-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China 5-Year LPR Fixing Moves Lower, Boosting Property Sector Suppor

EXECUTIVE SUMMARY

- LATEST CHINESE 5-YEAR LPR FIXING MOVES 15BP LOWER, 1-YEAR UNCHANGED

- SHANGHAI FINDS FIRST COVID-19 OUTSIDE QUARANTINE IN SIX DAYS (BBG)

- SHANGHAI ISSUES RETURN-TO-OFFICE RULE FOR BANKERS AS VIRUS EASES (BBG)

- FED’S KASHKARI: STRONG HOUSEHOLD FINANCES MAY MEAN FED MUST TO DO MORE (RTRS)

- SUGGESTIONS BIDEN & XI COULD SPEAK WITHIN “WEEKS”

- MR. YEN SAYS CURRENCY MAY WEAKEN TO 150 LEVEL LAST SEEN IN 1990 (BBG)

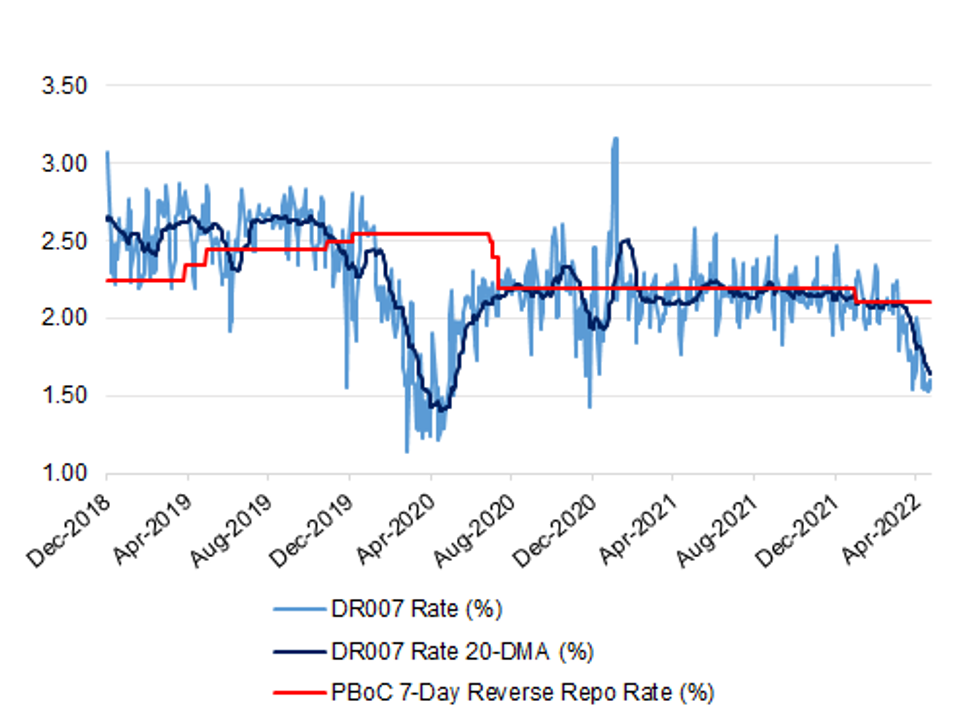

Fig. 1: China DR007 Rate Vs. PBoC 7-Day Reverse Repo Rate (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: The UK chancellor Rishi Sunak is under mounting Conservative pressure to radically cut taxes in the coming months. The question facing him is whether he can do it without pouring fuel on the inflationary fire. Cabinet ministers including Liz Truss and Jacob Rees-Mogg have led calls for Sunak to reduce the highest tax burden seen in Britain for 70 years, to help households cope with inflation that has hit a 40-year high of 9 per cent. Conservative MPs in recent days have piled pressure on Sunak. Sir Bernard Jenkin, a senior Tory MP, told the Financial Times he wanted to see value added tax abolished on domestic energy bills. Sir Edward Leigh, another Tory grandee, said Sunak had to move “in a far more radical direction on the overall tax burden”. According to one former cabinet minister, the chancellor should “cut taxes and reduce VAT across the board”. To the dismay of some Tory rightwingers, Sunak has left open the idea of actually increasing taxes on one sector, in the form of a windfall tax on UK oil and gas companies. David Canzini, Prime Minister Boris Johnson’s influential deputy chief of staff, is opposed, according to Conservative party insiders. “Canzini is always telling us we need to go back to Tory fundamentals,” said one. (FT)

EUROPE

ITALY: Italian Prime Minister Mario Draghi on Thursday made it clear to the broad coalition supporting his government that he had enough of their quarreling and foot- dragging on reforms worth billions of euros of European funds. Draghi called an emergency cabinet meeting late on Thursday, catching ministers off guard and sparking speculation of an imminent government crisis in Roman palazzos. The surprise gathering came after yet another day that yielded no progress on a key law needed to secure European Union post-Covid reconstruction money. In the end, the cabinet meeting proved anticlimactic. At a session that according to wire reports lasted a mere 10 minutes, Draghi secured support for a confidence vote on a law aimed at enhancing competition. The particularly thorny piece of legislation has been stuck in a Senate committee since before Easter. (BBG)

RIKSBANK: Sweden has an urgent need for further policy tightening so that the central bank does not have to take even tougher measures further ahead, Deputy Governor Martin Floden said on Thursday. "It is urgent to hike rates once or several times," Floden said. "Partly, because inflation now is high and we don't want it to become entrenched and the longer we wait, potentially the more we need to react," Floden said. A second reason was to gauge how the economy reacts to rate hikes, which have been very uncommon in recent years, he said. (RTRS)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on Slovenia (current rating: A; Outlook Stable)

- Moody’s on Malta (current ratings: A2; Outlook Negative) & Portugal (current rating: Baa2; Outlook Stable)

- S&P on Ireland (current rating: AA-; Outlook Stable) & Slovakia (current rating: A+; Outlook Stable)

- DBRS Morningstar on Lithuania (current rating: A (high), Stable Trend)

U.S.

