-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Asia Experiences Turnaround Tuesday

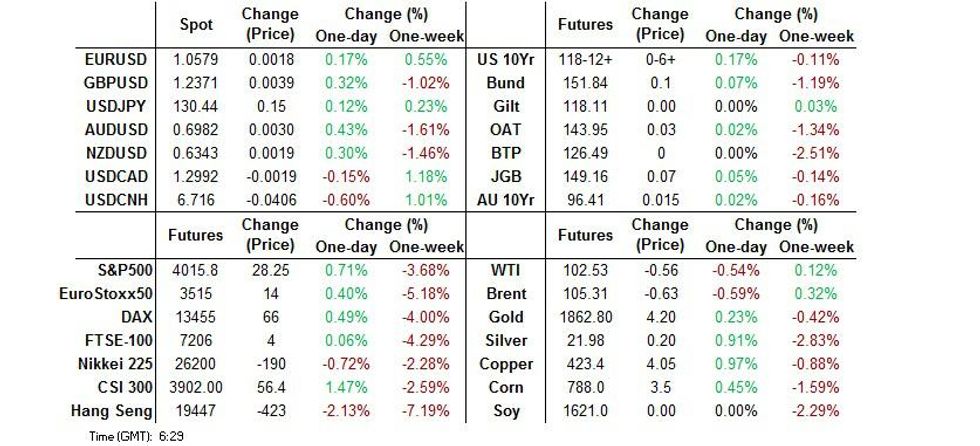

- Tuesday's Asia-Pac session provided a fairly frenetic round of trade, with an early flow/technical-driven round of risk-off trade largely reversing, allowing e-minis to move back into positive territory, aided by the stabilsation of mainland Chinese tech names (proxied by the ChiNext index), even as offshore investors sold Chinese equities via the Hong Kong/China Stock Connect links.

- USD/CNH was subjected to some notable swings but remains comfortably above CNH6.7000.

- The latest German ZEW survey and Norwegian CPI data headline the data docket on Tuesday. Meanwhile, there will be plenty of central bank rhetoric, with several Fed & ECB members due to appear.

US TSYS: Tsys Unchanged Into Europe After Busy Asia Trade

Cash Tsys are essentially unchanged across the curve after a fairly frenetic round of overnight dealing. TYM2 is last dealing +0-09+ at 118-15+, in line with late NY levels, 0-02 off the base of its 0-0-16+ range, with volume comfortably above 200K lots.

- The drift away from firmest levels of the session has continued through the second half of Asia-Pac trade, after the earlier technical/flow-related bid in U.S. Tsys faded.

- Note that the major U.S. Tsy futures contracts broke above their respective Monday highs in early Asia dealing, with yields across the curve through their Monday troughs. The richening took place at the same time that S&P 500 e-minis crossed below their Monday low (although technical support in the contract wasn’t tested) and Bitcoin looked below 30,000 (we do not usually comment on cryptocurrencies, but correlations with risk assets have increased in recent times).

- There was no overt headline news to trigger the move, leaving pure flows at the fore. Note that the move extended on the back of 3 block buys in TY futures (totaling 9,750 lots).

- A subsequent recovery in risk appetite, with the S&P 500 e-mini contract reclaiming the 4,000 level and mainland Chinese tech stocks (namely the ChiNext) reversing the early gap lower, allowed the space to move away from worst levels. Subsequent comments from Chinese market regulators have looked to soothe any worry re: Chinese equities, while a state-run media article flagged comments from analysts playing down the risk of further CNY depreciation.

- Small business optimism data is due during Tuesday’s NY session, with a deluge of Fedspeak (Williams, Waller, Mester, Kashkari & Barkin) & 3-Year Tsy supply also slated.

JGBS: Off Best Levels Even As 10-Year Auction Cover Ratio Surges

Spill over from Monday’s NY session and the previously outlined swings in wider risk appetite during Tuesday’s Asia-Pac session drove JGB trade on Tuesday.

- JGB futures are comfortably off of best levels as a result, last dealing +8 on the day.

- Cash JGBs run little changed to 1.5bp richer across the curve, with 7s and 20s providing the firmest points on the curve. Outperformance in 7s was likely linked to the overnight and early Tokyo bid in futures. Note that 10s have underperformed all day, which would have been linked to pre-auction concession ahead of today’s 10-Year JGB supply.

