-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Pushes Conservatives To Support CR

MNI US MARKETS ANALYSIS - JPY Surges on Rengo Pay Demand

MNI EUROPEAN OPEN: Mixed China Headlines Set The Tone In Asia

EXECUTIVE SUMMARY

- FED MINUTES: RESTRICTIVE POLICY MAY BECOME APPROPRIATE (MNI)

- ORR: RBNZ TO HIKE AT PACE TO CONTAIN INFLATION EXPECTATIONS (BBG)

- CHINA’S ECONOMIC SLUMP SHOWS NO SIGNS OF BOTTOMING OUT IN MAY (BBG)

- CHINA OUTLINES NEW ROUNDS OF FISCAL SUPPORT, WITH SHANGHAI PORT THROUGHPUT HIGHER AND SOME SHANGHAI SCHOOLS SET TO RE-OPEN

- RUSSIA SAYS IT’S OPENING SEA CORRIDORS (BBG)

- BANK OF KOREA’S RHEE PUTS INFLATION BATTLE BEFORE GROWTH FOR NOW (BBG)

- UK ENERGY BILLS TO BE CUT BY HUNDREDS AS PART OF £10BN SUPPORT PACKAGE (BBC)

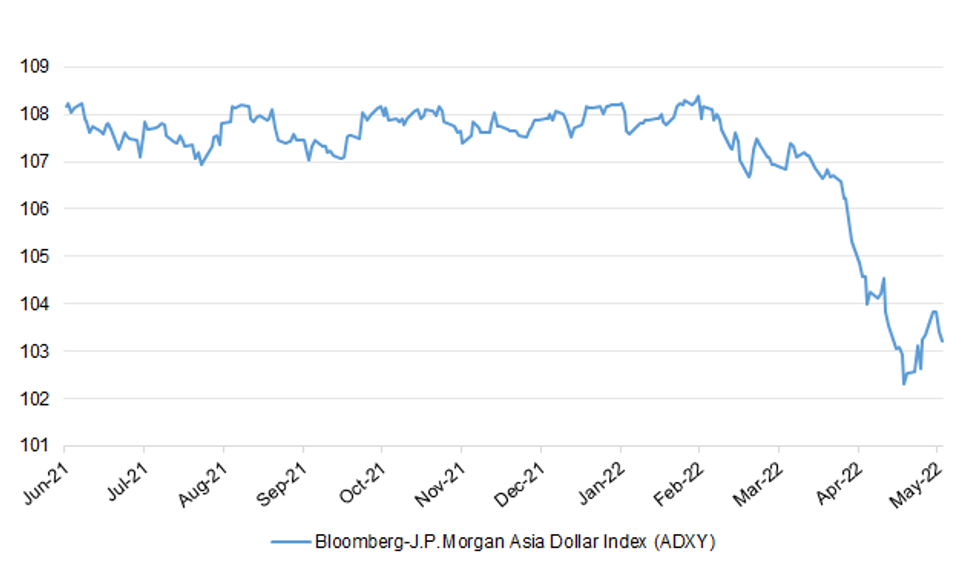

Fig. 1: Bloomberg-J.P.Morgan Asia Dollar Index (ADXY)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: The Bank of England’s Silvana Tenreyro defended the institution against accusations from former US Treasury Secretary Lawrence Summers that it was too relaxed in its approach to combating inflation, saying the bank couldn’t have predicted the swift surge in energy prices. Speaking in an event in Italy on Wednesday, Tenreyro said the BOE would have had to raise rates in the midst of the pandemic and spark large-scale unemployment in order to prevent the current surge in inflation. Tenreyro, considered a dovish official who nonetheless has backed all three of the BOE’s rate hikes this year, said starting rate hikes earlier would also have pushed real wages even lower than they are now amid the current inflationary crisis.

FISCAL: UK households are set to have hundreds of pounds knocked off energy bills this winter as part of a £10bn package to help people cope with soaring prices. The government had said people would get £200 off bills from October, which they would pay back over five years. However, the BBC understands that sum will be increased, possibly doubled, and will not need to be repaid. The support, to be announced by the chancellor on Thursday, is expected to be funded in part by a windfall tax. The one-off tax on oil and gas firms, which Labour has repeatedly called for amid resistance from the government, could raise £7bn. One-off payments to some vulnerable households and another cut in VAT on fuel could also be announced. (BBC)

