTION: Japanese MOF sells Y598.8bn 40-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y598.8bn 40-Year JGBs:

- High Yield: 0.760% (prev. 0.725%)

- Low Price 97.97 (prev. 99.15)

- % Allotted At High Yield: 39.9532% (prev. 91.4874%)

- Bid/Cover: 2.574x (prev. 2.367x)

FOREX: Risk-Off Storm Intensifies, Forces AUD/USD To Give Away Post-CPI Gains

The Asia-Pac session witnessed a renewed flight into safe haven currencies, as regional equity benchmarks retreated alongside U.S. e-mini futures on the back of imminent policy decision from the Fed & deepening geopolitical angst.

- The yen comfortably outperformed its G10 peers, with Tokyo traders digesting Monday headlines surrounding the Russo-Ukrainian stand-off. Demand for safer assets provided a tailwind for the greenback, but the DXY failed to re-test yesterday's peak.

- Sydney morning saw AUD catch a bid after Australian inflation data topped expectations, with the RBA's preferred measure of core inflation printing above the mid-point of the target range for the first time since 2014. The release boosted hawkish RBA bets, with market pricing pointing to potential for a rate hike as soon as in May.

- There was talk of cross flows applying pressure to the kiwi after Australian data hit the wires, albeit AUD/NZD struggled to take out the NZ$1.0700 figure. New Zealand's own Q4 CPI data on Thursday will provide an input into the comparative assessment of policy outlooks of Antipodean central banks.

- Post-CPI bid in AUD evaporated later in the Asia-Pac session, as risk-off flows intensified. AUD/USD erased its initial gains, but the Aussie remained the best performing high-beta currency. NOK was the main laggard, as the Ukraine tension outweighed an uptick in crude oil prices.

- German Ifo Survey & U.S. Conf. Board Consumer Confidence take focus on the data front today. Central bank speaker slate features ECB's Holzmann & Riksbank's Skingsley.

FOREX OPTIONS: Expiries for Jan25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1300-10(E1.6bln), $1.1330-40(E703mln), $1.1450(E1.1bln)

- USDJPY: Y115.25-40($663mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/01/2022 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 25/01/2022 | 0800/0900 | ** |  | ES | PPI |

| 25/01/2022 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 25/01/2022 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 25/01/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 25/01/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 25/01/2022 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 25/01/2022 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 25/01/2022 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 25/01/2022 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 25/01/2022 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 25/01/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 25/01/2022 | 1630/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 25/01/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.