-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI EUROPEAN MARKETS ANALYSIS: GBP Struggling Ahead Of UK Local Elections & BoE

- A lack of macro headline flow during overnight trading placed the focus on wider flows when it came to core FI trade in Asia hours.

- GBP weakness ahead of Thursday’s local elections across much of the UK has been the major point of note in Asia-Pac G10 FX trade. Sterling has edged away from worst levels of the session, but is still adrift at the bottom of the G10 FX performance table.

- Mnetary policy decisions from both the Bank of England and the Norges Bank are due later in the day, with ECB's Lane, Centeno & Holzmann and BoC's Schembri set to speak. Today's data highlights include German factory orders and U.S. weekly jobless claims. Elsewhere, EM central bank decisons & UK local elections will draw interest.

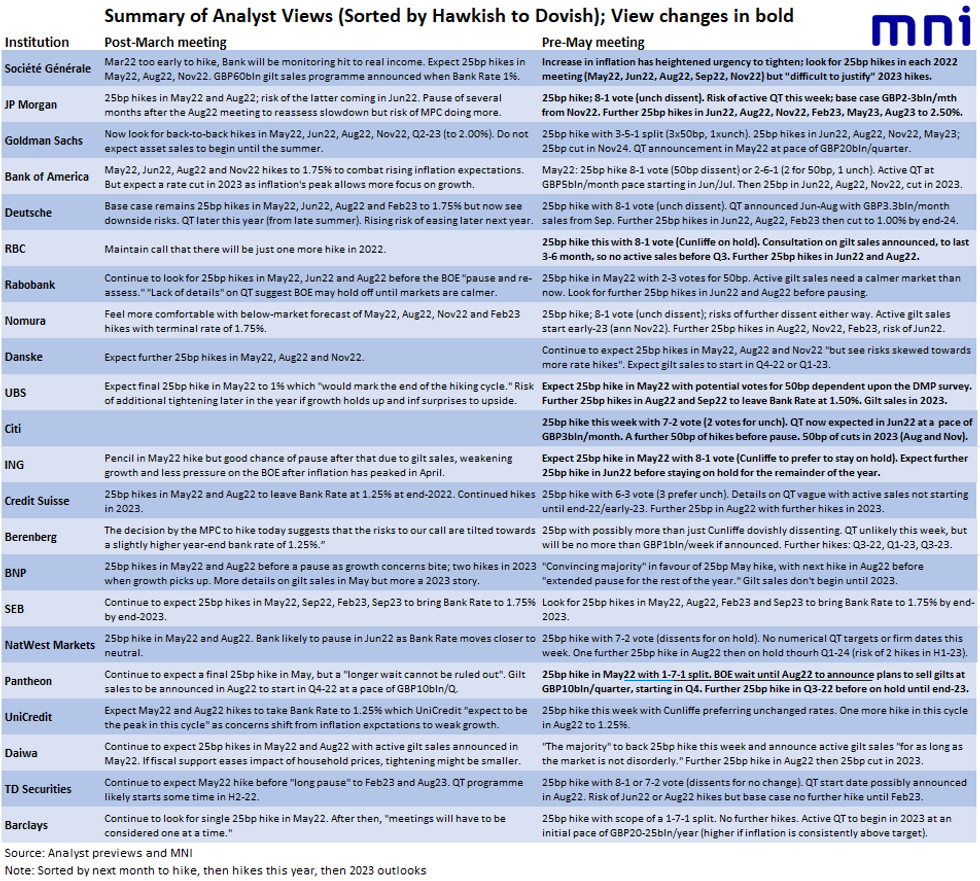

BOE: MNI BOE Preview - May 2022: 25bp Now, What Next?

EXECUTIVE SUMMARY

- Along with every analyst preview that we have read, the MNI Markets team expects a 25bp hike this week. Markets are pricing in just under 31bp for the meeting, which if at least a 25bp hike is assumed, equates to just over a 20% probability of a 50bp hike.

- We think that the biggest thing that could impact market pricing would be the removal of “coming months” from the forward guidance.

