-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Beijing To Protect Firms From U.S. Bill - MOFCOM

MNI BRIEF: SNB Cuts Policy Rate By 50 BP To 0.5%

MNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: Familiar Themes Dominate The Headlines At The Start Of A New Quarter

EXECUTIVE SUMMARY

- PUTIN'S ROUBLE GAS PAYMENT ORDER COVERS DELIVERIES DUE AFTER APRIL 1 (RTRS SOURCE)

- RUSSIA WILL NOT ASK EU TO END SANCTIONS (RIA)

- RUSSIA’S $1.45BN BOND BUYBACK HAS INVESTORS EYEING MONDAY (BBG)

- RBA’S BULLOCK PROMOTED TO DEPUTY GOVERNOR

- RBA CASH RATE SETS JUST 1BP SHY OF TARGET, HIGHEST LEVEL SEEN SINCE NOV ‘20

- DOZENS OF HONG KONG FIRMS HALTED AFTER MISSING EARNINGS DEADLINE (BBG)

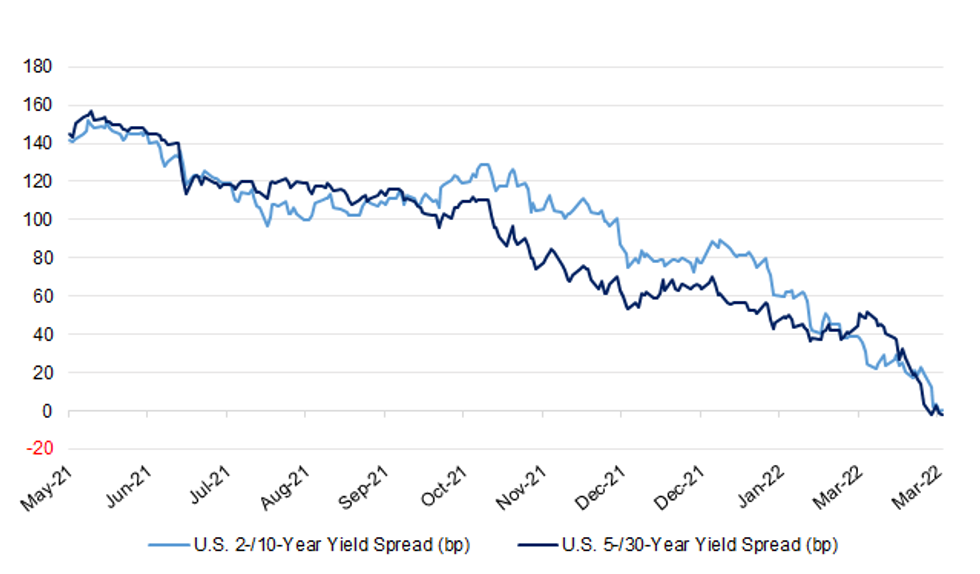

Fig. 1: U.S. 2-/10- & 5-/30-Year Yield Spreads (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: U.K. business confidence has collapsed to a 17-month low since Russia declared war on Ukraine, and many firms are putting investment plans on hold, according to a poll of executives. More than half are pessimistic about the British economy over the next year, the survey by the Institute of Directors found. A similar proportion say they are braced for inflation of more than 6% by the end of 2022. With energy costs exerting a widespread “negative impact” and companies facing a payroll tax increase in April, almost a quarter plan to cut investment. Also, fewer bosses expect wages and employment levels to rise, a sign that labor market pressures may be easing. (BBG)

ECONOMY: More UK businesses are preparing to raise prices than at any time since the 1980s, heaping further pressure on hard-pressed consumers amid recent increases in gas, electricity and petrol prices. The British Chambers of Commerce said its latest quarterly survey found almost two-thirds of firms expected to raise prices over the next three months, the highest since the survey began in 1989. Amid warnings from opposition MPs and business groups that ministers should offer more support to struggling businesses, a record number of manufacturers and services firms said they would be increasing prices. The survey of more than 5,600 firms also revealed domestic sales had stagnated across most sectors and business investment remained at historically low levels. (Guardian)

ECONOMY: A surge in demand for workers in Britain is showing some signs of stabilising, according to a survey published on Friday that may provide some comfort to the Bank of England as it worries about the risk of long-term inflation pressure. The Recruitment and Employment Confederation (REC) said new job postings fell by 25% in the last week of March from a week earlier, returning to the kind of increase seen in mid-January. "The jobs market has been super-heated in the first few months of this year, and was always likely to stabilise in the spring. We may be seeing the first signs of that now," REC chief executive Neil Carberry said. "Over the next few weeks, we will see whether this is the cooling we expected, or a slower market developing as employers factor rising inflation into their plans." (RTRS)

EUROPE

GERMANY: Germany could suffer unprecedented economic damage if energy imports from Russia would be curbed or stopped, BASF SE CEO Martin Brudermuller said in an interview to newspaper Frankfurter Allgemeine Sunday. (BBG)

GERMANY: The German government is weighing options for a unit of Russian gas giant Gazprom PJSC shunned by clients in response to the war in Ukraine, according to people familiar with the matter. Options being analyzed include restructuring Wingas GmbH, which supplies about 20% of the German gas market, or finding a new energy provider for its clients, said the people, who asked not to be identified because the talks are private. Berlin officials are currently studying what impact the possible failure of Wingas would have on the economy, and no final decision has been made. (BBG)

PORTUGAL: The ratio of non-performing loans at Portuguese banks was 3.6% at the end of December, down from 4.0% at the end of September, the Bank of Portugal says in a report on its website. (BBG)

ENERGY: Germany and Austria's declarations of an "early warning" on gas supply are a precautionary measure that increases the monitoring of supply, but no EU countries have yet signalled they are facing security of supply issues, a European Commission spokesperson said on Thursday. "In all cases, no security of supply issues have been signalled for the present point in time," the spokesperson said, adding the "early warning" alert is the lowest level of crisis notification in the European Union rules on gas supply security. (RTRS)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Moody’s on Italy (current rating Baa3; Outlook Negative)

- S&P on Poland (current rating: A-; Outlook Stable)

- DBRS Morningstar on France (current rating: AA (high), Stable Trend)

U.S.

