-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Equities Struggle, Chinese Tech Woes Evident

EXECUTIVE SUMMARY

- BIDEN SET TO CALL FOR END OF RUSSIA’S PREFERRED TRADE STATUS (BBG)

- RUSSIAN FORCES SHELL UKRAINE INSTITUTE WHICH HAS AN EXPERIMENTAL REACTOR (RTRS)

- RUSSIA SEEKS WAY TO RESUME STOCK TRADING NEXT WEEK (VEDOMOSTI)

- ONLY A HANDFUL OF ECB POLICYMAKERS WANTED TO KEEP MONEY TAPS OPEN (RTRS SOURCES)

- HAWKS IN CONTROL AT ECB AS INFLATION FEARS DICTATE POLICY (FT)

- RASKIN NOMINATION TAKES HIT AS MANCHIN BACKS SEPARATE FED VOTES

- SUNAK CONSIDERS LIMITED EXTRA MEASURES TO TACKLE COST OF LIVING CRISIS (GUARDIAN)

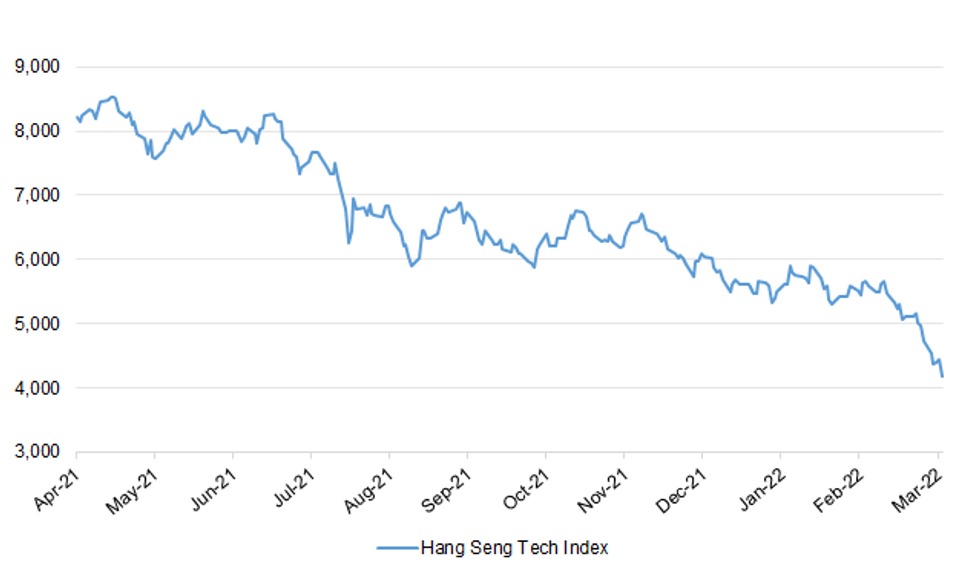

Fig. 1: Hang Seng Tech Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: Rishi Sunak will take some limited action to tackle the cost of living crisis in this month’s spring statement but will reject calls to beef up his much-criticised energy bill reduction scheme, government sources say. Amid mounting pressure from inside his own party, and with some City analysts predicting inflation could hit 10% within months, the chancellor has asked Treasury officials to draw up options for cushioning the blow for consumers. But Treasury sources stress that the government cannot protect the public from what is a global crisis – and underline the fact that the public finances are weaker than at the start of the pandemic, when Sunak took radical steps, including the furlough scheme. (Guardian)

FISCAL: Energy bosses have urged the chancellor to provide new financial support to customers and businesses as the war in Ukraine threatens to deepen the crisis which has engulfed the industry during the last six months. Sky News has seen a letter from Energy UK to Rishi Sunak in which it laments the use of energy "as a geopolitical weapon" and expresses deep concerns about repeated spikes in prices. The trade association - which counts the likes of British Gas-owner Centrica among its members - said it was "not concerned about UK security of supply" because of Britain's low dependence upon Russian gas imports. (Sky)

POLITICS: Scottish Conservatives leader Douglas Ross has withdrawn his letter of no confidence in Boris Johnson - submitted over the "partygate" row - due to the war in Ukraine. In a U-turn on his call for the prime minister to quit, Mr Ross said "the middle of an international crisis is not the time to be discussing resignations, unless it's the removal from office of Vladimir Putin". The decision comes little more than a week before the Scottish Conservatives conference in Aberdeen, which Mr Johnson has been invited to address. (Sky)

POLITICS: Sir Ed Davey, Liberal Democrat leader, has paved the way for a possible working relationship with Labour in a hung parliament to oust Boris Johnson’s Conservatives, pouring praise on Sir Keir Starmer for transforming the UK’s largest opposition party. In an interview with the Financial Times, Davey hinted at a pre-election rapprochement with Labour, saying he wanted the Lib Dems to be “influential in the next parliament and that means getting rid of the Conservative government”. Speaking ahead of his party’s mainly virtual spring conference this weekend, the Lib Dem leader also called for a one-year 2.5 percentage point cut in value added tax to alleviate the cost-of-living crisis. (FT)

EUROPE

ECB: Only a handful of European Central Bank policymakers made the case for keeping the ECB's money-printing programme open-ended at Thursday's meeting as concerns about inflation dominated the debate, two sources familiar with the discussion told Reuters. The ECB said on Thursday it would end asset purchases in the third quarter of this year, moving ahead with its exit from stimulus despite uncertainty about the economic impact of Russia's invasion of Ukraine. The sources said a clear majority of the ECB's Governing Council wanted to put an end-date on the Asset Purchase Programme (APP) and only a handful had called for keeping the previous guidance for purchases to run at least until October. (RTRS)

