-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Aussie Labour Market Tightens, Unemployment At 3.9%

MNI FOMC Hawk-Dove Spectrum

MNI EUROPEAN OPEN: Hawkish Tilt

EXECUTIVE SUMMARY

- FED NODS TO MARCH RATE HIKE, SIGNALS QT IS FORTHCOMING (MNI)

- U.S. HOLDS FIRM ON RUSSIAN DEMANDS AMID UKRAINE TENSIONS (BBG)

- RUSSIA, UKRAINE AGREE TO KEEP CEASEFIRE, NEW TALKS NEXT MONTH (AFP)

- PM JOHNSON FORCED TO WAIT FOR “PARTYGATE” REPORT AMID LEGAL WRANGLING (i)

- EU TO LAUNH WTO CASE AGAINST CHINA OVER LITHUANIA ROW (SCMP)

- CHINA IS SAID TO WEIGH BREAKING UP EVERGRANDE TO CONTAIN CRISIS (BBG)

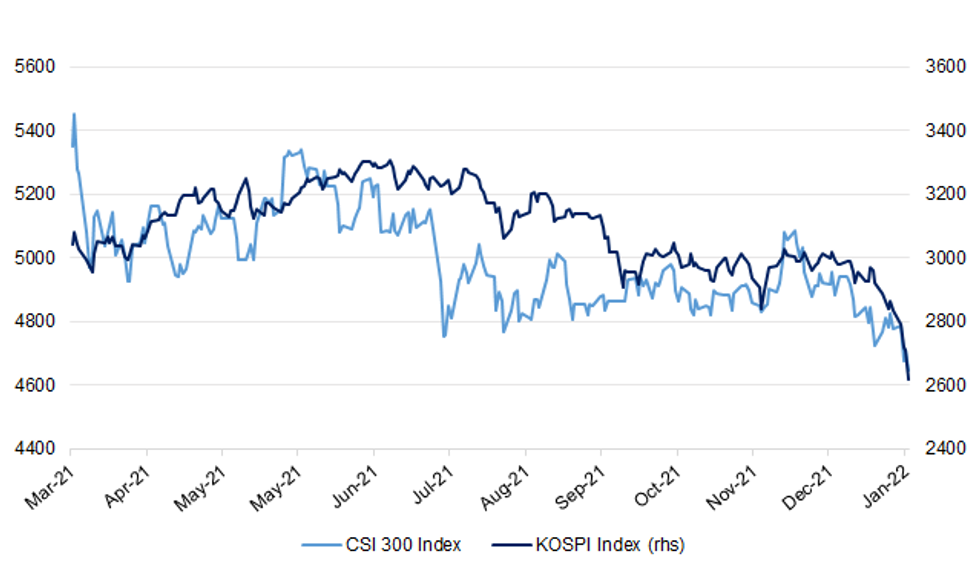

Fig. 1: CSI 300 & KOSPI Down 20% From Recent Peaks, Poised To Enter Bear Market

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Prime Minister Boris Johnson has been forced to wait for the report which could decide his future after Sue Gray‘s inquiry was delayed by legal wrangling. Cabinet Office mandarins have been locked in talks with lawyers, human resources executives and the Metropolitan Police Service about any redactions that may be needed before Ms Gray sends the report to No 10. (i)

POLITICS: Boris Johnson has told Tory MPs that he has received “bad advice” and warned that deposing him could result in a general election. The prime minister held 15-minute meetings with more than a dozen Tory MPs in recent days as he tries to shore up his support before a potential confidence vote. He has claimed that his successor would have to hold an election to legitimise their leadership and also argued that now is the wrong time to remove him given that Russia is on the brink of invading Ukraine. (Times)

POLITICS: Boris Johnson’s plight is leaving government in a state of near-paralysis, with key decisions delayed while No 10 focuses on defending the prime minister amid the Downing Street parties scandal, sources say. “It’s not as easy to get policy through if it has to involve No 10 at the moment. I’m aware the civil servants feel it – feel the slowdown,” said one frustrated aide in a Whitehall department. “You just need to have things to carry on doing.” (Guardian)

