-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Aussie FI Continues To Slide, Fed In View

- Aussie fixed income weakness extended in Sydney dealing.

- The Hang Seng sits 1.3% softer at typing after opening in the red, with a fresh round of weakness in China-based tech spurred by Chinese ride-hailing giant Didi Global (ADR -7.0% after hours) revealing that the U.S. SEC was investigating its 2021 IPO.

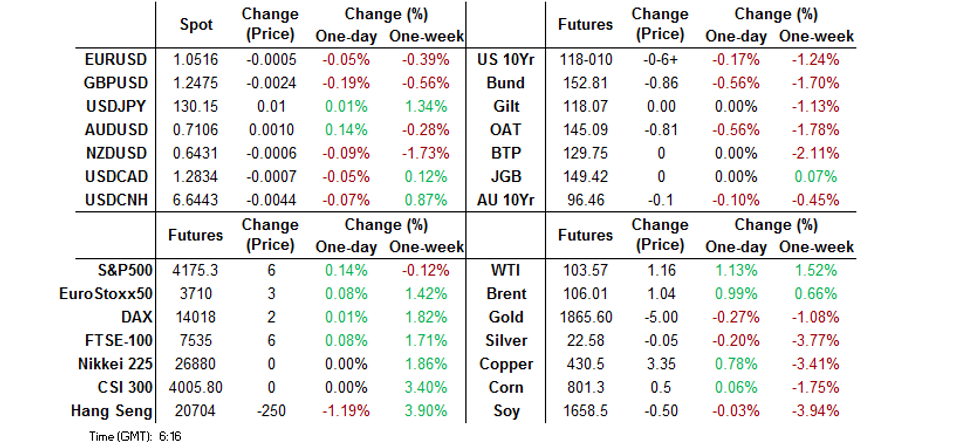

- All eyes are on the FOMC who will conclude their monetary policy meeting today and are widely expected to tighten policy. Consensus looks for a 50bp rate hike as pressure is mounting on the Fed to contain elevated inflation. Today's data highlights include U.S. ADP employment change, trade balance & ISM Services Index as well as a slew of Services PMIs from across the globe. Elsewhere, the European Commission is expected to propose a sixth round of sanctions on Russia later on Wednesday, with potential details on embargoes of Russian crude imports. We will also get an address from U.S. President Biden re: economic growth, jobs & deficit reduction.

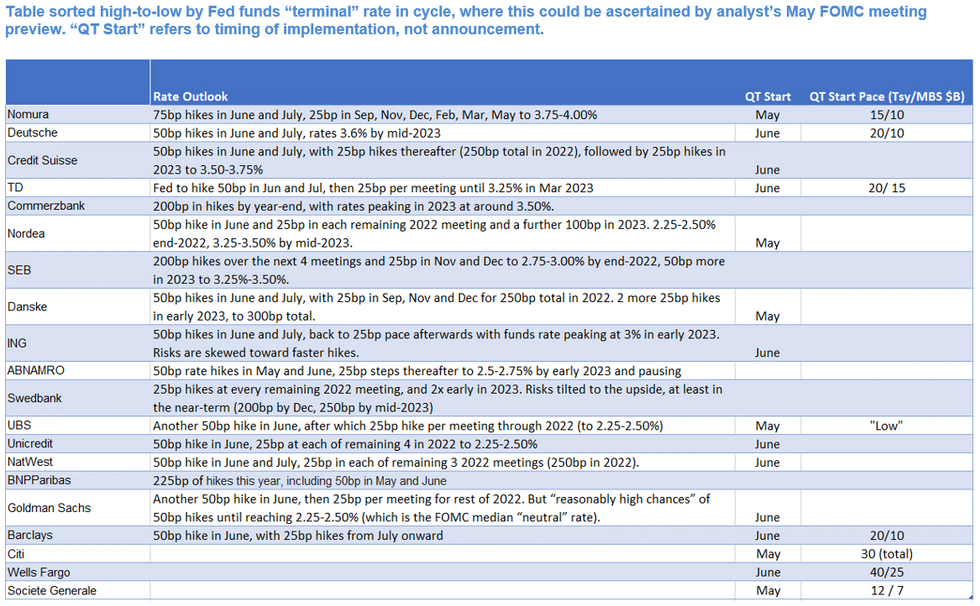

FED: MNI Fed Preview - May 2022: Nearing Peak Hawkishness

EXECUTIVE SUMMARY:

- May’s FOMC decision will be the most hawkish in recent memory, with a 50bp hike and the launch of balance sheet reduction.

