-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China Crude Oil Imports Accelerate In November

MNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI EUROPEAN MARKETS ANALYSIS: Equities Bid In Asia

- Macro headline flow was light overnight, with the most notable news being UK PM Johnson's recent worries being further exacerbated by a double by-election loss.

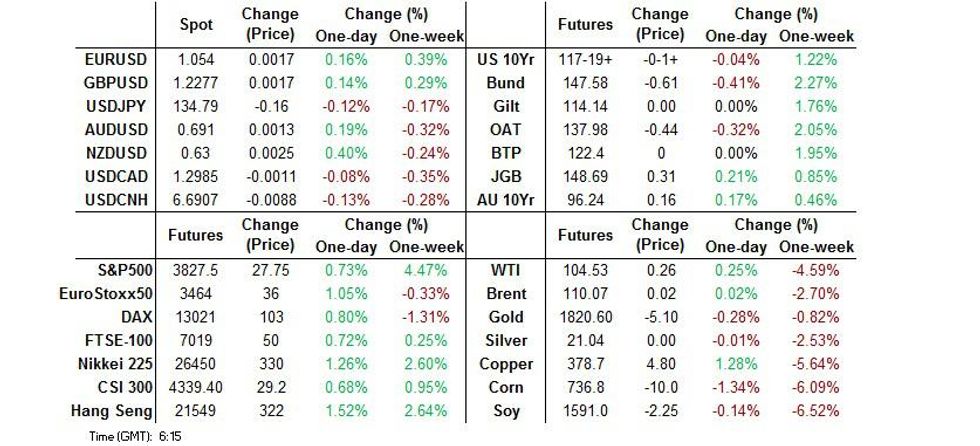

- The dollar index (BBDXY) faltered as U.S. Tsy yields fluctuated and e-mini futures advanced, with participants taking stock of the past week. The index is on track for its first weekly decline this month as the spectre of recession looms large.

- German Ifo Survey, UK retail sales & the final reading of U.S. Uni. of Mich. Sentiment take focus from here. The central bank speaker slate features Fed's Daly & Bullard, ECB's Centeno, de Cos & de Guindos as well as BoE's Pill & Haskel.

US TSYS: Marginally Cheaper In Asia

TYU2 deals -0-04 at 117-17, a touch above the midpoint of its 0-11 overnight range, on sub-standard volume of ~79K. Cash Tsys run 0.5-1.5bp cheaper across the curve, bear flattening.

- Cash Tsys blipped lower in overnight dealing before recovering some poise. Most of the Asia-Pac movement & volume in TYU2 came as wider core FI markets came under some light pressure, with gyrations in USD/JPY and a rally in regional equity benchmarks flagged as potential triggers, without any overt headline catalysts evident. Note that the Tsy space is still operating comfortably off of last week’s cycle cheaps.

- Outside of this, participants were left to digest yesterday’s soft PMI data out of Europe & the U.S., as well as the resultant richening in the wider core global FI space. A quick reminder that Tsys finished off of best levels on Thursday, with block sales in the futures space and hawkish Fedspeak from Governor Bowman (backing a 75bp hike in July, followed by some 50bp move) at the fore after the EGB cash close.

- Looking ahead, Friday’s NY session will bring the release of new home sales data, the final UoM sentiment reading for June and Fedspeak from Bullard (’22 voter) & Daly (’24 voter).

US TSY OPTIONS: Pullback In TY Skew Seen During Recent Bid

The premium that traders pay to hedge the risk of a sell off in TY futures has pulled back from the recent extremes, with puts moving away from richest levels vs. equivalent calls (a reminder that TY futures have moved away from the lowest levels observed since ’09 in recent sessions).

- This is depicted in the TY skew measure (using 1-month 25-delta calls and puts).

- This move comes at a time when stagflation/recession fears have become more embedded, with various members of the FOMC (including Chair Powell) sounding a little more cautious on that matter, while market pricing surrounding Fed pricing edging away from the recent hawkish extremes.

- Note that the TY skew measure failed to breach its Mar ’21, multi-year lows during the latest foray lower.

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

JGBS: Curve Twist Steepens As Futures Lead The Bid

JGB futures regained some poise after their early blip lower (no headlines apparent on the move lower, JPY crosses went bid and core FI weakened), last dealing +39 on the day, although the overnight session high has capped gains in Tokyo.

- 7s lead the bid on the wider cash JGB curve owing to the rally in futures, with the major JGB benchmarks running little changed to ~3bp richer out to 20s. Beyond that point there has been some modest cheapening, in the region of 0.5-1.5bp, with market dislocation matters and speculation surrounding the BoJ’s policy settings at the fore there.

