-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - ECB Set to Deliver Third Consecutive Cut

MNI China Daily Summary: Thursday, December 12

MNI EUROPEAN OPEN: Waller Reaffirms Hawkish View, Chinese City Re-Opening Drive Eyed

EXECUTIVE SUMMARY

- YELLEN TO JOIN POWELL-BIDEN MEETING (BBG)

- BIDEN PLEDGES TO BACK FED IN EFFORT TO COMBAT HIGH INFLATION (DJ)

- FED GOVERNOR WALLER PREPARED TO TAKE RATES PAST NEUTRAL (CNBC)

- EU AGREES COMPROMISE DEAL ON BANNING RUSSIAN OIL IMPORTS (BBC)

- NO-CONFIDENCE VOTE IN BORIS JOHNSON ‘LIKELY’ IF TORIES LOSE BY-ELECTIONS (FT)

- CHINA UNVEILS DETAILED NEW POLICIES TO SUPPORT THE ECONOMY (RTRS)

- SHANGHAI SAYS ALL RESIDENTS IN 'LOW-RISK' AREAS CAN RETURN TO WORK ON JUNE 1

- CHINA OFFICIAL PMI DATA NOT AS SOFT AS EXPECTED

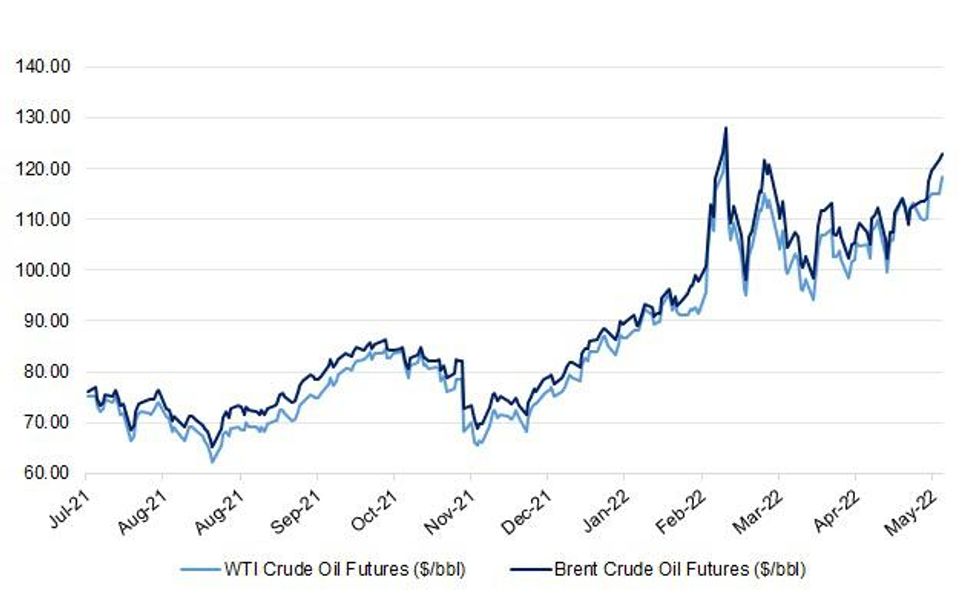

Fig. 1: WTI & Brent Crude Oil Futures ($/bbl)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Senior Conservative MPs said on Monday that Boris Johnson was likely to face a vote of no confidence in his leadership of the party if the Tories lose two parliamentary by-elections next month. Two more Conservative MPs on Monday called for the prime minister to quit following the partygate scandal, including former attorney-general Jeremy Wright. Wright said the affair had done “real and lasting damage” to the government’s reputation, adding: “For the good of this and future governments, the prime minister should resign.” (FT)

POLITICS: Conservative whips are discussing how to fight back if rebel MPs trigger a no confidence vote in Boris Johnson, as three new Tories pressured him to go. All Tory MPs will be immediately contacted if the 54 letters threshold is reached, according to one Conservative whip, in a lobbying drive to save the Prime Minister's job. On Monday, despite Parliament being in recess for the Queen's Platinum Jubilee, some Conservative MPs believed to be critical of Mr Johnson were contacted by their whips, who oversee party discipline. With loyalists of the Prime Minister scrambling to work out the size of the growing rebellion in the wake of Sue Gray's partygate report, there were fresh signs of unrest among the grassroots. (Telegraph)

FISCAL: Labour has called for an independent assessment of whether Rishi Sunak’s £21bn cost of living emergency package could cause inflation to rise even higher and a verdict on the fiscal impact of substantial borrowing. Pat McFadden, shadow chief secretary to the Treasury, wrote to the Office for Budget Responsibility (OBR) to ask it to analyse the impact of the measures. He said that, although the sums were “of the order of magnitude that would normally be announced within a budget”, the UK’s tax and spend watchdog should “provide authoritative and independent economic and fiscal projections”. (Guardian)

PENSIONS: The head of the UK’s largest private pension plan has said the scheme’s funding position had proved “resilient” after its £14bn deficit, which prompted strikes by thousands of university staff, shrank to £1.6bn in two years as markets surged. Bill Galvin, chief executive of the Universities Superannuation Scheme, the main retirement plan for the sector with 420,000 members, said on Monday the improved situation might enable the scheme to adjust the controversial cuts in benefits that triggered the industrial action by academics and other university staff. (FT)