ECB: The balance of power at the European Central Bank has shifted decisively in favour of hawkish officials determined to tackle the risk of inflation spiralling upwards, despite fears that the war in Ukraine could drag Europe into recession. Several ECB governing council members argued at Thursday’s meeting that it should wait before speeding up the withdrawal of its bond-buying stimulus due to uncertainty over the economic fallout from Russia’s invasion of Ukraine. But they were outnumbered by more hawkish voices. “The argument about inflation dominated and prevailed over anything else, including the war, the uncertainty and the fears about growth,” said one person involved in the meeting. “The risks of inflation are now seen as greater than other concerns by a majority of the council,” the person said, after the ECB announced it planned to stop net bond purchases in the third quarter in response to the recent surge in prices of energy and many other goods. Consumer prices in the eurozone have risen faster than the ECB expected for several months, hitting a record annual pace of 5.8 per cent in February. On Thursday, the ECB raised its forecast for inflation this year from 3.2 per cent to 5.1 per cent, citing the “exceptional energy price shocks” stemming from the war in Ukraine. A second person involved in Thursday’s meeting said: “It is getting clearer and clearer to more of my colleagues that the transitory story on inflation is a bankrupt story.” “It is not just oil and energy prices that are rising fast, you have food, non-energy industrial goods and services all accelerating at more than 2 per cent,” said the second person. “We have to do something — we cannot be the only central bank not reacting.” (FT)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include

- S&P on Malta (current rating: A-; Outlook Stable), Norway (current rating: AAA; Outlook Stable) & Portugal (current rating: BBB; Outlook Stable).

U.S.

FED: Sarah Bloom Raskin’s nomination to be Federal Reserve vice chair of supervision has taken another hit as key Senate Democrat Joe Manchin suggests President Joe Biden’s other four central bank nominees move forward without her. Senate Republicans have refused to show up for a Banking Committee vote to move the five nominees to the floor amid concerns about Raskin. West Virginia’s Manchin, who is not on the banking panel but is a crucial vote in the evenly divided Senate, wants the committee to vote on the other nominees, his spokesperson Sam Runyon confirmed. “If they’re willing to move four out of five? Take it and run with it. It’s a win,” Manchin said in an interview with Politico. (BBG)

INFLATION: White House press secretary Jen Psaki was pressed Friday about just how long Americans can expect high inflation to continue. Psaki told reporters that gas prices are expected to continue surging in the coming months due in large part to the ongoing Russian invasion of Ukraine. Psaki communicated that White House experts expect the markets to eventually stabilize and inflation to slow, saying the energy crisis is only "temporary." However, when Fox News' Peter Doocy pressed Psaki on how long "temporary" actually means, she demurred. "We rely on the assessment of the Federal Reserve and outside economic analysts who give an assessment of how long it will last. The expectations and their assessment at this point is that it will moderate at the end of the year," Psaki said. "There is also no question that when a foreign dictator invades a foreign country, and when that foreign dictator is the head of a country that is the third-largest supplier of oil in the world, that is going to have an impact. And it is." (Fox)

ECONOMY: U.S. Treasury Secretary Janet Yellen said on Thursday she expects a "soft landing" for the U.S. economy - not a recession - as the Federal Reserve raises interest rates to deal with steep inflation that is likely to get worse as Russia's invasion of Ukraine propels energy and other commodity costs higher. "I think that the labor market will remain strong," Yellen said in a CNBC interview. "I think it's appropriate for them to take action, but a soft landing is what I expect." (RTRS)

FISCAL: The Senate passed a full year $1.5 trillion federal funding bill that wards off a possible government shutdown while also providing Ukraine with aid to respond to the Russian invasion of its territory. A bipartisan sense of urgency to approve the $13.6 billion for humanitarian and security aid in response to Russia’s attack led to an overwhelming 68 to 31 vote on the legislation. The measure, which passed the House Wednesday, now heads to President Joe Biden’s desk for his signature. For majority Democrats, completing the bill in an era of hyper-partisanship counts as a major achievement. The government has been running on autopilot using Trump-era program funding levels since the start of the fiscal year on Oct. 1 and now domestic agencies will get a 6.7% boost. (BBG)

OTHER

GLOBAL TRADE: The Russian government has banned exports of cars, airplanes and drones until the end of this year, the Russian TASS news agency said on Thursday. Earlier on Thursday, Russia sought to retaliate against Western sanctions imposed over its invasion of Ukraine by banning exports of certain goods and agricultural commodities. (RTRS)

GLOBAL TRADE: Russia will suspend exports of wheat, meslin, rye, barley and corn to the Eurasian Economic Union (EEU) until Aug 31 in a move to secure its home market with enough food, the economy ministry said on Thursday. Russia will also ban sugar exports to third countries until Aug 31 but some exceptions would be possible for the EEU countries, membership of which comprises Armenia, Belarus, Kazakhstan, Kyrgyzstan and Russia itself, the ministry added. (RTRS)

GEOPOLITICS: China has since February faced continuous cyber attacks in which overseas actors took control of computers in the country to target Russia, Ukraine and Belarus, and most of these attacks originated in the United States, state news agency Xinhua said. Xinhua cited the National Computer Network Emergency Response Technical Team/Coordination Center of China, a cybersecurity technical centre that leads efforts to prevent and detect cybersecurity threats to the country. (RTRS)

U.S./CHINA: China's securities regulator said on Friday it is confident it will reach an agreement with U.S. counterparts on securities supervision, after U.S.-listed Chinese stocks tumbled as the first Chinese firms to be potentially de-listed were named. Earlier this week, the U.S. Securities Exchange Commission (SEC) identified five New York-listed Chinese companies that will be delisted if they do not provide access to audit documents, according to an 8 March post on its official website. Washington is demanding complete access to the books of U.S-listed Chinese companies, but Beijing bars foreign inspection of working papers from local accounting firms - an auditing dispute that puts hundreds of billions of dollars of U.S. investments at stake. In the note posted on its official WeChat page, the China Securities Regulatory Commission (CSRC) said that together with the Ministry of Finance, it has continued to communicate with the U.S. Public Company Accounting Oversight Board and has made "positive progress". (RTRS)

