-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Hong Kong Outperforms On Tech Giant Earnings

- A positive start for Chinese & Hong Kong equities provided the highlight of Asia-Pac dealing. The space benefitted from hope re: fresh policymaker support for the Chinese economy, news of accelerated special bond issuance from local Chinese governments during May and stronger than expected quarterly earnings data from a couple of the tech giants (Alibaba & Baidu). This allowed the Hang Seng to outperform on the day (last +2.8%), although Chinese & Hong Kong equities have ticked away from best levels, perhaps on the back of the latest round of credit stress surrounding the Chinese property developer space.

- The uptick allowed USD/CNH to more than unwind its early uptick, with the DXY falling to the bottom of the G10 FX performance table.

- U.S. PCE, wholesale inventories and U. of Mich. Sentiment as well as comments from ECB's Lane take focus from here.

US TSYS: Tight Asia Trade

Friday provided a very limited round of Asia-Pac Tsy trade as participants assessed bid in Hong Kong equities, the latest round of credit stress in the Chinese property developer sphere and Sino-U.S. tensions after a BBG source report noted that “the US and Taiwan are planning to announce negotiations to deepen economic ties, people familiar with the matter said, in a fresh challenge to Beijing, which has cautioned Washington on its relationship with the island.”

- Ultimately, Tsys are little changed on the day, with TYU2 +0-01 at 120-08, sticking to a tight 0-07 range on light volume of 80K (~20K of which is roll related). Cash Tsys are flat to 1.5bp richer across the curve, with 2s outperforming.

- PCE & the final UoM survey reading headline the NY docket on Friday, with the Dallas Fed m’fing activity print also due.

- A quick reminder that the U.S. will observe the Memorial Day holiday on Monday, which will result in curtailed cash Tsy trade on Friday, in addition to a cash Tsy closure and shortened futures trade on Monday.

JGBS: Curve Bull Flattens On Touted Shorter-Dated “Bridge Bond” Focus

Marginally weaker than expected Tokyo CPI data, BoJ Governor Kuroda’s continued focus on generating sustainable wage growth and the aforementioned Sino-U.S. tensions re: Taiwan provided a modest bid for the JGB space during the Tokyo morning.

- The contract sits a touch off of best levels ahead of the close, +4, with a lack of meaningful catalysts apparent during afternoon trade.

- Still, the contract has more than reversed overnight session losses, while the wider cash curve bull flattened as the major benchmarks richened by 0.5-3.0bp. 20s outperformed after the sector led yesterday’s cheapening.

- The outperformance in the super long end was aided by reports that Japan is looking to finance its planned increase in defence spending via “bridge bonds,” with a focus on relatively short-term debt and clear stipulations re: financing methods in an effort to play down fiscal worries.

- Looking ahead, the latest round of BoJ Rinban operations headline the domestic docket on Monday.

AUSSIE BONDS: Cheaper Ahead Of The Weekend

Aussie bonds drifted cheaper in early Sydney dealing and never looked like recovering, as futures added to overnight session losses, albeit while remaining in confined ranges. YM trades -4.0 & XM is -5.5 as we work towards the Sydney close. Super-long ACGBs are ~7bp cheaper on the day. EFPs are a touch wider, with a parallel shift in 3s and 10. Bills un 2-7bp cheaper through the reds.

- Retail sales growth slowed a touch in April when compared to March, although a virtually in line with expected headline M/M reading, coupled with the fact the print represented another record level of turnover, allowed some to focus on the relative strength of the Australian economy (which the RBA is relying on after recently embarking on a tightening cycle).

- The recent stabilisation in wider core FI markets, still elevated (in terms of recent history) outright yield levels & potential for cross-market demand vs. the likes of the U.S. Tsys seemingly combined to result in a firm round of ACGB Jun-31 supply. The weighted average yield printed 1.14bp through prevailing mids (per Yieldbroker), with the cover ratio printing at a very healthy level, just shy of 3.50x.

- The AOFM’s weekly issuance slate revealed a step up in note issuance, albeit to “only” A$2.0bn, while there will only be one ACGB auction next week, for an easily digestible A$1.0bn of ACGB Apr-25.

- GDP data (Wednesday) headlines the domestic docket next week, with the final round of partials due on Tuesday. We will also get private sector credit readings (Tuesday), CoreLogic house price data (Wednesday), the monthly trade balance print (Thursday) & housing finance data (Friday).

