-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Just How Hot Will U.S. CPI Data Be?

EXECUTIVE SUMMARY

- FED'S EVANS: HALF-POINT HIKES LIKELY, SHOULDN'T GO TOO FAR (RTRS)

- MICHAEL BARR FRONTRUNNER FOR BANK SUPERVISORY ROLE AT FED (POLITICO)

- BIDEN TO MAKE ANNOUNCEMENT ON LOWERING COSTS AT 2:45 PM CT TUES (BBG)

- AUSTRIAN LEADER PESSIMISTIC AFTER PUTIN TALKS (BBG)

- NETHERLANDS EXPLORES OPTIONS TO FILL GAS STORAGE BEFORE WINTER (BBG)

- JAPAN FINANCE MINISTER’S WARNING OFFERS YEN ONLY BRIEF RESPITE (BBG)

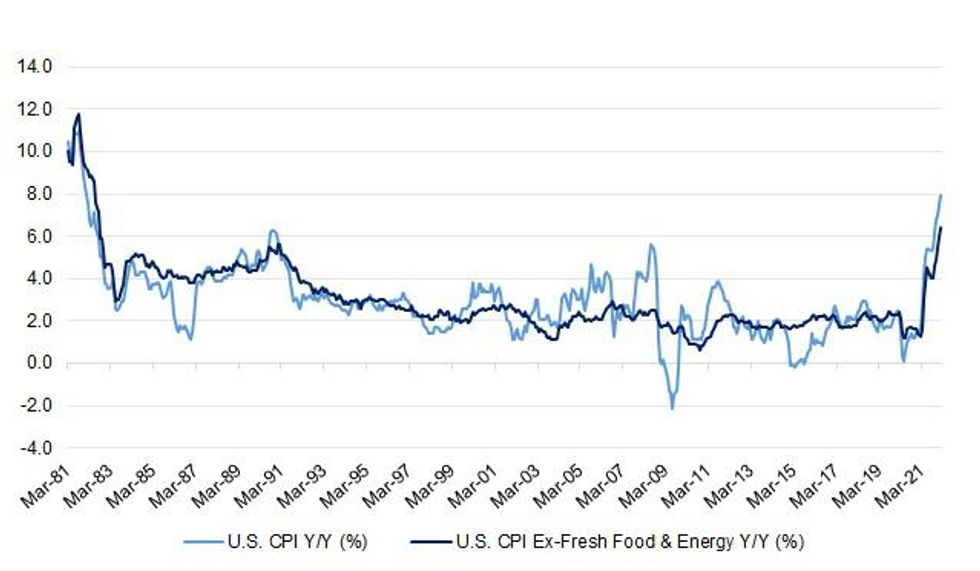

Fig. 1: U.S. CPI Vs. U.S. CPI Ex-Fresh Food & Energy Y/Y (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: British retailers reported weaker annual sales growth last month, reflecting growing pressure on consumer spending as well as seasonal factors around the timing of Easter which typically brings a boost to spending. (RTRS)

ECONOMY/CORONAVIRUS: Believe it or not, social study run by the University College of London shows that Britons are more worried about their finances than catching the Covid. 38% of the UK adults said they are worried about finances while 33% are concerned about becoming ill from the coronavirus. Results show growing distress over the cost of living crisis. (FT)

ENERGY: Gas and electricity bills are likely to rise by a further £500 this autumn, ministers have been warned, as the war in Ukraine weighs on wholesale energy prices. An initial assessment from Ofgem, the energy regulator, is understood to have concluded that the energy price cap is on course to rise to about £2,400 in October. Ofgem is said to have warned ministers that there is considerable uncertainty in the estimate and it could be higher if the disruption to markets continues throughout the summer. However, government sources denied claims that internal Ofgem estimates had suggested the price cap could rise to up to £5,000 in a worst-case scenario. (The Times)

POLITICS: Rishi Sunak should publish his tax returns in full, senior Tories suggested as they called for greater transparency from ministers in charge of the nation's finances. (Telegraph)

EUROPE

NETHERLANDS: The Dutch government is considering options to safeguard energy security by ensuring natural gas storage sites are filled before winter. Options include setting a minimum level that facilities need to have in stock, appointing a third party to fill up the sites or using a mechanism known as contracts for difference that will guarantee a fixed price for companies stashing away the fuel, according to the ministry of economic affairs and climate. A combination of all three is also being considered. (BBG)

SWEDEN: Sweden's PES unemployment rate fell to 3.2% in March from 3.4% in February, according to the Public Employment Service. (BBG)

U.S.

FED: Chicago Federal Reserve Bank President Charles Evans on Monday signaled he would not necessarily oppose getting interest rates up to a neutral setting of 2.25% to 2.5% by the end of the year, a pace that would require a couple of 50 basis-point rate hikes at upcoming Fed meetings. "Fifty is obviously worthy of consideration; perhaps it's highly likely even if you want to get to neutral by December," Evans told the Detroit Economic Club. But, he added, the Fed should not raise rates so fast that it doesn't have enough time to assess inflation pressures and adjust policy in response. "I think the optionality of not going too far too quickly is important," he said. "I would focus the attention on where do we want to be at the end of the year." (RTRS)

