-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI EUROPEAN MARKETS ANALYSIS: Another Day, Another High For USD/JPY

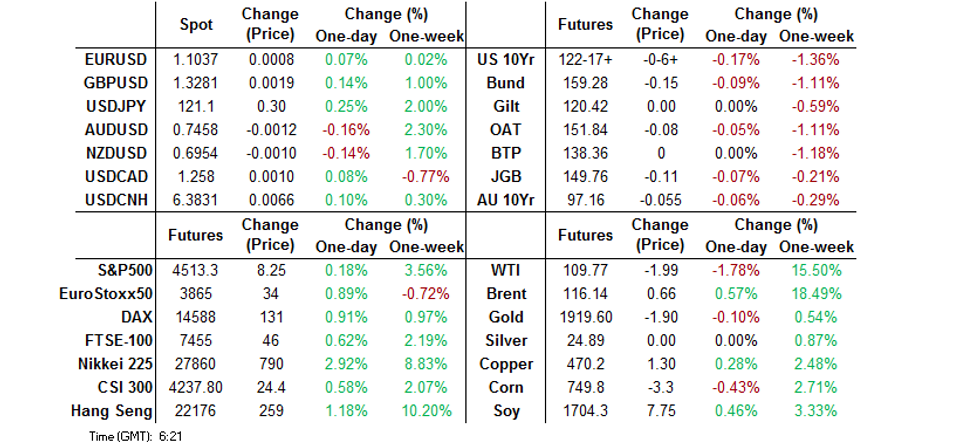

- TYM2’s technical support at the Mar 12 ’19 low (122-12), based on a continuation chart, held to the tick on the first test during Asia-Pac hours, limiting volatility during the second half of Asia-Pac trade, with a lack of fresh headline flow evident during overnight dealing.

- There was no sign of respite for the languishing yen as rising U.S. Tsy yields helped lift USD/JPY as high as to Y121.41, a new cycle peak. The rate went offered over the Tokyo fix but promptly regained poise. The latest portion of hawkish Fedspeak served as a reminder of growing policy divergence between the BoJ and most of its major peers.

- The European docket will be fairly UK-centric, with monthly inflation data and the Spring Statement ("mini-budget") from Chancellor Suna due. GBP has seen some modest strength in the lead-up to these events, with EUR/GBP testing the water below the GBP0.8300 mark overnight, before moving away from lows. Elsewhere, EZ consumer confidence & U.S. new home sales as well as plenty of central bank rhetoric will take focus later today. The speaker slate includes Fed & BoE chiefs.

BOND SUMMARY: TYM2 Support Holds On First Test

TYM2’s technical support at the Mar 12 ’19 low (122-12), based on a continuation chart, held to the tick on the first test during Asia-Pac hours, limiting volatility during the second half of Asia-Pac trade, with a lack of fresh headline flow evident during overnight dealing. TYM2 is last -0-07 at 122-17, after bouncing a little from the aforementioned support level on volume of 140K. Meanwhile, cash Tsys run 0.5-2.0bp cheaper on the day, bear steepening, with almost all of the major benchmark Tsy yields tagging fresh cycle highs in Asia hours, before pulling back from extremes. The aforementioned technical support in TYM2 and the long-term bear channel top in 10-Year Tsy yields (2.5419%) provide some market reference points that are worth watching in the immediate term. There wasn’t anything in the way of tangible reaction to comments from Cleveland Fed President Mester (’22 voter, hawk), who flagged her desire to raise rates to 2.50% by the end of the calendar year (above the median Fed dot of 1.875%), underscoring a desire to move at 50bp clips at some meetings. Asia-Pac flow was headlined by an FV/TY block (3K vs. 2K) although direction of the trades was hard to ascertain, some pointed to a steepener, but it is hard to be sure. Looking ahead, NY hours will bring new home sales data and Fedspeak from Powell, Daly & Bullard (all of whom have spoken in recent days). Tsy supply will consist of 20-Year Tsys and 2-Year FRNs

- JGB futures extended losses during the early rounds of Tokyo afternoon dealing, with a light uptick in the offer/cover ratio witnessed in today’s 5- to 10-Year BoJ Rinban operations pressuring that zone of the curve (note that the aforementioned offer/cover ratio was by no means elevated). The contract printed fresh cycle lows, before edging away from worst levels to close -11. Weakness in the longer end of the cash curve also extended, before paring back from extremes, with 30s and 40s ~1.5bp cheaper on the day at the bell, with twist steepening observed, as paper out to 5s traded little changed to 0.5bp richer. 10-Year JGB yields moved within 0.5bp of the level that triggered BoJ fixed rate operations back in in February (0.23%), before moving back from their peak.