- In terms of specifics, the latest 10-Year JGB auction saw softer than expected pricing, with the low price missing wider expectations, coming in at 99.53 (the BBG dealer poll looked for a low price of 99.56). Still, the cover ratio jumped to the highest level observed at a 10-Year JGB auction since the first half of the ‘00s, while the price tail experienced some incremental narrowing. It would seem that short cover and the BoJ’s reinforcement of its existing YCC settings outweighed any worry surrounding relative value appeal, with yields operating around 0.5bp shy of the upper limit of the BoJ’s permitted 10-Year JGB yield trading band. Still, as mentioned, wider price action in core FI markets dictated price action in JGBs, facilitating some very modest cheapening during the Tokyo afternoon.

- Local headline flow was dominated by comments from BoJ senior official Uchida, as he pushed back against any speculation that the BoJ could widen/alter its permitted 10-Year JGB yield trading band, likening such a move to a rate hike, while stressing that Japan doesn’t need to tighten monetary policy.

- Domestic household spending data was a touch firmer than expected but still in negative territory (-2.3 Y/Y vs. BBG median -3.3%).

- Tomorrow’s local docket looks particularly thin.

AUSSIE BONDS: Off Best Levels, Following Wider Flows

Wider risk appetite has been in the driving seat on Tuesday, with local headline flow lacking, while domestic data failed to provide any notable impetus for the space. The previously flagged recovery in risk appetite during Asia-Pac hours has allowed the space to pull back from best levels observed earlier in the session, with YM +7.0 & XM +2.0. This came after Monday’s U.S. Tsy bull steepening impulse drove price action in the overnight session. Longer dated cash ACGBs are ~1bp richer on the day.

- Retail sales ex-inflation for Q1 was marginally firmer than expected (+1.2 Q/Q vs. BBG median of +1.0%), although that was accompanied by a 0.3ppt reduction in the Q4 Q/Q reading, via revisions.

- Meanwhile, the monthly NAB business survey revealed an uptick in conditions but a downtick in confidence. The survey collator noted that “business conditions continued to strengthen in April, while confidence eased but remained above its long-run average. Trading conditions and profitability continued to strengthen, while employment was steady… Both confidence and conditions now look fairly strong across most industries, with the exception of transport & utilities and construction where cost pressures have been most acute. Capacity utilisation also continued to rise… Cost pressures continued to build, with labour cost growth up to 3.0% and purchase cost growth reaching 4.6% (in quarterly terms) - both at new highs. However, output price inflation eased with final product prices rising 1.7% and retail prices up 2.1%. Still, these rates of price growth remain high in the history of the survey and the strength in underlying costs suggests inflationary pressure is likely to continue building over coming months. Overall, the survey highlights the ongoing strength in activity and the broad-based nature of the recovery, against a backdrop of cost pressures continuing to pose a significant challenge for businesses.”

- Lower tier data also failed to impact the space.

- A quick look at tomorrow’s domestic docket suggests that the monthly Westpac consumer confidence data and A$400mn of ACGB Jun-51 supply will provide the focal points.

FOREX: Offshore Yuan Goes Bid, Poised To Snap Three-Day Losing Streak

Spot USD/CNH reversed gains after a failed re-test of a cycle high printed on Monday. There was little in the way of notable headline flow coinciding with that pullback, but Chinese equity indices clawed back their initial gap lower amid a strong rebound in Chinese tech.

- The pair's advance towards recent cycle highs may have been facilitated by the virtual removal of appreciation bias from the PBOC fixing. China's central bank set the mid-point of permitted USD/CNY trading range just 5 pips below sell-side estimate, ending a streak of downside surprises.

- The yen briefly turned bid into the Tokyo fix, possibly bolstered by comments from FinMin Suzuki, who noted that Japan is in close communication with the U.S. on FX and called recent rapid yen weakening "undesirable." It did not take USD/JPY much time to recoup resultant losses, the rate is back to neutral levels and the yen is among worst G10 performers.

- The greenback is trading on a heavier footing as we are heading for the London open. It underperforms all its G10 peers, with the DXY extending its move away from a cycle high printed on Monday.

- German ZEW Survey and Norwegian CPI headline the data docket going forward. Central bank rhetoric will be aplenty, with a decent number of Fed & ECB members due to speak.

