-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Will The PBoC Pull The Trigger Ahead Of Easter?

- Short/paid positioning in AUD rates allowed core fixed income markets to squeeze higher in overnight dealing in the wake of a softer than expected Australian labour market report, which shouldn't prove to be a gamechanger for the RBA.

- Speculation remains rife re: the potential for fresh PBoC easing before the weekend.

- Central bank focus turns to the ECB, with it due to review monetary policy settings later today. Besides the press conference with ECB Pres Lagarde, central bank speak will also come from Fed's Williams, Mester & Harker today. Swedish CPI as well as U.S. retail sales, jobless claims & Uni. of Mich. sentiment take focus on the data front.

MNI ECB Preview - April 2022: Be Prepared For A Hawkish Surprise

- While consensus expects no material change in policy at the April ECB meeting, we believe that it is a close call and that markets should be prepared for a hawkish surprise.

- Inflation has accelerated rapidly since the last meeting and waiting until September or later before starting to unwind negative rates feels like an exceptionally long time given the magnitude of recent inflation surprises and upside risks to energy prices.

- If the GC does decide to hold fire in April this would merely up the ante on the June meeting, but could also mean that the ECB is left playing catch up should wage demands start to reflect higher spot inflation.

US TSYS: A Little Firmer In Asia

The overnight uptick in U.S. Tsys has seemingly been all about cross-market spill over from the ACGB space, which was linked to the Australian labour market report release that we have fleshed out in earlier bullets. TYM2 last +0-08+ at 121-02, just off recent session highs, operating in a 0-17+ range on volume of ~130K. The cash curve has bull steepened with yields running 1.5-4.5bp richer as 3s outperform and 30s lag.

- Note that some speculation re: imminent policy easing from China’s PBoC may be providing additional support, after Wednesday’s guidance from Premier Li ahead of tomorrow’s MLF operations (there is also speculation that a RRR cut may come ahead of the weekend). Note that the last week or so has seen the Chinese Premier provide several warnings re: economic growth, while the pro-growth pivot when it comes to wider policymaking has been well-documented in recent months, with the government looking to achieve an ambitious GDP growth target for calendar ’22.

- There may have also been an element of geopolitical risk in the uptick (the flagship Russian warship had to be abandoned due to a fire, while the U.S. continues to mull sending a senior official to Kyiv), although the lack of immediate reaction to those stories detracts from that particular avenue of explanation.

- A combination of the above factors allowed the space to unwind a modest round of early Asia cheapening and more.

- U.S. retail sales, weekly jobless claims, the prelim UoM survey and Fedspeak from Williams, Mester & Harker is due during Thursday’s holiday-shortened NY session (cash markets will close at 14:00 Eastern). Note that the latest ECB decision will provide some cross-market interest during early NY hours.

JGBS: Firmer & Flatter, Even With Questionable 20-Year Supply Apparent

Spill over from Wednesday’s U.S. Tsy bid ultimately provided support to JGBs in early Tokyo dealing, with the Aussie-bond led bid in core global FI markets leading the space higher during the Tokyo afternoon.

- JGB futures are +21 late in the Tokyo day, while cash JGBs run 0.5-4.5bp richer across the curve, with the long end leading.

- It wasn’t all one-way traffic for the long end. The latest round of 20-Year JGB supply wasn’t well received, with the low price missing wider dealer expectations and tailing widening vs. the previous auction, although the cover ratio did nudge higher, albeit from a low base, holding below the 6-auction average in the process. This provided some limited headwinds for longer dated paper during the early rounds of afternoon trad before the aforementioned bid dominated.

- Elsewhere, fiscal support initiatives from the parties that form the ruling Japanese coalition were eyed but didn’t provide much in the way of market impact.

AUSSIE BONDS: Feeling The Squeeze

The market squeezed higher in the wake of the latest batch of domestic labour market data, with short/paid positioning in Aussie rates squeezed.

