-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: U.S. CPI Front & Centre On Thursday

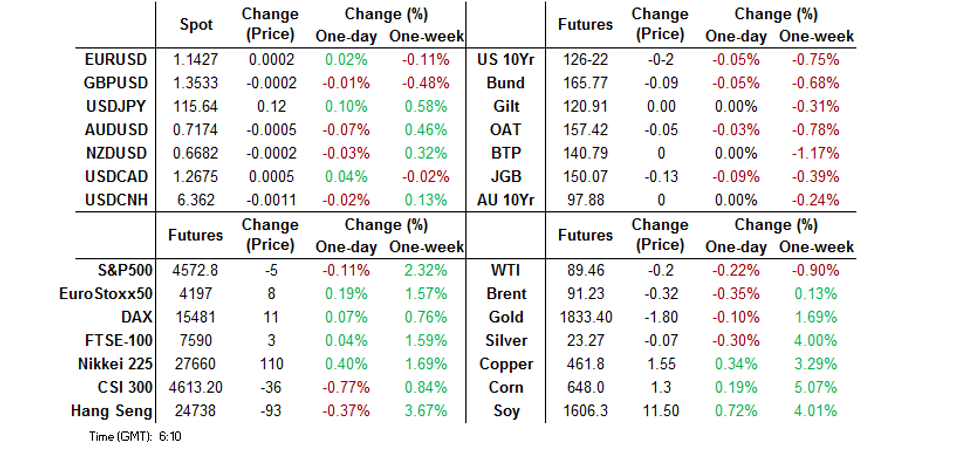

- E-minis nudged away from NY peaks, while U.S. Tsys richened at the margin. Broader market activity was limited ahead of today's U.S. CPI release.

- Headlines re: China's management of the troubled property developer space failed to impact sentiment.

- U.S. CPI is steals the limelight on Thursday. Other notable data releases include U.S. weekly jobless claims & Norwegian CPI. The Riksbank will deliver its monetary policy decision, while comments are due from ECB's Villeroy, Lane & de Guindos, as well as BoE's Bailey.

BOND SUMMARY: U.S. Tsys Muted Pre-CPI, JGBs Cheapen

E-minis moved away from their late NY session highs, lending modest support to U.S. Tsys during Asia-Pac trade. TYH2 last -0-02 at 126-22 as a result, 0-01+ off the peak of its 0-05 Asia-Pac range and away from Wednesday’s late NY lows. Cash Tsys run 0.5-1.5bp richer across the curve. There hasn’t been much to move the broader macro needle, with the latest round of headlines surrounding China’s management of the troubled property sector failing to generate a market reaction. Participants largely remain sidelined ahead of today’s U.S. CPI print. However, it wasn’t completely quiet on the flow front, a 6K block sale of TU futures and 40K delta hedged block buy of FVJ2 117.25 puts headlined overnight. On top of CPI, wage data and 30-Year Tsy supply provide further points of interest during NY hours.

- The latest round of cheapening didn’t lure participants into picking up off-the-run 15.5- to 39-Year JGBs at today’s liquidity enhancement auction, with spreads witnessed at auction widening, alongside a widening in the gap between the average and high spread observed when compared to the previous auction. The cover ratio held steady, just above 2.00x, although that is by no means firm. Some had suggested that the recent cheapening of super-long JGBs may draw increased lifer demand into the fold at today’s auction, that didn’t seem to occur. The super-long end led the cheapening post-supply, while JGB futures came under selling pressure, although that contract failed to break below its recent cycle low, subsequently recovering from worst levels of the day. 10-Year yields have registered a fresh cycle high, printing 22.8bp, with the major JGB benchmarks 0.5-4.0bp cheaper on the day, bear steepening. BoJ Governor Kuroda stressed that he sees no chance of a reduction in easing via a Mainichi interview that hit late in the Tokyo session.

- Aussie bond futures stuck to narrow ranges. There was a distinct lack of domestic news flow to provide any impetus. YM finished +1.5, with XM unch., after showing lower in early Sydney dealing. Cash ACGBs are flat to 1.5bp richer across the curve, with the long end underperforming. A reminder that today’s RBA ACGB purchases represented the final round of outright purchases under the RBA’s QE scheme (a decision surrounding the reinvestment of maturing bonds held under the scheme will come in May).