ECONOMY: Britain's car production fell 11% in April due to persistent chip shortages and supply chain issues, made worse by the Ukraine crisis, the UK auto trade association said on Thursday. Soaring energy prices and slowing global markets have only piled more pressure on the car industry, while Russia's invasion of Ukraine, a major hub for automotive parts, has left many car makers scrambling to find alternative sources. The Society of Motor Manufacturers and Traders (SMMT) said 60,554 vehicles left factory gates last month, compared with 68,306 units a year earlier. Electric cars made up more than a quarter of those vehicles, up about 2% year-over-year. (RTRS)

BREXIT/NORTHERN IRELAND: Public support for the Northern Ireland Protocol has more than doubled from a year ago, a new survey showed, as the UK and EU continue a heated dispute over the part of the Brexit treaty dealing with the region. There has been a “significant shift towards support for the Protocol,” with 33% saying it is “on balance a good thing,” compared to 16% in 2020, authors led by Queen’s University Belfast Professor Katy Hayward wrote in a research report. Underscoring the polarization of opinion, 21% said it was on balance a “bad thing,” up from 18% in 2020 and 33% regarded it as a “mixed bag,” according to the Northern Ireland Life and Times survey. (BBG)

EUROPE

IRELAND: Irish consumer sentiment fell for the fourth successive month in May as concerns around the cost of living continued to build and worries about a global recession intensified, a survey showed on Thursday. The KBC Bank Ireland consumer sentiment index dropped to 55.2 in May from 57.7 in April, only the fifth time since the survey began over two decades ago that confidence had fallen four months in a row. The last time it did so was in the summer of 2019, when a chaotic and very damaging Brexit seemed likely. Before that, four-month falls were recorded twice during the financial crisis in 2008 and 2010, and in 2001, when the dot-com bubble burst. (RTRS)

U.S.

FED: MNI: Restrictive Policy May Become Appropriate - Fed Minutes

- Federal Reserve officials think monetary policy may have to become restrictive in order to rein in inflation that has surged far above policymakers' worst fears, as they agreed unanimously to raise interest rates by 50 basis points at their May meeting, minutes released Wednesday showed - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FED: The U.S. Federal Reserve is making robust moves to tighten financial conditions that will bring down inflation that is too high, Fed Vice Chair Lael Brainard said on Wednesday. "High inflation is our most pressing challenge," Brainard said in a commencement speech at John Hopkins University in Washington. "That is why we are taking strong actions that will bring inflation back down." Brainard added that achieving low and stable inflation was particularly important for lower-income households, who spend more than three-quarters of their wages on essentials such as groceries, gas and rent, compared to 31% spent by higher-income families. In recent weeks, Fed policymakers have acknowledged the scale of their task with 40-year-high inflation having persisted longer than expected, raising the risk that the policy moves needed to bring it back down to the central bank's 2% goal could cause a recession. (RTRS)

FED: Federal Reserve Bank of Kansas City President Esther George will retire in January after 11 years as one of the U.S. central bank's more hawkish policymakers, and a search for her successor has begun, the regional Fed bank said on Wednesday. George's retirement by age 65 is mandated under rules for Fed bank presidents. The Kansas City Fed's board of directors has hired Egon Zehnder to aid in the nationwide search for her replacement, it said in a statement. Her successor will help set interest rates for the world's biggest economy as the Fed raises interest rates to fight the highest inflation in 40 years, made worse by a pandemic that has killed millions and continues to disrupt global supply chains, and by Russia's invasion of Ukraine that has sent energy prices soaring. The search for a new Kansas City Fed leader takes place against the backdrop of massive turnover among U.S. monetary policymakers, a group of 19 when all vacancies are filled.

ECONOMY: U.S. economic growth will exceed 3% in 2022, while roaring inflation has topped and will cool each month to around 2% by some point in 2024, according to a government forecast published Wednesday. The nonpartisan Congressional Budget Office estimated that real gross domestic product, or GDP, will grow 3.1% in 2022, driven by consumer spending and demand for services, according to the report released Wednesday. It revised its estimates for GDP growth in 2023 and 2024 upward to 2.2% and 1.5%, respectively, but still below this year’s pace. “In CBO’s projections, the current economic expansion continues, and economic output grows rapidly over the next year,” the CBO said in its report. “To fulfill the elevated demand for goods and services, businesses increase both investment and hiring, although supply disruptions hinder that growth in 2022.” (CNBC)