FED: Minneapolis Federal Reserve Bank President Neel Kashkari on Thursday suggested that because household finances are in some cases in better shape than before the pandemic, the Fed may end up needing to raise rates further to bring inflation under control. "Are these stronger balance sheets leading people to spend more, or be more confident, to just change their behavior, their spending patterns, and is that more sustainable - in which case maybe the Fed has to be even more aggressive," Kashkari told the Urban Institute. (RTRS)

FED: The U.S. Federal Reserve will lift interest rates higher by the end of this year than anticipated just a month ago, keeping alive already-significant risks of a recession, a Reuters poll of economists found. While U.S. inflation, running at a four-decade high, may have peaked in March, the Fed's 2% target is still far out of reach as disruptions to global supply chains continue to keep price rises elevated. The May 12-18 Reuters poll showed a near-unanimous set of forecasts for a 50-basis-point hike in the fed funds rate, currently set at 0.75%-1.00%, at the June policy meeting following a similar move earlier this month. One forecaster anticipated a hike of 75 basis points. The Fed is expected to hike by another 50 basis points in July, according to 54 of 89 economists, before slowing to 25- basis-point hikes for the remaining meetings this year. But 18 respondents predicted another half-percentage-point rise in September too. A majority of poll respondents now expect the fed funds rate to be at 2.50%-2.75% or higher by the end of 2022, six months earlier than predicted in the previous poll, and roughly in line with market expectations for a year-end rate of 2.75%-3.00%. That would bring it above the "neutral" level that neither stimulates nor restricts activity, estimated at around 2.4%. (RTRS)

FED: Treasury Secretary Janet Yellen rejected any idea that the Federal Reserve and its counterparts should boost their inflation targets given the importance of stable price expectations at a time when living costs are surging. “I don’t immediately see that as a reason to change,” the inflation target, Yellen told reporters Thursday in Bonn, Germany, referring to the potential for deglobalization to boost the trend rate of price increases. “The challenge is to meet the inflation targets that have been established.” US consumer prices have surged by more than an 8% annual rate the past two months, and some economists have questioned whether the Fed will be able to bring gains down to the 2% target for years. That’s in turn spurred speculation the Fed may need to boost its target. (BBG)

CORONAVIRUS: The Centers for Disease Control and Prevention’s independent vaccine experts recommended a Pfizer Covid booster shot for children ages 5 to 11 on Thursday, as infections rise across the country and immunity from the first two doses wanes off. The committee voted 11-1 in favor of a booster for the age group. CDC Director Rochelle Walensky will likely sign off on the panel’s recommendation, which would allow pharmacies, doctors’ offices and other health-care providers to start administering the shots. (CNBC)

EQUITIES: Senate Majority Leader Chuck Schumer (D-N.Y.) intends to put bipartisan tech antitrust legislation up for a vote by early summer, a Democratic source familiar with the situation tells Axios. Schumer is in charge of the Senate's agenda, and if the bill doesn't pass soon, its prospects in the next Congress look shaky. The legislation would then have to pass the House, where there is a companion bill. (Axios)

ENERGY: A closely divided House approved legislation Thursday to crack down on alleged price gouging by oil companies and other energy producers as prices at the pump continue to soar. A bill backed by House Democrats would give President Joe Biden authority to declare an energy emergency that would make it unlawful to increase gasoline and home energy fuel prices in an “excessive” or exploitative manner. The bill directs the Federal Trade Commission to punish companies that engage in price gouging and adds a new unit at the FTC to monitor fuel markets. (AP)

OTHER

GLOBAL TRADE: The world only has 10 weeks worth of wheat consumption in reserve, the lowest since the 2008 financial crisis, according to agriculture analysis firm Gro Intelligence. That’s more dire than other estimates. While governments peg global wheat inventories at 33% of annual consumption, Gro Intelligence CEO Sara Menker told a United Nations Security Council meeting on food security Thursday that the figure is actually closer to 20%. Menker, who has long warned about a future food crisis, said urgent action is needed to combat the growing threat of hunger. Soaring crop prices have put millions more at risk, while droughts and soaring fertilizer prices threaten to further reduce grain supplies. “This isn’t cyclical. This is seismic,” said Menker, a former energy commodities trader who predicted the crisis before the pandemic snarled supply chains. “It’s a once-in-a-generation occurrence that can dramatically reshape the geopolitical era.” (BBG)

GLOBAL TRADE: The US and United Nations Secretary-General Antonio Guterres are reviewing plans for the possible export of Ukrainian grain by railway through Belarus to the Lithuanian port of Klaipeda, the Wall Street Journal reported, citing unidentified US officials. The US may offer a six-month sanctions break on Belarus’s potash fertilizer industry, the newspaper said. Belarus’s main potash producer, which accounts for about a fifth of global supply, was hit with US sanctions last year to limit the financial benefits that President Alexander Lukashenko’s regime derives from exports. (BBG)

