-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Top Level U.S.-Russia Meetings Off The Table

EXECUTIVE SUMMARY

- BLINKEN-LAVROV MEETING CANCELED, BIDEN-PUTIN MEETING OFF THE TABLE

- FED’S BOSTIC: NEED TO MOVE OFF EMERGENCY STANCE (MNI)

- ECB’S HOLZMANN SEES TWO RATE HIKES BY YEAR-END, MORE AHEAD (NZZ)

- RBNZ HIKES OCR BY 25BP, OUTLINES QT PLANS

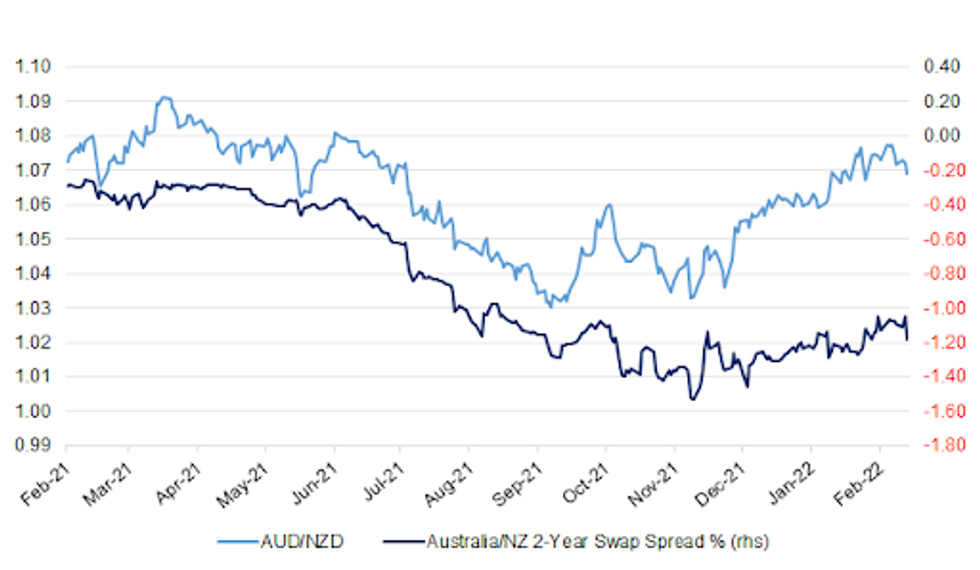

Fig.1: AUD/NZD vs. Australia/NZ 2-Year Swap Spread (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: Fraud and error are likely to have cost the UK government as much as £16bn across the Covid-19 emergency loan schemes, according to parliament’s spending watchdog, which described the losses as “unacceptable”. A report from the public accounts committee published on Wednesday said the Treasury should by the end of the year come up with estimates of fraud and error losses across the individual schemes and how much it intends to recover. (Guardian)

POLITICS: Boris Johnson has become the first British prime minister to be questioned under caution by the police, a leaked form appeared to confirm tonight. The Metropolitan Police is sending questionnaires to 88 people accused of attending lockdown-breaking gatherings as part of a criminal investigation into a dozen Downing Street parties across 2020 and last year. (The Times)

EUROPE

ECB: The European Central Bank should decide on a first rate increase in the summer, before the end of asset purchases, followed by a second move at the end of the year, Governing Council member Robert Holzmann tells Swiss newspaper NZZ in interview. Exiting era of negative interest rates would be a “strong signal” to the population and the market. ECB should be stronger in communicating the direction the base rate needs to move. Sees 1.5% as a neutral interest rate level that could realistically be achieved in 2024. (BBG)

POLICY: MNI BRIEF: Eurozone Policy Mix "Well Calibrated"- Official

- Eurozone policy remains "well calibrated despite easing pandemic restrictions, inflation pressures and rising geopolitical tensions, a senior EU official said on Tuesday, ahead of this weekend's informal meeting of finance ministers' and central bank governors in Paris - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

U.S.

