-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Thune Defends Two-Step 2025 Agenda

MNI US MARKETS ANALYSIS - EUR Steadies Ahead of ECB

MNI EUROPEAN OPEN: No Agreement In Russia-Ukraine Talks, More Due

EXECUTIVE SUMMARY

- RUSSIA SAYS UKRAINE AGREED TO ANOTHER ROUND OF TALKS (IFX)

- UKRAINE WAR TO SHELVE CALLS FOR ECB RATE HIKES (MNI SOURCES)

- JAPAN GOV'T NOMINATES HAJIME TAKATA AND NAOKI TAMURA FOR NEW BOJ BOARD MEMBERS ( RTRS)

- RBA HIGHLIGHTS UKRAINE WAR RISKS TO OUTLOOK AS KEY RATE HELD (BBG)

- WEST CONTINUES TO TRY AND RATCHET UP PRESSURE ON RUSSIA

- MOSCOW SHARES TO BE CLOSED FOR SECOND DAY On TUESDAY

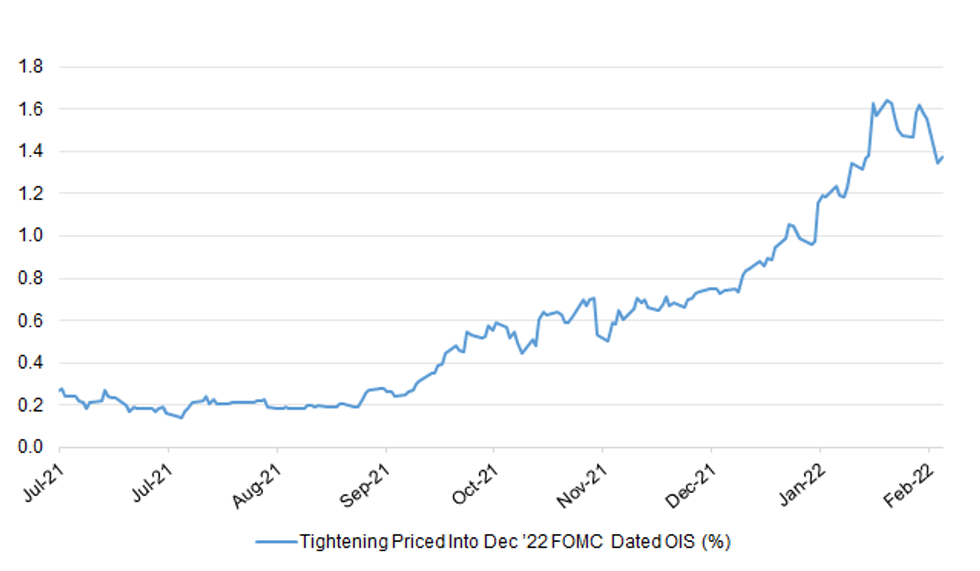

Fig.1: Tightening Priced Into Dec ’22 FOMC Dated OIS (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: Rishi Sunak is facing renewed pressure from business leaders to delay a planned £12bn rise in national insurance, amid warnings over soaring costs for companies and households as the Russian invasion of Ukraine drives up inflation. The manufacturing trade body Make UK, which represents 20,000 firms of all sizes across the country, said the tax hike planned for April should be pushed back until the UK economy is in a stronger position. It warned the government that pressing ahead would risk firms slamming the brakes on recruitment and putting the economic recovery from Covid at risk. With concerns mounting over the fallout from Vladimir Putin ordering his troops into Ukraine last week, the business lobby group said now was not the time to add further self-imposed costs on companies. (Guardian)

EUROPE

ECB: MNI SOURCES: Ukraine War To Shelve Calls For ECB Rate Hikes

- Russia’s invasion of Ukraine is set to put an end to any talk of increasing eurozone interest rates this year even from previously hawkish officials, Eurosystem officials told MNI, as European Central Bank policymakers emphasise two-way flexibility to deal with the competing risks of an additional spike in inflation and a potential blow to output - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

ECB: ECB President Lagarde tweeted the following on Monday: “German Finance Minister @c_lindner and I discussed how best to limit the implications of Russia’s unacceptable war on Ukraine for the European economy. I reiterated that the ECB will implement sanctions decided by the EU and we are ready to do all that is needed within our mandate to ensure price stability and financial stability.” (MNI)

ECB: European Central Bank Governing Council Member Ignazio Visco says central bank will guarantee market liquidity and full access for citizens to payments systems, according to Ansa news agency. Speaking during a webinar, Visco says ECB is closely monitoring the situation in Ukraine and the outlook for the economy will be discussed at the bank’s next monetary policy meeting in Frankfurt. (BBG)

ECB: The European Central Bank has put banks with close ties to Russia, such as Austria’s Raiffeisen Bank International and the European arm of VTB, under close observation following sweeping financial sanctions by the West that have already pushed one lender over the edge, two sources told Reuters. The ECB’s measures include a requirement on those banks to report their liquidity more frequently and to update supervisors on the impact of the sanctions on their assets and operations in Russia and Ukraine, the sources said. Supervisors heightened their scrutiny when Russia invaded Ukraine last week and were now in daily contacts with the banks, the sources added. (RTRS)

ECB/PORTUGAL: The impact of a euro-zone interest-rate hike would be quickly felt by Portuguese companies and families, according to the country’s central bank governor. “The structure of credit in Portugal is dominated by variable interest rates, so transmission of interest rates to funding costs, both for households and firms, will be very fast,” Mario Centeno, a member of the European Central Bank’s Governing Council, said in an interview in Lisbon on Monday. “So we need to be prepared for that.” (BBG)

FISCAL: The European Commission will propose that member countries tax the profits energy companies made from recent gas price spikes and invest the revenue in renewable energy and energy-saving renovations, sources familiar with the matter said on Monday.(RTRS)

U.S.