- Without a change in the guidance, a 50bp hike would be hawkish, even if it is accompanied by a wafer thin majority.

- Conversely, if there are more than 2 MPC members voting for rates to remain on hold (with Cunliffe and probably Tenreyro joined by one other) this would likely see a dovish reaction.

- Full piece here: MNI BoE Preview - May22.pdf

NORGES BANK: MNI Norges Bank Preview - May 2022: Policy Change Unlikely

EXECUTIVE SUMMARY

- Policy change unlikely in May, June meeting earmarked for next hike

- Inflationary pressure backs Bank decision to steepen rate path in March

- Markets see rates at 1.50% at year-end

- Full piece here:MNINBPrevMay22.pdf

The Norges Bank stuck to their guidance and raised rates by 25bps to 0.75% in March. The bank also name-checked the June meeting as the next most opportune time to tighten policy and signalled a further three hikes this year, bringing end-2022 rates to 1.50%. This makes a policy change at this meeting unlikely, despite mounting inflationary pressures and buoyant wages. A rate hike at each quarterly policy report meeting is infitting with their preference for ‘gradual’ normalisation.

The 2023 rate path (new at the March meeting) was modestly more hawkish than forecast, with policy now seen rising well north of neutral, to 2.50% by end-2023. Despite the marked steepening in the rate path projections, the Bank again leant heavily on the exogenous judgement factor to supress the front-end of the rate path. This is inline with the Bank’s preference for ‘gradual’ normalization of policy and leaves little chance of either a 50bps rate rise, or a rate rise at a non-forecast round meeting.

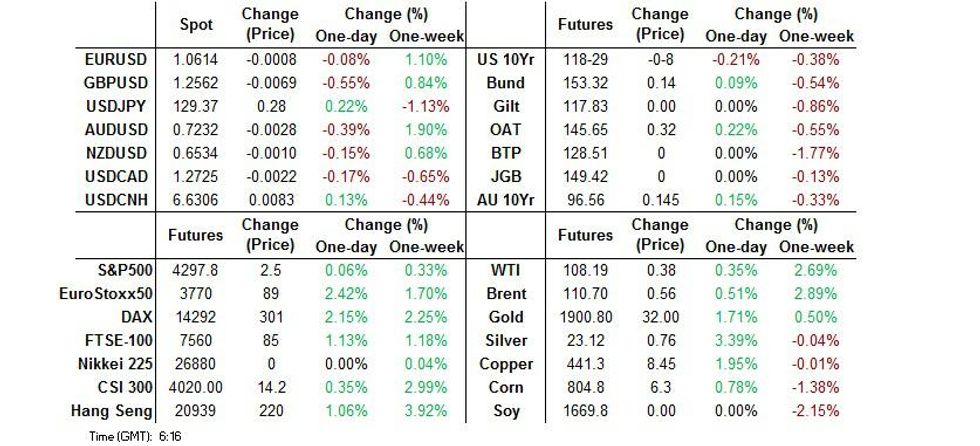

US TSYS: Limited Asia Futures Trade

TYM2 is -0-06+ at 118-30+, 0-01 off the base of its 0-12 overnight range, operating on under 65K lots. Cash Tsys are closed until London hours owing to the observance of a Japanese holiday, while there hasn’t been much in the way of meaningful macro news flow to digest during Asia hours.

- Two-way, but limited, trade was evident overnight with an early bid in Tsy futures reversing. TYM2 had a brief look above its NY session high after regional Fed follow through, a weak post-holiday start for Chinese tech names and a bid in the ACGB market were penned as potential driving factors for the early, limited richening in futures, before a pullback took place as the ChiNExt moved away from worst levels.

- A quick reminder that Fed Chair Powell’s pushback against the idea of a 75bp rate hike and guidance towards 50bp hikes at the next couple of FOMC meetings meant that short-end rates unwound a little of the embedded rate hike premium that could be observed pre-FOMC, resulting in bull steepening of the Tsy curve into the NY bell.

