-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

MNI EUROPEAN MARKETS ANALYSIS: Bonds Sell Off Further In Asia, With USD/JPY Pushing Above Y120.00

- U.S. Tsys continued to slide in Asia in the wake of Fed Chair Powell's hawkish rhetoric, with Goldman Sachs now looking for back-to-back 50bp rate hikes from the fed at its next two meetings.

- USD/JPY broke above Y120.00 for the first time since early '16. Note that several market participants flagged broken barrier options at the Y120.00 level. A brief pullback below that round figure was followed by another round of purchases, which took the pair as high as to Y120.47. BoJ policy divergence vs. wider developed market central banks, Japan’s notable reliance on energy imports (and the surge in related prices in recent weeks, resulting in diminished terms of trade for Japan) and the well-documented cheapening in U.S. Tsys (higher Tsy yields) have been the dominant inputs into price action for the cross during early ’22.

- Central bank speak takes focus today, in the absence of notable data releases. Comments are due from ECB's Lagarde, Lane, de Guindos, Villeroy & Panetta, Fed's Williams, Daly & Mester as well as Riksbank's Ingves & Skingsley.

BOND SUMMARY: Powell’s Words Go A Long Way

Core bond markets were generally a touch above worst levels late in the Asia session.

- The bear flattening of the U.S. Tsy curve continued in Asia-Pac dealing, as the region reacted to Fed Chair Powell’s hawkish tones, delivered Monday. Note that a little over 80bp of cumulative tightening is now priced into OIS covering the next two FOMC meetings, with a total of ~190bp of cumulative tightening priced over the remainder of the year. Also on that front, Goldman Sachs now look for back-to-back 50bp hikes in May & June. There was a brief respite in the sell off during early futures trade, with a very modest uptick observed, before the re-open of cash trade ushered in fresh cheapening pressure that never really looked like reversing. That leaves cash Tsys 4-6bp cheaper ahead of London trade, with 2s leading the way lower. TYM2 is -0-04 at 123-02, 0-05 off the base of its 0-14+ overnight range. There wasn’t much in the way of notable headline flow to observe, with RTRS sources flagging confirmation that J.P.Morgan had processed Russia’s bond coupon payments. Flow was headlined by a block seller of FVM2 (-2,934), while regional $-denominated issuance saw Indonesia start to market multi-tranche 10- & 30-Year paper, which could price as soon as today. NY hours will see Richmond Fed manufacturing activity data complimented by Fedspeak from Williams, Mester (’22 voter) & Daly (’24 voter).

- JGB futures played catch up after the elongated Tokyo weekend, with talk of a Y10tn+ fiscal stimulus package (to be delivered later this year) applying some domestic impetus to the sell off, even as Chief Cabinet Secretary Matsuno noted that the government isn’t looking at compiling a stimulus package at present. Still, JGB futures weren’t able to breach their February cycle low, with the contract closing -20 on the session. Cash JGBs bear steepened with the major benchmarks running little changed to 2bp cheaper on the day (10s are less than 1bp away from the level that triggered the BoJ’s fixed rate operations in Feb). Comments from BoJ Governor Kuroda failed to add anything meaningful to the monetary policy debate. JPY issuance saw Egypt flag a private placement of 5-Year JPY paper for Japanese institutional investors.

- Aussie bonds bear flattened, with U.S. Tsy gyrations in the driving seat, that left YM -19.0 and XM -14.0 at the bell, with longer dated cash ACGBs cheapening by ~11bp. RBA Governor Lowe continued to muddy the optics surrounding the eventual cash rate lift off, noting that the Bank is monitoring how “pervasive” the shift in inflation psychology is in Australia, with evidence required on that front before the Bank responds. The IR strip ran 7-26 lower come settlement.

