-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI INTERVIEW2: Poland To Push For EU Defence Fund

MNI EUROPEAN OPEN: Moderation In Shanghai & Beijing Restrictions Brightens Risk Outlook

EXECUTIVE SUMMARY

- CHINA’S COVID OUTBREAK WANES AS CURBS EASED TO BOOST ECONOMY (BBG)

- POWELL TO MEET WITH BIDEN ON TUESDAY

- POLL SHOWS JOHNSON FACING RED WALL WIPEOUT AS LABOUR RETURNS AMID PARTY FALLOUT (THE TIMES)

- RBNZ CONFIDENT OF ‘SOFT LANDING’ DESPITE RAPID RATE HIKES (BBG)

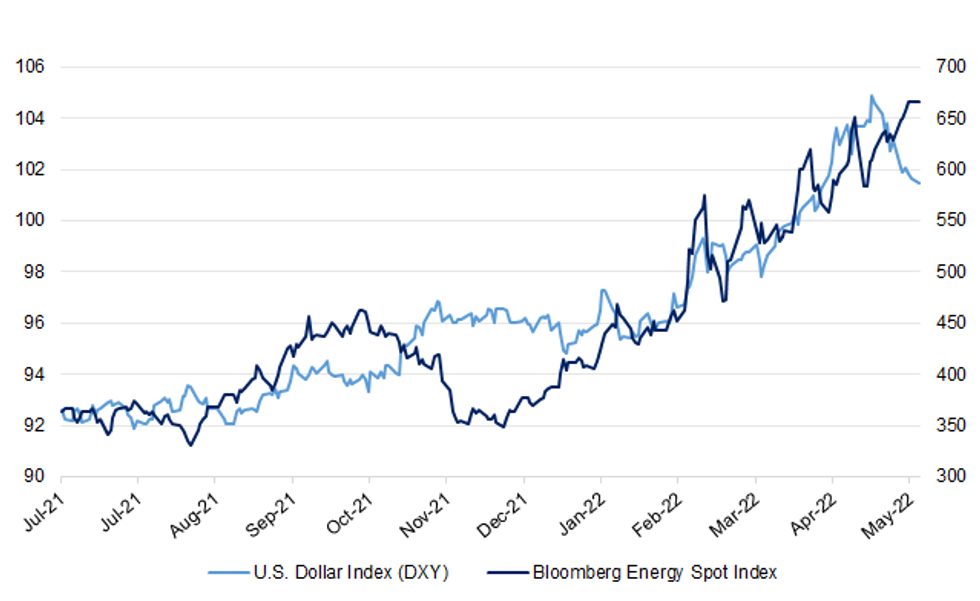

Fig. 1: U.S. Dollar Index (DXY) Vs. Bloomberg Energy Spot Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Boris Johnson would lose his seat if an election were held tomorrow, according to a poll that suggests the Conservatives face annihilation in the red wall constituencies they won in 2019. Johnson would be the highest-profile casualty on a night of Tory losses with Blyth Valley, Burnley, Leigh, and Stoke-on- Trent North among the seats likely to return to Labour. The YouGov MRP poll, which used the same model that predicted the outcome of the general election, shows that the Tories would lose all but three of the 88 battleground seats that they hold by a slim margin over Labour. Johnson would be unseated in his constituency of Uxbridge & South Ruislip, with much of London and its suburbs turning red. Sir Iain Duncan Smith, the former Tory leader, would lose his Chingford & Woodford Green constituency, while Steve Baker, the prominent Brexit rebel, could be defeated in Wycombe. (The Times)

POLITICS: A drip feed of no confidence letters in Boris Johnson has continued as pressure grows following the Sue Gray report into partygate. There has been a steady trickle of Conservative MPs publicly calling for the PM to go after senior civil servant Ms Gray published her findings into lockdown-breaking parties in Downing Street and Whitehall. Veteran Tory Sir Bob Neill, chairman of the Commons Justice Committee, added his name to that list on Friday, saying he did not regard the PM's explanations as "credible" so has submitted a letter of no confidence to Sir Graham Brady. Mr Johnson has said he did not regard the gatherings as parties and simply saw them as work events - which he says is backed up by the Met Police only fining him for one event, his birthday party. The only person who knows how many MPs have submitted a letter is Sir Graham, chair of the 1922 Committee of backbench Tory MPs. It takes 54 letters to trigger a no-confidence vote in the PM. As of Saturday afternoon, Sky News has counted 24 MPs - including Sir Bob - publicly calling for Mr Johnson to quit immediately since the Met Police fined the PM in mid-April. Not all have revealed if they have sent a letter to Sir Graham. (Sky)

POLITICS: Claims that details of an alleged Downing Street flat party were removed from Sue Gray's investigation into coronavirus rule breaking has been denied by No 10 sources. The Sunday Times reported that the senior civil servant, who on Wednesday delivered her 37-page report into events held in Downing Street and Whitehall during England's lockdowns, had pressure placed on her by senior members of Boris Johnson's team to remove certain details and names. The newspaper said the so-called "Abba party" held in the Prime Minister's flat on November 13 2020 was "tweaked" by Mr Johnson's chief-of-staff Steve Barclay on the eve of publication. (Press Association)

POLITICS: Simon Case, the cabinet secretary, has been told of previously unseen messages suggesting that Carrie Johnson held a law-breaking gathering in the No 10 flat. The head of the civil service has been sent a letter indicating that there was another event in the Downing Street flat that has not been made public. The disclosure, just days after the publication of the Sue Gray report, threatens to reignite the partygate scandal. Boris Johnson has spent much of the past week trying to draw a line under it and shore up his leadership with an extensive economic package. (The Times)