FISCAL: The U.S. budget deficit for fiscal 2022 will shrink to $1.036 trillion from $2.775 trillion in fiscal 2021 as a strong economic recovery from the COVID-19 pandemic produces a surge of tax receipts, the Congressional Budget Office said on Wednesday. The CBO said in new economic and baseline budget forecasts based on current tax and spending laws that its fiscal 2022 deficit forecast is now $118 billion less than an estimate made last July. (RTRS)

EQUITIES: Apple is boosting pay for workers amid rising inflation, a tight labor market and unionization pushes among hourly store employees. The iPhone maker on Wednesday told employees in an email that the company is increasing its overall compensation budget. Starting pay for hourly workers in the U.S. will rise to $22 an hour, or higher based upon the market, a 45% increase from 2018. Starting salaries in the U.S. are also expected to increase. (WSJ)

OTHER

GLOBAL TRADE: Cargo throughput at the Shanghai Pudong International airport at its peak the past week has also recovered to about 80% of pre-Covid levels, state-run CCTV reports, citing a transport ministry briefing on Thursday. Cargo throughtput at major China ports between May 1 and 24 rose 4.2% month-on-month, but down 0.7% y/y. (BBG)

GLOBAL TRADE: Russia’s Defense Ministry said it’s opening two sea corridors for international shipping from seven Ukrainian ports, after growing international criticism of an unfolding global food crisis triggered by a Russian blockade. Humanitarian maritime corridors from Black Sea and Sea of Azov ports including Odesa will operate from 8 a.m. to 7 p.m. daily, Mikhail Mizintsev, a Defense Ministry official said according to an emailed statement. But shipments may not begin moving quickly because Ukraine would have to remove its mines after seeking assurances of protection from Russia’s Black Sea fleet. The head of the UN’s World Food Program, David Beasley, said Monday that Russia’s blockade of Ukrainian ports, preventing shipments of grain from the country, is a “declaration of war” on global food security. (BBG)

GLOBAL TRADE: Several countries are raising the alarm over the growing crisis in global food supplies triggered by Russia’s invasion of Ukraine. The warring states are among the world’s top agricultural exporters and feed much of the developing world in particular. Saudi Finance Minister Mohammed al-Jadaan believes the world is not taking it seriously enough. “I think this is a very serious issue. The food crisis is real. I think it is still underestimated by the world community,” al-Jadaan told CNBC’s Hadley Gamble at the World Economic Forum in Davos, Switzerland. (CNBC)

GLOBAL TRADE: A senior United Nations official is due to visit Moscow in the coming days to "discuss the scheme by which we can export out fertilizers," Russia's U.N. Ambassador Vassily Nebenzia told Reuters on Wednesday. Nebenzia said that "formally fertilizers and grain are not under sanctions, but there are logistical, transport, insurance, bank transfer problems" created by Western sanctions imposed on Russia that "prevent us from exporting freely." "We are prepared to export fertilizers and grain from our ports to the world market," he said, adding that when it came to Ukrainian grain exports - "I think that should be negotiated with the Ukrainians, not with Russians." (RTRS)

U.S./CHINA: A bipartisan group of senators call on President Biden to not lift Section 301 tariffs, which currently target China “and their illegal and unfair trade practices.” Rolling back the tariffs on China would “expose many U.S. companies and workers to a sudden flood of imports, and signal to China that waiting out the United States is preferable to changing their non-market behavior,” Senators Rob Portman, Sherrod Brown, Mitt Romney, Elizabeth Warren and others write in letter. (BBG)

GEOPOLITICS: The U.S. military and Japan's Self Defense Force said on Thursday that eight of their fighter jets flew together over the Sea of Japan after North Korea earlier lobbed three missiles into the waters that separate Japan and the Korean peninsula. The exercise was meant to "showcase combined capabilities to deter and counter regional threats", the U.S. military said in a press release. (RTRS)

AUSTRALIA: Rampant rises in Australian house prices will grind almost to a halt this year, and an 8% decline is expected in 2023 as a cost-of-living crisis worsens and mortgage rates rise, a Reuters poll of property market analysts found. Cheap loans based on near-zero interest rates have nearly doubled house prices since the global financial crisis of the late 2000s, turning Australia into one of the world's least affordable places to buy property. Prices surged over 20% last year, the biggest annual increase since 1989, making it much harder for first-time buyers to get on the property ladder. That blistering pace will slow to just 1.0% this year, according to the median forecast in the May 11-25 poll of 11 analysts, down sharply from 6.7% forecast in a February poll. Prices are forecast to drop 8.0% next year, more than the 5.0% expected in the previous survey. (RTRS)