FED: MNI BRIEF: Bostic Says Fed Needs To Move Off Emergency Stance

- Atlanta Federal Reserve President Raphael Bostic said Tuesday the U.S. central bank should begin moving away from its emergency stance, even as tensions around Ukraine represent a downside risk - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FED: Directors at the Federal Reserve Banks of Cleveland, Kansas City and St. Louis sought 25 basis point increases in the discount rate in January while those at the remaining nine regional banks favored no change, according to minutes of discount rate meetings released by the Fed on Tuesday. “The directors of three Reserve Banks favored increasing the primary credit rate to 0.50%, in response to elevated inflation or to help manage economic and financial stability risks over the longer term”. Directors at the nine banks favoring no change cited uncertainties over the economic outlook. (BBG)

POLITICS: The Pentagon has approved the deployment of 700 unarmed National Guard troops to the nation’s capital as it prepares for trucker convoys that are planning protests against pandemic restrictions beginning next week. Defense Secretary Lloyd Austin approved the request Tuesday from the District of Columbia government and the U.S. Capitol Police, the Pentagon said in a statement Tuesday night. (ABC News)

OTHER

GLOBAL TRADE: The United States Trade Representative's (USTR) office said on Tuesday it opposed Canada's plan to enact a digital services tax (DST) and urged Canada to abandon plans for such a step. "The United States urges Canada to abandon any plans for a unilateral measure and instead redouble its commitment to the rapid implementation of Pillar One of the October 8 OECD/G20 agreement and the negotiation of a multilateral convention", the USTR office said in a statement. The USTR also raised concerns about measures that it said singled out American firms for taxation while excluding national firms engaged in similar lines of business. "Should Canada adopt a DST, USTR would examine all options, including under our trade agreements and domestic statutes", the USTR statement added. (RTRS)

RBNZ: New Zealand’s central bank raised interest rates for a third straight meeting and signaled it will need to hike further than previously expected to contain inflation, sending bond yields and the currency higher. The Reserve Bank’s Monetary Policy Committee increased the official cash rate by 25 basis points to 1% Wednesday. New forecasts published by the RBNZ show the cash rate climbing to 2.5% over the next 12 months and peaking at about 3.25% at the end of 2023. In November, it had forecast a peak of about 2.5%. “It was agreed that more monetary tightening was needed than signaled in the November statement,” the MPC said in its record of meeting. “The committee confirmed that the outlook for a higher OCR at the end of the projection horizon was a balanced reflection of the likely path of interest rates.” (BBG)

TAIWAN: Taiwan President Tsai Ing-wen orders government to strengthen preparedness to respond to national security issues in the Taiwan Strait, according to a statement from Taiwan’s presidential office. Taiwan’s national security units and military must enhance surveillance and reconnaissance of military dynamics in neighboring areas of the Taiwan strait despite having good control currently. Government must strengthen prevention of “cognitive warfare” conducted by foreign forces and assisted by local ones that aim to influence Taiwan’s public. The situation in Taiwan and Ukraine are essentially different in terms of significance in geopolitics and global supply chain. (BBG)

BRAZIL: Brazil’s government is mulling measures to stimulate the economy, said Economy Ministry’s Special Adviser for Strategic Affairs, Adolfo Sachsida, in an online presser. Proposals include changes to FGTS fund rules. There will be no changes in 2022 fiscal target to attend the new program. Government to revise 2022 GDP forecast in mid-March. Government infrastructure investments this year to reach 78b reais. (BBG)

RUSSIA: A possible meeting between U.S. President Joe Biden and his Russian counterpart Vladimir Putin is "certainly" not an option at the moment, the White House said. "At this point it certainly is not in the plans," said White House spokesperson Jen Psaki, who added that a de-escalation of conflict with Ukraine would be needed for such a summit. (RTRS)

RUSSIA: U.S. Secretary of State Antony Blinken said on Tuesday he had canceled a meeting with Russian Foreign Minister Sergei Lavrov planned for Thursday after Moscow's recognition of two separatist regions in Ukraine as independent entities. Blinken said he had agreed to meet with Lavrov, his counterpart, only if Russia did not invade Ukraine. "Now that we see the invasion is beginning and Russia has made clear its wholesale rejection of diplomacy, it does not make sense to go forward with that meeting at this time," Blinken told reporters after a meeting with Ukrainian Foreign Minister Dmytro Kuleba in Washington. (RTRS)