EUROPE

FDI: France topped an annual ranking of European countries as a destination for foreign investment projects for the third year in a row as Brexit continued to weigh on sentiment regarding the UK and a tight labor supply dissuaded companies from Germany. The number of new projects in France rose 24% in 2021 compared to only 2% in Britain and a 10% decline in Germany, according to a report by EY. The euro area’s second-biggest economy benefited from a reorganization of logistical and industrial supply chains and a rebound of sectors hit hard by the Covid pandemic, such as automotive and aeronautical manufacturers, the consulting company said. President Emmanuel Macron’s government has pointed to EY’s annual survey as a sign that his domestically unpopular pro- business reforms are bearing fruit. That message will be key for his party heading into legislative elections in June that will determine whether the French leader has a large enough majority in for further overhauls, including unpopular plans to raise the country’s retirement age. (BBG)

BANKS: Credit Suisseis in the early stages of weighing options to bolster its capital after a string of losses have eroded its financial buffers, two people with knowledge of the matter told Reuters. The size of the increase would be likely to exceed 1 billion Swiss francs ($1.04 billion), but this has not yet been determined, said one of the people, who declined to be named because the deliberations are still internal. The cash injection would help Switzerland's second-biggest bank to recover from billions of losses in 2021 and a series of costly legal headaches. Selling shares to some of its major existing investors is the preferred option, but Credit Suisse has not ruled out tapping all shareholders, this person said. A sale of a business, such as Credit Suisse's asset management division, is also a possibility, the other person said. The bank had not yet decided on any potential action, they said. Any transaction was envisaged for the second half of this year. “Credit Suisse is currently not considering raising additional equity capital," the bank said in a statement. "The Group is robustly capitalised with a CET1 ratio of 13.8% and a CET1 leverage ratio of 4.3%. Asset Management is an essential part of our group strategy presented last November, with four core divisions.” (RTRS)

U.S.

FED: Treasury Sec. Janet Yellen to join Tuesday meeting between President Biden and Federal Reserve Chair Jerome Powell “to discuss the state of the American and global economy, and the president’s top economic priority: addressing inflation as we transition from a historic economic recovery to stable, steady growth that works for working families,” according to Treasury guidance. (BBG)

FED: Federal Reserve Governor Christopher Waller said Monday he sees interest rate increases continuing through the rest of the year as part of an effort to bring inflation under control. Specifically, the central bank official said he would support hikes that exceed the "neutral" level considered neither supportive nor restrictive for growth. Estimates Fed officials provided in March point to a 2.5% neutral level, so that means Waller sees rates increasing at least another 2 percentage points from here. "Over a longer period, we will learn more about how monetary policy is affecting demand and how supply constraints are evolving," Waller said in remarks delivered in Frankfurt, Germany. "If the data suggest that inflation is stubbornly high, I am prepared to do more." (CNBC)

INFLATION: President Biden said he would support the Federal Reserve in its effort to combat high inflation by reducing economic demand, as the central bank lifts interest rates at its fastest pace in more than three decades. Mr. Biden outlined a broad three-part plan for addressing inflation, which is running at 40-year highs, in an opinion piece published Monday evening in The Wall Street Journal. He is set to meet with Fed Chairman Jerome Powell on Tuesday at the White House, the first such meeting since Mr. Powell was tapped by Mr. Biden and confirmed to a second four-year term by the Senate on May 12. Mr. Biden said it was likely that the pace of job growth could slow from a monthly pace of 500,000 jobs to around 150,000 as a necessary result of the Fed's efforts to combat high inflation. "The most important thing we can do now to transition from rapid recovery to stable, steady growth is to bring inflation down," Mr. Biden said. He said he agreed with the Fed's assessment "that fighting inflation is our top economic challenge right now." (Dow Jones)

OTHER

GLOBAL TRADE: Hon Hai expects logistics disruptions to gradually clear up as the city slowly opens to trade following a months-long Covid lockdown, Chairman Young Liu tells shareholders. Hon Hai is now more upbeat on its 2022 sales outlook than before. Supply chain should stabilize in the second half. (BBG)

GLOBAL TRADE: Samsung Electronics said on Tuesday that Vice Chairman Lee Jae-yong has met with Intel CEO Patrick Gelsinger to discuss how to work together in a wide range of semiconductor businesses, as competition heats up among industry leaders including Taiwan Semiconductor Manufacturing Co. amid global supply chain woes. (Nikkei)

U.S./CHINA: The current atmosphere in China-U.S. relations is abnormal, and the extreme anxiety on the U.S. side is “totally unnecessary”, China MOFA statement cites Foreign Minister Wang Yi’s speech made at a seminar on Tuesday. China’s overriding task is to concentrate on its own development, and if the U.S. only defines its relations with China as competition, it will only push both sides into confrontation and conflict. If the U.S. continues to backtrack on the Taiwan issue, it will fundamentally undermine peace across the Taiwan Straits and will eventually hurt itself. Right choice must be made and the Cold War mentality should be abandoned. (BBG)

GEOPOLITICS: Recep Tayyip Erdogan, the president of Turkey, said Sweden and Finland’s “uncompromising insistence” to join NATO has added an “unnecessary item” to the alliance’s agenda, according to an op-ed published in the Economist. Turkey is threatening to block the Nordic nations from joining NATO because it would increase security risks for the country and NATO’s future, Erdogan said in the article. Ankara has insisted that any new candidates for NATO membership recognize its concerns about Kurdish militias, a stance that has been a major source of tension. (BBG)

GEOPOLITICS: A trip by U.N. human rights chief Michelle Bachelet's to China fell short of expectation to provide a transparent clarification of human rights violation allegations in the region of Xinjiang, Germany's foreign ministry said on Monday. (RTRS)

BOJ: MNI INSIGHT: BOJ Eyes Industrial Lag And Consumption Rebound

- The Bank of Japan will likely maintain an overall view the economy will rebound as a trend as private consumption recovers with pandemic curbs lifted and phased tourism re-starts in June but is cautious on continued chip shortages restricting auto production, MNI understands - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