GLOBAL TRADE: Ukraine’s total area sown with corn fell 29% from a year earlier to about 3.8 million hectares, the Grain Association said. Global food costs are poised to climb further as drought, floods and heat waves threaten production worldwide just as Russia’s war in Ukraine throttles supply from one of the largest growers. (BBG)

GLOBAL TRADE: The federal government has banned Huawei from working on Canada's fifth-generation networks over security concerns — a decision critics say was long overdue. The move puts Canada in line with key intelligence allies like the United States which have expressed concerns about the national security implications of giving the Chinese tech giant access to key infrastructure. The government is also banning ZTE, another Chinese state-backed telecommunications firm. A government policy statement posted online says companies will have until June 28, 2024 to remove or terminate 5G equipment from Huawei and ZTE. They'll also have to remove or terminate any existing 4G equipment provided by the companies by December 31, 2027. The policy statement says the government expects companies to stop purchasing new 4G or 5G equipment from the companies by September of this year. "This is the right decision and we are pleased to announce it today because it will secure our network for generations to come," Innovation, Science and Industry Minister François-Philippe Champagne told a news conference Thursday. (CBC)

U.S./CHINA: U.S. President Joe Biden may talk with his Chinese counterpart Xi Jinping in the coming weeks, national security adviser Jake Sullivan said aboard Air Force One on Thursday. “I wouldn't be surprised if, in the coming weeks, President Biden and President Xi speak again," he said. (RTRS)

G7: The Group of Seven economic powers are determined to keep markets open, a draft G7 finance chief's communique said on Thursday in the face of moves from some countries to impose export controls on scarce agriculture commodities. "We are committed to keeping markets open and enhancing the resilience of agricultural and energy markets in line with climate and environmental goals," said the communique that is to be finalised before the meeting ends on Friday. It added that G7 central banks were closely monitoring the impact of price pressures on inflation expectations and would continue to calibrate the pace of monetary policy tightening according to economic data and in a clearly communicated way. (RTRS)

GEOPOLITICS: NATO’s top military brass welcomed Sweden’s and Finland’s applications to join, saying the aspiring members would boost the alliance’s security due to their land mass, modern capabilities and already high level of integration with allies. Asked how challenging it would be for the alliance to defend the two countries’ large geographic areas, archipelagoes and forests, NATO’s supreme allied commander for Europe, US General Tod Wolters, said “we look at those attributes as tremendous opportunities to improve our ability to comprehensively deter.” With Sweden and Finland in the alliance, they would also be able to share tactics, techniques and procedures in all domains, as allies would with them. “There are unique regional aspects that they have more expertise on than we’ve seen in the past,” he said. (BBG)

GEOPOLITICS: Finland will go through the demands Turkey has expressed in opposing Finland's and Sweden's plans to join the NATO military alliance, Finnish President Sauli Niinisto said on Thursday, after meeting with U.S. President Joe Biden and his Swedish counterpart at the White House. "We have reason to go through appropriately what Turkey has expressed and then provide our clear answers," Niinisto told reporters, adding he believes the matter would be discussed on a "high level." (RTRS)

GEOPOLITICS: Anticipating a potential future showdown over Taiwan, China is learning lessons from the war in Ukraine -- including from Russia’s failure so far to make extensive use of cyber warfare, an analyst said in Washington. In the view from Beijing, the US and allies “are fighting Russia today but might fight China next,” Bonny Lin, director of the China Power Project at the Center for Strategic and International Studies, told a House Foreign Affairs panel. China is taking steps to insulate itself strategically and economically, including making investments in food, energy and raw materials and developing alternatives to interconnected supply-chains and the SWIFT financial messaging service, she said. (BBG)

GEOPOLITICS: The US and Japan are planning to urge China to wind down its nuclear arsenal in a joint statement by President Joe Biden and Prime Minister Fumio Kishida after their summit next week, Yomiuri reports, without saying where it obtained the information. Joint statement to call for China to be transparent on the size of its current nuclear stockpile. Estimated to hold 350 warheads, trailing only the US and Russia, according to the Stockhold International Peace Research Institute. (BBG)

JAPAN: Japanese Finance Minister Shunichi Suzuki said on Thursday he called on his G7 counterparts to reaffirm the group's agreement on exchange-rate policy. "I explained how recent currency moves have been rapid, and that it was important to reaffirm the G7 agreement on exchange-rate policy," Suzuki told reporters after attending the first day of a Group of Seven finance leaders' gathering that ends on Friday. "I also told the meeting Japan will respond appropriately to exchange-rate moves, while communicating closely with G7 members," he said. (CNA)

JAPAN: The yen has the potential to drop to levels last seen in 1990 on Japan’s deepening monetary policy divergence with the US, Eisuke Sakakibara said. Nicknamed “Mr Yen” for his ability to influence the currency during his tenure as Japan’s vice finance minister from 1997-1999, Sakakibara said the contrast between a hawkish Federal Reserve and Bank of Japan’s loose monetary policy remains the single biggest driver of the yen’s weakness. Until that gap narrows, the yen is likely to remain under pressure against the world’s reserve currency. (BBG)