- Local headline flow has been fairly limited, with Japan’s Deputy Chief Cab Sec. Kihara noting that policymakers must be cautious of the economic risk of rising prices. This comes after the major CPI readings held steady in the month of May, matching expectations, while the services PPI print rose by 0.1ppt (in Y/Y terms) in the same month.

- Comments from BoJ Deputy Governor Amamiya are due later today.

- The summary of opinions frommt he Bank’s most recent monetary policy meeting will provide interest in Monday.

AUSSIE BONDS: A Little Off Best Levels; On Track For Largest Weekly Gain Since ‘11

Aussie bonds have pushed higher over the Sydney session with little by way of overt macro headline catalysts evident, as the cash ACGB space played catch up to overnight session bid in futures, which stemmed from the well-documented miss in Eurozone and U.S. PMI readings, resulting in heightened recessionary worry.

- The ACGB curve has bull steepened as a result, seeing yields run 12.5 to 17.0bp lower at typing with the belly leading the bid. YM and XM are 19.0 and 14.5 higher, respectively (overnight highs were not challenged), with bills running +8bp to +21bp through the reds, as the IR strip bull flattens.

- STIR markets are pointing to virtually unchanged expectations for rate hikes in July (when compared to Thursday’s levels), with the IB strip pricing in ~44bp of tightening for that meeting. Rate hike expectations further out have however continued to decline, with a cumulative ~236bp of tightening now priced in for calendar ‘22 (down from >290bp at the beginning of the week), supporting the shorter end of the ACGB curve.

- The AOFM issuance slate announced for next week looks light, with only A$600mn of ACGB Jun-51 on offer.

- RBA Governor Lowe is scheduled to take part in a panel discussion later on Friday re: global monetary policy challenges (1230 BST).

FOREX: USD/JPY Extends Losses, G10 FX Space Struggles For Shared Direction

The dollar index (BBDXY) faltered as U.S. Tsy yields fluctuated and e-mini futures advanced, with participants taking stock of the past week. The index is on track for its first weekly decline this month as the spectre of recession looms large.

- Price action across G10 FX space lacked clear risk directionality, with CHF landing at the bottom of the pile even as its safe haven peer JPY fared well.

- USD/JPY extended its retreat from recent cycle highs and seems poised to register its first weekly loss this month. Continued dip in 1-month risk reversal remained heavy, suggesting that sentiment among option traders was shifting further in favour of calls.

- Japan's core CPI printed perfectly in line with expectations (+2.1% Y/Y). The yen showed little to no reaction to the release.

- The kiwi dollar traded on a firmer footing in the absence of local catalysts and liquidity sapped by a public holiday/market closure in New Zealand.

- German Ifo Survey, UK retail sales & the final reading of U.S. Uni. of Mich. Sentiment take focus from here.

- The central bank speaker slate features Fed's Daly & Bullard, ECB's Centeno, de Cos & de Guindos as well as BoE's Pill & Haskel.

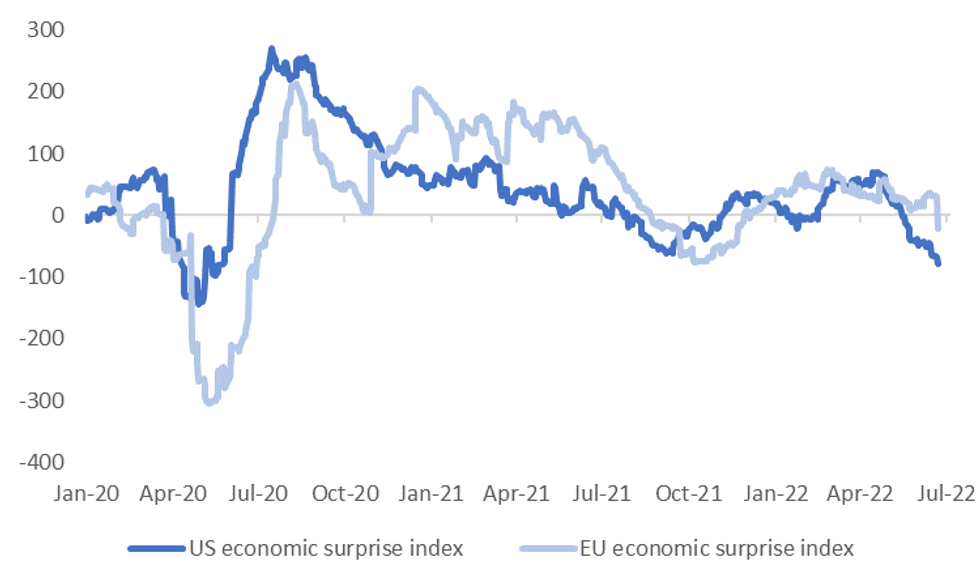

USD: Global Data Outcomes Still Disappointing

The global economic outlook took another hit on Thursday on disappointing PMI prints in the US and Eurozone. Fed tightening expectations continue to be dialled back but, as we outline below, this is not translating into uniform USD weakness.

