-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI BRIEF: Aussie Labour Market Tightens, Unemployment At 3.9%

MNI EUROPEAN OPEN: BoJ Reaffirms Stance, Tech Earnings Disappoint

EXECUTIVE SUMMARY

- FED NOMINEES: FOCUS IS ON FIGHTING INFLATION (MNI)

- FED’S DALY: ‘GRADUAL’ RATE HIKES WON’T DERAIL THE ECONOMY (MARKETWATCH)

- RUSSIA BLASTS U.S. TROOP MOVEMENT AS DESTRUCTIVE (BBG)

- UK TREASURY AND BOE WORK IN TANDEM TO HEAD OFF ‘COST OF LIVING CATASTROPHE’ (FT)

- BOJ’S WAKATABE: PREMATURE FOR BOJ TO TIGHTEN POLICY WITH GOAL UNMET (BBG)

- META SLUMPS AFTER REVENUE OUTLOOK MISSES ESTIMATES (BBG)

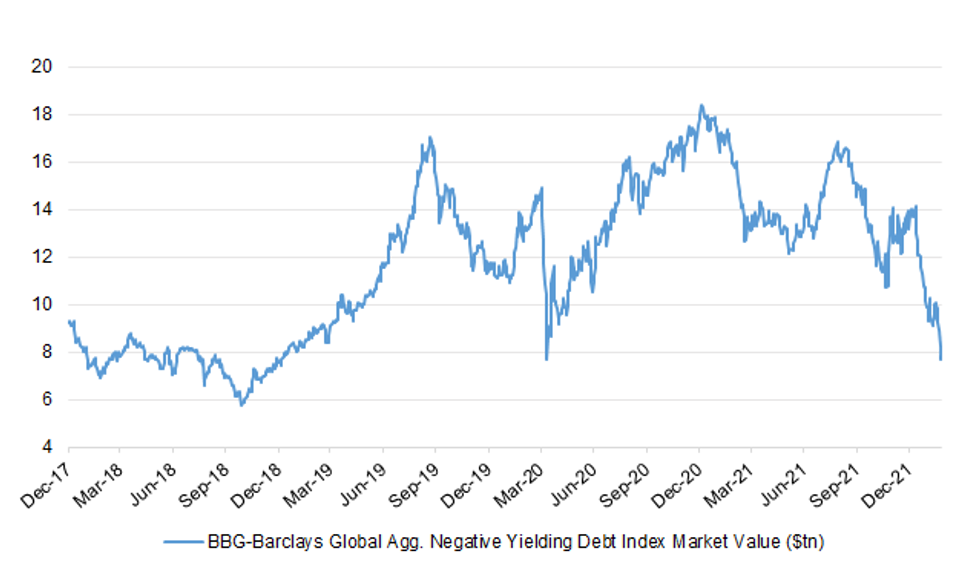

Fig. 1: BBG-Barclays Global Agg. Negative Yielding Debt Index Market Value ($tn)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

INFLATION/FISCAL: Rishi Sunak will join forces with the Bank of England on Thursday in an attempt to put the brakes on inflation, as he sets out plans to stop soaring energy bills causing a “cost of living catastrophe”. The chancellor will announce plans to slash hundreds of pounds from soaring domestic energy bills from April, seeking to control prices at a time when inflation had been expected to peak at close to 7 per cent. Meanwhile Andrew Bailey, BoE governor, is predicted to announce a rise in interest rates from 0.25 per cent to 0.5 per cent, confirming that fiscal and monetary firepower are both being deployed to hold down prices. The co-ordinated announcements are intended to calm nerves among consumers and in the markets, as Ofgem, the energy regulator, announces its plan for a sharp lift in Britain’s energy price cap from April. Ofgem moved forward to Thursday its announcement about the new level of the cap, which dictates bills for 22mn homes, from its original scheduled date of February 7. Analysts are expecting an increase in the cap of around £650 to more than £1,900 per household per year. (FT)

ECONOMY: Ministers are in danger of trapping the UK in a future of low growth and high taxes, according to the head of the country’s largest business group. Tony Danker, director-general of the CBI, will raise the concerns in a speech on Thursday about the impact of next year’s corporation tax rise on business activity with companies looking to invest as the country emerges from the coronavirus pandemic. The warning is the latest from business lobby groups about the effect of a series of tax increases ahead of a potential spring Budget when the government will come under pressure to tackle the rising cost of living. Others, such as the Federation of Small Businesses, have previously warned over the increase in national insurance in April. The FSB estimates that the hike will add more than £3,000 in tax for the average small business. (FT)