FED: JPMorgan Chase & Co. and BNP Paribas SA were among the dealers in Treasury securities who borrowed from an emergency lending facility launched by the Federal Reserve in 2020 as the pandemic swept the U.S., causing a panic in financial markets. The names of a range of firms were released Thursday by the Fed to meet legal disclosure requirements about credit extended under its Primary Dealer Credit Facility, Money Market Mutual Fund Liquidity Facility and the Commercial Paper Funding Facility. (BBG)

ECONOMY: The Trimmed Mean PCE inflation rate over the 12 months ending in February was 3.6 percent. According to the BEA, the overall PCE inflation rate was 6.4 percent on a 12-month basis, and the inflation rate for PCE excluding food and energy was 5.4 percent on a 12-month basis. (Dallas Fed)

CORONAVIRUS/FISCAL: Top Senate negotiators have said they are close to striking a deal to approve $10 billion in additional COVID relief funding with just a handful of days remaining before Congress heads off for a two-week recess. The Senate is expected to consider the legislation as soon as next week. (AB)

FUEL: A gasoline tax holiday remains an option under consideration as the Biden administration seeks to give Americans relief from high prices, a White House spokeswoman said Thursday. "The president is not taking anything off the table at this stage," White House communications director Kate Bedingfield told reporters. Earlier Thursday, Biden announced the U.S. would release 1 million barrels of oil per day for the next six months from the Strategic Petroleum Reserve, or more than 180 million barrels in total. House Speaker Nancy Pelosi, meanwhile, has sounded a skeptical note about the effectiveness of such a holiday. (MArketWatch)

US TSYS: Treasury bondholders are hoping for a reprieve after the most brutal three months of modern times. The swift selloffs that ripped through the market as traders braced for a more aggressive series of interest-rate hikes from the Federal Reserve hit investors with a loss of 3.1% in March, Bloomberg’s index shows. That’s the steepest monthly drop since 2004 and caps the worst quarter for Treasuries since the index starts in 1973, surpassing the rout seen when the central bank was fighting a wage-price spiral in 1980. Even inflation-adjusted Treasuries, which have served as a haven, have lost 2.7% since the start of the year. (BBG)

OTHER

U.S./CHINA/HONG KONG: The U.S. blasted China for intensifying a crackdown on democracy advocates over the past year, criticism that Hong Kong called “unfounded” and “ridiculous.” Authorities in Hong Kong blocked the pro-democracy opposition from playing a meaningful role in the city’s governance and criminalized peaceful political expression, the U.S. State Department said in a report released on Thursday. China’s government has continued to “dismantle Hong Kong’s democratic institutions, placed unprecedented pressure on the judiciary, and stifled academic, cultural, and press freedoms,” Secretary of State Antony Blinken said in a statement accompanying the report. “As the 25th anniversary of Hong Kong’s handover to Beijing approaches, Hong Kong’s freedoms are diminishing.” (BBG)

U.S./CHINA/TAIWAN: U.S. Trade Representative Katherine Tai on Thursday declined to say if Taiwan would be invited to join the Biden administration's Indo-Pacific economic plan, spurring Senate criticism that excluding the island would be a missed opportunity. (RTRS)

JAPAN: The target of the Bank of Japan's monetary policies is stable price inflation, not foreign exchange rates, Japanese finance minister Shunichi Suzuki told a press conference on Friday. Suzuki was replying to a question about the relationship between the yen's recent weakening and the central bank's ultra-easing. The government "will take appropriate steps on currency policies in close communication with currency authorities in the United States and others, as currency stability is important and sharp exchange-rate moves are undesirable," Suzuki added, repeating previous remarks made by top Japanese officials. (RTRS)

BOJ: Prime Minister Fumio Kishida’s government signed off on the reappointment of one of the Bank of Japan’s key policy architects in a move that suggests the central bank is looking for policy continuity after Governor Haruhiko Kuroda steps down next April. Shinichi Uchida, executive director in charge of monetary policy, will stay in his position for another four years from Friday, according to a statement by the central bank. Among BOJ watchers, Uchida is well known alongside Deputy Governor Masayoshi Amamiya as one of the key architects of Kuroda’s shock-and-awe bazooka in 2013, his switch to negative interest rates three years later and the introduction of yield curve control after that. (BBG)

BOJ: MNI INSIGHT: BOJ To Draw On Tankan's Sustained Price Rise Views

- Japanese companies are more likely to pass along higher costs to the retail level, but the willingness of households to pay more without significant wage gains remains the crux of any Bank of Japan decision to tweak the easy policy outlook as inflation looks set to reach near 2% in or after April and remain around that level at least in the medium term, MNI understands - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

RBA: Australian Treasurer Josh Frydenberg has filled a crucial vacancy on the policy-setting board of the Reserve Bank of Australia by appointing Michele Bullock to a five-year term as the central bank’s next deputy governor. Ms. Bullock is the first female deputy in the RBA’s 63-year history, and she fills the post that was unexpectedly vacated by Guy Debelle in early March. Coming from the prudential and financial stability side of the RBA, Ms. Bullock is expected to round out management skill sets at the top end of the central bank, which faces major challenges in areas such as expanding use of digital currencies, while soaring house-price growth remains a key criticism of policy makers. (WSJ)

AUSTRALIA: Australian Treasury Secretary Stephen Kennedy told a Senate hearing that the balance of risks to the government's inflation outlook were to the upside. Kennedy, who also sits on the RBA's board, says that with job vacancies at record levels it was possible that wage and inflation pressures could flow through faster than expected, adding there was a coming opportunity to normalize monetary policy. The hawkish commentary will likely fan bets that the RBA could be raising interest rates by midyear. (Dow Jones)

AUSTRALIA/CHINA: Australian Foreign Minister Marise Payne has criticized China's handling of the trial of Australian journalist Cheng Lei, who has been detained for nearly two years on suspicion of illegally supplying state secrets overseas. "We respect the sovereignty of China's legal system, but we have been very clear that this case has lacked transparency from the very beginning," Payne told Brisbane's 4BC radio station on Friday. "The Australian government has never been provided with details of the charges and... the ambassador was denied entry to Cheng Lei's trial," Payne said. "I do think that lack of transparency is very concerning." On Thursday, Canberra's ambassador to China, Graham Fletcher, was denied access to Cheng's trial in Beijing. The minister said the proceedings ended with the court deferring its verdict. A Chinese Foreign Ministry spokesperson said on Thursday that Cheng would have a "closed trial" and that "the verdict would be supplied at the suitable time." (DPA)

