-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Canada Commits To Just One Of Three Fiscal Anchors

MNI POLITICAL RISK - Thune Eyes 'Deficit-Negative' Legislation

MNI EUROPEAN MARKETS ANALYSIS: Hang Seng Ticks Higher On Audit Hope, Oil Recovers Early, Modest Dip

- TYM2 has been on the defensive during the first Asia-Pac session of the week, with oil prices initially softening (likely on the back of weekend comments from the Iranian Foreign Minister who suggested that the country is close to reaching an accord with the U.S. re: restoring the 2015 nuclear pact & the extension of tough social mobility restrictions in the Chinese city of Shanghai, alongside requirements for COVID nucleic testing), with losses holding as oil rebounded and the Hang Seng led regional equity indices higher in the wake of seemingly positive weekend steps from China re: U.S. audit demands when it comes to Chinese ADRs .

- The above factors overpowered any influence from the Russia-Ukraine situation. Note that a fresh round of Western sanctions on Russia is seemingly inbound, with the Russian pullback from around Kyiv resulting in some grim imagery, triggering fresh accusations of war crimes surrounding the deaths of Ukrainian civilians. Elsewhere, Russia has noted that talks with Ukraine have not progressed enough to facilitate a meeting between the Presidents of the countries and that the country’s position on the status of Crimea and Donbas remained unchanged. This came after a Ukrainian negotiator suggested that enough progress had been made for such a meeting to take place. Online talks between the two nations are set to continue on Monday.

- Today's data docket features U.S. factory orders & final durable goods orders as well as Canadian building approvals and the latest BoC business outlook survey. Comments are due from a couple of BoE members, Gov. Bailey and Dep Gov. Cunliffe.

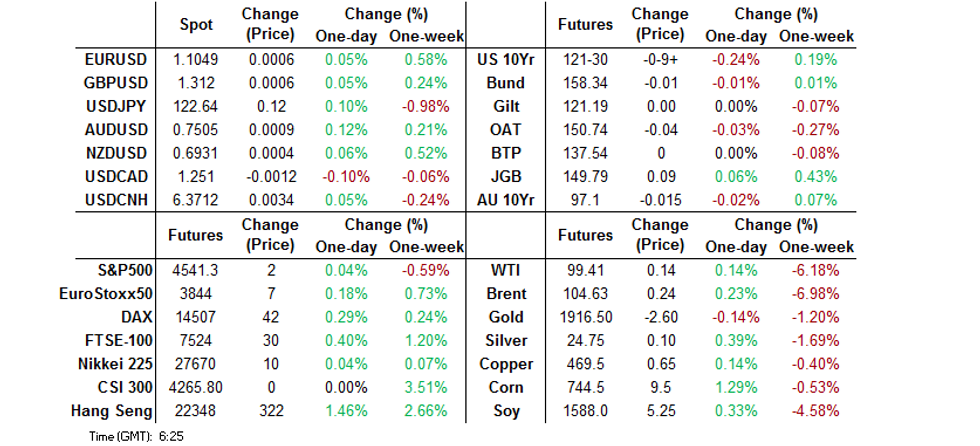

US TSYS: Cheaper To Start The Week

TYM2-0-09+ at 121-30, within the boundaries of Friday’s range & 0-02+ off the base of the contract’s 0-07+ Asia range. Volume is light at ~80K, limited by the observance of a Chinese holiday. Note that meaningful technical support isn’t seen until the Mar 28 low & bear tigger (120-30+), while Friday’s low (121-24), may provide a less significant area of technical support. Cash Tsys are 1.5-3.0bp cheaper on the day, bear steepening.

- TYM2 has been on the defensive during the first Asia-Pac session of the week, with oil prices initially softening (likely on the back of weekend comments from the Iranian Foreign Minister who suggested that the country is close to reaching an accord with the U.S. re: restoring the 2015 nuclear pact & the extension of tough social mobility restrictions in the Chinese city of Shanghai, alongside requirements for COVID nucleic testing), with losses holding as oil rebounded and the Hang Seng led regional equity indices higher in the wake of seemingly positive weekend steps from China re: U.S. audit demands when it comes to Chinese ADRs .

- The above factors overpowered any influence from the Russia-Ukraine situation. Note that a fresh round of Western sanctions on Russia is seemingly inbound, with the Russian pullback from around Kyiv resulting in some grim imagery, triggering fresh accusations of war crimes surrounding the deaths of Ukrainian civilians. Elsewhere, Russia has noted that talks with Ukraine have not progressed enough to facilitate a meeting between the Presidents of the countries and that the country’s position on the status of Crimea and Donbas remained unchanged. This came after a Ukrainian negotiator suggested that enough progress had been made for such a meeting to take place. Online talks between the two nations are set to continue on Monday.

