-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Tsys Struggle Ahead Of U.S. CPI

- The path of least resistance resulted in cheapening during Asi-Pac hours, with a few separate bursts of selling pressure seen in Tsys, initially in futures trade, but also in cash dealing. While some pointed to set up ahead of CPI data and the usual flow-driven narrative given the lack of overt headline flow, one contact earmarked discussions surrounding redemption-based liquidations of accounts at large U.S. funds, although this wasn’t verifiable. Syndication-related pressure from the ACGB space may have also played a part in the weakness.

- Official jaw-boning caused some perturbations in JPY price action. The yen went bid after Japanese Finance Minister Suzuki called sudden FX moves "undesirable" and said that the government would monitor their impact with "vigilance," in what arguably represented marginally firmer rhetoric on the matter than before. Suzuki's comments fell on fertile ground as market participants are on the lookout for hints on officials' tolerance threshold when it comes to yen depreciation after USD/JPY punched through the Y125.00 figure on Monday.

- U.S. CPI headlines the global data docket today, with German ZEW Survey & UK jobs market report also due. Fed's Brainard is the only major central bank speaker. We will also see comments from President Biden, with indications that he will make announcements re: fighting inflation during his address (scheduled for 14:45 central).

US TSYS: Cheaper Overnight, CPI Eyed

The path of least resistance resulted in cheapening during Asi-Pac hours, with a few separate bursts of selling pressure seen in Tsys, initially in futures trade, but also in cash dealing. While some pointed to set up ahead of CPI data and the usual flow-driven narrative given the lack of overt headline flow, one contact earmarked discussions surrounding redemption-based liquidations of accounts at large U.S. funds, although this wasn’t verifiable. Syndication-related pressure from the ACGB space may have also played a part in the weakness.

- TYM2 is -0-08+ at 119-15+, 0-04+ off the base of the contract’s 0-14+ overnight range (with the latter representing a fresh cycle low), on volume of ~160K. Cash Tsys run 2-4bp cheaper across the curve, with the space operating away from worst levels of Asia-Pac dealing. Note that 5+-Year paper managed to register fresh cycle highs in yield terms during Asia-Pac hours.

- Block trades dominated on the flow side in Asia, with a seller of TUM2 futures (-4.9K) and an existing TYK2 119.75 put position rolling down and out into the TYM2 118.50 puts (-20K/+20K) noted. Downside interest via screen lifts of the FVM2 111.25/110.25 & TYK2 118.50/117.50 put spreads was also observed during Asia trade.

- Looking ahead, CPI (see our full preview of that release here), average earnings data, NFIB small biz optimism, 10-Year Tsy supply & Fedspeak from Brainard will cross during NY hours. We will also see comments from President Biden, with indications that he will make announcements re: fighting inflation during his address (scheduled for 14:45 central).

JGBS: Tight Tokyo Trade, Insulated By BoJ Shadow

JGB futures traded either side of unchanged during the Tokyo morning, with an early uptick fading as the wider core global FI space came under pressure. Still, the JGB space received at least some insulation from the proximity of 10-Year JGB yields to the upper limit of the BoJ’s permitted trading band (hovering around 0.24%). That meant that futures recovered from worst levels of the day to last deal -5, while cash JGBs were little changed to ~1bp richer.

- In terms of domestic news flow, comments from Finance Minister Suzuki pointed to a need for vigilance when it comes to the monitoring of FX moves, which briefly weighed on the JPY crosses.

- Local PPI data for the month of March saw a slightly swifter than expected uptick in Y/Y terms, accompanied by an upside revision to the Feb print.

- A solid enough round of 5-Year JGB supply saw the low price match the wider dealer consensus (as proxied by the BBG dealer poll), while the price tail saw an incremental narrowing from already tight levels. The cover ratio ticked away from the multi-month low in the metric observed at March’s 5-Year auction, but still printed just below the 6-auction average. Nothing was observed in the way of meaningful, immediate reaction in futures & 5s post-supply.

AUSSIE BONDS: ACGB Nov-33 Syndication & Inflation Pressures Eyed

YM is now -3.0, while XM is -8.5, with the latter hovering 1.0 above worst levels of the session. The early twist steepening impetus moved into a state of bear steepening, with longer dated cash ACGBs a touch over 9.0bp cheaper on the day. EFPs are marginally narrower, with the 3-/10-Year EFP box flattening. Bills are flat to 2 ticks richer through the reds.