- To recap, March’s Australian labour market report provided a modest disappointment, but the labour market remains unequivocally strong. Headline job growth fell short of the +30.0K median exp. observed in the BBG survey, rising by 17.9K, driven solely by full-time job gains as part-time employment recorded a modest fall in March. The participation rate held steady at 66.4%, with the headline unemployment rate also holding steady at cycle/multi-decade lows of 4.0% vs. the BBG median 3.9%. Note that the unemployment rate nearly made it to rounding territory, printing a 3.9542%. ABS noted that seasonally adjusted hours worked decreased by 0.6%, “with floods in New South Wales and Queensland, a higher than usual number of people reported working reduced hours due to bad weather in March. This was in addition to the high number of people away from work due to illness.” The underemployment & underutilisation rates hit fresh cycle lows of 6.3% & 10.3%, respectively. Note that the labour market remains extremely tight, with forward-looking indicators pointing to further tightening. This report will not be a gamechanger for the RBA.

- That leaves YM +14.0 & XM + 11.0 at typing. EFPs are marginally wider, with the 3-/10-Year box flattening.

- The IR strip runs -3 to +18 through the reds. Underperformance in IRM2 was facilitated by a higher 3-month BBSW fixing.

- A reminder that the proximity to the elongated Syndey weekend may have accentuated the short covering, with geopolitical worry remaining elevated.

