-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Speculation Surrounding Russia Dominates In Asia

EXECUTIVE SUMMARY

- ECB'S CENTENO: RECESSION IN THE EURO ZONE IS NOT IN THE ECB SCENARIO (RTRS)

- ECB'S SCHNABEL: DEVELOPMENTS IN REAL WAGES A BIT SURPRISING (RTRS)

- PUTIN STIRS U.S. CONCERN THAT HE FEELS CORNERED, MAY LASH OUT (BBG)

- EU CLINCHES U.S. LNG DEAL, BRUSHES OFF RUSSIAN ROUBLE DEMAND (RTRS)

- BIDEN STICKS WITH LONGSTANDING U.S. POLICY ON USE OF NUCLEAR WEAPONS, AMID PRESSURE FROM ALLIES (WSJ)

- EU LEADERS TO AGREE ON MODEST TIGHTENING OF SANCTIONS (BBG)

- SHANGHAI ASKS ALL RESIDENTS TESTED FOR COVID BEFORE 6PM FRIDAY (BBG)

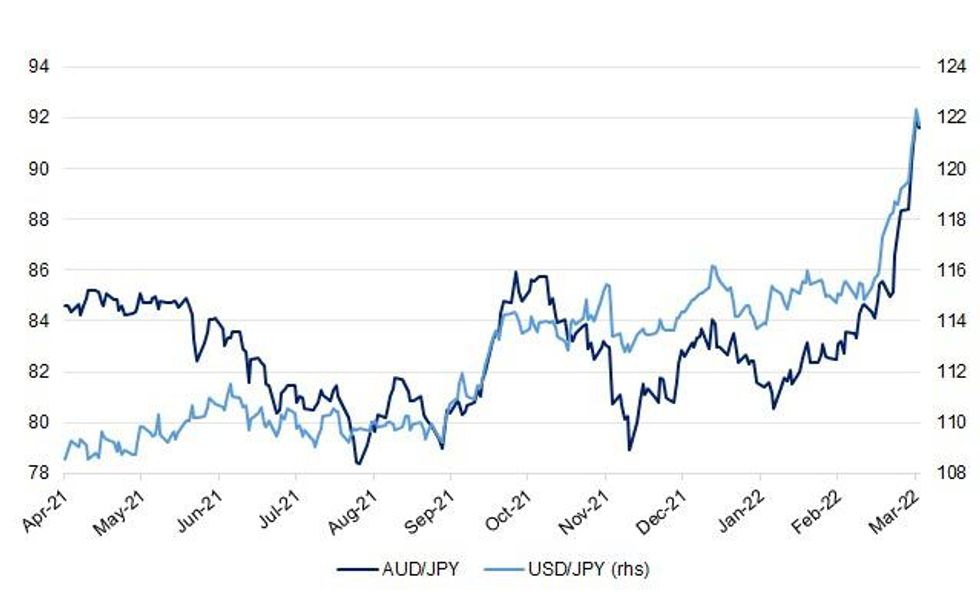

Fig. 1: USD/JPY & AUD/JPY

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: Wealthier families will be £3,000 worse off this year and a million people will be pushed into poverty, analysis of the spring statement reveals. Rishi Sunak was facing pleas last night from Conservative MPs for further support for family finances, and Boris Johnson accepted “we need to do more” to help with the cost of living. Despite the chancellor’s claim to be cutting taxes, only one in eight households will have their tax bills lowered during this parliament, according to the Resolution Foundation think tank. The average family faces a £1,100 hit in real incomes in 2022-23, rising to £3,200 for those in the top 10 per cent of working-age households, the biggest fall since the 1970s, the study estimates. (The Times)

FISCAL: MNI INTERVIEW:QE Legacy To Push Up UK Debt Costs As Rates Rise

- The UK’s large index-linked bond portfolio and extensive gilt purchasaes by the Bank of England have left the country badly placed to inflate away government debt, with increases in the official policy rate set to push up interest costs for a long period, the Office for Budget Responsibility’s David Miles told MNI - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

ECONOMY: MNI INTERVIEW: UK Faces Hit From Labour Exodus - OBR's Miles

- A 1.2% hit to UK gross domestic product from the reduction in the size of the workforce due to the Covid pandemic has been partly driven by a fall in immigration which is unlikely to be compensated soon, hitting medium-term productive capacity and tax revenues, the Office for Budget Responsibility’s David Miles told MNI - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

POLITICS: Rishi Sunak has said he is "just trying to stay at the crease" and "not get out" when asked by Sky News' political editor Beth Rigby about his leadership ambitions. The chancellor was speaking on this week's Beth Rigby Interviews programme. During his interview it was put to him that Boris Johnson once said, referring to his leadership intentions, that if a ball came loose from the back of the scrum "it would be a great, great thing to have a crack at". Asked if this would be his position too, Mr Sunak said that there is "a lot going on" at the moment and that he is "really focused" on doing his job as well as he can. "Well actually the PM is more of a rugby fan and I'm much more of a cricket and football fan, so I don't know what the appropriate analogy is," the chancellor said. "But, look, as we talked about, at the moment there is a lot going on. There's a big job to do - and I'm really focused on doing that job as well as I can." (Sky)

EUROPE

ECB: The European Central Bank would consider extending its money-printing programme beyond this summer if the euro zone economy fell into a "deep recession" because of the conflict in Ukraine, ECB board member Isabel Schnabel said on Thursday. The ECB said earlier this month its would end its bond-buying stimulus scheme this summer and raise interest rates for the first time in over a decade some time after that, as it comes to grips with a sudden rise in inflation. Schnabel, the most hawkish of the six board members who run the ECB, said the central bank had "left the door ajar" in case events took a turn for the worse for the euro zone, which is highly dependent on Russian gas and other raw materials. "If we now fall into a deep recession due to the Ukraine crisis, we'll have to rethink that," she told a German web show. (RTRS)

