-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Yen Sales Resume, T-Notes Correct Post-Fed Rally

- Post-FOMC musings dominate in Asia after U.S. policymakers rolled out the largest rate hike since 1994, but Chair Powell said such "unusually large" moves are unlikely to become a norm.

- Strong labour market and inflation expectations data fan hawkish RBA bets, applying some pressure to ACGBs.

- G10 FX space sees the risk switch flicked to on, with the yen underperforming again as U.S. Tsy yields climb.

BOND SUMMARY: Post-Fed Musings In Play, Strong Aussie Data Signals Keep Lid On ACGBs

Post-FOMC impetus carried over into Asia, lending support to JGBs and ACGBs as local markets re-opened, as T-Notes started correcting their relief rally, which gradually spilled over elsewhere. The initial impetus petered out as the session progressed, with core FI markets staging more or less coordinated recovery, even as ACGBs struggled to shake off data-induced weakness.

- T-Notes pulled back from post-Fed highs (115-30+) but the dip was supported at 115-05 and the contract trimmed losses. TYU2 sits +0-14+ at 115-19+ as we type, amid continued assessment of Fed policy outlook. Eurodollar futures run -1.5 to +5.5 ticks through the reds. Cash Tsy curve bear flattened, although yields now sit off highs & flats, last +1.0-6.7bp. The 5-/30-Year sector re-inverted after a brief foray into positive territory on Wednesday, while the 2-/10-Year bit of the curve trimmed yesterday's gains without testing zero. U.S. data docket for today includes housing starts, building permits, Philadelphia Fed Biz. Outlook & weekly jobless claims.

- JGB futures struggled to punch through overnight highs (147.34) and eased off ahead of the Tokyo lunch break before finding poise again. This leaves JBU2 at 146.97, 139 ticks above Wednesday's settlement and near re-opening levels. Cash JGB yields have faltered across the curve amid continued bond-buying by the BoJ. As a reminder, Japan's central bank will conclude its monetary policy meeting on Friday.

- Domestic data fuelled hawkish RBA bets, amplifying Fed-inspired pressure to ACGBs. The labour market remained tight, with above-forecast employment growth driven exclusively by full-time positions and coupled with an uptick in participation; consumer inflation expectations continued to soar. Futures extended losses to fresh session lows as the data hit the wires, before finding poise and trimming losses in sync with T-Notes. YM last +16.3 & XM +10.5, with bills running 3-12 ticks higher through the reds. Cash ACGB curve remains steeper, with yields last 7.0-13.5bp

FOREX: Risk-On Flows Dominate, Yen Resumes Losses

Regional reaction to the Fed's 75bp rate rise, dubbed by Chair Powell as an "unusually large" move, dominated early price action before petering out. Riskier currencies still comfortably outperform traditional safe havens, but the BBDXY recovered from initial lows as cash U.S. Tsy curve bear flattened in Tokyo trade.

- Higher U.S. Tsy yields resulted in fresh demand for USD/JPY, with BoJ bond-buying operations keeping JGB yields in check. The cross crept higher despite technical signals and options markets dynamics suggesting that correction might be in store. Wednesday's post-Fed dip in USD/JPY saw its RSI return from overbought territory, while 1-month risk reversal extended its slump to the lowest point (largest bearish bias) since Mar 9.

- The Aussie dollar topped the G10 scoreboard, despite showing little reaction to domestic data, which fanned hawkish RBA bets. Monthly jobs report testified to acute tightness in the labour market, while consumer inflation expectations soared to the highest level since 2008. Market pricing of July cash rate target hikes stabilised at 56bp after the release vs. ~51bp prior.

- AUD/NZD crept higher but the recent cycle high (NZ$1.1174) remained intact. The upswing was facilitated by weak GDP data released out of New Zealand, whose economy unexpectedly contracted in the three months through end-March. That said, NZD fared well against other G10 currencies amid better risk sentiment.