BREXIT: A Northern Ireland minister has ordered a halt to post-Brexit customs checks on agriculture-related goods in the most concrete defiance to date of trading rules put in place when the UK left the EU a year ago. Edwin Poots, the agriculture minister, announced his decision in Belfast on Wednesday after taking legal advice which he said concluded he could go ahead and halt inspections even without the full backing of Northern Ireland’s executive. “I can now direct the checks to cease in the absence of executive approval,” he said, adding the change would start at midnight. (FT)

POLITICS: Five Conservative MPs called for Boris Johnson’s resignation in just over 24 hours amid growing unrest at his handling of the Downing Street parties saga. A clutch of backbenchers from different generations and various wings of the party took the total number of Johnson’s own MPs publicly demanding his departure to 13. At least a further five, including members of the government, are considering submitting letters of no confidence in the coming days, The Times has learnt. While it is not thought to be a co-ordinated plot, momentum is growing behind a challenge. If Sir Graham Brady, the chairman of the 1922 Committee of Conservative backbenchers, receives 54 letters then Johnson will face a confidence vote among his parliamentary party. (The Times)

POLITICS/POLICY: Ministers have unveiled plans to tackle regional inequality - but Labour says the proposals lack ambition and new money to fund them. The levelling up strategy aims to close the gap between rich and poor areas by 2030 through improving services such as education, broadband and transport. Michael Gove said it would mean people can "take back control of their lives". But Labour asked: "Seriously, is this it?" - while researchers criticised the lack of detail. "This system is completely broken and he's given us more of the same," said Lisa Nandy, Labour's shadow levelling up secretary. Economic think tank the Institute for Fiscal Studies also suggested the government may have chosen its destination "with no sense" of how to get there. (BBC)

EUROPE

ITALY: Italy will drop restrictions for vaccinated people even in high-risk areas, Prime Minister Mario Draghi said, vowing to continue easing curbs in coming weeks. A four-tier system of restrictions is in place in Italy, with tighter rules for regions where infections and hospitalizations are higher, but regional authorities have asked to scrap it altogether. At a cabinet meeting Wednesday afternoon, Draghi said the government will announce a calendar of future reopening steps, and vowed to limit online schooling as much as possible. (BBG)

IRELAND: Growth in Ireland's service sector picked up in January as some firms reported a pick-up in trading conditions and consumer confidence following the lifting of almost all COVID-19 restrictions, a survey found on Thursday. The AIB IHS Markit Purchasing Managers' Index (PMI) was 56.2 in January, up from 55.4 in December. The rate of expansion was well ahead of the 50 mark that separates growth from contraction but among the weakest registered in the current 11-month upturn. The survey showed renewed growth in the transport, tourism and leisure sector, driven by the domestic market, including the beginnings of a recovery in local tourism. Cost pressures remained elevated, but the rate of input price inflation eased to a six-month low, while charges increased at the softest rate since last September. (RTRS)

U.S.

FED: The Federal Reserve can move gradually away from its ultra-easy monetary policy stance without derailing the U.S. economic expansion, said San Francisco Fed President Mary Daly on Wednesday. In an exclusive interview with MarketWatch, Daly said that she expects to fully support the initial benchmark interest rate hike at the Fed’s next meeting in March. “It is clear that inflation is too high and the labor market is strong, so we do need to act,” Daly said. But after that, the timing of “gradual” further rate hikes depends on the data. “I do absolutely expect the policy rate to rise over the course of the year, but by how much and how quickly and during what meetings – those things I’m going to leave open,” Daly said. The San Francisco Fed president, who is not a voting member of the Fed’s interest-rate committee this year, said the economy would continue to expand, just at a slower pace. (MarketWatch)

FED: MNI: Fed Nominees Say Focus Is On Fighting Inflation

- Federal Reserve nominees Lisa Cook, Philip Jefferson and Sarah Bloom Raskin said fighting inflation is the most important priority and it is crucial the central bank stand ready to prevent inflation expectations from becoming unanchored - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FED: The Federal Reserve’s chief bank watchdog shouldn’t tell lenders what sectors they can do business with, Sarah Bloom Raskin said in testimony set for delivery to the Senate committee weighing her confirmation as the most important U.S. supervisor of Wall Street banks. Raskin has drawn Republican opposition over her past remarks on climate change, and her prepared remarks appear to address that criticism. Raskin said that bank regulators must not be distracted by “short-term political agendas or special interest groups,” so they can focus on big-picture risks, including “from nature and cataclysmic weather-related events.” But, she also said that the supervision role isn’t about picking favorite industries. (BBG)

FED: After an earlier nominee for a top U.S. banking regulation post was torpedoed, White House officials are determined not to let it happen again and have circled around President Joe Biden’s nominees for three top Federal Reserve jobs. (RTRS)

FED: MNI INTERVIEW: Omicron To Prolong High Inflation - Fed's Garriga

- The Omicron variant of Covid is likely to prolong the record surge in U.S. inflation this year, with the headline PCE measure likely to end 2022 several tenths of a percent higher than forecast by the FOMC, Federal Reserve Bank of St. Louis research director Carlos Garriga said in an interview - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