BANKING: Government regulators said Monday that the U.S. financial system was functioning “in a normal manner” as global markets reacted to the invasion of Ukraine and sanctions imposed on Russia. The Financial Stability Oversight Council, headed by U.S. Treasury Secretary Janet Yellen, came to that conclusion during a previously unscheduled meeting Monday afternoon. The council would continue to monitor financial developments, according to a statement from the Treasury Department. (BBG)

CORONAVIRUS: The White House told federal agencies late on Monday they can drop COVID-19 requirements that employees and visitors wear masks in federal buildings in much of the country, according to a document seen by Reuters. The White House-led Safer Federal Workforce Task Force told agencies in new guidance that in counties with low or medium COVID-19 community levels they do not need to require individuals to wear masks in that federal facility, regardless of vaccination status. The White House directed agencies to revise federal employee masking and testing rules no later than March 4. (RTRS)

CORONAVIRUS: California, Oregon and Washington will no longer require masks in classrooms after the end of next week, as plunging Covid case rates across the West Coast accelerate efforts to return to something like normal life. The three states will shift to recommending masks in schools and child-care facilities, rather than mandating them, after March 11, according to a statement Monday. Oregon and Washington will lift mask rules for most other indoor settings at that time as well. California had let its mask requirement for indoor public spaces expire earlier this month. (BBG)

POLITICS: President Joe Biden plans to use his State of the Union address Tuesday to emphasize the united response by the U.S. and its allies against Russia while seeking to tout the condition of the economy and sell an optimistic view of the country’s future, administration officials said ahead of the address. (NBC)

OTHER

CENTRAL BANKS: MNI INSIGHT: Cenbanks Eye Dollar Funding, Have Tools In Place

- Major central banks are keeping a close eye on an increase in dollar funding costs, though stresses are still far from levels which might prompt actions such as a reintroduction of the 84-day dollar repo operations abandoned in July 2021, MNI understands - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

BOJ: Japan's government nominated economist Hajime Takata and banker Naoki Tamura to the Bank of Japan's nine-member policy board on Tuesday. Takata is an executive economist at Okasan Securities, and Tamura is a senior adviser at Mitsui Sumitomo Bank. Takata would replace Goushi Kataoka and Tamura would replace Hitoshi Suzuki on the board. Kataoka and Suzuki's five-year terms run until July 23. (RTRS)

RBA: The Reserve Bank of Australia said it will remain “patient” as it assesses risks stemming from Russia’s invasion of Ukraine and the resulting jolt to energy prices. The central bank -- as expected -- kept its cash rate at a record low 0.1% on Tuesday, Governor Philip Lowe said in a post-meeting statement. He reiterated that while inflation has picked up, it’s “too early to conclude” that it’s sustainably within the RBA’s 2-3% target. “The war in Ukraine is a major new source of uncertainty,” Lowe said. “Inflation in parts of the world has increased sharply due to large increases in energy prices and disruptions to supply chains at a time of strong demand.” (BBG)

BRAZIL: Brazil’s inflation rate is slowing and may end up the year below that of the U.S. after the Latin American nation pulled monetary and fiscal incentives last year, Economy Minister Paulo Guedes said. Consumer price gains will slow from its current 10% annual rate to about 5% by the end of 2022 after removing early the incentives given during the pandemic, Guedes told Bloomberg Television’s Shery Ahn during an interview in New York. “We contracted the fiscal policy during the recovery so there is no inflationary pressure,” he said on Monday. “Basically it’s global inflation when we talk about inflation in Brazil.” (BBG)

RUSSIA: Russian and Ukrainian sides have agreed to continue another round of talks in the coming days, Interfax reports, citing Russian official Vladimir Medinsky. Next round of talks to take place on the Polish-Belarus border, he says. Separately, speaking after the talks Ukraine’s adviser to president’s chief of staff Mykhaylo Podolyak says both sides “discussed the possibility of having another round of talks” soon and are going back to their respective capitals for consultations. (BBG)

RUSSIA: Initial talks between Russia and Ukraine concluded without result on Monday evening, with both delegations returning from the site of the negotiations in Belarus to their capitals for consultations. Kyiv is seeking a cease-fire in Ukraine and an end to hostilities, according to Mihailo Podolyak, a member of the Ukrainian delegation. “The parties identified a number of priority topics in which certain solutions were outlined,” he said after the discussions ended. “In order to get some opportunities for implementation and logistical solutions, the parties are returning to their capitals for consultations.” After the meeting ended, Mr. Podoloyak criticized his opponents in a tweet, saying “Unfortunately, the Russian side is still extremely biased regarding the destructive processes it launched.” (NYT)

RUSSIA: Satellite images taken on Monday show a Russian military convoy north of the Ukrainian capital of Kyiv that stretches for about 40 miles (64 km), substantially longer than the 17 miles (27 km) reported earlier in the day, a U.S. private company said. Maxar Technologies also said additional ground forces deployments and ground attack helicopter units were seen in southern Belarus, less than 20 miles (32 km) north of the Ukraine border. (RTRS)

RUSSIA: Russia has deployed about half of the forces it had at Ukraine's border into its former Soviet neighbour, Western officials said on Monday. (RTRS)

RUSSIA: Ukrainian defense Minister Oleksii Reznikov appealed directly to Russian soldiers fighting in Ukraine on Monday, saying they would receive full amnesty and monetary compensation if they voluntarily laid down their weapons. (RTRS)