ECB: The European Central Bank does not contemplate a recession in the euro zone in its economic scenario despite the conflict in Ukraine that has exacerbated inflationary pressures, ECB Governing Council member Mario Centeno said on Thursday. He said, however, that the situation was delicate and had to be followed very carefully by policymakers as it "depends on the evolution of the conflict", adding that the "normalisation of the ECB's monetary policy will be carried out gradually and proportionally at the end of this year". (RTRS)

ECB: Russia’s attack on Ukraine will diminish growth prospects but not the European Central Bank’s efforts to fight inflation, according to a top central bank official. The comments from Governing Council member Madis Müller, who spoke with POLITICO this week, suggest rising odds that the ECB will issue its first interest rate hike later this year as it continues to unwind its pandemic policy. Even if the war is likely to leave deeper scars on the eurozone’s economy than the latest ECB staff projections suggested in early March, Müller sees little chance of the central bank extending its bond purchases beyond the third quarter. "We should be careful not to create additional uncertainty in the markets by seeming to waver in our commitment to price stability due to the war in Ukraine," Müller said. "We are not hesitating in our commitment to price stability, which is our main objective." (POLITICO)

FISCAL: MNI SOURCES: EU Near Certain To Extend Debt Rule

- The European Union is almost certain to further extend the general escape clause temporarily exempting member states from rules on debt included in the Stability and Growth Pact as economic uncertainty grows, officials in Brussels told MNI.

GERMANY: MNI INTERVIEW:German Union Says Pay Should Match CPI Ex-Energy

- Hikes to German wages must match inflation stripping out the increase in energy costs, a senior official from one of the country’s biggest industrial unions told MNI, calling government moves to mitigate the effects of soaring fuel and power prices on households insufficient - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

ITALY/BTPS: Italy plans to sell up to EU5 billion ($5.5 billion) of bills due Sept. 30 in an auction on March 29. (BBG)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on the Netherlands (current rating: AAA; Outlook Stable)

- Moody’s on Hungary (current rating: Baa2; Outlook Stable) & Sweden (current rating: Aaa; Outlook Stable)

- S&P on Germany (current rating: AAA; Outlook Stable)

- DBRS Morningstar on the European Union (current rating: AAA, Stable Trend) & Finland (current rating: AA (high), Stable Trend)

U.S.

FED: MNI: Trade Kinks Put Price Surge On Longer Path-Supply - Experts

- A string of fresh shocks hitting supply chains are pushing back estimates for how long their detrimental effects will linger, supply chain experts and a Kansas City Fed economist told MNI, helping to explain why the Federal Reserve has ditched its previous patient stance where officials hoped supply chain kinks would soon straighten out - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

ECONOMY: National Economic Council Director Brian Deese says the U.S. economy is strong enough to navigate the current global challenges and adds that the Biden administration is looking to provide inflation relief to consumers. (BBG)

POLITICS: Donald Trump on Thursday sued his rival in the 2016 U.S. presidential election, Hillary Clinton, and several other Democrats, alleging that they tried to rig that election by tying his campaign to Russia. The lawsuit covers a long list of grievances the Republican former president repeatedly aired during his four years in the White House after beating Clinton, and comes as he continues to falsely claim that his 2020 election defeat by Democratic President Joe Biden was the result of widespread fraud. (RTRS)

POLITICS: U.S. President Joe Biden said on Thursday he would be lucky if his Republican predecessor, Donald Trump, made another bid for the White House in the 2024 presidential election. A news conference after meetings with NATO leaders veered into U.S. politics when Biden was asked about European concerns that "a figure like your predecessor, maybe even your predecessor himself" could take office and undo U.S. and NATO efforts to address Russian aggression in Ukraine. "The next election - I'd be very fortunate to have that same man running against me," said the Democratic president, who defeated Trump in the 2020 election. (RTRS)

OTHER

INFLATION: President Joe Biden said that the world will experience food shortages as a result of Russia’s invasion of Ukraine, and production increases were a subject of discussions at a Group of Seven meeting on Thursday. “It’s going to be real,” Biden said at a news conference in Brussels. “The price of the sanctions is not just imposed upon Russia. It’s imposed upon an awful lot of countries as well, including European countries and our country as well.” (BBG)

GLOBAL TRADE: China's state planner on Friday cut the number of sectors and industries that are off-limits to both Chinese and foreign investors on its so-called negative list for market access. The 2022 list of industries that are either restricted or prohibited has been cut to 117, according to a document released by the National Development and Reform Commission, from 123 on the 2020 list. Industries not on the list are open for investment to all and require no approval. (RTRS)

U.S./CHINA: Any attempt by the U.S. to prevent China from accessing high-tech products or technology will only result in new disruption to global industrial chains, hurting the interests of companies in the U.S. and the world as well, the Global Times said in an editorial. Intimidating China with economic consequences won’t change China’s stance toward the situation in Ukraine, the newspaper said. Since the U.S. cut Chinese high-tech companies off chip supplies, China has firmly pushed forward with its own development of semiconductor technology, it said. (MNI)

U.S./CHINA: US regulators have warned that investor hopes that it was close to an agreement with Beijing that would allow audit inspections of US-listed Chinese companies and avert the delisting of $2tn of shares were “premature”. The US Public Company Accounting Oversight Board on Thursday said it “remains unclear” whether Beijing will “permit and facilitate” access for its officials to inspect the audits of US-listed Chinese companies, as required by US law. The statement threatens to reverse gains made by US-listed Chinese equities over the past week. In an email to the Financial Times, the regulator said negotiations were ongoing, but that “full access to relevant audit documentation” was “not negotiable” for the PCAOB. (FT)

BOJ: Bank of Japan Governor Haruhiko Kuroda maintains his stance that a weaker yen is a plus for the Japanese economy while recognizing some downside to the currency’s drop. Decline in yen can cut disposable household incomes and harm the economy, Kuroda says in response to questions in parliament Friday. Trade impact of higher energy costs is not positive for Japan, which heavily relies on imports for its energy needs. Current cost-push inflation won’t drive inflation above 2% in a stable manner, so BOJ will keep up current easing. (BBG)