POLITICS: Boris Johnson will make it more difficult for the Tories to win the next election after the parties scandal, a Conservative MP has said. Sir Robert Syms, MP for Poole, said the party had no direction under Johnson. A total of 24 Tory MPs have called for the prime minister to quit and 11 have criticised him in public amid mounting disquiet in the party. (The Times)

POLITICS: Boris Johnson has plunged the Conservative party into an acute identity crisis as a result of Partygate and U-turns over tax policy, senior Tories warned last night, as more MPs called for him to resign as prime minister. Former Tory leader Iain Duncan-Smith told the Observer his party had been left with an “enormous identity problem” because it had raised taxes instead of cutting them under Johnson and the chancellor, Rishi Sunak, undermining a core Tory message that had helped win it successive general elections. (Observer)

ECONOMY: Three-quarters of small and medium-sized companies are worried about the long-term impact the cost of living crisis, soaring energy bills and rising inflation will have on their business, a survey has found. Just over half (51%) of SMEs said they were concerned that rocketing prices would dent consumer spending, in response to Barclays’ SME Barometer, a quarterly survey of business sentiment conducted for the bank. Rising energy bills and higher raw material costs are putting pressure on businesses and creating a challenging trading environment. More than a quarter of the 574 firms surveyed said they feared that having to increase their own prices in response would make them less competitive. A tight labour market is putting further pressure on businesses, they reported, with some struggling to hire new staff. Recently companies across a range of industries, from nurseries to nightclubs, have reported problems finding workers to fill vital roles. (Guardian)

FISCAL: The UK tax authority has admitted it has no idea how much tax is being evaded by UK residents holding money offshore, after new figures revealed hundreds of billions of pounds was held in tax havens. HM Revenue & Customs disclosed in freedom of information requests that UK residents had £850bn in financial accounts overseas — of which £570bn was based in tax havens — in 2019, the latest year HMRC has released statistics for. The figures come from financial data that has been shared with HMRC by more than 100 countries since 2017, under international rules known as the Common Reporting Standard (CRS). (FT)

BREXIT: Boris Johnson is drawing up plans to remove tracts of EU laws from British statute books by introducing “sunset clauses” that will force ministers to keep them, change them or scrap them. Jacob Rees-Mogg, the minister for Brexit opportunities, told the cabinet this month that the move would set an expiry date on EU regulations. The measures, in the Brexit freedoms bill, will introduce a five-year “expiry date” for 1,500 pieces of EU legislation. He told ministers it would reduce the burden of regulation on business. (The Times)

ENERGY: Six million households could face blackouts this winter because of Russia’s invasion of Ukraine, ministers have been warned, as they look to bolster electricity supplies by prolonging the life of coal and nuclear power stations. The Times has been told that the government’s “reasonable” worst-case scenario, which has been drawn up by officials from across Whitehall, says that there could be widespread gas shortages if Russia goes further in cutting off supplies to the EU. (The Times)

ENERGY: Boris Johnson is declaring war on petrol stations that fail to pass on the Government’s fuel duty cut, pledging to name and shame those that refuse to drop their prices. Three government sources said the Prime Minister had expressed fury that the 5p-a-litre cut to fuel duty announced in March was failing to materialise at many pumps. (Telegraph)

HOUSING: Data from portal Zoopla also indicates average time to sell a home is lengthening The UK’s red hot housing market is beginning to cool, with a growing number of sellers cutting asking prices and the average time to sell a home lengthening, according to data published by the property portal Zoopla. More than one in 20 homes for sale had their asking prices slashed last month, by an average of 9 per cent, Zoopla said, the highest level of discounting in 18 months. “We’re seeing the start of signals that things are softening,” said Gráinne Gilmore, the portal’s head of research. (FT)

HOUSING: First-time buyers who want to take advantage of the government’s help-to-buy scheme will have to reserve a property by the end of October, it has emerged – two months earlier than had been expected. The scheme, which offers an equity loan to buyers to enable them to buy a new-build property with a deposit of just 5%, is set to end in March 2023 – a decade after it was launched to kickstart the housing market after the financial crisis. (Guardian)

EUROPE

GERMANY: Germany’s governing parties and the main opposition group agreed to boost military investment by 100 billion euros ($107 billion) while declining to commit to spending 2% of gross domestic product on defense every year. The agreement by party representatives envisages meeting the 2% goal “on a multiyear average,” according to a Finance Ministry statement Sunday. The 100 billion-euro boost for Germany’s military will be ensured with an off-budget fund that requires a constitutional amendment, according to the statement. The North Atlantic Treaty Organization’s goal of having member countries spend at least 2% of GDP on defense has been a sore point between the US and some NATO alliance countries, particularly with Germany under former US President Donald Trump. “We won’t reach the 2% goal equally every year,” Frankfurter Allgemeine Sonntagszeitung cited Social Democratic Party co-chair Saskia Esken as saying.