JAPAN: Japanese Finance Minister Shunichi Suzuki said on Tuesday there was no change to the government's goal of balancing the primary budget for fiscal 2025. Suzuki made the remark after media reported on Monday that the government had dropped reference to the target year in a mid-year long-term economic policy roadmap draft. (RTRS)

JAPAN: Japan's economy will grow at a weaker rate than previously thought this quarter despite hopes for a strong rebound in consumption after showing resilience in the three months through March, a Reuters poll of economists showed. The world's third-largest economy is at risk of being hobbled by slowing economic growth in China and a surge in global raw material prices - both issues that could hurt Japan's key manufacturing sector, the poll showed. However, the slower expansion still indicates growth will be strong enough for the economy to recover to its pre-coronavirus pandemic levels of end-2019 this quarter, about 70% of poll respondents said. The economy was projected to expand an annualised 4.5% this quarter, below April's estimate for 5.1% growth, according to the median forecast of 36 analysts in the May 18-27 poll. (RTRS)

RBNZ: RBNZ Deputy Governor Christian Hawkesby comments in an online presentation to the Financial Services Council Tuesday in Wellington. Says RBNZ is forecasting a period of subdued consumption as higher rates impact some households. Given global and domestic risks “a recession is well within the realms of possibility”. Says economy is well placed to cope with high interest rates. Trends in core inflation and inflation expectations “give a clear message we need to continue removing stimulus”. Sees need to tighten conditions beyond neutral “which is 2%”. Least regrets policy means doing what it takes to keep inflation expectations anchored. By moving rates briskly now “we may be doing ourselves a favor relative to going slower and then having to lift rates later to very contractionary levels” (BBG)

RBNZ: The RBNZ will raise interest rates by half a percentage point in July and then adopt a more measured pace of tightening, said Christina Leung, principal economist at NZ Institute of Economic Research. The more measured pace reflects the lagged impact of higher interest rates on demand. “We expect that as households roll off historically low fixed mortgage rates onto markedly higher rates, the impact of rising interest rates on demand will become more apparent later this year. This will slow the economic recovery and reduce inflation pressures over 2023”. A tight labor market is supporting wage growth and supporting debt serviceability, while global export commodity prices remain historically high despite some recent easing. “These factors should cushion some of the impacts of rising interest rates and reduce the chances of a hard landing for the New Zealand economy”. (BBG)

RBNZ: RBNZ has published a “review version” of the insurance interim solvency standard, which contains a number of amendments over the July 2021 exposure draft. Invites interested parties to comment on any technical or workability issues not previously identified. Plans to finalize the Interim Standard over the coming months and publish by the end of September. (BBG)

BOK: South Korea’s inflation may accelerate further in months ahead as unions seek higher wages, threatening a price-income spiral that’s now one of the biggest concerns for the central bank, a former board member said. Wage negotiations between unions and employers typically occur in May and June. Some sectors are already seeing pay rises and there’s a chance a vicious cycle between inflation and wage expectations is unleashed, said Lim Ji-won, who earlier this month ended her four-year term at the Bank of Korea. “Whether this spiral begins or not is the key” to the inflation outlook, Lim said in an interview. She highlighted unionized workers’ tendency to demand wage increases based on the trajectory of inflation, home prices and GDP growth. (BBG)

SOUTH KOREA: South Korea will revisit contingency plans after local and overseas financial markets show high volatility due to rising uncertainty and will take necessary and timely steps if needed, Vice Finance Minister Bang Ki-sun says in a meeting. Government, Bank of Korea, Financial Supervisory Service and other institutions to strengthen information sharing while South Korea will try to communicate more closely with the market. Uncertainty, volatility in economy and financial markets rising after global inflation and normalization of monetary policies in major economies, together with the war in Ukraine pose risks. (BBG)

HONG KONG: Hong Kong is unlikely to further ease social distancing curbs as planned in June due to a series of Covid clusters stemming from bars, Chief Executive Carrie Lam said, as the city pursues a gradual return to normalcy. The third round of easing would have expanded venue capacity and allowed live music in bars, but Lam said at a regular Tuesday press briefing that her government had to be “prudent.” Waiting to lift those measures would not be detrimental to people’s lives, she added, whereas a wider outbreak could endanger livelihoods. “We are in a sort of stagnant situation with the number of positive tested cases staying at around 200 and 300 cases,” said Lam, who leaves her post at the end of June, when incoming leader John Lee takes office. “But there have already been 10 infection clusters in the community, including the recent two cases involving bars, so we have to take a very prudent approach.” (BBG)

MEXICO: Mexico’s Finance Ministry said a Bloomberg report overestimated the cost of a fuel subsidy and underestimated crude export revenue. The Finance Ministry sent a statement responding to the report. The article’s comparison is incomplete because it doesn’t include all income from the sale of crude, according to the Finance Ministry. Main source of oil revenue is Pemex and the private sector’s production and extraction of oil, but there are revenues from other hydrocarbons that should be considered. (BBG)

MEXICO: Mexico's public sector ran a fiscal surplus of 53,438.3 millions pesos in April, the Finance Ministry said on Monday. (RTRS)

BRAZIL: Brazil’s real appreciation will hit prices in the next three to four months, said director of monetary policy at the central bank Bruno Serra at an podcast interview. Central bank needs to fight second round effects of inflation. Interest rates close to 13% is the answer to a specific moment in time, and will converge back to neutral. This inflationary shock “will pass”. Last data print from inflation in services sector was “particularly bad.” The economy still has a “reasonable lag” and the labor market is not running hot, he said. (BBG)