RBNZ: New Zealand central bank governor Adrian Orr said the bank needs to raise interest rates “at pace” to prevent inflation expectations from becoming unanchored. “We believe that the worst outcome, which we most want to avoid, is one where (higher) inflation expectations become persistent,” Orr said in an interview with Bloomberg Television Thursday in Wellington. “What are people thinking about where inflation will be two years ahead, five years ahead, we want that to remain anchored. If they start drifting up with current inflation, that’s when we get concerned.” New Zealand two-year ahead inflation expectations have risen to 3.29%, while five-year expectations have climbed to 2.42%. The Reserve Bank aims to keep inflation in a 1-3% target band. Yesterday it delivered a second straight half-point increase in its Official Cash Rate, taking it to 2%, and forecast another 200 basis points of tightening over the coming 15 months. “We want to move at pace to a level of around 4%,” Orr said. “I can’t commit to exactly what we’ll do when, we need to see the data like everyone does. But our best intentions are at least there’s some more 50s and 25 movements.” (BBG)

NEW ZEALAND: Fonterra announced a record opening milk price payment for farmers next season underpinned by continued strong demand for dairy products and constrained global supply. But its profit fell. The co-operative expects to pay farmers between $8.25 and $9.75 per kilogram of milk solids for the season starting next month. The $9 per kgMS mid-point, which farmers are paid off, beats the previous record set this time last year of $8 per kgMS. The country’s largest dairy company has raised its forecast payment to farmers four times this season as tight milk supply underpins demand for New Zealand’s biggest export commodity. Disruption in Ukraine, China and Sri Lanka has weighed on recent global auction prices, prompting Fonterra to pull back its forecast earlier this month, but it expects those impacts will be short term. “The long-term outlook for dairy remains positive, despite recent geopolitical and Covid-19 related events impacting global demand in the short-term,” said chief executive Miles Hurrell. (Stuff NZ)

BOK: Newly installed Bank of Korea Governor Rhee Chang-yong said the central bank must prioritize tackling inflation over growth for the time being after raising interest rates earlier in the day and forecasting much stronger price growth this year. “The most important message from today’s decision is the need for a preemptive response to the negative ripple effects of inflation,” Rhee said Thursday after helming his first policy meeting as governor. Rhee spoke at a press briefing after the central bank increased its seven-day repurchase rate by a quarter percentage point to 1.75% for its fifth hike since last summer. All 18 analysts surveyed by Bloomberg had expected the move. The BOK now sees inflation at 4.5% this year, a sharp upward revision from its previous 3.1% forecast made in February, with the headline figure rising above 5% before eventually weakening. At the same time, it cut its growth view to 2.7% from 3%, an indication of the headwinds for the economy that the central bank must be careful not to add to. (BBG)

SOUTH KOREA: The government plans to announce a set of measures to tame inflationary pressure and stabilize people's livelihoods next week amid the prospect that the growth of consumer prices could top 5 percent, a senior official said Thursday. The country faces an urgent need to stabilize prices of food and other items closely linked to people's lives, according to First Vice Finance Minister Bang Ki-sun. "Some experts forecast consumer inflation could exceed 5 percent in May, accelerating from the growth rate in April," Bang said at a government vice-ministerial meeting on the economy. Consumer prices spiked 4.8 percent year-on-year in April, the fastest increase in more than 13 years, due to soaring energy costs and a rebound in demand from the pandemic. The April figure followed a 4.1 percent rise in March. (Korea Times)

NORTH KOREA: The U.N. Security Council will vote in the "coming days" on a U.S.-led push to further sanction North Korea over its renewed ballistic missile launches by banning tobacco, cutting oil exports to Pyongyang and blacklisting the Lazarus hacking group, a senior U.S. administration official said on Wednesday. North Korea fired three missiles on Wednesday, including one thought to be its largest intercontinental ballistic missile, after U.S. President Joe Biden ended a trip to Asia. It was the latest in a string of missile launches by North Korea this year. (RTRS)

GEOPOLITICS: Delegations from Sweden and Finland were in Ankara on Wednesday seeking to address Turkish objections to their joining the NATO military alliance. Turkey objects to the accession of the Nordic countries, citing their perceived support for the Kurdistan Workers' Party, or PKK, as well as the US-backed Syrian Kurdish militia, the YPG. Ankara claims such groups are a threat to its security. The Swedish delegation, led by State Secretary Oscar Stenstrom, and the Finnish delegation, led by his counterpart Jukka Salovaara, met Turkish presidential spokesman Ibrahim Kalin and Deputy Foreign Minister Sedat Onal at the presidential palace in Ankara. In a news conference after the talks that lasted about five hours, Kalin said Turkey had observed a "positive approach" by both countries when it came to lifting weapon export restrictions. However, he said Turkey would not agree to the two Nordic countries joining NATO unless specific steps were taken to address Ankara's objections. "We have made it very clear that if Turkey's security concerns are not met with concrete steps in a certain timeframe the process will not progress,'' Ibrahim Kalin told a news conference. (Deutsche Welle)