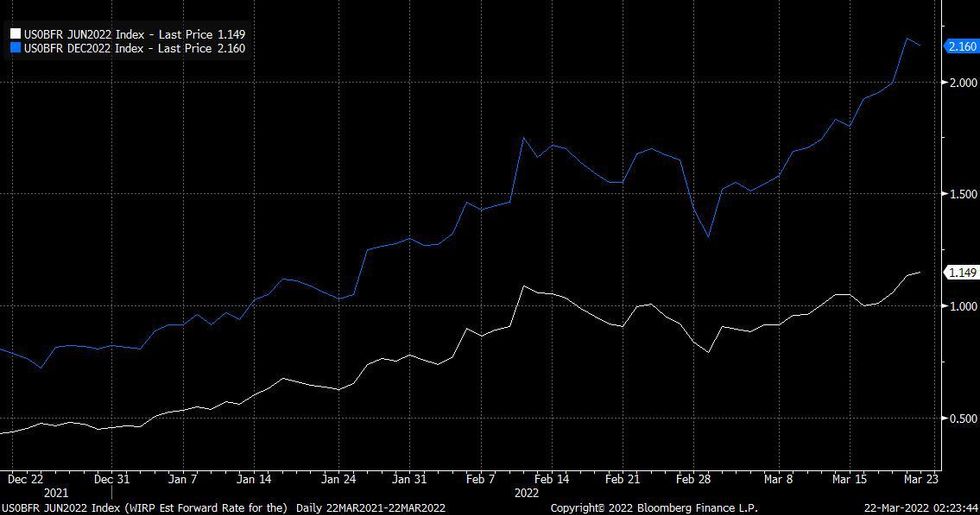

STIR: Non-Trivial Pricing Of Back-To-Back 50bp Hikes For Upcoming FOMC Meetings

Note that FOMC dated OIS now price in a cumulative ~82bp of tightening come the end of the Fed’s June meeting, meaning that a roughly 30% chance of back-to-back 50bp rate hikes from the Fed is priced for its next two meetings, with hawkish re-pricing most recently aided by Fed Chair Powell’s firmer tone when it comes to tightening (delivered on Monday). Meanwhile, December ’22 FOMC dated OIS is pricing in ~185bp of cumulative tightening over the remainder of the calendar year. That equates to ~7.4x 25bp hikes over the remaining 6 Fed meetings of ’22.

Fig. 1: June & Dec ’22 FOMC Dated OIS (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

STIR: What Is The Eurodollar Strip Saying About The Fed Further Out?

While the OIS strip flags the aforementioned degree of tightening in ’22, a quick look at the Eurodollar strip points to an increase in the pricing of Fed policy error shortly after. With the EDM3/M4 & EDM3/M5 spreads (we use EDM3 as the base month for the spreads as it currently has the highest implied interest rate on the Eurodollar strip) pulling sharply lower month-to-date, moving further into negative territory in the process. While the Fed is clearly cognisant of the risks that its tightening cycle poses to the economy, it is seemingly of the belief that it will be able to engineer a soft landing, markets are saying something very different. A quick reminder that the longer-term median dot in the Fed’s latest SEP lies below the ’23 & ’24 median dots, with the former residing at 2.375%.

Fig. 1: Eurodollar Jun ‘23/Jun ’24 & Jun ‘23/Jun ’25 Spreads (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

FOREX: Hawkish Powell Boosts Greenback, Yen Breaches Round Figure En Route To Six-Year Low

USD/JPY was bought into the Tokyo fix, printing above Y120.00 for the first time since early ’16 in the process. Note that several market participants flagged broken barrier options at the Y120.00 level. A brief pullback below that round figure was followed by another round of purchases, which took the pair as high as to Y120.47. BoJ policy divergence vs. wider developed market central banks, Japan’s notable reliance on energy imports (and the surge in related prices in recent weeks, resulting in diminished terms of trade for Japan) and the well-documented cheapening in U.S. Tsys (higher Tsy yields) have been the dominant inputs into price action for the cross during early ’22.