BRAZIL: Legislative bill that would implement a cap between 17% and 18% for state-level ICMS tax on fuels will be directly sent to Senate floor, Senate Head Rodrigo Pacheco said alongside state finance secretaries.nPacheco said that Senate will take the necessary time to analyze the bill while Fernando Bezerra Coelho, the bill’s rapporteur in the Senate, said he expects a vote on the bill within two weeks. Bezerra plans to meet with state secretaries on Tuesday and Thursday. Pacheco will meet with state governors this week. Decio Padilha, Pernambuco state Finance Secretary and head of the Committee of Finance Secretaries, said he will meet with his peers on Tuesday. States are studying whether to postpone a freeze of the ICMS fuel tax. (BBG)

BRAZIL: President Jair Bolsonaro, seeing his popularity drop in Brazil’s impoverished northeast, visited the region on Monday after heavy rains left more than 90 dead and 5,000 homeless over the past few days. The president, who’s up for re-election in October, flew with several cabinet members over areas where mudslides buried dozens of people in the state of Pernambuco. The region has been suffering with torrential rain for a week. (BBG)

IRAN: U.S. Secretary of State Antony Blinken on Monday condemned the "unjustified seizure" of two Greek-flagged vessels by Iran's Islamic Revolutionary Guard last week, the State Department said. (RTRS)

ENERGY: GasTerra will no longer receive gas from Russia's Gazprom from May 31 after refusing to agree to Moscow's demands for payment in roubles, the two companies said on Monday. GasTerra, which buys and trades gas on behalf of the Dutch government, said it had contracted elsewhere for the 2 billion cubic meters (bcm) of gas it had expected to receive from Gazprom through October. The company is 50% owned by Dutch government entities and 25% each by Shell and Exxon. "We understand GasTerra's decision not to agree to Gazprom's unilaterally imposed payment conditions," Dutch Energy Minister Rob Jetten wrote on Twitter. "This decision will have no consequences for the physical delivery of gas to Dutch households." (RTRS)

OIL: European Union leaders have agreed on a plan to block more than two-thirds of Russian oil imports. The ban is a compromise that will not affect pipeline oil imports for now, following opposition from Hungary. European Council chief Charles Michel said the deal cut off "a huge source of financing" for the Russian war machine. It is part of a sixth package of sanctions approved at a summit in Brussels, which all 27 member states have had to agree on. Mr Michel said the EU had also agreed hard-hitting measures targeting Russia's largest bank, Sberbank, and three state-owned broadcasters. EU members spent hours struggling to resolve their differences over the ban on Russian oil imports, with Hungary its main opponent. The compromise followed weeks of wrangling until it was agreed there would be "a temporary exemption for oil that comes through pipelines to the EU", Mr Michel told reporters. Because of this, the immediate sanctions will affect only Russian oil being transported into the EU over sea - two-thirds of the total imported from Russia. But in practice, European Commission President Ursula von der Leyen said the scope of the ban would be wider, because Germany and Poland have volunteered to wind down their own pipeline imports by the end of this year. "Left over is around 10-11% that is covered by the southern Druzhba," Ms Von der Leyen said, referring to the Russian pipeline supplying oil to Hungary, Slovakia and the Czech Republic. The European Council will revisit this exemption "as soon as possible", she added. (BBC)

FOREX: The emerging multi-polar world now includes foreign-exchange markets -- as China and Russia, the biggest challengers to U.S. supremacy, boost direct trading between their currencies. Monthly volumes on the ruble-yuan pair have surged 1,067% to almost $4 billion since the start of the war in Ukraine as the two nations seek to reduce their reliance on the dollar and boost bilateral trade to overcome current and potential U.S sanctions. The spike coincides with a rally in the ruble to a five-year high against the yuan. That’s a sign Russians are increasingly turning to Chinese goods to replace stalled Western imports and international brands that have vanished from store shelves. For China, it creates the latest boost for the internationalization of the yuan just when growing tensions with the U.S. are slowing that Process. “The main players in the yuan-ruble market are corporations and banks, but there is also a growing interest from retail investors,” said Yuri Popov, a currency and rates strategist at Sberbank CIB JSC. “The volume on the Moscow Exchange’s spot market has surged. This is due to sanctions concerns, as well as the intentions of Russia and China to encourage the usage of national currencies in bilateral trade.” (BBG)

CHINA

POLICY: China's cabinet unveiled a series of new policy measures on Tuesday to bolster the economy and stabilise jobs, including the acceleration of local government special bond issuance and cash support for firms that hire college graduates. Authorities will provide tax credit rebates to more sectors and allow firms in industries hit hard by COVID-19 curbs to defer social security payments, the State Council said in a document published on its website. The package of economic support had been flagged by the State Council in a routine meeting last week. (RTRS)

CREDIT: Chinese authorities are facing an uphill battle convincing companies and households to boost borrowing as long as Covid outbreaks and lockdowns continue to crush confidence. After loan growth weakened in April to the worst level in almost five years, several indicators suggest the data for May won’t be much better. Housing sales have continued to slump, indicating a lack of appetite for mortgages and subdued credit demand among real estate firms. Struggling to find enough clients, banks have been swapping bills with each other just so they can meet regulatory requirements for corporate lending. The reluctance to borrow stems in large part from uncertainty over China’s Covid curbs, and whether future outbreaks could lead to repeated lockdowns like the one that crippled activity in Shanghai for weeks. Businesses have had to halt production and cut jobs, revenue has slumped and profits have plunged. Many companies are putting expansion plans on hold. (BBG)