- Softer than expected Chinese services PMI data provided no real tangible impact on the space. Although the reading was much softer than expected (36.2 vs. BBG median of 40.0, representing the fastest rate of contraction observed since the initial COVID outbreak in early ‘20) the market was already looking for a weak print given the well-documented, localised COVID restrictions that have been implemented in China. The key findings of the survey largely reflected knowns. The details revealed the quickest fall in service sector output for over two years as COVID-19 restrictions tighten, a decline in new business gathering pace & a slight fall in employment. Still, Caixin noted that “businesses were moderately optimistic. Even as regional Covid-19 outbreaks dragged on, entrepreneurs were confident that they would be brought under control, although some worried that the control measures would last too long."

- Looking ahead, the latest BoE decision will be eyed during Thursday’s London/NY crossover. The MNI markets team expects a 25bp hike. We think that the biggest thing that could impact market pricing re: the BoE would be the removal of “coming months” from the forward guidance.

- NY hours will bring the release of weekly jobless claims data, challenger job cuts, as well as the monthly productivity and unit labour cost metrics.

AUSSIE BONDS: At Last, A Bid

YM & XM sit ~3bp shy of their respective session peaks, +18.0 & +15.0, respectively, at typing. This comes after both contracts managed to push through their overnight, post-Fed highs, with a weak start for Chinese tech equities, onshore reaction to the FOMC decision (including an unwind of some of the RBA rate hike premium embedded into markets), profit taking/short squeezing and cross market interest vs. U.S. Tsys were identified as potential drivers of the move.

- A recovery in Chinese tech equities and light pressure in U.S. Tsy futures has allowed the space to move back from richest levels of the session.

- Wider cash ACGB trades sees the 3- to 7-Year sector outperform on the curve.

- The IR strip trades 8-21bp richer on the day through the reds.

- A quick look at the BBG WIRP function points to the IB strip pricing a year-end cash rate of 2.95% vs. a peak of 3.10% observed on Wednesday.

- The RBA overnight cash rate set at 0.31%, up from 0.07% (capturing the rate hike from Tuesday), just above the mid-point of the cash rate target/interest rate paid on surplus E/S balance corridor (which stands at 0.30%).

- Local data saw a wider than expected trade surplus, even with exports missing expectations (imports were in line), while building approvals data was on the soft side vs. expectations. That, as well as softer than expected Chinese Caixin PMI data, had no impact on the space.

- Friday will bring the release of the Bank’s SoMP (although the major tweaks to its economic forecasts have already been flagged) and A$1.0bn of ACGB Nov-27 supply.

FOREX: AUD Weakens On Monetary Policy Musings, China Services PMI Miss

The Aussie dollar went offered even as firmer crude oil prices lent support to the CAD and NOK. The RBA's hawkish pivot communicated earlier this week was reassessed in the light of yesterday's monetary policy decision from the Fed, who delivered the expected 50bp rate hike and played down potential for larger rate increases going forward.

- AUD/NZD extended its pullback from a cycle peak printed on Wednesday in tandem with a parallel move in Australia/New Zealand 2-year swaps spread. RBNZ Gov Orr defended his inflation fighting record, brushing away suggestions from opposition lawmakers that his MPC was too slow in taking the heat out of the economy.

- Spillover from China likely played a role in AUD weakness, as Caixin Services PMI missed expectations by a solid margin, extending its run of downside surprises, as harsh Covid-19 countermeasures took their toll.

- The GBP depreciated, joining the AUD at the bottom of the G10 pile. Local elections to be held in the UK on Thursday provide a key source of political risk, as a poor result for the Tories would deliver another blow to PM Johnson. In addition, polls are showing that unionist Sinn Fein party maintains a lead over its rivals ahead of the Northern Ireland Assembly election.

- Offshore yuan see-sawed as the third consecutive firmer than expected PBOC fixing was countered by local PMI data. The People's Bank returned after the long weekend setting the yuan reference rate 27 pips below sell-side estimate, signalling continued willingness to lean against redback weakness.

- Central bank activity picks up from here, with monetary policy decisions from both the Bank of England and the Norges Bank coming up later in the day, with ECB's Lane, Centeno & Holzmann and BoC's Schembri set to speak. Today's data highlights include German factory orders and U.S. weekly jobless claims.

