-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Boris Johnson Digs In As Storm Clouds Gather

EXECUTIVE SUMMARY

- BORIS JOHNSON’S ALLIES CONCEDE TORY REBELS CLOSE TO TRIGGERING NO-CONFIDENCE VOTE (FT)

- U.S. MAY ALLOW MORE SANCTIONED OIL TO FLOW INTO MARKET

- U.S. COMMERCE SEC RAIMONDO: LIFTING TARIFFS ON GOODS MAY MAKE SENSE

- BEIJING OPENS UP RESTAURANTS, CINEMAS AS CHINA EASES CURBS (BBG)

- U.S., S. KOREA FIRE 8 MISSILES IN SHOW OF FIREPOWER AGAINST N. KOREA’S PROVOCATION (Yonhap)

- AUSTRALIA SAYS CHINESE FIGHTER JET INTERCEPTED ITS SURVEILLANCE PLANE

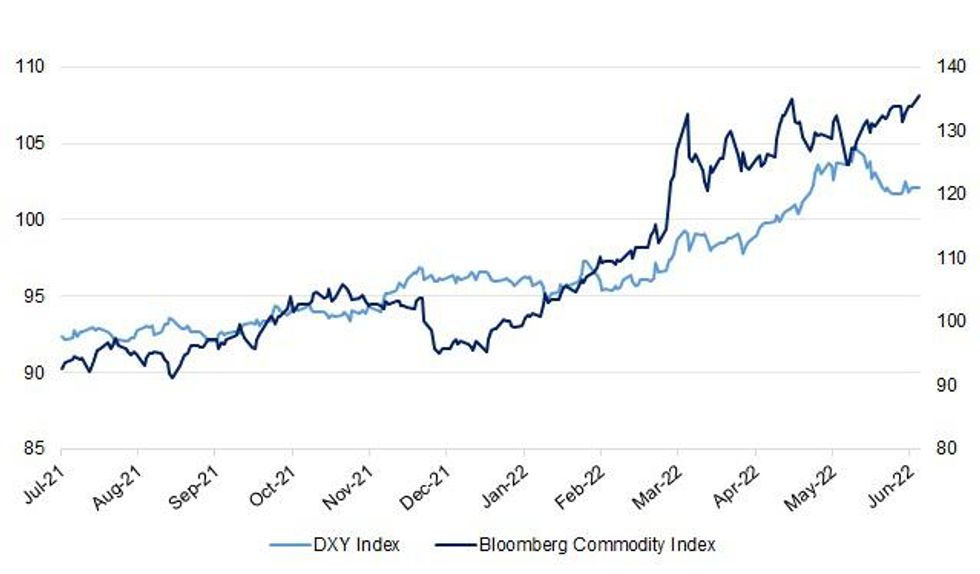

Fig. 1: Dollar Index (DXY) & Bloomberg Commodity Index (BCOM)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Boris Johnson’s key allies are preparing to defend him in a challenge to his leadership, as they conceded it was increasingly likely that rebel Conservative MPs had reached the key threshold needed to trigger a vote of no confidence in the UK prime minister this week. For such a vote to take place, Sir Graham Brady, chair of the influential 1922 committee of backbench Tory MPs, must receive 54 letters calling for Johnson to go. Allies of the prime minister said the threshold may have been reached following claims by a number of rebels on Sunday that they had enough support to trigger a ballot. (FT)

POLITICS: Paul Scully, business minister, told Channel 4 on Sunday: “We may well have a vote of no confidence [in Johnson’s position] but he will win that.” One close ministerial ally of Johnson dismissed a report in The Sunday Times that the figure was as high as 67. “I’m confident it’s not 67. But whether it’s over 54 is another matter,” he said. One leading critic of Johnson predicted that there was a 55 per cent chance of a confidence vote this week. “He is on the skids,” the MP said. “I think Brady will announce tomorrow and if he doesn’t, others will put letters in. It’s past the point of no return,” another influential Conservative MP predicted on Sunday. He noted that some Tories want to physically hand a letter in instead of using email or WhatsApp. (FT)

POLITICS: Boris Johnson’s allies will switch their focus to winning a vote of no confidence, conceding they now have little chance of stopping one being triggered. The prime minister will this week launch a health and housing policy fightback, in a last-ditch attempt to win over his critics. He is widely expected to face a vote on his leadership as soon as this week, with some MPs predicting the threshold of 54 letters asking for one has already been exceeded. (Guardian)

POLITICS: The prime minister could face a no-confidence vote as early as this week, in which he would need the support of 180 Tory MPs – half of the current total of 359 – in order to hold on to his job. Backers have suggested that he is all but certain to win any ballot, as the “payroll vote” of 173 ministers and parliamentary aides is almost enough to get him past the threshold. But one backbencher, who has called for Mr Johnson’s resignation, told The Independent that the PM cannot take the votes of members of his own government for granted. Two parliamentary private secretaries (PPS) have already quit over Partygate, and rebels believe that other government figures are privately ready to join the drive to unseat him. (Independent)

FISCAL: The Labour party has accused Rishi Sunak of causing uncertainty and damaging investment plans with his “haphazard, last minute” threat to impose a windfall tax on British electricity generators, a move that wiped £3bn off their share price. Labour, which initially championed a windfall tax on oil and gas producers, claims that Sunak is damaging the investment environment for new energy projects by threatening to extend the levy. (FT)

ECONOMY: Kwasi Kwarteng is mulling a support package for steelmakers and other manufacturers struggling to cope with rising energy costs. The business secretary is exploring whether the government could exempt heavy industrial manufacturers from network charges. (The Times)