FDI: Foreign companies are still reluctant to miss the business opportunities in China despite the impact of domestic Covid-19 outbreaks, and continue to increase investments, the Beijing Business Today reported. Just over 87% of interviewed foreign-funded companies maintained or expanded their business scale in Q1, and 72.1% of them increased investment by more than 5%, the newspaper said citing a report by China Council for the Promotion of International Trade released Monday. (MNI)

HOUSING: Housing markets in May have seen a marginal increase in sales but any significant recovery will require an easing on pandemic curbs and more policy support with buyers still hesitant, the 21st Century Business Herald reported. Home sales in 17 major cities monitored by the China Index Academy rose 8.8% m/m in May, among which that in second-tier and third-tier cities increased by 8.31% and 27.2%, respectively, the newspaper said. There may be a further sales increase after the Dragon Boat Festival holiday in early June, the newspaper said citing an unnamed real estate salesperson. (MNI)

CORONAVIRUS: China’s daily virus cases fell below 100 for the first time since early March after months of strict curbs, though omicron’s contagiousness means the reprieve from infections and Beijing’s intensive Covid Zero response may only be temporary. The country reported 97 new cases for Monday, according to the National Health Commission. The financial hub of Shanghai, formerly the epicenter of China’s outbreak, reported 31 cases, and Beijing found 18, with both cities loosening mobility restrictions as their flareups come under control. (BBG)

CORONAVIRUS: Shanghai will move into a normalised epidemic-control phase from Wednesday and will allow malls and shops to reopen and people in "low-risk" areas to return to work, city officials said on Tuesday. Railways will also resume normal operations and the number of domestic flights to the city will increase, vice mayor Zong Ming told an online press conference, adding that they will also look to adjust passenger load factors. Public venues, however, will still need to cap people flows at 75% of capacity and people will need to show a negative PCR test taken within the last 72 hours to enter. The city announced an end to its two-month lockdown on Monday. (RTRS)

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Tuesday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1000% at 9:24 am local time from the close of 1.7894% on Monday.

- The CFETS-NEX money-market sentiment index closed at 45 on Monday vs 41 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.6607 TUES VS 6.7048

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.6607 on Tuesday, compared with 6.7048 set on Monday.

OVERNIGHT DATA

CHINA MAY M’FING PMI 49.6; MEDIAN 49.0; APR 47.4

CHINA MAY NON-M’FING PMI 47.8; MEDIAN 45.5; APR 41.9

CHINA MAY COMPOSITE PMI 48.4; APR 42.7

JAPAN APR JOBLESS RATE 2.5%; MEDIAN 2.6%; MAR 2.6%

JAPAN APR JOB-TO-APPLICANT RATIO 1.23; MEDIAN 1.23; MAR 1.22

JAPAN APR RETAIL SALES +2.9% Y/Y; MEDIAN +2.6%; MAR +0.7%

JAPAN APR RETAIL SALES +0.8% M/M; MEDIAN +0.9%; MAR +1.7%

JAPAN APR DEPT STORE, SUPERMARKET SALES +4.0% Y/Y; MEDIAN +3.3%; MAR 1.5%

JAPAN APR, P INDUSTRIAL PRODUCTION -4.8% Y/Y; MEDIAN -3.6%; MAR -1.7%

JAPAN APR, P INDUSTRIAL PRODUCTION -1.3% M/M; MEDIAN -0.2%; MAR +0.3%

JAPAN MAY CONSUMER CONFIDENCE INDEX 34.1; MEDIAN 33.8; APR 33.0

JAPAN APR HOUSING STARTS +2.2% Y/Y; MEDIAN +2.4%; MAR +6.0%

JAPAN APR ANNUALISED HOUSING STARTS 0.883MN; MEDIAN 0.888MN; MAR 0.927MN

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 90.7; PREV 90.8

Consumer confidence dropped slightly by 0.1% last week with no significant reaction to the previous weekend’s federal election. This is the fifth election since the survey went weekly in 2008. Of the four elections prior to this one, there has been little immediate reaction in consumer confidence, with no large swings in either direction. Confidence going into the 2022 election was, however, well below previous pre-election levels. And it remains at a historically low level. Inflation expectations rose to 5.5%, its highest level since early April, and it likely reflects the rise in petrol prices. (ANZ)

AUSTRALIA APR BUILDING APPROVALS -2.4% M/M; MEDIAN 2.0%; MAR -19.2%

AUSTRALIA APR PRIVATE SECTOR CREDIT +8.6% Y/Y; MEDIAN +7.9%; MAR +8.0%

AUSTRALIA APR PRIVATE SECTOR CREDIT +0.8% M/M; MEDIAN +0.5%; MAR +0.6%

AUSTRALIA APR PRIVATE SECTOR HOUSES +0.5% M/M; MAR -3.9%

AUSTRALIA Q1 BOP CURRENT ACCOUNT BALANCE +A$7.5BN; MEDIAN +A$13.2BN; Q4 +A$13.2BN

AUSTRALIA Q1 NET EXPORTS OF GDP -1.7%; MEDIAN -1.4%; Q4 -0.2%

AUSTRALIA Q1 COMPANY OPERATING PROFIT +10.2% Q/Q; MEDIAN +5.0%; Q4 +4.6%

AUSTRALIA Q1 INVENTORIES SA +3.2% Q/Q; MEDIAN +0.7%; Q4 +1.5%

NEW ZEALAND APR BUILDING PERMITS -8.5% M/M; MAR +6.2%

NEW ZEALAND MAY ANZ BUSINESS CONFIDENCE -55.6; APR -42.0

NEW ZEALAND MAY ANZ ACTIVITY OUTLOOK -4.7; APR 8.0

Business confidence fell 14 points in May to -55.6, while own activity fell 13 points to -4.7. Activity indicators were mixed, with small falls dominating. Residential construction intentions continue to dive. Inflation pressures remain intense, but with signs of topping out. (ANZ)