- Offshore cues from U.S. Tsys remained front and centre for Aussie bonds, after the early Sydney vol., with futures closing above their respective session troughs (note that XM pushed through its early Sydney low before recovering). YM & XM were -5.5 at the bell, with light bear steepening observed in cash ACGB dealing.

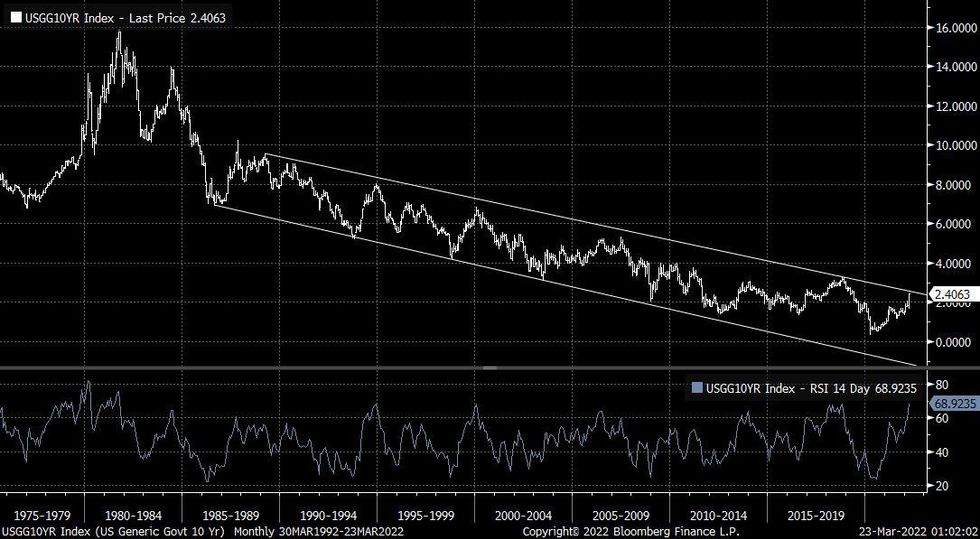

US TSYS: 10-Year Yields Nearing Bear Channel Top

10-Year Tsy Yields have moved towards the top of the near 35-Year bear channel, a break of the channel could be significant, although structural and demographic factors mean that most envisage lower bond yields vs. historical “norms” over the foreseeable future. Note that the upper bound of the channel resides at 2.5419% today, with 10s currently dealing around 2.41%. That ~13bp isn’t far away when we assess the recent daily ranges in yields, although sellers may be a little more wary as we approach the top of the channel, barring notable fundamental shifts.

- The 14-month RSI hasn’t crossed above the 70 overbought level in yield terms i.e. oversold in price terms, but isn’t far off, sitting just below 69.

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

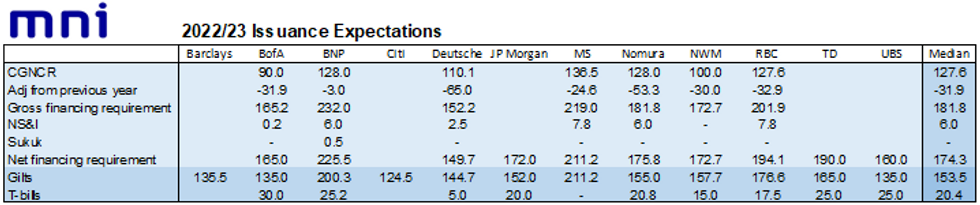

UK/GILTS: UK Issuance Deep Dive: Spring Statement 2022 Preview

- We look at expectations ahead of the Spring Statement. A median of 12 GEMM expectations for the remit comes in at GBP153.5bln with estimates ranging from GBP124.5bln to GBP211.2bln. We also look at the expected breakdown by maturity bucket.

- A median of 10 GEMMs expect the target stock of T-bills to be GBP20.4bln, with 8/10 looking for an increase to the stock in the GBP15-30bln range.

- We outline the major potential new measures that Sunak may be considering.