RUSSIA: Senate Majority Leader Charles Schumer (D-N.Y.) has requested an all-Senate briefing on the conflict between Russia and Ukraine as Russian forces have entered eastern Ukrainian territories controlled by separatists. "Leader Schumer has requested an all-Senators briefing on Russia-Ukraine," a spokesperson for Schumer's office said in an email on Tuesday. The Senate is currently scheduled to be out of town until Monday. It is unclear if the Senate would meet this week or wait until lawmakers return. (The Hill)

RUSSIA: Satellite images show a new deployment of more than 100 military vehicles and dozens of troop tents in southern Belarus near the Ukraine border, a private U.S. company said on Tuesday. The images also showed a new field hospital and heavy equipment transporters in western Russia close to the border with Ukraine, according to Maxar Technologies. (RTRS)

RUSSIA: U.S. President Joe Biden's move to impose a first tranche of sanctions against Russia was a strong "first move," Ukrainian Foreign Minister Dmytro Kuleba said, adding he also got a promise of more weapons from U.S. officials. "The sanctions that President Biden announced today - they look strong if we consider them as a first move," the Ukraine foreign minister said in an interview with Fox News on Tuesday. He added Ukraine was not seeking U.S. troops on the ground to resolve the crisis. Western nations on Tuesday punished Russia with new sanctions for ordering troops into separatist regions of eastern Ukraine. (RTRS)

RUSSIA: If Russia further invades Ukraine, the Biden administration could deprive it of a vast swath of low- and high-tech U.S. and foreign-made goods, from commercial electronics and computers to semiconductors and aircraft parts, people familiar with the matter told Reuters. President Joe Biden would achieve that by expanding the list of goods that require U.S. licenses before suppliers can ship them to Russia, and his administration would then deny those licenses, the people said. The measures, whose details have not previously been reported, are part of a suite of export control penalties that the United States has prepared to damage Russia's economy, targeting everything from lasers to telecoms equipment and maritime items. (RTRS)

RUSSIA: The European Union agreed new sanctions on Russia that will blacklist more politicians, lawmakers and officials, ban EU investors from trading in Russian state bonds, and target imports and exports with separatist entities. However, EU foreign ministers chose not to sanction Russian President Vladimir Putin, the EU's foreign policy chief Josep Borrell said following a meeting in Paris on Tuesday. Russia's formal recognition of two breakaway regions in eastern Ukraine was an unacceptable breach of Ukraine's sovereignty, Borrell said. "This package of sanctions that has been approved by unanimity by the member states will hurt Russia, and it will hurt a lot," Borrell told a news conference alongside France's foreign minister Jean-Yves Le Drian at a meeting in Paris. (RTRS)

RUSSIA: Germany and the European Union are in a position to decide on further sanctions against Russia in the event of a complete Russian invasion of Ukraine, which cannot be ruled out, Chancellor Olaf Scholz said on Tuesday. (RTRS)

RUSSIA: In his remarks Tuesday, Putin said that the Minsk agreement to end the war in the Donbas region no longer existed, and blamed Ukraine for its demise. He also said Russia's 2014 annexation of the Crimean Peninsula — widely condemned by the West as a breach of international law — should be internationally recognized as part of Russia. Asked about the possible use of Russian forces in the Donbas, the Russian president said his country will carry out its obligations if necessary, Reuters reported. (NBC News)

RUSSIA: Western sanctions will hit world markets and affect the well-being of Americans, but will not force Russia to change its foreign policy, Russian Ambassador to the United States Anatoly Antonov said. "There is no doubt that the sanctions imposed against us will strongly hit the global financial and energy markets. The United States will not be left out, where ordinary citizens will feel the full consequences of rising prices," Antonov said. (Sputnik)