SOUTH KOREA APR INDUSTRIAL PRODUCTION +3.3% Y/Y; MEDIAN +3.2%; MAR +3.7%

SOUTH KOREA APR INDUSTRIAL PRODUCTION SA -3.3% M/M; MEDIAN -1.2%; MAR +1.1%

SOUTH KOREA APR CYCLICAL LEADING INDEX CHANGE -0.3; MAR -0.2

UK MAY LLOYDS BUSINESS BAROMETER 38; APR 33

This month’s report for April is mixed and follows the significant decline in business confidence in March after Russia’s invasion of Ukraine. Firms reported a partial recovery in their trading prospects, but optimism for the wider economy declined for a second successive month. Taken together, overall business confidence was unchanged at 33% and is still slightly above the survey’s long-term historical average of 28%, but it remains the lowest since last summer. Seven out of the twelve UK regions reported higher business confidence this month. There was also a rebound in manufacturing confidence, but retail and services confidence levels were little changed and remain at or near their recent lows. Despite the more cautious outlook, especially regarding the wider economy, there was a further rise in firms’ own pricing expectations, to a new all-time high, with nearly six out of ten respondents anticipating higher prices for their product or service. There was also little sign in our survey that wage pressures are expected to moderate. Instead, the shift in firms reporting higher expected pay growth for the year ahead remained intact, even though anticipated staffing levels eased for a second month. (Lloyds Bank)

MARKETS

SNAPSHOT: Waller Reaffirms Hawkish View, Chinese City Re-Opening Drive Eyed

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 63.39 points at 27305.76

- ASX 200 down 38.36 points at 7248.2

- Shanghai Comp. up 23.668 points at 3172.729

- JGB 10-Yr future down 20 ticks at 149.71, yield up 0.4bp at 0.241%

- Aussie 10-Yr future down 10.5 ticks at 96.625, yield up 10.8bp at 3.358%

- U.S. 10-Yr future -0-22+ at 119-14, yield up 9.9bp at 2.837%

- WTI crude up $3.52 at $118.6, Gold down $2.33 at $1852.81

- USD/JPY up 41 pips at Y127.99

- YELLEN TO JOIN POWELL-BIDEN MEETING (BBG)

- BIDEN PLEDGES TO BACK FED IN EFFORT TO COMBAT HIGH INFLATION (DJ)

- FED GOVERNOR WALLER PREPARED TO TAKE RATES PAST NEUTRAL (CNBC)

- EU AGREES COMPROMISE DEAL ON BANNING RUSSIAN OIL IMPORTS (BBC)

- NO-CONFIDENCE VOTE IN BORIS JOHNSON ‘LIKELY’ IF TORIES LOSE BY-ELECTIONS (FT)

- CHINA UNVEILS DETAILED NEW POLICIES TO SUPPORT THE ECONOMY (RTRS)

- SHANGHAI SAYS ALL RESIDENTS IN 'LOW-RISK' AREAS CAN RETURN TO WORK ON JUNE 1

- CHINA OFFICIAL PMI DATA NOT AS SOFT AS EXPECTED

US TSYS: Cheaper Ahead Of Powell-Biden-Yellen Meeting

Spill over from Monday’s shunt lower in Bunds (on firmer than expected German CPI) and delayed reaction to the latest round of hawkish remarks from Fed Governor Waller applied pressure to Tsys during Asia-Pac dealing, with TYU2 -0-23+ at 119-13 at typing, 0-03 off the base of its 0-13 overnight range, operating on volume of ~150K during the overnight session. Cash Tsys are 7-11bp cheaper across the curve, with the 3- to 10-Year zone leading the weakness. Wider long end swap spreads suggest payside flows in swaps may have aided the cheapening.

- Note that the OIS strip currently prices a Fed Funds Rate of ~2.75% come the end of the Fed’s Dec ’22 meeting, per BBG WIRP. This is up from the ~2.65% seen at the close on Friday. Meanwhile, the Eurodollar strip runs 0.25-10.5bp cheaper through the reds, with the reds underperforming on the curve. A quick reminder that Atlanta Fed President Bostic (’24 voter) alluded to the potential for a pause in the Fed tightening cycle in September early last week, while some also suggested that a phrase in the minutes of the May FOMC meeting opened the potential for such a pause around year-end. While Waller’s comments didn’t contain much in the way of new information per se (his hawkish views are well documented), the recent Bostic/May FOMC minute conditioning may be exacerbating the market reaction. Some of the move we have seen may also be linked to setup ahead of Tuesday’s Powell-Biden meeting (Biden has laid out his inflation “plan” in a WSJ opinion piece), with Tsy Sec Yellen also set to join that particular gathering.

- Note that the confirmation of a fresh round of EU sanctions on Russian oil exports provided a very light bid for Tsy futures in early Asia trade (S&P e-minis have given up some of Monday’s gains as a result, last +0.2%, while WTI & Brent surged further) before selling kicked in.

- Chinese official PMI data wasn’t as soft as expected but had no meaningful impact on Tsys.

- Overnight block flow included an FV buyer (+4,100), FV/US (+4,250/-1,200) & TY/US steepeners (+2,000/-900) & TY downside interest via TYN2 119.00 puts (+5K).

- Eurozone CPI data provides the most notable economic release during the European morning, while NY hours will bring several rounds of second tier house price data, the monthly MNI Chicago PMI reading, consumer confidence and Dallas Fed m’fing activity data. Still, most of the focus will likely fall on the aforementioned Powell-Biden-Yellen gathering.