ECONOMY: Hundreds of flights were canceled at airports across the UK and Europe over the holiday weekend, and London commuters face severe disruptions from a strike starting Monday, handing Britons a sharp reminder of the country’s domestic woes after four days of celebrating the Queen’s Platinum Jubilee. (BBG)

ENERGY: UK ministers have come under attack for taking a “last minute” approach to bolstering domestic energy supplies this winter and avoiding the possibility of blackouts if Russia cuts off gas to Europe. The pushback came after EDF Energy was forced to put out a memo last week to explain that time had “run out” to delay the closure of one of Britain’s six remaining nuclear power plants at the end of July. (FT)

EUROPE

ECB: The European Central Bank is this week set to strengthen its commitment to prop up vulnerable eurozone countries’ debt markets if they are hit by a sell-off, as policymakers prepare to raise rates for the first time in more than a decade. The bulk of the 25 governing council members are expected to support a proposal to create a new bond-buying programme if needed to counter borrowing costs for member states, such as Italy, spiralling out of control, according to several people involved in the discussions. (FT)

EU: French President Emmanuel Macron’s party has proposed creating a new pan-European centrist alliance, party officials told POLITICO. The initiative would combine Macron’s Renaissance alliance and other parties with the longstanding Alliance of Liberals and Democrats for Europe (ALDE) party, which is currently holding a congress in Dublin. If the move goes ahead, it would increase Macron’s influence in European politics and effectively mean the end of ALDE, which was founded more than 40 years ago, as a separate entity. (Politico)

GERMANY: Russia's sanctions against Gazprom Germania and its subsidiaries could cost German taxpayers and gas users an extra 5 billion euros ($5.4 billion) a year to pay for replacement gas, the Welt am Sonntag weekly reported, citing industry representatives. In May, Russia decided to stop supplying Gazprom Germania, which had been the German subsidiary of Gazprom, after Berlin put the company under trustee management due to Russia's invasion of Ukraine. (RTRS)

FRANCE: France's finance minister said on Sunday he expected positive growth for 2022, but would revise economic forecasts at the start of July. "It's clear that with the war in Ukraine, inflation, all that will put into question the forecasts, but we will have positive growth in 2022," Bruno Le Maire told Europe 1 radio. The current forecast sees the economy growing by 4% in 2022. (RTRS)

FRANCE: France is in talks with the United Arab Emirates to replace Russian oil purchases, which will stop after the imposition of a European Union ban on Russian crude, Finance Minister Bruno Le Maire said on Sunday. "There are discussions with the United Arab Emirates. We have to find an alternative to Russian oil," Le Maire told Europe 1 radio. (RTRS)

DENMARK: Denmark’s prime minister said she’s open to a grand coalition that would include her political rivals in what would be the first such move in the Nordic country in more than four decades. Mette Frederiksen said the Covid-19 crisis and the war in Ukraine had made her back the idea because the government and the opposition have worked closely together, according to an interview in the Jyllands-Posten newspaper. Her Social Democrats and the opposition Liberals and Conservatives have traditionally taken turns forming minority governments. (BBG)

FINLAND: The head of Finnish intelligence has voiced his surprise that Russian reprisals have not yet followed its Nato application, as he sought to unblock the bid by reassuring Turkey on terrorism. Antti Pelttari, head of Supo, Finland’s security and intelligence service, told the Financial Times that Helsinki remained “vigilant” over the potential for Russian mischief but that its eastern neighbour’s resources were tied up in the war in Ukraine. (FT)

ESTONIA: Estonia’s governing coalition collapsed after the Baltic country’s prime minister accused her coalition partners of working against the nation’s values and failing to protect its independence in the aftermath of Russia’s full-scale invasion of Ukraine. At the request of Prime Minister Kaja Kallas, the president, Alar Karis, on Friday dismissed all seven ministers from the Centre party, which used to have formal ties with Russian president Vladimir Putin’s United Russia party. (FT)

UKRAINE: Russia struck Ukraine's capital Kyiv with missiles early on Sunday for the first time in more than a month, while Ukrainian officials said a counter-attack on the main battlefield in the east had retaken half of the city of Sievierodonetsk. Dark smoke could be seen from many miles away after the attack on two outlying districts of Kyiv. Ukraine said the strike hit a rail car repair works; Moscow said it had destroyed tanks sent by Eastern European countries to Ukraine. (RTRS)

UKRAINE: Russia flew a cruise missile “critically low” over the South Ukrainian Nuclear Power Plant on Sunday, Ukraine’s state-run nuclear power station operator Energoatom said. Energoatom said that Russian forces “still do not understand that even the smallest fragment of a missile that can hit a working power unit can cause a nuclear catastrophe and radiation leak.” (CNN)

UKRAINE: The Russian general Aleksandr Dvornikov “has received the task by June 10 of either completely capturing Severodonetsk, or completely cutting off the Lysychansk-Bakhmut highway and taking it under control,” Serhiy Hayday, head of Luhansk regional military administration said. (CNN)

UKRAINE: Volodymyr Zelensky’s chief of staff on Sunday hit back at remarks by Emmanuel Macron in which the French president said it was important not to “humiliate” Russia over the war in Ukraine. In an interview with French regional newspapers on Saturday, Macron said maintaining dialogue with Vladimir Putin was crucial “so that the day when the fighting stops we can build an exit ramp through diplomatic means”. In a post on messaging app Telegram on Sunday, as Russian air strikes on Kyiv resumed for the first time since April, Andriy Yermak responded, saying: “Some countries are proposing not to ‘humiliate’ Russia. At the same time we are being shelled: our cities, people.” (FT)