- Weekend Fedspeak saw NY Fed President Williams suggest that the Fed needs to move its policy settings towards a more neutral stance, but the pace at which it tightens will depend on the economic reaction. He also noted that the Fed could start trimming its B/S as soon as the next FOMC meeting, with inflation risks becoming "particularly acute." San Francisco Fed President Daly (’24 voter) acknowledged that the case for a 50bp rate hike in May had grown, while tipping her hat to the likelihood of multiple 50bp adjustments further down the line.

- Looking ahead, durable goods & factory orders data will headline during NY hours. Focus will also fall on the dynamic surrounding Russia’s latest sovereign bound payment and the aforementioned Russia-Ukraine talks.

JGBS: Bid, Aided By Rinban, Undeterred By Breakdown Of Ops & Impending Supply

The presence of the BoJ’s Rinban operations seemingly provided support from the off in Tokyo JGB trade, with futures +9 ahead of the Tokyo close, while cash JGBS are 0.5-2.0bp richer across the curve, as 7s lead and the super-long end lags, resulting in some bull steepening.

- Upticks in the offer/cover ratios observed at today’s BoJ Rinban operations failed to deter bulls, even though dealers were seemingly happy to sell into the recent BoJ-induced rally. The offer/cover ratio breakdown can be found below, although it is worth remembering that the prev. 3- to 5- & 10- to 25-Year operation figures would have been impacted by the YCC enforcement measures observed last week: 1-to 3- Year: 3.02x (prev. 1.95x), 3- to 5-Year: 2.64x (prev. 1.31x), 10- to 25-Year: 4.59x (prev. 3.51x).

- Note that swaps lagged across most of the curve, resulting in some swap spread widening.

- Looking to tomorrow’s local docket, highlights include BoJ speak from Governor Kuroda, household spending & labour cash earnings data & 10-Year JGB supply (30-Year JGB supply is due on Thursday).

AUSSIE BONDS: Little Net Movement

The space has struggled to garner much in the way of lasting traction when it comes to movement away from Friday’s settlement levels, even with U.S. Tsys starting the new week on the backfoot, signs of continued strength re: the domestic labour market (as evidenced by the earlier ANZ job ads print) and another move higher in Melbourne Institute inflation expectations (with the headline Y/Y metric moving to the highest level observed since ’08) noted. YM -0.5 and XM -1.5 at typing, with the 7-Year zone underperforming on the cash ACGB curve as the major benchmarks cheapen by 0.5-2.5bp.

- Bills run flat to 2 ticks lower through the reds,

- Note that political uncertainty remains in the air, with the opposition Labour Party leading in the polls ahead of the upcoming Federal Election (set to be held in May), although it would seem that the ruling coalition is chipping away at Labour’s lead.

- Looking ahead, tomorrow’s RBA decision provides the highlight of the local docket this week (Expect our full preview of that event to hit during the London morning).

FOREX: Antipodeans Rise, Yen Slips In Quiet Asia-Pac Session

Market closures in China and Taiwan limited activity in the Asia-Pacific timezone, leaving participants to assess weekend developments. Antipodean currencies led gains in G10 FX space while the yen brought up the rear, despite the risk of tighter Western sanctions against Moscow after Russian troops retreating from Kyiv suburbs left abundant evidence of their war crimes against civilian population. Signs of progress towards Iran nuclear deal and China's efforts to defuse tensions with the U.S. over audits may have offered some support to market sentiment.

- The Aussie dollar caught a bid in the Sydney morning, rising past the $0.7500 mark. Reminder that the RBA will deliver its monetary policy decision tomorrow, with the semi-annual Financial Stability Review coming up Friday.

- Yen sales resumed over the Tokyo fix negating an earlier spell of recovery. This pushed USD/JPY a handful of pips higher, with its RSI having another look into overbought territory.

- Today's data docket features U.S. factory orders & final durable goods orders as well as Canadian building approvals and BoC Business Outlook. Comments are due from a couple of BoE members, Gov Bailey and Dep Gov Cunliffe.

FOREX OPTIONS: Expiries for Apr04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0800(E1.2bln), $1.0865-75(E574mln), $1.1000-10(E1.1bln), $1.1100(E725mln)

- USD/JPY: Y122.50($509mln), Y123.50-60($799mln)

- EUR/GBP: Gbp0.8390-00(E611mln), Gbp0.8460(E793mln), Gbp0.8570-75(E611mln)

- USD/CNY: Cny6.3800($525mln)

ASIA FX: Chinese Holiday Weighs On Activity, Peso Leads Gains In Asia EM Basket

Market holidays in China and Taiwan limited activity at the start to the week, as participants assessed geopolitical headlines from over the weekend.

- CNH: Offshore yuan weakened a tad in holiday-thinned trade.

- KRW: Spot USD/KRW traded on a firmer footing as the won came under pressure amid the risk of fresh sanctions against Russia. BoK Acting Gov Lee told senior central bank officials that Russia's war on Ukraine is a conundrum for policymakers, as it accentuates inflation pressures while weighing on economic growth.

- IDR: The rupiah traded sideways, with participants eyeing the release of local consumer confidence data later this week.