U.S./CHINA: TikTok is nearing a deal for Oracle Corp to store its U.S. users' information without its Chinese parent ByteDance having access to it, hoping to address U.S. regulatory concerns over data integrity on the popular short video app, people familiar with the matter said. The agreement would come a year and a half after a U.S. national security panel ordered ByteDance to divest TikTok because of fears that U.S. user data could be passed on to China's communist government. That order was not enforced after Joe Biden succeeded Donald Trump as U.S. president last year. The panel, however, known as the Committee on Foreign Investment in the United States (CFIUS), has continued to harbor concerns over data security at TikTok that ByteDance is now hoping to address, the sources said. (RTRS)

CORONAVIRUS: The death toll from Covid-19 may be three times higher than official records suggest, according to a study that found stark differences across countries and regions. As many as 18.2 million people probably died from Covid in the first two years of the pandemic, researchers found in the first peer-reviewed global estimate of excess deaths. They pointed to a lack of testing and unreliable mortality data to explain the discrepancy with official estimates of roughly 5.9 million deaths. “At the global level, this is quite the biggest mortality shock since the Spanish flu,” said Christopher J.L. Murray, director of the Institute for Health Metrics and Evaluation at the University of Washington, where the study was conducted. Covid drove a 17% jump in deaths worldwide, he said in an interview. The flu pandemic that began in 1918 killed at least 50 million people. (BBG)

JAPAN: Japan’s government isn’t considering putting together an additional stimulus package at the moment, Finance Minister Shunichi Suzukitells reporters. Government is currently focused on putting next year’s budget through parliament, Suzuki says Friday after being asked about the possibility of a package given the impact of rising energy costs on households. Government is taking various measures to respond to the rise in energy prices, but will continue to closely watch its impact on households and firms. (BBG)

BOJ: Japan's economic and price conditions do not allow the central bank to withdraw its massive monetary stimulus, a senior Bank of Japan official said on Friday. "Unless there's risk of second-round effects, such as (an excessive) rise in wages, it's inappropriate to respond with monetary tightening," Seiichi Shimizu, head of the BOJ's monetary affairs department, told parliament. (RTRS)

RBA: Reserve Bank Governor Philip Lowe said he is paying close attention to Australians’ inflation psychology in order to determine whether temporary price spikes come to be seen by the public as more permanent. “If that shift were to occur, inflation would be higher and would be more persistent and we’d have to respond to that over time,” the governor said in response to questions following his opening address to the Australian Banking Association on Friday. (BBG)

RBNZ: MNI INTERVIEW: RBNZ Could Stop At 2.5%, "Shadow Board" Member

- A member of a “shadow board’ of the Reserve Bank of New Zealand believes the central bank could stop raising interest rates when they reach 2.5%, and not go beyond 3% as forecast by the latest guidance as it manages a potential tricky balance of a weaker economy and energy-driven inflation - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

RBNZ: New Zealand banks are calling on the Reserve Bank to delay implementation of new mortgage lending restrictions such as debt-to-income ratios as the housing market cools. Existing restrictions and rising interest rates are already slowing home-lending growth, and banks are concerned the introduction of further limits could have “unintended consequences,” the New Zealand Bankers Association said in a submission to the RBNZ posted on its website. It urged the central bank to assess the impact of market changes before using additional tools. New Zealand’s booming housing market last year prompted the RBNZ to begin consulting on the introduction of new lending restrictions to reduce financial stability risks as borrowers took on increasingly large amounts of debt. The RBNZ has said DTI ratios, which would tie the amount a person could borrow to their income, could be imposed by the fourth quarter of this year. However, the housing market is now showing signs of slowing and economists expect prices to fall this year and next. (BBG)

SOUTH KOREA: South Korea will probably face the peak of omicron variant spread over the next 10 days and the number of daily confirmed cases may reach up to 370,000, South Korea’s Prime Minister Kim Boo-kyum says in a meeting. South Korea earlier this week reported 342,446 daily new cases, a record. (BBG)

NORTH KOREA: The U.S. is preparing new penalties against North Korea after determining that Kim Jong Un’s regime used a pair of recent missile launches to test systems for a new ICBM project under development. The restrictions would aim to further block North Korea’s purchase of foreign technologies, a senior Biden Administration official told reporters Thursday, without providing more details. The U.S. is also ordering intensified intelligence surveillance and reconnaissance collection activities in the Yellow Sea and is enhancing ballistic missile defense forces in the region following the assessment, according to the official. (BBG)

NORTH KOREA: Japan is considering imposing additional sanctions on North Korea in response to repeated missile launches to test ICBM technology, Nikkei reports without attribution. Expanding asset freezes being floated as option. Will announce measures in concert with U.S.; Prime Minister Fumio Kishida alluded to the possibility of putting additional constraints on N. Korea earlier. (BBG)

TURKEY: Turkish President Tayyip Erdogan told U.S. President Joe Biden in a phone call on Thursday that it was past time to lift all "unjust" sanctions on Turkey's defence industry. According to a statement from Erdogan's office, he also told Biden that Turkey expected its request to purchase 40 new F-16 fighter jets and modernise its existing fleet to be finalised as soon as possible. Ankara had initially ordered more than 100 F-35 jets, made by Lockheed Martin Corp, but the United States removed Turkey from the programme in 2019 after it acquired Russian S-400 missile defence systems. Turkey has called the move unjust and demanded reimbursement for its US$1.4 billion payment. (RTRS)

MEXICO: Mexico Senate majority leader Ricardo Monreal is working on a bill that would pressure banks to make cheap loans to small and medium-size businesses as part of efforts to revive the country’s stalled economic recovery. The bill will be aimed at helping the “great many” businesses that were badly hit by the pandemic, Monreal told Bloomberg News in an interview. He plans to gain the consensus of the central bank, banking associations and the banking commission before moving forward with the bill, the senator said, without providing details of the proposal. “It’s important that banking is opened up to make low-interest loans to people who lost their businesses or people who closed their businesses during the pandemic,” Monreal, 61, said Wednesday. It will help “people who need a bank guarantee and need fresh money to do their activities in the country.” (BBG)