BANKS: Treasury Secretary Janet Yellen said it’s too early to contemplate adjusting capital requirements for U.S. banks based on how much risk they face from climate change. “It’s just premature at this point to talk about raising capital requirements,” Yellen said Wednesday in an interview with Bloomberg News. Before that could happen, she said, “it’s really important that regulators do the groundwork that’s necessary for them to evaluate risks to individual firms.” (BBG)

EQUITIES: Facebook parent Meta Platforms Inc. said user additions stalled in the fourth quarter and gave a disappointing forecast for the current period, raising concerns about the company’s future growth. Shares plunged as much as 24% in late trading. Facebook reported 2.91 billion monthly users in the fourth quarter, representing no growth from the prior period. The social network is feeling the impact of increased competition for users’ time, and a shift in interest to video where advertising isn’t as lucrative. Meta said revenue in the current quarter would be $27 billion to $29 billion, compared to $30.25 billion analysts estimated on average. (BBG)

EQUITIES: Stock markets’ selloff in January dealt double-digit losses to a range of hedge funds investing in technology and other fast-growing companies, sparking questions about whether a popular and lucrative strategy for these firms is running out of steam. Whale Rock Capital Management’s hedge fund lost 15.9% for the month in the share class that invests in public and private companies, following a 9% loss last year, according to a person familiar with the firm. Tiger Global Management’s hedge fund, which also lost money last year, lost 14.8% for the month, another person said. Melvin Capital Management and Light Street Capital Management both lost 15% following double-digit losses in 2021, clients said. (MarketWatch)

OTHER

GLOBAL TRADE: The number of absences reported to port operators in southern California each day is dropping “continues to drop, bringing operations closer to normal, Alan McCorkle, president of Yusen Terminals LLC at the Port of Los Angeles, said Wednesday. That’s a welcome sign for the more than 100 ships waiting off the coast to unload at the U.S.’s two largest ports of Los Angeles and Long Beach. Dockworkers have been hit hard by the omicron variant, with positive Covid-19 infections among Longshore and Warehouses Union workers on the West Coast reaching 1,878 through Jan. 28. That’s more positive cases among the almost 15,000 ILWU members than in all of 2021. (BBG)

U.S./CHINA: The U.S. House of Representatives on Wednesday advanced a multibillion-dollar bill aimed at increasing American competitiveness with China and boosting U.S. semiconductor manufacturing, teeing up the legislation for full approval by the chamber this week. (RTRS)

U.S./CHINA: President Biden is eager to sign the China competition bill into law, says White House spokeswoman Jen Psaki. (BBG)

U.S./CHINA: The Biden administration is developing new regulations that could lay the groundwork to bar TikTok and other Chinese-owned apps that present national security concerns, after revoking Trump administration orders that sought to ban the apps. The Commerce Department is reviewing comments on proposed rules that would expand government oversight of apps that could be exploited “by foreign adversaries to steal or otherwise obtain data,” according to a federal filing. The rules could allow the Commerce Department to require apps to submit to audits, allowing independent scrutiny of their source code and other data they collect. (Washington Post)

JAPAN: Bank of Japan Deputy Governor Masazumi Wakatabe says it would be premature to tighten policy before the BOJ’s 2% inflation target is achieved in a stable and sustainable manner. Any premature unwinding of stimulus could damage the economy’s recovery from the pandemic, Wakatabe says in an online speech to local business leaders in Wakayama. (BBG)

JAPAN: Japan’s government is considering extending the quasi-state of emergency covering Tokyo and 12 other prefectures beyond the Feb. 13 end date, broadcaster FNN reports, citing an unidentified government official. Extension until Feb. 27 floated as an option. “Difficult” to lift restrictions as planned amid recent rise in cases, official quoted as saying. Formal decision to come next week. (BBG)

NEW ZEALAND: New Zealand will finally begin reopening to the world at the end of this month, as frustration mounts over a border that’s been closed for almost two years to keep Covid-19 out. The border will reopen to vaccinated New Zealanders and some critical workers coming from Australia at midnight on Feb. 27, and to the same groups from the rest of the world from midnight March 13, Prime Minister Jacinda Ardern said in a speech Thursday in Auckland. Returning citizens will no longer need to enter a government managed isolation facility on arrival, but will be required to self-isolate and return negative tests. The five-step plan will allow non-citizen visa holders and as many as 5,000 international students to enter the country from midnight on April 12. By July, the border will be open to anyone from Australia and to travelers from other visa-waiver countries such as the U.S. and the U.K. The final step in October will see the border fully reopened to visitors from anywhere in the world. (BBG)