- However, already aggressive market hike pricing limits the potential hawkish impact.

- Focus will be on the FOMC’s openness to 75bp hikes and/or moving above “neutral”, and any hint of asset sales.

- For the full publication please use the following link:FedPrevMay2022.pdf

US TSYS: Limited Pre-FOMC Futures Trade In Asia

The combination of diminished Asian liquidity (including a cash Tsy market closure on the back of a holiday in Japan), proximity to the impending FOMC decision and a lack of meaningful macro news flow means that futures have meandered in narrow ranges during Asia-Pac dealing.

- TYM2 is last -0-05+ at 118-11, sticking to the 0-05+ range that was established early in the session, operating on a limited ~49K lots. Weakness in Aussie bonds provided some very modest pressure, while the latest bout of Hang Seng Tech Index weakness, linked to an SEC probe into Didi Global’s NY IPO, and another missile launch from North Korea provided some counter.

- Eurodollar futures sit 1.0 to 4.0 ticks below settlement levels through the reds.

- Looking ahead, the aforementioned FOMC decision headlines on Wednesday (see our full preview of that event here), with the latest quarterly Tsy refunding announcement, ADP employment data and ISM services survey also due.

AUSSIE BONDS: Perfect Storm Results In More Cheapening

A perfect storm weighed on the ACGB space during Wednesday’s Sydney session, with momentum, continued hawkish re-pricing of the wider market’s RBA expectations, a swift post-RBA move higher in BBSW fixings and trans-Tasman impetus from the firmer than expected wage data in the latest NZ labour market report all applying pressure at different points in the day.

- Some focus was given to newswire headlines re-running sell-side RBA rate calls that were published yesterday, with Westpac’s Bill Evans now looking for a 40bp hike in June, while Goldman Sachs look for back-to-back 50bp rate hikes over the next two meetings and a cash rate of 2.60% by year-end.

- BBG’s WIRP function points to the IB strip pricing in a cumulative ~265bp of tightening across the 7 scheduled meetings in the remainder of the calendar year, which would take the cash rate to 3.00%.

- This dynamic allowed YM & XM to tag fresh cycle lows, although the early bear flattening impulse on the YM/XM curve has receded, with YM -9.0 & XM -10.0. The very front end of the cash ACGB curve provided the weakest point, further out, super longs have cheapened more than the bely.

- Local data was firmer than expected, with retail sales moving to a record outright level and housing finance data providing comfortable beats vs. wider expectations (moving higher across all 3 major metrics vs. expectations for a dip across the 3).

- The IR strip runs 8-19 ticks softer through the reds, with IRU2 providing the weakest point, aided by the aforementioned BBSW fixing dynamics.

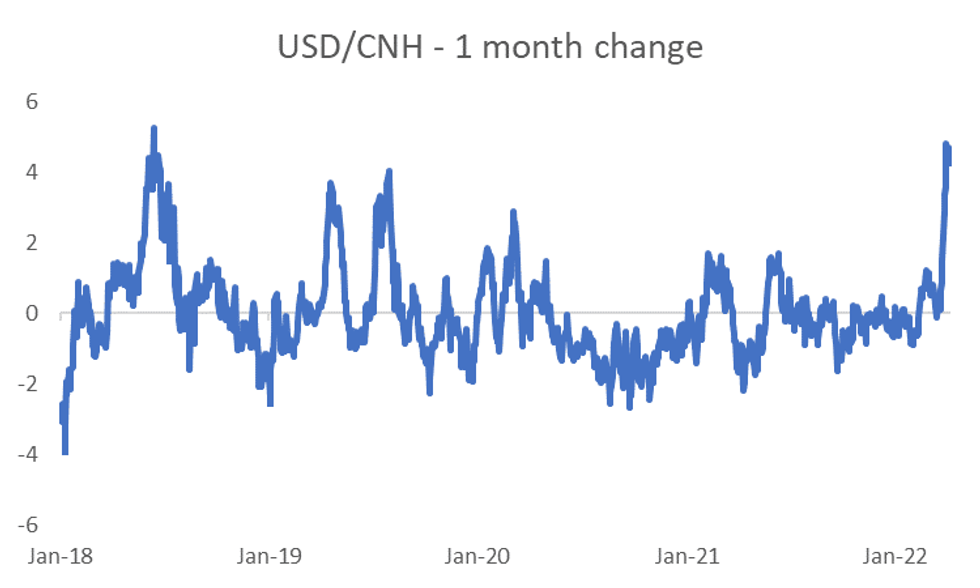

FOREX: Light Risk-On Flows Emerge Ahead Of FOMC Rate Decision, Offshore Yuan Whip-Saws

Light risk-on flows emerged in G10 FX space with Fed rate decision looming large, as U.S. e-mini futures lodged some gains. Activity remained limited by public holidays in several financial centres across Asia, including mainland China and Japan. When this is being typed, high-beta currencies sit atop the G10 pile, while the Swiss franc lags behind.