RUSSIA: Ukraine informed the International Atomic Energy Agency (IAEA) today that the country’s nuclear power plants were continuing to be operated safely and securely, Director General Rafael Mariano Grossi said, adding that he remained gravely concerned about maintaining their safety and security during the current conflict. Ukraine’s nuclear power programme – 15 reactors at four sites – usually accounts for roughly half its electricity production. (IAEA)

RUSSIA: The most recent decree by Russian President Vladimir Putin on special economic measures will not be Moscow's only response to the new sanctions of a number of countries against the Russian Federation in connection with the operation in Ukraine, Russian presidential spokesman Dmitry Peskov told TASS. (TASS)

RUSSIA: Americans should not be worried about nuclear war, U.S. President Joe Biden said on Monday, the day after Russian President Vladimir Putin put Russia's nuclear deterrent on high alert amid Moscow's ongoing invasion of Ukraine. (RTRS)

RUSSIA: Russia has not shown interest in creating a “deconfliction mechanism” with the United States over the Ukrainian conflict, the Pentagon said on Monday. Pentagon spokesman John Kirby said the United States was looking at potential options for some sort of mechanism between the two countries to avoid military accidents, but was not sure Russia would be interested in one. The two countries have a similar mechanism in other areas, like Syria, where they both operate in close proximity. (RTRS)

RUSSIA: Ukrainian Foreign Minister Dmytro Kuleba said on Tuesday that U.S. Secretary of State Antony Blinken had offered his country, which is under attack from its neighbour Russia, more support in the form of sanctions and weapons. "In our call, Secretary Blinken affirmed that the U.S. support for Ukraine remains unfaltering," Kuleba said on Twitter. "I underscored that Ukraine craves for peace, but as long as we are under Russia's assault we need more sanctions and weapons. Secretary assured me of both. We coordinated further steps." (RTRS)

RUSSIA: White House spokesperson Jen Psaki said sanctions on Russia's energy exports were not off the table, but could also have "extreme consequences for the world energy markets, particularly ours and Europe's." (RTRS)

RUSSIA: Sen. Joe Manchin III criticized President Biden’s response to the Russian invasion of Ukraine on Monday, arguing that the White House was pushing “hypocritical” policies on energy imports. Mr. Manchin, West Virginia Democrat, said that the administration needs to curtail its reliance on Russian petroleum if it was serious about holding Russian President Vladimir Putin accountable for his belligerence in Ukraine. “The entire world is watching as Vladimir Putin uses energy as a weapon in an attempt to extort and coerce our European allies,” said Mr. Manchin, who chairs the Senate Energy Committee. “While Americans decry what is happening in Ukraine, the United States continues to allow the import of more than half a million barrels per day of crude oil and other petroleum products from Russia during this time of war.” (The Washington Times)

RUSSIA: Germany is sending Tornado warplanes and a maritime patrol aircraft on a reconnaissance mission to the Baltic Sea area, Germany's mission to NATO said on Twitter on Monday. A spokesperson for the defence ministry in Berlin said she could not immediately give any details due to operational security concerns. Earlier in the day, the German navy dispatched six additional warships, four of them to the Baltic Sea. (RTRS)

RUSSIA: France will move its embassy in Ukraine to the western city of Lviv from the capital Kyiv, Foreign Minister Jean-Yves Le Drian said on Monday, the last Western country to move its diplomatic mission as conditions worsen on the ground in Russia's invasion. (RTRS)

RUSSIA: Russia's foreign ministry said on Monday that those supplying lethal weapons to Ukraine will bear responsibility should they be used during Russia's military campaign there. The ministry added that the steps the European Union has taken against Russia will not be left without a harsh response. (RTRS)

RUSSIA: The European Union is preparing for any disruptions of natural gas supplies from Russia as it weighs the risk Moscow could halt shipments in retaliation for sanctions. EU energy ministers discussed on Monday various supply-shock scenarios following Russia’s invasion of Ukraine. The emergency gathering took place days after a decision by Western governments to impose penalties on Russia’s central bank and to exclude some of the country’s banks from the SWIFT financial system. “Following the measures taken by the EU and the international community to sanction Russia, we can’t exclude that Russia will take retaliatory steps that will impact the energy trade,” EU Energy Commissioner Kadri Simson told reporters on Monday after the meeting. (BBG)

RUSSIA: The European Union and its allies are preparing new sanctions against Russia to "raise the cost" of President Vladimir Putin's war in Ukraine, a top French official said on Monday. "There will be more sanctions. It's a priority," an aide to French President Emmanuel Macron told reporters on condition of anonymity, saying they could be announced "in the coming days". (AFP)

RUSSIA: Russian football clubs and national teams have been suspended from all competitions by Fifa and Uefa after the country's invasion of Ukraine. The world and European football governing bodies said they would be banned "until further notice". It means the Russian men's team will not play their World Cup play-off matches next month and the women's team have been banned from this summer's Euro 2022 competition. Spartak Moscow have also been kicked out of the Europa League and their last-16 opponents RB Leipzig will advance to the quarter-finals. Uefa has also ended its sponsorship with Russian energy giant Gazprom. (BBC)

RUSSIA: Canadian Prime Minister Justin Trudeau said Monday that his administration will ban Russian crude oil imports in response to Russia’s invasion of Ukraine. “Today we are also announcing our intention to ban all imports of crude oil from Russia, an industry that has benefited President Putin and his oligarchs greatly,” Trudeau said, according to a translation of his comments in French. Canada is the first Western nation to officially target Russia’s energy complex. The White House said Monday that it has not yet ruled out restrictions on U.S. purchases of oil and gas. But it has so far not sanctioned the industry directly. (CNBC)