ITALY: Italy's business lobby Confindustria forecasts an almost 2% hit on the country's gross domestic product (GDP) on average per year in 2022 and 2023 in case of a stop of natural gas imports from Russia in June, it said in a research note. (RTRS)

ITALY: Italy is considering tightening a state guarantee scheme designed to help banks shed bad debts while weighing its extension to cushion the hit from the Ukraine war and the pandemic, according to people familiar with the matter. Since its 2016 launch, the 'GACS' scheme has helped Italian banks offload 96 billion euros ($103 billion) in bad debts by softening the hit from the disposals to their earnings. As of end-2021 investors held 11.6 billion euros in GACS-backed debt, Treasury data showed in April. The scheme in its current form expires on June 14. (RTRS)

RATINGS: Sovereign credit rating reviews of note from after hours on Friday included:

- Fitch affirmed Italy at BBB; Outlook Stable

- Fitch affirmed Sweden at AAA; Outlook Stable

- DBRS Morningstar confirmed Poland at A, Stable Trend

U.S.

FED: President Joe Biden will meet with Federal Reserve Chair Jerome Powell on May 31 to discuss the state of the American and global economy, White House said in an emailed statement. (BBG)

FED: The U.S. Federal Reserve is carrying $330 billion in unrealized losses on its holdings of U.S. Treasury and mortgage-backed securities as of the end of March, according to newly released financial statements showing the impact of rising interest rates on the market value of the Fed's balance sheet. (RTRS)

INFLATION: The Trimmed Mean PCE inflation rate over the 12 months ending in April was 3.8 percent. According to the BEA, the overall PCE inflation rate was 6.3 percent on a 12-month basis, and the inflation rate for PCE excluding food and energy was 4.9 percent on a 12-month basis. (Dallas Fed)

ECONOMY: MNI INTERVIEW: High Prices Key Driver of Weak Sentiment- UMich

- High inflation is a major reason Americans feel even worse about the economy than they did at the start of the pandemic, the head of the University of Michigan's Survey of Consumers told MNI, despite some tentative signs consumers expect prices to come down. "They continue to hold pretty pessimistic views about the general state of the economy going forward and the common theme is inflation," said Joanne Hsu said in a phone interview Friday. "They are very concerned. They're worried about inflation. They're worried about their fellow Americans" - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

OTHER

GLOBAL TRADE: Ukraine’s Agriculture Ministry said farmers are nearing the completion of the spring planting season for grains and legumes, with the area sown for plants such as wheat and corn down by 22% from last year in wartime conditions. The total area, including oilseed crops such as sunflower and soybeans, is expected to fall by about 16% this year. The main challenge for producers is shipping the harvest to foreign markets given the maritime blockade of Black Sea ports crucial to Ukrainian exports. (BBG)

GLOBAL TRADE: Russian President Vladimir Putin told the leaders of France and Germany in a phone call on Saturday that Russia was willing to discuss ways to make it possible for Ukraine to resume shipments of grain from Black Sea ports, the Kremlin said. (RTRS)

U.S./CHINA: Visiting Chinese State Councilor and Foreign Minister Wang Yi said Saturday that China-U.S. relations are not a zero-sum game and the U.S. should address the bilateral ties based on the principles of mutual respect, peaceful coexistence and win-win cooperation. In response to a recent policy speech by U.S. Secretary of State Antony Blinken, who described China as "the most serious long-term challenge to the international order," Wang said there are major misconceptions in the U.S. views about the world, China and China-U.S. relations. The world is not what the United States has described and the most pressing task facing the international community is to jointly protect human life and health, promote world economic recovery and safeguard world peace and tranquility, which calls for the establishment of a community with a shared future and for the implementation of purposes and principles enshrined in the UN Charter, Wang said. (China News)

U.S./CHINA: The US government announced on Friday that it would extend for six months its tariff exclusions for surgical masks and other Chinese products that help prevent the spread of Covid-19. The exclusions will remain in effect until November 30, and the Office of the US Trade Representative (USTR) “may continue to consider further extensions and/or additional modifications as appropriate”, it said in a Federal Register notice. Amid a recent rise in Covid-19 infections, the USTR determined that tariff exclusions for 81 product categories were necessary. The decision came after a review of public comments and advisories from other US government agencies responsible for managing the Section 301 tariffs on Chinese goods. (SCMP)

U.S./CHINA/TAIWAN: The US Navy reportedly conducted dual aircraft carrier exercises on Saturday and Sunday to the southeast of Okinawa, not far from the location where the Liaoning aircraft carrier group of the Chinese People's Liberation Army (PLA) Navy just wrapped up its three-week-long drills. (Global Times)

GEOPOLITICS: The Biden administration is seeking ways to enforce the rules in the new Indo-Pacific Economic Framework, U.S. Trade Representative Katherine Tai said, describing the initiative as "not a traditional trade agreement." (Nikkei)

GEOPOLITICS: Turkish President Tayyip Erdogan said talks with Finland and Sweden about their joining NATO were not at the "expected level" and Ankara cannot say yes to "terrorism-supporting" countries, state broadcaster TRT Haber reported on Sunday. (RTRS)

GEOPOLITICS: Defense ministers of South Korea, the United States and Japan have been arranging trilateral talks on the sidelines of an annual security forum in Singapore next month, Japan’s Kyodo News reported Sunday. South Korean Defense Minister Lee Jong-sup and his U.S. and Japanese counterparts, Lloyd Austin and Nobuo Kishi, are reportedly expected to join the Shangri-La Dialogue in Singapore set for June 10-12. (Yonhap)

BOJ: Bank of Japan Governor Haruhiko Kuroda pledged on Monday to patiently stick to powerful monetary easing to help the economy recover from the COVID-19-induced doldrums. Kuroda also told parliament the yen was regaining stability from recent rapid weakening that was "undesirable". (RTRS)