- New Zealand's labour market report failed to make an impression as its main parameters were narrowly mixed. The unemployment rate held steady, while participation shrank a tad and previous employment growth readings were revised lower, yet wage data remained firm. Our analysis showed that annual employment growth ended a run of upside surprises seen in the previous quarters.

- Offshore yuan's price action was fairly choppy amid holiday-thinned liquidity. Spot USD/CNH knee-jerked higher as Beijing shut over 40 metro stations. Those gains proved short-lived and the rate sank into negative territory, before gradually trimming losses.

- All eyes are on the FOMC who will conclude their monetary policy meeting today and are widely expected to tighten policy. Consensus looks for a 50bp rate hike as pressure is mounting on the Fed to contain elevated inflation.

- Today's data highlights include U.S. ADP employment change, trade balance & ISM Services Index as well as a slew of Services PMIs from across the globe.

FOREX OPTIONS: Expiries for May04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0550-70(E820mln), $1.0600(E1.9bln), $1.0700(E1.1bln)

- USD/JPY: Y130.30-50($656mln)

ASIA FX: Won Gains In Muted Asia Trade

A number of Asian financial centres were closed in observance of public holidays, which limited liquidity across Asia EM FX space.

- CNH: Offshore yuan wobbled as participants assessed local Covid-19 developments and prepared for the upcoming FOMC policy meeting. Spot USD/CNH jumped as Beijing closed over 40 metro stations but then pulled back sharply, before trimming losses.

- KRW: Spot USD/KRW re-opened on a softer footing. The pair clawed back some losses as North Korea conducted another missile test, firing an apparent ballistic missile towards the East Sea.

- PHP: Spot USD/PHP crept higher, narrowing in on key resistance from PHP52.500. The Marcos-Duterte tandem keeps a comfortable lead over rivals ahead of the May 9 election.

- Markets were closed in mainland China, Indonesia, Malaysia and Thailand.

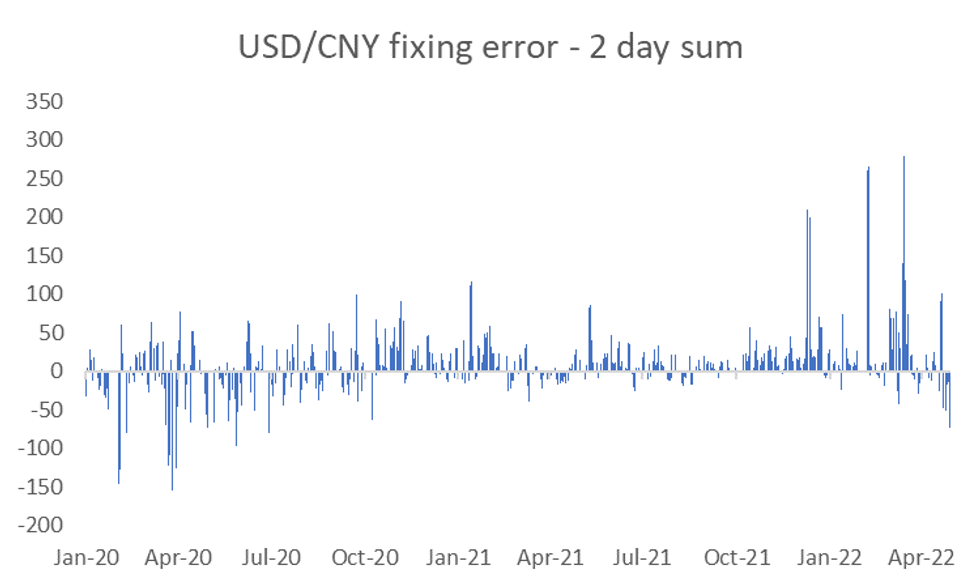

CNY: Focus On Tomorrow's USD/CNY Fix

Whilst most market attention tomorrow morning will be on digesting the Fed meeting outcome, for USD/CNH watchers the onshore USD/CNY fix will also be in focus.