JGBS AUCTION: Japanese MOF sells Y499.8bn of 15.5-39 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y499.8bn of 15.5-39 Year JGBs in a liquidity enhancement auction:

- Average Spread: +0.016% (prev. 0.000%)

- High Spread: +0.029% (prev. +0.004%)

- % Allotted At High Spread: 65.1006% (prev. 23.8095%)

- Bid/Cover: 2.012x (prev. 2.076x)

JGBS AUCTION: Japanese MOF sells Y4.6210tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.6210tn 3-Month Bills:

- Average Yield -0.0908% (prev. -0.0968%)

- Average Price 100.0244 (prev. 100.0260)

- High Yield: -0.0819% (prev. -0.0930%)

- Low Price 100.0220 (prev. -0.0930%)

- % Allotted At High Yield: 4.5460% (prev. 1.3166%)

- Bid/Cover: 2.502x (prev. 3.252x)

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.75% 21 Nov ‘32 Bond, issue #TB165:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.75% 21 November 2032 Bond, issue #TB165:

- Average Yield: 2.1435% (prev. 1.8898%)

- High Yield: 2.1450% (prev. 1.8925%)

- Bid/Cover: 3.2250x (prev. 3.6550x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 65.3% (prev. 4.9%)

- Bidders 45 (prev. 48), successful 20 (prev. 26), allocated in full 12 (prev. 15)

US TSYS: Looking At The Setup Into CPI

U.S. CPI provides the immediate event risk for broader markets.

- A downside surprise would likely provide a more notable market reaction than an upside surprise given the well-documented fear re: inflationary pressure. For deeper insight surrounding the release please see our full preview.

- U.S. Tsy market positioning also points to the potential for a greater market reaction if the CPI data disappoints.

- The latest J.P.Morgan Tsy client survey revealed a slight moderation in overall net shorts (from the recent multi-year extremes) in the week ending 7 Feb, even as global core FI markets sold off on the back of hawkish turns from the BoE & ECB, in addition to a firmer than expected NFP report. The short covering theme seemingly carried through Wednesday’s 10-Year Tsy supply, which was very well received. Still, net shorts remain stretched in a historical sense.

- A quick reminder that there has been a swift repricing of Fed hike expectations in recent months after the Fed’s late ’21 pivot and persistent upside inflationary pressure.

- OIS markets currently price ~32bp of tightening for the March FOMC (recent Fedspeak has downplayed the odds of a 50bp hike at that meeting, although some regional Fed Presidents have noted that a 50bp rate hike could be on the table further down the line, inflation-dependent), with a cumulative ~138bp of tightening i.e. ~5.5x 25bp rate hikes, priced by the end of the year.

- Bank of America probably have the most aggressive sell-side view on the matter, looking for 7 hikes during ’22.

- The sell-side and market views are much more aggressive than the Fed’s base case. The latest Fed dot plot (produced in Dec ’21) revealed median expectations of 3 hikes in calendar ’22, although some of those that fell in line with the Fed median have outlined hawkish risks to their views in recent weeks.

Fig. 1: Tightening Priced Into FOMC Dec ‘22 Dated OIS (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

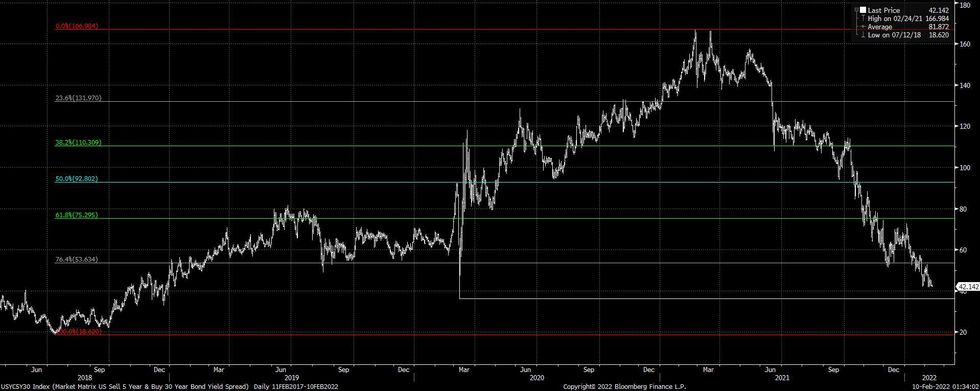

- Zooming out, the 5-/30-Year yield spread operates just above the recent flats. An upside surprise in the CPI release may open the way towards the ’20 COVID vol flats (36.3bp). Through there, the ’18 flats sit nearly 25bp below current levels.