RBA: Market Pricing Of ’22 Tightening Remains Comfortably Off Of Peak

A quick look at STIR pricing shows that the IB strip looks for the cash rate to sit around 2.60% come the end of the RBA’s December ’22 meeting (per BBG’s WIRP function), comfortably shy of the ~3.00% cycle peak observed earlier in the month. Global growth fears and a slight moderation in market pricing re: the U.S. Fed tightening cycle have facilitated this pullback.

- Note that our policy team published an interview with RBA board member Harper late on Thursday (Sydney time).

- Harper noted that both surveys of consumers and financial market pricing indicate that inflation expectations remain within the RBA’s 2%-3% target range while a weakening housing market should dampen future price increases. He added that “as house prices fall, this will drag on consumption and add to the moderating influence on future inflation of interest rate rises and the rising cost of living,” Asked if he saw downside economic risks in the medium term, Harper said the strength of the labour market and the outlook for public spending, including plans announced by the new government, made a recession “highly unlikely.” On wages, Harper noted that a pickup in wage growth would not add fuel to inflation so long as productivity was “growing at least as fast as real wages.”

- All in all, he seemingly stuck with the central message provided by the Bank in recent weeks.

- ~230bp of tightening across the remaining 7 meetings of ’22 still seems fairly aggressive given the RBA’s recent rounds of communique and back to usual business language re: 25bp rate hikes.

- Also, note some of the higher frequency housing data has shown a modest fall in house prices in the major cities in the wake of the first hike of the cycle.

FOREX: Greenback Offered Amid Better Sentiment, Aussie Rises Post-Retail Sales

Positive risk sentiment lingered on after a solid session on Wall Street, supported by an early bid in Chinese equities. Offshore yuan garnered some strength, which radiated across G10 FX space. The redback shrugged off a plunge in Chinese industrial profits amid hopes for more policymaker support, as local governments are accelerating special bond issuance to stabilise investment and growth.

- The greenback fell prey to better risk appetite and landed at the bottom of the G10 pile, as the dollar index (DXY) pulled back from a one-week high, even as U.S. e-mini futures slipped. Traditional safe havens JPY and CHF also faced headwinds.

- On recent yen moves, Japan PM Kishida said they have been driven by different factors and the government is focusing on easing the impact on households and businesses. He added that FX moves are expected to stabilise on the back of steps to avoid the outflow of funds from Japan.

- The Antipodeans set the pace for gainers in G10 FX space. AUD/USD climbed to a three-week high after Australia's retail sales rose 0.9% M/M (vs. BBG est. +1.0% M/M) to a fresh record in April, suggesting that household spending remains healthy despite rising costs of living.

- U.S. PCE, wholesale inventories and U. of Mich. Sentiment as well as comments from ECB's Lane take focus from here.

FX OPTIONS: Expiries for May27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E2.9bln), $1.0525(E1.2bln), $1.0550(E1.5bln), $1.0570-75(E1.0bln), $1.0625-35(E2.4bln), $1.0650-60(E3.6bln), $1.0690-00(E1.5bln), $1.0750-65(E1.9bln)

- AUD/USD: $0.7165(A$804mln)

- USD/JPY: Y125.70-75($550mln), Y126.98-05($1.8bln), Y127.75($1.2bln)

- EUR/GBP: Gbp0.8450-60(E680mln), Gbp0.8650(E588mln)

- NZD/USD: $0.6475(N$553mln)

- USD/CAD: C$1.2750-70($1.1bln), C$1.2900-10($705mln)

- USD/CNY: Cny6.7250($780mln)

ASIA FX: Won Leads The Charge Higher

Outside of INR, all EM Asia FX currencies are firmer against the USD, with the won leading the charge at +1%.

- CNH: USD/CNH traded higher earlier on geopolitical concerns and a benign USD/CNY fix. However, strength in local equities, lower Covid numbers and further signs of stimulus support saw the currency rebound. From highs above 6.7800 we dipped back to 6.7475.

- KRW: USD/KRW spot has traded sharply lower, down more than 1% from yesterday's levels to sub 1255. Strength in tech equity sentiment from overnight and further gains in regional equities have been the main drivers of today's surge. There have also been reports of month end USD selling from exporters.

- INR: USD/INR is only modestly higher, probing above 77.60, but rupee is underperforming strength elsewhere in the region. Higher energy prices a likely headwind. Earlier, RBI Governor Das stated he will not hike to the extent it derails growth. He also noted that the RBI is less mindful of outright levels in USD/INR but on the rate of depreciation.