RUSSIA: Turkey has decided to restrict Russian warships from using waterways it controls to transit into the Black Sea due to Vladimir Putin’s invasion of Ukraine, according to Turkish officials familiar with the matter. The officials, who asked not to be named due to the sensitivity of the matter, fleshed out President Recep Tayyip Erdogan’s pledge earlier on Monday to “exercise” the authority over the straits granted to Turkey by the 1936 Montreux Convention to prevent an escalation of fighting. The Turkish straits give Russia’s Black Sea fleet entry to the Mediterranean. The Montreux agreement allows Ankara to regulate maritime traffic through the waterways during peace and wartime alike. (BBG)

RUSSIA: Norway has asked the central bank to come up with a plan by March 15 to remove Russian assets from its $1.3 trillion sovereign wealth fund. After ordering that the fund’s investments in Russia be frozen, the finance ministry has asked Norges Bank to prepare a proposal for the implementation of the sale, including dates for adjusting the benchmark index and changes in the investment universe, according to a letter from the ministry. The timeline could be shortened if the situation changes significantly, it said. The Oslo-based fund is the world’s biggest owner of publicly traded companies with a portfolio of about 9,000 stocks. The government announced late on Sunday a decision to drop Russian assets from the fund in response to the country’s invasion of Ukraine. With Russia on Monday announcing a ban on selling shares on the Moscow Stock Exchange, it may take time to complete the sale, the ministry said. The sale must take place within the current sanctions, which are legally binding. The decision covers Russian financial instruments, real estate, infrastructure. (BBG)

RUSSIA: A suspension of stock trading on the Moscow Exchange will extend through Tuesday, the Bank of Russia said. Russia's central bank said in a written statement Monday evening that derivatives trading also wouldn't resume Tuesday. It said the Moscow Exchange's operating hours for Wednesday would be announced later. (WSJ)

RUSSIA: Nasdaq Inc and Intercontinental Exchange Inc's NYSE have temporarily halted trading in the stocks of Russia-based companies listed on their exchanges, their websites showed. The halts were due to regulatory concerns as the exchanges seek more information following economic sanctions imposed on Russia because of its invasion of Ukraine, people familiar with the matter said. The Nasdaq-listed stocks halted are: Nexters Inc , HeadHunter Group PLC, Ozon Holdings PLC, Qiwi PLC and Yandex. (RTRS)

RUSSIA: JPMorgan is set to remove Russia from the environmental, social and governance (ESG) versions of its emerging market bond indexes, while it continues to review the country's ejection from its widely used emerging debt benchmarks. A source familiar with the bank told Reuters on Monday Russia is set to be removed from the ESG versions of JPMorgan's Government Bond Index-Emerging Markets indexes, and the JP Morgan Emerging Market Bond Index. JPM is consulting with clients about when and how to remove Russia from the ESG index, the person added. The bank is still reviewing the impact of sanctions launched by the West on Russia, on the country's presence in its main emerging market bond indexes. (RTRS)

RUSSIA: Russia's stock market is "uninvestable" after stringent new Western sanctions and central bank curbs on trading, making a removal of Russian listings from indexes a "natural next step", a top executive at equity index provider MSCI said on Monday. "It would not make a lot of sense for us to continue to include Russian securities if our clients and investors cannot transact in the market," Dimitris Melas, MSCI's head of index research and chair of the Index Policy Committee, told Reuters. "It is obvious to all of us that the market is very difficult to trade and, in fact, it is uninvestable today." (RTRS)

RUSSIA: FTSE Russell is actively monitoring recent sanctions imposed on Russian government bonds and Russian entities with respect to the impact for the FTSE fixed income indices, according to a statement today. FTSE Russell confirms that there is no impact to March 2022 index profiles due to the sanctions detailed in the statement. (BBG)

RUSSIA: Mastercard Inc said late on Monday it had blocked multiple financial institutions from its payment network as a result of sanctions imposed on Russia over Moscow's invasion of Ukraine. Mastercard will continue to work with regulators in coming days, the company said in a statement. It also promised to contribute a $2 million for humanitarian relief. (RTRS)

RUSSIA: India’s top lender will not process any transactions involving Russian entities subject to international sanctions imposed on Russia after its invasion of Ukraine, according to a letter seen by Reuters and people familiar with the matter. (RTRS)

RUSSIA: S&P Global Ratings said today that, following its downgrade of Russia on Feb. 25, 2022, it has lowered its long- and short-term issuer credit ratings on Raiffeisenbank AO, UniCredit Bank AO, and Gazprombank JSC, as well as Alfa-Bank JSC and its holding company ABH Financial Ltd. (see the ratings list). We also placed our ratings on Russian financial institutions, their debt issues, subsidiaries, and related entities on CreditWatch with negative implications, since we believe these entities face increased geopolitical and economic risks. The CreditWatch placement on our rating on subsidiaries reflects the likelihood that a potential decline in the parent companies' creditworthiness would have a negative knock-on effect on those entities. (S&P)

SOUTH AFRICA: South Africa’s President Cyril Ramaphosa named Andrea Johnson as the new head of the National Prosecuting Authority’s Investigating Directorate that is spearheading efforts to prosecute those involved in state capture and graft. Johnson, a senior deputy director in the NPA with more than 25 years’ experience, including in district, regional and high court prosecutions replaces Hermione Cronje, who quit after less than three years in the post. Johnson who was part of the team that prosecuted Jackie Selebi, a former South African police chief and Interpol president for corruption in 2010, takes over March 1. (BBG)