- Wider core global fixed income weakness (read U.S. Tsys) and pressure surrounding the syndication of the new ACGB Nov-33 (which saw A$15.0bn priced vs. an orderbook of A$37.5bn) allowed the ACGB curve to steepen, with hedging flows surrounding the pricing of the syndication pressuring XM to fresh cycle lows

- An early bid was seen in YM & the IR strip, with some pointing to the degree of RBA tightening already priced into the curve as a potential area of support, in addition to the twist steepening seen in the U.S. Tsy space on Monday.

- YM and the IR strip then eased back from best levels with some pointing to the inflation components of the latest NAB business survey, with the summary on that matter noting that “the continued escalation in price growth over recent months suggests a strong Q1 CPI reading is likely when released later in the month and based on the monthly trend could well continue to build in Q2.”

FOREX: JPY Wobbles As Officials Watch It With "Vigilance," AUD Advances

Official jaw-boning caused some perturbations in JPY price action. The yen went bid after Japanese Finance Minister Suzuki called sudden FX moves "undesirable" and said that the government would monitor their impact with "vigilance," in what arguably represented marginally firmer rhetoric on the matter than before. Suzuki's comments fell on fertile ground as market participants are on the lookout for hints on officials' tolerance threshold when it comes to yen depreciation after USD/JPY punched through the Y125.00 figure on Monday. A recent analytical piece from ING suggested that the pair could run as high as to Y130.00 without provoking an intervention.

- The dip in USD/JPY was short-lived and the rate quickly returned to neutral levels, with participants assessing the balance of risks to the yen. They weighed the growing uneasiness of officials about rapid yen depreciation against the familiar prospect of Fed/BoJ divergence. Implied USD/JPY volatilities rose across the curve.

- The Aussie dollar outperformed after NAB Business Conditions jumped 9 points to 18 in March, pointing its largest monthly increase since mid-2020.

- Offshore yuan crept higher, defying the headwinds of China's dire Covid-19 situation and a slightly weaker than expected PBOC fix.

- U.S. CPI headlines the global data docket today, with German ZEW Survey & UK jobs market report also due. Fed's Brainard is the only major central bank speaker.

ASIA FX: Offshore Yuan Gains As Most Asia EM FX Weaken

Offshore yuan bucked the regional trend and garnered some strength despite apparent domestic headwinds.

- CNH: Spot USD/CNH went offered despite China's gloomy Covid-19 situation and a slightly (20-pip deviation) weaker than expected PBOC fix. Worth noting that Chinese authorities signalled discomfort with the spread of Covid-19, with Premier Li asking local officials to "add a sense of urgency" when implementing policies.

- KRW: Firmer U.S. Tsy yields underpinned an upswing in spot USD/KRW, after the rate completed a double-bottom pattern on Monday. Participants are preparing for Thursday's monetary policy decision from the BoK, with analysts divided on the likelihood of a rate hike.

- IDR: The rupiah held a very tight range amid limited local headline flow. Several parties supporting the extension of President Widodo's term rowed back on their earlier declarations after the leader pushed back against the idea.

- MYR: Spot USD/MYR had a look above the MYR4.2400 figure for the first time since Nov 29 but trimmed gains thereafter.

- PHP: Spot USD/PHP extended its rally to a two-week high before paring gains.

- THB: The baht lost some altitude on broader regional trend ahead of the Songkran holiday. The BoT released the minutes from its March monetary policy meeting, but they did not offer much in the way of fresh insights.

EQUITIES: Lower In Asia; China-Based Tech Loses Early Bid

Virtually all major Asia-Pac equity indices are in the red at typing, following a negative lead from Wall St. on Monday. Equity indices in Hong Kong and China fell to a lesser extent than their major regional peers, but remain at their lowest levels for the month amidst an ongoing COVID outbreak in China and elevated worry re: regulatory crackdowns.

- The CSI 300 sits 0.4% lower at writing, operating at session lows after struggling to stay above neutral levels throughout Asia-Pac dealing. A statement made late on Monday by the China Securities Regulatory Commission (CSRC) highlighting government support to stabilise expectations of listed companies and investors as well as to encourage share buybacks has done little to reverse the CSI300’s fortunes on Tuesday, with the index currently trading at two-week lows.