BRAZIL: Brazil’s Lower House approved a bill that allows a change in ICMS tax on fuels and cuts to zero the PIS/Cofins taxes on diesel, cooking gas and biodiesel and those applied to imports of aviation kerosene until Dec. 31. (BBG)

RUSSIA: Russian forces shelled an institute in the city of Kharkiv that is home to an experimental nuclear reactor and a neighboring hostel is on fire, the Ukrainian Parliament said on Thursday. In a tweet, the parliament's official website said fighting close to the Institute of Physics and Technology was continuing. (RTRS)

RUSSIA: Satellite images taken on Thursday show a large Russian military convoy, last seen northwest of Kyiv near Antonov airport, has largely dispersed and redeployed, a private U.S. company said on Thursday. Maxar Technologies said images show armored units maneuvering in and through the surrounding towns close to the airport. It said images also show convoy elements further north have repositioned near Lubyanka with towed artillery howitzers in firing positions nearby. (RTRS)

RUSSIA: Ukraine told the U.N. nuclear watchdog on Thursday it has lost all contact with the radioactive waste facilities at Chernobyl next to the defunct power plant at the site of the world's worst nuclear accident in 1986, which is now held by Russian forces. "Ukraine informed the International Atomic Energy Agency (IAEA) that it had lost today all communications with the Chornobyl Nuclear Power Plant (NPP), the day after the Russian-controlled site lost all external power supplies," the IAEA said in a statement, adding that before there was contact by email. (RTRS)

RUSSIA: The Russian defence ministry said on Thursday it had agreed to allow a Ukrainian repair team to access power lines in the area around the Chernobyl nuclear power station, Interfax news agency said, giving no further details. The U.N.'s nuclear watchdog said earlier that in the wake of the Russian invasion of Ukraine, communications with Chernobyl and another nuclear power station at Zaporizhzhia had degraded and the situation was concerning. (RTRS)

RUSSIA: Boris Johnson has said he fears Vladimir Putin may deploy chemical weapons in Ukraine as that would be "straight out of Russia's playbook". Speaking on Sky News' Beth Rigby Interviews programme, the prime minister said the only way the war in Ukraine can end is if the Russian president realises he has made a "catastrophic mistake". Mr Johnson reiterated Western officials' fears that Mr Putin could use chemical weapons in Ukraine after Moscow accused Kyiv of planning to deploy them in the battlefield. "The stuff that you're hearing about chemical weapons is straight out of their playbook," he said. "They start saying that there are chemical weapons that have been stored by their opponents or by the Americans. "And so when they themselves deploy chemical weapons, as I fear they may, they have a sort of maskirovka - a fake story - ready to go.” (Sky)

RUSSIA: Premier Li Keqiang reiterated China’s support for cease- fire talks between Russia and Ukraine, while continuing to avoid criticizing the invasion ordered last month by Putin. China has sought to avoid taking a clear side in the war, urging talks and protecting civilians while abstaining from UN resolutions and voicing support for the “legitimate security concerns” cited by Putin to justify the assault. (BBG)

RUSSIA: President Cyril Ramaphosa said on Thursday South Africa had been asked to mediate in the Russia-Ukraine conflict, and that he had told his Russian counterpart Vladimir Putin in a phone call it should be settled through negotiations. (RTRS)

RUSSIA: The United Nations Security Council will convene on Friday at Russia's request, diplomats said, to discuss Moscow's claims, presented without evidence, of U.S. biological activities in Ukraine. The United States has dismissed Russian claims as 'laughable,' warning Moscow may be preparing to use chemical or biological weapons. (RTRS)

RUSSIA: EU leaders issued a joint statement saying they would support Ukraine “in pursuing its European path” and that it belongs in the “European family,” but stopped short of mentioning any special or accelerated candidacy status. The Baltic nations and Poland had been pushing for a more fulsome blessing for Ukraine’s interest in joining the EU, but Germany and the Netherlands argued there was no way to circumvent or speed up the accession process. EU leaders will reconvene later Friday morning for the second day of their informal summit at Versailles near Paris. (BBG)

RUSSIA: President Joe Biden on Friday is set to call for an end of normal trade relations with Russia, clearing the way for increased tariffs on Russian imports, according to people familiar with the matter. His announcement to revoke the trade privileges will come alongside the Group of Seven nations and European Union leaders, the people said. The president can’t unilaterally change Russia’s trade status because that authority lies with Congress, where Democratic and Republican lawmakers have called for the revocation. Suspending normal trade relations with the U.S., which other countries call most favored nation status, would put Russia in the company of countries like Cuba and North Korea. It would allow the U.S. to hit Russia with significantly higher tariffs than it applies to other World Trade Organization members, which has as a core principle non-discrimination among members and treating all members equally. Just like the U.S., the other countries calling for the repeal over Russia’s invasion of Ukraine will go through their own processes, the people said. (BBG)

RUSSIA: MSCI said it has noted that certain current index constituents belong to issuers which are domiciled in Developed Market countries, but have credit exposure to Russia via their corporate ownership structure. MSCI said it shall exclude bonds with such exposure from the MSCI Corporate Bond Indexes at the close of March 11. (BBG)

RUSSIA: Ed Eisler’s hedge fund has returned all Russia-linked cash as the investment firm distances itself from sanctioned companies or individuals after Vladimir Putin’s invasion of Ukraine. The fund’s board decided Thursday to redeem all capital affected by sanctions imposed by the U.S., European Union or U.K., according to an internal memo seen by Bloomberg. As a result, Eisler Capital no longer has direct or indirect exposure to Russian capital in any of its funds. “The redemption has been conducted in a swift and orderly manner,” the London-based investment firm told its staff. “Eisler Capital will continue to maintain the highest standards in meeting its legal, regulatory, and fiduciary Responsibilities.” (BBG)