BOJ: MNI INSIGHT: BOJ Policy Could Pivot With Changing Price Views

- Bank of Japan officials are focused on whether inflation expectations among corporates and households have strengthened enough, and can be sustained amid high geopolitical uncertainty and energy costs, to cautiously look at fresh policy options, MNI understands - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

JAPAN: MNI BRIEF: BOJ's Kuroda, MOF's Suzuki Want Orderly Yen Trade

- Bank of Japan Governor Haruhiko Kuroda said on Friday that the yen's drop against the U.S. dollar recently does not reflect a loss of confidence in the Japanese currency, while Finance Minister Shunichi Suzuki said that rapid forex moves are undesirable - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

JAPAN: Japan’s Prime Minister Fumio Kishida is poised to order a package of measures next week, Finance Minister Shunichi Suzuki said, as he seeks to address a deteriorating economic picture. “I believe there’ll be instructions from the prime minister next week, so we’ll consider measures based on those orders,” Suzuki told reporters Friday. “There needs to be a solid response to reduce the impact of rises in oil and grain prices on citizens and firms.” (BBG)

SOUTH KOREA: Daily Covid-19 cases have been showing signs of a gradual drop after passing its peak, South Korean health ministry official Lee Ki-il says in a briefing. (BBG)

NORTH KOREA: North Korea's latest launch was a huge, new intercontinental ballistic missile (ICBM), state media reported on Friday, in a test leader Kim Jong Un said was designed to demonstrate the might of its nuclear force and deter any U.S. military moves. It was the first full ICBM test by nuclear-armed North Korea since 2017, and flight data indicated the missile flew higher and longer than any of North Korea's previous tests, before crashing into the sea west of Japan. (RTRS)

NORTH KOREA/RUSSIA: The United States has imposed sanctions on two Russian companies and a North Korean entity for transferring sensitive items to North Korea's missile program, the State Department said on Thursday. It named the Russian entities as the Ardis Group of Companies LLC (Ardis Group) and PFK Profpodshipnik LLC. The North Korean entity targeted for sanctions was named as the Second Academy of Natural Science Foreign Affairs Bureau. In addition, Russian national Igor Aleksandrovich Michurin and North Korean national Ri Sung Chol were also sanctioned, the State Department said. (RTRS)

HONG KONG: Nearly half of the European companies in Hong Kong plan to fully or partially relocate operations and staff out of the city, a new survey suggests, in the latest sign that the world’s toughest Covid-19 travel and quarantine restrictions are eroding the appeal of Asia’s main finance hub. Around 25% of responding companies said they planned to fully relocate out of Hong Kong in the next year, according to a survey from the European Chamber of Commerce in Hong Kong, while another 24% said they are planning to partially move out of the city. Roughly 34% of firms said they were uncertain about their plans, while just 17% said they had no desire to relocate over the next 12 months. (BBG)

MEXICO: The Central Bank of Mexico (Banxico) on Thursday raised the key interest rate for the seventh consecutive time as it also raised its inflation forecast for the year due to pressures from the COVID-19 pandemic and geopolitical conflict. In a statement, the bank said its Board of Governors unanimously decided to raise the overnight interbank interest rate (the interest rate banks use to borrow from and lend to each other) by 50 basis points to 6.5 percent as of Friday. "Global inflation continued to rise, driven by bottlenecks, and high food and energy prices," the bank said. "Adding to the shocks from the pandemic are pressures stemming from the geopolitical conflict," the bank added. (Xinhua)

MEXICO: Mexico’s President Andres Manuel Lopez Obrador apologized to members of Mexico’s central bank after announcing their key rate decision hours before the official announcement. The president’s blunder sparked cries from economists that he had violated the Banco de Mexico’s autonomy, but at a banking conference on Thursday he said that it was an honest mistake. “I want to tell you that I reaffirm my commitment to respecting the autonomy of Bank of Mexico,” he told bankers and investors at the meeting. (BBG)

MEXICO: President Andres Manuel Lopez Obrador’s apology to Mexico’s central bank for revealing its rate decision hours before the official announcement is “very important” and timely, Banxico board member Gerardo Esquivel said in an interview with journalist Paola Rojas. Banxico decisions are taken with complete liberty: Esquivel. “There is no risk to this institution’s autonomy under any circumstance or in any sense,” Esquivel said in the audio interview, which he retweeted. (BBG)

MEXICO: The ongoing global pandemic and Russia’s invasion of Ukraine are pressuring Mexico inflation, central bank Governor Victoria Rodriguez said at a banking conference in Acapulco. The economy is continuing its recovery, Rodriguez said. Mexico’s banking system is in a solid position for the economic recovery. (BBG)

MEXICO: Mexican Finance Minister Rogelio Ramirez de la O said the crisis in Ukraine sparked by the Russian invasion will impact value chains and affect inflation. “We are at the beginning of a new monetary cycle and the end of low interest rates. The tension in Europe will prolong the disruption of some global value chains and will have effects on prices,” he said during a press conference on Thursday. (RTRS)

MEXICO: Mexico will work closely with banks focused on small businesses, supply chains and drawing factories from Asia, Finance Minister Rogelio Ramirez de la O said at a banking conference in Acapulco. Mexico is developing regulatory changes to boost fintech companies. Ramirez de la O said he asked the banking regulator to simplify rules to increase financing to companies. Mexico is working to support small and medium businesses with 10b pesos of credits. (BBG)

MEXICO: President Andres Manuel Lopez Obrador reiterated he prefers the buyer of Citibanamex to be Mexican, but he said the government won’t put any obstacles on the sale. AMLO said at a banking conference in Acapulco he wants the Citi art collection to be public and that whoever buys Citibanamex needs to have been paying taxes. AMLO said he won’t seek any bill affecting banks. AMLO said remittances are the main source of financing in Mexico. (BBG)

MEXICO: Mexico Deputy Finance Minister Gabriel Yorio announced the issuance of new sustainable bonds on Twitter. Instruments to be known as BondESG will be issued at a “reviewable rate” and referenced to the new TIIE swap rate. Yorio said it’s one of the steps to develop the local sustainable debt market. (BBG)