BRAZIL: Brazilian President Jair Bolsonaro will attend the Summit of the Americas in Los Angeles in June, after accepting an invitation for a bilateral meeting with U.S. President Joe Biden, a columnist at the O Globo newspaper reported on Wednesday. (RTRS)

BRAZIL: Brazil’s lower house passed a bill on Wednesday that determines a cap between 17% and 18% for state-level ICMS tax on fuel, natural gas, electricity, communications and public transport as it labels them as essential goods and services. 403 lawmakers voted in favor and 10 voted against the bill. Lawmakers voted against amendments that could change the text and now it moves to Senate. Text requires the federal govt to compensate states that suffer a reduction greater than 5% in tax collections until Dec. 31, 2022. (BBG)

BRAZIL: The Brazilian government is expected to change all its nominations for the Petrobras board of directors, local newspaper O Globo reported on Wednesday. The current chair of state-lender Banco do Brasil, Ieda Cagni, is likely to be on the government's list of replacements, the report said. (RTRS)

RUSSIA: Ukraine’s Foreign Minister Dmytro Kuleba told the World Economic Forum in Davos that if the issue of security guarantees for Ukraine isn’t resolved in one way or another, “there will always be a risk of war in Europe as long as Russia remains Russia.” He said Ukraine needs security guarantees and that while its continued aspiration to join NATO “did not fly,” it needs “something now.” Kuleba said his country is upset that a sixth round of European Union sanctions against Russia is “hanging in the air” because of Hungary’s resistance to an embargo on Russian oil purchases. (BBG)

RUSSIA: The EU, UK and US announced the creation of the Atrocity Crimes Advisory group will will aim to ensure “efficient coordination of their respective support to accountability efforts on the ground,” according to a joint statement. “The overarching mission of the ACA is to support the War Crimes Units of the Office of the Prosecutor General of Ukraine in its investigation and prosecution of conflict-related crimes,” according to the statement. (BBG)

RUSSIA: Russia could already be in default on some of its foreign currency debts, according to bondholders that claim they are still owed a small interest payment that Moscow didn’t send to them earlier this spring. A change in U.S. sanctions on Wednesday is expected to cut off Russia’s ability to stay current on its dollar-denominated sovereign debt, which it has managed to continue servicing since the invasion of Ukraine began. Some investors, though, allege that Moscow has defaulted already by failing to pay about $1.9 million. (WSJ)

RUSSIA: Russia recorded its first weekly deflation for the first time since August 2021, data showed on Wednesday, a day before an extraordinary rate-setting meeting that the central bank plans to hold on Thursday. Weekly inflation spiked to 2.22% in early March, soon after Russia started what it calls a "special military operation" in Ukraine on Feb. 24, but has been slowing since then, capped by a rapid recovery in the rouble. In the week to May 20, the consumer price index (CPI) declined 0.02% after rising 0.05% in the previous week, data from statistics service Rosstat showed. Inflation is slowing even after the central bank lowered its key interest rate to 14% from 17% in April and said it saw room for more cuts, as it tries to manage a shrinking economy and high inflation. On Wednesday, the central bank said it would hold an off-schedule meeting on Thursday where it is widely expected to lower the cost of lending. So far this year, consumer prices in Russia rose 11.82%, Rosstat said. (RTRS)

METALS: MMG’s Las Bambas mine said it regretted that meetings with six communities and the govt ended without reaching an agreement, according to a statement from the company. Las Bambas said communities’ demands, including a 50% share of the mine’s profit in exchange for land already acquired by the company, were not covered by law. (BBG)

METALS: Arcelormittal has agreed to an above inflation wage increase for all workers, the National Union of Metalworkers of South Africa says in an emailed statement. (BBG)

CHINA

ECONOMY: China’s economy remained deep in a slump in May as lockdowns continued to weigh on activity, and as the threat of omicron and expanded restrictions dampened sentiment. That’s the outlook based on Bloomberg’s aggregate index of eight early indicators for this month. The overall gauge stayed below the mark that separates improving from deteriorating conditions for a second straight month. (BBG)