- 2.00% in 10-Year Tsy yields presents the obvious psychological hurdle in benchmark outright yields in the case of a fresh leg lower in the broader Tsy market. 10s currently yield ~1.93%, operating a touch shy of their recent ~1.97% peak. Note that 10s haven’t traded above 2.00% in yield terms since Aug ’19.

Fig. 2: U.S. 5-/30-Year Yield Spread (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

JAPAN: Flow Data Shows Lack Of Japanese Participation In Last Week’s FI Sell Off

The latest Japanese weekly international security flow data revealed relatively limited net flows when it comes to the four major headline metrics. We do note that Japanese investors were marginal net buyers of foreign bonds amid the BoE/ECB/NFP-inspired sell off. Although those particular flows were insignificant in net terms, it is interesting that Japanese investors didn’t participate in the sell off, on net. Note that some desks flagged Japanese repatriation flows in U.S. Tsy trade early this week (Monday & Tuesday) i.e. U.S. Tsy selling.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 72.9 | -555.2 | 469.2 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 264.5 | 690.7 | 337.5 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 287.7 | 561.8 | -307.6 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -234.4 | -120.9 | -357.0 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

FOREX: Waiting Mode

High-beta currencies lost ground in Asia, with major FX pairs happy to hold tight ranges, as market participants shied away from taking too much risk ahead of the release of U.S. CPI data later today. Broader headline flow failed to provide notable catalysts ahead of that key data signal.

- Cautious mood music undermined commodity-tied FX, even as crude oil prices were broadly steady. The AUD ignored an uptick in domestic consumer inflation expectations.

- Modest initial yen strength dissipated, even as the spread between U.S. Tsy & JGB yields narrowed. Some might suspect that Gotobi Day flows played a role in sapping some strength from the yen.

- USD/CNH slipped amid a pullback in the DXY. The PBOC set the USD/CNY reference rate at CNY6.3599, perfectly in line with the average estimate based on a Blomberg survey of market participants.

- While U.S. CPI is set to steal the limelight, other notable data releases include U.S. weekly jobless claims & Norwegian CPI. The Riksbank will deliver its monetary policy decision, while comments are due from ECB's Villeroy, Lane & de Guindos as well as BoE's Bailey.

FOREX OPTIONS: Expiries for Feb10 NY Cut 1000ET (Source DTCC)

- EUR/USD: $1.1250-65(E560mln), $1.1280-00(E768mln), $1.1330-40(E1.3bln), $1.1410-30(E753mln), $1.1500(E1.7bln), $1.1600(E1.6bln)

- GBP/USD: $1.3500(Gbp564mln)

- AUD/USD: $0.7150-60(A$1.4bln), $0.7170-75(A$635mln), $0.7190-00(A$545mln)

- USD/CAD: C$1.2670-80($830mln), C$1.2810($1.2bln)

- USD/CNY: Cny6.3000($760mln)

ASIA FX: INR Slips After RBI Decision, Bank Indonesia Up Next

Overnight greenback sales provided a degree of support to Asia EM currencies as onshore markets re-opened, but caution ahead of the release of U.S. CPI kept a lid on gains. The Indian rupee underperformed after the RBI left its reverse repo rate unchanged.

- CNH: Spot USD/CNH erased its initial gains as the DXY slipped in tandem with U.S. Tsy yields. The PBOC fix fell in line with broader expectations.

- KRW: Spot USD/KRW re-opened on a softer footing, but managed to gradually recoup those initial losses. NK News & 38 North circulated reports suggesting that North Korea is preparing a military parade ahead of upcoming holidays. Separately, Pres Moon said that a joint summit with DPRK Supreme Leader Kim & U.S. Pres Biden is "just a matter of time."