FOREX OPTIONS: Expiries for May10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0665-75(E716mln)

- AUD/USD: $0.7200(A$506mln)

- USD/CAD: C$1.2935($3.2bln)

- USD/CNY: Cny6.6440($650mln)

ASIA FX: Redback Reverses Losses As Asia EM FX Space Finds Poise

The U.S. dollar lost allure and most Asia EM currencies gained, led by a rebound in offshore yuan.

- CNH: Spot USD/CNH pulled back sharply after a failed re-test of cycle highs printed on Monday, as Chinese equities recouped their opening losses. The redback paid little attention to the PBOC fix, which ended a streak of downside surprises. The mid-point of permitted USD/CNY trading band was set a mere 5 pips shy of sell-side estimate, following a series of two-digit surprises in the recent days, when the People's Bank was leaning against yuan depreciation. Worth noting that the PBOC reiterated its pledge to support the economy in the quarterly monetary policy report released on Monday.

- KRW: Spot USD/KRW lodged a fresh cycle high at KRW1,278.75, the strongest level since Mar 23, 2020. President Yoon Suk-yeol formally took office.

- IDR: Spot USD/IDR went offered after Thursday's data showed that headline CPI inflation accelerated to a multi-year high, printing slightly above median estimate.

- MYR: Spot USD/MYR faltered ahead of BNM monetary policy decision, due tomorrow. In the meantime, Malaysia's Department of Statistics reported that industrial output grew 5.1% Y/Y in March, beating expectations.

- PHP: Spot USD/PHP lost ground as onshore markets re-opened after the Election Day. Preliminary results showed that Ferdinand Marcos was on track to win the presidential poll by a landslide, while Sara Duterte was poised to secure a resounding victory in the vice-presidential race.

- THB: The baht outperformed the greenback in line with regional trend, even as Thailand's monthly consumer confidence index fell to a multi-month low of 40.7.

- INR: The rupee re-opened on a firmer footing after BBG circulated a source report Monday noting that the RBI was intervening in all FX markets and intended to continue to do so.

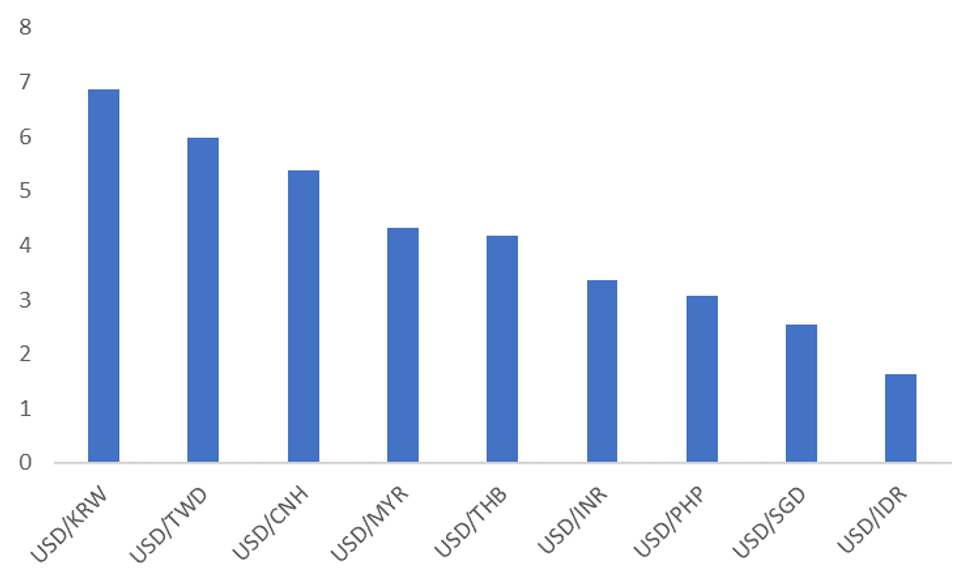

ASIA FX: Intervention Risk Rising?

Intervention risks are rising for USD/Asia pairs, but fundamentals still point to a challenging outlook.

- The RBI made headlines overnight, when newswire sources noted that it intervened in the FX market to defend the rupee. This came after the currency dropped to a record low against the USD (USD/INR rose above 77.50).