NEW ZEALAND: New Zealand on Thursday announced a phased reopening of its border that has been largely closed for two years, but the travel and airline industry said much more was needed to revive the Pacific island nation’s struggling tourism sector. Ardern said opening borders in a managed way would allow people to reunite and help fill workforce shortages while ensuring the healthcare system could manage an increase in cases. “Our strategy with Omicron is to slow the spread, and our borders are part of that,” she said, referring to the highly contagious variant of the virus currently dominant around the world. (RTRS)

SOUTH KOREA: Finance Minister Hong Nam-ki said Thursday the country's housing prices are expected to pick up their declining pace amid the central bank's rate hike and tighter lending rules. Hong said the government is committed to implementing its current real estate policy with a focus on increasing the home supply in a bid to stabilize housing prices. "We think housing prices need to undergo a downward correction to some degree, given that home prices have excessively risen. The government plans to stick to its housing policy to stabilize housing prices," Hong said in a meeting on the housing policy. Sales prices of apartments in Seoul fell 0.01 percent in the fourth week of January from a week earlier, marking the first decline in 20 months, according to the Korea Real Estate Board. (Yonhap)

BOK: South Korea should stay vigilant on the possibility of heightening financial market volatility amid persistent worries over inflation in major economies and other risk factors, though the markets showed signs of stability in recent days, a senior central bank official said Thursday. The Bank of Korea (BOK) held a meeting to monitor global financial market situations following the five-day Lunar New Year holiday that ended on Wednesday during which local stock and currency markets were closed. The meeting was presided over by BOK Vice Gov. Lee Seung-heon. "During the Lunar New Year holiday, international financial markets appear to have remained stable as a whole," Lee was quoted as saying at the meeting. (Yonhap)

BOC: MNI BRIEF: BOC Sees Rising Path of Rates to Curb Inflation

- Bank of Canada Governor Tiff Macklem said on Wednesday that interest rates will rise to slow inflation from around 5% now back toward the 2% target next year, without signaling if the first move will come at the next decision in March - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

CANADA: Candice Bergen was voted interim leader of the Conservatives on Wednesday evening after a majority of party MPs voted to remove Erin O'Toole as leader earlier in the day. Bergen has been the MP for the Manitoba riding of Portage—Lisgar since 2008. She most recently served as the Conservatives' deputy leader and has been among the party's most prominent voices in the House of Commons. As interim leader, Bergen will not be allowed to run for permanent leader when that race is conducted. A date has not yet been determined. (CBC News)

CANADA: Canada’s federal banking regulator, Peter Routledge, said he believes that rising interest rates will curb some of the speculative demand in the nation’s housing markets, with some regions potentially recording price declines. Routledge made the comments on The Herle Burly podcast. “There is a speculative fever that takes over private markets and that’s what’s playing out,” Routledge said on a podcast hosted by former Liberal Party adviser David Herle (BBG)

MEXICO: Mexico’s central bank will probably raise the key interest rate this month, and then follow inflation data and U.S. Federal Reserve decisions closely to decide its next moves, Banxico board member Jonathan Heath said. The debate for February’s decision will be whether to increase borrowing costs by a quarter point or half a point, he noted in a podcast with a Grupo Financiero Banorte analyst. He added that starting in March, it may be difficult to hike rates each time by 50 basis points as Mexico waits for the Fed to act and needs to take into account its own sluggish economy, Heath said.

BRAZIL: Brazil’s central bank signaled that it sees a reduction in the pace of interest rates adjustments after announcing Wednesday an increase of 150 basis points in the country’s borrowing costs to 10.75%. “For its next steps, the Committee foresees as adequate, at this moment, a reduction in the pace of adjustment of the interest rate,” the central bank said in a statement after the decision. “This indication reflects the stage of the tightening cycle as its cumulative effects will manifest themselves over the relevant horizon.” The central bank is undertaking one of the world’s most aggressive monetary policy tightening, after boosting rates eight times from 2% a year ago. (BBG)

RUSSIA: Russia denounced the U.S. decision to move more forces to Eastern Europe, warning it could complicate diplomatic efforts to resolve the crisis. “These unjustified, destructive steps increase military tensions and narrow the space for political solutions,” Interfax quoted Deputy Foreign Minister Alexander Grushko as saying. (BBG)

RUSSIA: US State Department spokesperson Ned Price rejected Moscow’s assertion that Washington is escalating tensions by sending additional troops to Europe, accusing Russia of attempting to turn “reality upside down”. “These are not permanent moves; they are precisely in response to the current security environment in light of this increasingly threatening behaviour by the Russian Federation,” Price told reporters. (Al Jazeera)

RUSSIA: President Joe Biden, French President Emmanuel Macron“affirmed their support for Ukraine’s sovereignty and territorial integrity” and reviewed “ongoing coordination on both diplomacy and preparations to impose swift and severe economic costs on Russia should it further invade Ukraine,” White House says in readout of call between leaders. (BBG)