JAPAN: Japanese Prime Minister Fumio Kishida is planning to announce his administration’s plan to increase defense spending in a summit meeting with US President Joe Biden, broadcaster TV Asahi reports, without attribution. Kishida will consider the level of NATO members’ defense budget, which is ~2% of GDP, in boosting the spending. Premier will raise cooperation on semiconductor R&D and production as well as Japan’s participation in the Indo-Pacific Economic Framework. Will reaffirm importance of peace and stability in the Taiwan Strait; will call on China to be transparent on its nuclear warheads and urge it to reduce stockpile. (BBG)

RBNZ: New Zealand's central bank will hike its policy interest rate by half a percentage point to counter soaring inflation when it meets on May 25, making a hike of that magnitude for the first time at successive meetings, a Reuters poll found. The 50 basis point hike last month was the biggest increase in official cash rate (OCR) for two decades, and the Reserve Bank of New Zealand (RBNZ) signalled then that more hikes were needed to bring inflation under control after it hit a three decade high last quarter. All but one of 21 economists in the May 13-19 Reuters poll forecast the RBNZ would hike the OCR by 50 basis points again to 2.00% at the meeting next Wednesday. One economist expected a 25 basis point hike. It would be the first time since the OCR's introduction in March 1999 that RBNZ has raised the rate by half a percentage point at two consecutive policy meetings. (RTRS)

SOUTH KOREA: South Korea is expected to face a "grave" risk from rising inflation for the time being, as the recovery of consumption will further add price pressure amid high energy costs, a senior government official said Friday. The government plans to beef up its monitoring of key items, including cooking oil and petroleum products, in a bid to ease the burden from elevated inflation, according to First Vice Finance Minister Bang Ki-sun. "Price situations facing the South Korean economy are not good," Bang said at the government's first vice ministerial meeting on inflation. (Yonhap)

ASIA: Asian economies must be mindful of spillover risks as a decade of unconventional easing policies by major central banks is withdrawn faster than expected, International Monetary Fund (IMF) Deputy Managing Director Kenji Okamura said. This risk applied particularly to the most vulnerable economies, said Okamura, without naming them. Asian economies faced a choice between supporting growth with more stimulus and withdrawing it to stabilise debt and inflation, he said. While Bank of Japan policy runs counter to a global shift towards monetary tightening, central banks in the United States, Britain and Australia raised interest rates recently. Okamura, a former Japanese vice finance minister for international affairs, also said the COVID-19 pandemic, the war in Ukraine and tighter global financial conditions would make this year "challenging" for Asia. The war was affecting Asia through higher commodity prices and slower growth in Europe, he said. Speaking at his first media event since becoming one of four deputy managing directors at the global lender last year, Okamura warned on the prospect of even more forceful tightening if inflation expectations kept on "drifting". "There is a risk that drifting inflation expectations could require an even more forceful tightening," he said. Okamura called for calibrated policies and clear communication. (RTRS)

BRAZIL: Brazil's Economy Ministry maintained on Thursday its forecast of a 1.5% increase in gross domestic product this year and 2.5% next year, as previously reported by Reuters on Wednesday. The ministry raised the IPCA consumer price index projection to 7.9% in 2022 from 6.55% seen in its previous outlook, from March. Inflation in 2023 is now seen at 3.6% from 3.25% before. (RTRS)

RUSSIA: Russian forces will take Ukrainian territory all the way to the “historical borders” of the Donetsk and Luhansk regions and “demilitarize” nearby areas, a top Kremlin official said, reconfirming Moscow’s ambitious war aims there even as its troops struggle to advance against heavy Ukrainian resistance. Sergei Kiriyenko, first deputy chief of the presidential staff, didn’t indicate a time frame for the takeovers in a televised meeting with youth groups. Occupation authorities in the territories held by Russia have suggested they’re likely to seek annexation by Moscow. The Kremlin’s public statements on its aims have shifted over the months since the Feb. 24 invasion. President Vladimir Putin said then that Russia didn’t plan to occupy Ukraine. Since then officials have laid out plans to permanently hold at least the territories occupied by Russian forces in the east and south. Ukraine has refused to cede any land in now-stalled peace talks. (BBG)

RUSSIA: Russia's Chief of General Staff Valery Gerasimov and U.S. Joint Chiefs of Staff Chairman General Mark Milley held a phone call, RIA news agency reported on Thursday, citing the Russian defence ministry. They discussed issues of "mutual interest", including Ukraine, RIA said. The call took place six days after a phone conversation between the defence ministers of the two countries, their first since Russia launched what it calls its special military operation in Ukraine. (RTRS)

RUSSIA: The White House is working to put advanced anti-ship missiles in the hands of Ukrainian fighters to help defeat Russia's naval blockade, officials said, amid concerns more powerful weapons that could sink Russian warships would intensify the conflict. Ukraine has made no secret it wants more advanced U.S. capabilities beyond its current inventory of artillery, Javelin and Stinger missiles, and other arms. Kyiv's list, for example, includes missiles that could push the Russian navy away from its Black Sea ports, allowing the restart of shipments of grain and other agricultural products worldwide. Current and former U.S. officials and congressional sources have cited roadblocks to sending longer range, more powerful weapons to Ukraine that include lengthy training requirements, difficulties maintaining equipment, or concerns U.S. weaponry could be captured by Russian forces, in addition to the fear of escalation. (RTRS)