POLITICS: A new raft of Conservative MPs are poised to send letters of no confidence in Boris Johnson when the long-awaited “partygate” report is published, as the prime minister was pressured by his supporters to oversee a complete clearout of No 10. The Guardian has learned that senior backbenchers are to move as a collective to force a no-confidence vote in Johnson once senior civil servant Sue Gray releases her findings, which on Tuesday helped trigger a criminal inquiry. (Guardian)

POLITICS: Leaked emails appear to contradict Boris Johnson’s claim that he did not intervene to authorise the evacuation of more than 150 stray dogs and cats from Afghanistan. The prime minister had said it was “complete nonsense” to suggest that he stepped in to help Pen Farthing, founder of the animal charity Nowzad, secure safe passage out of Kabul in August. New evidence submitted to the foreign affairs committee by Raphael Marshall, a civil servant turned whistleblower, suggests that the prime minister did just that. Those involved in the evacuation said that Farthing’s campaign had frustrated attempts to save other Afghans. (Times)

POLITICS: Boris Johnson's parliamentary assistant contacted a private charter company in the hope of securing a plane to transport animals and staff during the evacuation of Afghanistan, telling them that her boss was keen, Sky News understands. (Sky)

POLITICS: British lawmakers have accused the government of leaking market sensitive information to the media before the budget last October. In a report published Thursday, the influential Treasury Committee called for a formal investigation after the national minimum wage rate was reported by ITV News two days before the budget. A number measures were trailed but the announcement of a 6.6% increase in the minimum wage for those aged 23 and over constituted “inside information as defined by market abuse regulations,” the cross-party panel said. (BBG)

POLITICS/ECONOMY: Raising National Insurance contributions will lead to higher prices in the shops, a report by MPs has warned Boris Johnson. The Commons Treasury Committee says that the planned increase in April risks driving up inflation while the country grapples with a cost of living crisis. (Telegraph)

EUROPE

ECB: The European Central Bank has warned lenders with significant Russian exposure to ready themselves for the imposition of international sanctions against Moscow if it invades Ukraine. The warning from the ECB, which supervises 115 of the biggest eurozone banks, comes as the US has warned that Russia would face “massive consequences” if sent troops into Ukraine. Sanctions would raise significant risks for the international banks with large Russian exposure, including Citi of the US, France’s Société Générale, Austria’s Raiffeisen and Italy’s UniCredit. ECB officials have asked for details of how the banks would handle different scenarios, such as a move to block Russian banks from accessing the Swift international payments system, according to several people briefed on the talks. (FT)

GERMANY/UKRAINE: Germany will supply 5,000 military helmets to Ukraine to help defend against a possible Russian invasion, it said on Wednesday - an offer Kyiv mayor and former world champion boxer Vitali Klitschko dismissed as "a joke" that left him "speechless". Defence Minister Christine Lambrecht said Berlin, which has faced growing criticism of its refusal to supply arms to Ukraine as other Western countries have done, was responding to a request for military equipment, specifically helmets. (RTRS)

GERMANY/CHINA: Chinese hacker group APT 27, long suspected of launching attacks on Western government agencies, has started targeting German companies in sectors such as pharmaceuticals and technology, Germany's Federal Office for the Protection of the Constitution (BfV) said on Wednesday. In addition to stealing trade secrets and intellectual property, the hackers may be trying to penetrate customers' and service providers' networks to infiltrate several companies at once, the BfV said in a circular to companies. (RTRS)

ITALY/RUSSIA: Prime Minister Mario Draghi's government urged organizers to cancel the event — a virtual chat with top Italian executives [with Vladimir Putin] — and asked state-controlled companies not to attend, likely aware of the bad optics of Italian business leaders digitally rubbing elbows with Putin just as his troops were threatening war in Ukraine. Almost instantly, Moscow swooped in, with Kremlin spokesperson Dmitry Peskov calling it "a perverted understanding" to suggest Putin might be using the meeting to win business support amid possible looming sanctions against Russia. Despite the Italian government's protests, the meeting went ahead on Wednesday, with some state-controlled Italian companies such as energy giant Enel choosing to still attend. Others, including energy firms Eni and Snam, bowed out. (POLITICO)