RUSSIA: Russia and the United States are expected to hold consultations in the near future concerning the functioning of their foreign missions and the situation with Russia’s Ambassador to the US Anatoly Antonov, a source in the Russian Foreign Ministry told TASS on Wednesday. "This topic is discussed on a daily basis among other numerous issues related to the operation of foreign missions," he said when asked about how realistic it is that Antonov will have to leave the US amid the situation related to the issuance of visas to the security personnel of the US ambassador to Russia. "There will be targeted consultations on the subject in the near future at the level of direct supervisors of bilateral relations," the source added. (TASS)

RUSSIA: German Chancellor Olaf Scholz plans to hold a meeting with Russian President Vladimir Putin in Moscow in the near future, as he himself said in an interview with the ZDF TV channel on Wednesday. "I will soon talk [with Putin] in Moscow, discussing the necessary issues. There is a need for a well-coordinated policy towards the European Union and NATO," Scholz pointed out. "It [the meeting] is scheduled to take place in the near future," he added without specifying the date of his visit to Moscow. Scholz noted that he maintained active contact on the Ukraine issue with allies and partners in the European Union. "There is almost nothing else that concerns us. And I certainly have talked with the Russian president and we are currently making the necessary preparations," he said, adding that he would make a visit to the US soon. (TASS)

RUSSIA: German media regulator MABB has officially banned the broadcasting of RT DE in the country, claiming that the broadcast organisers had no necessary permission. German watchdog's decision to ban RT DE from broadcasting is forcing Moscow to retaliate against German media in Russia, the Russian Foreign Ministry said on Wednesday. (Sputnik)

RUSSIA: Boris Johnson has told Vladimir Putin of his "deep concern about Russia's current hostile activity" on the Ukrainian border amid fears Moscow is planning to invade its neighbour. More than 100,000 Russian troops have amassed near the border in a major military build-up. The prime minister spoke to the Russian president in a phone call on Wednesday afternoon. (Sky)

RUSSIA: Lithuania’s president called for Germany and the US to commit more troops to his Baltic country and send a signal to Moscow over its military build-up in Ukraine and neighbouring Belarus. Gitanas Nauseda said the Baltic countries were facing their “most dangerous situation since regaining independence” in 1990-91 due to the more than 100,000 Russian troops amassed on the border with Ukraine and “even more importantly” their presence in Belarus, an ally of Moscow. That puts Russia’s military potentially only 100km from its exclave in Kaliningrad, along the narrow “Suwalki gap” that divides Lithuania and the other Baltic states from Poland and the rest of Europe. (FT)

SOUTH AFRICA: South Africa’s excess deaths, seen as a more accurate assessment of the impact of the coronavirus than official statistics, have fallen to levels last seen before the omicron variant was identified. (BBG)

SOUTH AFRICA: A sub-variant of the omicron coronavirus strain, known as BA.2, is spreading rapidly in South Africa and may cause a second surge of infections in the current wave, one of the country’s top scientists said. BA.2 is causing concern as studies show that it appears to be more transmissible than the original omicron strain, the discovery of which was announced by South Africa and Botswana in November. Research also shows that getting a mild infection with either of the two strains may not give a robust enough immune response to protect against another omicron infection. There’s no indication that the sub-variant causes more severe disease from infection surges seen in Denmark and the U.K. Separately, South Africa’s excess deaths, seen as a more accurate assessment of the impact of the coronavirus than official statistics, have fallen to levels last seen before the omicron variant was identified.

ENERGY: Ten Democratic U.S. Senators urge the Biden administration to reevaluate the export of LNG, saying in a letter that domestic natural gas producers’ pricing overseas results in higher prices for U.S. consumers. The group, led by Senators Jack Reed and Angus King, say rising natural gas prices have placed a “heavy burden” on American families. (BBG)

OIL: Algeria will raise its oil production to 992,000 barrel per day (bpd) in March as part of an OPEC+ agreement reached on Wednesday, Energy Minister Mohamed Arkab said, according to a report by state news agency APS. Arkab said the decision by the Organization of the Petroleum Exporting Countries and allies led by Russia to continue moderate 400,000 bpd monthly output increases was due to the Omicron coronavirus variant not affecting global economies. OPEC+ will however continue monitoring the oil market amid the rapid spread of Omicron, he said. (RTRS)