- IDR: Spot USD/IDR re-opened sharply lower, with broader greenback weakness driving the move. The 1 month NDF is now sub 14600. Bloomberg cited veteran analyst Dorab Mystry as noting that Indonesia's palm oil exports "are still not fully operational," with domestic storage tanks filling up quickly.

- PHP: USD/PHP is back sub 52.30 today, around 0.25% below closing levels from yesterday. Monetary Board Member Medalla will replace Diokno as central bank chief from July 1, while the incoming Finance Secretary said he wants to keep Rosalia de Leon as the Treasurer.

- MYR: USD/MYR is back down through 4.3800, likely aided by the push in Brent above $117/bbl. Outside of commodity moves, Zuraida Kamaruddin quit Bersatu and will be meeting the PM to discuss her resignation as Plantation Industries and Commodities Minister. Malay Mail reported that Premier Ismail Sabri may respond with a Cabinet reshuffle next week.

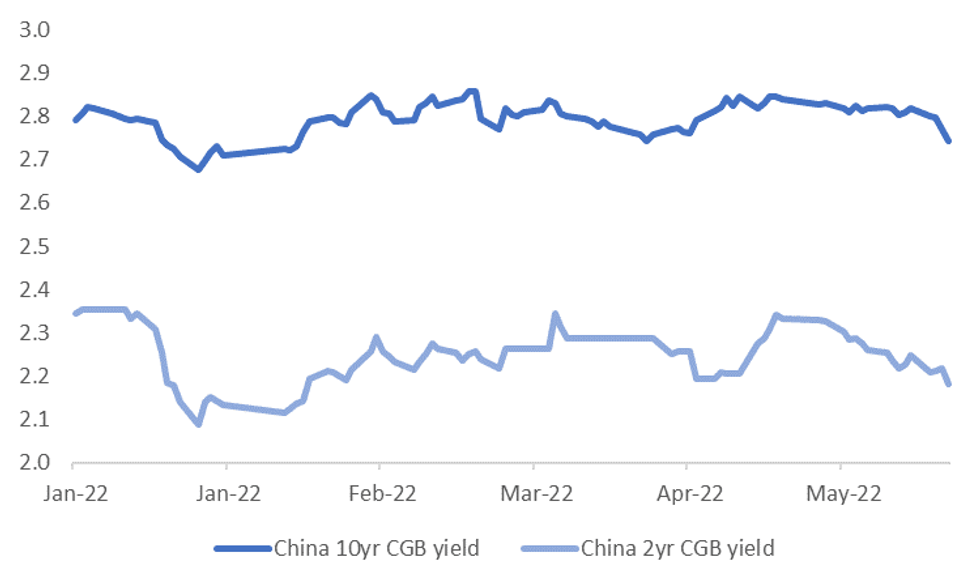

CNH: Lower Bond Yields in Focus, CNH Diverges From DXY

Renewed China growth fears are driving fresh downside in onshore Chinese yields, see the chart below.

- The 2yr and 10yr saw decent moves lower yesterday, with both tenors not too far away from multi-month lows. These moves came after Premier Li's warning around 2022 growth challenges on Wednesday.

- Further downside pressure in yields is likely to remain in focus today.

Fig 1: China 2yr & 10yr CGB Yields Seeing Fresh Downside

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

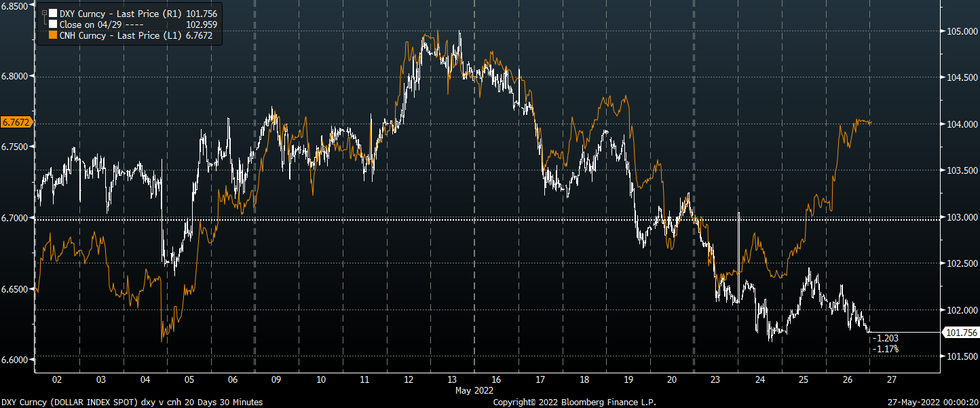

- Such a backdrop is starting to drive a wedge between USD/CNH and the DXY index, see the second chart below.