UKRAINE: Britain will supply Ukraine with multiple-launch rocket systems that can strike targets up to 80 km (50 miles) away, it said on Monday, in a move that was coordinated with the United States in response to Russia's invasion. Defence Secretary Ben Wallace said Britain's support for Ukraine would change as Russia's tactics evolved, explaining the gift of the M270 multiple-launch systems. (RTRS)

UKRAINE: Spain is to supply Ukraine with anti-aircraft missiles and Leopard battle tanks in a step up of its military support to the country, according to government sources cited by newspaper El Pais on Sunday. (RTRS)

UKRAINE: President Volodymyr Zelenskyi visited the leading positions of the Ukrainian military in the Zaporizhia region. (Pravda)

SERBIA: Serbian President Aleksandar Vucic will address the nation on Monday in connection with the cancellation of the visit of Russian Foreign Minister Sergei Lavrov to Belgrade. This was reported on Sunday by the National Television of the Republic. It is reported that the President of Serbia will address the citizens of Serbia on the evening news at 19:30 in connection with the closure of airspace over Bulgaria, North Macedonia and Montenegro for Lavrov's aircraft. (TASS)

RATINGS: Sovereign rating reviews of note from after hours on Friday include:

- S&P affirmed Lithuania at A+; Outlook Stable

- DBRS Morningstar confirmed Germany at AAA, Stable Trend

U.S.

POLITICS: The House's Jan. 6 committee has split behind the scenes over what actions to take after the public hearings: Some members want big changes on voting rights — and even to abolish the Electoral College — while others are resisting proposals to overhaul the U.S. election system, Axios has learned. Why it matters: Televised hearings begin Thursday night. Committee members are in lockstep about capturing Americans' attention by unfurling a mountain of evidence connecting former President Trump and those close to him with the attack on the Capitol. (Axios)

POLITICS/ECONOMY: US Treasury Secretary Janet Yellen said she never urged for the adoption of a smaller COVID-19 relief package, rebutting a media report in which a biographer was quoted as claiming that she asked officials to scale back the US$1.9 trillion American Rescue Plan by a third. "I never urged adoption of a smaller American Rescue Plan package, and I believe that ARP played a central role in driving strong growth throughout 2021 and afterwards," Yellen said in a statement on Saturday. (RTRS)

ECONOMY: Abbott Laboratories said on Saturday that it has reopened its baby formula production plant in Sturgis, Michigan, taking a step toward alleviating an acute nationwide shortage that has sent parents scrambling for supplies. The company said it will begin production of EleCare and other specialty and metabolic formulas, with initial EleCare product release to consumers beginning on or about June 20. Roughly 73% of baby products are out of stock nationwide as of May 22, according to data firm Datasembly. (RTRS)

EQUITIES: Tesla Inc Chief Executive Elon Musk said on Saturday that the electric vehicle maker's total headcount will increase over the next 12 months, but the number of salaried staff should be little changed, backtracking from an email just two days ago saying that job cuts of 10% were needed. "Total headcount will increase, but salaried should be fairly flat," Musk tweeted in a reply to an unverified Twitter account that made a "prediction" that Tesla's headcount would increase over the next 12 months. (RTRS)

OTHER

GLOBAL TRADE: President Joe Biden’s commerce chief said it “may make sense” to lift tariffs on some goods as a way to tame the hottest inflation in almost four decades. “Steel and aluminum -- we’ve decided to keep some of those tariffs because we need to protect American workers and we need to protect our steel industry; it’s a matter of national security,” Gina Raimondo said in an interview Sunday on CNN’s “State of the Union.” “There are other products -- household goods, bicycles -- it may make sense,” she said, when asked if the administration would consider ending duties on billions of dollars of imports from China. (BBG)

NATO: A NATO summit in Madrid at the end of June is not a deadline for a decision on Sweden and Finland's membership bids, which are opposed by Turkey, the Turkish president's spokesman said on Saturday. (RTRS)

NATO: NATO kicked off nearly a two-week U.S.-led naval exercise on the Baltic Sea on Sunday with more than 7,000 sailors, airmen and marines from 16 nations, including two aspiring to join the military alliance, Finland and Sweden. The annual BALTOPS naval exercise, initiated in 1972, is not held in response to any specific threat. But the military alliance said that “with both Sweden and Finland participating, NATO is seizing the chance in an unpredictable world to enhance its joint force resilience and strength” together with two Nordic aspirant nations. (AP)

NATO/JAPAN: Japanese Prime Minister Fumio Kishida is considering attending a summit of leaders from the North Atlantic Treaty Organization (NATO) in late June to spur coordination with the West over Russia's invasion of Ukraine, sources familiar with the matter said. The move would mark an unusually aggressive stance for a Japanese leader although Kishida has repeatedly condemned Russia over what he has described as a "war crime" against Ukraine. (RTRS)

WORLD BANK: The World Bank Group leadership is under fresh fire from the US administration to step up its climate change efforts, after a blunt complaint from the US Treasury about its failure to take the level of action required. A letter to the international financial institution headed by Trump appointee David Malpass, seen by the Financial Times, says progress had been made to meet Treasury secretary Janet Yellen’s requests but there remained “specific gaps and room for increased climate ambition”. It also urges more “forceful and constructive leadership”. A US Treasury official said that while it “appreciated” the steps taken by the World Bank to advance climate ambitions over 2021, it had “continued to make clear” its position about the bank falling short on its climate ambition. (FT)