OVERNIGHT DATA

JAPAN JAN, F JIBUN BANK SERVICES PMI 47.6; FLASH 46.6

JAPAN JAN, F JIBUN BANK COMPOSITE PMI 49.9; FLASH 48.8

The Japanese services sector entered 2022 facing a renewed downturn in demand conditions. Latest PMI data signalled a return to contraction territory for both business activity and total new orders, with the rates of reduction the sharpest for five and four months, respectively. Panel members highlighted that the Omicron variant and renewed restrictions had dampened output and demand. Moreover, service providers reduced staffing levels at the sharpest pace for 20 months as firms struggled to replace voluntary leavers. Firms were also less optimistic that activity would rise over the next 12 months, as positive sentiment reached a five-month low. The weakness in the larger service sector contributed to a broad stagnation in private sector output in January. Total business activity dipped into contraction territory for the first time since September, despite a near eight-year high in manufacturing output growth. Businesses in the Japanese private sector did, however, note an easing in price pressures for the first time since August as input prices rose at the softest pace for three months. Despite this, input price inflation remained above the longterm trend as supply chain disruption continued to dampen domestic and global activity. This remains a major headwind for the Japanese private sector along with uncertainty regarding future variants of COVID-19. That said, IHS Markit estimates the economy will return to prepandemic levels within 2022, forecasting growth of 3.4% this year." (IHS Markit)

AUSTRALIA JAN, F MARKIT SERVICES PMI 46.6; FLASH 45.0

AUSTRALIA JAN, F MARKIT COMPOSITE PMI 46.7; FLASH 45.3

The surge in COVID-19 cases heavily impacted business confidence in the service sector, leading to lower demand and a sharp decline in activity. That said, employment conditions remained resilient in the face of the Omicron wave with firms indicating their desire to keep hiring. Supply issues meanwhile snowballed amid the worsening of COVID-19 conditions. Staff absenteeism, delivery delays and material shortages led to further accumulation of backlogged work, thus reflecting capacity constraints even as demand eased. Price pressures in the service sector also worsened because of constraints, which remains a trend worth watching moving forward. This is particularly so given the risk of inflation worsening with the unleashing of pent-up demand following the recovery from the Omicron COVID-19 wave. (IHS Markit)

AUSTRALIA DEC BUILDING APPROVALS +8.2% M/M; MEDIAN -1.0%; NOV +2.6%

AUSTRALIA DEC PRIVATE SECTOR HOUSES -1.8% M/M; NOV -1.6%

AUSTRALIA DEC TRADE BALANCE +A$8.356BN; MEDIAN +A$9.850BN; NOV +A$9.756BN

AUSTRALIA DEC EXPORTS +1% M/M; MEDIAN +1%; NOV +4%

AUSTRALIA DEC IMPORTS +5% M/M; MEDIAN +5%; NOV +8%

AUSTRALIA Q4 NAB BUSINESS CONFIDENCE +18; Q3 -2

According to Alan Oster, NAB Group Chief Economist, “Business confidence lifted in Q4 as high vaccination rates and the end of lockdowns saw economic activity rebound and the outlook improve considerably.” “Conditions were steady overall, reflecting that lockdown impacts were less severe in 2021 than in 2020,” said Mr Oster. “That said, many of the worst affected sectors such as retail and recreation & personal services saw conditions improve, and conditions also improved in NSW and Victoria where the most significant lockdowns had been imposed.” “The economy was showing considerable strength prior to the spread of the Omicron variant, and that translated into a positive outlook for the coming months,” said Mr Oster. “We now know that Omicron has dampened that recovery somewhat but, fundamentally, we expect that positive trajectory to continue when the current virus outbreak recedes.” Ongoing supply chain issues and border closures saw 85% of firms report availability of labour as a constraint on output, while 47% reported availability of materials as a constraint – both records in the history of the survey. As a result, both cost growth and retail price growth remained elevated. “A large share of businesses reported facing supply constraints in late 2022 as disruptions to global supply chains as well as a tightening labour market began to bite, and that has translated into higher inflation in official data,” said Mr Oster. “The key question will be when, if at all, supply chain pressures ease as well as how quickly wages respond to an increasingly tight labour market.” (NAB)

NEW ZEALAND JAN ANZ COMMODITY PRICE INDEX +1.0% M/M; DEC -0.3%

SOUTH KOREA JAN MARKIT M’FING PMI 52.8; DEC 51.9

South Korean manufacturers entered 2022 with the strongest improvement in operating conditions for six months, according to the latest PMI data. The improved reading of the Manufacturing PMI came as firms reported a renewed rise in output and the sharpest improvement in new order inflows since July. Moreover, firms noted that the rise in demand was broad-based, with a renewed expansion in new export sales. That said, supply chain disruption continued to hold back a stronger recovery in activity and demand in the manufacturing sector. Material shortages and rising input costs were exacerbated by delays in sourcing and receiving inputs, though firms will be buoyed by indications that these pressures were easing. Input prices rose at a softer pace, while the deterioration in vendor performance was the slowest in three months. Goods producers remained confident that output would rise over the coming 12 months, with firms citing a stronger degree of optimism coming into the new year. Positive sentiment reached the highest for five months amid hopes that the pandemic would near its end, which would trigger a significant recovery in global supply chains and boost the domestic and global economy." (IHS Markit)