FX OPTIONS: Expiries for May05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500-10(E1.2bln), $1.0565-85(E995mln), $1.0600(E1.7bln), $1.0750-65(E1.6bln), $1.0800(E1.5bln)

- GBPUSD: $1.2550(Gbp502mln), $1.2900(Gbp1.2bln)

- EUR/GBP: Gbp0.8600(E952mln)

- USD/JPY: Y127.50($685mln)

- EUR/JPY: Y135.00(E523mln)

- AUD/USD: $0.7135-50(A$571mln)

- USD/CAD: C$1.2865-80($869mln), C$1.2890-05($689mln), C$1.3075($1.2bln), C$1.3100($1.8bln)

ASIA FX: Post-FOMC Reflections & Chinese Data Take Focus

Currencies from the Asia EM basket struggled for a uniform direction, as the region digested yesterday's monetary policy decision from the FOMC (and resultant risk relief rally) as well as economic data released out of China upon its return from a holiday.

- CNH: Spot USD/CNH slipped as the PBOC's first post-holiday yuan fixing proved firmer than expected, but staged a rebound as China's Caixin Services PMI missed expectations. Survey results showed that China's services sector shrank at the fastest pace since February 2020. The rate eased off its best levels through the rest of the session, but remains above neutral levels.

- MYR: Spot USD/MYR retreated during the first trading session this week, with onshore markets catching up with overnight FOMC policy announcement, with Chair Powell's rhetoric proving less hawkish than expected.

- PHP: Spot USD/PHP moved away from key resistance located at PHP52.500. Peso may have drawn some additional support from local CPI data, which showed that headline inflation accelerated to +4.9% Y/Y in April, beating median estimate of +4.6% and breaching the BSP's target range of +2.0%-4.0%.

- THB: Thailand also returned from a holiday, with spot USD/THB opening sharply lower. Headline CPI inflation slowed to +4.65% Y/Y in April, printing below the median estimate of +4.81%, but participants were aware of potential for renewed acceleration this month, linked to the government's decision to remove a cap on diesel prices.

- INR: The rupee gained after the Reserve Bank of India delivered a surprise rate hike on Wednesday citing the need to tame inflation.

- Financial markets in South Korea and Indonesia were closed in observance of respective public holidays.

EQUITIES: Higher In Asia; Chinese Stocks Reverse Early Losses As Policy Support Calls Grow Louder

Most Asia-Pac equity indices trade higher at typing, tracking a strongly positive lead from Wall St. High-beta names across various sectors were notable outperformers, likely benefitting from spillover from an unwinding of worry re: larger Fed rate hikes in ‘22. Japanese and South Korean markets are shut for a holiday.

- The Hang Seng Index sits 0.8% firmer at typing, paring opening gains particularly after Chinese Caixin PMIs crossed, pointing to further contraction in the Services industry (while also corroborating with earlier official estimates). China-based tech leads gains despite fresh reports of U.S. regulators expanding their list of Chinese companies facing the boot from U.S. exchanges over a well-documented audit dispute, with Bilibili Inc, Baidu Inc, and Meituan contributing the most to gains, seeing the Hang Seng Tech Index add 1.7% at writing.

- Zooming out, PBOC’s pledge on Wednesday to “normalise” supervision for internet platform companies appears to have been met with lukewarm reception overall, with the Hang Seng Tech Index trading below three-week highs seen last Friday’s (with that move spurred by similar comments from the CCP’s Politburo meeting).

- The CSI300 deals 0.5% firmer at typing, breaking above neutral levels on a broad surge across virtually all sub-indices, with the most gains contributed by the heavyweight consumer staples sub-index. Chinese equities caught a bid after state media reported on a swathe of measures to promote investments, exports, and support internet platform companies, again reinforcing recent messages from the Politburo and the PBOC. While the announcements have been light on details thus far, Chinese state media has notably carried analyses pointing to possible state support for internet platform companies (particularly to help “stabilise growth” and “ensure employment”), and also on possible further easing of curbs on the property sector.