RBNZ: New Zealand’s central bank plans to undertake two rounds of public consultation on its monetary policy remit this year before proposing any changes to Finance Minister Grant Robertson in 2023. The Reserve Bank also considers it appropriate to consult other political parties on the remit, which defines the Monetary Policy Committee’s price stability and employment goals. Those goals are currently to aim for 2% inflation and support maximum sustainable employment. Under its new legislation, the RBNZ must consult with the public on the remit and provide advice to the minister on possible revisions before it is renewed every five years. That wasn’t the case with the previous policy targets agreement, which the remit replaced in 2019. The current remit is due to expire on Feb. 13, 2024, and the bank is required to provide advice to the minister no later than Nov. 13, 2023. (BBG)

BOK: South Korea's nominee to be the central bank chief on Friday said the Bank of Korea should better coordinate with the government as monetary and fiscal policies need to work in tandem to support growth and stabilize prices. Speaking to reporters in Seoul, Rhee Chang-yong, a veteran International Monetary Fund official, also said the country's soaring household debt will need to be curbed as the quality of debt could deteriorate with the ageing population. (RTRS)

SOUTH KOREA: South Korea's consumer prices are estimated to have grown at a faster pace in March as Russia's invasion of Ukraine has driven up oil prices, a senior government official said Friday. Inflationary pressure is likely to remain high for the time being as external economic uncertainty has heightened, according to First Vice Finance Minister Lee Eog-weon. "Expectations are growing that inflation growth will pick up in March, led by a jump in prices of petroleum products," Lee said at a government meeting on inflation. (Yonhap)

SOUTH KOREA: South Korea will ease social distancing measures, allowing private gatherings of up to 10 people and restaurants to operate until midnight as there are signs that the spread of the omicron variant is slowing, Prime Minister Kim Boo-kyum said in a meeting. (BBG)

SOUTH KOREA: South Korea will consider lifting most social distancing measures if Covid-19 spread continues to slow for the next 2 weeks, Health Minister Kwon Deok-cheol said during a briefing. Will keep core measures including wearing masks when indoors. (BBG)

TURKEY/RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- S&P on Turkey (current rating: B+; Outlook Negative)

BRAZIL: Economy Minister Paulo Guedes’s push for lower taxes may well become one of his few economic legacies in Brazil, and one that could prove to be more short-lived than he would hope for. Over the past couple of months, the government has given up on 39 billion reais ($8.2 billion) in revenue by reducing taxes on cooking gas, diesel and several types of merchandise. The so-called IPI levy on industrialized goods was initially slashed by 25%, and then again this week to a total of 33%. Now Guedes wants to increase the list of products benefiting from zero import tariffs, and even additional IPI cuts aren’t ruled out. (BBG)

BRAZIL: Brazil’s former Carwash Judge Sergio Moro gave up his presidential bid for now and switched parties in an attempt to facilitate negotiations around a single centrist candidate who could potentially challenge the leftist and right-wing front-runners in the October election. (BBG)

RUSSIA: Russia is redeploying elements of its forces from Georgia to reinforce its invasion of Ukraine, British military intelligence said on Thursday. "Between 1,200 and 2,000 of these Russian troops are being reorganised into 3x Battalion Tactical Groups," Britain's Ministry of Defence said. (RTRS)

RUSSIA: The United States wants Ukraine's borders to be respected as before the invasion was launched and it seems Russia is prioritizing taking the eastern Donbass region, Pentagon spokesperson John Kirby said on Thursday. "We want Ukraine's sovereignty, all of their sovereignty, their borders as it was before the end of February to be respected," he told Fox News. (RTRS)

RUSSIA: Britain and its allies have agreed to send more lethal weapons to Ukraine to help defend it against Russia's invasion, British defence minister Ben Wallace said on Thursday. "There'll be more lethal aid going into Ukraine as a result of today. A number of countries have come forward either with new ideas or indeed more pledges of money," Wallace told reporters after hosting over 30 international partners at a conference. He said the lethal aid included longer range artillery, ammunition, and more anti-aircraft weapons. (RTRS)

RUSSIA: Britain is concerned that the United States, France and Germany will push Ukraine to “settle” and make significant concessions in peace talks with Russia, The Times has been told. A senior government source said there were concerns that allies were “over-eager” to secure an early peace deal, adding that a settlement should be reached only when Ukraine is in the strongest possible position. (The Times)

RUSSIA: President Joe Biden said Russian leader Vladimir Putin may have fired some of his advisers or put them under house arrest, and that it’s an “open question” as to whether Putin is fully informed on his military’s performance in Ukraine. Biden told reporters at the White House on Thursday that “there’s some indication that he has fired or put under house arrest some of the advisers.” “But I don’t want to put too much stock in it at this time because we don’t have that much hard evidence,” he added. Kremlin spokesman Dmitry Peskov said in an interview that Biden’s comments were “a perfect example of disinformation of a head of state.” Asked if that meant it was Biden instead of Putin who was poorly informed, Peskov replied, “exactly.” Biden’s remarks add to a steady drip of suggestions in Washington and by U.S. allies of distance between Putin and his top advisers. The comments also build on indications of inner- circle dissent, such as the departure of Russia’s climate envoy and the unsuccessful bid by central bank Governor Elvira Nabiullina to step aside. (BBG)

RUSSIA: The Russian defence ministry said on Thursday it would open a humanitarian corridor from the besieged city of Mariupol to Zaporizhzhia on Friday, Tass news agency reported. It quoted Colonel-General Mikhail Mizintsev, the director of the Russian National Center for Defense Management, as saying Moscow was acting on a request that French President Emmanuel Macron and German Chancellor Olaf Scholz had made to Russian President Vladimir Putin. (RTRS)

RUSSIA: The United Nations said its aid convoy was able to get through to the northeastern city of Sumy, where it delivered food, medicine and other supplies. But it said that the UN and partners have still not been able to deliver aid to other regions, including the besieged port of Mariupol, “despite extensive efforts and ongoing engagement with the parties to the conflict.” (BBG)

RUSSIA: Russian troops began leaving the Chernobyl nuclear plant after soldiers got “significant doses” of radiation from digging trenches at the highly contaminated site, Ukraine’s state power company said Thursday as fighting raged on the outskirts of Kyiv and other fronts. The International Atomic Energy Agency said it was unable to confirm the reports of radiation exposure and is “seeking further information.” The IAEA said it was told by Ukrainian officials that Russia has transferred control of the facility, in writing, back to Ukraine. (BBG)

RUSSIA: The Treasury Department on Thursday announced sanctions on a global network of individuals and shell companies it says are helping the Russian military to evade the multilateral controls on exports of advanced technology to Moscow while the Kremlin wages war against Ukraine. At the center of the network is Serniya Engineering, a Moscow-based company that the Biden administration said operates under the direction of Russian intelligence services. (CNBC)