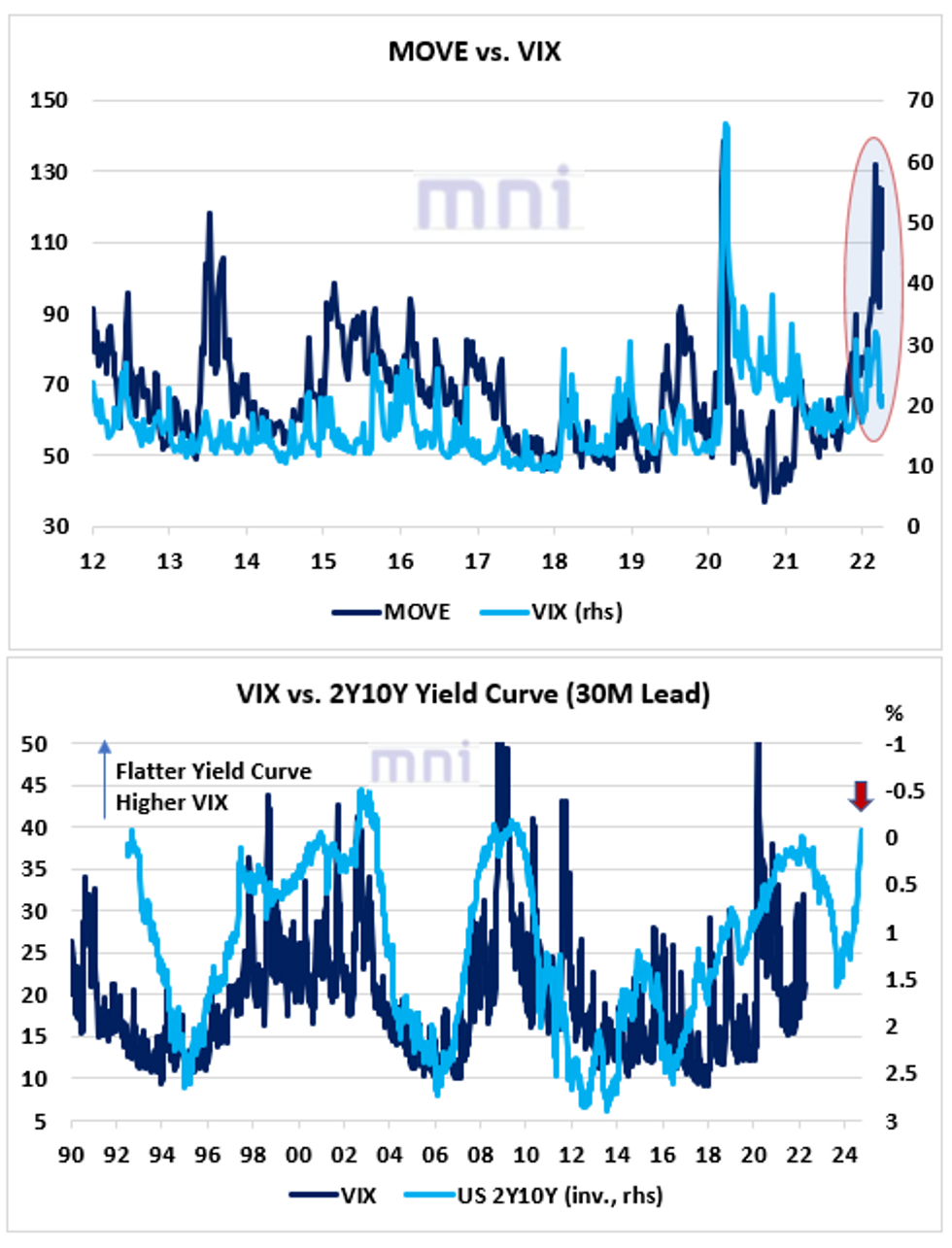

CROSS-ASSET: Sharp Flattening Pricing In Higher Volatility Regime In the Long Run

- Divergence has been widening sharply in recent weeks between the MOVE index, which measures bond market volatility, and the VIX as rising inflationary pressures have led to a sharp retracement in LT bond yields (top chart).

- While investors tend to ‘rush’ to buy the dip when equities correct, the dynamics in the bond market have been slightly different, particularly when inflation is rising.

- US 10Y yield surged to a local high of 2.8320% yesterday (Dec 2018 highs) before starting to consolidating lower in the past two days.

- However, price volatility in the equity market is expected to remain elevated in 2022 as equities perform poorly in stagflationary regimes (high inflation, falling economic activity).

- In addition, the bottom chart shows that the sharp flattening of the yield curve has generally preceded high-volatility regimes in the past 30 years.

- The bottom chart shows that the 2Y10Y yield curve has historically strongly led the VIX by 30 months.

Source: Bloomberg/MNI

FOREX: Yen Gets Some Reprieve, Antipodean Divergence Unfolds

The kiwi dollar extended its rebound from post-RBNZ lows, diverging from its Antipodean cousin. Australia's labour market report provided a modest disappointment, although the labour market remained extremely tight. Slightly softer crude oil prices may have generated another headwind for the Aussie dollar.

- The yen got some reprieve after a relentless sell-off in recent weeks, with USD/JPY slipping through yesterday's low. Speculation was rife about the possible terminal levels of USD/JPY rally, with the yen caught in the cross-currents of the BoJ's commitment to ultra-loose policy and escalating attempts by Japanese officials to jawbone the currency off worst levels.

- The greenback eased in tandem with U.S. Tsy yields and underperformed all of its major peers.

- Central bank focus turns to the ECB who will review monetary policy settings. Eurozone's single currency has been treading water in early Asia trade.

- Besides the press conference with ECB Pres Lagarde, we will also hear from Fed's Williams, Mester & Harker today.

- Swedish CPI as well as U.S. jobless claims & Uni. of Mich. Sentiment take focus on the data front.