RUSSIA: Russian Foreign Ministry spokesperson Maria Zakharova said on Tuesday that new Western sanctions against Russia were illegitimate, TASS news agency quoted her as saying. (RTRS)

RUSSIA: Russia has made a decision to evacuate its diplomatic staff from Ukraine, the foreign ministry said on Tuesday. "Our first priority is to take care of Russian diplomats and employees of the Embassy and Consulates General. To protect their lives and safety, the Russian leadership decided to evacuate staff of Russian missions in Ukraine, which will be implemented in the very near future," it said in a statement. (RTRS)

RUSSIA: A military convoy of more than 100 trucks with soldiers was seen heading in the direction of the Ukrainian border in Russia's Belgorod region, a witness told Reuters on Tuesday. (RTRS)

RUSSIA: Ukrainian President Volodymyr Zelenskiy on Tuesday said he was introducing the conscription of reservists for a special period but ruled out a general mobilisation after Russia announced it was moving troops into eastern Ukraine. (RTRS)

RUSSIA: Ukraine's foreign minister on Tuesday said that "no sanctions will be enough" until Russian forces leave Ukraine, a day after Russian President Vladimir Putin recognized two separatist regions in the country as independent and announced he would deploy "peacekeeping" forces there. "No sanctions will be enough until Russian boots withdraw from Ukrainian soil," Dmytro Kuleba told CNN's Jake Tapper on "The Lead." (CNN)

RUSSIA: UN chief Antonio Guterres has dismissed Russia’s plans to send troops to eastern Ukraine as “not peacekeepers at all”, as Western nations imposed stinging sanctions against Moscow, including measures that would aim to starve the country of financing. Guterres said Russia’s moves to recognise the two separatist regions in eastern Ukraine violated the country’s territorial integrity and sovereignty, and called for an immediate ceasefire. (Al Jazeera)

SOUTH AFRICA: Eskom Holdings SOC Ltd., South Africa’s indebted power utility, is considering selling distribution assets as prospects of the government taking over about half of its 392 billion rand ($26 billion) obligations dim, people with knowledge of the matter said. State-owned Eskom, which supplies almost all of South Africa’s power, has said that it needs to cut its borrowings to about 200 billion rand to be sustainable, and the idea of the government taking a chunk of the debt has been discussed for several years. (BBG)

ENERGY: President Joe Biden on Tuesday pledged that his administration is using "every tool at our disposal" to limit the effect on gas prices in the US of sanctions he announced against Russia, acknowledging that Americans will likely see rising prices at the pump in the coming months. A senior administration official later told reporters the White House was "quite deliberate" in ensuring "the pain of our sanctions is targeted at the Russian economy, not ours." The official said the US worked in "very close consultations overnight with Germany" ahead of Chancellor Olaf Scholz's announcement earlier Tuesday that he'd stopped the certification of the Nord Stream 2 pipeline with Russia following Moscow's actions in eastern Ukraine. The official added that Tuesday's decision serves to "reduce Europe's addiction to Russian gas," adding that the US will work in concert with allies to surge national gas supplies from other sources in an effort to address shortages. (CNN)

OIL: South Korea will release oil from its reserves in case tension in Ukraine results in energy supply disruptions, Vice Finance Minister Lee Eog-weon says in a meeting. To try to diversify raw material import sources. Will work to stabilize financial markets, which are facing increased volatility. To take measures to stabilize market timely, according to contingency plan. (BBG)

CHINA

YUAN: The yuan has increasingly appeared as a safe-haven currency in the past two years, and it has enough room and resilience against possible spillover effects from the Federal Reserve’s expected rate hike, said the Securities Times in a front-page commentary. The yuan has maintained its strength amid the gradually rising U.S. dollar index since H2 2021, and become an alternative asset in the Russia-Ukraine crisis, the newspaper said. The increase in the proportion of yuan in global payment currencies will also provide strong support for the basic stability of yuan, as the proportion has increased to 3.2% in January to a four-year high, making it the fourth most active currency in the world, the newspaper said. (MNI)