- Bank Indonesia also noted yesterday that it would stabilize the rupiah if necessary. Spot USD/IDR is close to fresh 1 year highs of just above 14550.

- Korean authorities have also spoken about the need to stabilize markets as well in recent weeks.

- China is leaning against depreciation risks, with a stronger fixing bias, although this bias is probably best described as modest rather than strong.

- USD/HKD also hit the top end of its trading band at 7.8500 today.

All USD/Asia pairs are comfortably above their respective 200 day MAs, see the first chart below.

- Asian central banks will be mindful of how quickly local FX has depreciated and are unlikely to welcome markets becoming too one-sided if history is a guide.

- Such rhetoric or increased FX intervention is likely to remain part of the FX landscape going forward.

Fig 1: USD/Asia Deviation From 200-Day MA (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

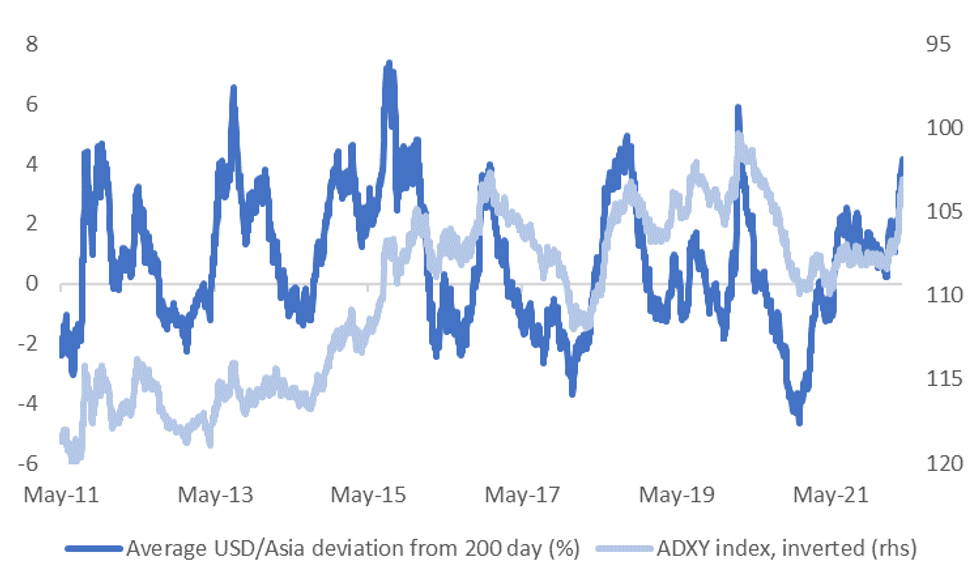

If we take an unweighted average of the deviation from the 200 day MAs we get a result just above 4%, see the second chart below.

- The other line on the chart is the ADXY index, which is inverted. Historically, the deviation has tended to peak between 4-6%, on average, for USD/Asia pairs.

- A definitive peak in USD/Asia pairs won't come until the fundamental backdrop has meaningfully improved.

- Still, intervention risks can still impact sentiment on a daily/intra-day basis.

Fig 2: Average Deviation From 200-Day MA For USD/Asia And ADXY index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