- U.S. e-mini equity index futures sit a little below neutral levels at typing, trading within a fairly limited range in Asia-Pac dealing after closing ~3% high after Powell’s presser.

GOLD: Revisiting $1,900/oz As Powell Puts Away 75bp Hike For Now

Gold deals ~$19/oz higher at typing to print ~$1,900/oz, on track for a third consecutive higher daily close with tailwinds from Fed Chair Powell’s presser on Thursday evident.

- To elaborate, the precious metal builds on a ~$13/oz higher close on Wednesday after Powell said that a 75bp hike was “not something that the committee is actively considering” for the next few meetings, with the overall move higher facilitated by broad declines in U.S. real yields and the USD (DXY).

- Support for gold from a steady beat of negative economic data surprises (keeping in mind well-documented debate re: stagflation) continues to take a back seat to worry re: >50bp rate hikes for now, with little reaction observed in the yellow metal on downside surprises in ADP employment data and the ISM’s service sector index on Wednesday (while noting that U.S. PMI data came in ahead of BBG median expectations).

- A cumulative ~100bp in hikes is now priced into July FOMC dated OIS, implying expectations for back-to-back 50bp hikes in both the June and July meetings. OIS markets now show expectations for around 3 x 50bp hikes across the five remaining FOMC meetings for the year, with a cumulative ~195bp of tightening now priced in through calendar ‘22.

- From a technical perspective, bullion has broken resistance at $1,900/oz (May 2 high), exposing further resistance at its 20-Day EMA (around $1,917.3/oz) and at $1,958.4/oz (Apr 20 high). On the other hand, support is situated at $1,850.5/oz (May 3 low).

OIL: Holding On To Gains As EU Sanctions Meet Resistance, Chinese Data Points To Slowdowns

WTI and Brent are between $0.30 - $0.40 firmer at typing, a little below two-week highs made earlier in the session at $108.93 and $111.34 respectively.

- To recap, both benchmarks closed ~$5 higher apiece on Wednesday as the European Commission unveiled proposed sanctions on Russian crude, including measures targeting insurance and financing operations on its transportation. The proposal now likely enters a phase of negotiation as consensus amongst the bloc’s 27 members is required, with RTRS source reports pointing to debate re: conditional exemptions on the embargo for Hungary and Slovakia.

- Looking to China, worry re: reduced energy demand continues to be front and centre, with the Apr Caixin Services PMI slowing to 36.2 (vs. BBG median 40.0; Mar 42.0), the second-lowest on record since readings began in 2005. COVID cases in the country have continued to stay low at 5K cases nationwide, although Shanghai continues to see low double-digit cases “in the community” (outside of lockdowns).

- Elsewhere, U.S. EIA crude inventory data crossed on Wednesday, recording a surprise build in crude stockpiles (diverging from Tuesday’s reports of API estimates pointing to a decline) and an increase in Cushing hub stocks, while a smaller-than-expected drawdown in gasoline and distillate stocks was observed.

- OPEC+ is expected to meet later on Thursday to discuss production quota increases for June (expected to raise target by 432K bpd), although well-documented difficulties in increasing production amongst some members of the group i.e. Libya and Nigeria) likely remain front and centre for the space.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/05/2022 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 05/05/2022 | 0630/0830 | *** |  | CH | CPI |

| 05/05/2022 | 0645/0845 | * |  | FR | Industrial Production |

| 05/05/2022 | 0700/0300 | * |  | TR | Turkey CPI |

| 05/05/2022 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 05/05/2022 | 0800/1000 | *** |  | NO | Norges Bank Rate Decision |

| 05/05/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 05/05/2022 | 1000/1200 |  | EU | ECB Lane Speech on Euro Area Outlook | |

| 05/05/2022 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 05/05/2022 | 1130/1230 |  | UK | BOE post-MPC press conference | |

| 05/05/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 05/05/2022 | 1230/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 05/05/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 05/05/2022 | 1300/1400 |  | UK | Bank of England DMP Survey | |

| 05/05/2022 | 1340/0940 |  | CA | BOC Deputy Schembri speech to Indigenous group. | |

| 05/05/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 05/05/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 05/05/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.