PROPERTY: China's local governments should guard against excessive easing of housing policies, pushing the real estate market back to excessive growth and returning to overly relying on real estate for economic growth, the Economic Daily said in a commentary. With local policies to stabilize the property market and improve the credit environment, the market has shown some stabilizing trends from the overall cooling since H2 2021 with home prices in some cities rebounding, the newspaper said. Any easing measures should be more targeted to meet the demand of first-time buyers while avoiding speculation, the newspaper said. (MNI)

PROPERTY/CREDIT: Chinese developer Zhenro is holding a series of investor calls on its exchange offer and consent solicitation on its offshore senior notes, according to an invitation sent to bondholders. Zhenro will host group and one-on-one calls through Wednesday afternoon and Thursday, the invitation seen by Bloomberg News shows. The company did not immediately respond to request for comment. (BBG)

OVERNIGHT DATA

AUSTRALIA Q4 CONSTRUCTION WORK DONE -0.4% Q/Q; MEDIAN +2.5%; Q3 -1.2%

AUSTRALIA Q4 WAGE PRICE INDEX +2.3% Y/Y; MEDIAN +2.4%; Q3 +2.2%

AUSTRALIA Q4 WAGE PRICE INDEX +0.7% Q/Q; MEDIA +0.7%; Q3 +0.6%

SOUTH KOREA MAR BUSINESS SURVEY M’FING 93; FEB 90

SOUTH KOREA MAR BUSINESS SURVEY NON-M’FING 84; FEB 82

SOUTH KOREA Q4 SHORT-TERM EXTERNAL DEBT $166.2BN; Q3 $164.6BN

CHINA MARKETS

PBOC NET INJECTED CNY190 BLN VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY200 billion via 7-day reverse repos with the rates unchanged at 2.10% on Wednesday. The operation has led to a net injection of CNY190 billion after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to offset the impact of tax season and maintain stable liquidity at month-end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.1000% at 09:25 am local time from the close of 2.1882% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 46 on Tuesday vs 44 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3313 WEDS VS 6.3487

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3313 on Wednesday, compared with 6.3487 set on Tuesday.

MARKETS

SNAPSHOT: Top Level U.S.-Russia Meetings Off The Table

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 is closed

- ASX 200 up 44.423 points at 7205.7

- Shanghai Comp. up 26.702 points at 3484.188

- JGBs are closed

- Aussie 10-Yr future down 7.0 ticks at 97.720, Aussie 10-Yr yield up 7bp at 2.27%

- US 10-Yr future +0-02 at 126-17, cash Tsys are closed

- WTI crude up $0.22 at $92.12, Gold down $2.23 at $1896.4

- USD/JPY down 3 pips at Y115.05

- BLINKEN-LAVROV MEETING CANCELED, BIDEN-PUTIN MEETING OFF THE TABLE

- FED’S BOSTIC: NEED TO MOVE OFF EMERGENCY STANCE (MNI)

- ECB’S HOLZMANN SEES TWO RATE HIKES BY YEAR-END, MORE AHEAD (NZZ)

- RBNZ HIKES OCR BY 25BP, OUTLINES QT PLANS

BOND SUMMARY: Antipodean Headline Flow Dominates

TYH2 stuck to a narrow 0-05+ overnight, hampered by the closure of cash Tsy trade, owing to the observance of a Japanese holiday. The contract last deals -0-00+ at 126-14+, just off the base of the overnight range. Gyrations in the ACGB space provided some lead for Tsys, but a lack of meaningful macro headline flow made for a contained session. The space looked through the cancellation of Thursday’s Blinken-Lavrov meeting, while the White House took a Biden-Putin meeting off the table (until there is a de-escalation re: Ukraine). Fedspeak from Daly & 5-Year Tsy supply are due on Wednesday.