- Further CNY weakness in trade weighted terms is likely to remain a theme until the domestic macro picture in China finds a firmer footing.

Fig 2: USD/CNH & DXY Divergence

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

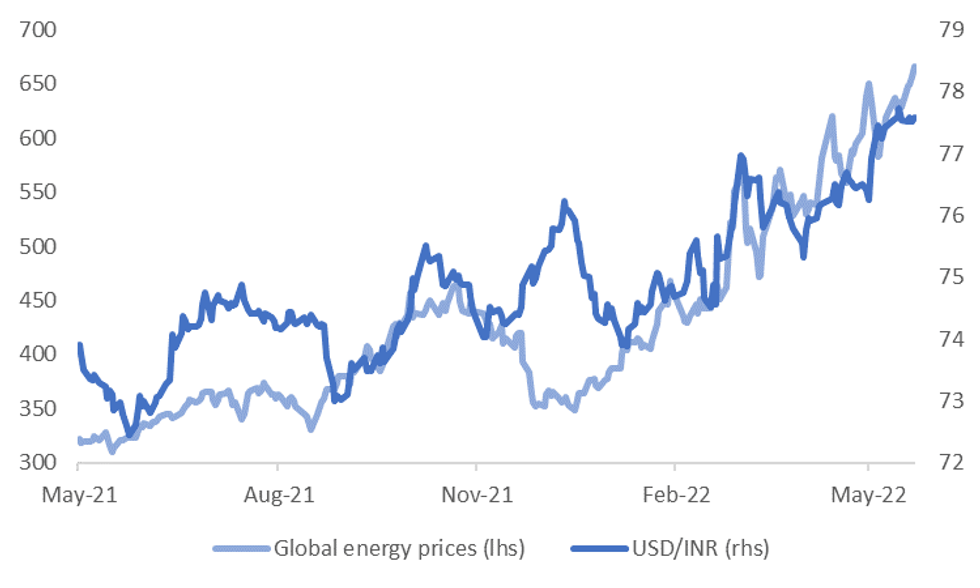

INR: Rupee Lags On Higher Energy Prices

USD/INR spot is tracking above 77.60 in early trade, the only currency within the region to falter against the USD today.

- Higher energy prices are likely presenting a headwind. The Bloomberg spot commodity energy index is now at fresh highs, see the first chart below. This has coincided with Brent crude pushing back above $117/bbl.

- Whilst India is importing large volumes of oil from Russia, which won't be inline with benchmark spot oil prices, we have seen the correlation between USD/INR and energy prices rising this year.

Fig 1: Global Energy Prices & USD/INR

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

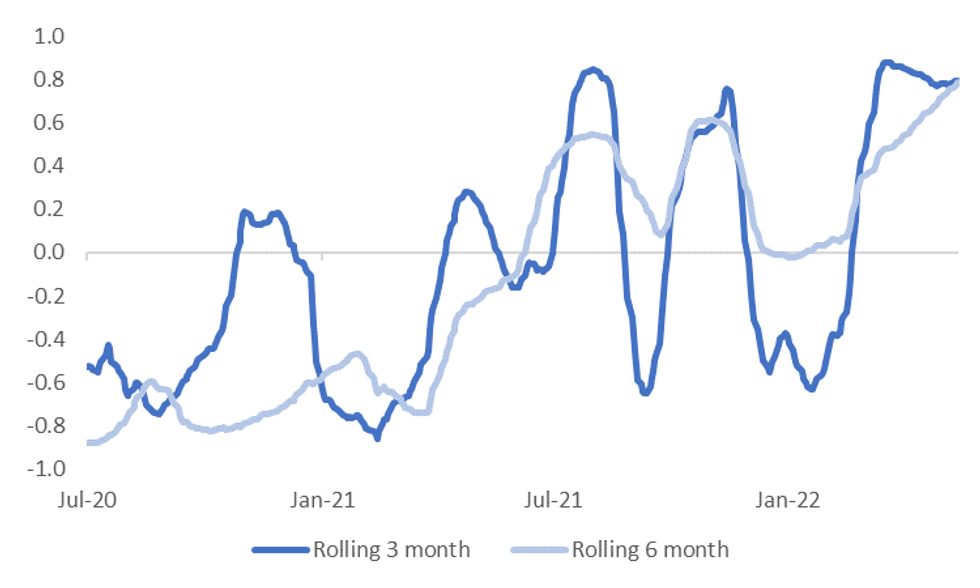

- This is illustrated more clearly with the second chart, where the rolling 3 month and 6 month correlations between energy prices and USD/INR is plotted.