DENMARK: The BA.2 subvariant of the Omicron coronavirus variant, which is dominant in Denmark, appears more contagious than the more common BA.1 sub-lineage, Danish Health Minister Magnus Heunicke said on Wednesday in a national address. (RTRS)

IRELAND: A number of large Russian warships have been spotted sailing towards Ireland ahead of a planned naval exercise off the coast of Cork next month. Military experts believe the flotilla, which includes five ships, will be used in the drills some 130 nautical miles off the south west, an area within Ireland’s Exclusive Economic Zone (EEZ). (Irish Times)

GAS: Nord Stream 2 AG has established a German subsidiary, Gas for Europe GmbH. The new company will become the owner and operator of the 54 km section of the Nord Stream 2 gas pipeline located in German territorial waters and the onshore facilities site in Lubmin as an independent transport system operator in accordance with the German Energy Act (Nord Stream 2)

U.S.

POLITICS: Justice Stephen Breyer will step down from the Supreme Court at the end of the current term, according to people familiar with his thinking. Breyer is one of the three remaining liberal justices, and his decision to retire after more than 27 years on the court allows President Joe Biden to appoint a successor who could serve for decades and, in the short term, maintain the current 6-3 split between conservative and liberal justices. (NBC)

POLITICS: Senate Majority Leader Chuck Schumer wants to confirm President Joe Biden’s choice to replace Justice Stephen Breyer on an expedited timeline that would take only weeks to finish. Schumer plans to move Biden’s nominee through the process on a timetable similar to that used by Republicans to confirm Justice Amy Coney Barrett in 2020, according to a person familiar with his plans. She was confirmed 30 days after then-President Donald Trump made the nomination. “We want to move quickly,” Schumer told reporters in New York. “We want to get this done as soon as possible.” (BBG)

POLITICS: Conservatives know they're unlikely to stop President Biden from filling a Supreme Court vacancy, but they plan to target Senate Democrats who face competitive re-election fights and are all but certain to vote for the successor to Justice Stephen Breyer. Between the lines: The general strategy will be to tie those Democrats to positions seen as political liabilities in states like Arizona, Georgia and New Hampshire, where incumbents are seeking re-election this year, an operative briefed on early strategy talks told Axios. (Axios0

OTHER

GEOPOLITICS: Envoys from Moscow and Kyiv on Wednesday committed to a fragile ceasefire in eastern Ukraine during talks in Paris and agreed to continue their discussions against the backdrop of warnings that Russia may be preparing to invade its neighbour. A German government source later confirmed that the next round would take place in Berlin in the second week of February. An aide to French President Emmanuel Macron, speaking on condition of anonymity, stressed that the talks had been about resolving the separatist fighting in eastern Ukraine since 2014, not the threat of a Russian invasion. But "the question was whether the Russians wanted to signal a thaw", he said, adding that the "difficult" discussions had ultimately resulted in something positive. "In the current circumstances, we received a good signal," he said. (AFP)

GEOPOLITICS: The U.S. has handed over its written response to Russia’s security demands, the latest step in the high-stakes diplomacy over Moscow’s buildup of more than 100,000 troops on Ukraine’s border. Now it’s up to President Vladimir Putin’s government, which didn’t see its key demands met, to reply. The document delivered in Moscow on Wednesday by U.S. Ambassador John Sullivan sets out “a serious diplomatic path forward,” Secretary of State Antony Blinken told reporters in Washington. “We are open to dialogue, we prefer diplomacy. It remains up to Russia to decide how to respond. We are ready either way.” But the top U.S. diplomat also made clear that the report largely sticks to points presented by the U.S. and NATO allies in recent weeks: It rejects Russia’s demand that NATO redraw its borders and close its door to Ukraine’s potential future membership, instead offering suggestions such as arms control talks and greater transparency over troop movements and military exercises. “We will uphold the principle of NATO’s open door,” Blinken said, reaffirming the U.S. and European position that Russia shouldn’t get to dictate which nations join the military alliance. “We also do lay out areas where we believe that together we could actually advance security for everyone, including for Russia.” (BBG)