FED: MNI INTERVIEW: Fed Contacts Less Sanguine On Inflation – Tallman

- Elevated U.S. inflation should begin moderating later this summer although concern from business leaders suggests it could take even longer to get consumer prices under control, Cleveland Fed research director Ellis Tallman told MNI - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FED: Former Treasury Department official Michael Barr has emerged as the frontrunner for the top job overseeing banks at the Federal Reserve, according to people familiar with the matter, after President Joe Biden’s last pick faced opposition from Sen. Joe Manchin (D-W.Va.). Barr, now dean of the University of Michigan’s public policy school, played a major role in the crafting of financial safeguards in the wake of the 2008 Wall Street meltdown and has been a longtime consumer advocate. (POLITICO)

INFLATION: Biden heads back to Iowa for the first time as president on Tuesday at a moment when he’s facing yet more political peril. He’s saddled with sagging approval ratings and inflation at a 40-year high while his party faces the prospect of big midterm election losses that could cost it control of Congress. The president is set to promote his economic plans to help rural families struggling with higher costs at the gas pump and elsewhere, while highlighting the $1 trillion bipartisan infrastructure law enacted last fall. It includes money to improve internet access, as well for modernizing wastewater systems, reducing flooding threats and improving roads and bridges, drinking water and electric grids in sparsely populated areas. (The Washington Post)

INFLATION: White House economic adviser Brian Deese says the Biden administration expects an elevated consumer price index when numbers are released on Tuesday. Deese says the administration eyes inflation decreasing at the end of 2022 and into 2023. (BBG)

INFLATION: The Biden administration is bracing for Tuesday’s key consumer inflation report to show that the prices Americans pay soared in March, as Russia’s assault on Ukraine caused energy prices to jump. White House press secretary Jen Psaki said Monday that the Labor Department’s previous report — which showed prices rising at a dramatic rate in February — failed to include the majority of the jump in oil and gas costs caused by the Kremlin’s unprovoked invasion. “We expect March CPI headline inflation to be extraordinarily elevated due to Putin’s price hike,” Psaki told reporters. (CNBC)

ECONOMY: 2 of every 5 workers who switched jobs over the past year are looking for work again, according to a new survey published by Grant Thornton, a consulting firm. These workers will likely account for a good deal of churn in the labor market as the so-called Great Resignation continues, and suggests employers may need to reconsider pay, benefits and other workplace issues. (CNBC)

CORONAVIRUS: Philadelphia will again require masks in indoor public settings such as restaurants, schools and businesses starting next week, the city said on Monday, responding to what appears to be a fresh wave of coronavirus transmissions. The new rule, which is set to take effect on April 18, will make Philadelphia the first major city in the United States to reimpose such a mandate. New infections in Philadelphia are rising quickly, up 50% from the start of April, prompting the city to step up prevention measures, city Health Commissioner Cheryl Bettigole said at a news briefing. COVID hospitalizations, a lagging metric, remain stable, she said. (RTRS)

CORONAVIRUS: The U.S. Justice Department on Monday asked a federal appeals court to allow the Biden administration to resume enforcing a federal employee vaccine mandate that had been blocked by a lower-court judge in January. It said the appeals court should issue its order immediately to allow the ruling to take effect, arguing it is "justified by the serious ongoing harm to the public interest and to the government." (RTRS)

OTHER

U.S./CHINA/CORONAVIRUS: The U.S. State Department has ordered all non-emergency government staff and their family members in Shanghai to leave as Covid surges and told U.S. citizens to reconsider travel to China, according to an announcement dated April 11. “Reconsider travel to the People’s Republic of China (PRC) due to arbitrary enforcement of local laws and COVID-19-related restrictions,” the State Department said. “Do not travel to the PRC’s Hong Kong Special Administrative Region (SAR), Jilin province, and Shanghai municipality due to COVID-19-related restrictions, including the risk of parents and children being separated,” the statement said. “Reconsider travel to the PRC’s Hong Kong SAR due to arbitrary enforcement of local laws.” (CNBC)

U.S./CHINA/HONG KONG: U.S. State Department Spokesperson Ned Price tweeted the following on Tuesday, “Hong Kong’s position as a free, global financial center depends on the free flow of information and opinions. We call on the Hong Kong government to free Allan Au and all others imprisoned for exercising their fundamental freedoms. Journalism is not a crime.” (MNI)

JAPAN: Japanese Finance Minister Shunichi Suzuki ramped up government verbal warnings over the weakening of the yen with remarks that briefly supported a gain in the currency. “The government will closely monitor developments in the foreign exchange market, including the recent depreciation of the yen with a sense of vigilance,” Suzuki told reporters Tuesday. “That includes the impact on the Japanese economy.” The yen briefly strengthened to 125.11 against the dollar from 125.48 before the remarks, though the gains were short-lived. The currency traded below levels seen before Suzuki’s comments within less than an hour. (BBG)

RBA: Australian financial markets are pricing in aggressive interest-rate increases starting in June, but a former senior economist at the Reserve Bank of Australia says government bond traders are on track to be disappointed. According to Peter Tulip, now the chief economist at the Centre for Independent Studies, the preconditions for an increase in RBA interest rates, the first since 2010, are unlikely to be met in the near future. "Hawks have been predicting an imminent acceleration in inflation for most of the past decade," Mr. Tulip told Dow Jones Newswires. "They have been persistently wrong. We should be very skeptical of these forecasts and wait until we see accelerating inflation in the data." (Dow Jones)

AUSTRALIA: Australian prime mortgage arrears hit a record low in 4Q 2021, thanks to low interest rates, a buildup in savings, and strong jobs growth, S&P said in a statement. The S&P Performance Index for Australian prime mortgages fell to a record 0.74% in Dec. vs 0.97% a year earlier. How long this will last depends on the pace and quantum of expected interest rate rises. Given the inclusion of interest-rate buffers in debt-serviceability assessments, expect most borrowers can withstand a moderate level of interest-rate increases. (BBG)