RUSSIA: The Biden administration announced $100 million in military assistance to Ukraine including artillery, radar and other equipment ahead of the $40 billion Ukraine aid package sent to him by Congress on Thursday. Biden said the package will “allow us to send even more weapons and ammunition to Ukraine, replenish our own stockpile and support US. troops stationed on NATO territory.” The Pentagon said the equipment will include 18 155MM howitzers, their carriers and three counter-artillery radars. Defense Department spokesman John Kirby said the artillery is proving “critical” equipment for Ukrainian forces. He said the $100 million exhausts existing “drawdown” authority from US stockpiles. The latest shipments will bring the total amount of US military assistance provided to Ukraine since Russia’s invasion to $3.9 billion. (BBG)

RUSSIA: Training for Ukrainian soldiers on heavy artillery has started in Germany, Chancellor Olaf Scholz said in a joint press conference with Dutch Prime Minister Mark Rutte in the Netherlands on Thursday. Rutte pledged more military support for Ukraine from Germany and the Netherlands but said there won’t be more shipments of howitzers. There are limits to “what we can do,” Rutte said. (BBG)

RUSSIA: U.S. Treasury Secretary Janet Yellen said the G7 finance leaders on Thursday agreed to provide Ukraine the financial resources it needs in its struggle against Russia's invasion, but did not confirm an $18.4 billion figure pledged in the group's draft communique. Yellen told reporters after the first day of a G7 finance ministers and central bank governors' meeting here that pledges exceeded the $15 billion in economic support that Ukraine has estimated it needs over the next three months, with U.S. legislation including $7.5 billion in economic aid, the European Commission pledging 9 billion euros and other countries, including Canada and Germany, pledging additional amounts. "The message was, 'We stand behind Ukraine. We're going to pull together with the resources that they need to get through this,'" Yellen said. (RTRS)

RUSSIA: German Chancellor Olaf Scholz upped the pressure on predecessor Gerhard Schroeder to leave his lucrative jobs as chairman of both the state-owned Russian oil giant Rosneft PJSC and the shareholders’ committee of Nord Stream AG following Russia’s invasion of Ukraine. Schroeder, 78, served as chancellor from 1998 to 2005, but the former leader has become an embarassment to his party for refusing to cut his close ties to Russian President Vladmir Putin and Moscow’s state-owned energy companies. Scholz welcomed a decision by lawmakers of his ruling coalition to strip Schroeder of his office in the lower house of parliament. (BBG)

SOUTH AFRICA/RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- S&P on South Africa (current rating: BB-; Outlook Stable)

OIL: Treasury Secretary Janet Yellen said officials have discussed secondary sanctions and other ways to limit Russia’s oil revenues while minimizing the impact on energy prices during a meeting of finance ministers from the Group of Seven countries. The US has already banned oil imports from Russia, and European Union countries are aiming to do the same thing, gradually over the next year. In the meantime, G-7 officials also discussed the potential of using secondary sanctions to enforce a price cap on Russian oil, Yellen told reporters. (BBG)

CHINA

PBOC: PBOC: Chinese banks cut a key interest rate for long-term loans by a record amount, a move that would reduce mortgage costs and may help counter weak loan demand caused by a property slump and Covid lockdowns. The five-year loan prime rate, a reference for home mortgages, was lowered to 4.45% from 4.6%, according to a statement by the People’s Bank of China Friday. That was the largest reduction since a revamp of the rate in 2019. A majority of economists surveyed by Bloomberg had predicted a cut by five to 10 basis points. The cut is a significant move to boost loan demand, as consumer and business confidence has been battered by Covid lockdowns and a downturn in the property sector that has seen a string of developer defaults and falling home prices. The lower rate will be applied to new mortgages immediately, while existing mortgages won’t be repriced until next year at the earliest. (BBG)

POLICY: China’s plans to bolster growth as Covid outbreaks and lockdowns crush activity will see a whopping $5.3 trillion pumped into its economy this year. The figure -- based on Bloomberg’s calculation of monetary and fiscal measures announced so far -- equates to roughly a third of China’s $17 trillion economy, but is actually smaller than the stimulus in 2020 when the pandemic first hit. That suggests even more could be spent if the economy fails to pick up from its current funk -- a possibility raised by Premier Li Keqiang earlier this week. (BBG)

YUAN: The yuan may fluctuate between 6.7 to 7.0 against the U.S. dollar in the near term as the central bank may intervene to prevent any rapid depreciation, wrote Zhang Ming, senior fellow of the Institute of Finance and Banking at the Chinese Academy of Social Sciences in a blog post. Neither inflation nor the currency would be a constraint on the central bank to continue with monetary easing in the short term, as higher inflation is still half a year away, said Zhang. Monetary policy should be looser with rate and RRR cuts to match with fiscal expansion to boost the economy, Zhang added. (MNI)

ECONOMY: Output of Shanghai's industries, located at the heart of manufacturing in the Yangtze River Delta, shrank 61.5% in April from a year earlier, the local statistics bureau said on Friday, slammed by a city-wide COVID lockdown. That compared with a 7.5% drop in March. (RTRS)

FISCAL: China should issue CNY2 trillion of special Treasury bonds to fund epidemic control and subsidise consumer coupons to lower-income groups, the Securities Times reported citing analysts. Fiscal policy should strengthen support for financing small businesses by offering fiscal discounts, loan guarantees or increasing the write-off of non-performing loans, the newspaper cited analysts as saying. It is necessary to expand fiscal discounts for struggling companies, the newspaper said citing Wang Yifeng, chief banking analyst at Everbright Securities. (MNI)