- IDR: Spot USD/IDR remained on the back foot despite trimming some of its initial losses. Bank Indonesia will announce their monetary policy decision today, but the benchmark interest rate is expected to remain unchanged.

- MYR: Spot USD/MYR oscillated within a familiar range, in a futile search for any notable catalysts. Malaysia's quarterly GDP data will draw attention tomorrow.

- PHP: Spot USD/PHP extended its pullback from PHP51.500, which represents key resistance re-tested earlier this week. Philippine jobless rate edged higher, albeit amid wider participation, December data showed.

- THB: Spot USD/THB traded on the back foot, as participants weighed Wednesday's BoT monetary policy decision (policy settings unchanged, emphasis on risks from inflation) against continued surge in daily Covid-19 cases, which climbed to a five-month high.

- INR: Onshore rupee came under pressure as the RBI stood pat on interest rates, defying expectations of a reverse repo rate hike (consensus was split, for the record).

EQUITIES: Regional Benchmarks Mixed As U.S. CPI Approaches

Japanese, Korean, and Australian equity benchmarks outperformed in Thursday’s Asia-Pac session, lodging modest gains of 0.3%-0.4%, although the indices trade off of their respective session peaks.

- Chinese equities struggled. The CSI300 is 0.6% lower on the day, with little in the way of bullishness apparent in the wake of Tuesday’s “National Team” buying. Chinese tech leads the losses, with the ChiNext dealing 2.7% softer at typing.

- The Hang Seng edged 0.3% lower after retreating from three-week highs earlier in the session, led by losses in index heavyweight HSBC (-1.2%), as well as commerce and industry stocks.

- E-mini futures are flat to 0.3% lower, with the NASDAQ leading losses ahead of U.S. CPI data due later. Participants are wary of the potential for firmer than expected CPI readings.

GOLD: U.S. CPI Is Upon Us

Spot gold has stuck to a ~$3/oz range in Asia, operating just shy of yesterday’s NY session peak. This comes after Wednesday’s downtick in our weighted U.S. real yield monitor and the DXY (both of which finished off of session lows) provided support for bullion. Today’s U.S. CPI print provides the immediate material risk event, with the fears surrounding inflationary pressure well-documented. Technical resistance comes in at the 76.4% retracement of the Jan 25-28 down leg ($1,836.5/oz), which capped the rally on Wednesday. A break above there would expose the Jan 25 high/bull trigger ($1,853.9/oz). Initial support is seen at the Feb 7 low ($1,805.6/oz).

OIL: Little Changed In Asia

WTI and Brent are a handful of cents below neutral levels at writing. A downtick in U.S. e-mini equity futures applied some weight to crude in Asia-Pac dealing, although both contracts operated comfortably above their respective Wednesday’s troughs.

- While geopolitical fears surrounding Russia & Iran have pulled back from their recent extremes (applying some pressure to crude in recent sessions), ultimate solutions to those matters are still not forthcoming.

- As a reminder, Wednesday’s U.S. DOE crude inventory data revealed a “surprise” ~4.8mn bbl drawdown in headline crude stocks, as U.S. crude stockpiles hit the lowest level witnessed since 2018

- Recent session lows provide technical support ($88.41 in WTI & $89.93 in Brent), while resistance is located WTI’s Jan 4 high ($93.17) and Brent’s Feb 7 high ($94.00).

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/02/2022 | 0700/0800 | * |  | NO | CPI |

| 10/02/2022 | 0830/0930 | ** |  | SE | Riksbank Interest Rate |

| 10/02/2022 | 1000/1100 |  | EU | European Commission Winter Economic Forecasts | |

| 10/02/2022 | 1200/1300 |  | EU | ECB de Guindos on Europe post-covid at LSE | |

| 10/02/2022 | 1315/1415 |  | EU | ECB Lane on supply chain disruptions panel discussion | |

| 10/02/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 10/02/2022 | 1330/0830 | *** |  | US | CPI |

| 10/02/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 10/02/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 10/02/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 10/02/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 10/02/2022 | 1700/1700 |  | UK | BOE Bailey speech at TheCityUK Dinner | |

| 10/02/2022 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 10/02/2022 | 1900/1400 | ** |  | US | Treasury Budget |

| 10/02/2022 | 1900/1400 | *** |  | MX | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.