MARKETS

SNAPSHOT: BoJ Reaffirms Stance, Tech Earnings Disappoint

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 319.96 points at 27213.64

- ASX 200 down 9.687 points at 7078

- Shanghai Comp. is closed

- JGB 10-Yr future down 4 ticks at 150.61, yield up 0.1bp at 0.180%

- Aussie 10-Yr future up 4.5 ticks at 98.115, yield down 4.5bp at 1.867%

- U.S. 10-Yr future +0-00+ at 128-04+, yield down 0.89bp at 1.766%

- WTI crude down $0.41 at $87.85, Gold down $0.89 at $1805.91

- USD/JPY up 6 pips at Y114.52

- FED NOMINEES: FOCUS IS ON FIGHTING INFLATION (MNI)

- FED’S DALY: ‘GRADUAL’ RATE HIKES WON’T DERAIL THE ECONOMY (MARKETWATCH)

- RUSSIA BLASTS U.S. TROOP MOVEMENT AS DESTRUCTIVE (BBG)

- UK TREASURY AND BOE WORK IN TANDEM TO HEAD OFF ‘COST OF LIVING CATASTROPHE’ (FT)

- BOJ’S WAKATABE: PREMATURE FOR BOJ TO TIGHTEN POLICY WITH GOAL UNMET (BBG)

- META SLUMPS AFTER REVENUE OUTLOOK MISSES ESTIMATES (BBG)

BOND SUMMARY: Core FI Supported By NASDAQ Weakness, JGB Futures Lag

Earnings-driven weakness for NASDAQ 100 e-minis provided some modest support for U.S. Tsys overnight, although there has been a move away from session extremes. TYH2 last +0-01 at 128-05, trading a touch shy of the peak of a 0-06+ range. Meanwhile, cash Tsys run 0.5-1.5bp richer across the curve, with very modest bull steepening in play. Thursday’s busy NY docket includes the ISM services survey, factory & durable goods data, weekly jobless claims, unit labour costs and challenger job cuts. We will also get the testimonies of Fed Governor nominees Raskin, Cook & Jefferson (the pre-released initial comments from the 3 didn’t reveal any major talking points, with a focus on inflation front & centre). Further afield, monetary policy decisions from the ECB & BoE will provide interest during early NY hours.

- JGB futures underperformed within the broader core FI space for most of the session, but manged to finish +1, while cash JGBs run little changed to 1.5bp richer across the curve, with some modest twist flattening in play. There was a lack of headline catalysts to facilitate the aforementioned underperformance in futures. Meanwhile, the super-long end drew support from a smooth round of 30-Year JGB supply (low price topped wider exp. while cover ratio dipped vs. prev. auction, but remained above the 6-auction average). Elsewhere, BoJ Deputy Governor Wakatabe was the latest BoJ board member to overtly push back against tightening/YCC tweak speculation.

- Aussie bonds drew support from the NASDAQ driven risk aversion, with YM +2.5 & XM +4.5, as the cash ACGB curve bull flattened. Local data had no tangible impact on the space. Bills finished unch. to +4 through the reds.

JGBS AUCTION: Japanese MOF sells Y723.5bn 30-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y723.5bn 30-Year JGBs:

- Average Yield 0.788% (prev. 0.719%)

- Average Price 97.86 (prev. 99.51)

- High Yield: 0.788% (prev. 0.720%)

- Low Price 97.85 (prev. 99.50)

- % Allotted At High Yield: 90.1222% (prev. 88.4482%)

- Bid/Cover: 3.447x (prev. 3.629x)

JAPAN: Limited Net International Security Flows, But Directional Changes Seen

Net investor flows witnessed in Japan’s latest round of weekly international security flow data were relatively limited in absolute size, but there were some interesting changes in net direction.

- Japanese investors were net sellers of foreign bonds, ending a streak of 3 consecutive weeks of net purchases, as hawkish central bank worry accelerated.

- Japanese investors were also net buyers of foreign equities, ending a streak of 3 consecutive weeks of net selling (buying the latest leg of the dip).

- Foreign investors reverted to net purchases of Japanese bonds after the largest round of weekly net sales since September was observed in the previous week.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -555.8 | 15.8 | 1016.3 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 690.2 | -86.7 | -760.7 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 561.8 | -1720.0 | -739.0 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -120.6 | 9.6 | 659.2 |

EQUITIES: Earnings Pressure On NASDAQ E-Minis Weighs On Broader Sentiment

Weakness in the NASDAQ 100 (on the back of disappointing earnings releases from both Facebook parent Meta & Spotify) weighed on broader risk appetite during Asia-Pac hours. This meant that the Nikkei 225 shed a touch over 1.0%, while the ASX 200 registered marginal losses. A reminder that broader Asia-Pac liquidity remains crimped by the ongoing observance of the LNY holiday period in both China & Hong Kong. The NASDAQ 100 led the losses in e-minis, last -2.2%, while the S&P 500 is -0.9% and the DJIA contract is marginally lower on the day (loosely as you would expect, based on relative tech sensitivity).