TURKEY: Turkey has decided to lower the value-added tax (VAT) on electricity used for residential and agricultural irrigation purposes from 18% to 8% and readjusted the electricity tariffs for low-consumption households, President Recep Tayyip Erdoğan said on Monday. The announcement comes as part of efforts designed to ease the pressure on households and businesses affected by high energy bills amid soaring inflation. Erdoğan reiterated the government’s determination to solve the inflation problem rapidly, saying Turkey would see the consumer prices largely under control by summer. (Daily Sabah)

IRAN: Iranian and U.S. officials are entering a crucial week of negotiations to restore the 2015 nuclear deal, with significant differences remaining on several key issues and new concerns that Russia’s invasion of Ukraine could complicate the talks. Iran’s chief negotiator, Ali Bagheri-Kani, arrived in Vienna Monday morning with positions that could prove difficult to bridge with his Western counterparts, diplomats said. With Iran continuing to expand its nuclear work, Western diplomats have warned that the negotiations could collapse if a deal isn’t reached this week. (WSJ)

IRAN: In Washington, U.S. State Department spokesman Ned Price told reporters, "We are prepared to walk away if Iran displays an intransigence to making progress." (RTRS)

METALS: Rusal temporarily halts production at the Nikolaev Alumina Refinery located in Ukraine’s Nikolaev region due to “unavoidable logistical and transport challenges” on the Black Sea and surrounding area, according to Hong Kong stock exchange filing. Alumina production will be severely curtailed in the short term at the site. No immediate wider impact on aluminum production at co.’s associated aluminum smelters. Co. will continue to take necessary steps to keep employees and their families in Ukraine safe and secure business continuity. (BBG)

OIL: Two cargoes of Russian oil loaded late last week for U.S. ports may be among the last shipments of their kind as the market seeks alternatives amid mounting sanctions against Russia’s financial system. Commodity trading giant Vitol booked vessels Elli and Matterhorn Spirit to carry a combined 780,000 barrels of either crude or fuel oil for delivery in the U.S. in March, according to data from oil analytics firm Vortexa. There has been no new bookings of Russian oil for the U.S. since February 21st, according to shipping reports compiled by Bloomberg. Existing bookings show Friday is the last day for a Russian cargo to load for the U.S. (BBG)

CHINA

ECONOMY: China should ensure a more than 5% economic growth in 2022, and make sure its new GDP exceeds that of the U.S., so to cope with rising risks of global stagflation and geopolitical conflicts, wrote Xu Hongcai, deputy director of the Economic Policy Commission of the China Associate of Policy Science at a blog post. A marginally looser monetary policy is necessary for the short term, but more efforts should be made to unblock the transmission mechanism and improve the efficiency of the use of funds, said Xu. Xu noted the first-ever negative growth in M1 in January may indicate companies have turned their loan funds into long-term fixed deposits, and funds returned to the banking system instead of flowing to stock, real estate markets nor the real economy. (MNI)

ECONOMY: Chinese Commerce Minister Wang Wentao said on Tuesday that China must "do everything possible" to spur consumption this year. Some recovery momentum was seen in February, after increased downward pressure on consumption since the fourth quarter, Wang said at a press briefing. (RTRS)

PBOC: China has the ability and conditions to effectively respond to external shocks and domestic downward pressure, stabilizing the economy and inflation, and continue to be a bright spot in the global economy, said the People’s Bank of China in an article post on its social media account. The prudent monetary policy will be flexible on its intensity and focus, aiming to maintain stability before seeking progress as well as guide banks to vigorously expand credit issuance, optimize credit structure and promote lower financing costs, the statement said. (MNI)

YUAN: More institutional investors raise the short-term outlook of yuan against the U.S. dollar to around 6.25, or even above 6.2, with global risk aversion rising amid the Russia-Ukraine conflict, the 21st Century Business Herald reported. The onshore yuan hit a record intraday high of 6.3025 since May 2018 on Monday, the newspaper said. The yuan may continue to hit new highs with the help of safe-haven capital inflows should geopolitical risks keep escalating and global financing markets decline, as the market believes China’s central bank has more flexible monetary policy space to stabilize its economic growth amid rising global commodity prices and inflationary pressures, the newspaper said citing an unnamed market source. (MNI)

CORONAVIRUS: One of China’s top health experts raised the possibility that China could follow western nations and attempt to live with Covid-19, a rarely voiced view in the country as it persists with its Covid-Zero strategy. “Western countries have taken the lead in practicing the coexistence with the virus, which is very risky and courageous. We shall observe and learn from the experience and lessons of western countries with a calm and humble attitude for our own use.” Zeng Guang, former chief epidemiologist of Chinese Center for Disease Control and Prevention, said on his social media Account. “At an appropriate timing in the near future, China will surely present its version of the roadmap for co-existing with the virus,” Zeng said. (BBG)