BOJ: Bank of Japan Governor Haruhiko Kuroda says Japan’s economy is still in the middle of a recovery from the pandemic and facing downward pressure from rising commodity prices. “In this situation, monetary tightening is not at all a suitable measure,” Kuroda says in a speech. Top priority is to continue with monetary easing persistently. Necessary to create a virtuous economic cycle between wage increases and price rises. See a rise in inflation expectations and tolerance for price gains, making wage growth a key factor. (BBG)

JAPAN: Prime Minister Fumio Kishida is likely to want the Bank of Japan to stick with its current policy direction even after a change of governor, according to a senior ruling party member. Shouji Nishida, head of a pro-spending group in the party with ties to former premier Shinzo Abe, pointed to the fiscal policy plan published last week as proof that Kishida is more committed than previously thought to the BOJ’s inflation target. (BBG)

JAPAN: Japan's government is considering resuming a national travel discount campaign as soon as late this month to help the tourism industry recover from a COVID-19 slump, the Nikkei newspaper said on Saturday. A revived "Go To Travel" campaign would likely serve as a core measure to stimulate consumer demand, the business daily reported, without citing sources. (RTRS)

AUSTRALIA/CHINA: Beijing has defended the interception of an RAAF aircraft by a Chinese fighter jet over the South China Sea, using state media to accuse Australia of “hyping” up the incident. Canberra on Sunday lodged a protest with Beijing after a Chinese J-16 fighter jet last month flew alongside then cut across an RAAF P-8 maritime surveillance plane, releasing flares and chaff that was ingested by the engine. (AFR)

AUSTRALIA/CHINA: Prime Minister Anthony Albanese said the Australian government has reached out to Beijing to raise concerns over what he described as a “dangerous maneuver” between a Chinese fighter jet and an Australian surveillance plane over the South China Sea. (BBG)

AUSTRALIA: Australian consumer prices have accelerated from the 5.1% recorded in the first three months, Treasurer Jim Chalmers said, intensifying pressure on households and suggesting further interest-rate increases ahead. “It’s now really clear that the inflation challenge that Australians are facing is worse,” Chalmers told News Corp. in an interview Sunday, saying he’ll likely raise the forecast in next month’s economic statement to parliament. “People should anticipate that it will be higher than it is now. Significantly higher.” (BBG)

NORTH KOREA: South Korea and the United States fired eight ballistic missiles into the East Sea on Monday in response to North Korea's missile launches the previous day, according to the South's military. On Sunday, the North shot eight short-range ballistic missiles (SRBMs) from four different locations into the East Sea following a South Korea-U.S. naval exercise last week involving an American aircraft carrier. "The South Korea-U.S. combined firing of the ground-to-ground missiles demonstrated the capability and posture to launch immediate precision strikes on the origins of provocations and their command and support forces," the JCS said in a press release. (Yonhap)

NORTH KOREA: South Korean President Yoon Suk-yeol said on Monday North Korea's missile and nuclear weapons programmes have reached a level where they pose a threat to regional and world peace. Yoon made the comment at a Memorial Day event a day after North Korea launched a barrage of short-range ballistic missiles in probably its largest single test. (RTRS)

HONG KONG: Hong Kong is seeing Covid-19 cases climb again, with the number of new infections at a six-week high amid a growing cluster that originated at a group of nightclubs in the financial hub’s Central district. The city reported 515 cases on Sunday, the most since April 23. More than 200 cases have been linked to the outbreak associated with four bars, thought to have emerged after the latest round of social-distancing curbs were loosened about a week ago. (BBG)

AMERICAS: The Biden administration has made a final decision against inviting the governments of Cuba, Venezuela and Nicaragua to a regional summit this week, bucking calls from Mexico’s president to include all countries or risk him staying home. (BBG)

AMERICAS: Canada Prime Minister Justin Trudeau said Friday he will travel to the United States on Tuesday to visit the North American Aerospace Defense Command (NORAD) headquarters and then partake in the Summit of the Americas in Los Angeles, hosted by U.S. President Joe Biden. (RTRS)

MEXICO: Mexicans started casting votes in six state elections on Sunday that are likely to boost President Andres Manuel Lopez Obrador's party, in one of the last major tests of his electoral clout before the political focus shifts to the race to succeed him. Lopez Obrador's leftist National Regeneration Movement (MORENA) and its allies are tipped to win most of the governorships up for grabs, tightening the party's grip on the political landscape against a fractured opposition. (RTRS)

TURKEY: Turkish President Tayyip Erdogan said on Sunday that inflation figures from the month of May, when annual consumer prices jumped to a 24-year high, showed inflation was now on a downward trend. Speaking to members of his ruling AK Party, Erdogan said his government was working on ways to alleviate Turks' economic woes and combat soaring prices. (RTRS)

RUSSIA: Russia will expand the list of targets it will attack in Ukraine if Western countries send them long-range weapons, President Vladimir Putin says. (BBC)

RUSSIA: The Wagner group has obtained lucrative Sudanese mining concessions that produce a stream of gold, records show — a potential boost to the Kremlin’s $130 billion gold stash that American officials worry is being used to blunt the effect of economic sanctions over the Ukraine war, by propping up the ruble. (NYT)

RUSSIA: Russian Foreign Minister Sergei Lavrov's visit to Serbia has been cancelled after countries around Serbia closed their airspace to his aircraft, a senior foreign ministry source told the Interfax news agency on Sunday. (RTRS)