NEW ZEALAND: The Electricity Authority has decided to adopt a new Transmission Pricing Methodology which determines how Transpower NZ recovers the cost of running the grid from its transmission customers, the regulator says in a statement. Authority believes households and businesses should pay for the service they receive according to how much they are expected to benefit from it, so the new TPM is centered around a benefit-based charge. Expects new TPM will encourage investment in renewable generation, and electrification of industry. Expects new TPM will future-proof the system to meet increasing demand and use of distributed energy resources, like electric vehicles, batteries and smart appliances. (BBG)

NEW ZEALAND: The latest NZIER Quarterly Survey of Business Opinion (QSBO) shows the wide spread of the more transmissible Omicron variant of COVID-19 reduced activity and business confidence in the March quarter. Despite the relaxation of lockdown and other restrictions since early December, many people stayed home due to infection, self-isolation or fear of infection. This has had a negative impact on both demand and supply, particularly in the retail and services sectors. A net 33 percent of businesses surveyed expect a weakening in general economic conditions over the coming months on a seasonally adjusted basis, while a net 9 percent of businesses reported weaker activity in their own business in the March quarter. (NZIER)

BOK: A confirmation hearing for the nominee for chief of the central bank has been scheduled for next week, a parliamentary committee said Tuesday. Rhee Chang-yong, President Moon Jae-in's pick for governor of the Bank of Korea (BOK), will be asked to testify before the parliamentary strategy and finance committee at 10 a.m. next Tuesday, the committee said. Rhee is expected to be asked about the source of his 4.2 billion won (US$3.46 million) in reported assets and his approach to monetary policy. (Yonhap)

BRAZIL: Brazil's top election authority, the Supreme Electoral Court (TSE), told Reuters on Monday it has invited the European Union for the first time to observe its general elections this year, when President Jair Bolsonaro will seek re-election. Bolsonaro has questioned the validity of Brazil's electronic voting system and made baseless allegations of fraud in the 2018 race, stirring concerns that he may not accept the results of the October election. Recent opinion surveys show the far-right president trailing well behind leftist former president Luiz Inacio Lula da Silva. (RTRS)

RUSSIA: Ukrainian President Volodymyr Zelenskiy said on Monday that Russia could use chemical weapons in Ukraine and called on the West to impose strong sanctions on Moscow that would deter even talk of the use of such weapons. There were unconfirmed reports on Monday suggesting that chemical weapons were used in the besieged southern Ukrainian port of Mariupol. "We treat this with the utmost seriousness," Zelenskiy said in his nightly video address on Monday. He did not say chemical weapons had already been used. (RTRS)

RUSSIA: The mayor of Mariupol told the Associated Press that more than 10,000 civilians have died in the city in Ukraine since the Russian invasion. Mayor Vadym Boychenko told the AP by telephone that corpses were “carpeted through the streets of our city” and that the death toll could be more than 20,000. Last week, he cited a preliminary estimate that 5,000 people had died. Boychenko also said Russian forces have brought mobile crematoria to the city to dispose of the bodies. He accused them of refusing to allow humanitarian convoys into the city in an attempt to disguise the carnage. (BBG)

RUSSIA: Russia is moving military vehicles closer to the front lines in Ukraine's Luhansk region in what looks like a move to prepare for a new assault, Serhiy Gaidai, the region's governor, said on television on Monday. (RTRS)

RUSSIA: Standing alongside the Indian ministers for foreign affairs and defense on Monday, US Secretary of State Antony Blinken delivered a pointed message about supporting Ukraine. Blinken noted that the United States would continue to call on nations to back Kyiv, “just as we call on all nations to condemn Moscow's increasingly brutal actions.” (CNN)

RUSSIA: The U.S. offered a grim assessment that Russia’s invasion is likely to enter “a more protracted and a very bloody phase” as it focuses on Ukraine’s Donbas region, in the words of Pentagon spokesman John Kirby. “By what we have seen in the past, we’re probably turning another page in the same book of Russian brutality,” Kirby said at a Pentagon news conference. Meanwhile, Kirby said an initial shipment of 100 Switchblade drones has arrived in the region. He said the total number of the dive-bombing armed drones that the U.S. will send to Ukraine will be in the hundreds. (BBG)

RUSSIA: The United States believes Russian President Vladimir Putin may be willing to take more aggressive action against the US, including dialing up his attempts to interfere with American elections in response to its support for Ukraine, according to four sources familiar with recent US intelligence assessments. That could include direct attacks on US election infrastructure, among a broad range of options, the sources said. There is no evidence that Putin has made a decision to interfere in upcoming elections or that he has preferred candidates, the sources said. Attempted hacks on voting infrastructure would also not be easy, because voting systems in the US are so diffuse and decentralized. (CNN)

RUSSIA: Biden and Modi both publicly expressed growing alarm at the destruction inside Ukraine, especially in Bucha, where many civilians have been killed. "Recently, the news of the killings of innocent civilians in the city of Bucha was very worrying," Modi said during a brief portion of the meeting open to reporters. "We immediately condemned it and have asked for an independent probe." Modi also said he had suggested in recent conversations with Russia that President Vladimir Putin and Ukrainian President Volodymyr Zelenskiy hold direct talks. (RTRS)