POLICY: China will increase policy intensity following high-level calls to stabilise economic growth at a quicker pace, including the issuance of special treasury bonds to stimulate consumption and support investment, and more financing guarantee funds to boost credit, Yicai.com reported citing Lian Ping, head of Zhixin Investment Research Institute. The central bank may further reduce the deposit reserve ratio and interest rate if necessary and use structural tools, said Lian. China should increase rescue efforts to accelerate the resumption of production and ensure smooth traffic and logistics for supply chain stability, said Yicai citing Wen Bin, chief researcher of China Minsheng Bank. (MNI)

PBOC: China’s central bank asks banks to keep increasing inclusive-finance loans to small and micro businesses, according to a notice issued by PBOC. Financial institutions should ease or remove assessment requirements on loans to small firms. Banks should tilt towards central and western regions and sectors hit hard by Covid when offering loans PBOC continues to support small and medium-sized banks to issue perpetual bonds and tier-2 capital bonds. PBOC encourages banks to offer favorable interest rates and service fees, and reduce penalty interest for small firms in regions and sectors hit by Covid outbreak

CREDIT: Banks in Shanghai should ensure stable credit growth by supporting the reasonable financing needs of real estate developers and construction companies, and better meeting credit demand of homebuyers, according to a statement on the People’s Bank of China Shanghai head office. Banks should not blindly cut off loans to companies affected by the pandemic, especially smaller businesses, and should help them ease financial pressure with loan extensions, renewals or adjusting repayment plans, the statement said. (MNI)

FISCAL: Consumers will receive up to 10,000 yuan for each purchase of a new-energy vehicle, and the southern Chinese city will make another 20,000 license plates available, according to a local government statement that lists multiple measures to boost consumption. The city will organize sales promotion events for consumer electronic products during May-August; consumers can receive up to 2,000 yuan for purchases of mobile phones, computers, wearable devices and other items. Consumers can also get up to 2,000 yuan to buy home appliances in May-August. (BBG)

FISCAL: China's finance ministry said on Thursday that it would offer subsidies to Chinese airlines from May 21 to July 20, to help carriers weather the COVID-19 downturn. Cash support will only be provided when average daily numbers of domestic flights per week are lower or equal to 4,500 flights, and the maximum grant would be 24,000 yuan ($3,574) per hour, the ministry said in a statement on its website. (RTRS)

CORONAVIRUS: High school students in grade 2 and 3 will return to school from June 6 while grade 3 students in secondary school will do from June 13, Yang Zhenfeng, an official with Shanghai Municipal Education Commission, says at a briefing. Rest of the students will continue online classes till the end of the semester. Students in primary school and first two grades in secondary school won’t be required to take term-end exams. (BBG)

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Thursday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8148% at 09:52 am local time from the close of 1.6970% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 44 on Wednesday vs 50 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.6766 THURS VS 6.6550

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.6766 on Thursday, compared with 6.6550 set on Wednesday.

OVERNIGHT DATA

JAPAN APR PPI SERVICES +1.7% Y/Y; MEDIAN +1.5%; MAR +1.3%

AUSTRALIA Q1 PRIVATE CAPITAL EXPENDITURE -0.3% Q/Q; MEDIAN +1.5%; Q4 +2.3%

MARKETS

SNAPSHOT: Mixed China Headlines Set The Tone In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 19.98 points at 26657.82

- ASX 200 down 36.538 points at 7118.7

- Shanghai Comp. up 20.342 points at 3127.806

- JGB 10-Yr future down 17 ticks at 149.94, yield up 1.8bp at 0.231%

- Aussie 10-Yr future up 1.0 tick at 96.750, yield down 1bp at 3.230%

- U.S. 10-Yr future +0-00+ at 120-19+, yield down 0.18bp at 2.743%

- WTI crude up $0.53 at $110.85, Gold down $8.81 at $1844.7

- USD/JPY up 11 pips at Y127.43

- FED MINUTES: RESTRICTIVE POLICY MAY BECOME APPROPRIATE (MNI)

- ORR: RBNZ TO HIKE AT PACE TO CONTAIN INFLATION EXPECTATIONS (BBG)

- CHINA’S ECONOMIC SLUMP SHOWS NO SIGNS OF BOTTOMING OUT IN MAY (BBG)

- CHINA OUTLINES NEW ROUNDS OF FISCAL SUPPORT, WITH SHANGHAI PORT THROUGHPUT HIGHER AND SOME SHANGHAI SCHOOLS SET TO RE-OPEN

- RUSSIA SAYS IT’S OPENING SEA CORRIDORS (BBG)

- BANK OF KOREA’S RHEE PUTS INFLATION BATTLE BEFORE GROWTH FOR NOW (BBG)

- UK ENERGY BILLS TO BE CUT BY HUNDREDS AS PART OF £10BN SUPPORT PACKAGE (BBC)

US TSYS: Off Worst Levels Of Asia Trade, Little Changed Into European Hours

TYM2 last deals +0-00+ at 120-19+, 0-01+ shy of the peak of its 0-09 Asia range, while cash Tsys run at virtually unchanged levels across the curve.