RUSSIA: An unknown individual set a National Guard building on fire in Russia’s Komsomolsk-on-Amur in the Khabarovsk region, says Komcity News, a local media outlet. (Novaya Gazeta Europe)

RUSSIA: A Russian general was killed in eastern Ukraine, a Russian state media journalist said on Sunday, adding to the string of high-ranking military casualties sustained by Moscow. The report, published on the Telegram messaging app by state television reporter Alexander Sladkov, did not say precisely when and where Major General Roman Kutuzov was killed. (RTRS)

KAZAKHSTAN: In Kazakhstan, during the referendum, amendments to the constitution were supported by 75% to 79% of the population, the exit poll data cited by KazTAG showed. The amendments propose to reduce the powers of the head of state. Close relatives of the president will be banned from holding public office. All references to the special status of the country's first president, Nursultan Nazarbayev, will be removed from the constitution. (Kommersant)

MIDDLE EAST: President Joe Biden will delay visits to Saudi Arabia and Israel until next month, NBC reported. Biden will embark on a “broader” Middle East trip in July, the report said, citing officials it didn’t identify. The president said earlier on Friday that there were “no direct plans” for him to visit Saudi Arabia but he would likely meet the kingdom’s leaders if a trip was organized. (BBG)

SAUDI ARABIA: Two Saudi government delegations plan to visit the United States this month, officials said on Saturday, as Riyadh and Washington step up efforts to fix strained ties and lay the ground for an eventual visit by U.S. President Joe Biden. The first delegation is expected to visit Washington on June 15 and will be led by Saudi Minister of Commerce Majid bin Abdullah al-Qasabi. The second, led by Investment Minister Khaled Al-Falih, is planned by the end of the month, two officials said. The officials declined to be named as the plans had not been made public. (RTRS)

SAUDI ARABIA: U.S. President Joe Biden should not visit Saudi Arabia or meet its Crown Prince Mohammed bin Salman, who approved an operation to capture or kill murdered journalist Jamal Khashoggi, according to U.S. intelligence, a leading Democratic lawmaker said on Sunday. (RTRS)

SYRIA: The U.S.-backed Syrian Democratic Forces would coordinate with Syrian government troops to fend off any Turkish invasion of the north, the SDF commander told Reuters on Sunday, saying Damascus should use its air defence systems against Turkish planes. (RTRS)

METALS: Russian aluminium producer Rusal has launched legal action against Rio Tinto seeking to restore access to its 20% share of the alumina produced at a jointly-owned refiner in Queensland, Australian media reported on Sunday. (RTRS)

METALS: The London Metal Exchange is being sued for $456 million over its decision to halt and undo trading in nickel after a short squeeze in March caused prices to sky rocket. The exchange is being sued by Elliott Associates, LP and Elliott International, LP in a case filed in the English High Court on June 1, according to a statement issued by Hong Kong Exchanges & Clearing Ltd., its parent company. (BBG)

GRAIN: Moscow agreed with Kyiv and Ankara a preliminary scheme for the exit of Ukrainian ships with grain from Odessa: in the territorial waters of the neighboring country, the Turkish military will be engaged in demining, they will also escort the ships to neutral waters. There, the ships will meet Russian ships and escort them to the Bosphorus. This was stated to Izvestia by a high-ranking informed source. According to him, so far the scheme has been agreed only for Odessa. The interlocutor also noted: all Ukrainian grain is now delivered to the EU by rail and bus, but it has not yet reached the end consumers. The Turkish parliament explained to Izvestiya that Ankara is participating in this operation, since it is important for it to resolve the world food problem. (Izvestia)

OIL: Libya’s biggest oil field resumed production after about a two-month halt, potentially helping the OPEC member get back to full production. The Sharara field in the west of the country, which can pump 300,000 barrels each day, was closed after protesters gathered at the site in April demanding Prime Minister Abdul Hamid Dbeibah quits. The field has restarted operations, according to people familiar with the matter. (BBG)

OIL: The US may allow more sanctioned Iranian oil onto global markets even without a revival of the 2015 nuclear accord, according to the biggest independent crude trader. “Uncle Sam might just allow a little bit more of that oil to flow,” Mike Muller, head of Asia at Vitol Group, said Sunday on a podcast produced by Dubai-based Gulf Intelligence. “If the midterms are dominated by the need to get gas prices lower in America, turning a somewhat greater blind eye to the sanctioned barrels flowing out is probably something you might expect to see. US intervention in these flows has always been pretty sparse.” (BBG)

OIL: Italian oil company Eni SpA and Spain's Repsol SA could begin shipping Venezuelan oil to Europe as soon as next month to make up for Russian crude, five people familiar with the matter said, resuming oil-for-debt swaps halted two years ago when Washington stepped up sanctions on Venezuela. The volume of oil Eni and Repsol are expected to receive is not large, one of the people said, and any impact on global oil prices will be modest. But Washington's greenlight to resume Venezuela's long-frozen oil flows to Europe could provide a symbolic boost for Venezuelan President Nicolas Maduro. The U.S. State Department gave the nod to the two companies to resume shipments in a letter, the people said. U.S. President Joe Biden's administration hopes the Venezuelan crude can help Europe cut dependence on Russia and re-direct some of Venezuela's cargoes from China. Coaxing Maduro into restarting political talks with Venezuela's opposition is another aim, two of the people told Reuters. (RTRS)

CHINA

CORONAVIRUS: Beijing will further relax Covid-19 curbs by allowing indoor dining, as China’s capital steadily returns to normal with inflections falling, state media said on Sunday. Beijing and the commercial hub Shanghai have been returning to normal in recent days after two months of painful lockdowns to crush outbreaks of the omicron variant. Dine-in service in Beijing will resume on Monday, except for the Fengtai district and some parts of the Changping district, the Beijing Daily said. Restaurants and bars have been restricted to takeaway since early May. (CNBC)