RUSSIA: German Chancellor Olaf Scholz said Berlin will send more military support to Ukraine, without giving any details. “With the decision I made, Germany broke with a long tradition of not supplying weapons to a country like Ukraine,” Scholz told reporters Monday at a news conference with Albanian Prime Minister Edi Rama. The chancellor pointed to German weapon deliveries such as anti-tank missiles, anti-aircraft missiles and ammunition over the past weeks. “And we will continue to support Ukraine,” he said. “We’ll do this in close cooperation with all our friends, with whom we coordinate on this. There will be no going it alone, but only joint and carefully considered actions.” (BBG)

RUSSIA: Austrian Chancellor Karl Nehammer said he was “rather pessimistic” on the prospects for peace in Ukraine after meeting Putin in Moscow on Monday, citing a spiral of violence emerging in Ukraine’s east. Speaking to reporters after the meeting, Nehammer defended his decision to meet the Russian President as a way to confront him with war crimes committed in Ukraine. He called the talks “direct, honest and tough,” and signaled European solidarity. Nehammer is the first European leader to meet Putin in person since the war started. (BBG)

RUSSIA: Polish Prime Minister Mateusz Morawiecki said EU members must quickly offer more military support for Kyiv as Russia prepares a new assault on Ukraine’s eastern Donbas region. “The most decisive battle is about to begin, and at the same time the largest tank battle in this part of the world since World War II,” he said. He also criticized Austria’s chancellor for meeting Putin, saying that instead of talking to a “war criminal,” European leaders should focus on rapidly widening sanctions. (BBG)

RUSSIA: About five to seven European Union members require a transition period before imposing sanctions on Russian oil purchases so they can secure energy supplies and avoid domestic unrest, Finnish Foreign Minister Pekka Haavisto said, after meeting with his EU counterparts in Luxembourg. “My guess is that we will be able to sanction oil, but it will take some time,” Haavisto told reporters, adding that his home nation has no qualms on the issue. (BBGI)

RUSSIA: France’s foreign ministry said in a statement that six Russian officials under diplomatic cover must leave the country after an intelligence investigation found out their activities were contrary to “our national interests.” (BBG)

RUSSIA: Japan’s government announced asset freezes on 398 individuals, including the two adult daughters of Putin as part of its latest round of sanctions over the war in Ukraine. Russian Foreign Minister Sergei Lavrov’s wife and daughter were also added to list. Asset freezes were also expanded to 28 entities including the country’s biggest bank Sberbank. (BBG)

RUSSIA: Ireland’s government told all the country’s ports to deny entry to Russian-registered vessels starting next Sunday, RTE reported. The move is implementing an EU decision to sanction Russian vessels and restrict access, the broadcaster said. (BBG)

RUSSIA: A panel of dealers and investors in the credit-default swaps market was asked to rule whether Russia triggered a potential “failure to pay” event, in what would be the first step toward a potential derivatives payout. The so-called Credit Derivatives Determinations Committee hasn’t yet decided whether it will consider the question, which pertains to Russia’s move last week to pay interest on its bonds in rubles. Any ruling wouldn’t in itself trigger a payout on contracts insuring against a Russia default, but it could pave the way later. (BBG)

SOUTH AFRICA: South Africa's state-owned power utility Eskom said on Monday that it was implementing rolling five-hour power cuts with immediate effect because a unit at one of its power plants had stopped functioning. "Unit 5 of Medupi Power Station has just tripped... Regretfully, Stage 2 load-shedding has been implemented immediately," it said in a statement. The announcement comes just hours after the company, which supplies almost 90% of the country's power, had said that its systems were severely constrained. (RTRS)

ENERGY: U.S. President Joe Biden made clear to Indian Prime Minister Narendra Modi during a virtual meeting on Monday it was not in India's interest to increase its imports of energy from Russia, White House press secretary Jen Psaki said. Psaki described the meeting as productive and constructive, and not "adversarial." She declined to say if Biden asked for any specific commitments from India on energy imports. Biden told Modi the United States stood ready to help India diversify its energy imports, Psaki said, noting India's imports from the United States are already much bigger than their Russian imports. "The president conveyed very clearly, that it is not in their interest to increase that," she said. (RTRS)

ENERGY: India’s Foreign Minister Subrahmanyam Jaishankar repeated his nation’s previous calls for dialogue and diplomacy, while minimizing the significance of its Russian energy purchases. “Our total purchases for the month might be less than what Europe does in an afternoon,” he told a reporter. “So you might want to think about it.” (BBG)

ENERGY: Italy and Algeria have signed accords to intensify their cooperation in the energy sector and increase the north African state's energy exports to Rome, Italian Prime Minister Mario Draghi said on Monday. Draghi said the deals were a significant step in Italy's drive to reduce its dependency on Russian gas. "Others will follow," he told reporters in Algiers following a meeting with Algerian President Abdelmadjid Tebboune. (RTRS)

ENERGY: Japan’s industry minister said the country has never felt any pressure from the U.S. to withdraw from the Sakhalin oil and gas projects, according to Reuters. “We intend to continue to hold the concessions in Sakhalin 1 and 2 projects as they are stable sources of long-term and inexpensive energy and are important to the lives of the Japanese citizens and business activities,” Koichi Hagiuda, Japan’s industry minister, told a news conference on Tuesday. “While ensuring a stable energy supply, Japan will work to reduce our dependence on Russian energy by diversifying energy sources, including renewable and nuclear power, and diversifying supply sources,” Hagiuda said, Reuters reported. He also said the ministry was not aware of any Japanese companies being asked by Russian state-owned companies to pay in rubles for natural gas transactions. (CNBC)