RUSSIA: The U.S. Commerce Department will impose further sanctions in the coming days targeting Russia's defense, aerospace and maritime sectors, adding 120 entities from Russia and Belarus to its entity list, the White House said on Thursday. That will bring the number of Russian and Belarusian parties added to the list to more than 200 since the invasion of Ukraine began, spokesperson Kate Bedingfield told a news conference. (RTRS)

RUSSIA: Estonian Prime Minister Kaja Kallas asked the European Commission to present a proposal to withhold a share of the revenue that goes to Russia for its energy exports as a possible alternative to a broader energy embargo, according to a document seen by Bloomberg News. The Baltic nation, which has demanded tougher sanctions on Moscow, is proposing that the money stay frozen in a special account until Russia withdraws its troops from Ukraine, and wants the proposal to be included in the EU’s next sanctions package. Kallas said that the EU has collectively paid more than 22 billion euros ($24 billion) to import energy from Russia since the start of the war last month. (BBG)

RUSSIA: Russia will respond to European Union sanctions and says the 27-nation bloc might realize that a confrontation with Moscow is not in its interests, RIA cited a senior foreign ministry official as saying on Friday. "The actions of the EU will not remain unanswered ... the irresponsible sanctions by Brussels are already negatively affecting the daily lives of ordinary Europeans," Nikolai Kobrinets told the news agency. (RTRS)

RUSSIA: Russia will not ask the European Union to end sanctions and has a sufficient "margin of safety", the RIA news agency quoted a Russian foreign ministry official as saying on Friday. "The European Union is not the centre of the universe," Nikolai Kobrinets, the head of the European cooperation department at the ministry, said. (RTRS)

RUSSIA: Japanese Prime Minister Fumio Kishida confirmed Friday that the country wouldn’t pull out of the Sakhalin-1 offshore oil joint venture with Russia. The move was widely expected as Japanese officials have stressed since Russia’s invasion of Ukraine that both the Sakhalin-1 and Sakhalin-2 projects are crucial for Japan’s energy security. “Our country’s policy is not to withdraw,” Kishida told parliament. (BBG)

RUSSIA: JPMorgan Chase & Co. processed a coupon payment from Russia for one of its dollar bonds, allowing the nation to continue sidestepping a default. JPMorgan, which is listed as a paying agent on the prospectus for Russia’s debt due in 2030, processed a payment amounting to nearly $447 million on Thursday, according to a person familiar with the matter. That covers an $87.5 million coupon payment and a $359 million principal payment, said the person, who declined to be named because they aren’t authorized to speak publicly. Questions arose over Russia’s ability to service its 2030 debt last week after Clearstream, the Luxembourg-based bank that was listed as the clearinghouse in bond documents, blocked the account for the National Settlement Depository. The NSD receives the Russian government’s payments on some of its foreign bonds for distribution. (BBG)

RUSSIA: Russia bought back the bulk of a soon-to-mature $2 billion bond using rubles, leaving the nation with far fewer dollars to repay its holders on April 4. The Finance Ministry said it had repurchased the equivalent of $1.45 billion of the bond maturing on Monday, or 72% of the debt outstanding, according to a statement on Thursday. That leaves just $552.4 million of the security remaining in circulation, according to the ministry, which said it sent corresponding notifications to the paying agent, Citibank N.A.’s London branch. It’s a step that ensures local investors get payments regardless of the restrictions and sanctions that have been slapped on the nation for its invasion of Ukraine. Still, the clock is ticking for President Vladimir Putin’s government to repay the outstanding balance when it matures. “Monday is still a key date for holders that did not sign up and are thus awaiting the final redemption payment at par,” said Padhraic Garvey, head of global debt and rate strategy at ING Financial Markets. (BBG)

RUSSIA: Russian Railways JSC, EuroChem and Chelyabinsk Pipe Plant have missed deadlines to make interest payments on foreign-denominated bonds after the cash got stuck for compliance checks on its way to investors. The companies now face the risk of creditors declaring they’re in default. The specter of default hash shadowed Russia in the wake of sanctions imposed in response to the invasion of Ukraine. (BBG)

CHINA/RUSSIA: The trading volume of the onshore yuan versus the Russian ruble falls to 137m yuan ($21.6m) in March, the lowest since May, according to data from China Foreign Exchange Trade System. CNY/RUB trading volume was 151m yuan in February. The number of transactions in the currency pair dropped to 24 last month, lowest since Jan. 2020 and down from 53 in the previous month. (BBG)

SOUTH AFRICA/RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Moody’s on South Africa (current rating: Ba2; Outlook Negative)

EQUITIES: Trading in 33 Hong Kong-listed stocks was halted on Friday after a number of firms missed a deadline to report annual results, adding another layer of uncertainty to a market that’s trying to recover from a recent low. Troubled Chinese developers including Sunac China Holdings Ltd. and Shimao Group Holdings Ltd. were among the stocks suspended. China Aoyuan Group Ltd. said publishing unaudited results at this stage could “potentially be misleading to the shareholders and potential investors.” This year’s number compares with 57 for 2021 and at least nine for 2020. The barrage of trading halts comes at a bad time for the city’s equity market, after the Hang Seng Index slid to a 10-year low last month. Beijing’s repeated vows to provide stability have failed to restore investors’ confidence, and regulatory risks as well as lockdowns inChina are weighing on the earnings outlook. (BBG)

GOLD: Some gold refineries are refusing to remelt Russian bars even though market rules permit them to do so, in a sign of how toxic the country’s products have become in certain commodities markets. The London Bullion Market Association, a club of big banks that acts as the overseer of the world’s key gold market, has drawn a distinction between newly produced Russian gold, which it has barred from its market, and metal that was produced before the invasion, which it is still allowing to trade. However, at least two major gold refiners are refusing to remelt old Russian bullion bars, according to people familiar with the situation who asked not be identified as the matter is private. (BBG)

COPPER: Freeport-McMoRan Inc. and Goldman Sachs Group Inc. share a bullish outlook for copper. They appear to diverge, however, on how much of an impact higher prices would have on supply growth. Goldman analyst Nicholas Snowdon told a copper conference Wednesday that current near-record prices need to go much higher in order to stimulate a supply response. The next day, Freeport boss Richard Adkerson said market tightness “is far beyond a price issue.” So while copper companies like Freeport, the top publicly trader producer, are raking in the cash, there’s not much they can do to significantly accelerate projects given a deterioration of deposit quality and more demanding operating environments, Adkerson said in an interview. That’s a problem, with copper demand set to surge in the clean energy transition. (BBG)