JAPAN: The approval rating of Prime Minister Fumio Kishida's cabinet reached 66% in the latest Nikkei survey, the highest since it was sworn in last October. Approval edged up from the 64% of April, while the cabinet's disapproval rating fell to 23% from 27%, in the poll conducted with TV Tokyo over the weekend. (Nikkei)

AUSTRALIA: After 20 years in parliament and several attempts at claiming the leadership, Peter Dutton has become the new Liberal leader after former prime minister Scott Morrison's election defeat. Mr Dutton was assumed to be the next leader after the other most-likely challenger, former treasurer Josh Frydenberg, lost his seat in the election night "teal bath" of independents who claimed inner-city Liberal seats. (AC)

AUSTRALIA: David Littleproud has been chosen as the next leader of the Nationals. Littleproud ousted former deputy prime minister Barnaby Joyce following a post-election leadership spill in Canberra on Monday morning, with NSW Senator Perin Davey elected deputy. (Guardian)

RBA: Eminent economists insist Labor’s election promise to review the Reserve Bank of Australia and monetary policy settings must be undertaken by an independent overseas expert to maintain its credibility. The group of 11 economists, including former RBA board member Warwick McKibbin, Saul Eslake, Chris Richardson, Peter Tulip, Danielle Wood, Richard Holden and Steven Hamilton, said the probe was a “once-in-a-generation” opportunity and must not simply be “a performance appraisal”. “Full independence is crucial if the review is to make the most of this unique opportunity,” the group said in an open letter to Treasurer Jim Chalmers. “No institution can be expected to independently or credibly review itself. A foreign perspective would bring valuable external scrutiny to the process and enable a benchmarking of the RBA against its overseas counterparts.” (Australian Finance Review)

RBNZ: New Zealand’s central bank is confident it can guide the economy to a “soft landing” even as it raises interest rates aggressively to tame inflation. “It’s difficult to engineer a soft landing -- typically a significant reduction in inflation is accompanied by negative economic growth -- but there’s reasons to believe New Zealand is well placed to pull it off this time around,” Paul Conway, the Reserve Bank’s new chief economist, said in an interview Monday in Wellington. “The labor market is strong and that’s the underlying reason why the New Zealand economy is well placed to weather the storm.” The RBNZ last week raised its official cash rate by half a percentage point for a second consecutive meeting and forecast a steeper tightening track that will take the OCR to around 4% next year. Conway said the Monetary Policy Committee didn’t seriously consider a bigger move of 75 basis points. “75 wasn’t seriously on the table because we are pretty convinced that we can get to where we need to get with 50-point increments” he said, adding the bank was “signaling there’s probably some more 50 points coming over the next little while.” (BBG)

RBNZ: Reserve Bank of New Zealand's chief economist Paul Conway said on Monday the central bank's current rate track was their "best foot forward on their current view" but it could change depending on economic indicators. "If we get six weeks or 12 weeks down the track and the place is cooling a bit more quickly than anticipated... we get to play the game again," he said in an interview with Reuters. He added, however, the monetary policy committee was really cognizant of the risks around inflation expectations getting away from them. (RTRS)

SOUTH KOREA: President Yoon Suk-yeol instructed officials Monday to swiftly execute a new 62 trillion-won (US$49.4 billion) extra budget for small businesses hit by the pandemic. Yoon made the remark during a weekly meeting with his senior secretaries, shortly after the budget was approved at a Cabinet meeting following its passage through the National Assembly late Sunday. "It's a great relief that the extra budget proposal passed through the National Assembly," Yoon said during the meeting, reiterating it is the state's responsibility to compensate business owners who suffered under government-imposed coronavirus restrictions. "I urge the financial authorities to swiftly execute it so that small business owners and self-employed people who are holding on to their last breaths can swiftly make payments to stabilize their livelihoods," he said. (Yonhap)

NORTH KOREA: North Korea removed virus lockdown measures that had been in place for more than two weeks in its capital, news reports indicated, after saying policies by leader Kim Jong Un have controlled the country’s first Covid outbreak. Kim’s regime has partially lifted the lockdown in Pyongyang and eased curbs in “stabilized areas,” Yonhap News Agency of South Korea on Monday reported diplomatic sources as saying. Residents in Pyongyang were allowed to leave their homes for the first time since May 12 and business were slowly opening, NK News on Sunday reported sources in the isolated state as saying. North Korea has not allowed in outside workers to help with the pandemic or verify any of its numbers for the public health crisis that could have overwhelmed its antiquated medical system -- and posed a threat to Kim’s regime. It and Eritrea are the only two countries that have not administered vaccines, putting their people at increased risk. (BBG)

HONG KONG: Hong Kong will relax some Covid-19 testing requirements for incoming passengers as the city takes small steps toward easing travel restrictions. While travelers still need a nucleic acid test withing 48 hours of the scheduled departure of their flight to the financial hub, they will no longer have to give documentary proof of the lab’s accreditation, the Hong Kong government said in a statement Sunday. The city will also drop requirements for transit passengers to have a pre-flight polymerase chain reaction-based nucleic acid test. The changes take effect from June 1 and are the latest tweaks from a government that says it’s committed to a strict Covid Zero policy even as case numbers dwindle and much of the world outside China opens up. Hong Kong lifted a ban on non- residents coming to the city from the start of May but still requires inbound passengers to quarantine for at least seven days after their arrival. (BBG)