JGBS: Futures Lead The Way Lower

Cash JGBs trade little changed to ~1.5bp cheaper across the curve, with 7s providing the weakest point, aided by the extension of the overnight sell off in JGB futures, with the latter running 18 ticks lower than yesterday’s settlement, a little off worst levels of the day. The wider core global FI impetus facilitated the modest cheapening observed during Tokyo hours.

- Fiscal matters dominated local headline flow, with Finance Minister Suzuki noting that there was no change to the government's goal of balancing the primary budget balance during FY25. This came after several media outlets pointed to the government dropping the timeframe reference in an economic policy roadmap draft.

- The latest round of 2-Year JGB supply went well, with the low price coming in above that foreseen in the BBG dealer survey, while the price tail held relatively tight and the cover ratio moved higher, comfortably above its 6-auction average.

- Elsewhere, local data revealed a modest downtick for the unemployment rate, softer than expected industrial production and generally in line, to slightly firmer than expected retail sales readings.

- Q1 capex & corporate profit data headline Wednesday’s local docket.

JGBS AUCTION: Japanese MOF sells Y2.2637tn 2-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.2637tn 2-Year JGBs:

- Average Yield: -0.058% (prev. -0.054%%)

- Average Price: 100.127 (prev. 100.118)

- High Yield: -0.054% (prev. -0.050%)

- Low Price: 100.120 (prev. 100.110)

- % Allotted At High Yield: 32.8287% (prev. 4.8301%)

- Bid/Cover: 5.426x (prev. 4.340x)

AUSSIE BONDS: A Sigh Of Relief Re: GDP Allows Bonds To Extend Early Cheapening

Aussie bond futures moved to fresh session lows in the wake of the release of domestic data and the official Chinese PMI readings (which weren’t as soft as expected), after the wider impetus applied pressure pre-data.

- A quick look at the domestic Q1 data reveals a much narrower than exported current a/c surplus, alongside firmer than expected inventories data and company profits (Although the latter was solely driving by the mining industry). The monthly reference points revealed softer than expected building approvals readings, while private sector credit topped expectations.

- The latest round of partials data removed downside worry re: tomorrow’s Q1 GDP reading (some had touted the potential of a negative Q/Q reading in recent days), with notable sell-side expectation adjustments made. Firmer than expected inventory and public spending prints drove upward revisions, with a range of 0.6-1.1% when it comes to Q/Q GDP growth estimates provided by the major sell-side names that we have seen updated revisions for (BBG consensus now stands at +0.7%).

- YM -10.5 & XM -11.0 at typing as a result, just off worst levels of the day. Super long cash ACGBs have cheapened by ~13bp. The IR strip runs 1-16bp cheaper on the session, while EFPS are comfortably wider on the day, with the 3-/10-Year box bull flattening.

- Outside of Q1 GDP data, tomorrow’s domestic docket will being final manufacturing PMI data from S&P Global, the latest CoreLogic house price reading and A$1.0bn of ACGB Apr-25 supply.

EQUITIES: Mixed In Asia; Chinese PMIs Add To Relief Amidst COVID Easing Hopes

Major Asia-Pac equity indices are mixed at writing, with Chinese and Hong Kong equities outperforming.

- The Hang Seng Index is 0.5% better off at typing, operating a little below four-week highs made earlier in the session. Hong Kong-listed stocks have caught a bid on a better-than-expected official Chinese PMI print, pointing to a moderating pace of contraction in the manufacturing and services sectors as the country accelerates towards the lifting of COVID-related restrictions in Shanghai and Beijing. China-based tech stocks outperformed, with the Hang Seng Tech adding 1.8% to hit its own four-week highs at writing. A note that a majority of the Hang Seng’s constituents have reported Q1 earnings thus far, with Meituan and Sino Biopharmaceutical’s earnings likely being the events to watch later this week.

- Looking to China, the CSI300 trades 1.1% higher at writing, on track to make a third straight day of gains on tailwinds from aforementioned COVID-related easing and PMI print.

- The Nikkei 225 sits a little below neutral levels at typing, albeit back from worst levels earlier in the session. Broad gains in energy and materials-related names were neutralised by a mixed performance amongst major exporters on JPY weakness, adding to underperformance in the real estate sub-index

- The Australian ASX200 lagged regional peers, trading 0.6% lower at typing, on track to break a two-day streak of gains after hitting 3-week highs on Monday. A mixed performance in energy and material-related names was worsened by drag from a miss in Building Approvals data, adding to weakness in technology-related equities. On the latter, the S&P/ASX All Technology Index deals 1.5% softer, led lower by losses in large-caps Block Inc (-3.3%) and Xero Ltd (-1.5%).

- U.S. e-mini equity index futures sit 0.1% to 0.5% better off with NASDAQ contracts outperforming, operating a little below their respective four-week highs made in Monday's session.

OIL: Multi-Month Highs On Prospect Of EU Sanctions, Improvements In Chinese COVID Situation

WTI is ~+$3.00 and Brent is ~+$0.90 at typing, operating a little below their respective 12 and 10-week highs made earlier in the session. Both benchmarks have caught a bid as EU leaders announced in-principle agreement to cut over two-thirds of all oil imports from Russia by end-22 (~90% when factoring in separate German and Polish commitments to cut Russian crude supplies), sending crude to levels last witnessed around mid-March.

- Turning to China, participants are eyeing the planned re-opening of Shanghai on Wednesday, where most residents (~22.5mn out of the city’s 25mn total pop.) will be allowed to leave their homes and drive their cars after two months of lockdowns.