- Keeping within China, worry re: regulatory hurdles for tech stocks (both China and Hong Kong-listed) remains elevated despite the authorities on Monday approving their first batch of 45 new video games in nine months, with observers noting that none of the video games were from Chinese internet gaming giants Netease and Tencent. The duo nonetheless caught a bid on the news, bucking the broader trend of losses in the tech space, with the Chinese STAR 50 sitting 1.7% worse off and the Hang Seng Tech Index reversing opening gains to trade 0.8% lower at typing.

- The Australian ASX200 deals 0.6% lower at writing, printing a touch above two-week lows made earlier in the session. Virtually all sub-indices are in the red with tech names leading losses, seeing the ASX/S&P All Technology Index sit 1.1% worse off at typing. Energy-related equities broadly underperformed as well, as major crude benchmarks have traded a touch above multi-week lows made on Monday.

- U.S. e-mini equity index futures deal 0.4% to 0.5% softer at writing, sitting a touch above session lows heading into European hours.

GOLD: Bracing For “Extraordinarily Elevated” U.S. Headline CPI

Gold deals ~$3/oz higher to print $1,956/oz at writing, operating a shade below session highs and comfortably around the middle of Monday’s range despite an uptick in nominal U.S. Tsy yields and the USD (DXY), with the 10-Year Tsy yield earlier hitting fresh multi-year highs at 2.83%. A note that this comes as U.S. Mar CPI is due to cross at 1230 GMT, where White House officials have already flagged the possibility for the headline CPI reading to be “extraordinarily elevated”, owing to higher energy prices in March.

- To recap Monday’s price action, the precious metal closed ~$6/oz firmer amidst a broad downtick in U.S. real yields to record a fourth straight day of gains, backing away from best levels at $1,969.6/oz in the NY session after successive Fedspeak from the Fed’s Waller, Bowman, Bostic, and Evans at two separate events.

- Focusing on the latter, comments from Chicago Fed President Evans (‘23 voter) facilitated a limited move in gold to around session lows after he said that he would not oppose the Fed hiking rates to 2.25% or 2.5% by the end of ‘22, representing a slightly more hawkish tilt to his comments last week, supporting the same by early ‘23 instead.

- Up next, Fed Governor Brainard will speak at a WSJ event later on Tuesday (1610 GMT).

- Looking to technical levels, bullion’s Monday highs took out initial resistance at $1,966.1/oz (Mar 24 high), exposing further resistance at $2,009.2/oz (Mar 10 high). Support is seen around ~$1,911.3/oz (50-Day EMA), a short distance away from the bear trigger at $1,890.2/oz (Mar 29 low).