CORONAVIRUS/FISCAL: Shanghai will focus on helping small and medium-sized enterprises to resume operations from the Covid-19 lockdown, the Shanghai Securities News reported. Many SMEs especially in catering, entertainment, maintenance, and logistics were hit hard by the epidemic, the newspaper said. The government will prioritise refunding taxes for SMEs, and it is estimated that enterprises in Shanghai will see relief totaling about CNY140 billion in 2022, the newspaper said. The government will also magnify financing guarantees for SMEs to help them renew their loans, the newspaper said. (MNI)

CORONAVIRUS: Shanghai found the first cases of Covid-19 outside of quarantine in six days, raising questions about whether the easing of the city’s lockdown will be impacted. Total infections in Shanghai rose to 858 on Thursday from 719 on Wednesday, with three of the cases found outside of government quarantine. Authorities started to ease the lockdown -- which had confined residents to their homes and curtailed business activity -- earlier this week after the city hit a milestone of three days of zero community transmission. (BBG)

CORONAVIRUS: Shanghai issued detailed rules for financial companies in the city’s Pudong district to resume operations after signs that a major Covid-19 outbreak has been put under control. Under the rules, employees returning to work must not exceed 40% of total staff of a financial institution, the official Shanghai Securities News reported, citing the Pudong financial authority at a virtual meeting held Thursday evening. Workers will be allowed to return in batches, and in principle each batch shall not exceed 20% of a company’s total number of employees, it added. Financial institutions should resume work and production under closed-loop arrangements and in strict accordance with relevant epidemic prevention requirements. (BBG)

CREDIT: Another Chinese developer is preventing retail investors from buying its onshore debt after dramatic declines, as the industry continues to deal with a liquidity crisis and a record pace of missed bond payments. Jinke Properties Group Co. said in a stock exchange filing its move was in order to “protect investor interests and ensure stable bond-market operations.” Limiting buyers to institutional investors also occurred for yuan notes of China Evergrande Group and Sunac China Holdings Ltd. before both firms defaulted on dollar debt. Jinke is the country’s 18th-largest builder by contracted sales, according to China Real Estate Information Corp. But it’s not just developers that enact buying limits. Firms the past several years including Brilliance Auto Group Holdings Co. have also forbid individual investors from making bond purchases after prices fell sharply as the borrowers struggled with their debt. (BBG)

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Friday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9449% at 09:37 am local time from the close of 1.5848% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 46 on Thursday vs 44 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7487 FRI VS 6.7524

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7487 on Friday, compared with 6.7524 set on Thursday.

OVERNIGHT DATA

JAPAN APR CPI +2.5% Y/Y; MEDIAN +2.5%; MAR +1.2%

JAPAN APR CORE CPI +2.1% Y/Y; MEDIAN +2.0%; MAR +0.8%

JAPAN APR CORE-CORE CPI +0.8% Y/Y; MEDIAN +0.7%; MAR -0.7%

NEW ZEALAND APR TRADE BALANCE +NZ$584MN; MAR -NZ$581MN

NEW ZEALAND APR TRADE BALANCE 12 MTH YTD -NZ$9.117BN; MAR -NZ$9.303BN

NEW ZEALAND APR EXPORTS NZ$6.31BN; MAR NZ$6.48BN

NEW ZEALAND APR IMPORTS NZ$5.73BN; MAR NZ$7.06BN

NEW ZEALAND APR CREDIT CARD SPENDING +1.1% Y/Y; MAR +3.5%

NEW ZEALAND APR CREDIT CARD SPENDING +0.7% M/M; MAR +3.4%

SOUTH KOREA APR PPI +9.2% Y/Y; MAR +9.0%

UK MAY GFK CONSUMER CONFIDENCE -40; MEDIAN -39; APR -38

MARKETS

SNAPSHOT: China 5-Year LPR Fixing Moves Lower, Boosting Property Sector Support

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 316.66 points at 26720.04

- ASX 200 up 77.239 points at 7141.7

- Shanghai Comp. up 34.431 points at 3131.396

- JGB 10-Yr future up 23 ticks at 149.84, yield down 0.7bp at 0.236%

- Aussie 10-Yr future up 9.0 ticks at 96.680, yield down 8.5bp at 3.297%

- U.S. 10-Yr future +0-02+ at 119-25, yield up 0.18bp at 2.839%

- WTI crude down $1.36 at $110.85, Gold up $0.87 at $1842.44

- USD/JPY down 15 pips at Y127.66

- LATEST CHINESE 5-YEAR LPR FIXING MOVES 15BP LOWER, 1-YEAR UNCHANGED

- SHANGHAI FINDS FIRST COVID-19 OUTSIDE QUARANTINE IN SIX DAYS (BBG)

- SHANGHAI ISSUES RETURN-TO-OFFICE RULE FOR BANKERS AS VIRUS EASES (BBG)

- FED’S KASHKARI: STRONG HOUSEHOLD FINANCES MAY MEAN FED MUST DO MORE (RTRS)

- SUGGESTIONS BIDEN & XI COULD SPEAK WITHIN “WEEKS”

- MR. YEN SAYS CURRENCY MAY WEAKEN TO 150 LEVEL LAST SEEN IN 1990 (BBG)

US TSYS: Off Lows Even As China LPR Move Supports Equities

TYM2 last deals +0-02 at 119-24+, 0-03 shy of the peak of the 0-10+ Asia-Pac range, on volume of ~100K. Benchmark cash Tsys run 1bp cheaper to 1bp richer as the curve twist flattens, pivoting around 10s.