- Tsys bounced from cheapest levels of Asia-Pac dealing, after initially being helped lower by a light bid in e-minis and the likes of the Nikkei 225 (as some flagged the potential for the Fed to pause its expeditious tightening cycle around year-end after a reference in the May meeting minutes). A heavy start for Chinese equities allowed the space to find a bit of a base, with a subsequent recovery from Chinese equities failing to provide any meaningful headwinds for Tsys.

- E-minis are still softer on the day, reversing early Asia gains on worries re: Chinese growth, while some pointed to tech giant Apple’s move to pay higher wages as another headwind for the space and an explanatory factor behind the NASDAQ 100 leading the way lower.

- There hasn’t really been much in the way of meaningful macro headline flow to digest, outside of China matters. This included China revealing its latest, limited fiscal and credit support measures, the partial re-opening of schools in Shanghai from early June and an uptick in throughput at the port of Shanghai.

- Thursday’s NY session will include weekly jobless claims & pending home sales data, the latest Kansas City Fed manufacturing activity survey, revised Q1 GDP readings and 7-Year Tsy supply. Elsewhere, Fedspeak will come from San Francisco Fed President Daly (’24 voter) and Vice Chair Brainard (on digital currencies).

JGBS AUCTION: Futures Soften Late In The Day, Curve Steeper, 20s Lead Weakness

JGB futures have come under pressure ahead of the bell, with nothing in the way of an overt catalyst apparent, as the contract hits fresh session lows in recent dealing, last -18 on the day. The move comes as 20s cheapen in cash JGB trade, while 30s and 40s outperformed 20s in the wake of a relatively solid round of 40-Year JGB supply. The major cash JGB benchmarks run 0.5-3.0bp cheaper across the curve.

- This comes after a firmer Nikkei 225 resulted in the bear steepening of the JGB curve during early Tokyo dealing, while the paring of the Nikkei’s early gains failed to provide any meaningful support for the space.

- In terms of auction specifics, 40-Year JGB supply saw the cover ratio tick away from the multi-year low observed at the previous 40-Year auction (although it still held below its 6-auction average of 2.53x), while the high yield is lower than wider expectations evident ahead of the auction (which stood at 1.085%). The steep domestic yield curve (in both domestic and international terms) and short-term stability in government bond markets, coupled with the fact that 40-Year yields are near cycle highs, seemingly enticed bidders, as we suggested may be the case in our auction preview.

- Elsewhere, last week’s international security flow data revealed that foreign investors were net buyers of Japanese bonds for a second consecutive week, registering the largest round of net weekly purchases seen since March. FX hedging cost-related yield pickup and the BoJ’s continued insistence that it will stick with its current policy settings likely facilitated the bid.

- Tokyo CPI data headlines the domestic docket on Friday.

JGBS AUCTION: Japanese MOF sells Y699.2bn 40-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y699.2bn 40-Year JGBs:

- High Yield: 1.070% (prev. 1.095%)

- Low Price 97.74 (prev. 87.50)

- % Allotted At High Yield: 53.1502% (prev. 77.6000%)

- Bid/Cover: 2.416x (prev. 2.194x)

AUSSIE BONDS: Looking Offshore For Moves

Aussie bonds have traded on the previously outlined swings in risk appetite, operating off worst levels of the session at typing, after dipping lower alongside U.S. Tsys in early Sydney trade.

- That leaves YM -0.5 & XM +1.0, while wider cash ACGB trade sees a pivot around the 7-Year zone as the curve twist flattens, with 30s richening by ~2.5bp.

- The 3-/10-Year EFP box has twist flattened.

- Bills run -4 to +1 through the reds, twist flattening.