OVERNIGHT DATA

CHINA FEB M’FING PMI 50.2; MEDIAN 49.8; JAN 50.1

CHINA FEB NON-M’FING PMI 51.6; MEDIAN 50.7; JAN 51.1

CHINA FEB COMPOSITE PMI 51.2; JAN 51.0

CHINA FEB CAIXIN M’FING PMI 50.4; MEDIAN 49.1; JAN 49.1

The Caixin China General Manufacturing PMI came in at 50.4 in February, up from 49.1 the previous month, showing manufacturing activity bounced back into expansionary territory. Overall, the Chinese manufacturing sector stayed on the track for recovery. Supply in the manufacturing sector improved. Overall demand was strong, though external demand remained subdued. The gauges for both output and total new orders returned to expansionary territory. The gauge for total new orders hit its highest level in eight months in February. Amid the worsening effects of the pandemic, which disrupted transportation, external demand remained weak. The gauge for new export orders in February remained in contractionary territory for the seventh straight month. The job market remained under pressure. Although supply and demand in the manufacturing sector improved, goods producers remained cautious about hiring new staff. The measure for employment remained in contractionary territory for the seventh consecutive month, but the rate of contraction was milder than the previous month. The quantity of purchases increased slightly in February as raw material prices remained high. Stocks of purchased items fell. Logistics delivery times got longer due to pandemic disruption. Stocks of finished goods fell. Due to rising new orders and a shortage of employees, backlogs of work increased. Inflationary pressure grew. The gauges for input and output prices rose in February, with both hitting their highest levels since October. The price increases were mainly a result of rising transportation costs and raw material prices that remained elevated. Business owners held a positive outlook. The measure of future output expectations rose to the highest in eight months. Surveyed companies said they were confident that market demand would further improve and domestic outbreaks of Covid-19 would be controlled. (IHS Markit)

JAPAN FEB, F JIBUN BANK M’FING PMI 52.7; FLASH 52.9

February PMI data pointed to a softer expansion in the Japanese manufacturing sector. The rate of growth eased to a five-month low, however, amid a renewed reduction in production levels and a broad stagnation in new orders. Panel members commented that the rise in COVID-19 cases due to Omicron and sustained material shortages had held back a stronger improvement in a sector that had up until now been trending upwards. Significant supply chain disruption which dampened output and demand in the latest survey period was attributed to severe material shortages and delivery delays. As a result, input price pressures intensified further, with average cost burdens rising at the sharpest pace in thirteen-and-a-half years. Moreover, firms doubled down on efforts to protect against future disruption and price pressures by raising safety stocks of raw materials and other inputs at the quickest pace in the history of the survey. As a result, manufacturers commented that the degree of optimism regarding the 12-month outlook for output eased to a six-month low in February, with hopes for an end to the pandemic held back by concerns of further waves of infection. This is broadly in line with the IHS Markit prediction for industrial production to grow 5.9% in 2022. (IHS Markit)

JAPAN FEB VEHICLE SALES -18.6% Y/Y; JAN -12.5%

AUSTRALIA FEB, F MARKIT M’FING PMI 57.0; FLASH 57.6

The latest IHS Markit Australia Manufacturing PMI indicated that the sector’s expansion accelerated, aided by the renewal of manufacturing production growth in February. The easing of the COVID-19 Omicron wave had similarly minimised the disruptions towards production, leading to the positive change in February. That said, supply chain issues persisted, with the severe lengthening of delivery times leading to price inflation climbing in February. Wage inflation will be a key area to watch as manufacturers continued to hire at a rapid pace while facing challenges in securing suitable candidates. Overall business optimism improved in February, which is a positive sign for the Australian manufacturing sector. (IHS Markit)

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 99.2; PREV 101.8

Consumer confidence dropped 2.6% last week amid rising COVID cases in WA, floods in Queensland and northern NSW and escalating geopolitical tensions. Most of the decline took place during the latter part of the week as daily COVID cases breached 1,000 in WA, massive storms battered the east coast and the invasion of Ukraine began. Confidence fell 1.8% in Victoria, 10.9% in Queensland and 4.9% in WA, while it rose 0.7% in NSW and 3.6% in SA. The fact Queensland and WA fell the most suggests local factors were key. Household inflation expectation surged to a new seven-year high at 5.3% as retail petrol prices continued to climb higher. (ANZ)

AUSTRALIA FEB CORELOGIC HOUSE PRICES +0.3% M/M; JAN +0.8%

AUSTRALIA Q4 BOP CURRENT ACCOUNT BALANCE +A$12.7BN; MEDIAN +A$15.3BN; Q3 +A$22.0BN

AUSTRALIA Q4 NET EXPORTS OF GDP -0.2%; MEDIAN -1.0%; Q3 +1.0%

AUSTRALIA JAN HOME LOANS VALUE +2.6% M/M; MEDIAN +0.3%; DEC +4.4%

AUSTRALIA JAN OWNER-OCCUPIER LOAN VALUE +1.0% M/M; MEDIAN +3.8%; DEC +5.3%

AUSTRALIA JAN INVESTOR LOAN VALUE +6.1% M/M; DEC +2.4%

AUSTRALIA FEB COMMODITY INDEX 137.2; JAN 144.4

AUSTRALIA FEB COMMODITY INDEX SDR +16.7% Y/Y; JAN +22.2%

SOUTH KOREA FEB TRADE BALANCE+840MN; MEDIAN -$280MN; JAN -$4,834MN

SOUTH KOREA FEB EXPORTS +20.6% Y/Y; MEDIAN +18.7%; JAN +15.2%

SOUTH KOREA FEB IMPORTS +25.1% Y/Y; MEDIAN +24.1%; JAN +35.4%

CHINA MARKETS

PBOC NET DRAINS CNY50 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY50 billion via 7-day reverse repos with the rate unchanged at 2.10% on Tuesday. The operation has led to a net drain of CNY50 billion after offsetting the maturity of CNY100 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0135% at 09:50 am local time from the close of 2.2952% on Monday.

- The CFETS-NEX money-market sentiment index closed at 53 on Monday vs 45 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3014 TUES VS 6.3222

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3014 on Tuesday, compared with 6.3222 set on Monday, marking the strongest parity since Apr 20, 2018.