- The Citi US EASI continues to trend lower, see the first chart below, making fresh lows back to 2020.

- The EU EASI also fell sharply, which is the other line on the chart. This has closed some of the wedge between the two series, albeit to +50 in EU's favor versus recent highs of close to +100.

- Downside surprises to data outcomes, relative to expectations, should bias growth expectations lower all else equal.

Fig 1: Citi US & EU EASIs Trending Lower

Source: Citi, MNI - Market News/Bloomberg

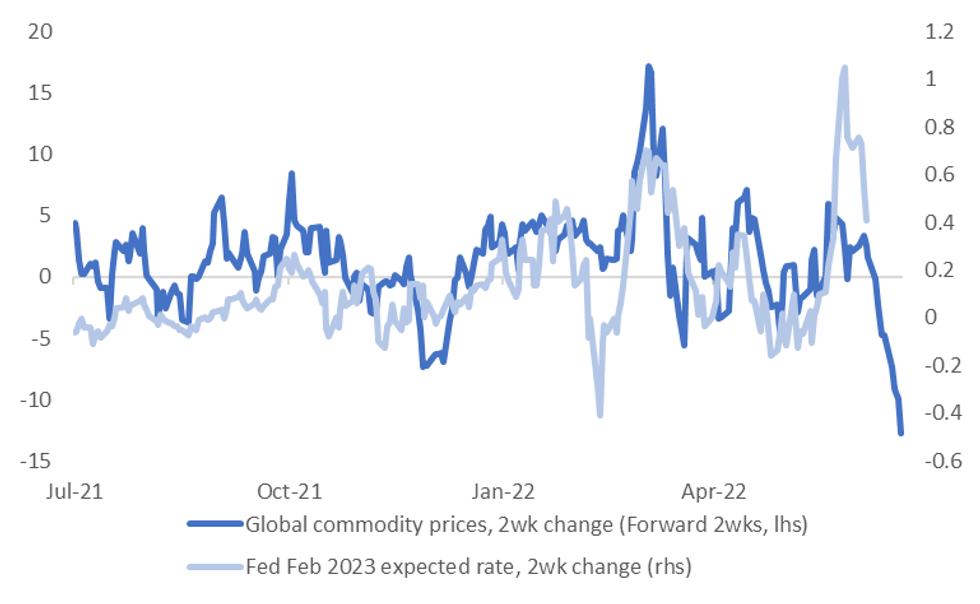

- The follow on effect of weaker data outcomes is weighing on commodity prices, as recession fears rise. The Bloomberg spot commodity index has lost a further 4.63% week to date, on top of last week's 7.3% fall.

- The second chart below overlays the 2-week change in this spot commodity index, against the 2-week change in Fed expectations for early 2023. Note the commodity price series is pushed forward by 2 weeks.

- Fed expectations for early 2023 are down around 30bps through this week, and over 40bps from mid-June highs.

Fig 2: US Fed Expectations & Global Commodity Prices

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- A further unwinding of Fed tightening expectations is USD negative all else equal, but relative shifts also matter.

- The US yield differential has risen this week against the EUR and GBP, but has fallen against JPY, on a 2yr basis.

- While for the commodity FX bloc there is the clear headwind from lower global growth expectations/weaker commodity prices.