OIL: Russian Urals oil supplies from the state's Baltic ports to Turkey jumped to a record in March as buyers in northwest Europe avoided the grade amid Western sanctions, traders said and Refinitiv Eikon data showed. Urals oil cargoes from Baltic ports going to Turkey reached 500,000 tonnes last month, breaking the previous record of 200,000 set in January. Turkey bought cargoes that would normally go to refiners in northern Europe after many Western companies decided to "self-sanction" and stop buying Russian goods. European sanctions do not target Russian oil directly, but they complicate financing of purchases, shipping and insurance payments. (RTRS)

OIL: OPEC told the European Union on Monday that current and future sanctions on Russia could create one of the worst ever oil supply shocks and it would be impossible to replace those volumes. OPEC Secretary General Mohammad Barkindo made the remarks in a meeting on Monday with EU officials, according to a copy of his speech seen by Reuters. (RTRS)

CHINA

PBOC: China is more likely to cut reserve requirement ratios and interest rates in Q2 judging by the loan data released Monday, the Shanghai Securities News said citing analysts. Data released yesterday indicated a lack of demand by businesses, residents and consumption, which makes pro-active policies more necessary, the newspaper said. However, the central bank’s policy space may be limited given the inversion of China-U.S. interest rate spread, so structural tools have become more important, the newspaper said. (MNI)

YUAN: The yuan is more likely to see a mild weakening against the U.S. dollar instead of a sharp depreciation in the short and medium term, as China's relatively high trade surplus will offset the capital outflows in portfolio investments, the China Securities Journal reported citing analysts. Though the China-U.S. 10-year treasury bond spread turned negative for the first time since mid-2010 on Monday, the real interest rate spread is still considerable after taking inflation into account, the newspaper said citing analysts. The central parity rate of the yuan may fluctuate between 6.3 and 6.8 against the U.S. dollar this year, the Journal said citing Gao Ruidong, the chief economist at Everbright Securities. (MNI)

ECONOMY: Chinese regulators urged banks and insurers to offer financial support for the cargo and logistics sector which has been affected by COVID-19 outbreaks, as the country grapples with the worst virus resurgence in two years. To ensure stable supply chains, the China Banking and Insurance Regulatory Commission asked financial institutions to pull out all the stops to support freight logistics firms and truck drivers, a statement showed on Tuesday. (RTRS)

ECONOMY: Chinese authorities are stepping up efforts to keep logistics flowing as restrictions imposed to control the pandemic threaten to disrupt everything from the transportation of medical goods to energy and raw materials, the 21st Century Business Herald reported citing both a notice from the State Council on Monday and other levels of the government. Local authorities should not ban roads and shipping lanes or set up quarantine testing stops along the highway, the State Council said. China’s logistics industry faces grave challenges due to the rising Covid cases, the newspaper said citing the China Federation of Logistics and Purchasing. (MNI)

CORONAVIRUS: The number of people released from Shanghai’s lockdown is smaller than it initially seemed, with the majority of the city’s 25 million residents still subject to tight movement restrictions which keep them in their homes or compounds. On Monday Shanghai announced it was easing the lockdown for the 43% of compounds which had no virus infections in the past two weeks. However details released overnight showed that those 7,565 areas included not just residential complexes but also hotels, shopping malls and government buildings. Moreover, many of the compounds where lockdowns have been eased are located on the less-densely populated outskirts of the Chinese financial hub. Of the nine Shanghai districts that have announced easing measures, six are in the suburbs. (BBG)

OVERNIGHT DATA

JAPAN MAR PPI +9.5% Y/Y; MEDIAN +9.2%; FEB +9.7%

JAPAN MAR PPI +0.8% M/M; MEDIAN +0.9%; FEB +0.9%

JAPAN MAR BANK LENDING INCL TRUSTS +0.5% Y/Y; FEB +0.3%

JAPAN MAR BANK LENDING EX-TRUSTS +0.5% Y/Y; FEB +0.3%

AUSTRALIA MAR NAB BUSINESS CONDITIONS 18; FEB 9

AUSTRALIA MAR BUSINESS CONFIDENCE 16; FEB 13

Business conditions surged higher in March and confidence also strengthened. Trading conditions and profitability rose markedly, suggesting demand remains strong, and employment also rose. The improvement was largely driven by the retail sector, which saw conditions rise 23pts, as well as recreation & personal services and finance, business & property. Confidence jumped in the transport, construction, and recreation & personal services sectors, and leading indicators also strengthened overall with capacity utilisation up to 83.1%. Across the states, WA saw a significant boost to conditions as the border fully reopened and conditions and confidence are now fairly strong across all jurisdictions. Overall, both conditions and confidence are now back around the levels last seen in the pre-Delta rebound, despite activity having more than recovered its pre-Covid level. Cost growth escalated further in the month, with labour cost growth hitting 2.7% in quarterly terms and purchase cost growth up to 4.2% – both tracking at considerably higher rates than at any other point in the history of the survey. However, firms seem to have been able to pass on at least some cost pressure with prices also rising at their fastest rate in the history of the survey at 2.3%. The escalation in price growth included prices in retail sector, which rose 3.7% in quarterly terms, likely supporting margins and helping to explain the very strong increase in the profitability index for the sector. The continued escalation in price growth over recent months suggests a strong Q1 CPI reading is likely when released later in the month and based on the monthly trend could well continue to build in Q2. (NAB)