BRAZIL: Brazil President Jair Bolsonaro criticized fuel prices hike and said that value due to taxes. Oil refining abroad makes fuel prices more expensive, he said during a live on social media. (BBG)

RUSSIA: Joe Biden said the US and its allies are prepared to respond with proportionate severity if Russia uses chemical weapons during its invasion of Ukraine as he urged the west to sustain pressure on Vladimir Putin and remain unified in its response to the war. “It would trigger a response in kind,” the US president said at a press conference when asked whether the use of chemical weapons would prompt a military response from Nato, adding that the alliance would decide how to react “at the time”. He added: “The nature of the response would depend on the nature of the use.” (FT)

RUSSIA: In a statement reported by Russia's Ria news agency, Russia's foreign ministry said Nato's decision to continue supporting Ukraine showed the military alliance wanted the conflict to continue. (BBC)

RUSSIA: Biden administration officials are worried that Russian President Vladimir Putin may lash out dangerously as Russian troops find themselves bogged down in Ukraine and Western sanctions begin to bite. The internal assessment of senior officials, speaking on condition of anonymity, is that Putin’s tendency when boxed in is to escalate rather than back down. Their view is that the Russian leader’s choices could include the blanket bombing of Ukrainian cities or the use of chemical weapons -- or even tactical nuclear weapons. One of the hardest challenges facing the U.S. and its European allies is trying to anticipate the next move of someone they see as behaving in an increasingly erratic manner and who they fear could become even more dangerous amid signs Russia’s military campaign has not gone according to plan. The failure to quickly overwhelm Ukraine’s military raises the risk of what Western intelligence agencies are calling “vertical escalation.” (BBG)

RUSSIA: President Biden, stepping back from a campaign vow, has embraced a longstanding U.S. approach of using the threat of a potential nuclear response to deter conventional and other nonnuclear dangers in addition to nuclear ones, U.S. officials said Thursday. During the 2020 campaign Mr. Biden promised to work toward a policy in which the sole purpose of the U.S. nuclear arsenal would be to deter an enemy nuclear attack. Mr. Biden’s new decision, made earlier this week under pressure from allies, holds that the “fundamental role” of the U.S. nuclear arsenal will be to deter nuclear attacks. That carefully worded formulation, however, leaves open the possibility that nuclear weapons could also be used in extreme circumstances to deter enemy conventional, biological, chemical and possibly cyberattacks, said the officials. (WSJ)

RUSSIA: Russia will emerge from the conflict in Ukraine weaker and more isolated, a senior Pentagon official said on Thursday. "I think with a high degree of certainty that Russia will emerge from Ukraine weaker than it went into the conflict. Militarily weaker, economically weaker, politically and geopolitically weaker, and more isolated," said Under Secretary of Defense for Policy Colin Kahl. Khal also said an upcoming Pentagon defense strategy document would declare Russia an "acute threat." But Russia cannot pose a long-term system challenge to the United States, unlike China, he said. (RTRS)

RUSSIA: It is "foolish" to believe that Western sanctions against Russian businesses could have any effect on the Moscow government, Russian ex-president and deputy head of security council Dmitry Medvedev was quoted as saying on Friday. The sanctions will only consolidate the Russian society and not cause popular discontent with the authorities, Medvedev told Russia's RIA news agency in an interview. (RTRS)

U.S./CHINA/ RUSSIA: Amid escalating geopolitical tensions, US President Joe Biden on Thursday said that he has amply made it clear to his Chinese counterpart Xi Jinping of the potentially dire economic consequences if China provides assistance to Russia. Biden said he "made no threats," but did make clear that Xi "understood the consequences of him helping Russia." The US President said he pointed out the consequences of Russia's behavior, and pointed out that China had sought to develop stronger economic ties with the West. "I think that China understands that its economic future is much more closely tied to the West than it is to Russia. And so I am hopeful that he does not get engaged," Biden said. (Mint)

U.S./CHINA/RUSSIA: Russia’s invasion of Ukraine has made it more of a strategic burden on China, the US Under Secretary of Defense for Policy Colin Kahl has said. I do think that there’s a degree to which what Putin has done in Ukraine makes Russia much more of a strategic burden for Beijing than it was six weeks ago or six months ago.” (The Guardian)

EUROPE/CHINARUSSIA: European Union officials suspect that China may be ready to supply semiconductors and other tech hardware to Russia as part of an effort to soften the impact of sanctions imposed over the invasion of Ukraine. The EU is concerned that China is ready to help President Vladimir Putin’s government weather the economic penalties it has put in place along with the U.S., the U.K. and Japan with particular focus on the availability of high-tech components, according to two people with knowledge of the bloc’s internal assessments. Beijing and Moscow have denied any requests for aid were made or accepted. One of the EU officials said that the bloc so far has no hard evidence to back up its concerns. A spokesman for the EU Commission declined to comment. (BBG)

RUSSIA: U.S. President Joe Biden said he thinks Russia should be removed from the Group of Twenty (G20) major economies and the topic was raised during his meetings with world leaders in Brussels earlier on Thursday. "My answer is yes, depends on the G20," Biden said, when asked if Russia should be removed from the group. Biden also said if countries such as Indonesia and others do not agree with removing Russia, then in his view, Ukraine should be allowed to attend the meetings. (RTRS)

RUSSIA: US President Joe Biden said it’s up to Ukraine to decide whether it’s necessary to cede some of its territory in order to reach a ceasefire. (CNN)

RUSSIA: U.K. Prime Minister Boris Johnson said that even if Ukraine is unable to join NATO, allies can help it create a deterrent by sending equipment, training and intelligence, giving Ukraininans the “tools to protect themselves.” Johnson also said he’s not optimistic that Putin wants peace, and warned that Russia may bomb Ukraine’s cities the way it did in Chechnya during wars fought two decades ago. (BBG)

RUSSIA: Leaders of the European Union are expected to back a modest tightening of earlier sanctions against Russia for its invasion of Ukraine, but refrain from imposing major new measures, as countries remain divided on whether to tackle energy supplies. Under pressure from the U.S. and with Biden in Brussels as their guest, the leaders are likely to approve sanctioning more Russian tycoons and the closing of some loopholes as early as Thursday night, according to EU diplomats. They are expected to avoid a major cut-off of oil and gas purchases despite a push from several countries. Austria said it won’t agree to an energy embargo. (BBG)