MARKETS

SNAPSHOT: No Agreement In Russia-Ukraine Talks, More Due

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 346.4 points at 26858.61

- ASX 200 up 47.375 points at 7096.5

- Shanghai Comp. up 7.798 points at 3469.335

- JGB 10-Yr future up 9 ticks at 150.59, yield down 1.2bp at 0.180%

- Aussie 10-Yr future down 5.0 ticks at 97.805, yield up 5.0bp at 2.188%

- U.S. 10-Yr future -0-06 at 127-08, yield up 3.1bp at 1.856%

- WTI crude up $0.97 at $96.66, Gold down $2.69 at $1906.17

- USD/JPY up 3 pips at Y115.03

- RUSSIA SAYS UKRAINE AGREED TO ANOTHER ROUND OF TALKS (IFX)

- UKRAINE WAR TO SHELVE CALLS FOR ECB RATE HIKES (MNI SOURCES)

- JAPAN GOV'T NOMINATES HAJIME TAKATA AND NAOKI TAMURA FOR NEW BOJ BOARD MEMBERS (RTRS)

- RBA HIGHLIGHTS UKRAINE WAR RISKS TO OUTLOOK AS KEY RATE HELD (BBG)

- WEST CONTINUES TO TRY AND RATCHET UP PRESSURE ON RUSSIA

- MOSCOW SHARES TO BE CLOSED FOR SECOND DAY ON TUESDAY

BOND SUMMARY: Asia Fades The Latest Rally

Asia-Pac participants were seemingly keen to fade some of Monday’s NY Tsy richening (which was in part related to month-end index extension dynamics) allowing core FI markets to move off of their Monday/early Asia peaks. Surprise expansionary readings for both the Chinese official and Caixin manufacturing PMI prints added a further source of (light) pressure, with the official nonmanufacturing PMI release also topping wider expectations.

- This leaves TYM2 -0-05+ at 127-08+ ahead of European hours, operating a little off the base of its 0-09 overnight range, on ~150K lots. Cash Tsys run 2.5-3.5bp cheaper across the curve. NY hours will see the latest ISM m’fing survey headline, while Fedspeak will come via Mester (’22 voter) & Bostic (’24 voter).

- JGB futures traded above yesterday’s settlement levels for the duration of Tokyo dealing, but finished shy of best levels, +9. Cash JGBs were as much as 1.5bp richer out to the 20-Year sector, with the 7- to 10-Year zone leading, as a smooth 10-Year auction helped support. 30+-Year paper was marginally cheaper on the day, as the curve twist steepened. Wires ran headlines noting that the Japanese government is set to nominate Hajime Takata, an economist at Okasan Securities, and Naoki Tamura, of Sumitomo Mitsui, to replace outgoing BoJ board members Kataoka & Suzuki, whose terms finish on 23 July. Kataoka is the dovish stalwart on the board, with initial suggestions pointing to a less dovish makeup if these nominations are ratified. There wasn’t much in the way of market reaction to the report.

- ACGBs unwound their overnight and early Sydney firming ahead of the RBA decision, with the day’s big event ultimately producing nothing in the way of tangible market reaction. The Bank left its monetary policy settings unchanged, as expected, tipping its hat to the risks posed by the Russia-Ukraine conflict, while it sounded a little more worried re: the short-term inflationary impulse. Still, it referenced its prior forecasts when it came to underlying inflation The statement introduced references to wider employee compensation measures (outside of WPI), which although new to the post-meeting statement, had been covered by Governor Lowe in recent rounds of rhetoric (some noted that this gives the RBA more wiggle room when it comes to a quicker lift off, if deemed necessary). YM was unch., with XM -5.0 at the bell, a little off worst levels of Sydney dealing.

JGBS AUCTION: Japanese MOF sells Y2.1126tn 10-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.1126tn 10-Year JGBs:

- Average Yield 0.179% (prev. 0.175%)

- Average Price 99.23 (prev. 99.27)

- High Yield: 0.180% (prev. 0.176%)

- Low Price 99.22 (prev. 99.26)

- % Allotted At High Yield: 57.0000% (prev. 97.0987%)

- Bid/Cover: 3.235x (prev. 3.269x)

EQUITIES: Higher In Asia As Volatility Ebbs

Most major Asia-Pac equity indices are firmer at typing, with a lack of escalation in the Russia-Ukraine conflict during the Asian session allowing participants to strike a more optimistic tone.

- The Nikkei 225 leads regional peers, adding 1.5% at typing, and is on track to record gains for a third straight session. Large caps, particularly those with a focus on exports, such as Fast Retailing Co and Tokyo Electron, lead gains within the index, shrugging off a slowdown in the Feb Jibun Bank M’fing PMI reading (52.7 vs Jan 55.4).

- The Hang Seng underperformed, sitting 0.3% softer at typing, on track for a fourth consecutive lower daily close. This came as authorities announced a lockdown of Hong Kong to conduct mandatory COVID-19 testing. The heaviest losses were observed in the utilities (-1.0%) and real estate sub-indices (-1.0%), with the former now trading at levels not witnessed since Mar ’21. For the latter, sentiment in China-based real estate developers suffered as February home sales data from independent real estate research firm China Index Academy suggested that momentum in the sector is still weak (30 out of 100 cities reported a rise in the prices of new homes, against 44 in January).

- U.S. e-mini equity index futures are little changed into European hours.

OIL: Underpinned In Asia

WTI and Brent are +$0.90 at writing, printing ~$96.60 and ~$98.90 respectively.

- To recap, both benchmarks have backed away from Monday’s best levels, as the latest round of western sanctions on Russia have largely spared Russian energy exports, easing earlier worries re: disruptions to global oil supplies. A note that difficulties still remain for energy exports as several banks have halted trade financing for Russian commodities over the past week, with participants assessing the possible impediment to the movement of crude out of Russia.