- Key data releases today include U.S. weekly jobless claims & housing starts. Central bank activity stays in high gear on Thursday, with the BoE & SNB due to announce their rate decisions. Several ECB members are set to speak, while the BoJ begins its two-day monetary policy meeting.

FOREX OPTIONS: Expiries for Jun16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0540-60(E576mln), $1.0743-50(E513mln)

- EUR/GBP: Gbp0.8750(E873mln)

- NZD/USD: $0.6200(N$818mln), $0.6300(N$654mln)

ASIA FX: Sharp Rebound in USD/CNH

Asian FX has been on the back foot for most of today, although there have been some pockets of strength. CNH and KRW have lost ground, while INR and IDR haven't been able to build positive momentum. Modest outperformance from THB and PHP.

- CNH: USD/CNH has tracked higher for most of the day. We are close to recapturing the 6.7100 handle, which is around 0.6% above the NY close. The CNY fix came out slightly weaker than expected, while equities have struggled to stay positive. Home prices also fell -0.17% in May. The rebound in USD/CNH from the overnight lows just below 6.6700 has been impressive.

- HKD: Spot USD/HKD has reluctantly decoupled from the upper end of its permitted trading band. On Wednesday, the HKMA increased its purchases of the local currency by a further HKD13.824bn after earlier buying HKD11.775bn for June 17 settlement. The size of purchases announced Wednesday (HKD25.599bn) is the largest for a single day since Oct 8, 2009, when the Monetary Authority bought HKD26.350bn in defence of its currency peg.

- KRW: USD/KRW has broadly followed USD/CNH higher. the 1 month NDF is back to 1286, around 0.60% above NY closing levels. The positive impetus from onshore equities has waned through the session. The government announced a number of reforms, including cutting the corporate tax rate and removing capital gains tax for most stock investors. It also cut its GDP forecast and raised the inflation forecast for 2022.

- INR: USD/INR is building a base above 78.00. The trade deficit for May hit a record wide, while onshore covid cases are trending higher, albeit from a low base.

- IDR: After opening weaker, spot USD/IDR is back to unchanged on the day at 14745. BI Gov Warjiyo said that the central bank expects 2022 inflation to reach +4.2% Y/Y, in breach of the target range, due to elevated commodity prices. Core price growth is expected to remain within the target range. His projections were reported by Investor Daily Indonesia. Note BI meets next Thursday.

- THB: USD/THB is back sub 35.00, around 0.20% lower for the session. The authorities announced they may extend trading hours for pubs and bars, as covid cases drop. Reminder that the BoT said Wednesday that it stands ready to "take care" of excessive THB volatility if needed.

CHINA: Growth Rate Closer To 2%-2.5%

Executive Summary:

- China alternative measures of GDP growth have been pricing in a significantly lower level of economic activity, therefore confirming that the current official’s growth target rate of 5.5% is ‘unrealistic’.

- According to think tank CASS measure, the current level of GDP growth is closer to 2%-2.5% (rather than the 4.8% reported in Q1).

- CNY remains vulnerable in the medium term as the CH-US bond yield premium keeps falling into deeper negative territory.

Link to full publication:

China Alternative Growth Measures Pricing in (Much) Lower GDP Growth

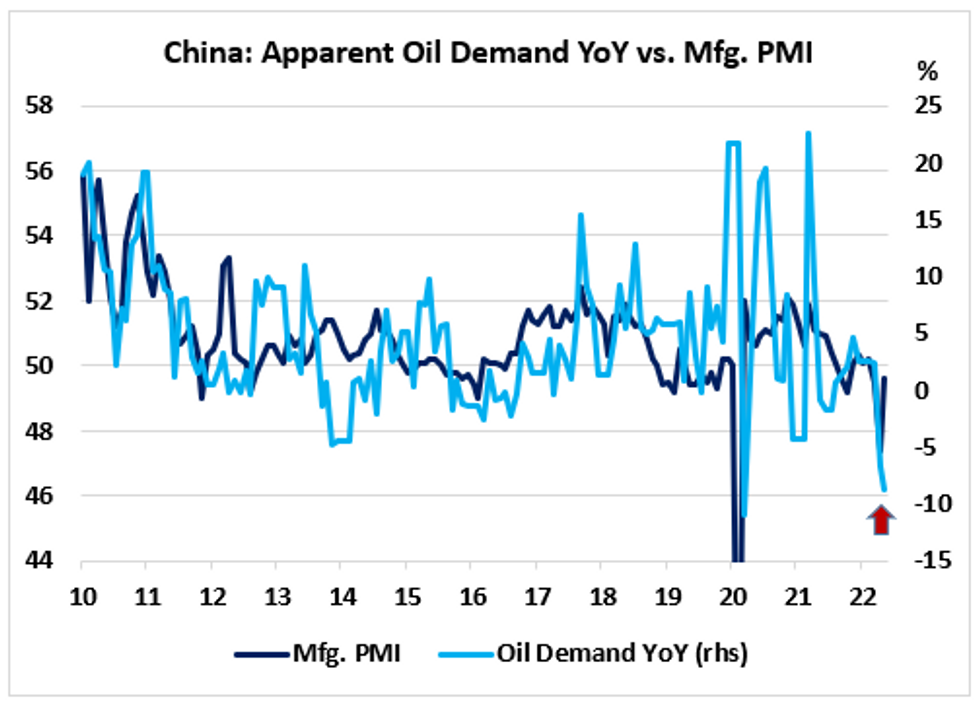

Economic data showed a modest ‘pick up’ in the economic activity in May with PMIs rebounding towards the 50 threshold and industrial production bouncing back into the positive territory overnight (+0.7% YoY, up from -2.9% the previous month). However, China’s apparent oil demand, which some analysts consider as a leading indicator of business activity, continued to drop in May, down 8.7% YoY, therefore pricing in a further slowdown in the near term.

The chart below shows that a plunge in apparent oil demand (YoY) has generally been associated with a sharp contraction in China manufacturing PMI.

Source: Bloomberg/MNI.

EQUITIES: Mostly Higher In Asia On Light Post-FOMC Tailwinds

Major regional equity indices are mostly higher at typing, tracking a positive lead from Wall St. Most benchmarks nonetheless trade below their best levels for the session, having pared opening gains as earlier optimism surrounding the Fed’s rate hike decision on Wednesday moderated throughout Asia-Pac dealing.

- Sentiment in high-beta equities across the region was markedly more positive in the wake of the Fed’s 75bp hike on Wednesday, with focus swirling around Fed Chair Powell saying that “unusually large” hikes would likely be rare going forward.

- The Nikkei 225 leads regional peers to trade 1.2% higher at typing, on track to snap four straight sessions of declines, with ~200 of the index’s 225 constituents in the green. Major exporters and large-cap names such as Fast Retailing Co. lead gains, aided by continued weakness in the JPY, and optimism from Japanese export data outperforming expectations earlier in the session. Elsewhere, the energy and material sub-sectors notably lagged peers amidst weakness in major energy and commodity benchmarks,

- China’s CSI300 sits 0.4% better off at writing, with richly-valued consumer staples (particularly large-cap Kweichow Moutai) and healthcare equities leading gains.

- The Hang Seng Index is 0.4% worse off at typing, bucking the broader trend of gains after reversing an earlier, higher open on weakness in China-based tech names and property-related equities. On the latter, the Hang Seng Properties Index trades 1.1% lower, with evident investor worry re: a rise in borrowing costs impacting property sales, following the Fed’s move to raise rates on Wednesday.

- The ASX200 trades 0.3% firmer, led by gains in tech names and the major miners. The S&P/ASX All Technology Index is 1.3% better off, having pared gains from as much as 1.9% earlier in the session. Large-caps Block Inc, Xero Ltd, and REA Group lead gains, with a limited recovery in the cryptocurrency space from its own lows likely lending support to some of the index’s constituents as well.