- Out political risk team notes that this is a parliamentary event that at the start of the year would have likely passed with relatively little fanfare, but now due to spiking inflationary pressures and the war in Ukraine, is garnering significant political focus.

- Full document: MNI_UK_DeepDive_Spring_Statement_Mar2022.pdf

FOREX: Y121 Gives Way

There was no sign of respite for the languishing yen as rising U.S. Tsy yields helped lift USD/JPY as high as to Y121.41, a new cycle peak. The rate went offered over the Tokyo fix but promptly regained poise. The latest portion of hawkish Fedspeak served as a reminder of growing policy divergence between the BoJ and most of its major peers.

- Other yen crosses extended recent swings to fresh cycle extremes. EUR/JPY topped out just shy of the Y134.00 figure, while AUD/JPY cleared Sep 21, 2017 high of Y90.31 and soared to best levels since late 2015.

- Offshore yuan slipped as the PBOC reintroduced mild weak bias into the daily fixing of USD/CNY trading band mid-point. The gap between actual fixing and average sell-side estimate was just 18 pips but could still be treated as an indication of the PBOC's preferences re: yuan trajectory.

- The European docket will be fairly UK-centric, with monthly inflation data and the Spring Statement ("mini-budget") from Chancellor Sunak. The sterling garnered some strength in the lead-up to these events, with EUR/GBP probing the water below the GBP0.8300 mark.

- Elsewhere, EZ consumer confidence & U.S. new home sales as well as plenty of central bank rhetoric will take focus later today. The speaker slate includes Fed & BoE chiefs.

FOREX OPTIONS: Expiries for Mar23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0850(E621mln), $1.1065-80(E1.1bln)

- EUR/JPY: Y130.50(E815mln)

- USD/CAD: C$1.2630-50($1.3bln)

ASIA FX: Won Outperforms, Yuan Slips

The won led gains in Asia EM FX space, with most regional currencies posting modest gains.

- CNH: Mild selling pressure hit offshore yuan upon the reintroduction of weak bias into the daily fixing of USD/CNY trading band mid-point. The divergence vs. expectations was not too large (18 pips) but enough to signal that the PBOC would prefer a slightly weaker redback.

- KRW: South Korean won picked up a bid and outperformed its regional peers as local equity benchmarks crept higher. Outgoing President Moon tapped IMF Asia Director Rhee to succeed BoK Gov Lee once the latter's term expires at the end of the month.

- IDR: The rupiah edged higher after Governor Warjiyo told lawmakers that Bank Indonesia can be patients in raising interest rates, with policymakers planning to reduce liquidity first to keep supporting growth.

- MYR: Spot USD/MYR went bid and pierced the MYR4.2200 figure for the first time since Dec 21. Little to write home on domestic headline flow.

- PHP: Spot USD/PHP ebbed lower as most regional currencies registered gains. The rate stayed within yesterday's range.

- THB: Improvement in sentiment provided some support to the baht, with participants assessing the government's decision to freeze retail diesel prices until end-April.

EQUITIES: Higher In Asia

Major Asia-Pac equity indices are flat to higher as high-beta and tech stocks across the region outperformed, following a positive lead from Wall St’s tech-led rally on Tuesday. Utilities and energy equities broadly lagged peers, as commodity and major crude benchmarks traded below Tuesday’s best levels in Asia-Pac dealing.

- The Nikkei 225 outpaced most regional peers for a second day to sit 2.9% firmer at writing, with 213 out of the index’s 225 constituents in the green. The JPY has continued to weaken with USD/JPY hitting fresh cycle highs at Y121.41 during the session, driving outperformance in large-caps and export-oriented names.

- The ASX200 struggled to extend the opening move higher, finishing 0.5% better off come the bell. Tech stocks (S&P/ASX All Technology Index: +2.3%) led gains, with rallies observed in healthcare equities as well, while energy and materials sub-indices underperformed their index peers.

- The Hang Seng is 1.6% better off, led by gains in China-based technology companies, with the Hang Seng Tech Index dealing 2.5% firmer at writing. Familiar large-cap names such as Alibaba and Xiaomi have lifted sentiment in the wider China-based tech space with announcements of share buyback schemes, while tech stocks have continued to find tailwinds from Chinese regulators recently announcing their intention to enact market-supportive measures.

- The CSI300 deals 0.4% firmer at typing, with gains in the consumer staples sector and healthcare equities offset by losses across virtually every other sector.