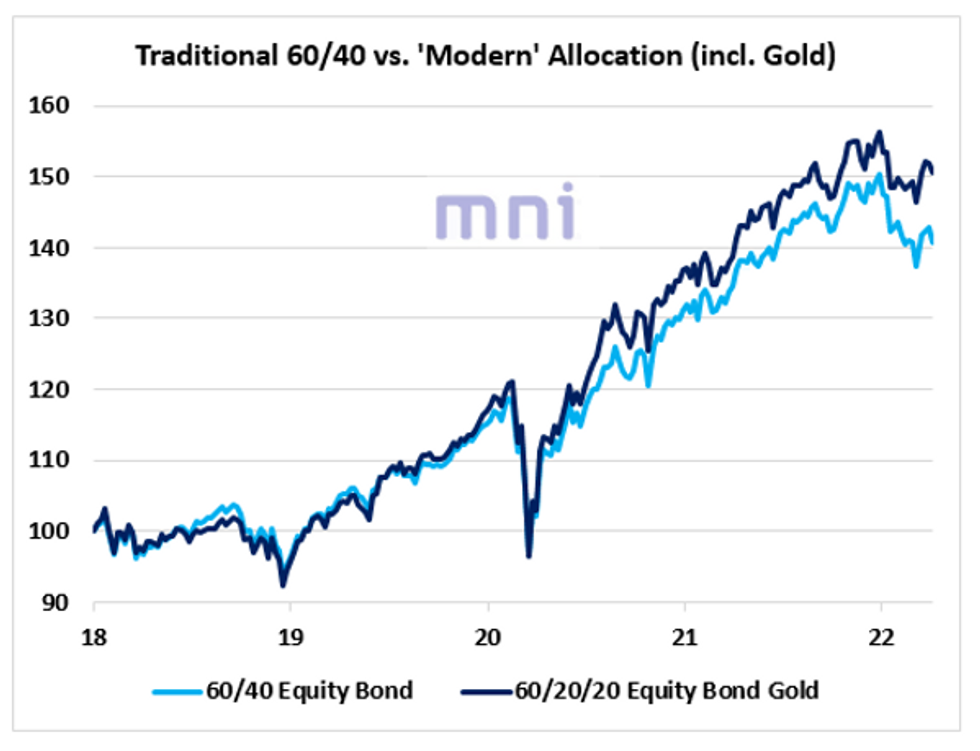

CROSS-ASSET: Divergence Increases Between Traditional 60/40 And ‘Modern’ Allocation (Including Gold)

EXECUTIVE SUMMARY

- In the past few weeks, we have seen that support for Gold has remained strong despite the dramatic fall in negative-yield debt, the rise in real rates, USD strength and the fall in annual change in liquidity.

- Gold has historically acted as a ‘zero-beta’ asset that generally rises in periods of geopolitical uncertainty and market selloffs.

- The persistence of inflation has led to a significant divergence between the traditional 60/40 asset allocation and the ‘Modern’ allocation (which includes gold).

- Link to full publication: Gold - Modern Allocation.pdf

The chart below shows the performance of the classic 60/40 equity bond portfolio and the ‘Modern’ allocation, in which we swap 20% of the bond allocation for gold (60/20/20 equity bond gold portfolio).

The 60/20/20 portfolio currently trades at a 10-point premium over the classic 60/40 portfolio (indexed in January 2018) as gold prices have remained firm in the current environment (relative to LT government bonds).

Source: Bloomberg/MNI.

OIL: Firmer Amidst Progress In Shanghai’s COVID Fight

WTI and Brent are ~$2.00 better off at writing apiece, operating around session highs and comfortably above their respective six-week and four-week lows made on Monday.

- To recap, both benchmarks closed ~$4 lower on Monday amidst heightened worry re: China’s energy demand outlook as the country deals with a well-documented COVID outbreak. Elsewhere, crude remains under pressure as debate re: the International Energy Agency’s (IEA) plan to release up to 240mn bbls of crude (when including the U.S.) over 6 months, continues to do the rounds in Asia.

- Focusing on China, crude has caught a bid on Tuesday amidst signs of some improvement in Shanghai’s pandemic situation, with authorities partially easing lockdowns in some “low-risk” areas, while reporting over 23K fresh local COVID cases for Apr 11, a reduction from the Apr 10 all-time high above 26K. Elsewhere, partial restrictions on movement and indoor activities are still in place for the city of Guangzhou (pop. ~18mn), with authorities bracing for a potential surge in cases there.

- Expectations for OPEC to raise monthly production quotas remain weak, with the group’s SecGen Barkindo saying on Monday that missing Russian crude supplies could exceed 7mn bpd, with the resulting shortfall being “totally out of” OPEC’s control. A note that this comes on the back of

- The prompt spreads of both WTI and Brent futures continue to weaken from their peaks in March and have narrowed to near-neutral levels at typing, suggesting an easing in prior worry re: tightness in global crude supplies.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/04/2022 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 12/04/2022 | 0600/0800 | *** |  | DE | HICP (f) |

| 12/04/2022 | 0645/0845 | * |  | FR | Foreign Trade |

| 12/04/2022 | 0645/0845 | * |  | FR | Current Account |

| 12/04/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 12/04/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 12/04/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 12/04/2022 | 1230/0830 | *** |  | US | CPI |

| 12/04/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 12/04/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 12/04/2022 | 1610/1210 |  | US | Fed Governor Lael Brainard | |

| 12/04/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/04/2022 | 1700/1300 |  | US | Philadelphia Fed's Patrick Harker | |

| 12/04/2022 | 1800/1400 | ** |  | US | Treasury Budget |

| 12/04/2022 | 2245/1845 |  | US | Richmond Fed's Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.