RUSSIA: There will be no stock trading on the Moscow Exchange on Friday, as the closure of Russia's stock market reaches the two-week mark. In a notice posted on its website late Thursday evening, the Russian Central Bank said there would be no stock trading on the exchange the next day. The Moscow Exchange's currency market will be open. (Dow Jones)

RUSSIA: Bank of Russia and Moscow Exchange are considering ways to reopen trading of equities without allowing a collapse in prices, Vedomosti reports, citing unidentified people close to the central bank and exchange. Central bank not opposed to reopening Monday or Tuesday; no final decisions made. Among options under discussion are starting bond trading and then stocks trading in discrete auction format for limited period before reopening normal trading. All trading instruments unlikely to restart simultaneously. (BBG)

RUSSIA: Russia is prepared to pay its foreign creditors on condition that a freeze on much of its $643 billion cash pile is lifted, according to Finance Minister Anton Siluanov. Speaking at a government meeting attended by President Vladimir Putin, Siluanov reiterated Russia’s decision to service its dollar and euro-denominated bonds in rubles. Bondholders would be able to get their payments in hard currency only if a block on the central bank’s reserves held overseas is removed, he said. (BBG)

RUSSIA: The International Monetary Fund joined a growing chorus that’s warning of a risk that Russia will default on debt obligations following its invasion of Ukraine. A Russian default is no longer “an improbable event,” IMF Managing Director Kristalina Georgieva told reporters Thursday. (BBG)

IRAN: Iran's foreign minister said on Friday a "good and durable" nuclear deal is within reach, "if U.S. acts realistically & consistently." "No single party can determine end result, a joint endeavour is needed," Hossein Amirabdollahian added on Twitter. (RTRS)

IRAN: The U.S. State Department on Thursday said Washington has no intention of offering Russia anything new or specific as it relates to sanctions on Moscow in talks to reach a nuclear deal with Iran. State Department spokesperson Ned Price told reporters a nuclear deal with Iran is down to a small number of outstanding issues and called on all parties, including Russia, to focus on resolving the final issues to reach a deal. (RTRS)

PERU: Peru’s central bank raised its benchmark interest rate to 4.0% from 3.5%, the monetary authority said on Thursday, marking its eighth consecutive rate hike as the South American country faces stubborn inflation above the bank’s annual target range. The 12-month inflation rate stood at 6.15% in February, compared to the bank’s target of between 1% and 3%, pushed up by higher food and fuel prices as well as a weakening sol currency versus the U.S. dollar. (RTRS)

IMF: International Monetary Fund chief Kristalina Georgieva on Thursday said she expected mounting pressure on Russia to end the war in Ukraine given the spillover effects it is having on economies around the world. Georgieva told CNBC that she had spoken on Wednesday with a Chinese central bank official who expressed great concern about the loss of human life and suffering in Ukraine. She said the IMF was preparing to revise downward its forecast for global economic growth as a result of the war and deep sanctions imposed on Russia, but still expected a "positive trajectory" for the world economy. (RTRS)

METALS: The London Metal Exchange will not restart the trading of nickel contracts on Friday as it had anticipated because the criteria for restarting have not been met, the exchange said in a members notice on Thursday. "In relation to netting off long and short positions, the initial responses indicated limited potential uptake, particularly from those with short positions, and considerable differences in view on the appropriate price," the exchange said. (RTRS)

ENERGY: European Commission President Ursula von der Leyen is seeking the political green light from European Union leaders to propose in May measures to phase out dependencies on Russian fossil fuels by 2027. Von der Leyen outlined her plan to heads of government at their informal summit in Versailles on Thursday, according to a post on Twitter. The commission earlier this week published an overhauled energy strategy aiming to cut reliance on Moscow following President Vladimir Putin’s invasion of Ukraine. (BBG)

ENERGY: The G7 club of the most industrialised nations on Thursday urged big energy-producing countries to boost deliveries to blunt the impact of the Russian invasion of Ukraine on prices. "We call on oil and gas producing countries to act in a responsible manner and to examine their ability to increase deliveries to international markets particularly where production is not meeting full capacity noting that OPEC has a key role to play," G7 energy ministers said in a joint statement. They added it was "necessary to consider effective measures in order to stop the increase in the gas price". (AFP)

OIL: A refinery in Saudi Arabia's capital, Riyadh, was attacked by a drone on Thursday morning but petroleum supplies were not affected, Saudi state news agency SPA reported early on Friday. The attack caused a small fire that was controlled and did not result in any injuries or casualties, SPA said citing a statement by an energy ministry official. "The refinery's operations and supplies of petroleum and its derivatives were not affected," the statement said.

OIL: The White House said on Thursday that Venezuela's release of two jailed American citizens earlier this week was not done in exchange for sanctions relief or oil. "The release of the detainees was not for the exchange for sanctions relief or buying oil," White House spokesperson Jen Psaki told reporters. (RTRS)

OIL: Qatar Energy sold two cargoes of Al-Shaheen crude for May loading at a premium of ~$12/bbl to Dubai benchmark price, said traders who asked not to be identified. Buyers were Chinese companies. (BBG)

CHINA

ECONOMY: China's Premier Li Keqiang said on Friday it was not an easy thing to achieve a gross domestic product (GDP) growth goal of around 5.5% in 2022 for an economy as big as China's. This year, China has encountered a new downtrend, but the macroeconomic policies would help achieve the sustainability of China's economy, said Li at a press conference after the close of the country's annual meeting of parliament. (RTRS)

ECONOMY: China's Premier Li Keqiang said on Friday that preferably the country would create over 13 million new urban jobs this year, which is more than its target. Fiscal and monetary policies this year will support employment, Li said at a press conference after the close of the China's annual parliament meeting. The government has set a target to create at least 11 million urban jobs this year. (RTRS)