- Tomorrow's USD/CNY fix will be the first since last Friday, as China markets re-open.

- The last two fixes (Thurs and Fri last week), came in below market estimates by -36 and -37pips respectively. Interestingly, this is the largest cumulative downside surprise for the fixing across 2 sessions since early 2020, see the first chart below.

- Tomorrow's fix carries extra uncertainty, as we can often see more meaningful divergences between the fix and market expectations after China markets have returned from holidays. This is particularly the case if we see a strong USD move whilst onshore markets have been closed.

- At this stage, broad USD levels aren't greatly different from the end of last week, but this could change come tomorrow morning depending on the Fed meeting.

Leaning against the depreciation trend comes after the sharp sell-off in the China currency over the past month, see the second chart below.

- Historically, the authorities have managed the pace of change in the China currency, and this episode is not likely to be any different.

- The market will still likely be focused on relative fundamentals, in terms of divergence monetary policy trends and the continuing Covid situation onshore in China and what impact this has on the growth outlook.

- Short term volatility can still be driven by the fixing bias though.

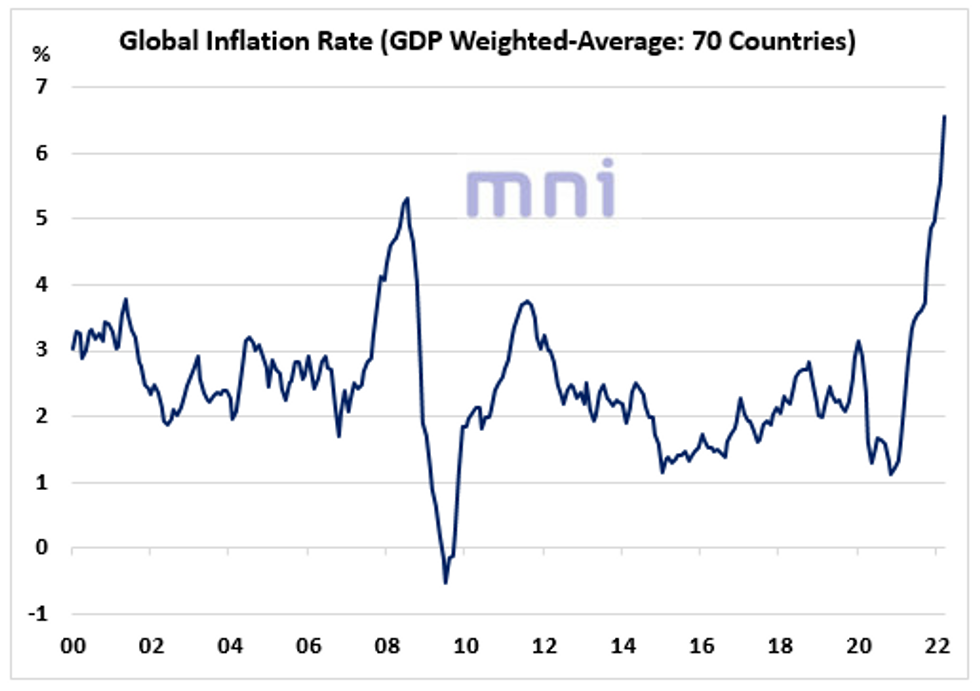

MNI MARKETS ANALYSIS: Global Inflation Reaches New High of 6.5%

EXECUTIVE SUMMARY

- Inflationary pressures continue to remain elevated in most of the developed and emerging market economies, mostly driven by the surge in energy and food prices following the Ukraine war shock.

- Our global inflation gauge rose to a new high of 6.5% in March (based on the inflation rate of 70 DM and EM countries) after breaking above its 5.3% peak reached just before the 2008 Global Financial Crisis last month.

- Interestingly, inflationary pressures have also started to accelerate again in Asia/SE Asia (inflation has remained low or has been easing in most of the Asian economies until recently).

- Link to full publication: Inflation Global - May.pdf

Source: Bloomberg/MNI.

EQUITIES: Mostly Lower Ahead Of FOMC; Chinese Tech Hit By SEC Probe Of Didi

Asia-Pac equity indices trade mostly lower at typing, bucking a positive lead from Wall St. as Chinese and Japanese markets remain shuttered for national holidays.