TURKEY: President Recep Tayyip Erdogan spoke up against higher interest rates as a remedy for inflation a day after Turkey’s central bank opted to carry on with its ultra-loose approach, even as pressure builds on consumer prices and the lira. “Those who try to impose on us a link between the benchmark rate and inflation are either illiterates or traitors,” Erdogan said on Friday in Istanbul, addressing a group of businesspeople. “Don’t pay attention to the ramblings of those whose only quality is in viewing the world from London or New York.” (BBG)

TURKEY: Turkey’s president told journalists that Ankara remains committed to rooting out a Syrian Kurdish militia from northern Syria. “Like I always say, we’ll come down on them suddenly one night. And we must,” Turkish President Recep Tayyip Erdogan said on his plane following his Saturday visit to Azerbaijan, according to daily Hurriyet newspaper and other media. Without giving a specific timeline, Erdogan said that Turkey would launch a cross-border operation against the Syrian Kurdish People’s Protection Units, or YPG, which it considers a terrorist group linked to an outlawed Kurdish group that has led an insurgency against Turkey since 1984. That conflict with the Kurdistan Workers' Party, PKK, has killed tens of thousands of people. (AP)

RUSSIA: The “liberation” of Ukraine’s Donbas is an “unconditional priority” for Moscow, while other Ukrainian territories should decide their future on their own, RIA news agency cited Russia’s Foreign Minister Sergei Lavrov as saying on Sunday. “The liberation of the Donetsk and Luhansk regions, recognized by the Russian Federation as independent states, is an unconditional priority,” Lavrov said in an interview with French TV channel TF1, according to RIA. For the rest of the territories in Ukraine, “the people should decide their future in these areas,” he said. (RTRS)

RUSSIA: Several explosions were heard in the Ukrainian city of Kharkiv on Sunday hours after a visit by President Volodymyr Zelenskiy, who was making his first trip outside of the Kyiv region since the start of Russia's invasion, a Reuters journalist said. A large plume of dark smoke could be seen rising northeast of the city centre. Kharkiv has been subjected to Russian shelling in recent days after several weeks of relative quiet. (RTRS)

RUSSIA: Ukraine said its forces were holding out against an intense Russian assault in the eastern Donbas region amid heavy artillery fire but implored the west to supply weapons to help Kyiv turn the tide of the war. Serhiy Haidai, governor of the Luhansk region that makes up half of the Donbas, said on Sunday that Ukraine had driven Russian troops back from a highway, allowing Kyiv’s forces to supply the key city of Sievierodonetsk. Russia is concentrating its forces on capturing Sievierodonetsk, the last big city in Luhansk still under Ukrainian control, as part of an offensive in the Donbas more than three months into President Vladimir Putin’s invasion. (FT)

RUSSIA: Russia’s defence ministry said on Saturday that the eastern Ukrainian town of Lyman had fallen under the full control of Russian and Russian-backed forces in the region. (RTRS)

RUSSIA: Ukrainian forces may have to retreat in Luhansk to avoid being captured, the region's governor has said. Serhiy Gaidai said Russian troops have entered Severodonetsk, the largest Donbas city still in Ukrainian hands. (Sky)

RUSSIA: The Russian navy on Saturday conducted another test of a prospective hypersonic missile, a demonstration of the military’s long-range strike capability amid the fighting in Ukraine. The Defence Ministry said the Admiral Gorshkov frigate of the Northern Fleet in the White Sea launched the Zircon cruise missile in the Barents Sea, successfully hitting a practice target in the White Sea about 1,000 kilometres (540 nautical miles) away. (SCMP)

RUSSIA: Russia has learned from previous mistakes on the battlefield, even if its progress in Ukraine remains “incremental,” Pentagon spokesman John Kirby told reporters on Friday. Russia has attempted to remedy some of the challenges it faced in “logistics and sustainment,” which left Putin’s troops without crucial supplies in the early days of the war, Kirby said. Part of the improvement stems from the fact that the Donbas region is closer to Russia and part comes from a higher degree of caution about “getting too far ahead,” he added. The Russian military has had only limited success in its attempts to improve the integration of its air and ground operations. “They’re using smaller units now in smaller places and smaller movements,” Kirby said. Russia also continues to face problems with the “command and control” of its troops in the field, he added. (BBG)

RUSSIA: Russian President Vladimir Putin held a call with French President Emmanuel Macron and German Chancellor Olaf Scholz. The group discussed stalled negotiations between Russia and Ukraine, with the Kremlin saying Kyiv was to blame for the current impasse. Putin “confirmed the openness of the Russian side to the resumption of dialogue,” Russia said in a read-out following the 80-minute call. Scholz and Macron called on Putin “to engage in serious direct negotiations with the President of Ukraine and to find a diplomatic solution to the conflict,” according to a read-out from the German Federal Government. Putin also said the West delivering weapons to Ukraine could risk “further destabilization of the situation and the aggravation of the humanitarian crisis.” (CNBC)

RUSSIA: Russia's National Settlement Depository (NSD) on Friday successfully paid coupons in foreign currency on two Eurobonds, an NSD representative told Reuters, a move that could mean Russia may have again averted a default. (RTRS)

RUSSIA: Russia will prepare a settlement mechanism before June payouts that will allow it to service its dollar-denominated foreign debt, Finance Minister Anton Siluanov said in a TV interview aired on Friday. Siluanov also said Moscow expects to receive up to an additional 1 trillion roubles ($15.27 billion) in oil and gas revenues this year, funds from which will be channelled to increased social welfare payments. (RTRS)