PBOC: The escalating conflicts between Russia and Ukraine and the resulting higher commodity prices may fan inflation and reduce the People's Bank of China's policy space, Zhang Ming, a senior fellow at the Chinese Academy of Social Sciences. With the adjustments in global capital markets, foreign funds may also exit China’s stock markets, increasing volatility, Zhang said in his personal WeChat blogpost. The higher global commodity prices are likely to force the Federal Reserve to quicken its policy tightening, slowing global growth further and causing more volatility, Zhang said. (MNI)

YUAN: China may tighten controls over foreign exchange again if capital outflow increases following expected U.S. rate hikes, Beijing News reported citing Huang Yiping, a former monetary advisor at the People’s Bank of China and now a professor at Peking University. The expected rate hikes by the U.S. Federal Reserve may exert the same pressure on China as other emerging markets, including capital outflow, currency depreciation, rising rates and falling asset prices, Huang said. China still has policy space relative to other central banks grappling with inflation, including possible interest rate cuts, Huang was cited saying. (MNI)

YUAN: China’s move to double the yuan trading band for the ruble helps to better absorb the fluctuation of ruble-U.S. dollar pair and prevent arbitraging, Yicai.com reported citing Guan Tao, chief economist of Bank of China International. The currency pair will be allowed to trade 10% around the fixing rate for the first time, as the ruble continued to plummet against the dollar. Sino-Russian trade companies are facing greater currency risks and a wider trading brand allows them to reduce exchange risks, the newspaper said citing Tu Yonghong, deputy director of the International Monetary Institute, RUC. (MNI)

POLICY: China's Premier Li Keqiang confirmed on Friday plans to step down after his current term expires next March. The No. 2 in the hierarchy of China's ruling Communist Party, Li has been premier since 2013, and is constitutionally limited to two terms. "This is the last year I will be premier," Li told a news conference. President Xi Jinping is expected to secure a precedent-breaking third term as party chief at a party meeting this autumn to elect leaders for the next five years. In 2015, China revised its constitution to drop a limit of two terms for those holding the post of president. Party leaders can choose the next premier.

EQUITIES: Didi Global Inc. has suspended preparations for its planned Hong Kong listing after failing to appease Chinese regulators’ DIDI US Equity demands that it overhaul its systems for handling sensitive user data, according to people familiar with the matter. (BBG)

CORONAVIRUS: China’s daily caseload exceeded 1,000 for the first time in two years, as the highly infectious omicron variant spawns outbreaks at a scale only seen at the peak of the start of the pandemic in Wuhan. The country reported 1,100 domestic infections, data from the National Health Commission showed. The tally has ballooned from just over 300 cases a day in less than a week, presenting a significant challenge to China’s zero-tolerance approach to the virus. (BBG)

CORONAVIRUS: “China has adopted a coordinated approach to its Covid response and economic and social development,” Premier Li Keqiang said as the National People’s Congress in Beijing drew to a close. “We will continue to work to make our response more scientific and targeted based on the Covid situation.” Li also commented on Hong Kong, which is battling one of the world’s deadliest outbreaks, saying the government there “needs to fulfill its primary responsibility in tackling the situation and the central government will give its full support.” (BBG)

OVERNIGHT DATA

JAPAN JAN HOUSEHOLD SPENDING +6.9% Y/Y; MEDIAN +3.4%; DEC -0.2%

JAPAN Q1 BSI LARGE ALL INDUSTRY -7.5 Q/Q; Q4 +9.6

JAPAN Q1 BSI LARGE M’FING -7.6 Q/Q; Q4 +7.9

NEW ZEALAND FEB BUSINESSNZ M’FING PMI 53.6; JAN 52.3

New Zealand's manufacturing sector saw a lift in the level of expansion for February, according to the latest BNZ - BusinessNZ Performance of Manufacturing Index (PMI). The seasonally adjusted PMI for February was 53.6 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). This was 1.3 points higher than January, and above the long-term average of 53.1 for the survey. BusinessNZ's Director, Advocacy Catherine Beard said that there were certainly some positive signs with the February result. However, this needed to be balanced with the wider spread of Omicron potentially affecting business plans in the months ahead, as well as comments from manufacturers still firmly in negative territory (69.9%). "In terms of the main sub-indices, New Orders (58.2) increased to its highest level since July 2021, while Production (52.1) did experience a slight improvement, although still at its second lowest value since September 2021. Employment (51.7) rose back into expansion, while Finished Stocks (50.0) dropped to its lowest result since November 2021." BNZ Senior Economist, Craig Ebert stated that “underlying unease will certainly be piqued by the sustained high COVID case numbers as we go into March. The next PMI result may also see fallout from the Russia/Ukraine conflict, whose global impacts will be felt far and wide." (BNZ)

NEW ZEALAND FEB FOOD PRICES -0.1% M/M; JAN +2.7%

SOUTH KOREA JAN BOP CURRENT ACCOUNT BALANCE +$1,810.9MN; DEC +$6,062.0MN

SOUTH KOREA JAN BOP GOODS BALANCE +$672.3MN; DEC +$4,481.7MN

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Friday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on

- its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1000% at 09:25 am local time from the close of 2.0752% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 59 on Thursday, up from 45 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3306 FRI VS 6.3105

The People's Bank of China (PBOC) set the dollar-yuan central parity rate high at 6.3306 on Friday, compared with 6.3105 set on Thursday.