GEOPOLITICS: Russian Foreign Minister Sergei Lavrov and his U.S. counterpart Antony Blinken may meet next week in Geneva to discuss U.S.’s response to Russia’s security proposals, Kommersant reports, citing unidentified people familiar with details. (BBG)

GEOPOLITICS: U.S. Department of State Ned Price told NPR: “I want to be very clear - if Russia invades Ukraine, one way or another, Nord Stream 2 will not move forward, and we want to be very clear about that.” (NPR)

GEOPOLITICS: Turkish President Tayyip Erdogan said on Wednesday that he had invited Russian leader Vladimir Putin to visit the republic. "We invited Mr. Putin to our country. We want to take some steps to organize our bilateral meeting," he said on the NTV channel . According to Erdogan, he would like to discuss bilateral relations with the President of the Russian Federation. He also reiterated Ankara's readiness "if both sides wish" to host the presidents of Russia and Ukraine, Vladimir Putin and Vladimir Zelensky, so that they can "continue to restore the atmosphere of peace." (TASS)

GEOPOLITICS: The North Atlantic Alliance has not kept previous promises of not moving eastward and has now moved right up to Russia's borders, Dmitry Medvedev, deputy chairman of the Russian Security Council (SB), said in an interview with Russian media, including the TASS agency. The Russian documents on security guarantees handed over to the US and NATO are not rigid, but very specific and definite, Medvedev said. Negotiations on security guarantees are the only way to resolve the situation, the deputy chairman of the Security Council believes. "We do not want any war, no one is looking for a war, and everything must be done so that there is no war," Medvedev said.(TASS)

GEOPOLITICS: UK Defence Secretary Ben Wallace is in Europe to build momentum for sanctions against Russia and support for Ukraine amid fears of another invasion. Mr Wallace has also confirmed that he'll soon be travelling to Moscow for talks with Russia's Defence Minister, Sergei Shoigu. But he's lowering expectations of any diplomatic breakthrough. He told the BBC there's still "a chance" that an invasion by Russia could be stopped, but he added "I'm not optimistic". (BBC)

GEOPOLITICS: UK Foreign Minister Liz Truss may visit Russia within the next two weeks, Russian Foreign Minister Sergey Lavrov told reporters on Wednesday. "We have already agreed on the date," he said. "It’ll happen in the next two weeks." (TASS)

GEOPOLITICS: The Pentagon wants to supercharge its development of hypersonic weapons programs in order to keep up with advances by Russia and China, according to four people familiar with the effort. On Feb. 3, Defense Secretary Lloyd Austin plans to meet with the CEOs of about a dozen defense companies to attack the problem, said the people, who spoke on condition of anonymity to discuss internal deliberations. The meeting comes after the military services delivered budget proposals for fiscal 2023 that Austin believed did not adequately speed up development and fielding of the weapons in order to keep up with Chinese and Russian advances, the people said. (POLITICO)

CORONAVIRUS: Moderna Inc said on Wednesday it had started a mid-stage study, testing a booster dose of its COVID-19 vaccine specifically designed to target the Omicron coronavirus variant, a day after rival Pfizer Inc launched a similar trial. The company said while a third shot of its original coronavirus vaccine increased neutralizing antibodies against the variant at the lower dose, their levels declined six months after the booster dose was administered. (RTRS)

GLOBAL TRADE: The European Union is set to pull the trigger on a World Trade Organization (WTO) case against China, having completed its own investigation into Beijing’s alleged coercion of Lithuania. The EU will file a request for consultation with China in Geneva imminently, according to multiple sources familiar with the matter, having gathered what it sees as ample evidence from interviews with affected Lithuanian business over the past month. (SCMP)

U.S./CHINA: U.S. Secretary of State Antony Blinken spoke to Chinese Foreign Minister Wang Yi about Ukraine on Wednesday, highlighting global security and the economic risks that could stem from further Russian aggression, the State Department said. "Secretary Blinken ... conveyed that de-escalation and diplomacy are the responsible way forward," department spokesman Ned Price said in a statement. (RTRS)