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 94.6; PREV 93.4

Consumer confidence rose by 1.3% last week, adding to the prior week’s gain of 2.5%, as petrol prices dropped sharply for a second straight week. Confidence remains below neutral and well below its long-run average. Household inflation expectations remained unchanged at 5.8%, despite lower petrol prices. With the terminal gate prices of petrol declining further last week, retail prices are likely to be even lower in the coming weeks. The flow-through of the reduction in petrol excise should provide additional impetus. This should lead to lower inflation expectations and, along with the Easter holidays, this is likely to boost sentiment. Among the states, confidence rose in NSW by 6.1%, after four straight weeks of decline. Confidence also rose in WA (10.4%), while it dropped in Victoria (-1.3%), Queensland (-0.2%) and SA (-10.7%). (ANZ)

AUSTRALIA MAR CBA HOUSEHOLD SPENDING +5.7% Y/Y; FEB +5.6%

AUSTRALIA MAR CBA HOUSEHOLD SPENDING +9.2% M/M; FEB +1.9%

The CommBank HSI Index rose by a strong 9.2%/mth in March to take the index to its highest level since the series began in 2017. The increase in March more than made up for the weakness of January and the small bounce in February, with the start of the year affected by seasonal factors and the Omicron variant. The increase in March now sees the index 0.6% higher than the previous peak in December 2021.Gains in March were led by a 31.8%/mth surge in Transport spending intentions, with strong gains also seen for Travel, Retail, Household services, Entertainment and Health & fitness. Indeed, 11 out of the 12 spending categories showed improvement in March.This improvement in March is consistent with our view that the Australian economy had considerable momentum by the end of Q1 22 and is also consistent with our expectations of an RBA rate hike cycle starting in June –but with this cycle to be relatively shallow.Onan annual basisthe HSI Index is up 5.7%/yr, building on the improvement seen in recent months and supportive of our view that the Australian economy will grow strongly in 2022. (CBA)

NEW ZEALAND FEB NET MIGRATION SA -593; FEB -952

SOUTH KOREA FEB MONEY SUPPLY L SA +0.5% M/M; JAN +0.7%

SOUTH KOREA FEB MONEY SUPPLY M2 SA +0.6% M/M; JAN +0.6%

UK MAR BRC SALES LIKE-FOR-LIKE -0.4% Y/Y; FEB +2.7%

CHINA MARKETS

PBOC NET INJECTS CNY20 BLN VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY20 billion via 7-day reverse repos with the rates unchanged at 2.10% on Tuesday. The operation has led to a net injection of CNY20 billion as no reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1000% at 09:28 am local time from the close of 1.9075% on Monday.

- The CFETS-NEX money-market sentiment index closed at 41 on Monday vs 42 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3795 TUES VS 6.3645

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3795 on Tuesday, compared with 6.3645 set on Monday.

MARKETS

SNAPSHOT: Just How Hot Will U.S. CPI Data Be?

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 510.62 points at 26310.9

- ASX 200 down 47.387 points at 7437.8

- Shanghai Comp. down 21.016 points at 3146.11

- JGB 10-Yr future down 5 ticks at 149.25, yield down 0.1bp at 0.240%

- Aussie 10-Yr future down 8.0 ticks at 96.855, yield up 8bp at 3.089%

- U.S. 10-Yr future -0-08+ at 119-15+, yield up 3.44bp at 2.815%

- WTI crude up $1.87 at $96.16, Gold up $3.99 at $1957.46

- USD/JPY unch. at Y125.37

- FED'S EVANS: HALF-POINT HIKES LIKELY, SHOULDN'T GO TOO FAR (RTRS)

- MICHAEL BARR FRONTRUNNER FOR BANK SUPERVISORY ROLE AT FED (POLITICO)

- BIDEN TO MAKE ANNOUNCEMENT ON LOWERING COSTS AT 2:45 PM CT TUES (BBG)

- AUSTRIAN LEADER PESSIMISTIC AFTER PUTIN TALKS (BBG)

- NETHERLANDS EXPLORES OPTIONS TO FILL GAS STORAGE BEFORE WINTER (BBG)

- JAPAN FINANCE MINISTER’S WARNING OFFERS YEN ONLY BRIEF RESPITE (BBG)

US TSYS: Cheaper Overnight, CPI Eyed

The path of least resistance resulted in cheapening during Asi-Pac hours, with a few separate bursts of selling pressure seen in Tsys, initially in futures trade, but also in cash dealing. While some pointed to set up ahead of CPI data and the usual flow-driven narrative given the lack of overt headline flow, one contact earmarked discussions surrounding redemption-based liquidations of accounts at large U.S. funds, although this wasn’t verifiable. Syndication-related pressure from the ACGB space may have also played a part in the weakness.

- TYM2 is -0-08+ at 119-15+, 0-04+ off the base of the contract’s 0-14+ overnight range (with the latter representing a fresh cycle low), on volume of ~160K. Cash Tsys run 2-4bp cheaper across the curve, with the space operating away from worst levels of Asia-Pac dealing. Note that 5+-Year paper managed to register fresh cycle highs in yield terms during Asia-Pac hours.

- Block trades dominated on the flow side in Asia, with a seller of TUM2 futures (-4.9K) and an existing TYK2 119.75 put position rolling down and out into the TYM2 118.50 puts (-20K/+20K) noted. Downside interest via screen lifts of the FVM2 111.25/110.25 & TYK2 118.50/117.50 put spreads was also observed during Asia trade.

- Looking ahead, CPI (see our full preview of that release here), average earnings data, NFIB small biz optimism, 10-Year Tsy supply & Fedspeak from Brainard will cross during NY hours. We will also see comments from President Biden, with indications that he will make announcements re: fighting inflation during his address (scheduled for 14:45 central).