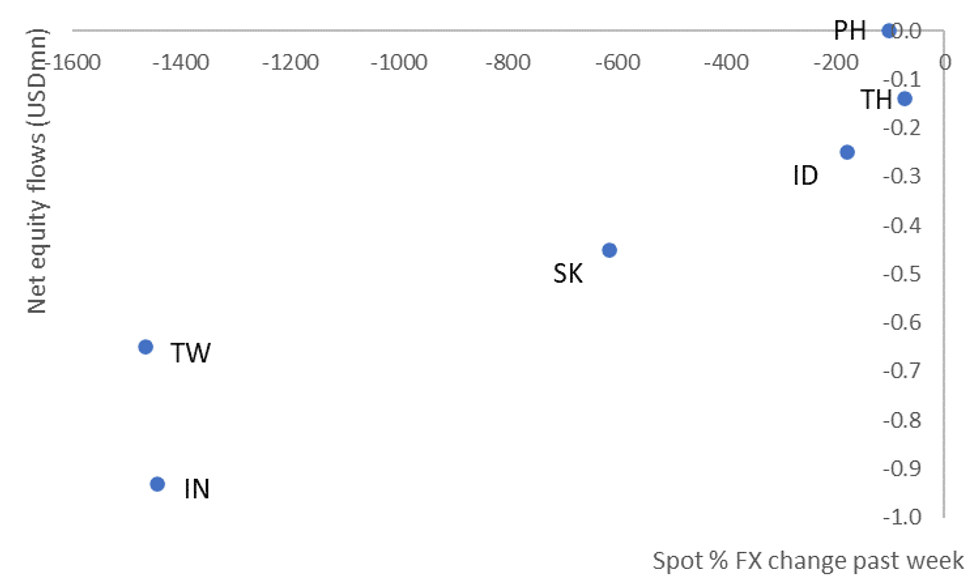

ASIA FX: Net Equity Outflows Persist

Offshore investors are still net sellers of equites in EM Asia markets.

- Net equity outflows continue from major EM Asia economies, see the table below. India and Taiwan have seen the strongest outflow momentum, in absolute terms. South Korea follows, while the smaller markets show the same trends.

Table 1: Net Equity Flows For EM Asia Markets

| USDmn | Past week | YTD |

| South Korea | -615 | -12076 |

| Taiwan | -1466 | -27868 |

| India | -1442 | -18351 |

| Indonesia | -178 | 4834 |

| Thailand | -72 | 3604 |

| Philippines | -101 | 288 |

Source: MNI - Market News/Bloomberg

The pace of outflows still enjoys a reasonable correlation with relative FX performance, see the scatter plot below. Asian FX has enjoyed a modest recovery through the afternoon session today. Any sustained improvement is likely to require both stabilizing equity market sentiment and improved flow trends from an offshore investor standpoint.