- Tsys unwound the cheapening impulse that came on the back of the latest Chinese 5-Year LPR fixing moving 15bp lower (consensus looked for a 5bp cut), with the move aimed at supporting the Chinese property sector. There wasn’t an overt reason for the uptick from session cheaps, with wider risk assets underpinned and a lack of major risk-negative headline flow evident.

- Note that earlier in the session we had some mixed headlines re: the COVID situation in the Chinese city of Shanghai (reopening plans for the financial district of Pudong were outlined vs. 3 COVID cases being detected outside of the city’s quarantine facilities).

- A Fox Business interview with St. Louis Fed President Bullard headlines domestically on Friday.

JGBS: A Firm End To The Week

JGB futures initially eased from late overnight levels on the back of slightly firmer than expected national core CPI data, although the move back from lows didn’t take long, probably given the focus on previous BoJ rhetoric, which foretold such a move (in rough absolute terms), while the Bank has played down the need to tweak its policy settings given the cost-push nature of the currently inflationary impulse (in addition to technicalities surrounding mobile phone charges). The BoJ remains focused on facilitating a rebound in economic growth and fostering an environment that will generate sustained underlying inflationary pressure.

- Futures then nudged higher through the remainder of the morning, before the previously outlined uptick from session cheaps for U.S Tsys provided support in the afternoon.

- A reminder that the BoJ’s continued presence in the market as it enforces its YCC conditions is seemingly limiting any sell offs in paper out to 10s at present.

- The latest round of 20-Year JGB supply came in on the firmer side and likely aided the bid further, with the cover ratio moving higher (topping the 6-auction average of 3.34x), price tail narrowing to a much more normal level vs. what was seen at the previous 20-Year auction and low price topping wider expectations. Stabilisation of the wider core global FI space, short covering and lifer demand likely resulted in the smooth passage of supply (factors we flagged in our auction preview).

- JGB futures last print +22, just off best levels, with cash JGBs running little changed to ~2.5bp firmer. 7s and the super-long end lead the bid, with 7s benefitting from the move in futures and the super-long end rallying in the wake of supply.

- In terms of flows, note that BBG headlines covering the monthly JSDA data pointed to foreign funds selling the largest monthly amount of 10-Year JGBs on record in April, while major domestic banks bought the largest amount of 10-Year JGBs since ’14 during the month, once again, per BBG headlines.

- Looking ahead to next week, Tokyo CPI headlines the domestic docket (Friday), with 40-Year JGB supply (Thursday) and the usual BoJ Rinban & fixed rate operations also due.

JGBS AUCTION: Japanese MOF sells Y964.3bn 20-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y964.3bn 20-Year JGBs:

- Average Yield 0.757% (prev. 0.724%)

- Average Price 100.74 (prev. 101.31)

- High Yield: 0.759% (prev. 0.742%)

- Low Price 100.70 (prev. 101.00)

- % Allotted At High Yield: 68.5886% (prev. 98.7309%)

- Bid/Cover: 3.765x (prev. 3.102x)

JGBS AUCTION: Japanese MOF sells Y4.7714tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.7714tn 3-Month Bills:

- Average Yield -0.1210% (prev. -0.1218%)

- Average Price 100.0302 (prev. 100.0304)

- High Yield: -0.1162% (prev. -0.1142%)

- Low Price 100.0290 (prev. 100.0285)

- % Allotted At High Yield: 54.1000% (prev. 62.4000%)

- Bid/Cover: 2.818x (prev. 3.231x)

AUSSIE BONDS: Tight, Pre-Election Trade

Aussie bond futures have been happy to hug tight ranges, generally tracking gyrations in risk sentiment, with participants on the sidelines ahead of the weekend, filtering through news re: domestic political matters. That leaves YM +6.0 and XM +8.5 at typing, with the contracts never straying too far from late overnight levels during the first half of Sydney trade. 10s provide the firmest point on the wider cash ACGB curve. EFPs are a touch tighter today, with the 3-/10-Year EFP box flattening. Bills run 2-9bp firmer through the reds.

- A quick reminder that the Federal election that will take place over the weekend. It isn’t expected to be too much of a market moving event given the lack of meaningful policy differentiation observed between the ruling coalition and opposition Labor Party. The ruling coalition has narrowed the gap to the opposition during the run in, although most projections still point towards a slim majority for Labor when the dust settles (read more on the matter in our full preview of the event: https://marketnews.com/mni-political-risk-analysis-australia-election-preview )

- Some still pointed to election risk as a headwind for the ASX & AUD on Friday. On this front, we would suggest that a hung parliament outcome (which may require some form of Labor-Green power sharing agreement) would provide much more uncertainty than a win for the opposition Labor Party (which the opinions polls currently lean towards) or the ruling coalition.

- On the supply side, market stabilisation, a digestible DV01, as well as the recent demand for access the line as seen in the RBA’s SLF mechanism in recent days and the relative rarity when it comes to taps of the line seemed to combine to result in a well-received round of ACGB Apr-27 supply. The weighted average yield printed 1.22bp through prevailing mids (per Yieldbroker), with the cover ratio comfortably above 3.00x (very solid in post-QE times). Next week’s AOFM issuance slate sees the AOFM revert to a combination of 10- & 30-Year basket issuance.