- Local data had no tangible impact on the space, with private capex providing soft GDP partial data (at least on face value) for a second consecutive day (-0.3% Q/Q vs. BBG median of +1.5%), although there was a positive revision for Q421 (up to +2.3% Q/Q from +1.1%). We also saw a much firmer than expected markup in firms’ 22-23 capex plans, while the GDP-centric equipment, plant and machinery capex category was firmer than the headline, rising by 1.2% Q/Q.

- Friday will see A$800mn of ACGB Jun-31 supply, the release of the AFM weekly issuance slate and monthly domestic retail sales data.

EQUITIES: Chinese Equities Bounce, E-Minis Marginally Lower

A heavy start for Chinese equities (in the wake of Chinese Premier Li’s Wednesday warning re: the health of the Chinese economy) weighed on wider risk appetite in early Asia trade, with e-minis and the likes of the Nikkei 225 unwinding their opening bid.

- The unveiling of the latest round of fiscal and credit support measures in China, coupled with the partial re-opening of schools in Shanghai from early June & an uptick in throughput at the Shanghai Port (to ~95% of capacity) then facilitated a rebound for Chinese equities, with the CSI 300 now ~0.6% firmer on the day, although wider equity indices were a little more reticent to go bid. The Nikkei 225 is little changed on the day.

- E-Minis sit 0.2-0.5% below settlement after pulling lower alongside the early move in Chinese equities. Some suggested the underperformance in the NASDAQ contract could be attributed to tech giant Apple outlining a round of wage hikes given the current inflationary burden felt by households.

- Note that some pointed to the minutes covering the latest U.S. Federal reserve meeting as a source of support for e-minis in late NY/early Asia trade, with suggestions that the Fed may pause for breath around the end of the year after the current, expeditious round of tightening ends (based on a reference in the text of the minutes).

OIL: Marginally Higher In Asia

Crude futures were subjected to two-way trade within confined ranges during Asia-Pac hours, with an early downtick for Chinese equities on growth fears (after Premier Li’s Wednesday warning re: the Chinese economy) applying some modest pressure. That was before the announcement of a partial school re-opening in the Chinese city of Shanghai, fiscal support to boost consumption in the Chinese city of Shenzhen and news of another uptick in throughput at the Shanghai Port (to 95% of capacity) combined to facilitate a recovery from worst levels. WTI & Brent sit ~$0.50 above their respective settlement levels at typing as a result.

- Tight U.S. refined product markets ahead of the U.S. driving season and the ongoing saga re: the next round of EU sanctions on Russia continue to provide the wider areas of interest for the space.

GOLD: Loses Further Momentum

Gold has spent much of the Asia session on the back foot, dipping to $1846, close to 0.40% below NY closing levels at the time of writing. The overnight low was just below $1845.

- Today's price action has been against a mixed cross asset backdrop. Regional Asian equities are firmer/resilient, while US equity futures have drifted lower through the afternoon session.

- US yields have been fairly steady, but that mirrors the overnight session, with the 10yr holding fairly close to 2.75%. US real yields edged down overnight to 0.19%, we were at 0.26% at the start of the week. This didn't sentiment much overnight in gold though.

- The USD is mixed, with the DXY a touch higher, while A$ and NZD have drifted down. USD/CNH is up close to 0.50% on the day, as China growth concerns have weighed. By extension this should weigh on the global growth outlook but this hasn't helped haven demand for gold today.

FOREX: G10 Volatility Subdued, Yuan Goes Offered

Risk appetite waned as U.S. e-minis pared earlier gains, but there was no obvious rush to safety. European FX outperform at the margin as we head for the London session, with G10 currency pairs holding tight ranges.

- Offshore yuan retreated despite Shanghai's reported progress on clearing ports and re-opening schools. The overhang of Premier Li's suggestion that the local economy is in some aspects faring worse than in 2020 loomed large.

- The BoK raised its key interest rate by 25bp, in line with expectations. Newly installed Governor Rhee vowed to place more focus on inflation. The won showed a muted reaction.

- U.S. GDP (second reading), pending home sales and weekly jobless claims as well as Canadian retail sales take focus from here. Comments are due from Fed's Brainard as well as ECB's Centeno & de Cos.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/05/2022 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 26/05/2022 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 26/05/2022 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 26/05/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 26/05/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 26/05/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 26/05/2022 | 1230/0830 | *** |  | US | GDP (2nd) |

| 26/05/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 26/05/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 26/05/2022 | 1400/1000 |  | MX | Mexican central Bank policy meet minutes | |

| 26/05/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 26/05/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 26/05/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 26/05/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 26/05/2022 | 1600/1200 |  | US | Fed Vice Chair Lael Brainard | |

| 26/05/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.