Fig 1: Net equity flows and FX performance - past week

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

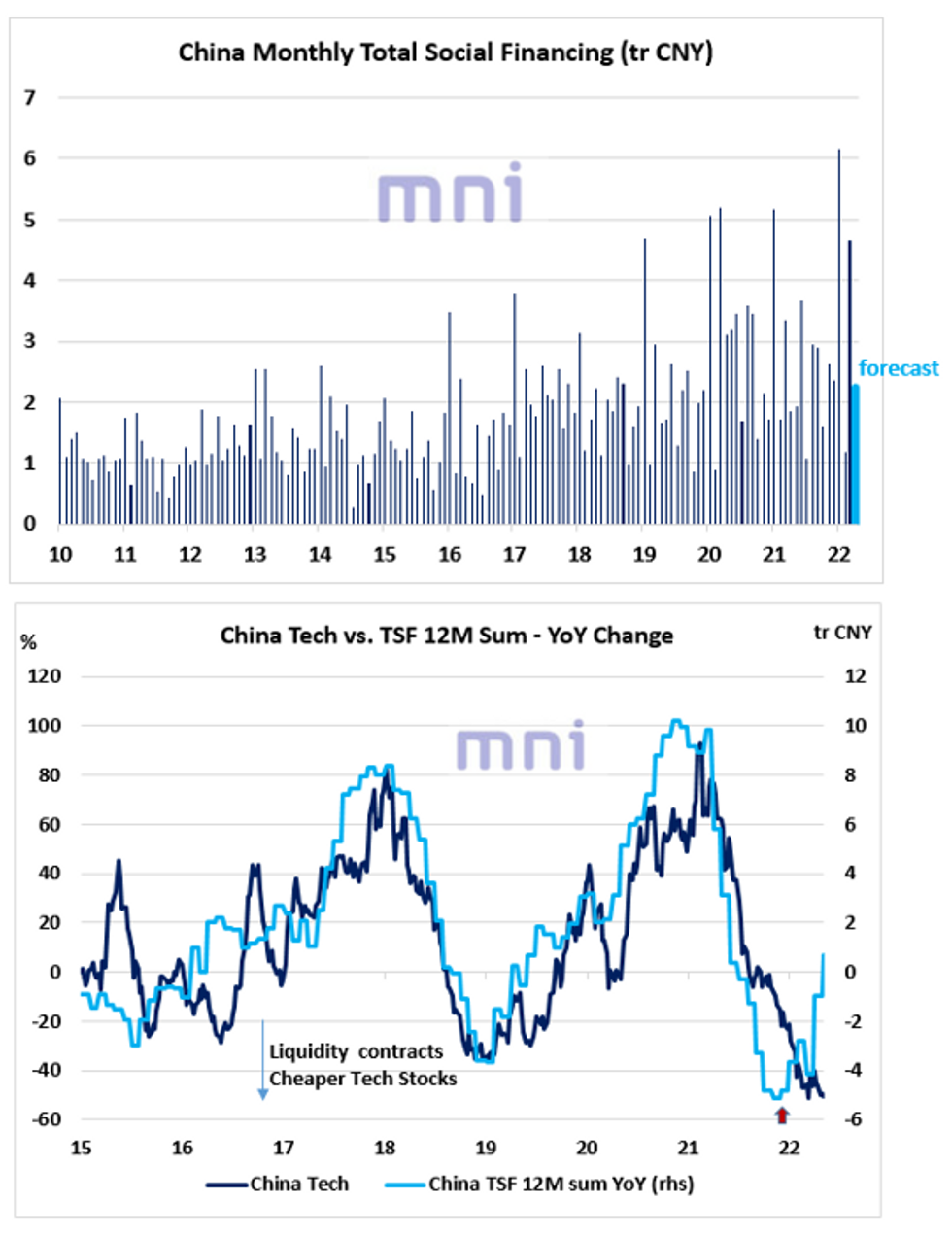

CROSS-ASSET: Chinese Liquidity To Continue To Rise, But Global Risk Off Leaves Risky Assets Vulnerable

EXECUTIVE SUMMARY

- China ‘liquidity’ is expected to continue to increase in April; however, global risk off environment driven by the surge in stagflation risk combined with the geopolitical uncertainty leaves risky asset vulnerable in the near term.

- China remains the ‘cheapest’ equity market among the EM world using a price-to-book z-score approach.

- The easing policy signals combined with the rise in liquidity have been mostly impacting the Chinese yuan, which is now down over 5% since mid April.

- Link to full publication: ChinaPreview.pdf

This week, the PBoC is expected to release its April update on the aggregate financing data, which is expected to rise by 2.2tr CNY after a 4.65tr CNY jump in March (top chart).

China annual change in ‘liquidity’, which we define as the annual change in the Total Social Financing (TSF) 12M sum, is expected to continue to rise, increasing to 667bn CNY (up from a record low of -5.1tr CNY reached in October 2021). Even though the rise in liquidity should be strongly supporting risky assets (particularly ‘liquidity sensitive’ sector such as tech), the global risk off environment has left China equities vulnerable. The bottom chart shows that China tech stocks have been performing poorly despite the rebound in liquidity since the start of the year.

Source: MNI - Market News/Bloomberg

EQUITIES: Hang Seng Gaps Down Again; Chinese Stocks Gain As Support For SMEs Outlined

Most Asia-Pac equity indices are in the red on a negative lead from Wall St., with the MSCI Asia Pacific Index tipped to close lower for a seventh straight session.

- The ASX200 sits 1.4% weaker at typing, paring earlier losses of ~2.5% (fresh three-month lows at the time). Steep losses were seen in major mining stocks with the ASX200’s materials and energy sub-indices leading losses, tracking broad declines in major commodity benchmarks. Australian tech equities fared a little better as seen in the S&P/ASX All Technology Index trading 0.2% lower at writing, although notable losses in index heavyweight Block Inc (-12.8%) largely neutralised gains elsewhere in the sector.

- The Hang Seng Index is on track to close in the red for a fourth straight session, sitting 2.8% lower at typing, led by weakness in China-based tech stocks. The Hang Seng Tech Index correspondingly sits 4.7% worse off, with steep losses seen in large-caps JD.com (-9.7%), Tencent Holdings (3.7%), and Trip.com (-7.4%). Headlines proclaiming the exit of global investors from Chinese equities have been gaining momentum in recent weeks, with titan BlackRock reported on Monday to have changed their previously bullish stance, citing growth risks from pandemic control measures. Regulatory measures imposed by the Chinese authorities on internet live streaming platforms over the weekend again sparked debate re: recent pledges for regulatory reprieve and targeted support towards internet platform companies.