RUSSIA: In response to Belarus' unfriendly actions against employees of Ukrainian diplomatic institutions in Minsk and Brest, Ukraine has taken a number of measures, in particular, reducing the number of staff of the Belarusian embassy in Ukraine to five people, Spokesperson of the Ministry of Foreign Affairs Oleh Nikolenko has said. In addition, the Foreign Ministry said that Ukraine is canceling the diplomatic accreditation of other employees of the Belarusian embassy. Their and the family members' stay on the territory of Ukraine is declared undesirable. (Interfax)

RUSSIA: Japan will freeze the assets of 25 more Russians and prohibit exports to 81 Russian organisations in response to Moscow’s war in Ukraine, the country’s foreign ministry said on Friday. The move comes after Prime Minister Fumio Kishida said on Thursday Japan will take steps to revoke Russia’s “most favoured nation” trade status and prevent domestic cryptocurrency exchanges from carrying out transactions with sanctioned entities. (Al Jazeera)

RUSSIA: The Biden administration is drafting an executive order invoking the Defense Production Act to alleviate shortages of key minerals needed for the technology to store clean energy. The act, which would bolster the manufacturing capacity of electric vehicle producers in particular, indicates that the administration is open to using executive power to achieve progressive policy goals as Congress remains reluctant to pass key parts of his green energy agenda. (The Intercept)

RUSSIA: The Justice Department on Thursday unsealed charges against four Russian nationals it accused of carrying out a yearslong hacking campaign that targeted thousands of computers in the U.S. and around the world in a bid to gain access to systems that could disrupt or physically damage vital energy facilities. The defendants all worked for the Russian government and targeted hundreds of companies in 135 countries, U.S. authorities said. (WSJ)

RUSSIA: Australia has placed new sanctions on Belarusian President Alexander Lukashenko and his family, following their support of Russia's invasion of Ukraine. The government has also imposed sanctions on 22 Russian propagandists and disinformation operatives, including senior editors of state broadcaster Russia Today. Foreign Minister Marise Payne said the latest round of sanctions against the Belarus president was due to the country providing strategic support to Russia. (Daily Mail)

RUSSIA: European Union leaders may discuss Russia's demand that "unfriendly" countries pay in roubles for Russian gas sales at a two-day summit in Brussels starting on Thursday, a senior EU official said. "This can be discussed," the official said, adding that leaders may assess whether Moscow's request would threaten the effectiveness of EU sanctions against Russia over its invasion of Ukraine. (RTRS)

RUSSIA: Some holders of a $3 billion Russia bond received an overdue interest payment, signaling that the heavily sanctioned nation will once again sidestep a default. The $66 million interest payment started showing up in accounts on Thursday, according to two international bondholders, who asked not to be identified because they weren’t authorized to speak publicly. The payment was in dollars, one of the people said. A third bondholder reached Thursday said they had yet to see the payment. It’s the third Eurobond coupon payment that Russia is set to complete in the past week, a relief to investors who feared that it would neither be able -- nor willing -- to navigate the plethora of sanctions to meet its debt obligations. (BBG)

RUSSIA: Any demand by Russia to receive payment in roubles for its gas exports would represent a breach of contract, Italian Prime Minister Mario Draghi said on Thursday. President Vladimir Putin has said Russia, the world’s largest natural gas producer, will soon require “unfriendly” countries to pay for fuel in roubles, raising alarm about a possible gas crunch in Europe. Draghi told reporters the issue had not been discussed at a summit of Group of Seven leaders but would probably to be raised at a meeting of European Union leaders scheduled to start later in the day. “This is basically a breach of contract, this is important to understand,” Draghi said. (RTRS)

RUSSIA: Faced with stiffening sanctions from Western countries over its invasion of Ukraine, Russia is considering accepting bitcoin as payment for its oil and gas exports. In a videotaped news conference held on Thursday, the chair of Russia’s Duma committee on energy said in translated remarks that when it comes to “friendly” countries such as China or Turkey, Russia is willing to be more flexible with payment options. Chair Pavel Zavalny said that the national fiat currency of the buyer — as well as bitcoin — were being considered as alternative ways to pay for Russia’s energy exports. The energy chair also doubled down on President Vladimir Putin’s promise on Wednesday to require “unfriendly” countries to pay for gas in Russian rubles. Putin’s announcement sent European gas prices soaring over worries the move might aggravate an energy market already under pressure. “If they want to buy, let them pay either in hard currency, and this is gold for us, or pay as it is convenient for us, this is the national currency,” Zavalny said, in comments that echoed the president’s warning from the day before. (CNBC)

RUSSIA: Russia's space director said on Thursday that Europe had wrecked cooperation by imposing sanctions against his agency, and rockets that were meant to launch European satellites would now be used for Russian companies or countries friendly to Moscow. Dmitry Rogozin, head of Roscosmos, said in a Chinese television interview that this would apply to about 10 rockets. "At this moment, after the European Space Agency and the whole European Union have taken a frenzied position on the conduct of (Russia's) special military operation in Ukraine and introduced sanctions against Roscosmos, we consider further cooperation impossible," Rogozin said. (RTRS)

RUSSIA: EU leaders meeting in Brussels have issued a statement demanding an end to Russia’s “war of aggression against Ukraine” and slamming its attacks on the country’s civilian population and infrastructure. “These war crimes must stop immediately. Those responsible, and their accomplices, will be held to account in accordance with international law,” the leaders said. They added that EU stands by Ukraine and will continue to “provide coordinated political, financial, material and humanitarian support”. (Al Jazeera)

METALS: In a notice on Thursday, the LME said that it was introducing a ban on submitting orders outside the price limits with immediate effect, “to support the fair and orderly functioning” of the market. It said it could take disciplinary action against traders who fail to comply. (BBG)