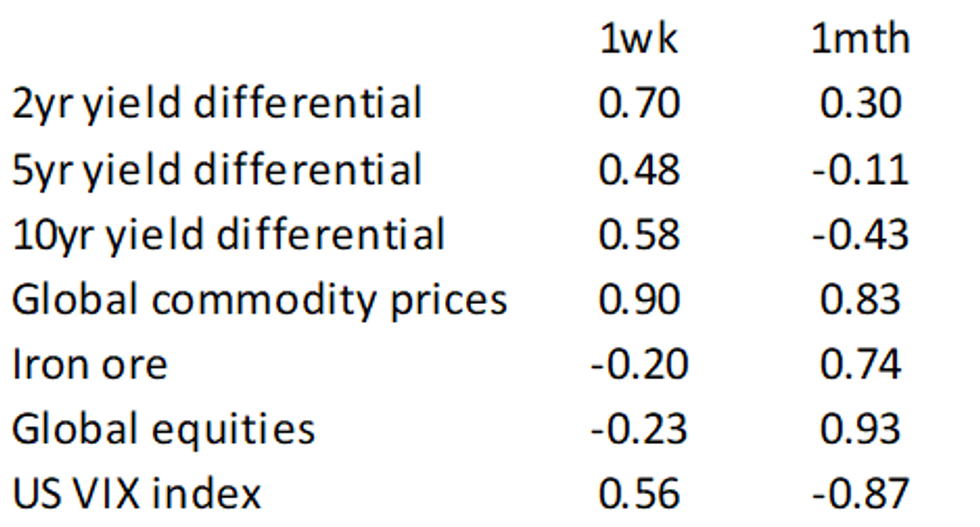

AUD: A$ Correlation With Yields Dips, Rebounds For Commodities

AUD/USD correlations have bumped around once again over the past week. Since last week's update, correlations with yield differentials have edged down, while bouncing for aggregate commodities.

- The table below presents the levels correlations for AUD/USD and various cross asset drivers for the past week and month.

- The past week has seen lower correlations with yield differentials, although we remain in positive territory. The correlation remains strongest at the front end. The AU-US 2yr spread has fallen sharply over the past week, back to -28bps. We remain above mid-month lows though.

- RBA Governor Lowe stating either a 25 or 50bps hike at the July meeting would be considered (i.e not a 75bps move), and questions over how high the terminal rate will go, have seen the 2yr AU yield fall by around 56bps over the past week. Weaker global growth fears have also weighed.

- On this this latter point, the A$ correlation with aggregate commodities has rebounded strongly. Much of the focus this week has been on slumping base metal prices amid on-going data misses in the US and the EU.

- The correlation with iron ore remains fairly weak though and has also slipped against global equities. The A$ hasn't enjoyed much benefit from better global equity sentiment in the past week.

Table 1: AUD/USD Correlations

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

FOREX OPTIONS: Expiries for Jun24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0390-00(E970mln), $1.0450(E664mln), $1.0495-00(E1.3bln), $1.0600(E761mln)

- GBP/USD: $1.2280-00(Gbp560mln)

- AUD/USD: $0.6895-00(A$1.1bln), $0.7100-20(A$989mln)

- USD/CAD: C$1.2950($675mln)

- USD/CNY: Cny6.8250($550mln), Cny6.8300($800mln)

ASIA FX: Philippines' Peso Weakness Continues

PHP depreciation continues, as the BSP’s gradualist approach to rate hikes continues to weigh. Spot USD/PHP is close to 55.00. CNH and KRW are slightly firmer, although the won has lagged the local equity rebound. Mixed trends have been seen elsewhere.

- CNH: USD/CNH has drifted lower through the course of the session. We dipped below the overnight low of 6.6950 and got sub 6.6900 before some support emerged. China equities are higher, but there have been better performers within the region. The USD/CNY fixing bias was close to neutral.

- KRW: USD/KRW finally saw some selling interest, although has lagged the +2% gain in local equities. The 1 month NDF got to 1295, but we are now back above 1298. US Treasury Secretary will reportedly visit South Korea in July. FX could be on the agenda, given FX stability made into the joint leader’s statement between the two Presidents in May.

- SGD: USD/SGD is modestly lower on the day, tracking back to 1.3880. Calls for a potential intra-meeting policy tightening from the MAS continues to grow after yesterday's stronger than expected inflation data. The SGD NEER is around 0.35% below the top end of the MAS band.

- PHP: USD/PHP has climbed to a new cyclical high today. We got close to 55.00 and currently sit at 54.95. Yesterday's 25bp rate rise was consistent with the BSP's stated preference for more gradual tightening (i.e. reluctance to hike by 50bp), signalled by incoming Gov Medalla on the eve of the announcement. The new Governor also stated today that FX intervention is only designed to curb volatility and the central bank is not defending the peso.

- IDR: USD/IDR spot is slightly higher, back close to 14850. As widely expected, BI left rates on hold yesterday. For now, Bank Indonesia will keep draining liquidity from the system as the preferred way of tightening policy. On the FX front, the Bank stands ready to intervene if needed, but is not particularly worried about recent rupiah depreciation.

- THB: USD/THB opened higher but has seen some selling interest above 35.55. The BoT said Thursday that headwinds to global growth are likely to result in a slowdown in exports, which will be the "main challenge" for the Thai economy later this year. Overseas shipments have been key for Thailand's post-COVID recovery amid weak domestic consumption and struggling tourism industry.