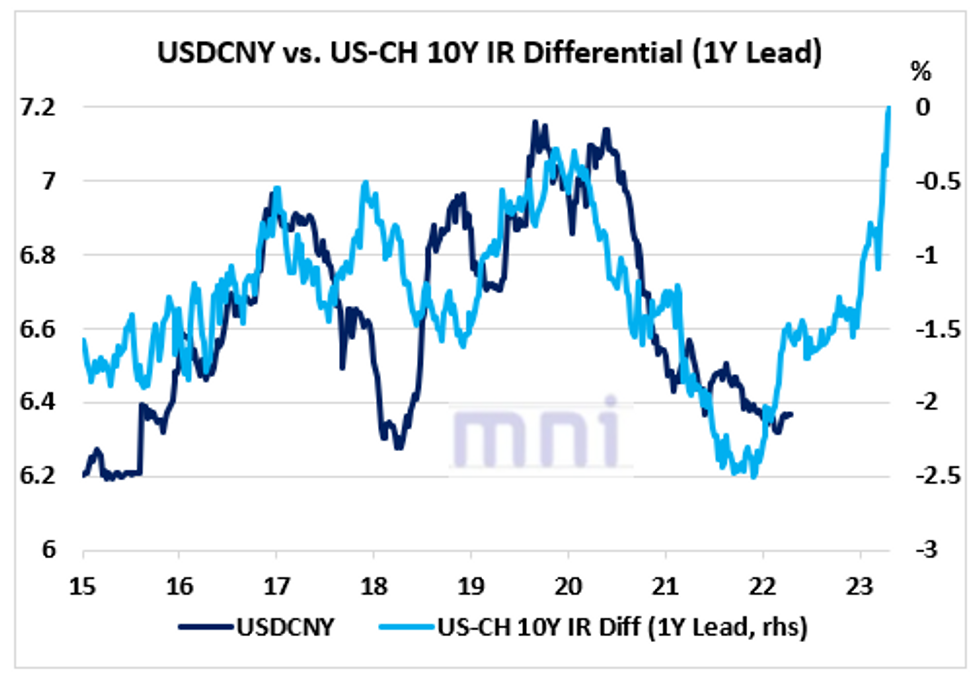

CNY: Should We Expect A Sharp CNY Depreciation In The Coming 6 to 12 Months?

With the China 10Y bond yield premium (over US 10Y) plunging to zero, investors have been questioning if the risk reward on USDCNY is now skewed to the upside following the sharp Yuan appreciation in the past two years.

- We also saw that the premium on the 2Y yield (China vs. US) went negative in the end of March following the dramatic surge in US ST rates in the past month.

- USDCNY has been trading above the 6.35 level in the past month after testing a local low at 6.3070 in the beginning of March.

- Key resistance to watch on the topside stands at 6.4050 (200DMA).

- The chart shows that the 10Y interest rate differential (between US and China) has smoothly led the USDCNY exchange rate by 12 months.

- Hence, selling pressure on the CNY could gradually increase in the coming months as the interest rate differential keeps reaching new highs.

Source: Bloomberg/MNI.

ASIA FX: SGD, KRW Outperform As Local Monetary Authorities Stick To Global Tightening Trend

Thursday's Asia session was all about regional central banks as the BoK and MAS took tightening steps, while China State Council's rhetoric fuelled expectations of imminent PBOC easing.

- CNH: Spot USD/CNH wobbled just shy of neutral levels amid growing expectations of an imminent RRR cut. China's State Council called for RRR reduction "at an appropriate time," echoing rhetoric which had typically presaged prompt PBOC action.

- KRW: South Korean won held firm as the BoK raised the 7-Day Repo Rate by 25bp despite holding its meeting during an interregnum, with its Governor-in-waiting yet to attend his confirmation hearing. Economists were almost evenly divided, with one camp expecting a 25bp hike and the other looking for no change. The decision was unanimous as policymakers saw the need to curb inflation.

- SGD: Singapore dollar was the best performer in the region after the MAS tightened policy by tweaking the parameters of the S$NEER policy band. The Monetary Authority slightly raised the slope of the currency band and re-centred it higher, with the latter move expected by just half of the analysts surveyed by Bloomberg. The width of the S$NEER band was left unchanged but, truth be told, this is the least frequently used setting. The MAS cited inflation concerns, ignoring below-forecast GDP data released alongside its statement.

- IDR: Spot USD/IDR held a tight range as domestic headline flow failed to offer much of real note.

- MYR: Spot USD/MYR faltered in the wake of overnight greenback sales.

- Markets were shut in the Philippines, Thailand and India.

EQUITIES: Higher As Tech Names Lead Bid, Chinese Easing Bets In Focus

Virtually all major Asia-Pac equity indices are higher at writing, with blue-chip and tech-related names across the region catching a bid following a positive tech-led rally from Wall St.

- The Nikkei 225 outperformed major regional peers at +1.1%, on track for a second day of gains with ~200 of its 225 constituents in the green. Cyclical and tech-related plays were notably firmer, with large-caps Fast Retailing and Tokyo Electron leading gains in the index for a second day.

- The Hang Seng sits 0.4% better off at writing, on track for a third straight day of gains. Broad gains were seen across nearly all sectors of the index although financials struggled, mostly trading flat to lower at writing. China-based tech caught a bid as well, seeing the Hang Seng Tech Index deal 0.9% firmer at writing. Large-cap Alibaba Group notably underperformed its HSTECH peers however, grabbing headlines as reports pointed to co-founder Jack Ma’s Ant Group coming under investigation from China’s top anti-graft agency (among other agencies).