JAPAN: The largest international business group in Japan has warned that the country’s tight border restrictions risk staunching foreign investment and crushing Tokyo’s efforts to compete as a global financial centre. Christopher LaFleur, a special adviser and former chair of the American Chamber of Commerce in Japan, said a de facto ban on the entry of non-resident foreigners would probably deter international companies from maintaining a presence in the country. (FT)

AUSTRALIA/CHINA: China’s new ambassador to Australia has called for the two countries to get their relationship “back to the right track” after more than four years of chilly diplomatic relations, saying he saw his role as a “noble mission.” Xiao Qian, Beijing’s new top diplomat in Canberra, said the two governments were at a “critical juncture” in a statement issued shortly after he arrived in Australia on Wednesday. (BBG)

RBNZ: Karen Silk has been appointed as the Assistant Governor / General Manager of Economics, Financial Markets and Banking at the Reserve Bank of New Zealand – Te Pūtea Matua. (RBNZ)

SOUTH KOREA: South Korea will closely monitor financial market movements and trends related to Fed’s monetary policy and take steps to stabilize the market preemptively if needed, Vice Finance Minister Lee Eog-weon says in a meeting. To take market stabilization steps if needed, such as direct purchase of government bonds, in coordination with the Bank of Korea. BOK to strengthen monitoring of both domestic and external risk factors and take timely market stabilizing measures if needed. (BBG)

NORTH KOREA: North Korea fired two suspected short-range ballistic missiles Thursday, adding to its biggest monthly barrage of weapons tests since August 2019 and forcing its nuclear program back onto the Biden administration’s agenda. South Korea’s Joint Chiefs of Staff said the military “detected two projectiles that appeared to be short-range ballistic missiles,” fired at around 8 a.m. from around North Korea’s eastern city of Hamhung toward waters off the nearby coast. (BBG)

RUSSIA: Russian President Vladimir Putin does not plan to participate in the Munich Security Conference this year, Russian leader's press secretary Dmitry Peskov told RIA Novosti. For the first time in two years, the Munich Security Conference is to be held in person on February 18-20. (RIA Novosti)

MEXICO: Commissioners at Mexico’s telecom regulator voted 3-2 against a project that proposed to deny a pay-TV license to billionaire Carlos Slim’s Claro, according to people familiar with the situation. The vote means the project will have to go back to the units at the regulator studying the case, three people said, asking not to be named because the information isn’t yet public. (BBG)

INDONESIA: Policy normalization aims at getting Indonesia ready to face heightened global risks, according to Bank Indonesia Governor Perry Warjiyo. The central bank expects Indonesia’s yield differentials to be more flexible amid the risks, Warjiyo said in Bank Indonesia’s Annual Investment Forum on Thursday. Key interest rate is to remain low until the central bank sees signs of inflation picking up. At the same time, the central bank will make sure there is sufficient liquidity in the domestic banking system for lenders to extend loans. (BBG)

HONG KONG: The two-week nomination period for Hong Kong’s chief executive race will begin on February 20, nearly a week later than previously indicated, formally kicking off the contest to decide who will be the next leader of the city’s new “patriots-only” government. Announcing the dates of the nomination period, which will conclude on March 5, the Registration and Electoral Office also disclosed its latest guidelines for the election. (SCMP)

HONG KONG: Bank of America Corp. is looking at moving staff from Hong Kong to Singapore as the Chinese territory’s strict zero Covid approach is forcing businesses to review their operations, the Financial Times reported. The U.S bank is looking at roles in a number of business lines and operations, the newspaper said, citing a person close to the bank. It’s doing contingency planning and it’s unclear how many people could be moved, according to the report. (FT)

IRAN: Iran will likely reach agreement on limits to its nuclear program by the end of February with the pact starting operation by April, including the lifting of the embargo on Iranian oil sales, Russian envoy Mikhail Ulyanov said in televised comments Wednesday. (BBG)