- Aussie bonds ran lower in early Sydney trade, with Western sanctions on Russia avoiding the worst-case scenario. The presence of 10-Year ACGB supply, RBA-related jitters ahead of WPI data and perhaps some pre-RBNZ trans-Tasman spill over provided further sources of downward impetus early on, with YM testing cycle lows. WPI data provided the most marginal of misses in Y/Y terms but was still in broadly line with RBA assumptions. This saw the space off of worst levels as some of the more aggressive market pricing re: RBA hiking moderated at the margin (although CBA are sticking with their June hike call). Still, hawkish trans-Tasman spill over capped the space, with the RBNZ delivering the widely expected 25bp hike, as it outlined its QT plans and signalled a higher path for interest rates over the forecast horizon (in which it envisages a move comfortably above its estimate of neutral levels). YM was -8.5, while XM was -7.0. EFPs narrowed by 1.0-1.5bp on the session.

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.25% 21 May ‘32 Bond, issue #TB158:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.25% 21 May 2032 Bond, issue #TB158:

- Average Yield: 2.2870% (prev. 1.9536%)

- High Yield: 2.2900% (prev. 1.9575%)

- Bid/Cover: 3.3650x (prev. 2.1450x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 38.8% (prev. 4.1%)

- Bidders 47 (prev. 37), successful 18 (prev. 23), allocated in full 11 (prev. 18)

EQUITIES: Higher As China Tech Leads Rally

The major Asia-Pac equity indices trade 0.5-0.9% higher at writing despite a negative lead from Wall St., as the former benefitted from the perception that western sanctions on Russia were more lenient than some participants had earlier feared. A quick reminder that Japanese markets were closed on Wednesday, as the country observed a national holiday.

- The Hang Seng leads gains amongst regional peers, +0.9% at writing. China-based large cap tech names such as Meituan outperformed, despite losses in their U.S. ADRs on Tuesday. The Hang Seng Tech Index added 1.3% as a result. Fears over a wide regulatory crackdown on tech companies have eased from Friday’s extremes, with a lack of escalation evident when it comes to fresh regulatory burden, at least week-to-date. Elsewhere, rumours pointing to a renewed crackdown on the online gaming sector haven’t been realised, yet.. The bid in Chinese equities also fed into mainland dealing.

- E-minis sit 0.4-0.7% better off at writing, with lingering worry re: Russia-Ukraine tensions providing a cap on the space. Participants continue to debate the possibility of a diplomatic resolution to the situation, with a lack of impending top level dialogue evident (Blinken-Lavrov and Biden-Putin talks are “off the table” for now).

OIL: Slightly Higher In Asia

WTI and Brent are ~$0.40 higher from settlement at typing, printing $92.31 and $97.24 respectively.

- To recap, both benchmarks backed away from fresh cycle highs on Tuesday ($96.00 for WTI and $99.50 for Brent), with participants removing some of the geopolitical risk premium that had developed earlier in the day as it became apparent that western sanctions re: Russia were a little more lenient than some had feared. BBG source reports carrying remarks from a senior U.S. State Dept official noted that the sanctions were designed to avoid upsetting energy markets.

- A reminder that hope surrounding a potential U.S.-Iran nuclear deal remains elevated, providing at least some counter to the impulse from the ongoing Russia-Ukraine situation.

- From a technical perspective, bullish conditions remain intact for oil. Tuesday’s rally saw WTI and Brent clear resistance at $98.94 (2.764 projection of the Dec 2-9-20 price swing) and $95.82 (Feb 14 high and bull trigger), respectively, before pulling back to current levels. Bulls now look to $98.24 (3.00 proj. of the Dec 2-9-20 price swing) in WTI and $100.00 (key psychological barrier) in Brent.

GOLD: Steady In Asia

Gold is virtually unchanged from settlement at typing, printing $1,899.6/oz in very limited Asia-Pac dealing.

- To recap, gold closed lower on Tuesday as the initial round of sanctions from the U.S., UK, and the EU on Russia were deemed to be less harsh than some had feared. The precious metal remains below Tuesday’s cycle highs ($1,914.25/oz), with some beginning to question Russia’s willingness to move troops beyond the separatist states of Luhansk & Donetsk (and further into Ukraine). Still, the elevated threat of deeper Russian incursions continues to provide background support for gold, while providing a sense of continuous headline risk.