MARKETS

SNAPSHOT: Equities Struggle, Chinese Tech Woes Evident

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 506.8 points at 25187.47

- ASX 200 down 67.231 points at 7063.6

- Shanghai Comp. down 42.146 points at 3253.946

- JGB 10-Yr future up 8 ticks at 150.58, yield down 0.8bp at 0.186%

- Aussie 10-Yr future down 2.9 ticks at 97.601, yield up 3.3bp at 2.399%

- U.S. 10-Yr future up 0-07+ at 126-08, yield down 1.05bp at 1.9759%

- WTI crude down $0.03 at $105.98, Gold down $13.51 at $1983.69

- USD/JPY up 58 pips at Y116.72

- BIDEN SET TO CALL FOR END OF RUSSIA’S PREFERRED TRADE STATUS (BBG)

- RUSSIAN FORCES SHELL UKRAINE INSTITUTE WHICH HAS AN EXPERIMENTAL REACTOR (RTRS)

- RUSSIA SEEKS WAY TO RESUME STOCK TRADING NEXT WEEK: VEDOMOSTI

- ONLY A HANDFUL OF ECB POLICYMAKERS WANTED TO KEEP MONEY TAPS OPEN (RTRS SOURCES)

- RASKIN NOMINATION TAKES HIT AS MANCHIN BACKS SEPARATE FED VOTES

- SUNAK CONSIDERS LIMITED EXTRA MEASURES TO TACKLE COST OF LIVING CRISIS (GUARDIAN)

BONDS: Firmer In Asia Hours, But Off Best Levels

Core fixed income markets drew support from the wider equity weakness evident during early Asia-Pac dealing, with some focus on the spill over move lower in Chinese tech names owing to U.S. regulatory scrutiny on the space. Uncertainty surrounding the Russian shelling of a Ukrainian facility with an experimental nuclear reactor also supported. There has been a light retrace from best levels, with a pretty sharp turn away from lows during early afternoon equity dealing in both Hong Kong & China allowing e-mini futures to unwind their early Asia losses. Note that the timing of the equity move will generate speculation re: the potential for Chinese national team involvement.

- TYM2 prints +0-07+ at 126-08 around the middle of its 0-10 Asia range. Cash Tsys run flat to 1.5bp richer, with the belly leading. UoM sentiment data headlines the NY economic docket on Friday, while President Biden will make an address re: Russia (at 10:15 Easter/15:15 London). There are suggestions that Biden may use the address to head a G7 call for an end to Russia’s preferred trade status, which would clear the way for further tariffs on Russian goods.

- JGB futures unwound their overnight losses as we moved through the Tokyo morning, aided by the aforementioned risk-negative pressures. Cash JGB trade saw the bulk of the major benchmarks bid in the morning, with the long end playing catch up in the afternoon. Still a late uptick in domestic equities (linked to wider dynamics) kept a lid on the space. This left futures +5 and cash JGBs little changed to 1bp richer across the curve come the bell. There hasn’t been much in the way of notable domestic headline flow. The head of the BoJ’s monetary policy department noted that "unless there's risk of second-round effects, such as (an excessive) rise in wages, it's inappropriate to respond with monetary tightening," in an appearance in front of parliament. Elsewhere, Japanese Finance Minister Suzuki flagged that the government isn’t looking at deploying an economic fiscal package at present, while it is keeping an eye on the impact of the price of oil re: households & firms.

- There wasn’t much to take from RBA Governor Lowe’s latest address. Lowe continued to embed optionality into lift off timing when it comes to the cash rate. He once again noted that it is plausible that the cash rate could start to rise this year or in ’23, while flagging a move closer to sustainable inflation within the Bank’s target range (although he noted that Australia is not there yet), which means that he isn’t feeling any “pressure” when it comes to hiking rates. Lowe then pointed to close attention re: inflation psychology. He also noted that there are multiple strong internal candidates to replace outgoing Deputy Governor Debelle. Futures nudged higher in early Sydney dealing, but finished shy of best levels, with YM -3.6 & XM -2.9.

JGBS AUCTION: 3-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y4.62041n 3-Month Bills:

- Average Yield -0.0875% (prev. -0.0934%)

- Average Price 100.0235 (prev. 100.0251)

- High Yield: -0.0800% (prev. -0.0856%)

- Low Price 100.0215 (prev. 100.0230)

- % Allotted At High Yield: 4.7875% (prev. 44.8954%)

- Bid/Cover: 2.525x (prev. 2.490x)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Wednesday 16 March it plans to sell A$1.0bn of the 1.25% 21 May 2032 Bond.

- On Thursday 17 March it plans to sell A$1.5bn of the 27 May 2022 Note & A$1.0bn of the 8 July 2022 Note.

- On Friday 18 March it plans to sell A$1.0bn of the 4.25% 21 April 2026 Bond.

EQUITIES: Lower As Russia-Ukraine Talks Fizzle, Inflation Worry Lingers

Most major Asia-Pac equity indices trade sharply lower at writing to build on a negative lead from Wall St., while a milder selloff was witnessed in EM equity indices. High-beta stocks across the region struggled, facilitated by Thursday’s hot U.S. CPI print, and a lack of progress in “high-level” Russia-Ukraine talks towards de-escalating the conflict in Ukraine, with some idiosyncracies also working against Chinese related tech names.

- The Hang Seng underperformed, sitting 3.4% weaker at typing. The index has hit fresh five-year lows as China-based tech stocks struggled, with the Hang Seng Tech Index (-7.5% at typing) recording new all-time lows. To elaborate, the move lower comes as Chinese stocks listed in the U.S. experienced their worst day in over a decade (Nasdaq Golden Dragon China Index: -10.1%) after the U.S. SEC identified five Chinese companies on Thursday that could be subject to delisting under non-compliance with auditing requirements.

- The CSI300 is 2.4% worse off at typing, with the steepest declines witnessed in the richly valued consumer staples and healthcare sub-indices.

- The ASX200 fared a little better than regional peers, reversing early gains to close 0.9% lower. Most of the sectors within the index traded lower on the day, although the utilities, energy, and materials sub-indices ended between 0.1% to 0.5% better off.

- U.S. e-mini equity index futures sit 0.4% to 0.7% lower at writing, dealing a touch above their session lows heading into European hours.