ISRAEL: Israel is planning a campaign to discredit a UN commission formed to investigate the violence in Gaza last May and the root causes of the protracted conflict in the occupied West Bank and Gaza, according to an Israeli Foreign Ministry cable seen by Axios. Why it matters: Israeli officials say they are highly concerned that the commission’s report will refer to Israel as an "Apartheid state" and that its findings could damage Israel's reputation, particularly among progressives in the West. The report is expected in June. (Axios)

KAZAKHSTAN: Deputies of the Senate of Kazakhstan at a plenary session approved amendments abolishing the lifetime chairmanship of the ex-president of the republic Nursultan Nazarbayev in the Assembly of the People of Kazakhstan (ANC) and the Security Council, follows from the broadcast on the Senate’s website. (RIA Novosti)

CHINA

FISCAL: China's governments should continue to curb administrative expenses, optimize spending structure and improve the efficiency of capital use, the Economic Daily said in a commentary. Stabilizing growth requires higher spending on major projects to improve infrastructure and people’s livelihood, the newspaper said. Though China's last year fiscal revenue grew 10.7% y/y to CNY20.25 trillion, CNY480 billion above target, it was partly driven by the lower comparable base of the previous year. If compared with 2019, the growth rate is 6.4%, and the two-year average growth rate is 3.1%, which is lower than GDP growth, the newspaper noted. (MNI)

ECONOMY: China will pick up the pace in “perfecting” legal rules against unfair competition among companies, an official of the top market watchdog said on Thursday. Appropriate “traffic lights” will be set up, with anti-trust rules focusing on areas such as the platform economy, technological innovation, information security and livelihoods, Yuan Xilu, a regulatory official, told reporters. The disorderly expansion of online platform companies exploiting their advantages in capital, data and technology has squeezed individual businesses, added Pu Chun, vice minister of the watchdog, the State Administration for Market Regulation. (RTRS)

PROPERTY: Chinese authorities are considering a proposal to dismantle China Evergrande Group by selling the bulk of its assets, according to people familiar with the matter. The restructuring proposal, submitted to Beijing by officials in Evergrande’s home province of Guangdong, calls for the developer to sell most assets except for its separately listed property management and electric vehicle units, the people said, asking not to be identified discussing a private matter. A group led by China Cinda Asset Management Co., a state-owned bad debt manager and major Evergrande creditor, would take over any unsold property assets, the people said. (BBG)

PROPERTY: China Evergrande Group aims to present a preliminary debt restructuring plan in six months as the company conducts an audit, according to a company statement on Hong Kong Exchanges and Clearing late Wednesday. The indebted developer reiterated that it will assess the status of the company and formulate a plan to safeguard the rights of stakeholders while listening carefully to creditors. (MNI)

YUAN: The Chinese yuan could strengthen above 6.32 against the U.S. dollar should global capital continue to flow into China’s stock and bond markets to hedge risks amid escalating Russia-Ukraine tensions and concerns about other developing markets' debt due to U.S. tightening, the 21st Century Business Herald reported citing FX traders. On Wednesday, the onshore yuan touched 6.3205 against the dollar, the highest since April 2018. Forex regulators may act if the yuan surges above 6.25 to curb speculation, the newspaper cited traders as saying. In the first three weeks of 2022, the net inflow of foreign capital into the A-share market reached a record daily average of US$413 million, the newspaper said. (MNI)

OVERNIGHT DATA

CHINA DEC INDUSTRIAL PROFITS +4.2% Y/Y; NOV +9.0%

JAPAN DEC, F MACHINE TOOL ORDERS +40.6% Y/Y; FLASH +40.5%

AUSTRALIA DEC WESTPAC LEADING INDEX -0.03% M/M; NOV +0.22%

The Index growth rate remains in slight negative territory in December consistent with the high degree of uncertainty around the near-term outlook as the strong reopening forces we saw in the December quarter are impacted by the current spectacular spread of Omicron. In that regard we have lifted our growth forecast for the December quarter 2021 from 2.2% to 2.6%, partly reflecting the compound boost of over 12% to retail sales in October/ November. In contrast, our own high frequency credit and debit card data for the first few weeks of January is pointing to a marked fall in consumer spending over that period which can be attributed to the Omicron shock. With confidence related spill overs to business investment and inventories in January we have marked down our forecast growth rate in the March quarter from a robust 2.3% to zero. Later quarters have been boosted to reflect the delayed catch up although, overall, forecast growth in 2022 has been lowered from 6.4% to 5.5%. (Westpac)