- MYR: Weaker oil prices applied some pressure to the ringgit, with spot USD/MYR building on its Friday's strength. UMNO SecGen confirmed that Malaysia's largest party will not cooperate with coalition partner Bersatu in the next general election.

- PHP: The Philippine peso outperformed in the region, with spot USD/PHP lodging a fresh one-month low. Up this week we have Philippine inflation, jobs and trade data.

- THB: The baht oscillated around neutral levels, ahead of today's comments from BoT Gov Sethaput & tomorrow's release of local CPI figures, with inflation expected to have accelerated further beyond the central bank's target range.

EQUITIES: Hang Seng Leads Way Higher On U.S. Audit Hope

Gains for Hong Kong's Hang Seng & Hang Seng Tech indices helped to reverse an early downtick in e-minis & the major regional equity indices during the first Asia-Pac session of the week. The move came after the weekend saw China's CSRC propose the revision of confidentiality rules re: offshore equity listings, removing a legal hurdle to Sino-U.S. cooperation on the heavily contentious audit front. The Hang Seng outperformed regional peers as a result, adding ~1.2% come the lunch break, while wider regional liquidity was impacted by the observance of a Chinese national holiday (note that Chinese and Hong Kong markets will be closed on Tuesday). The likes of the Nikkei 225, ASX 200 and S&P 500 e-mini futures have lodged marginal gains.

GOLD: Looking At Friday’s Lows

Gold has tested Friday’s base, which came after the combination of hotter than expected Eurozone inflation, a solid U.S. NFP print and a firmer than expected prices paid component in the latest U.S. ISM m’fing survey allowed U.S. real yields to move higher (based on our weighted U.S. real yield monitor). Softer oil prices have also fed into gold’s weakness in recent sessions, although uncertainty surrounding the Russia-Ukraine conflict continues to provide some counter to bullion’s bearish impulse. Spot last deals ~$6/oz softer on the day, just below $1,920/oz, with the 50-day EMA providing initial support and a bearish outlook in play after the unwind of the recently observed overbought conditions.

OIL: Early Downtick Pared

WTI and Brent crude futures sit little changed on the day, after the early downtick faded. Continued apprehension when it comes to meaningful progress surrounding the de-escalation of the Russia-Ukraine conflict allowed crude to reverse early losses.

- The early downward impetus came on the back of weekend confirmation that the IEA will release oil from strategic reserves alongside the well-documented U.S. SPR release (although no further details have been forthcoming), while worry re: Chinese demand remained evident given the extension of the COVID-related lockdown & nucleic testing requirements in the city of Shanghai, and finally, but perhaps most importantly, Iran signalled that a deal re: the revival of the previous nuclear accord with the U.S. is “close,” after the country sent suggestions to the U.S. via European mediators (a reminder that the U.S. has previously suggested that it does not expect a deal to be forthcoming in the immediate term). Elsewhere, we note that Yemeni factions have declared a 2-month ceasefire in the 7-year long civil war.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Period | Flag | Country | Release | Prior | Consensus | |

| 04/04/2022 | 0600/0200 | * | Mar |  | TR | CPI m/m | 4.81 | 6.00 | % |

| 04/04/2022 | 0600/0200 | * | Mar |  | TR | CPI y/y | 54.44 | 61.5 | % |

| 04/04/2022 | 0600/0800 | ** | Feb |  | DE | trade balance exports m/m | -2.8 | 2.0 | % |

| 04/04/2022 | 0600/0800 | ** | Feb |  | DE | trade balance imports m/m | -4.2 | 1.2 | % |

| 04/04/2022 | 0600/0800 | ** | Feb |  | DE | trade balance m/m | 3.5 | 7.8 | E (b) |

| 04/04/2022 | 1230/0830 | * | Feb |  | CA | Building Permits | -- | -- | % |

| 04/04/2022 | 1400/1000 | ** | Feb |  | US | Factory New Orders | 1.4 | -0.6 | % |

| 04/04/2022 | 1400/1000 | ** | Feb |  | US | Factory Orders ex-transport | 1.0 | 0.3 | % |

| 04/04/2022 | 1430/1030 | ** | Q2 |  | CA | BOC Business Outlook Indicator | 6.0 | -- | |

| 04/04/2022 | 1430/1030 | ** | Q2 |  | CA | Future sales (bal. of opinion) | 3.0 | -- | % |

| 04/04/2022 | 1430/1030 | ** | Q2 |  | CA | Investment (bal. of opinion) | -- | -- | % |

| 04/04/2022 | 1430/1030 | ** | Q2 |  | CA | Respondents seeing CPI 2%/less | -- | -- | % |

| 04/04/2022 | 1530/1130 | * | 08-Apr |  | US | Bid to Cover Ratio | -- | -- | |

| 04/04/2022 | 1530/1130 | * | 08-Apr |  | US | Bid to Cover Ratio | -- | -- |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.