RUSSIA: Foreign investors can open accounts in Russian banks in rubles and hard currency to receive payment, the finance minister told the business newspaper published in Moscow. In short, it’s a reverse-image of the way European nations now pay for Russian gas while avoiding obstacles imposed by sanctions. “This is how it works for gas payments: we get foreign currency, then it is converted to rubles” on behalf of the gas buyer, Siluanov said. “The Eurobond settlement mechanism will operate in the same way, but in the opposite direction.” (BBG)

RUSSIA: Russia's state-owned railway monopoly RZhD will raise freight tariffs for the majority of cargo by 11% from June 1, according to the Federal Monopoly Service (FAS) document seen by Reuters. A source close to the matter confirmed that the Russian authorities have suggested raising tariffs, adding that this decision is likely to be approved. The tariff increase will apply to all cargo except for imported consumer goods, internal shipments of food as well as construction materials, according to the FAS document. Russia also plans to scrap a 10.5% discount on energy coal exports and a 60% discount on long-range exports for three months, the document showed. The FAS did not immediately reply to Reuters' request for comment. RZhD declined comments. (RTRS)

SOUTH AFRICA: South Africa’s central bank will transition to a new, more simple monetary policy implementation framework that should help improve transmission from June 8. The transition is expected to last 12 weeks, the South African Reserve Bank said in a statement on its website. “The amendments to the framework are technical in nature and will affect how monetary policy is implemented but will not affect the inflation target range or the interest rate decisions of the MPC,” the statement said. The new framework will see the central bank shifting to a surplus system from its current deficit set-up, meaning that the central bank will allow commercial banks to hold and earn interest on excess reserves. It will also introduce measures to prevent banks from hoarding liquidity and thus help maintain an interbank money market, similar to the “tiered floor” framework used by the Reserve Bank of New Zealand and the Norges Bank. (BBG)

SOUTH AFRICA: South African power utility Eskom Holdings SOC Ltd said it has suspended loadshedding thanks to a marginal improvement in the generation capacity, while cautioning that the system will continue to be constrained in the coming weeks. The company appealed to South Africans to use electricity sparingly and switch off all non-essential items to limit the impact, in a statement it posted on Twitter on Sunday. (BBG)

IRAN: Greece accused Iran of “piracy” after Iranian forces seized two Greek oil tankers in the Persian Gulf in apparent retaliation for Greece’s seizing an Iranian tanker and letting the U.S. confiscate its crude oil. Greece’s Foreign Ministry complained to the Iranian ambassador in Athens over the “violent taking over of two Greek-flagged ships” in the Persian Gulf after Iran said it has taken the vessels. Iran’s paramilitary Revolutionary Guard said on Friday that Iranian forces “seized two Greek tankers for violations in Gulf waters,” according to a statement quoted by Iranian state news agency IRNA. The Greek ministry called for the immediate release of the vessels and their crews, saying the “acts effectively amount to acts of piracy,” according to a statement. The ministry warned that the seizure would have “particularly negative consequences” in the bilateral relations between Greece and Iran and on Iran’s relations with the European Union. (POLITICO)

COLOMBIA: A construction magnate who was little known at the start of the year has surged into Colombia’s runoff election with a real chance at winning the presidency as voters coalesce against his leftist rival. Rodolfo Hernandez got 28% of votes, compared to 40% for former guerrilla Gustavo Petro, the electoral authority said Sunday night after an election in which no candidate reached the 50% threshold to avoid a second round. Federico Gutierrez, who polls showed was Petro’s main rival, only got 24%. He and many of his key supporters have already endorsed Hernandez. Hernandez, Gutierrez and center candidate Sergio Fajardo between them got about 12 million votes, compared to 8.5 million for Petro, potentially giving the businessman the upper hand in the runoff. (BBG)

PERU: Peru’s revolving door government that’s already gone through four cabinets lost another top aide, who was swiftly replaced by a new member, with President Pedro Castillo already naming more than 50 ministers in his first 10 months in power. Juan Ramon Lira Loayza, already an official with the labor ministry, was sworn in Sunday night to take over for outgoing Labor Minister Betssy Chavez, who was censured by congress May 26. Chavez’s reprimand by lawmakers came with the support of those close to Vladimir Cerron, the leader of Castillo’s own Peru Libre party. (BBG)

METALS: A ship has entered the Ukrainian port of Mariupol for the first time since Russia completed its capture of the city to load metal and ship it east to Russia, TASS news agency reported on Saturday, in a move that Kyiv decried as looting. (RTRS)

ENERGY: Serbian President Aleksandar Vucic said on Sunday he had agreed a new three-year gas supply contract in a phone call with Russian President Vladimir Putin. (RTRS)

ENERGY: German Economy Minister Robert Habeck on Sunday expressed fears that the European Union's unity was "starting to crumble" ahead of a summit to discuss an oil embargo against Russia and plans to cut dependence on Russian energy. (RTRS)

OIL: European Union governments failed to reach an agreement on an embargo on Russian oil on Sunday, but will continue negotiations on Monday morning as they seek to prepare an agreement in time for an EU summit on Monday afternoon, an EU official said. The proposal under discussion now among EU countries assumes a ban on Russian oil delivered to the EU by sea by the end of the year, but foresees an exemption for oil delivered by the Russian Druzhba pipeline, which supplies Hungary, Slovakia and Czechia. (RTRS)

OIL: Iraq is looking to boost is oil production capacity to 5 million b/d by 2025, the country's oil minister said during a visit to France, as OPEC's second largest producers seeks to drum up foreign investments to help develop its oil fields. (Platts)