- EUR/JPY punched through the Y132.00 figure as it rose to the highest point since Feb 11, bringing Feb 10 cycle high of Y133.15 into view.

- The Antipodeans advanced, with a surge in AUD/JPY capped by a resistance zone located slightly above the Y89.00 mark and representing a series of intraday highs from January 2018.

- The greenback caught a bid as the Asia-Pacific digested latest comments from Fed Chair Powell, who flagged the possibility of a half-point rate hike if necessary. His hawkish posturing helped reinforce the perception that U.S. policymakers were determined to contain rising consumer prices.

- The PBOC fix fell virtually in line with expectations. China's central bank set the midpoint of permitted USD/CNY trading band at CNY6.3664. Spot USD/CNH edged higher while staying within yesterday's range.

- Central bank speak takes focus today, in the absence of notable data releases. Comments are due from ECB's Lagarde, Lane, de Guindos, Villeroy & Panetta, Fed's Williams, Daly & Mester as well as Riksbank's Ingves & Skingsley.

ASIA FX: Hawkish Fedspeak Supports USD/Asia Crosses

Better U.S. Tsy yields drove USD/Asia crosses higher on Tuesday, with the region digesting the latest round of hawkish comments from Fed Chair Powell, who left a 50bp rate hike on the table.

- CNH: Spot USD/CNH edged higher, with the in-line PBOC doing little to affect that trend. China's State Council reiterated the pledge to support domestic economy and financial markets on Monday. This would include firmer monetary policy stimulus, albeit without flooding the market with liquidity.

- KRW: Spot USD/KRW traded sideways after a higher re-open, with the pair generally holding above the KRW1,220.00 figure. South Korean President-elect Yoon vowed to submit a new extra budget to parliament as soon as he takes office if outgoing President Moon fails to propose one now.

- IDR: Spot USD/IDR pierced the IDR14,350 level on its way to best levels in two weeks. Indonesia removed all quarantine restrictions for vaccinated travellers, while FinMin Indrawati outlined plans to reduce this year's bond issuance target by at least IDR100tn.

- MYR: Spot USD/MYR rallied to a multi-week high in the absence of notable domestic headline flow.

- PHP: The peso went offered on the back of the broader regional impetus.

- THB: The baht retreated to a multi-week low amid rising oil prices.

EQUITIES: Financials Bid On Powell’s Remarks

Most major Asia-Pac equity indices are flat to higher at writing, bucking a negative lead from Wall St. Financial stocks caught a bid after Fed Chair Powell’s hawkish remarks on Monday (mainly on a willingness to back a more aggressive 50bp hike in May if necessary), outperforming peers in various indices across the region.

- The Nikkei 225 leads gains amongst regional peers, being 1.4% better off at writing to trade at one-month highs. Large-caps in energy and financials outperformed, while export-oriented names were notably bid as well. The move higher in the latter was facilitated by the Japanese Yen falling to fresh 6-year lows, with the USDJPY printing above Y120.00 for the first time since early ‘16.

- The Hang Seng sits 1.6% higher at typing, operating at session highs on gains in technology stocks after Alibaba Group announced a record $25bn stock buyback plan during the session. Broad sentiment in China-based stocks has steadied (Hang Seng China Enterprises Index: +2.2%) as monetary policy easing expectations have risen, with Xinhua reporting pledges from China’s State Council (chaired by Premier Li Keqiang) for market-supportive measures on Monday, building on dovish remarks made last Wednesday by Premier Li as well. Looking elsewhere domestically, the Hang Seng’s utilities sub-index took a beating, led by a ~14% drop in The Hong Kong China & Gas Co. on an earnings miss.

- U.S. e-mini equity index futures deal 0.1% to 0.3% softer at typing.

GOLD: Flat In Asia

Gold is back from session lows, dealing ~$1/oz firmer to print $1,937/oz at typing, sticking within a relatively tight ~$8/oz range during Asia hours. The precious metal operates well clear of Monday’s troughs as developments in the Russia-Ukraine conflict remain front and centre, with elevated worry over further armed escalation evident.