- U.S. e-mini equity index futures sit 0.1% to 0.2% higher at typing, operating a touch below the session’s best levels.

GOLD: Little Changed In Asia

Gold is virtually unchanged at typing, printing ~$1,921.7/oz after trading on either side of neutral levels during Asia-Pac dealing. The precious metal is off Monday’s low but has prolonged a pullback from cycle highs made in early March ($2,070.4/oz Mar 8 high), with focus turning to Fed messaging re: the potential/likelihood for > 25bp rate hikes at the upcoming FOMC meetings.

- To recap Tuesday’s price action, the precious metal pared losses from worst levels in the NY session ($1,910.9/oz) to close ~$15 lower, with the overall decline facilitated by an uptick in U.S. real yields.

- May FOMC dated OIS now prices in ~48bp of tightening, pointing to a >90% chance of a 50bp rate hike at that meeting. The move higher comes after Fed Chair Powell’s hawkish comments earlier in the week, with subsequent Fedspeak showing little to no pushback against the idea of 50bp rate rate hikes at some point in ‘22.

- Worry re: the Russia-Ukraine conflict has provided some support ahead of the $1,900/oz psychological level. To elaborate, ongoing ceasefire negotiations continue to yield little in the way of concrete developments, with both sides showing no real sign of conceding when it comes to their well-documented conditions for a peace deal.

- From a technical perspective, short-term conditions remain bearish for bullion, although it continues to operate within previously defined technical levels. Support is seen at $1,895.3/oz (Mar 15 low), while resistance is situated at $1,954.7 (Mar 15 high).

OIL: Higher Even Though Potential For EU Embargo Fades

WTI is +$1.40 and Brent +$1.60, printing ~$110.70 and ~$117.10 respectively. Both benchmarks have backed away from the week’s best levels, as earlier expectations of imminent EU sanctions on Russian energy exports have been pared back in the face of internal EU opposition led by Germany and Hungary.

- Elsewhere, news of the (partially Russian) Caspian Pipeline Consortium (CPC) shutting ~1mn bpd of crude production for up to two months due to storm damage saw little reaction from major crude benchmarks. A note that while crude exports from the CPC do not come under recent U.S. sanctions on Russian oil, CPC crude already faces difficulties in finding buyers amidst well-documented concerns re: buying Russian-linked crude, with some crude from the CPC pipeline mixing with Russian grades before being loaded from the Russian port of Novorossiysk.

- Looking to the supply dynamics for oil, participants continue to debate the likelihood and pace of demand destruction for crude in the face of elevated prices. While retail gasoline prices have hit record highs in many large economies (e.g. the U.S. and Japan), several governments have been raising related subsidies and slashing fuel taxes (such as in New Zealand, South Korea, and some U.S. states), as they look to support demand in the near-term.

- Weekly U.S. API inventory crossed late on Tuesday, with reports pointing to a surprise drawdown in crude stocks, alongside declines in gasoline and distillate stockpiles, while there was a build in Cushing hub inventories. Looking ahead to EIA data due later on Wednesday (1430 GMT), WSJ median estimates point to virtually unchanged headline crude inventories, with drawdowns in gasoline and distillates expected once again.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/03/2022 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 23/03/2022 | 0700/0700 | *** |  | UK | Producer Prices |

| 23/03/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 23/03/2022 | - |  | UK | OBR Economic and Fiscal Forecast | |

| 23/03/2022 | - |  | UK | DMO 2022-23 Financing Remit | |

| 23/03/2022 | 1200/1200 |  | UK | BOE Bailey Panels BIS Innovation Summit | |

| 23/03/2022 | 1200/0800 |  | US | Fed Chair Jerome Powell | |

| 23/03/2022 | 1230/1230 |  | UK | FY 2022/23 Budget statement | |

| 23/03/2022 | 1315/1415 |  | EU | ECB Lagarde Speech at BIS Innovation Summit | |

| 23/03/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 23/03/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 23/03/2022 | 1435/1035 |  | US | New York Fed's John Williams | |

| 23/03/2022 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/03/2022 | 1530/1530 |  | UK | DMO Quarterly Consultation Meetings Agenda | |

| 23/03/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 23/03/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/03/2022 | 1545/1145 |  | US | San Francisco Fed's Mary Daly | |

| 23/03/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 23/03/2022 | 1900/1500 |  | US | St. Louis Fed's James Bullard | |

| 24/03/2022 | 2200/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.