- Crude has managed to shake off Monday’s BBG sources report, which suggested that the U.S. and its allies are discussing a co-ordinated release of up to 60mn bbls of crude from emergency reserves, with a decision expected “within days”.

- Uncertainty remains when it comes to the prospects of an Iranian nuclear deal, with a Reuters source report on Monday stating that the Iranian position has “become even more uncompromising”, suggesting that the country wants “to open issues that had already been agreed”. The U.S. has also since stated a willingness to pull out of talks should Iran show “intransigence to making progress”.

- From a technical perspective, resistance for WTI and Brent remains intact at their Feb 24 highs of $100.54 and $105.79, respectively, while support is seen at $90.06 (Feb 23 low and key support) for WTI, and $96.00 (Feb 25 low) for Brent.

GOLD: Marginally Softer In Asia

Gold is ~$4 worse off, printing $1,905.0/oz at typing. The precious metal trades well clear of Friday and Monday’s troughs, with worry surrounding an ongoing escalation in the Russia-Ukraine conflict continuing to support haven demand.

- To recap, planned European shipments of lethal weaponry to Ukraine and the increasingly visible impact of western sanctions on Russia (i.e. the Ruble’s plunge and the Russian CB doubling interest rates on Monday) has drawn strong rhetoric and retaliatory sanctions from Russia, with participants wary of further escalation re: more sanctions from western powers on Russia (noting that Russian President Putin ordered nuclear deterrent forces to be on “high alert” on Sunday over “aggressive statements” made by leading NATO powers).

- Worry re: a nuclear escalation has however eased from its extremes, after the U.S. indicated that they would not elevate their own nuclear posture in response.

- Russia-Ukraine talks held on Monday yielded no breakthroughs, although both delegations have indicated that there will be a second round of negotiations after consultations with their respective leaderships.

- Looking to technical levels, gold trades within its bull channel (drawn from the Aug 9 ’21 low), with the outlook remaining bullish despite recent volatility. Resistance is situated at ~$1,940.1 (top of bull channel), while support is seen at $1,878.4 (Feb 24 low and key short-term support).

FOREX: PBOC Leans Against Wind Of Yuan Appreciation, Market Sentiment Stabilises

The greenback crept higher in tandem with U.S. Treasury yields as market sentiment stabilised, with Monday's unrest caused by sweeping Western sanctions against Russia now in the rearview mirror. Demand for the Japanese yen and Swiss franc waned as safe haven assets lost their allure. High-beta FX were generally better bid, albeit the kiwi dollar retreated amid thin local headline flow.

- Spot USD/RUB edged lower but remained comfortably above the RUB100 mark. Japan confirmed it was joining sanctions against Russia, which would limit the CBR's access to tens of billions of dollars worth of its yen-denominated FX reserves. Bloomberg data showed that the indicative bid-ask spread for USD/RUB was the widest since at least early November.

- The PBOC signalled its discomfort with recent yuan appreciation via the daily fixing of USD/CNY reference rate. The mid-point of permitted trading band for the yuan was set at CNY6.3014, 59 pips above sell-side estimate. The weaker than expected fixing came on the heels of a Reuters report noting that "major Chinese state-owned banks were buying dollars in the onshore spot currency market on Monday, in what appeared to be attempts to defend the yuan from rising past the 6.31 per dollar level." Spot USD/CNH clawed back its initial losses even as the results of official & Caixin PMI surveys showed that China's manufacturing sector unexpectedly avoided contraction in February.

- German CPI, Canadian GDP and a slew of PMI readings from across the globe will take focus later in the day, alongside speeches from Fed's Bostic & Mester, BoE's Mann & Saunders and Norges Bank's Bache.

FOREX OPTIONS: Expiries for Mar01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1100-10(E572mln), $1.1200-10(E844mln), $1.1264-75(E1.2bln), $1.1345-60(E1.4bln)

- USD/JPY: Y114.70($507mln), Y115.70-80($581mln)

- AUD/USD: $0.7150-60(A$521mln), $0.7190-05(A$682mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/03/2022 | 0730/0730 |  | UK | DMO Gilt Operations Announcement W/C 4/11 April | |

| 01/03/2022 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/03/2022 | 0845/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/03/2022 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/03/2022 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/03/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/03/2022 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 01/03/2022 | 0930/0930 | ** |  | UK | BOE M4 |

| 01/03/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/03/2022 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 01/03/2022 | 1000/1100 | *** |  | IT | HICP (p) |

| 01/03/2022 | 1000/1100 | *** |  | DE | Saxony CPI |

| 01/03/2022 | - |  | EU | ECB Panetta at G7 Finance Ministers/CB Governors Meeting | |

| 01/03/2022 | - | *** |  | US | domestic made vehicle sales |

| 01/03/2022 | 1300/1400 | *** |  | DE | HICP (p) |

| 01/03/2022 | 1300/1400 |  | EU | ECB Lagarde visits Chancellor Scholz | |

| 01/03/2022 | 1330/0830 | * |  | US | construction spending |

| 01/03/2022 | 1330/0830 | *** |  | CA | GDP - Canadian Economic Accounts |

| 01/03/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 01/03/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/03/2022 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/03/2022 | 1830/1830 |  | UK | BOE Saunders speech at East Anglia University | |

| 01/03/2022 | 1900/1400 |  | US | Atlanta Fed's Raphael Bostic | |

| 01/03/2022 | 1900/1900 |  | UK | BOE Mann panels Cleveland Fed discussion | |

| 01/03/2022 | 1900/1400 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.