ECONOMY: Domestic tourism accelerated in China during the three-day Dragon Boat Festival last week though still down on year, with Shanghai and Beijing returning to Top 10 traveling destinations as Covid-19 curbs ease, the China Securities Journal reported. Revenue from domestic tourism was CNY25.82 billion during the holiday, falling 12.2% y/y and recovering to 65.6% of the pre-pandemic level, the newspaper said citing data by the Ministry of Culture and Tourism. A total of 79.61 million trips were made across the country, a decrease of 10.7% y/y and 86.7% of the same period in 2019, the newspaper said. (MNI)

ECONOMY: China should plan and introduce more extraordinary incremental policies to help small businesses and people affected by the epidemic to improve their cash flow, wrote Guan Tao, chief economist at BOC Securities in a blog post. Currently, the market is reluctant to borrow, and banks are afraid to lend due to weaker cash flows at companies and for individuals entering the third year of Covid-19 outbreaks, said Guan. If the private sector continues to add leverage, it could erode their financial health and will take a long time for companies and individuals to repair their balance sheets in the future, which will drag down the pace of economic recovery, said Guan. (MNI)

CREDIT: New yuan loans likely rebounded sharply in May to as much as around CNY1.5 trillion from April’s over four-year low of CNY645.4 billion, as top regulators repeatedly called for credit growth to support the economy, the Securities Daily reported citing analysts. Bill financing and short-term corporate loans may still be the main support, while medium and long-term corporate loans are expected to improve slightly, the newspaper said citing Tan Yiming, chief fixed-income analyst at Minsheng Securities. Personal loans may remain sluggish amid weakened incomes and low appetite for spending on home purchases, Tan was cited as saying. (MNI)

CORONAVIRUS: China’s worst Covid-19 outbreak is ending, with cases continuing to fall, all major cities loosening restrictions and daily life mostly returning to normal. Infections are trending down nationwide, thanks to the ebbing outbreaks in Shanghai and Beijing. Of China’s top 50 cities by economic size, none currently have widespread restrictions in place. Tianjin hasn’t reported any local cases for the past 3 days and most public transport has resumed, while Beijing is resuming dine-in services and reopening parks and entertainment venues. However, public transport remains suspended in the Fengtai district and some parts of Changping in the capital. Shanghai reported 3 cases found outside of the quarantine system on Sunday. While the city continues to reopen, the sporadic community cases have seen some residential compounds locked down again.(BBG)

ENERGY: China is wasting more and more clean energy as it adds wind turbines and solar panels faster than its grid is able to digest them. Nearly 12% of power generated by wind turbines in Inner Mongolia this year has been wasted because the grid couldn’t take it, along with 10% of solar power in Qinghai, Economic Information Daily reported, citing government data. In sunny and windswept but sparsely populated Gansu province, the utilization rate of wind and solar power could drop below 90% this year from nearly 97% in 2021. (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY10 BILLION VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.10% on Monday. The operation has led to a net drain of CNY10 billion after offsetting the maturity of CNY20 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8778% at 09:44 am local time from the close of 1.6274% on June 2, the last working day before the Dragon Boat Festival holiday.

- The CFETS-NEX money-market sentiment index closed at 42 on June 2.

PBOC SETS YUAN CENTRAL PARITY AT 6.6691 MON VS 6.7095

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.6691 on Monday, compared with 6.7095 set on Thursday.

OVERNIGHT DATA

CHINA MAY CAIXIN SERVICES PMI 41.4; MEDIAN 46.0; APR 36.2

CHINA MAY CAIXIN COMPOSITE PMI 42.2; APR 37.2

In May, the Caixin China General Composite PMI came in at 42.2, up from 37.2 the previous month. May’s reading was its third lowest since 2005, after those of February 2020 and April 2022. The pandemic weighed on supply as well as domestic and overseas demand. Employment weakened further. Outstanding business grew. And business costs remained high. Overall, in May, local Covid outbreaks continued and manufacturing and services activity improved slightly, but continued to contract, with services hit harder. Demand was slightly stronger than supply. The fallout from the epidemic on market supply and demand has been transmitted to the labor market, which is deteriorating at a faster pace in both the manufacturing and services sectors. Disrupted supply chains and longer logistics delivery times have yet to improve. Businesses remained under great cost pressure. The damage from the latest wave of domestic outbreaks may surpass that of 2020. It’s necessary for policymakers to pay closer attention to employment and logistics. Removing obstacles in supply and industrial chains and promoting resumption of work and production will help to stabilize market entities and protect the labor market. Also, the government should not only offer support to the supply side, but also put subsidies for people whose income has been affected by the epidemic on the agenda. (Caixin)

AUSTRALIA MAY MELBOURNE INSTITUTE INFLATION +4.8% Y/Y; APR +3.4%

AUSTRALIA MAY MELBOURNE INSTITUTE INFLATION +1.1% M/M; APR -0.1%

AUSTRALIA MAY ANZ JOB ADVERTISEMENTS +0.4% M/M; APR -2.0%

MARKETS

SNAPSHOT: Boris Johnson Digs In As Storm Clouds Gather

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 191.3 points at 27952.47

- ASX 200 down 22.652 points at 7216.1

- Shanghai Comp. up 33.473 points at 3228.931

- JGB 10-Yr future down 13 ticks at 149.73, yield up 0.6bp at 0.240%

- Aussie 10-Yr future up 0.5 ticks at 96.51, yield down 0.3bp at 3.481%

- U.S. 10-Yr future +0-03+ at 118-21, yield up 0.92bp at 2.942%

- WTI crude up $0.78 at $119.65, Gold up $5.29 at $1856.48

- USD/JPY down 25 pips at Y130.63

- BORIS JOHNSON’S ALLIES CONCEDE TORY REBELS CLOSE TO TRIGGERING NO-CONFIDENCE VOTE (FT)