ENERGY: The European Union and United States are set to unveil a deal on Friday to supply Europe with more U.S. liquefied natural gas (LNG), sources told Reuters, as the European bloc seeks to quickly curb its reliance on Russian fossil fuels. The invasion of Ukraine by Russia, Europe's top gas supplier, pushed already-high energy prices to records and has prompted the EU to pledge to cut Russian gas use by two thirds this year, by hiking imports from other countries and quickly expanding renewable energy. President Joe Biden, who attended the EU leaders summit in Brussels on Thursday, promised the United States would deliver at least 15 billion cubic metres (bcm) more LNG to Europe this year than planned before, sources familiar with the matter said. (RTRS)

ENERGY: A European Union deal to phase out Russian oil, gas and coal imports to the bloc remains 'on the table,' but a final agreement could take another month due to ongoing disagreement on the detail among member states, Slovenia's Prime Minister Janez Jansa said March 24. Slovenia, one of Europe's most dependent member states in terms of imports of Russian oil and gas, will reiterate its support for an EU move to phase out imports of Russian fossil fuels at a European Council heads of state meeting in Brussels March 24, Jansa told reporters ahead of the meeting. (S&P Global)

ENERGY: Canada will increase oil and gas exports by the equivalent of 300,000 barrels a day to help nations that are trying to shift away from Russian supplies, the country’s resources minister said. Energy producers can raise shipments of crude by 200,000 barrels a day and natural gas by the equivalent of 100,000 by year-end by accelerating planned projects to expand output, Jonathan Wilkinson said Thursday at a press conference in Paris. Canada and the U.S. already have the pipeline capacity to handle the extra volumes, with some of the extra oil expected to be shipped to Europe via the Gulf Coast, he said. “Canada indicated to our European friends that we will work to help them in the current situation that they find themselves,” he said. (BBG)

ENERGY: Nord Stream 2 to file bankruptcy petition in Zug, Switzerland, in coming days, Stuttgarter Zeitung cites CEO Matthias Warnig as saying in an interview. Warnig says filing will be tied to “interim moratorium” petition, without elaborating further. As Managing Director of Nord Stream 2, he’ll focus exclusively on fulfilling his duties pursuant to the bankruptcy proceedings, moratorium. Warnig plans to relinquish all mandates and give up all other business activities. Says there’s no justification for Ukraine war. (BBG)

ENERGY: The Swiss trading arm of Russian energy giant Lukoil has scaled back operations after the oil company cut its supply of capital to guarantee nearly $1 billion in margin calls in the wake of Western sanctions, according to three people familiar with the matter. Litasco, which was handling more than 3.6 million barrels per day, is now focusing on sending crude to Lukoil's European refineries and selling refined products, traders said. (RTRS)

OIL: Oil exports via the Caspian Pipeline Consortium (CPC) pipeline will partially resume oil loadings from its Black Sea terminal on Thursday after successful inspection of the single port mooring (SPM-1), four sources familiar with the matter said. CPC, which accounts for 1% of world’s oil supply, suspended oil loadings on Wednesday after inspection of SPM-2 and SPM-3 showed damage to the loading facilities due to stormy weather in the Black Sea that led to a jump in global oil prices. (RTRS)

CHINA

YUAN: The yuan should be allowed to gain appropriately given that China’s inflation is more stable while other major economies grapple with high inflation and the consequent recession, the 21st Century Business Herald said in an editorial. China can maintain self-sufficiency in agricultural products including grain and fertilizer, although it needs imports of cooking oil and animal feed, it said. China may however be pressured by a global recession, so it should actively improve income distribution and promote the “inner circulation” of its domestic economy, it said. (MNI)

INFLATION: Chinese Premier Li Keqiang told officials the country must ensure stable grain output this year in the face of the complex situation and surging inflation globally, Xinhua News Agency said. China has sufficient stockpiles of grain and key agricultural products and supply is ensured, Li said. The government should help businesses deal with rising prices of fertilizer, pesticide and diesel, and it should help companies increase production potential and diversify import sources for some products, Li said. (MNI)

CORONAVIRUS/ECONOMY: Manufacturers across China are preparing their factories to operate as highly isolated “bubbles” that can continue to run for weeks even during tough government-ordered coronavirus lockdowns. The moves follow the success of some plants in maintaining output during the past two months despite the country’s biggest Covid-19 outbreak since the disease raged through the city of Wuhan in early 2020. (FT)

CORONAVIRUS: Shanghai asked anyone in the city not yet tested for Covid to get a test before 6pm Friday or they will face movement restrictions as a result of health code changing color, Wu Jinglei, director of the Shanghai Heath Commission, said at a press conference. (BBG)

OVERNIGHT DATA

JAPAN MAR TOKYO CPI +1.3% Y/Y; MEDIAN +1.2%; FEB +1.0%

JAPAN MAR TOKYO CORE CPI +0.8% Y/Y; MEDIAN +0.7%; FEB +0.5%

JAPAN MAR TOKYO CORE-CORE CPI -0.4% Y/Y; MEDIAN -0.5%; FEB -0.6%

JAPAN FEB SERVICES PPI +1.1% Y/Y; MEDIAN +1.2%; JAN +1.2%

UK MAR GFK CONSUMER CONFIDENCE -31; MEDIAN -30; FEB -26

CHINA MARKETS

PBOC NET INJECTS CNY70 BLN VIA OMOS FRIDAY

The People's Bank of China (PBOC) injected CNY100 billion via 7-day reverse repos with the rates unchanged at 2.10% on Friday. The operation has led to a net injection of CNY70 billion after offsetting the maturity of CNY30 billion repos today, according to Wind Information.

- The operation aims to keep liquidity stable at the end of the month, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1920% at 09:49 am local time from the close of 2.0366% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 48 on Thursday vs 43 on Wednesday.

PBOC SETS YUANC CENTRAL PARITY AT 6.3739 FRI VS 6.3640

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3739 on Friday, compared with 6.3640 set on Thursday.