AUSTRALIA Q4 IMPORT PRICE INDEX +5.8% Q/Q; MEDIAN +1.4%; Q3 +5.4%

AUSTRALIA Q4 EXPORT PRICE INDEX +3.5%% Q/Q; MEDIAN -2.6%; Q3 +6.2%

NEW ZEALAND Q4 CPI +5.9% Y/Y; MEDIAN +5.7%; Q3 +4.9%

NEW ZEALAND Q4 CPI; +1.4% Q/Q; MEDIAN +1.3%; Q3 +2.2%

SOUTH KOREA FEB BUSINESS SURVEY M’FING 90; JAN 92

SOUTH KOREA FEB BUSINESS SURVEY NON-M’FING 82; JAN 78

SOUTH KOREA DEC RETAIL SALES +11.6% Y/Y; NOV +9.6%

SOUTH KOREA DEC DEPT STORE SALES +36.5% Y/Y; NOV +18.3%

SOUTH KOREA DEC DISCOUNT STORE SALES -6.1% Y/Y; NOV -10.3%

CHINA MARKETS

PBOC INJECTS NET CNY100BN VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY200 billion via 14-day reverse repos with the rate unchanged at 2.25% on Thursday. The operation has led to a net injection of CNY100 billion after offsetting the maturity of CNY100 billion repos today, according to Wind Information.

- The operation aims to keep liquidity stable before the Spring Festival, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1600% at 09:28 am local time from the close of 2.0131% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 44 on Wednesday vs 49 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3382 THURS VS 6.3246

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3382 on Thursday, compared with 6.3246 set on Wednesday.

MARKETS

SNAPSHOT: Hawkish Tilt

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 812.74 points at 26198.59

- ASX 200 down 123.325 points at 6838.3

- Shanghai Comp. down 42.046 points at 3413.562

- JGB 10-Yr future down 19 ticks at 150.77, yield up 1.4bp at 0.155%

- Aussie 10-Yr future down 5 ticks at 97.955, yield up 7.8bp at 2.023%

- U.S. 10-Yr future -0-03+ at 127-13, yield down 1.61bp at 1.848%

- WTI crude down $0.84 at $86.51, Gold down $6.05 at $1813.53

- USD/JPY up 2 pips at Y114.66

- FED NODS TO MARCH RATE HIKE, SIGNALS QT IS FORTHCOMING (MNI)

- U.S. HOLDS FIRM ON RUSSIAN DEMANDS AMID UKRAINE TENSIONS (BBG)

- RUSSIA, UKRAINE AGREE TO KEEP CEASEFIRE, NEW TALKS NEXT MONTH (AFP)

- PM JOHNSON FORCED TO WAIT FOR “PARTYGATE” REPORT AMID LEGAL WRANGLING (i)

- EU TO LAUNCH WTO CASE AGAINST CHINA OVER LITHUANIA ROW (SCMP)

- CHINA IS SAID TO WEIGH BREAKING UP EVERGRANDE TO CONTAIN CRISIS (BBG)

BOND SUMMARY: JGBs & ACGBs Under Post-FOMC Pressure, Tsys Stabilise

Asia-Pac core FI came under pressure from the post-FOMC impulse, while U.S. Tsys stabilised in the wake of a sharp sell-off. The Fed concluded their monetary policy meeting by paving way for a rate hike in March, while their rhetoric was testament to the potential for a steeper tightening path than had been previously anticipated.

- JGBs softened across the curve, as cash trading re-opened in Tokyo. Yields remain comfortably in positive territory, as Wednesday's FOMC meeting reinforced expectations of a growing policy divergence between the U.S. and Japan, with the BoJ committed to their current ultra-loose stance. JGB futures started the session on a softer footing and ground lower thereafter. JBH2 sits at 150.78, 18 ticks below last settlement, after hitting its worst levels in a week. The auction for 2-Year JGBs, which saw low bid match dealer expectations, provoked little to no market turbulence.