ENERGY: Russian President Vladimir Putin's order for foreign gas buyers to use Gazprombank to make gas payments in roubles covers deliveries due after April 1, a source familiar with the situation told Reuters. "Payments for 'April gas' on some contracts start in the second half of April, on others - in May," the source added. (RTRS)

ENERGY: Russia's Gazprombank on Thursday said it would provide conditions to allow convenient payments for Russian gas in roubles, Tass news agency said. Gazprombank told Tass it has the right technology and experience to quickly and expertly fulfill a state order to switch to roubles for gas payments which President Vladimir Putin signed earlier in the day. (RTRS)

OIL: The Biden administration has worked with allies in the IEA in recent weeks to coordinate releases which will bring the total volume to global markets to well over 1 million barrels per day, the official said. He estimated that the release could push down U.S. gasoline prices anywhere from 10 cents to 35 cents per gallon, depending on how much allies and partners let go from their reserves. Biden said U.S. allies and partners could release an additional 30 million to 50 million barrels. The IEA, a watchdog representing industrialized nations including the United States, but not Russia, meets on Friday when it may announce a release. The group presided over its fourth coordinated oil release on March 1 of over 60 million barrels of crude – its largest yet. The U.S. portion of the release was about half of that. (RTRS)

OIL: Japan will act appropriately on oil reserves release while closely watching global developments, the Japanese industry minister said on Friday, ahead of a meeting by International Energy Agency (IEA) member countries later in the day. (RTRS)

OIL: U.S. oil production fell in January by 2% to the lowest since September 2021, according to a monthly report from the U.S. Energy Information Administration on Thursday. Oil production fell to 11.4 million barrels per day (bpd) in January from 11.6 million barrels per day the month prior, the report showed. (RTRS)

OIL: Add steel shortages to the growing list of reasons U.S. shale producers aren’t raising output as fast as needed amid a global energy crisis. To drill more wells, they need steel tubes to line the inside of the holes and get the crude out. Those pipes have become more expensive and scarce. Oil and gas producers also have to boost wages to find and retain workers. They say those higher expenses, along with Biden administration’s tough environmental policy and investors’ pressure to keep costs under control, make them reluctant to ramp up production. (BBG)

OIL: Venezuela's state-run energy firm PDVSA is in talks to buy and lease several oil tankers amid a possible expansion in exports, according to three sources and a document seen by Reuters, a sign the country expects U.S. sanctions on its petroleum sector to be eased. Russia's invasion of Ukraine has set off a global hunt for new oil supplies, especially the heavy oil produced by Venezuela. A high-level meeting between U.S. and Venezuelan officials in Caracas this month opened the door for talks over sanctions imposed on PDVSA in 2019, which were later reinforced by former U.S. President Donald Trump as part of his "maximum pressure" campaign to oust Venezuelan President Nicolas Maduro. (RTRS)

CHINA

PBOC: The People’s Bank of China is likely to keep liquidity ample this month to meet an expected liquidity gap of about CNY300 billion, the Shanghai Securities News reported citing analysts. The central bank still has the policy space to cut reserve requirement ratios or policy rates in April, the newspaper said. Reducing the rate of the Medium-term Lending Facility is key to stimulating the loan demand of companies and residents, the newspaper said citing analyst Wang Qing at Golden Credit Rating. An interest rate cut this month is more likely as it can more effectively help corporates cut loan costs and prevent a falling real estate market, it said. (MNI)

ECONOMY: China's manufacturing gauge can return to expansion in the next few months after the government stated its strong fiscal policy support, such as accelerated local government bond issuances that support infrastructure investment and help boost industrial production, Yicai.com said citing analysts. However, domestic Covid-19 outbreaks and commodity prices are having a greater-than-expected impact on the economy, putting pressure on growth, it said. Monetary loosening is now more necessary with a growing possibility of an RRR cut, Yicai said. (MNI)

CORONAVIRUS: Shanghai started part two of its phased lockdown on Friday, confining some 16 million people living in the western part of the city to their homes after ending a four-day lockdown of the eastern half. Residents in the western part of the Chinese financial hub, where about two-thirds of Shanghai’s population lives, were confined to their homes starting at 3 a.m. on Friday. Shanghai has emerged as the epicenter of China’s worst virus outbreak since the early days of the pandemic. The city’s daily infections shot up from less than five at the beginning of March to almost 6,000 earlier this week, though they’ve subsequently declined. (BBG)

CORONAVIRUS: Many patients have died in recent days at a large Shanghai elderly-care hospital amid a Covid outbreak, the Wall Street Journal reported, citing people familiar with the situation. Shanghai hasn’t officially reported any Covid-related deaths or outbreaks in its elderly-care centers since cases began climbing in March. The fatalities are a sign that infections are hitting Shanghai harder than authorities have publicly disclosed, the report said. (BBG)

EQUITIES: U.S.-listed Chinese stocks tumbled on Thursday, wrapping up their worst start of the year since 2008, as worries about of a wave of possible delistings remains high. The Nasdaq Golden Dragon China Index closed 5.4% lower in New York, with iQIYI Inc. and Baidu Inc. sinking at least 8%. The index fell for a fourth consecutive quarter, or 21%. E- commerce giants Alibaba Group Holding Ltd. declined 6.7% on Thursday and ended the quarter 8.4% lower, while JD.com Inc. and Pinduoduo Inc. also slid more than 5.9% on Thursday. Investors remain on edge over the outlook for the shares after months of U.S. regulatory pressure involving the companies’ audits. Securities and Exchange Commission Chair Gary Gensler on Wednesday dialed down prospects of an imminent deal that would allow Chinese firms to keep trading on American exchanges. (BBG)

OVERNIGHT DATA

CHINA MAR CAIXIN M'FING PMI 48.1; MEDIAN 49.9; FEB 50.4

Policymakers are facing double challenges of “precision” — improving the level of precision of epidemic control measures, to strike a balance between maintaining the normal order of production and life and guarding safety and health of the people; ensuring fiscal policy and monetary policy are implemented precisely. Policymakers should care about vulnerable groups, enhancing supports for key industries and small and micro businesses, to stabilize market expectations. (Caixin)