- The cancellation of Thursday’s Blinken-Lavrov meeting, and subsequent White House comments noting that a potential meeting between Biden & Putin “certainly is not in the plans” provided little in the way of market reaction.

- On the technical front, gold remains in an uptrend, with resistance located at $1,916.6 (Jun 1 ’21 high and key bull trigger). A break above this level would expose the top of the bull channel drawn from the Aug 9 ’21 low.

FOREX: Hawkish RBNZ Rate Outlook Underpins NZD, Market Sentiment Stabilises

The kiwi leapt higher, taking the lead in G10 FX space, as the RBNZ raised the OCR by 25bp and forecast more aggressive interest-rate action for the period ahead. The MPC now expect their policy rate to rise faster and peak at a higher point, with the balance sheet runoff officially set to commence through a combination of bond maturities and managed sales. The statement highlighted that the decision to hike the OCR by 25bp rather than 50bp was "finely balanced," while the Committee was "willing to move the OCR in larger increments if required." Explicit readiness to deliver bold tightening steps and a relatively hawkish OCR track underscored the Reserve Bank's resolve in combating soaring inflation.

- AUD/NZD took a nosedive after the RBNZ published their Monetary Policy Statement. New Zealand policy decision was announced after Australia reported unimpressive wage price (WPI) data, which prompted participants to pare RBA rate hike bets. The conjunction of Antipodean developments weighed on 2-Year Australia/New Zealand swap spread, which filtered through into AUD/NZD price action. The rate bottomed out within touching distance from its 50-DMA, which has remained intact since early December, before trimming some losses.

- Nonetheless, the AUD is heading for the London session as the second best G10 performer after its Antipodean cousin. The Aussie dollar unwound its marginal post-WPI dip registered against major peers, as the spillover from hawkish RBNZ decision and improving risk environment extended a helping hand. The recovery in market sentiment (U.S. e-mini futures operated in the green) lent support to the broader high-beta FX space.

- Demand for safe haven assets waned, with the greenback struggling for any topside impetus. JPY and EUR also came under pressure. Note that liquidity in Asia hours was sapped by a market holiday in Japan. Overnight news flow provided little to alter the familiar narrative on the Russia-Ukraine conflict, with participants assessing the first barrage of sanctions imposed by the West.

- The yuan ignored a marginally stronger PBOC fix. Spot USD/CNH crept higher after China's central bank set the reference rate 17 pips below sell-side estimate, only to gradually return to virtually neutral levels thereafter.

- While geopolitical risk will continue to draw attention today, data highlights include final EZ CPI & German consumer confidence. Speeches are due from Fed's Daly, ECB's de Guindos, de Cos & Villeroy and BoE's Bailey, Broadbent, Haskel & Tenreyro.

FOREX OPTIONS: Expiries for Feb23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1200(E1.0bln), $1.1250(E601mln), $1.1275(E1.1bln), $1.1300-15(E1.6bln), $1.1350-60(E1.4bln), $1.1380-85(E575mln)

- USD/JPY: Y114.00($860mln)

- AUD/USD: $0.7190-00(A$1.3bln), $0.7225($637mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/02/2022 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 23/02/2022 | 0700/1500 | ** |  | CN | MNI China Liquidity Suvey |

| 23/02/2022 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 23/02/2022 | 0915/1015 |  | EU | ECB Elderson Intro & panel participation at Eurofi Seminar | |

| 23/02/2022 | 0930/0930 |  | UK | BOE Governor Bailey et al at TSC | |

| 23/02/2022 | 1000/1100 | *** |  | EU | HICP (f) |

| 23/02/2022 | 1130/1230 |  | EU | ECB de Guindos Q&A at El Español & Invertia symposium | |

| 23/02/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 23/02/2022 | 1330/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 23/02/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/02/2022 | 1500/1500 |  | UK | BOE Tenreyro speaks at NIESR Institute lecture | |

| 23/02/2022 | 1630/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 23/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/02/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 23/02/2022 | 2030/1530 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.