JGBS: Tight Tokyo Trade, Insulated By BoJ Shadow

JGB futures traded either side of unchanged during the Tokyo morning, with an early uptick fading as the wider core global FI space came under pressure. Still, the JGB space received at least some insulation from the proximity of 10-Year JGB yields to the upper limit of the BoJ’s permitted trading band (hovering around 0.24%). That meant that futures recovered from worst levels of the day to last deal -5, while cash JGBs were little changed to ~1bp richer.

- In terms of domestic news flow, comments from Finance Minister Suzuki pointed to a need for vigilance when it comes to the monitoring of FX moves, which briefly weighed on the JPY crosses.

- Local PPI data for the month of March saw a slightly swifter than expected uptick in Y/Y terms, accompanied by an upside revision to the Feb print.

- A solid enough round of 5-Year JGB supply saw the low price match the wider dealer consensus (as proxied by the BBG dealer poll), while the price tail saw an incremental narrowing from already tight levels. The cover ratio ticked away from the multi-month low in the metric observed at March’s 5-Year auction, but still printed just below the 6-auction average. Nothing was observed in the way of meaningful, immediate reaction in futures & 5s post-supply.

JGBS AUCTION: Japanese MOF sells Y2.0279tn 5-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.0279tn 5-Year JGBs:

- Average Yield 0.027% (prev. -0.007%)

- Average Price 99.89 (prev. 100.06)

- High Yield: 0.029% (prev. -0.003%)

- Low Price 99.88 (prev. 100.04)

- % Allotted At High Yield: 91.6838% (prev. 57.3359%)

- Bid/Cover: 3.614x (prev. 3.292x)

AUSSIE BONDS: ACGB Nov-33 Syndication & Inflation Pressures Eyed

YM is now -3.0, while XM is -8.5, with the latter hovering 1.0 above worst levels of the session. The early twist steepening impetus moved into a state of bear steepening, with longer dated cash ACGBs a touch over 9.0bp cheaper on the day. EFPs are marginally narrower, with the 3-/10-Year EFP box flattening. Bills are flat to 2 ticks richer through the reds.

- Wider core global fixed income weakness (read U.S. Tsys) and pressure surrounding the syndication of the new ACGB Nov-33 (which saw A$15.0bn priced vs. an orderbook of A$37.5bn) allowed the ACGB curve to steepen, with hedging flows surrounding the pricing of the syndication pressuring XM to fresh cycle lows

- An early bid was seen in YM & the IR strip, with some pointing to the degree of RBA tightening already priced into the curve as a potential area of support, in addition to the twist steepening seen in the U.S. Tsy space on Monday.

- YM and the IR strip then eased back from best levels with some pointing to the inflation components of the latest NAB business survey, with the summary on that matter noting that “the continued escalation in price growth over recent months suggests a strong Q1 CPI reading is likely when released later in the month and based on the monthly trend could well continue to build in Q2.”

AUSSIE BONDS: The AOFM sells A$100mn of the 1.25% 21 Aug ‘40 I/L Bond, issue #CAIN413:

The Australian Office of Financial Management (AOFM) sells A$100mn of the 1.25% 21 August 2040 I/L Bond, issue #CAIN413:

- Average Yield: 0.8269% (prev. 0.2498%)

- High Yield: 0.8400% (prev. 0.2550%)

- Bid/Cover: 3.6000x (prev. 5.0867x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 40.0% (prev. 81.2%)

- Bidders 39 (prev. 50), successful 21 (prev. 9), allocated in full 18 (prev. 7)

AUSSIE BONDS: Pricing Of New ACGB Nov-33

The AOFM announces that "the issue by syndication of the new 3.00% 21 November 2033 Treasury Bond has been priced at a yield to maturity of 3.14 per cent. The issue size is $15.0 billion in face value terms. There was a total of $37.5 billion of bids at the final clearing price. Settlement of the issue will occur on 20 April 2022. Commonwealth Bank of Australia; Deutsche Bank; National Australia Bank; and UBS AG, Australia Branch were Joint Lead Managers for the issue. The AOFM will be mindful of the performance of the bond when considering the timing of future issuance."

EQUITIES: Lower In Asia; China-Based Tech Loses Early Bid

Virtually all major Asia-Pac equity indices are in the red at typing, following a negative lead from Wall St. on Monday. Equity indices in Hong Kong and China fell to a lesser extent than their major regional peers, but remain at their lowest levels for the month amidst an ongoing COVID outbreak in China and elevated worry re: regulatory crackdowns.

- The CSI 300 sits 0.4% lower at writing, operating at session lows after struggling to stay above neutral levels throughout Asia-Pac dealing. A statement made late on Monday by the China Securities Regulatory Commission (CSRC) highlighting government support to stabilise expectations of listed companies and investors as well as to encourage share buybacks has done little to reverse the CSI300’s fortunes on Tuesday, with the index currently trading at two-week lows.

- Keeping within China, worry re: regulatory hurdles for tech stocks (both China and Hong Kong-listed) remains elevated despite the authorities on Monday approving their first batch of 45 new video games in nine months, with observers noting that none of the video games were from Chinese internet gaming giants Netease and Tencent. The duo nonetheless caught a bid on the news, bucking the broader trend of losses in the tech space, with the Chinese STAR 50 sitting 1.7% worse off and the Hang Seng Tech Index reversing opening gains to trade 0.8% lower at typing.

- The Australian ASX200 deals 0.6% lower at writing, printing a touch above two-week lows made earlier in the session. Virtually all sub-indices are in the red with tech names leading losses, seeing the ASX/S&P All Technology Index sit 1.1% worse off at typing. Energy-related equities broadly underperformed as well, as major crude benchmarks have traded a touch above multi-week lows made on Monday.