JAPAN Q1 TANKAN LARGE M'FING INDEX 14; MEDIAN 12; Q4 17

JAPAN Q1 TANKAN LARGE NON-M'FING INDEX 9; MEDIAN 5; Q4 10

JAPAN Q1 TANKAN LARGE M'FING OUTLOOK 9; MEDIAN 10; Q4 13

JAPAN Q1 TANKAN LARGE NON-M'FING OUTLOOK 7; MEDIAN 8; Q4 9

JAPAN Q1 TANKAN LARGE ALL INDUSTRY CAPEX +2.2%; MEDIAN +4.4%; Q4 +9.3%

JAPAN Q1 TANKAN SMALL M'FING INDEX -4; MEDIAN -6; Q4 -1

JAPAN Q1 TANKAN SMALL NON-M'FING INDEX -6; MEDIAN -9; Q4 -3

JAPAN Q1 TANKAN SMALL M'FING OUTLOOK -5; MEDIAN -8; Q4 -1

JAPAN Q1 TANKAN SMALL NON-M'FING OUTLOOK -10; MEDIAN -8; Q4 -6

JAPAN MAR, F JIBUN BANK M'FING PMI 54.1; FLASH 53.2

The Japanese manufacturing sector saw an improvement in operating conditions at the end of the first quarter of 2022, as March PMI data pointed to a renewed expansion in production levels. Moreover, new order inflows saw a quickening in growth, as firms recovered from the surge in COVID-19 cases at the start of the year. That said, international markets were subdued, following the reintroduction of strict restrictions across parts of China and the outbreak of war between Russia and Ukraine. As a result, new export orders fell at the sharpest rate since July 2020. Anecdotal evidence also linked the war to exacerbated price and supply pressures, with Japanese manufacturers recording the sharpest rise in input prices since August 2008. This came amid a rapid rise in raw material prices, most notably oil. At the same time, firms recorded a marked deterioration in lead times that was the greatest for three months amid material shortages. There was a survey-record increase in stocks of inputs as firms sought to grow safety stocks and unused inputs accumulated due to shortages of critical components. Beyond the immediate future, firms remained confident about the year-ahead outlook for output, though the downside risks led to the softest degree of optimism for seven months. This is in line with current estimates for industrial production to rise 3.7% in 2022, meaning that output lost to the pandemic is unlikely to be recovered until 2023. (S&P Global)

JAPAN MAR VEHICLE SALES -14.8% Y/Y; FEB -18.6%

AUSTRALIA MAR, F S&P GLOBAL M'FING PMI 57.7; FLASH 57.3

Manufacturing sector growth improved in March according to the latest S&P Global Australia Manufacturing PMI, supported by robust demand conditions. Despite a renewed rise in COVID-19 cases and domestic flooding disruptions, manufacturing production remained resilient. That said, supply constraints became more profound in March with the deterioration in vendor performance and both manpower and input shortages reported. The negative consequences of the Ukraine war also showed up across both price and delivery times indicators. Supply issues may also be further aggravated going forward with interests amongst manufacturers to build safety stock, which is a trend worth watching. Overall sentiment remained positive, but sunk to the lowest since July 2021. (S&P Global)

AUSTRALIA MAR CORELOGIC HOUSE PRICE INDEX +0.3% M/M; FEB +0.3%

AUSTRALIA FEB HOME LOANS VALUE -3.7% M/M; MEDIAN +1.5%; JAN +2.5%

AUSTRALIA FEB OWNER-OCCUPIER LOAN VALUE -4.7% M/M; MEDIAN +1.0%; JAN +0.8%

AUSTRALIA FEB INVESTOR LOAN VALUE -1.8% M/M; MEDIAN +5.5%; JAN +6.1%

NEW ZEALAND MAR ANZ CONSUMER CONFIDENCE 77.9; FEB 81.7

NEW ZEALAND MAR ANZ CONSUMER CONFIDENCE -4.7% M/M; FEB -16.4%

Consumer confidence dropped another 4 points in March to 77.9, a fresh record low in data that data began in 2004. The proportion of people who believe it is a good time to buy a major household item fell another 5 points to -26. Inflation expectations rose to 6%. House price inflation expectations eased from 4.8%to 2.7%, and are lowest in Wellington (0.7%). The ANZ-Roy Morgan Consumer Confidence Index dropped further to a fresh record low in March, as a perfect storm of Omicron, rising living costs, a retreating housing market and rising interest rates soured the mood. (ANZ)

SOUTH KOREA MAR TRADE BALANCE -$140MN; MEDIAN $0MN; FEB +$831MN

SOUTH KOREA MAR EXPORTS +18.2% Y/Y; MEDIAN +19.0%; FEB +20.6%

SOUTH KOREA MAR IMPORTS +27.9% Y/Y; MEDIAN +27.5%; FEB +25.2%

SOUTH KOREA MAR S&P GLOBAL M'FING PMI 51.2; FEB 53.8

South Korean manufacturers reported that sharp price rises and sustained supply chain disruption had hindered production and demand at the end of the first quarter of the year. Despite the headline PMI remaining above the 50.0 no-change mark, this masked a renewed contraction in output levels, while new orders broadly stagnated as rising raw material prices hit demand. Higher oil, metals and semiconductor prices meant that the disruption was broad-based across the manufacturing sector. Rising raw material prices also meant that input price inflation accelerated to a threemonth high. Moreover, manufacturing firms noted the impact that economic sanctions on Russia and the war with Ukraine had on international demand, with new export sales falling at the fastest pace since mid-2020. Despite headwinds from ongoing price and supply issues, positive sentiment remained strong in March. The degree of optimism was marked, despite softening from February and was underpinned by hopes that higher demand would boost prospects once price pressures eased. However, some businesses reported concerns regarding the wider fallout from the Russia-Ukraine war. This is in line with the current estimate for industrial production to rise 2.6% in 2022. (S&P Global)

CHINA MARKETS

PBOC NET DRAINS CNY90BN VIA OMOS FRIDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.10% on Friday. The operation has led to a net drain of CNY90 billion after offsetting the maturity of CNY100 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0382% at 09:33 am local time from the close of 2.2449% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 45 on Thursday, flat from the close of Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3509 FRI VS 6.3482

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3509 on Thursday, compared with 6.3482 set on Thursday.