MARKETS

SNAPSHOT: Speculation Surrounding Russia Dominates In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 6.5 points at 28116.93

- ASX 200 up 19.134 points at 7406.2

- Shanghai Comp. down 25.133 points at 3225.131

- JGB 10-Yr future down 16 ticks at 149.48, yield up 1bp at 0.240%

- Aussie 10-Yr future down 1.0 tick at 97.160, yield up 1.1bp at 2.777%

- U.S. 10-Yr future -0-04+ at 122-25, yield down 1.24bp at 2.359%

- WTI crude down $0.41 at $111.99, Gold up $1.11 at $1958.91

- USD/JPY down 74 pips at Y121.60

- ECB'S CENTENO: RECESSION IN THE EURO ZONE IS NOT IN THE ECB SCENARIO (RTRS)

- ECB'S SCHNABEL: DEVELOPMENTS IN REAL WAGES A BIT SURPRISING (RTRS)

- PUTIN STIRS U.S. CONCERN THAT HE FEELS CORNERED, MAY LASH OUT (BBG)

- EU CLINCHES U.S. LNG DEAL, BRUSHES OFF RUSSIAN ROUBLE DEMAND (RTRS)

- BIDEN STICKS WITH LONGSTANDING U.S. POLICY ON USE OF NUCLEAR WEAPONS, AMID PRESSURE FROM ALLIES (WSJ)

- EU LEADERS TO AGREE ON MODEST TIGHTENING OF SANCTIONS (BBG)

- SHANGHAI ASKS ALL RESIDENTS TESTED FOR COVID BEFORE 6PM FRIDAY (BBG)

BOND SUMMARY: Tsys Flatten A Touch In Asia, JGBs Soften On BoJ Inaction

Asia-Pac hours saw participants buy into Thursday’s dip, in the main, with a lack of overt headline flow apparent. Widespread COVID testing in the Chinese city of Shanghai and continued speculation surrounding the Russia-China situation were seen as supportive factors (in what seemed to be an exercise of finding an explainer for a modest bid after equity indpired cheapening into the NY bell), although ranges were tight. TYM2 sits -0-04+ at 122-05, dealing in the middle of the contract’s 0-07+ overnight range. Volume in the contract is sub-standard, at least in recent terms, running shy of 100K. 2s have cheapened by ~0.5bp, bucking the broader trend, as 30s run ~2.0bp richer on the session, with twist flattening evident. Looking ahead, pending home sales and final UoM sentiment provide the economic readings of note during NY dealing, with Fedspeak from Waller, Williams & Barkin (’24 voter) due.

- BoJ inaction, when it came to the move above 0.23% in 10-Year JGB yields, facilitated further JGB cheapening during the Tokyo morning, although afternoon trade was a little more tepid. The major cash JGB benchmarks were running little changed to ~4bp cheaper late in the day, as 40s provided the weakest point on the curve, resulting in bear steepening. Note that 10-Year JGB yields now sit at 0.24%, 1bp above the trigger point for BoJ fixed rate operations in Feb and 1bp below the top of its -/+0.25% permitted 10-Year JGB yield trading range. JGB futures were 16 ticks lower on the day, but off of worst levels, after registering fresh cycle lows. Technical support in the contract is seen at the 0.5% 10-DMA envelope (149.37), which is now within touching distance. BoJ Governor Kuroda flagged the importance of YCC when it comes to the Bank’s monetary policy operations in his latest Diet appearance, which would suggest that there are no immediate plans to alter the Bank’s permitted 10-Year JGB yield trading range (although he didn’t make direct reference to the current band settings, outside of “trading around 0%”). This seemingly makes it a case of when, not if, the BoJ will act on 10-Year JGB yields, if needs be. He also pointed to no desire to alter monetary policy settings based on cost-push inflation dynamics (a known). Elsewhere, Japanese Finance Minister Suzuki flagged an unveiling of a fiscal support package for some time next week (in line with press speculation).

- Aussie bond futures went out around the middle of their Sydney ranges, YM -1.0 & XM -2.0, with the space back from best levels after drawing support from the previously outlined firm round of ACGB Nov-24 supply and some modest regional demand for U.S. Tsys during early Asia-Pac dealing, allowing a correction from early Sydney troughs. The space looked through next week’s atypical AOFM issuance slate.

JOGBS AUCTION: Japanese MOF sells Y4.6204tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.6204tn 3-Month Bills:

- Average Yield -0.0815% (prev. -0.0774%)

- Average Price 100.0219 (prev. 100.0206)

- High Yield: -0.0800% (prev. -0.0752%)

- Low Price 100.0215 (prev. 100.0200)

- % Allotted At High Yield: 84.8845% (prev. 98.7396%)

- Bid/Cover: 2.937x (prev. 2.738x)

AUSSIE BONDS: The AOFM sells A$1.0bn of the 0.25% 21 Nov ‘24 Bond, issue #TB159:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 0.25% 21 November 2024 Bond, issue #TB159:

- Average Yield: 2.0318% (prev. 1.4148%)

- High Yield: 2.0325% (prev. 1.4175%)

- Bid/Cover: 3.9900x (prev. 4.8370x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 43.6% (prev. 34.5%)

- Bidders 30 (prev. 45), successful 8 (prev. 13), allocated in full 3 (prev. 8)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Wednesday 30 March it plans to sell A$1.5bn of the 2.75% 21 April 2024 Bond.

- On Thursday 31 March it plans to sell A$1.0bn of the 24 June 2022 Note & A$1.0bn of the 12 August 2022 Note.

- On Friday 1 April it plans to sell A$300mn of the 1.75% 21 June 2051 Bond.

EQUITIES: Mixed As Chinese Equities Struggle

The major Asia-Pac equity indices are mixed at typing, bucking a positive lead from Wall St. Still, equity indices across the region remain on track to record gains for at least a second week with the exception of the CSI300, as persistent weakness has been observed in Chinese high-beta large caps after the PBoC’s monthly LPR fixings were conducted at unchanged levels on Monday.

- Australia’s ASX200 shrugged off the broader trend of losses, sitting 0.3% better off at the close on outperformance in its materials and energy sub-indices.