- U.S. e-mini equity index futures deal 0.3% firmer at typing apiece, backing away from session highs at ~1.0% heading into European hours. The contracts nonetheless sit a little below their respective best levels made on Wednesday, holding on to much of their post-FOMC gains.

GOLD: Edges Away From Overnight Highs

Gold has edged down slightly during today's Asia session. We are just above $1830, versus late NY highs of +$1840.

- We are only down 0.20% from NY closing levels, with fairly tight ranges prevailing overall.

- The USD is slightly firmer against the majors in terms of EUR, JPY and GBP, so Gold's pullback from overnight highs is in line. Contributing to this move was an earlier spike in US yields, although we have moved away from the day's highs.

- Equity sentiment has been fairly positive throughout the region, which has likely reduced safe haven demand at the margin.

- The CEO of Newmont, the world's largest gold producer, stated the precious metal's floor price is getting higher ($1500-$1600). This is up from the previous floor around $1200 and owes to surge in global inflation pressures.

OIL: Higher In Asia As Supply Worry Weighed Against Stagflation Risk

WTI is +$0.90 and Brent is +$0.70 at writing, continuing a limited recovery from their respective two-week lows made on Wednesday as the USD (DXY) has extended a pullback from fresh 20-year highs as well.

- To recap, WTI and Brent closed ~$3.60 and ~$2.70 weaker respectively on Wednesday for a second straight day of losses. Both benchmarks were initially sent lower after the release of U.S. EIA crude inventory data, while the Fed’s 75bp rate hike later in the session saw crude hit fresh session lows, with worry re: declining energy demand from reduced economic activity evident.

- To elaborate on the former, the latest round of weekly EIA data pointed to a large, surprise build in U.S. crude inventories (based on WSJ estimates), alleviating some supply worry, while distillate inventories increased. Gasoline inventories saw a surprise drawdown (keeping in mind the ongoing “summer driving season”, while Cushing hub stockpiles declined.

- Keeping within the country, U.S. oil production has topped 12mn bpd according to EIA data, the most since Apr ‘20. Expectations re: the possibility of further, significant ramping up of crude production and refining remains evidently muted however, given well-documented difficulties flagged by prominent U.S. producers, with some outlining issues with supplying operations/expansion amidst supply chain disruptions.

- Elsewhere, the International Energy Agency (IEA) published their monthly report on Wednesday, further pointing to tightness in global crude supplies in the near-term. World demand for crude is forecast to surpass pre-pandemic levels in ‘23 (thus rising to record levels), while the IEA highlighted that global crude supplies are unlikely to keep up amidst Russian output decreases, and various oil producers continuing to hit production caps. A note that this comes after OPEC on Tuesday projected global crude demand to surpass pre-pandemic levels in ‘22.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/06/2022 | 0730/0930 |  | CH | SNB interest rate decision | |

| 16/06/2022 | 0730/0930 | *** |  | CH | SNB policy decision |

| 16/06/2022 | 0750/0950 |  | EU | ECB Panetta Speech & Q&A at European Payments Council | |

| 16/06/2022 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 16/06/2022 | 0830/1030 |  | EU | ECB de Guindos at Osservatorio Giovani-Editori Conference | |

| 16/06/2022 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 16/06/2022 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 16/06/2022 | - |  | JP | Bank of Japan policy meeting | |

| 16/06/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 16/06/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 16/06/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 16/06/2022 | 1400/1000 | *** |  | US | Housing Starts |

| 16/06/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 16/06/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 16/06/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 17/06/2022 | 0830/0930 |  | UK | BOE Tenreyro Opens BOE Household Finance Workshop | |

| 17/06/2022 | 0900/1100 | ** |  | EU | Construction Production |

| 17/06/2022 | 0900/1100 | *** |  | EU | HICP (f) |

| 17/06/2022 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 17/06/2022 | - |  | JP | Bank of Japan policy meeting | |

| 17/06/2022 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 17/06/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 17/06/2022 | 1430/1530 |  | UK | BOE Pill Panels BOE Household Finance Workshop |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.