MARKETS

SNAPSHOT: Familiar Themes Dominate The Headlines At The Start Of A New Quarter

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 127.29 points at 27694.4

- ASX 200 up 4.713 points at 7504.3

- Shanghai Comp. up 20.197 points at 3272.4

- JGB 10-Yr future up 7 ticks at 149.77, yield down 0.9bp at 0.211%

- Aussie 10-Yr future unch. at 97.100, yield up 0.2bp at 2.842%

- U.S. 10-Yr future -0-18 at 122-10, yield up 4.75bp at 2.386%

- WTI crude down $0.51 at $99.77, Gold down $0.05 at $1937.43

- USD/JPY up 88 pips at Y122.58

- PUTIN'S ROUBLE GAS PAYMENT ORDER COVERS DELIVERIES DUE AFTER APRIL 1 (RTRS SOURCE)

- RUSSIA WILL NOT ASK EU TO END SANCTIONS (RIA)

- RUSSIA’S $1.45BN BOND BUYBACK HAS INVESTORS EYEING MONDAY (BBG)

- RBA’S BULLOCK PROMOTED TO DEPUTY GOVERNOR

- RBA CASH RATE SETS JUST 1BP SHY OF TARGET, HIGHEST LEVEL SEEN SINCE NOV ‘20

- DOZENS OF HONG KONG FIRMS HALTED AFTER MISSING EARNINGS DEADLINE (BBG)

US TSYS: A Soft Start To Q2

We got a weaker start to Q2 for the U.S. Tsy space as Asia-Pac participants reacted to late NY dealing weakness, before a light bid came in as the latest Chinese Caixin m’fing PMI print was softer than expected, representing the fastest rate of contraction observed in the reading since the COVID outbreak-driven contraction in Feb ’20. The survey collator noted that production fell at the quickest rate observed for just over two years amid tighter COVID restrictions. Steep declines in total new work and foreign demand were also een, while suppliers' delivery times worsened and cost pressures intensified. That made for pretty grim reading all around. The space then drifted lower again, with TYM2 making fresh session lows. The contract is last -0-19 at 122-09, 0-01+ off the base of its 0-14 overnight range, while cash Tsys are 4-5bp cheaper across the curve. Flow was dominated by block buying of the FVK2 113.75 puts (2x 2.0K).

- Looking ahead, NY hours will be dominated by the latest NFP print (see our full preview of that release here). Elsewhere, the monthly ISM m’fing print & Fedspeak from Chicago Fed President Evans (’23 voter) are due. We also note that Russia-Ukraine discussions will resume (in an online format).

JGBS: Early Tokyo Bid Fades From Extreme

The bull flattening of the JGB curve extended at the Tokyo re-open, as the impulse from the BoJ Rinban plan tweaks for Q2 (announced after Tokyo hours yesterday) initially provided support, before the broader FI cheapening evident since late NY trade limited the rally (40s failed to cross back below 0.90% in yield terms) and started to apply some pressure. Note that 10-Year yields traded as low as 0.195% this morning but sit around 0.205% ahead of the close. Cash JGBs sit little changed to 2.5bp richer across the curve, with the early bull flattening giving way to bely outperformance.

- •Early Tokyo futures trade was two-way and volatile in nature, given the above inputs, with a show above the overnight high, before gains were pared back. That left the contract +9 late in the Tokyo day.

- •There hasn’t been much in the way of market pertinent local news flow to outline.

- •The latest BoJ Tankan survey saw large businesses downgrade their outlook (although the related readings were mostly in line to a touch better than expected), with a similar story playing out for small firms. Do note that large firms’ capex expectations moderated, providing a softer than expected reading.

JGBS AUCTION: Japanese MOF sells Y4.6204tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.6204tn 3-Month Bills:

- Average Yield -0.0979% (prev. -0.0815%)

- Average Price 100.0263 (prev. 100.0219)

- High Yield: -0.0930% (prev. -0.0800%)

- Low Price 100.0250 (prev. 100.0215)

- % Allotted At High Yield: 58.9961% (prev. 84.8845%)

- Bid/Cover: 3.579x (prev. 2.937x)

AUSSIE BONDS: A Higher Cash Rate Setting, New RBA Deputy & Syndication News

An active start to the new quarter for the space, with the weakness in U.S. Tsys applying some pressure early on, before Australian Treasury Sec Kennedy (who also sits on the RBA board) noted that inflation risks are on the upside, while stressing that an orderly movement of fiscal/monetary policy to maintain low unemployment will be pivotal. He went on to note that there is an opportunity for monetary policy to “normalise,” while tipping his hat to risks that wage growth may exceed forecasts (notable wage growth is the need that the RBA constantly refers to when it comes to outlining its views on the path of policy). Also note that the effective interbank overnight cash rate set at 0.09%, 1bp off the RBA’s 10bp target, after setting at 5bp and below since Nov ’20. This would have provided further pressure for the space, on top of Kennedy’s relatively hawkish remarks. Resultant price action was volatile, with losses pared relatively quickly.

- XM then blipped lower on the ACGB Nov-33 syndication announcement (due in the w/c 11 April), before recovering above pre-announcement levels. Note that many expected such an announcement (some even expected pricing next week), while next week’s AOFM issuance slate is light in the runup to syndication, with that combination likely facilitating the bounce after the initial early hedging flows subsided.

- The space then meandered through the remainder of Sydney hours, blipping higher into the close. YM -3.5 & XM +1.5, comfortably off of lows and session flats.

- Elsewhere, RBA Assistant Governor Bullock was promoted to Deputy Governor after Debelle’s recent, impromptu resignation, in turn making her the favourite to succeed RBA Governor Lowe at the end of his term (while seemingly promoting a feeling of continuity as opposed to upheaval).

AUSSIE BONDS: The AOFM sells A$300mn of the 1.75% 21 Jun ‘51 Bond, issue #TB162:

The Australian Office of Financial Management (AOFM) sells A$300mn of the 1.75% 21 June 2051 Bond, issue #TB162:

- Average Yield: 3.2119% (prev. 2.6294%)

- High Yield: 3.2175% (prev. 2.6325%)

- Bid/Cover: 2.0133x (prev. 2.8167x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 36.0% (prev. 76.9%)

- Bidders 39 (prev. 64), successful 23 (prev. 25), allocated in full 16 (prev. 17)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Wednesday 6 April it plans to sell A$500mn of the 2.50% 21 May 2030 Bond.

- On Thursday 7 April it plans to sell A$1.0bn of the 8 July 2022 Note & A$1.0bn of the 12 August 2022 Note.

- It also notes that subject to market conditions, a new 21 November 2033 Treasury Bond is planned to be issued via syndication in the week beginning 11 April 2022. Further details of the issue will be announced during the week beginning 4 April 2022.