- ACGB yields shot higher as cash trading resumed after an Australian holiday, with Aussie bonds taking a hit from the FOMC's hawkish pivot. Yields last sit 6.2-8.7bp higher across the curve, after hitting fresh cycle highs in early Sydney trade. The main futures contracts tried to move away from worst levels, but YM eased off later in the session and last trades -8.0, with XM -6.0 (off lows) at typing. Bills trade 2-11 ticks lower through the reds.

- T-Notes blipped higher early on and stabilised thereafter. TYH2 last changes hands -0-03 at 127-13+. Eurodollar futures run 4.0-12.0 ticks lower through the reds. Tsy curve runs flatter in cash Tokyo trade, with yields last seen +3.0bp to -1.8bp. Advance GDP data, durable goods orders & weekly jobless claims headline the U.S. data docket today, with a 7-Year Tsy auction also due.

JGBS AUCTION: Japanese MOF sells Y2.4394tn 2-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.4394tn 2-Year JGBs:

- Average Yield -0.054% (prev. -0.093%)

- Average Price 100.119 (prev. 100.196)

- High Yield: -0.049% (prev. -0.090%)

- Low Price 100.110 (prev. 100.190)

- % Allotted At High Yield: 11.3799% (prev. 8.3284%)

- Bid/Cover: 3.874x (prev. 4.249x)

FOREX: Risk-Off Flows Sweep Across G10 FX Space After Fed's Hawkish Turn

The Fed's hawkish pivot turned the risk switch to off, driving defensive flows across the G10 FX space. Wednesday saw the FOMC set the scene for a March rate hike, while Fed Chair Powell signalled resolve in efforts to tackle elevated inflation, raising the prospect of a more aggressive tightening trajectory.

- Participants sought shelter in safe havens. USD/JPY printed a one-week high in early trade before trimming gains as demand for the greenback re-emerged. The DXY touched its best levels since Dec 20.

- Commodity-tied currencies went offered alongside crude oil futures, with the Antipodeans leading losses. The kiwi dollar was the worst performer, despite another beat in New Zealand's inflation data. Consumer prices in New Zealand grew 5.9% Y/Y in Q4, topping the median estimate & Nov MPS projection of 5.7%, as headline inflation reached the fastest pace since 1990. Meanwhile, the RBNZ's preferred measure of underlying inflation accelerated to +3.2% Y/Y, moving further above the mid-point of the Reserve Bank's target range. NZD/USD ignored domestic data and tumbled to its worst levels since early Nov 2020.

- Offshore yuan sank as the Asia-Pacific digested hawkish FOMC rhetoric. A slightly weaker than expected yuan fixing may have amplified selling pressure which helped the redback move further away from a new cycle high printed pre-FOMC on Wednesday.

- Today's data docket is rather U.S.-centric and includes local GDP, durable goods orders & jobless claims. Comments are due from ECB's Scicluna.

FOREX OPTIONS: Expiries for Jan27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1100(E524mln), $1.1150(E687mln), $1.1200-05(E692mln), $1.1250(E552mln)

- USD/JPY: Y113.00($761mln), Y113.50-60($867mln), Y114.80-00($1.1bln)

- GBP/USD: $1.3285-03(Gbp576mln), $1.3548-70(Gbp795mln)

- EUR/JPY: Y127.00(E1.1bln)

- AUD/USD: $0.7220(A$640mln)

- USD/CAD: C$1.2560-65($927mln)

- USD/CNY: Cny6.3450($560mln), Cny6.3500($1.3bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/01/2022 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 27/01/2022 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 27/01/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 27/01/2022 | 1330/0830 | ** |  | US | durable goods new orders |

| 27/01/2022 | 1330/0830 | *** |  | US | GDP (adv) |

| 27/01/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 27/01/2022 | 1330/0830 | * |  | CA | Payroll employment |

| 27/01/2022 | 1500/1000 | ** |  | US | NAR pending home sales |

| 27/01/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 27/01/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 27/01/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 27/01/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.