- The Hang Seng sits 1.3% softer at typing after opening in the red, with a fresh round of weakness in China-based tech spurred by Chinese ride-hailing giant Didi Global (ADR -7.0% after hours) revealing that the U.S. SEC was investigating its 2021 IPO. Large-caps such as Alibaba Group and Tencent Holdings fell by >3% each come the Asian session, spurring a 3.1% decline in the Hang Seng Tech Index. Meituan (-5.9%) led losses amidst China-based tech names, contributing to the gloom in the sector following news of a non-executive director selling a large part of his stake in the company at a discount to its current price.

- The ASX200 fares a little better than most equity index peers, sitting a little below neutral levels at typing. The Australian equity benchmark has reversed earlier gains on broad weakness in tech stocks, with the S&P/ASX All Technology Index dealing 1.0% softer at typing, with heavyweights Block Inc and REA Group underperforming. Materials stocks broadly struggled with losses observed in the major miners (BHP, Mineral Resources, Rio Tinto), while financials outperformed, led by gains in the “big four” banks.

- U.S. e-mini equity index futures are back from session highs, dealing flat to 0.1% higher at typing.

GOLD: Southbound Ahead Of FOMC

Gold sits ~$6/oz worse off at typing to print ~$1,862/oz, operating around session lows and extending a pullback from Tuesday’s best levels.

- To recap Tuesday’s price action, the precious metal’s rebound from 11-week lows ($1,850.5/oz) was blunted as initial tailwinds from a retreat in U.S. real yields and the USD (DXY) unwound later in the NY session, ultimately seeing gold top out at $1,878.1/oz before paring gains.

- Looking ahead, Apr ADP Employment Change (BBG median +385K, +431K Mar), crosses at 1215 GMT, ahead of Fed Chair Powell’s May FOMC presser at 1830 GMT. While the Fed is widely expected to announce QT and a 50bp hike for May, some focus will likely be on potential shifts in language surrounding the possibility of larger rate hikes further into ‘22.

- May FOMC dated OIS currently point to back-to-back 50bp rate hikes for the May and June meetings, with a ~40% chance of a 75bp move for June now priced in.

- From a technical perspective, gold has broken support at $1,854.7/oz (May 2 low), exposing further support at $1,848.8 (76.4% retracement of Jan28-Mar8 rally) and $1,821.1/oz (Feb 11 low). Resistance is seen some distance away at $1,900/oz (May 2 high).

OIL: Supply Worry Creeps In As Chinese COVID Cases Fall, EU Sanctions Eyed

WTI and Brent are ~$1.00 firmer apiece, operating a little above Tuesday’s worst levels at typing. Both benchmarks have caught a minor bid as worry re: tight global supply remains evident, with prior concern re: demand destruction in China continuing to ease from extremes seen earlier in April.

- To elaborate on the latter, fresh COVID case counts in China have continued to decline, although lockdowns in parts of Shanghai look set to continue as community transmission persists (authorities are looking at zero community transmission before lifting lockdowns). Elsewhere, authorities in Beijing escalated pandemic control measures slightly on Wednesday, shutting 40 subway stations (~10% of the city’s network) concentrated around the Chaoyang district (previously flagged epicentre of Beijing’s outbreak so far).

- A BBG survey has pointed to OPEC increasing output by ~10K bpd in April amidst supply woes in Libya and Nigeria, compounding well-documented sentiment re: the group’s inability to meet monthly target production increases (noting that a similar survey for Mar pointed to a 90K bpd increase for that month).

- The latest round of U.S. API inventory estimates crossed late on Tuesday, with source reports pointing to a larger-than-expected drawdown in crude inventories and a decline in gasoline and distillate stockpiles, while a build in Cushing hub stocks was observed. Up next, U.S. EIA inventory data crosses at 1430 GMT, with WSJ estimates calling for declines in crude, gasoline, and distillate inventories.

- Looking ahead, the European Commission is expected to propose a sixth round of sanctions on Russia later on Wednesday, with potential details on embargoes of Russian crude imports.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/05/2022 | 0600/0800 | ** |  | DE | Trade Balance |

| 04/05/2022 | 0715/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 04/05/2022 | 0745/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 04/05/2022 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 04/05/2022 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 04/05/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 04/05/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 04/05/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 04/05/2022 | 0900/1100 | ** |  | EU | Retail Sales |

| 04/05/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 04/05/2022 | 1215/0815 | *** |  | US | ADP Employment Report |

| 04/05/2022 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 04/05/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 04/05/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (Final) |

| 04/05/2022 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 04/05/2022 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 04/05/2022 | 1800/1400 | *** |  | US | FOMC Statement |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.