- The Chinese CSI300 trades 0.7% higher at writing, with a rise in consensus towards impending PBoC easing measures evident. Of note, a BBG report has highlighted that 15 of 20 economists surveyed currently predict that the PBoC will lower rates on the one-year MTLF on Friday, with 11 calling for a 10bp cut to 2.75%.

- U.S. e-mini equity index futures are 0.2% to 0.5% firmer, dealing a little below their respective session highs at writing.

GOLD: Flat In Asia; A Touch Below One-Month Highs

Gold is virtually unchanged, printing $1,977/oz and operating a little below Wednesday’s best levels at typing in fairly limited Asia-Pac dealing. The precious metal has struggled for direction in Asia amidst a lack of meaningful headline flow, although a downtick in the USD (DXY) and nominal U.S. Tsy yields (with positive spillover to U.S. Tsys from the bid in ACGBs flagged earlier) has helped to facilitate a limited move off its session lows.

- To recap, gold added ~$11/oz on Wednesday, hitting fresh one-month highs ($1,981.6/oz) during the session and recording a sixth straight day of gains. The move higher comes as U.S. real yields have broadly remained below recent cycle highs, with the DXY backing away from fresh two-year highs made on Wednesday as well.

- U.S. PPI on Wednesday came in above expectations with the annual print hitting a fresh record high, although there was little by way of immediate reaction in the price of bullion.

- From a technical perspective, initial resistance at $1,980.3/oz (50.0% retracement of Mar8-29 downleg) has been broken, exposing further resistance at $2,001.6/oz (61.8% retracement of Mar8-29 downleg). Support is seen some distance away, at around ~$1,915.1/oz, the 50-Day EMA.

OIL: Slightly Lower In Asia

WTI is -$0.60 and Brent is -$0.30 at typing, both operating a little below their respective session highs made on Wednesday.

- To recap, both benchmarks closed ~$4 higher on Wednesday, hitting one-week highs late in the session as worry re: tightness in global supply continues to build.

- To elaborate, the International Energy Agency on Wednesday estimated that ~3mn bpd of Russian oil would be removed from global markets in May, double the decline currently predicted for April, effectively projecting that the impact of sanctions and buyer aversion on Russian crude exports will only kick in from next month onwards.

- Elsewhere, a note that IEA and OPEC data on production figures for the latter crossed earlier this week, pointing to the group missing its collective output increase target for March and underscoring well-documented concerns re: the ability of some OPEC members to hit production quotas.

- U.S. EIA data crossed on Wednesday, with little initial reaction observed in major crude benchmarks despite a larger than expected (~9.4mn bbl build vs. 256.3K BBG median) build in U.S. crude inventories and an increase in hub stocks. The data release mostly corroborated Tuesday’s reports on the latest round of API inventory estimates, with larger than expected drawdowns in distillate and gasoline stockpiles observed.

U.S.: Easter Weekend Exchange Schedules

The impending Easter holiday weekend will result in the closure/adjustment of trading hours of the major U.S. exchanges over the coming days, please use the links below to access the holiday schedules on an exchange-by-exchange basis.

ASIA: Regional Exchange Easter Holiday Schedules

Below is a summary of select regional exchange schedules over the Easter holiday period:

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/04/2022 | 0600/0800 | *** |  | SE | Inflation report |

| 14/04/2022 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 14/04/2022 | 1145/1345 | *** |  | EU | ECB Deposit Rate |

| 14/04/2022 | 1145/1345 | *** |  | EU | ECB Main Refi Rate |

| 14/04/2022 | 1145/1345 | *** |  | EU | ECB Marginal Lending Rate |

| 14/04/2022 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 14/04/2022 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 14/04/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 14/04/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 14/04/2022 | 1230/0830 | *** |  | US | PPI |

| 14/04/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 14/04/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 14/04/2022 | 1230/1430 |  | EU | ECB President Lagarde Post-meet presser | |

| 14/04/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 14/04/2022 | 1400/1000 | * |  | US | Business Inventories |

| 14/04/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 14/04/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 14/04/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 14/04/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 14/04/2022 | 1920/1520 |  | US | Cleveland Fed's Loretta Mester | |

| 14/04/2022 | 2200/1800 |  | US | Philadelphia Fed's Patrick Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.