CHINA

CORONAVIRUS: China reported the fewest new Covid-19 cases in almost three months, with the easing of outbreaks in Beijing and Shanghai emboldening authorities to relax some of the strictest virus controls of the pandemic and move to stimulate the country’s faltering economy. In Beijing, infections dropped to 12 on Sunday, from 21 on Saturday. Curbs on movement in several districts started to be loosened yesterday after officials said the outbreak was under control. The decline has eased concern that Beijing could have been headed for a lockdown when it was reporting several dozen cases a day earlier in the outbreak despite increasingly strict restrictions. (BBG)

CORONAVIRUS/POLICY: Shanghai will scrap unreasonable restrictions to accelerate the resumption of work and production and promote consumption and investment after a two-month lockdown to curb the spread of Covid-19, Xinhua News Agency reported citing a statement on the municipal gov website on Sunday. Among the latest 50 measures to reignite growth, the city will issue 40,000 new vehicle licenses, reduce the purchase tax on some vehicles, and subsidise car buyers of electric vehicles, the statement said. It will also launch over eight shantytown renovation projects, and expand corporate bond issuance to fund infrastructure construction. (MNI)

PROPERTY/CREDIT: Fantasia Holdings was served with a winding-up petition filed by Flower SPV 4 against the company at the Grand Court of the Cayman Islands in connection with loan facilities of outstanding amount of about $149 million, according to a filing to HKEX. If the company is ultimately wound up as a result of the petition, any transfer of shares, or any alteration in the status of the members, will be void unless a validation order is obtained from the court. Company says it will oppose the petition vigorously. Company will seek legal advice and take all necessary actions to protect its legal rights. Company will apply to the court for a validation order. Trading in the shares will remain suspended until further notice. (BBG)

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Monday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1000% at 9:22 am local time from the close of 1.7138% on Friday.

- The CFETS-NEX money-market sentiment index closed at 41 on Friday vs 44 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7048 MON VS 6.7387

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7048 on Monday, compared with 6.7387 set on Friday.

OVERNIGHT DATA

SOUTH KOREA APR RETAIL SALES +10.6% Y/Y; MAR +7.1%

SOUTH KOREA APR DEPARTMENT STORE SALES +19.1% Y/Y; MAR +7.8%

SOUTH KOREA APR DISCOUNT STORE SALES +2.0% Y/Y; MAR 0.0%

MARKETS

SNAPSHOT: Moderation In Shanghai & Beijing Restrictions Brightens Risk Outlook

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 591.75 points at 27373.62

- ASX 200 up 85.69 points at 7268.4

- Shanghai Comp. up 9.849 points at 3140.089

- JGB 10-Yr future down 1 tick at 149.95, yield down 0.2bp at 0.231%

- Aussie 10-Yr future unch. at 96.730, yield down 0.2bp at 3.253%

- U.S. 10-Yr future -0-00+ at 120-04, cash Tsys are closed

- WTI crude up $1.02 at $116.09, Gold up $7.46 at $1861.18

- USD/JPY down 14 pips at Y126.98

- CHINA’S COVID OUTBREAK WANES AS CURBS EASED TO BOOST ECONOMY (BBG)

- POWELL TO MEET WITH BIDEN ON TUESDAY

- POLL SHOWS JOHNSON FACING RED WALL WIPEOUT AS LABOUR RETURNS AMID PARTY FALLOUT (THE TIMES)

- RBNZ CONFIDENT OF ‘SOFT LANDING’ DESPITE RAPID RATE HIKES (BBG)

US TSYS: Tight Overnight, Memorial Day Limits Activity With Cash Closed

Tsy futures clung to extremely tight ranges in Asia, with cash markets closed and liquidity thinned owing to the observance of the Memorial Day holiday in the U.S.

- The previously outlined risk-positive backdrop, which largely focused on the unwind of some COVID restrictions in the Chinese cities of Shanghai & Beijing (in addition to a raft of economic support unveiled for the former) failed to have a meaningful impact on Tsy futures (granted the S&P 500 is only +0.5% vs. settlement levels), although some light pressure has been observed as European traders start to file in.

- That leaves TYU2 -0-01+ at 120-03, with that level representing the base of the 0-05 overnight range. Note that the contract is operating on very light volume, with under 40K lots changing hands thus far.

- German CPI data and the continuing discussions re: the next round of EU sanctions on Russian oil exports will likely garner most of the interest on Monday.

- A quick reminder that cash Tsys will not be open until Tuesday’s Asia-Pac session, while Tsy futures will be subjected to holiday-curtailed hours on Monday.

JGBS: Tight Start To The Week

Cash JGBs are little changed across the curve, sitting within -/+0.5bp boundaries vs. Friday’s closing levels. Meanwhile, JGB futures nudged lower during the Tokyo morning as domestic equities firmed on the wider global impetus, with the former unwinding its modest overnight gains, before recovering some poise in the afternoon, to last deal at unchanged levels.

- Comments from Japanese PM Kishida & BoJ Governor Kuroda failed to unveil any fresh, market-moving information.

- Meanwhile, participants chose not to react to trivial movements in the offer/cover ratios observed in today’s BoJ Rinban operations, although the presence of the ops may have helped limit losses during the morning.

- Tuesday’s local docket is headlined by the monthly labour market report, industrial production and retail sales prints, with 2-Year supply also due.