- The general trajectory for the correlations has been higher. As energy markets have become more supply driven, arguably this has become more of a headwind for INR. In 2020 and 2021 rising commodity prices tended to also reflect improving global demand conditions, which could have boosted Indian exports and cushioned the INR to a degree.

- Renewed strength in energy prices comes as USD/INR threatens to break higher. Spot has traded a tight range for the past few weeks, with likely RBI intervention capping moves into the 77.70-80 are.

- Earlier, RBI Governor Das stated that the central bank doesn't like run away depreciation pressures for the currency. Hence the RBI is unlikely to be targeting a specific level in USD/INR but rather the rate of change.

- In the current context though, the RBI may wish to avoid fresh USD/INR highs at a time when the broader USD has weakened.

- INR is likely to remain a laggard though compared to the rest of the EM Asia FX bloc.

Fig 2: Correlations Between USD/INR & Energy Prices

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EQUITIES: Hang Seng Outperforms On Tech Giant Beats

A positive start for Chinese & Hong Kong equities provided the highlight of Asia-Pac dealing. The space benefitted from hope re: fresh policymaker support for the Chinese economy, news of accelerated special bond issuance from local Chinese governments during May and stronger than expected quarterly earnings data from a couple of the tech giants (Alibaba & Baidu). This allowed the Hang Seng to outperform on the day (last +2.8%), although Chinese & Hong Kong equities have ticked away from best levels, perhaps on the back of the latest round of credit stress surrounding the Chinese property developer space.

- The move higher in Chinese & Hong Kong equities allowed e-minis to find a bit of a base after they took a hit in the wake of a BBG source report noted that “the US and Taiwan are planning to announce negotiations to deepen economic ties, people familiar with the matter said, in a fresh challenge to Beijing, which has cautioned Washington on its relationship with the island.” Note that losses were modest, even at their extremes, with the 3 major contracts last 0.1% softer on the session.

- Friday’s bid in Asia-Pac equities came on the back of a positive Wall St. lead, with Thursday seeing the U.S. indices benefit from a better than expected quarterly earnings report from Macy’s, among other retailers (bucking the recent trend of disappointing reports out of the sector), and speculation surrounding a Fed tightening pause at some point in Q4.

GOLD: Recovers Modestly

Gold is up slightly today, +0.20%, to be back close to $1854, but we remain comfortably within recent ranges.

- For the most part, Gold has followed broader USD sentiment today. The early dip below $1850 coincided with some USD strength but the DXY is now -0.30% below the NY closing level, hence the precious metal's recovery.

- Equity sentiment in the region has been strong, with HK and China related markets leading the move higher. This has likely capped Gold's rebound to degree from a risk sentiment standpoint. US equity futures are lower, but only slightly.

- US yields have edged down in the 2yr, but the 10yr has remained steady. The real US 10yr continued to ease overnight, down to 0.13%. This is likely to help keep a floor under gold demand. Dips back to $1840 are generating support.

OIL: Flat In Asia, U.S. Refined Product Demand/Scarcity & Russia Front & Centre

WTI and Brent crude futures are little changed on the day, with buoyant regional equity indices providing some cushion for crude during Asia-Pac dealing. This has allowed crude futures to consolidate Thursday’s $3.00+ gains, with continued worry surrounding tight U.S. refined product markets ahead of driving season and the bid in equity markets cited as the major drivers behind yesterday’s gains. Note that WTI is on course to lodge a fifth straight round of weekly gains based on current price levels.

- When it comes to tight U.S. product markets, BBG sources have reported that “the Biden administration is reaching out to the oil industry to inquire about restarting shuttered refineries, as the White House scrambles to address record high- gasoline prices that are setting off political alarm bells ahead of the midterm elections.”

- Elsewhere, the elongated EU discussions re: the next round of Russian sanctions continue to drag on. Thursday saw Hungary note that it needs 3 to 4 years to move away from Russian oil, with such a move requiring huge investment. A Hungarian official used an interview with RTRS to stress that any deal with the EU re: a Russian crude embargo must address all of the country’s concerns.

- When it comes to wider demand for Russian oil, Kpler has flagged a record level of Russian oil aboard tankers, with most of that cargo bound for India & China.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/05/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 27/05/2022 | 0800/1000 | ** |  | EU | M3 |

| 27/05/2022 | 1135/1335 |  | EU | ECB Lane Panelist at BOJ-IMES Conference | |

| 27/05/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 27/05/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 27/05/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 27/05/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.