- U.S. MAY ALLOW MORE SANCTIONED OIL TO FLOW INTO MARKET

- U.S. COMMERCE SEC RAIMONDO: LIFTING TARIFFS ON GOODS MAY MAKE SENSE

- BEIJING OPENS UP RESTAURANTS, CINEMAS AS CHINA EASES CURBS (BBG)

- U.S., S. KOREA FIRE 8 MISSILES IN SHOW OF FIREPOWER AGAINST N. KOREA’S PROVOCATION (Yonhap)

- AUSTRALIA SAYS CHINESE FIGHTER JET INTERCEPTED ITS SURVEILLANCE PLANE

BOND SUMMARY: U.S. Tsy Yields Ease Off Initial Highs, ACGB Yields Slip Ahead Of RBA Rate Decision

Core FI wobbled in the first Asia-Pac session of the week, with participants digesting weekend headline flow. Worrying geopolitical reports (North Korean missile launches, a dangerous incident involving Australian & Chinese aircraft) were weighed against Beijing's decision to ease COVID-19 curbs further and talk of a potential removal of some tariffs by the U.S. in a bid to tackle inflation.

- T-Notes managed to stay afloat, even as their initial uptick proved short-lived. TYU2 rose to 118-23+ in early trade, unwound this move, then gradually regained poise. It last changes hands +0-04 at 118-21+, while Eurodollars run -0.25 to +1.0 tick through the reds. Cash U.S. Tsy yields trade 0.4-0.8bp higher across the curve, off earlier highs.

- JGB futures unwound the initial uptick (with peak at 149.81) and traded sideways thereafter, as the Nikkei 225 recouped opening losses and continued to climb. JBM2 trades at 149.74 at typing, a dozen ticks below previous settlement. Cash JGB yields sit higher across the curves, but off earlier highs. Comments from BoJ Gov Kuroda were shrugged off.

- Australian YM trades +0.5 and XM +1.0, the latter is heading towards its earlier session highs. Bills last seen +4 to -4 ticks through the reds. Cash ACGB curve has bull flattened, with yields last sitting up to 1.8bp lower. The AOFM sold A$300mn of ACGB Jun '51, market reaction was muted. Domestic data also failed to provoke much response. All eyes were already on the RBA, set to deliver its monetary policy decision tomorrow, with hawkish rate hike bets moderating at the margin.

AUSSIE BONDS: The AOFM sells A$300mn of the 1.75% 21 Jun ‘51 Bond, issue #TB162:

The Australian Office of Financial Management (AOFM) sells A$300mn of the 1.75% 21 Jun ‘51 Bond, issue #TB162:

- Average Yield: 3.7995% (prev. 3.5857%)

- High Yield: 3.8025% (prev. 3.5900%)

- Bid/Cover: 2.5600x (prev. 2.7667x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield: 73.5% (prev. 23.5%)

- Bidders 49 (prev. 48), successful 21 (prev. 19), allocated in full 13 (prev. 14)

EQUITIES: Chinese Sentiment Lifted On Earnings; Australia Underperforms Ahead Of RBA Decision

Major Asia-Pac equity indices are mostly higher at typing, bucking a negative lead from Wall St. The positive performance comes despite the small beat in U.S. NFPs (fuelling hawkish Fed worry from some quarters), with optimism surrounding China’s well-documented post-COVID re-opening taking focus elsewhere.

- The CSI300 sits 1.5% higher at typing, a little under seven-week highs made earlier in the session. The Chinese equity benchmark broke above the 4,100 level following the release of May Caixin Services PMIs, the latter which missed expectations (41.4 vs. BBG median 46.0), but still pointed to an improvement over the previous month (Apr 36.2). Chinese tech names were amongst the best performers on the day, with the ChiNext and STAR50 indices adding 4.1% and 4.3% respectively at typing.

- Zooming out, a slew of BBG reports have pointed to equity analysts for Chinese stocks slowing/reversing their cuts to forward earnings estimates, coming as Chinese internet tech giants have generally reported better-than-expected Q1 earnings.

- Turning to the Hang Seng, the Hong Kong benchmark index has added 1.1% at writing, with China-based tech outperforming. The Hang Seng Tech Index accordingly deals 2.3% firmer at typing, with overall sentiment boosted by Meituan’s (+6.9%) after-hours earnings beat last Friday.

- The Nikkei 225 reversed earlier losses to trade 0.7% higher at writing, with the energy and utilities sub-indices leading gains. Major exporters mostly underperformed amidst JPY strength, with USD/JPY backing away from last-Friday’s one-month highs.

- The Australian ASX200 sits 0.3% worse off at typing, with high-beta tech names struggling ahead of the RBA’s MonPol decision on Tuesday, where the central bank is expected to raise rates for a second, consecutive time. The S&P/ASX All Technology Index trades 1.6% lower at typing, diving to worst levels soon after Monday’s open, led by underperformance in large-caps Block Inc, Xero Ltd, and REA Group. Magellan Financial Group was a notable loser as well, dealing 12.8% lower on typing after reporting a A$3.6bn decline in FUM.