- To recap Monday’s price action, gold closed ~$15/oz higher despite U.S. real yields and the Dollar (DXY) ticking higher, with the latter dynamic aided by hawkish remarks from Fed Chair Powell).

- Looking to the Russia-Ukraine conflict, hope surrounding a diplomatic resolution from ongoing ceasefire talks has moderated, with the Kremlin stating on Monday that “there has been no significant progress so far”. Elsewhere, relations between the west and Russia have deteriorated, with former Russian President Medvedev issuing a lengthy letter denouncing the Polish leadership (noting that Russian attacks on Ukraine have come to within 15 miles of Poland’s border), while Moscow summoned the U.S. ambassador to Russia over President Biden’s labelling of President Putin as a “war criminal”, stating that Russo-U.S. relations were “on the verge of rupture”. The European Commission has also called for the stockpiling of supplies essential for protection in a nuclear incident (i.e. suits and iodine pills), exacerbating worry in some quarters re: a nuclear escalation in Europe.

- Looking to technical levels, bullion’s short-term conditions remain bearish, following the pullback from Mar 8 cycle highs at $2,070.4/oz. The longer-term bullish trend remains intact however, with the pullback considered to be corrective. Support is situated at $1,895.3 (Mar 15 low), while resistance is seen at $1,954.7/oz (Mar 15 high).

OIL: Higher In Asia

WTI is +$2.20 and Brent is $3.30 at writing, printing ~$114.30 and ~$118.90 respectively to build on a three-day streak of gains (~+$17). Both benchmarks have caught a bid in recent sessions as earlier optimism re: ongoing Russia-Ukraine ceasefire talks has moderated (with both sides not moving from their well-documented demands), shifting focus amongst participants to the potential impact of Russian crude supplies being removed from global markets in the coming weeks.

- Looking ahead, participants will be watching for possible EU measures (e.g. embargos or taxes) on Russian energy exports to the bloc this week, although outright sanctions are not expected to be enacted yet amidst strong internal opposition. Further discussions will be held on Thursday, when U.S. President Biden is due to arrive in Brussels.

- Elsewhere, there has been little discernible progress in ongoing U.S.-Iran nuclear talks, with Washington stating that an agreement was neither “imminent” nor “certain”, while also emphasising that the U.S. was prepared to make “difficult decisions” to return Iran’s nuclear programme to limits observed under a nuclear deal.

- Keeping within the region, Saudi Arabia has flagged the possibility of more Houthi attacks on its oil facilities, stating that it “won’t bear any responsibility” for disruptions to global crude supplies. A note that OPEC heavyweights Saudi Arabia and the UAE continue to show no sign of plans to speed up planned output increases, although international pressure on the group to do so continues to build (the UK, Japan, and Germany being the most recent parties to call for production increases).

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/03/2022 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 22/03/2022 | 0720/0820 |  | EU | ECB de Guindos in Panel at Money Review Banking Summit | |

| 22/03/2022 | 0900/1000 | ** |  | EU | EZ Current Acc |

| 22/03/2022 | 1000/1100 | ** |  | EU | Construction Production |

| 22/03/2022 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 22/03/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 22/03/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 22/03/2022 | 1310/1410 |  | EU | ECB Panetta Opening CCP Risk Management Conference | |

| 22/03/2022 | 1315/1415 |  | EU | ECB Lagarde Speech at BIS Innovation Summit | |

| 22/03/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 22/03/2022 | 1515/1515 |  | UK | BOE Cunliffe Panels BIS Innovation Summit | |

| 22/03/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 22/03/2022 | 1700/1800 |  | EU | ECB Lane Panels Discussion on Flexible Exchange Rates | |

| 22/03/2022 | 1800/1400 |  | US | San Francisco Fed's Mary Daly | |

| 22/03/2022 | 2100/1700 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.