AUSSIE BONDS: The AOFM sells A$700mn of the 4.75% 21 Apr ‘27 Bond, issue #TB136:

The Australian Office of Financial Management (AOFM) sells A$700mn of the 4.75% 21 April 2027 Bond, issue #TB136:

- Average Yield: 2.9758% (prev. 0.9920%)

- High Yield: 2.9775% (prev. 0.9950%)

- Bid/Cover: 3.2914x (prev. 5.7950x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 71.8% (prev. 46.2%)

- Bidders 40 (prev. 53), successful 13 (prev. 16), allocated in full 8 (prev. 8)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Tuesday 24 May it plans to sell A$150mn of the 0.25% 21 November 2032 Indexed Bond.

- On Wednesday 25 May it plans to sell A$300mn of the 1.75% 21 June 2051 Bond.

- On Thursday 26 May it plans to sell A$1.0bn of the 26 August 2022 Note & A$500mn of the 23 September 2022 Note.

- On Friday 27 May it plans to sell A$800mn 1.50% 21 June 2031 Bond.

EQUITIES: Better Bid In Asia As Chinese 5-Year LPR Lowered

A larger than expected cut in the latest Chinese LPR fixing, aimed at boosting support for the property sector, facilitated a bid in the major Asia-Pac regional indices ahead of the weekend, even with mixed headlines coming out of Shanghai re: COVID (reopening plans for the financial district of Pudong were outlined vs. 3 COVID cases being detected outside of the city’s quarantine facilities). Elsewhere, risk assets may have benefitted from White House suggestions that Presidents Biden & Xi could speak again, within weeks.

- This leaves the major regional equities up 1-2% at typing, with the ASX 200 slightly lagging vs. its regional counterparts. Some pointed to election risk as a headwind for the ASX, with Australia set to head to the voting booths on saturday. On this front, we would suggest that a hung parliament outcome (which may require some form of Labor-Green power sharing agreement) would provide much more uncertainty than a win for the opposition Labor Party (which the opinions polls currently lean towards).

- E-minis are 0.7-1.1% better off, with the NASDAQ 100 leading.

OIL: Overnight Downtick

WTI & Brent have shed a little over $1.00 apiece vs. their respective settlement levels. The final Asia-Pac session of the week provided mixed headlines when it came to the Chinese COVID situation, with Shanghai unveiling the initial return to work limitations for the financial district of Pudong, while the city also discovered 3 COVID cases outside of quarantine facilities (with little in the way of official communique surrounding the matter evident).

- Crude markets experienced a degree of two-way price action given the lack of meaningful fundamental news flow evident during overnight trade.

- As a reminder, Thursday saw confirmation that the G7 were discussing a potential price cap for Russian oil via secondary sanctions, although no further details were forthcoming.

GOLD: On Course To Break Run Of Weekly Losses

A limited round of Asia-Pac dealing leaves spot gold little changed around $1,840/oz, with bullion on track to break a 4-week run of weekly losses after a lower USD and general worries re: the wider growth outlook/stagflation provided support on Thursday. Familiar technical lines in the sand remain in play.

FOREX: Aussie Dollar Lags, Greenback Shakes Off Weakness

The Aussie dollar went offered, lagging better risk sentiment, amid positioning ahead of this weekend's federal election. This week's opinion polls have shown the race tightening, with the prospect of a hung parliament likely putting some participants on the defensive. On the eve of the election day, the opposition Labour party remains ahead of the ruling Liberal/National Coalition, but PM Morrison could still replicate his upset victory from last election, while a minority Labour administration propped up by the Greens could lead to policy instability.

- The news that Shanghai found three COVID-19 cases outside of quarantine facilities, snapping a six-day run of no community transmission, applied pressure to offshore yuan. Spot USD/CNH remains ~120 pips above neutral levels, after the PBOC trimmed its 5-Year LPR by a record amount of 15ppt, while keeping the 1-Year LPR unchanged (confusion in headlines sparked some short-lived volatility).

- NZD/USD is on track to register its first weekly gain after seven consecutive weeks of losses. All key data ahead of next Wednesday's RBNZ monetary policy meeting have been released, leaving market participants to digest available signals.

- There was good demand for CHF, which sits atop the G10 pile. Regional reaction to remarks from SNB Pres Jordan may have facilitated the move, after the official flagged a sense of concern with price pressures.

- The greenback traded on a firmer footing, aided by an uptick in U.S. Tsy yields.

- The yen firmed even as it is a Gotobi Day today.

- UK retail sales & EZ consumer confidence will take focus later in the day. Comments are due from ECB's Muller, Kazaks, Simkus, Centeno, de Cos as well as BoE's Pill.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/05/2022 | 0600/0800 | ** |  | DE | PPI |

| 20/05/2022 | 0600/0700 | *** |  | UK | Retail Sales |

| 20/05/2022 | 0730/0830 |  | UK | BOE Chief Economist Huw Pill speech | |

| 20/05/2022 | - |  | EU | ECB Lagarde & Panetta in G7 Meeting | |

| 20/05/2022 | 1200/1400 |  | EU | ECB Lane in Discussion at Stockholm Uni | |

| 20/05/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 20/05/2022 | 1400/1000 | * |  | US | Services Revenues |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.