EQUITIES: Higher In Asia On Outperformance In Tech; Commodity Benchmarks Hit Multi-Month Lows

Virtually all Asia-Pac equity indices have caught a bid, tracking a lead from Wall St. tech-based names were mostly higher while commodity-related equities region wide sold off for another day, with BCOM (-0.2%) operating around freshly-made three-month lows at writing.

- The Nikkei 225 sits 0.8% better off at typing, with the broader TOPIX Index lagging (+0.5%). Large-caps Tokyo Electron and Shin-Etsu Chemical contributed the most to gains in the index, while energy and utility names lagged. Elsewhere, The Mothers Index (of high growth and emerging stocks) outperformed, adding 5.4% at typing with ~80% of its constituents in the green.

- The Hang Seng Index outperformed to add 1.5%, operating around two week highs at typing on gains across virtually all sub-indices. The Hang Seng Tech Index sits 3.0% firmer at writing, hitting fresh session highs on an extended rally in Chinese EV makers and China-based tech.

- The ASX200 trades 0.4% higher, with the index on track this week to snap a two-week streak of losses (during which saw the index shed 10.6% to hit 19-month lows). Healthcare and tech-based names lead gains, with the S&P/ASX All Technology Index sitting 5.1% better off at writing.

- U.S. e-mini equity index futures deal 0.4% to1.0% firmer at typing with NASDAQ contracts outperforming, reflecting outperformance the cash index on Thursday’s NY session, as well as the bid in tech-related names over the Asian session.

GOLD: Treading Water In Asia; On Track For Second Weekly Decline

Gold deals ~$2/oz higher to print $1,825/oz at typing, regaining some poise after dipping to fresh one-week lows earlier in the session (at $1,821.8/oz).

- To recap, gold closed $15/oz lower on Thursday, with the move lower facilitated by an uptick in the USD (DXY). The precious metal struggled to rise above neutral levels for much of the session, with little impetus observed on the release of (slightly) above-estimate U.S. jobless claims, and a fairly weak set of Eurozone and U.S. PMI figures.

- July FOMC dated OIS now price in ~72bp of tightening for that meeting, with an initial rise to ~82bp on Thursday (post-Powell’s demurral on Wednesday to rule out 100bp hikes) ebbing. Fedspeak has increasingly coalesced around a 75bp hike for July, with Fed Gov Bowman being the latest to do so on Thursday.

- Rate hike pricing further out has retreated, with OIS markets showing a cumulative ~184bp of tightening priced in for the remainder of ‘22 (down from >220bp earlier this week), reflecting debate from some quarters re: less aggressive hiking in case of a Fed-led economic slowdown.

- Looking to technical levels, previously outlined support and resistance levels remain intact at $1,787.0/oz (May 16 low) and $1,889.1/oz (trendline resistance from Mar 8 high) respectively.

OIL: Directionless In Asia; Supply Picture Remains Tight

WTI and Brent have pared an earlier, minor bid to sit virtually unchanged at typing, operating comfortably around the middle of their respective ranges on Thursday.

- To recap, both benchmarks shed ~$2 on Thursday on worry re: a Fed-led economic slowdown, although fresh comments from Fed Chair Powell pledging “unconditional” commitment to the Fed’s inflation fight ultimately saw WTI and Brent remain clear of their respective five-week lows seen on Wednesday.

- The prompt spread for Brent has hit multi-month highs at around ~$3.60, widening ~$0.80 on a week-on-week basis, pointing to the potential for near-term tightness in crude supplies.

- Looking to the U.S., there was little by way of concrete action out of a meeting between Energy Sec. Granholm and oil executives, keeping in mind recent pressure on the Biden administration to rein in energy prices.

- Elsewhere, RTRS source reports have pointed to no change in plans from OPEC+ re: planned output increases for August, with the group’s well-documented difficulty in hitting collective production quotas likely to limit the impact of the move.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/06/2022 | 0600/0700 | *** |  | UK | Retail Sales |

| 24/06/2022 | 0700/0900 | *** |  | ES | GDP (f) |

| 24/06/2022 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 24/06/2022 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 24/06/2022 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 24/06/2022 | 1130/0730 |  | US | St. Louis Fed's James Bullard | |

| 24/06/2022 | 1130/1330 |  | EU | ECB de Guindos Panels UBS Discussion | |

| 24/06/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 24/06/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 24/06/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 24/06/2022 | 1330/1430 |  | UK | BOE Pill Speaks at Walter Eucken Institute Conference | |

| 24/06/2022 | 1345/1445 |  | UK | BOE Haskel Panels Chatham House London Conference | |

| 24/06/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 24/06/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 24/06/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 24/06/2022 | 2000/1600 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.