- The Nikkei 225 sits virtually unchanged at typing after opening sharply higher, trading on either side of neutral levels, leaving a 7-day streak of gains in the balance. The earlier move lower came as USD/JPY retreated below the Y122.00 mark, with that dynamic weighing after the recent yen weakness boosted hopes re: corporate earnings for Japanese companies. Understandably, outperformance in commodity-related sub-indices was countered by weakness in export-oriented names.

- The Hang Seng underperformed, sitting 2.2% worse off at typing. China-based tech names led losses, with the Hang Seng Tech Index dealing ~4.1% softer after index heavyweight JD.com slipped on the issuance of new shares at a relatively steep discount. Large cap peers such as Tencent and Alibaba struggled for a second day, while Meituan (~-7.0% at writing) has fallen ahead of its earnings beat later on Friday.

- U.S. e-mini equity index futures are flat to 0.2% firmer at typing.

OIL: Flat As EU Embargo Worry Further Recedes

WTI and Brent are virtually unchanged at typing, struggling to make headway above neutral levels in Asia-Pac dealing. Both benchmarks operate off Thursday’s best levels as expectations for imminent EU sanctions on Russian crude have faded, but remain on track to close higher for the week (after two straight weeks of declines).

- To elaborate, deliberations between EU leaders on Thursday saw familiar opposition re: sanctions on Russian energy. On a related issue, while source reports have highlighted a potential U.S.-EU deal to boost LNG supplies to the latter via the former, near-term measures appear insufficient (RTRS and FT sources say that the agreement is for 15bn cubic metres more LNG from the U.S., against the EU’s current 50bn cubic metres target re: replacement of Russian natural gas imports).

- Elsewhere, RTRS source reports have pointed to a partial resumption in oil loadings from the CPC pipeline (reported on Thursday as having completely halted exports), with a source estimating that exports for CPC Blend crude would be reduced to 800K bpd from 1.4mn bpd.

- Looking to the Middle East, progress towards an Iranian nuclear deal appears to have halted, with Iran’s Foreign Minister saying on Thursday that the U.S. was “wasting time”. On the other hand, U.S. officials have not budged from earlier statements that it is up to Iran to make “difficult decisions”, while emphasising that the U.S. has begun exploring alternatives to the deal.

GOLD: Higher As West Expands Sanctions On Russia

Gold is ~$3/oz higher, printing $1,961/oz at typing. The precious metal operates near the top of Thursday’s range as relations (and rhetoric) continues to worsen between Russia and the western powers. Focus now turns to details surrounding an incoming fifth round of EU sanctions on Russia, after the U.S. and UK outlined their latest measures on Thursday.

- To recap, the precious metal closed ~$15/oz higher on Thursday for a second straight day of gains, although an uptick in U.S. real yields helped bullion move away from best levels late in NY dealing.

- On the Russia-Ukraine conflict, NATO has agreed to increase military deployments in the east, while a mobilisation of the alliance’s “chemical, biological, radiological and nuclear defence elements” was also announced, underscoring fears re: potential Russian weapon choices. NATO leaders have so far refused to specify what their response to a Russian chemical/biological attack on Ukraine would be, with U.S. President Biden stating that such an attack would “trigger a response in kind”.

- Looking to technical levels, gold has broken initial resistance at $1,954.7/oz (Mar 15 high), exposing further resistance at $2,009.2 (Mar 10 high).

FOREX: BoJ Inaction, Demand For Save Havens Throw Lifeline To Embattled Yen

Defensive feel took hold in G10 FX space, even as latest headline flow failed to add much to the familiar picture. Growth proxies such as AUD, NZD and CAD lost ground, with JPY and CHF lodging gains. Demand for safe havens allowed the yen to snap its recent rout, which earlier this week drove USD/JPY through several round figures to fresh multi-year highs.

- The yen drew additional support from the BoJ's inaction with regard to the move above 0.23% in benchmark 10-Year JGB yield. A break above that level triggered BoJ fixed rate operations back in Feb as the central bank sought to defend the upper end of permitted 10-Year yield trading range (-/+0.25%). There was speculation that the level could again act as a trigger for BoJ intervention but the central bank chose to stay on the sidelines.

- Spot USD/JPY pulled back below the Y122.00 mark to a session low of Y121.51 from yesterday's Y122.44 cycle peak. Implied volatilities remained elevated, even as those further out the curve posted marginal downticks.

- Aiding the retreat in USD/JPY was broader greenback weakness. The USD remains among the weakest G10 performers in the lead-up to the London session as lower U.S. Tsy yields bite.

- BoJ's Kuroda said that yen depreciation doesn't mean that the Japanese currency has lost credibility and (together with FinMin Suzuki) underscored the importance of stable FX rates.

- Final U.S. Uni. of Mich. Sentiment, German Ifo Survey & UK retail sales take focus from here. Speeches are due from Fed's Williams, Daly, Barkin & Waller, BoC's Kozicki & Norges Bank's Bache.

FOREX OPTIONS: Expiries for Mar25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1000(E1.6bln)

- USD/JPY: Y119.25($1.0bln)

- AUD/USD: $0.7370-80(A$507mln)

- USD/CAD: C$1.2610-15($517mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/03/2022 | 0700/0700 | *** |  | UK | Retail Sales |

| 25/03/2022 | 0800/0900 | *** |  | ES | GDP (f) |

| 25/03/2022 | 0800/0900 | ** |  | ES | PPI |

| 25/03/2022 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 25/03/2022 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 25/03/2022 | 0900/1000 | ** |  | EU | M3 |

| 25/03/2022 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 25/03/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 25/03/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 25/03/2022 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 25/03/2022 | 1400/1000 |  | US | New York Fed's John Williams | |

| 25/03/2022 | 1500/1100 |  | US | San Francisco Fed's Mary Daly | |

| 25/03/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 25/03/2022 | 1530/1130 |  | US | Richmond Fed's Tom Barkin | |

| 25/03/2022 | 1600/1200 |  | US | Fed Governor Christopher Waller | |

| 25/03/2022 | 1645/1245 |  | CA | BOC Deputy Kozicki speaks at SF Fed conference on "A world of difference: households, the pandemic and monetary policy" |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.