- U.S. e-mini equity index futures are 0.4% to 0.7% better off to operate around session highs, extending a rise off of their respective troughs on Friday at typing.

OIL: Higher Despite Supply-Positive Developments; Incoming Crude Demand Surge Debated

WTI and Brent are ~$1.00 higher apiece at typing, with both benchmarks a little under freshly-made highs at $120.99 and $121.95 respectively.

- Looking to the Middle East, Saudi Arabia raised crude prices for customers in Asia by more than expected, mainly on raised demand forecast expectations for the region. The move saw major crude benchmarks catch a bid early in Monday’s session, with WTI and Brent building on six straight weeks of gains.

- Keeping within the region, U.S.-Saudi relations continue to be in focus, with U.S. President Biden delaying a previously-flagged, possible trip to Saudi Arabia. On the other hand, RTRS source reports have since flagged that two Saudi delegations to the U.S. are expected to arrive in mid and end-June, led by the Saudi Commerce and Investment Ministers respectively.

- Turning to energy demand expectations, debate re: an incoming rise in fuel demand has accordingly done the rounds in Asia, with participants looking to the U.S. driving season (noting that Chevron CEO Wirth stated late last week that he has seen little sign of demand destruction amidst high gasoline prices), a rebound in Chinese energy consumption, and a recovery in international travel/flights for cues.

- On the supply side of the equation, worry surrounding the outlook for crude supply likely eased a little as Vitol Head of Asia Mike Muller suggested over the weekend that the U.S. may turn a “blind eye” to Iranian exports of crude amidst stalled nuclear talks in Vienna, while RTRS source reports have pointed to the U.S. allowing for Venezuelan crude to be shipped to Europe by as soon as July.

- Elsewhere, Libya announced that it has restarted production at its largest (280K bpd) Sharara oilfield after a two-month halt.

GOLD: Pushing Back Above $1855

Gold has recovered modestly through the session, up around 0.25% from NY closing levels to $1855. We remain comfortably within recent ranges.

- Today's price action has seen the late recovery from the Friday NY session extend. Oil is tracking higher in the region, while the USD is softer against the majors, although moves are quite small at this stage. The DXY remains above 102.00. Other cross asset signals are less supportive for gold though.

- Equities are tracking higher in terms of US futures (close to 0.5% for the S&P500), while China/HK have recovered after an indifferent start to post gains in the 0.5-1.0% region. Likewise for Japanese equities.

- US yields are a touch higher in terms of Cash Tsys (10yr close to 2.94%), which is building on gains from the Friday session. The real US 10yr yield still edged down though on Friday (from 0.26% to 0.22%).

- Gold weakness on Friday broadly tracked the rebound in USD sentiment. This saw us move down to sub $1850, from above the $1870 level.

- Elsewhere, the Bolivian congress will debate a bill that allows the central bank to buy gold produced in the country to raise its FX reserves. Currently the local central bank holds $2.5bn in gold reserves (as at the end of May).

FOREX: Antipodeans Lag Behind Ahead Of RBA Monetary Policy Decision, Yen Takes Lead

Geopolitical concerns and the prospect of tighter monetary policy weighed generated risk-off flows across G10 FX space, even as equity benchmarks in China and Japan clawed back initial losses, while U.S. e-mini futures crept higher from the off.

- Geopolitical tensions in the Asia-Pacific resurfaced over the weekend. North Korea test-fired a barrage of eight ballistic missiles on Sunday, provoking a symmetrical response from the U.S. and South Korea. Elsewhere, Australia confirmed an incident involving its surveillance plan and a Chinese fighter jet.

- The yen took the lead and spot USD/JPY shed ~30 pips, while regional risk barometer AUD/JPY retreated under the Y94.00 mark. The BoJ released the text of a speech from Gov Kuroda, who merely reiterated his well-documented views on monetary policy.

- Antipodean currencies paced losses in the G10 FX basket. BBG trader sources suggested that the Aussie dollar was sold by leveraged funds as market pricing leaned further towards a 25bp hike to the cash rate target come the end of tomorrow's RBA monetary policy meeting (28bp worth of tightening priced now vs. 31bp last week).

- AUD/USD extended its pullback from a multi-week high printed last Friday, piercing the $0.7200 figure in the process. The pair's implied volatility climbed across the curve, with the short-end posting largest gains, amid uncertainty about the outcome of RBA deliberations.

- Offshore yuan weakened steadily as the session progressed. China's Caixin Services PMI printed at 41.4, missing the median estimate of 46.0 by considerable margin.

- The global economic docket is particularly light during the remainder of the day.

FOREX OPTIONS: Expiries for Jun06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0647-50(E1.6bln), $1.0675(E743mln), $1.0700(E1.4bln), $1.0800(E1.5bln)

- USD/JPY: Y127.00($1.2bln), Y129.00-05($540mln), Y130.00($545mln)

- EUR/GBP: Gbp0.8750-75(E516mln)

- USD/CAD: C$1.2500($600mln), C$1.2650($600mln), C$1.2725-35($1.7bln)

- USD/CNY: Cny6.80($1.2bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 06/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 07/06/2022 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 07/06/2022 | 0430/1430 | *** |  | AU | RBA Rate Decision |

| 07/06/2022 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 07/06/2022 | 0700/0900 | ** |  | ES | Industrial Production |

| 07/06/2022 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 07/06/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 07/06/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/06/2022 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 07/06/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 07/06/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 07/06/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 07/06/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 07/06/2022 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.