AUSSIE BONDS: Tight Session, Awaiting GDP Data

Aussie bond futures were happy to operate in narrow ranges on Monday, with YM unch. & XM +0.5 as we work towards the Sydney close. Note that the contracts are off worst levels of the Sydney session, even with Chinese equities and U.S. e-mini futures underpinned by the previously outlined positive developments surrounding the COVID situation in China & resultant support package announced for the Chinese city of Shanghai. Wider cash ACGB trade sees the major benchmarks running within -/+1bp of Friday’s closing levels, twist flattening, with a pivot around the 5-Year zone. 3- & 10-Year EFPs are a little wider on the day, bull flattening. Bills are -1 to +1 through the reds.

- There hasn’t been much to note when it comes to market moving domestic headline flow, with the Liberal & National parties getting new leaders after the former ruling coalition that consisted of the two parties was ousted in the federal election.

- Meanwhile, focus continues to grow on the impending RBA review, with a group of domestic economists calling for an independent overseas expert to head up the matter.

- Looking ahead to tomorrow’s docket, local matters will be headlined by the final round of Q1 GDP partials ahead of the release of the national accounts on Wednesday. Elsewhere, private sector credit and building approvals data will hit.

EQUITIES: The Bid Extends

The combination of positive spill over from Friday’s U.S. equity trade (whereby the S&P 500 added 2.5% on the day, providing the firmest weekly gains observed for the index since late ’20), the unwind of some COVID-related restrictions in the Chinese cities of Beijing & Shanghai and the deployment of fresh support measures for Shanghai’s economy buoyed risk appetite in Asia. This extended what some perceive to be a bear market rally, while month-end rebalancing flows provide another potential supportive factor for U.S. equities. The Hang Seng & the Nikkei 225 added ~2.0% against this backdrop, while e-mini futures print 0.2-1.0% firmer on the day, with the NASDAQ 100 contract leading the bid there.

OIL: Crude A Touch Firmer In Asia

A mix of the easing of COVID restrictions in both Shanghai & Beijing, firmer equities, a softer USD and continued focus on tight U.S. product markets as the U.S. driving season gets underway, supported crude on Monday. WTI sits $1.00 higher on the day at typing as a result.

- Elsewhere, progress when it comes to EU sanctions on Russian crude exports remains elusive, although talks on the matter are set to continue on Monday. RTRS sources have suggested that the current proposal on the table involves “a ban on Russian oil delivered to the EU by sea by the end of the year, but foresees an exemption for oil delivered by the Russian Druzhba pipeline, which supplies Hungary, Slovakia and Czechia.”

GOLD: Bounces On USD Weakness

Gold has spiked higher this afternoon, regaining the $1860 handle, around 0.35% above closing levels form last week.

- The early trend for gold was very benign. We spent the early part of the day oscillating around the $1850 level.

- This early tone was weighed down by firmer risk appetite as stronger equities for Asia Pac, and a further recovery in US equity futures, dampened flows into the safe haven asset.

- However, this turned around on the back of USD weakness. To be fair, the DXY is only down modestly (-0.10%) from closing levels at the end of last week. The tone in USD/Asia pairs has been much weaker though, led by the China currency (USD/CNH down -0.90% at the time of writing to 6.6600).

- Like last week, the bulls will be eyeing a test of $1865/$1870, while support should emerge between the $1845/$1850 level in the near term.

FOREX: China COVID Positives Support Risk, BBDXY Shows Below Its 50-DMA

The U.S. dollar struggled to find poise and the BBDXY index showed at its worst levels in more than a month, probing the water below its 50-DMA for the first time since the outbreak of Russia's war on Ukraine on Feb 24. Note that U.S. bond markets will be shut until Tuesday, in observance of the Memorial Day holiday.

- Positive market sentiment triggered light risk-on flows across G10 FX space, as regional stock indices crept higher in tandem with U.S. e-mini futures. Further easing of COVID-19 restrictions in Beijing and Shanghai, and a fresh package of economic support measures announced by the latter megacity, sparked optimism.

- The yen fared better than its safe haven peers USD and CHF, which sit at the bottom of the G10 pile. Comments from BoJ Gov Kuroda may have provided some support. The official told lawmakers that the yen has "relatively stabilised" and refused to admit that the BoJ's ultra-loose monetary policy was behind its earlier depreciation.

- Commodity-tied currencies led gains in F10 FX space amid firmer crude oil prices. The kiwi gains alongside its high-beta peers, as the RBNZ's new Chief Economist Conway expressed optimism about the Bank's ability to engineer a "soft landing" for the economy and said the MPC did not seriously consider a 75bp rate hike last week.

- Offshore yuan posted sharp gains, with USD/CNH quickly narrowing in on last week's lows. Aforementioned positives surrounding COVID-19 dynamics seemed to occupy the driving seat.

- German CPI & Swedish GDP as well as speeches from Fed's Waller and ECB's Centeno & Nagel take focus from here. Elsewhere, EU leaders will begin their two-day special summit devoted to Ukraine, energy, defence & food security.

FOREX OPTIONS: Expiries for May30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0650(E828mln), $1.0675(E1.3bln), $1.0725(E503mln), $1.0800(E759mln)

- AUD/USD: $0.7210(A$607mln)

- USD/CNY: Cny6.7500($780mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/05/2022 | 0600/0800 | *** |  | SE | GDP |

| 30/05/2022 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 30/05/2022 | 0700/0900 | *** |  | ES | HICP (p) |

| 30/05/2022 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 30/05/2022 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 30/05/2022 | 0900/1100 | *** |  | DE | Saxony CPI |

| 30/05/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 30/05/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 30/05/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 30/05/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 30/05/2022 | 1230/0830 | * |  | CA | Current account |

| 30/05/2022 | 1500/1100 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.