EQUITIES: Asia-Pac Equities Mixed, With Plenty Of Headline Worry Apparent

A negative lead from Wall St., worries surrounding Chinese economic growth (with the latest Caixin m’fing PMI print missing exp., providing the sharpest rate of contraction observed since Feb ’20, which represented the onset of the wider COVID breakout), questions re: the potential delisting of Chinese equities in the U.S. and the ongoing conflict in Ukraine provided pressure for regional equity benchmarks during the early part of the first Asia-Pac session of the new quarter.

- A more downbeat BoJ Tankan survey (although the headline metrics were largely in line to a touch better than expected), including softer than expected capex intentions, provided further headwinds.

- Elsewhere, dozens of Hong Kong equities were halted after missing a deadline re: filing annual reports.

- Still, mainland Chinese equities bounced from early lows, with most pointing to hope re: increased policymaker support for the economy, with the CSI 300 adding ~1% during the Chinese morning session.

- The Nikkei 225 and Hang Seng also recovered from worst levels, aided by the bounce in Chinese equities. Continued BoJ easing and a weaker JPY added some f support for Japanese equities, but the Nikkei 225 is still ~0.5% lower on the day, given the early headwinds. While U.S. e-mini futures added 0.3% to settlement levels, after a sharp month-/quarter-end related sell off late in the NY day.

OIL: WTI Looks Below $100 In Asia

WTI has managed a marginal extension through Thursday’s low during Asia-Pac dealing and last sits a little over $0.50 softer on the day, just below $100 (after the level provided support on Thursday), while Brent futures have also extended Thursday’s move lower, losing a handful of cents, with $104.00 providing a bit of a floor for now.

- A reminder that Thursday’s sharp losses were a product of the sizeable U.S. SPR stock release initially touted in Asia-Pac hours, and later confirmed by the Biden administrations (1mn bpd set to be released over a ~6 month period), with the prospect of further action from the IEA later today (the Biden admin have flagged the potential for another 30-50mn bbl release on the part of the IEA).

- While most of the sell-side acknowledge a fairly short-term downside risk/bias to prices on the above, most continue to flag the structural support for crude, especially with OPEC+ maintaining their gradual approach when it comes to providing an uptick in production.

- Elsewhere, Russian energy pricing matters, the continued Russia-Ukraine conflict and the resumption of talks between the two nations (in an online format), set for Friday, provide plenty of other headline risk to keep an eye on.

GOLD: Rangebound In Pre-NFP Asia Session

Bullion has meandered through Asia-Pac dealing to trade little changed, just shy of $1,935/oz. This comes after spot tested $1,950/oz in NY hours, before pulling back from best levels, with the late shunt higher in U.S. real yields (based on our weighted U.S. real yield monitor) capping, then pressuring, bullion. The move higher in U.S. real yields has continued during Asia-Pac hours, accompanied by a modest uptick in the DXY, but bears have been wary of attempting to push gold lower, perhaps given the proximity to Friday’s U.S. NFP print.

- Note that Gold ETF holdings have surged since the onset of the Russia-Ukraine crisis, which has provided a leg of support on the flow side, as fund participation picks up. Note that ETF holdings of gold remain elevated in historical sense, and after the recent run higher sit a little over 5% shy of the all-time peak observed in late ’20.

- The aforementioned NFP print provides the notable risk event ahead of the weekend, while Russia-Ukraine matters will keep participants on headline watch.

FOREX: Yen Turns Tail Again, Antipodeans Diverge

Yen sales resumed on Friday with USD/JPY running as high as Y122.73 (more than 1 big figure better off) at its intraday peak. The pair's well-defined technical lines in the sand remained intact, albeit its RSI flirted with overbought territory. The move may have been driven by Tokyo reaction to the BoJ once again re-affirming its dovish credentials via its Q2 Rinban plan, as it looks to exert greater control over the yield curve via more frequent and larger (in cumulative terms) operations after the recent test of its YCC parameters. U.S./Japanese yield spreads widened from both ends in Tokyo trade, with Tsys cheaper and JGBs richer, which likely amplified the impact of yield spread movements. To top it all off, the BoJ's Q1 Tankan survey suggested that sentiment among Japan's large manufacturers deteriorated for the first time in seven quarters, underscoring the need for the central bank to stick to its ultra-loose monetary policy stance.

- Japan's FinMin Suzuki reiterated that sudden moves in FX markets are "undesirable," with officials closely watching their impact on the economy. The official added that the BoJ does not directly target currency rates.

- The Aussie dollar caught a bid after Treasury Secretary Kennedy (who also sits on the RBA Board) said that the balance of risks to inflation outlook were to the upside, pointing to the opportunity for monetary policy to "normalise." AUD/USD climbed to $0.7500 but rejected that round figure and gave away the bulk of its earlier gains, while AUD/NZD crossed above the NZ$1.0800 mark.

- In contrast to its Antipodean cousin, the kiwi dollar went offered. The latest ANZ survey showed that consumer confidence in New Zealand plunged to an all-time low (data begins in 2004) amid rising costs of living, rising interest rates, retreating housing market and spread of Omicron.

- U.S. NFP report provides the main point of note on today's data docket, with flash EZ CPI and a slew of Manufacturing PMI readings also due.

- Comments are due from ECB's de Cos, Centeno, Schnabel, Knot & Makhlouf, Fed's Evans & Riksbank's Ohlsson.

FOREX OPTIONS: Expiries for Apr01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1085-00(E844mln)

- USD/JPY: Y120.00($575mln), Y121.50-60($930mln)

- AUD/USD: $0.7525(A$522mln), $0.7550(A$564mln), $0.7600(A$551mln)

- USD/CAD: C$1.2660-80($1.1bln)

- USD/CNY: Cny6.3800($525mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/04/2022 | 0630/0830 | ** |  | SE | Manufacturing PMI |

| 01/04/2022 | 0630/0830 | *** |  | CH | CPI |

| 01/04/2022 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/04/2022 | 0745/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/04/2022 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/04/2022 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/04/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/04/2022 | 0800/1000 | * |  | NO | Norway Unemployment Rate |

| 01/04/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/04/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 01/04/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/04/2022 | 1230/0830 | *** |  | US | Employment Report |

| 01/04/2022 | 1305/0905 |  | US | Chicago Fed's Charles Evans | |

| 01/04/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/04/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/04/2022 | 1400/1000 | * |  | US | Construction Spending |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.