- U.S. e-mini equity index futures deal 0.4% to 0.5% softer at writing, sitting a touch above session lows heading into European hours.

OIL: Firmer Amidst Progress In Shanghai’s COVID Fight

WTI and Brent are ~$2.00 better off at writing apiece, operating around session highs and comfortably above their respective six-week and four-week lows made on Monday.

- To recap, both benchmarks closed ~$4 lower on Monday amidst heightened worry re: China’s energy demand outlook as the country deals with a well-documented COVID outbreak. Elsewhere, crude remains under pressure as debate re: the International Energy Agency’s (IEA) plan to release up to 240mn bbls of crude (when including the U.S.) over 6 months, continues to do the rounds in Asia.

- Focusing on China, crude has caught a bid on Tuesday amidst signs of some improvement in Shanghai’s pandemic situation, with authorities partially easing lockdowns in some “low-risk” areas, while reporting over 23K fresh local COVID cases for Apr 11, a reduction from the Apr 10 all-time high above 26K. Elsewhere, partial restrictions on movement and indoor activities are still in place for the city of Guangzhou (pop. ~18mn), with authorities bracing for a potential surge in cases there.

- Expectations for OPEC to raise monthly production quotas remain weak, with the group’s SecGen Barkindo saying on Monday that missing Russian crude supplies could exceed 7mn bpd, with the resulting shortfall being “totally out of” OPEC’s control. A note that this comes on the back of

- The prompt spreads of both WTI and Brent futures continue to weaken from their peaks in March and have narrowed to near-neutral levels at typing, suggesting an easing in prior worry re: tightness in global crude supplies.

GOLD: Bracing For “Extraordinarily Elevated” U.S. Headline CPI

Gold deals ~$3/oz higher to print $1,956/oz at writing, operating a shade below session highs and comfortably around the middle of Monday’s range despite an uptick in nominal U.S. Tsy yields and the USD (DXY), with the 10-Year Tsy yield earlier hitting fresh multi-year highs at 2.83%. A note that this comes as U.S. Mar CPI is due to cross at 1230 GMT, where White House officials have already flagged the possibility for the headline CPI reading to be “extraordinarily elevated”, owing to higher energy prices in March.

- To recap Monday’s price action, the precious metal closed ~$6/oz firmer amidst a broad downtick in U.S. real yields to record a fourth straight day of gains, backing away from best levels at $1,969.6/oz in the NY session after successive Fedspeak from the Fed’s Waller, Bowman, Bostic, and Evans at two separate events.

- Focusing on the latter, comments from Chicago Fed President Evans (‘23 voter) facilitated a limited move in gold to around session lows after he said that he would not oppose the Fed hiking rates to 2.25% or 2.5% by the end of ‘22, representing a slightly more hawkish tilt to his comments last week, supporting the same by early ‘23 instead.

- Up next, Fed Governor Brainard will speak at a WSJ event later on Tuesday (1610 GMT).

- Looking to technical levels, bullion’s Monday highs took out initial resistance at $1,966.1/oz (Mar 24 high), exposing further resistance at $2,009.2/oz (Mar 10 high). Support is seen around ~$1,911.3/oz (50-Day EMA), a short distance away from the bear trigger at $1,890.2/oz (Mar 29 low).

FOREX: JPY Wobbles As Officials Watch It With "Vigilance," AUD Advances

Official jaw-boning caused some perturbations in JPY price action. The yen went bid after Japanese Finance Minister Suzuki called sudden FX moves "undesirable" and said that the government would monitor their impact with "vigilance," in what arguably represented marginally firmer rhetoric on the matter than before. Suzuki's comments fell on fertile ground as market participants are on the lookout for hints on officials' tolerance threshold when it comes to yen depreciation after USD/JPY punched through the Y125.00 figure on Monday. A recent analytical piece from ING suggested that the pair could run as high as to Y130.00 without provoking an intervention.

- The dip in USD/JPY was short-lived and the rate quickly returned to neutral levels, with participants assessing the balance of risks to the yen. They weighed the growing uneasiness of officials about rapid yen depreciation against the familiar prospect of Fed/BoJ divergence. Implied USD/JPY volatilities rose across the curve.

- The Aussie dollar outperformed after NAB Business Conditions jumped 9 points to 18 in March, pointing its largest monthly increase since mid-2020.

- Offshore yuan crept higher, defying the headwinds of China's dire Covid-19 situation and a slightly weaker than expected PBOC fix.

- U.S. CPI headlines the global data docket today, with German ZEW Survey & UK jobs market report also due. Fed's Brainard is the only major central bank speaker.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/04/2022 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 12/04/2022 | 0600/0800 | *** |  | DE | HICP (f) |

| 12/04/2022 | 0645/0845 | * |  | FR | Foreign Trade |

| 12/04/2022 | 0645/0845 | * |  | FR | Current Account |

| 12/04/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 12/04/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 12/04/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 12/04/2022 | 1230/0830 | *** |  | US | CPI |

| 12/04/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 12/04/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 12/04/2022 | 1610/1210 |  | US | Fed Governor Lael Brainard | |

| 12/04/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/04/2022 | 1700/1300 |  | US | Philadelphia Fed's Patrick Harker | |

| 12/04/2022 | 1800/1400 | ** |  | US | Treasury Budget |

| 12/04/2022 | 2245/1845 |  | US | Richmond Fed's Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.