GOLD: Lower In Asia

Gold deals ~$6 lower at typing, printing $1,991.9/oz in very limited Asia-Pac dealing. The precious metal has struggled to make headway above $2,000/oz since backing away from 20-month highs on Tuesday, but operates above the previous week’s range as elevated worry remains re: stagflation and the Russia-Ukraine conflict.

- To recap, bullion initially rose to session highs at $2,009.2/oz on Thursday, following reports that “high-level” talks between the FMs of Russia and Ukraine yielded virtually no progress towards a ceasefire, nor a diplomatic solution to the conflict. The yellow metal however came under pressure later in NY, with the earlier risk-off impulse countered by an uptick in the Dollar (DXY).

- A note that Russian FM Lavrov emphasised Russia’s initial war goals of the “demilitarisation” and “denazification” of Ukraine, upending earlier sentiment that Russian demands had softened.

- Elsewhere, little initial reaction was observed in gold when it came to Thursday’s U.S. CPI print, which produced the fastest rise in 40 years on a Y/Y basis (matching expectations). Focus turns to the FOMC next week (Mar 15-16), with OIS markets re-embedding Fed hike premium for calendar ‘22 over the last 10 days. 25bp of tightening is priced in for the March FOMC, while a cumulative ~160bp of tightening has been priced in through calendar ’22, with the latter returning to pre-Russia-Ukraine conflict levels.

- From a technical perspective, the overall trend for goal remains bullish, with recent pullbacks seen as allowing for overbought conditions to unwind. Support for gold is situated at $1,961.2/oz (Mar 7 low), while resistance is seen at $2,070.4/oz (Mar 8 high).

OIL: Flat In Asia

WTI is +$0.30 and Brent is unch., with the benchmarks operating around the lower end of their respective Thursday ranges at typing.

- Both benchmarks are on track for their steepest weekly decline since Mar ’20, having backed away from recent 14-year highs as embargoes on Russian crude exports have been less extensive than previously feared (i.e. only the U.S. and the UK have adopted such measures, while Europe remains undecided), while participants continue to assess the prospect of Venezuelan and Iranian oil being reintroduced to global markets.

- On the latter issue, negotiations re: an Iranian nuclear deal have shown cracks, with Iranian officials accusing the U.S. on Thursday of making “unreasonable offers” and applying “unjustified pressure to hastily reach an agreement”. Iranian FM Amirabdollahian has since dialled down rhetoric by stating that a nuclear deal was still “within reach if “U.S. acts realistically and consistently”, although uncertainty re: the prospects of a successful deal remains elevated.

- Confirmation of a drone attack on a Saudi refinery in early Asian hours saw little movement in crude prices, with authorities stating that the refinery’s operations and supplies of petroleum were unaffected.

- From a technical perspective, the trend direction for crude remains upwards, with the sharp pullback this week seen as allowing for overbought conditions to unwind. Resistance for WTI and Brent is situated at the 50.0% retracement of Wednesday’s range, at $115.24 and $117.73 respectively, while support is seen at $101.80 (20-day EMA) for WTI and $104.23 (20-day EMA) for Brent.

FOREX: USD Generally Bid In Asia, But EUR Leads The Way

A couple of bouts of general USD demand were evident in Asia-Pacific hours, with residual weakness in the Chinese tech sphere on the back of Thursday’s regulatory announcements out of the U.S. re: audit-related non-compliance of 5 Chinese U.S.-listed firms and some worry about Russian shelling of a Ukrainian building with an experimental nuclear reactor inside seemingly creating USD demand.

- JPY weakness surrounding the Tokyo fix bolstered the rally in USD/JPY, with a second wave of JPY weakness coming during the afternoon. This meant the JPY found itself at the bottom of the pile when it came to G10 FX trade, even as the wider equity sphere traded lower. USD/JPY has registered fresh multi-year highs as a result, adding 60 pips to trade just shy of Y116.75 into European hours. Technically, bulls will now look to test resistance in the form of the 2.00 projection of the Apr-23-Jul 2-Aug 4 ’21 price swing (Y117.08).

- It wasn’t all one-way traffic for the USD. Asia-Pac participants were keen to buy the EUR in early regional dealing, likely looking to capitalise on the EUR/USD cheapening witnessed during the second half of Thursday’s NY session, after the impulse from the ECB’s hawkish moves when it came to QE faded.

- UK GDP readings, U.S. UoM sentiment, the Canadian labour market report and post-meeting ECB speak from Centeno & Rehn provide the highlights of the broader docket on Friday.

FOREX OPTIONS: Expiries for Mar11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0875-85(E710mln), $1.1200(E1.1bln)

- USD/JPY: Y114.00($525mln), Y114.50($1.2bln), Y114.75-90($1.3bln), Y115.25-30($1.1bln), Y115.75-90($1.4bln), Y116.00($1.9bln), Y116.15-25($1.1bln)

- AUD/USD: $0.7395-00(A$859mln)

- USD/CAD: C$1.2550($860mln), C$1.2710-25($617mln), C$1.2900($1.2bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/03/2022 | 0700/0800 | *** |  | DE | HICP (f) |

| 11/03/2022 | 0700/0700 | ** |  | UK | UK monthly GDP |

| 11/03/2022 | 0700/0700 | ** |  | UK | Index of Services |

| 11/03/2022 | 0700/0700 | *** |  | UK | Index of Production |

| 11/03/2022 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 11/03/2022 | 0700/0700 | ** |  | UK | Trade Balance |

| 11/03/2022 | 0800/0900 | *** |  | ES | HICP (f) |

| 11/03/2022 | 1330/0830 | ** |  | CA | Capacity Utilization |

| 11/03/2022 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 11/03/2022 | 1330/0830 | * |  | CA | Household debt-to-disposable income |

| 11/03/2022 | 1500/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 11/03/2022 | 1500/1000 | * |  | US | Services Revenues |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.