- The CSI 300 was the sole major Asia-Pac index to notch gains, sitting 0.2% firmer at typing, reversing earlier losses after opening at two-week lows (~1.5% lower). The bid in Chinese equities came largely after the State Council and PBOC issued guidance supportive of SMEs, with the former outlining that local authorities should provide small businesses with subsidies for rent, utilities, and insurance, while also highlighting separate (but related) guidance to banks in areas such as loan extensions and forex hedging.

- U.S. e-mini equity index futures deal 0.3% to 0.8% firmer at writing after hitting fresh cycle lows earlier in Asia-Pac dealing, with Nasdaq contracts trading around levels last witnessed in end-’20.

GOLD: Key Support Eyed Ahead Of Fedspeak; Ukraine Escalation Risk Put Away For Now

Gold trades ~$6/oz higher, printing $1,860/oz at writing. The precious metal has risen a little above Monday’s worst levels at writing catching a bid as nominal U.S. Tsy yields continue to trade around the bottom of their respective ranges on Monday.

- To recap Monday’s price action, gold closed ~$30/oz lower, hitting one-week lows as U.S. real yields broadly moved higher by the session’s end, while the USD (DXY) was little changed on the day after backing away from fresh 20-year highs.

- Looking to Russia, Putin’s Victory Day speech made on Monday overall showed no indication of meaningful escalation in the Russia-Ukraine war, easing prior worry from some quarters re: a wider conflict. Defence analysts have however highlighted significant unresolved issues such as an “off-ramp” for Russia to de-escalate, as well as the lingering possibility of escalation in the coming weeks given the plausibly inconvenient timing (May is a traditional Russian holiday period).

- A note that a packed Fedspeak slate is due later today from the likes of Williams (voter), Barkin (‘24), Waller (voter), Kashkari (‘23), and Mester (‘24).

- From a technical perspective, gold remains vulnerable after moving below support at the 50-Day EMA, and trades a short distance away from support at $1,848.8/oz (76.4% retracement of the Jan28-Mar8 rally). On the other hand, resistance sits at $1,909.8/oz (May 5 high).

OIL: Fresh One-Week Lows In Asia As Soft Economic Data Abounds

WTI and Brent are ~$1.50 worse off apiece at typing, extending Monday’s losses and operating a little above their respective one-week lows made earlier in the session.

- To recap, both benchmarks notched ~$6 declines on Monday, tracking broader selloffs in equities globally with worry evident re: China’s ongoing pandemic control measures and global stagflation risks, while a fresh 20-year high in the USD (DXY) applied some pressure to the space.

- On stagflation worry, a NY Fed survey released on Monday pointed to rising long-term inflation expectations amongst consumers, suggesting expectations for slower growth as well. Looking at Europe, a German economist was cited as saying that an end to Russian gas imports would see a “deep recession” in Europe’s biggest economy and trigger half a million job losses “by most calculations”, coming as Russia has already cut gas supplies off EU members Poland and Bulgaria.

- Turning to China, COVID cases in China have continued their steady descent, although authorities have continued to double down on the country’s zero-COVID policy, elevating uncertainty re: lockdowns across the country. Recent economic data releases have shown Chinese exports slowing to their weakest pace in nearly two years, with refinery throughput estimated to have fallen ~6%, the sharpest such decline since early 2020.

- Elsewhere, a Platts survey has pointed to collective production in OPEC+ for April falling ~2.59mn bpd short of the current production quota, led lower by struggling Russian production amidst well-documented difficulties in the Russian crude industry.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/05/2022 | 0600/0800 | * |  | NO | CPI Norway |

| 10/05/2022 | 0800/1000 | * |  | IT | Industrial Production |

| 10/05/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 10/05/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 10/05/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 10/05/2022 | 1140/0740 |  | US | New York Fed's John Williams | |

| 10/05/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 10/05/2022 | 1315/0915 |  | US | Richmond Fed's Tom Barkin | |

| 10/05/2022 | 1345/0945 |  | US | Treasury Secretary Janet Yellen | |

| 10/05/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 10/05/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 10/05/2022 | 1700/1300 |  | US | Minneapolis Fed's Neel Kashkari and Governor Christopher Waller | |

| 10/05/2022 | 1720/1920 |  | EU | ECB de Guindos at IESE Banking Industry Meeting | |

| 10/05/2022 | 1900/1500 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.