OIL: Crude Futures Marginally Lower In Asia

Some tech-driven weakness in U.S. e-mini futures has applied light weight to crude oil futures since Wednesday’s settlement, although both WTI & Brent have recovered from worst levels, to trade down ~$0.30 & ~$0.20, respectively, at typing. A reminder that Wednesday’s OPEC+ meeting resulted in the widely expected and pre-prescribed 400K bpd cumulative production hike for March, with plenty of questions apparent re: some of the pact’s participants’ ability to meet their individual production quotas.

GOLD: Flat In Asia, Upcoming Event Risk Eyed

Bullion is little changed, printing just above $1,805/oz, sticking to a very narrow range in Asia-Pac hours, after a downtick in the broader DXY supported gold on Wednesday. Softer than expected U.S. ADP employment data & continued focus on geopolitical tension surrounding Russia dominated yesterday’s headline flow, doing gold bulls no harm. Still, a familiar range remains in play, meaning the technical parameters that we have fleshed out in recent days remain intact.

- Looking ahead, Thursday’s BoE & ECB monetary policy decisions will provide some interest for participants, although more focus will be afforded to Friday’s U.S. NFP release.

FOREX: Tech Equity Weakness Generates Risk Aversion, Which Then Moderates

Risk aversion was the order of the day in Asia, albeit it gradually moderated as the session progressed. Riskier currencies went offered in early trade on the back of tech weakness in U.S. equity space, with NASDAQ 100 e-minis in retreat after disappointing earnings reports from Meta and Spotify.

- The AUD was the worst performer in the space, with AUD/USD extending its pullback from a one-week high printed Tuesday. Its Antipodean cousin clawed back some of its initial losses, which allowed AUD/NZD to come off a fresh seven-month high.

- USD/JPY regained poise after an initial downtick, as participants gradually lost some interest in the yen. The DXY continued to trade on a slightly firmer footing and may snap its three-day losing streak.

- Monetary policy decisions from the ECB & BoE headline today's economic docket, with a slew of global Services PMI readings as well as U.S. weekly jobless claims, factory orders & final durable goods orders also due.

- In addition to scheduled press conferences with ECB Pres Lagarde & BoE Gov Bailey, it may be worth following parliamentary testimonies from Fed nominees Raskin, Cook & Jefferson.

FX OPTIONS: Expiries for Feb03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1150-60(E1.9bln), $1.1195-00(E654mln), $1.1220-25(E720mln) $1.1275-00(E1.9bln), $1.1310-25(E1.2bln), $1.1335-40(E542mln)

- USD/JPY: Y112.35-50($965mln), Y113.00-20($657mln), Y113.80-00($606mln), Y114.90-00($1.9bln)

- GBP/USD: $1.3300(Gbp593mln), $1.3400(Gbp779mln), $1.3500-05(Gbp635mln)

- AUD/USD: $0.7100-20(A$1.1bln), $0.7130-50(A$1.4bln), $0.7200-08(A$755mln)

- NZD/USD: $0.6750-60(N$532mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/02/2022 | 0700/0200 | * |  | TR | Turkey CPI |

| 03/02/2022 | 0815/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 03/02/2022 | 0845/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 03/02/2022 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 03/02/2022 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 03/02/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 03/02/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (f) |

| 03/02/2022 | 1000/1100 | ** |  | EU | PPI |

| 03/02/2022 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 03/02/2022 | 1230/1230 |  | UK | BOE post-MPC Press Conference | |

| 03/02/2022 | 1245/1345 | *** |  | EU | ECB Deposit Rate |

| 03/02/2022 | 1245/1345 | *** |  | EU | ECB Main Refi Rate |

| 03/02/2022 | 1245/1345 | *** |  | EU | ECB Marginal Lending Rate |

| 03/02/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 03/02/2022 | 1330/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 03/02/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 03/02/2022 | 1330/1430 |  | EU | ECB post-policy meeting presser | |

| 03/02/2022 | 1345/0845 |  | US | Senate Hearing On Federal Reserve Nominees | |

| 03/02/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (f) |

| 03/02/2022 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/02/2022 | 1500/1000 | ** |  | US | Factory New Orders |

| 03/02/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 03/02/2022 | 1630/1130 | ** |  | US | US Bill 4 Week Treasury Auction Result |

| 03/02/2022 | 1630/1130 | * |  | US | US Bill 8 Week Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.