- Zooming out, Chinese authorities reported 97 fresh COVID cases nationwide for Monday, the first time the national daily case count has come in below 100 since Mar 2. Well-documented worry re: the nation’s COVID-zero strategy remains evident however, with little sign that officials are looking to dial back the strategy ahead of the Chinese Communist Party’s (CCP) 20th Party Congress scheduled for the second half of ‘22.

- Elsewhere, the U.S. “summer driving season” has kicked off, although record high gasoline prices in the country have continued to drive debate over the extent of demand destruction, raising expectations from some quarters re: a smaller-than-expected rise in fuel demand.

- Looking ahead, OPEC+ meets on Thursday, although RTRS source reports have pointed to the group sticking to the previously-mentioned 432K bpd output target increase for July (keeping in mind the group’s well-documented difficulties in hitting production targets).

GOLD: Lower In Asia; Facing Headwinds Above $1,850/oz

Gold is ~$5/oz weaker to print $1,850/oz at typing, back from worst levels earlier in the session, and continuing to operate within a ~$30/oz trading range observed over the past week.

- The largest moves in gold came on the cash open of US Tsys after the long weekend, seeing bullion dive to session lows amidst a rise in the USD (DXY) and nominal U.S. Tsy yields, with nominal U.S. 10-Year Tsy yields rising ~9bp to 2.83% at typing. The move in the latter was possibly facilitated by previously flagged remarks on Monday by the Fed’s Waller, emphasising the need for “several” 50bp rate hikes until inflation is brought down to the 2% target. A note that this comes after U.S. Personal Consumption Expenditure (PCE) data last Friday came in at +6.3% Y/Y. Looking elsewhere, gold registered little reaction to better-than-expected Chinese PMIs.

- To recap Monday’s price action, the precious metal closed a little higher, with a downtick in the USD (DXY) to five-week lows providing little by way of an observable bullish impetus.

- From a technical perspective, a corrective cycle remains in play for gold despite recent highs. A recent break of resistance at the 20-Day EMA suggests a potential test of the 50-Day EMA (~$1,882.0/oz), although gains are still considered corrective, with a downward primary trend direction observed by our technical analyst. Immediate support is seen at $1,807.5/oz (May 18 low).

FOREX: Greenback Gains As Cash U.S. Tsys Retreat On Return From Holiday

The U.S. dollar turned bid as Tsys retreated once cash trading resumed after the long weekend. Hawkish central bank speak facilitated greenback purchases, as Fed's Waller backed "tightening policy by another 50bp for several meetings," possibly until inflation eases closer to the 2% target.

- EU leaders reached agreement on a partial embargo on Russian oil, which will prohibit seaborne imports without affecting pipeline supplies for now. There were no curveballs in official communique, hence reaction across G10 FX space was limited.

- Spot USD/JPY added ~50 pips, ripping through the Y128.00 mark on its way to a near two-week high. USD/JPY 1-month 25 delta risk reversal advanced in tandem with the spot rate, hitting its best levels since May 18.

- AUD/NZD showed above yesterday's high, supported by relative data outcomes, but gains were capped by the NZ$1.1000 figure. The ANZBO showed further deterioration in NZ business activity, widening the gap with AU business conditions as measured by NAB.

- Regional risk barometer AUD/JPY moved to a three-week high, piercing its 50-DMA in the process. NZD/JPY also lodged a new three-week high, but trimmed gains after rejecting its 50-DMA.

- China's official PMI figures improved and were better than expected in May, but the economy remained in contraction, across both manufacturing and non-manufacturing sectors. Offshore yuan was steady after the release, having slipped earlier.

- On the data front, focus turns to flash EZ CPI, German unemployment, Canadian GDP as well as U.S. Conf. Board Consumer Confidence & MNI Chicago PMI. In addition, ECB's Villeroy, Visco & Makhlouf as well as Riksbank's Ingves are set to speak.

- Elsewhere, U.S. President Biden, Tsy Sec Yellen and Fed Chair Powell will hold a meeting at the White House, while EU leaders will resume their Brussels summit.

FOREX OPTIONS: Expiries for May31 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0590-00(E8.3bln), $1.0625-30(E1.6bln), $1.0645-50(E1.1bln), $1.0740-60(E1.3bln), $1.0800(E1.1bln), $1.0875-00(E1.6bln)

- USD/JPY: Y127.75-85($739mln)

- GBP/USD: $1.2550(Gbp3.5bln), $1.2645(Gbp2.2bln), $1.2680(Gbp827mln)

- AUD/USD: $0.7000(A$616mln), $0.7118-25(A$662mln)

- USD/CNY: Cny6.7200($709mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/05/2022 | 0630/0830 | ** |  | CH | Retail Sales |

| 31/05/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 31/05/2022 | 0645/0845 | ** |  | FR | PPI |

| 31/05/2022 | 0645/0845 | ** |  | FR | Consumer Spending |

| 31/05/2022 | 0645/0845 | *** |  | FR | GDP (f) |

| 31/05/2022 | 0700/0900 | *** |  | CH | GDP |

| 31/05/2022 | 0755/0955 | ** |  | DE | Unemployment |

| 31/05/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 31/05/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 31/05/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/05/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 31/05/2022 | 1230/0830 | *** |  | CA | CA GDP by Industry and GDP Canadian Economic Accounts Combined |

| 31/05/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 31/05/2022 | 1300/0900 | ** |  | US | FHFA Quarterly Price Index |

| 31/05/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 31/05/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 31/05/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 31/05/2022 | 1430/1030 | ** |  | US | Dallas Fed Manufacturing Survey |

| 31/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 31/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.