-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China Continues To Roll Back COVID Restrictions, While Russia Defaults

EXECUTIVE SUMMARY

- FED’S DALY BACKS 75BP HIKE IN JULY

- DUTCH PREMIER SAYS IT’S UP TO ITALY TO CONTAIN BOND SPREADS (BBG)

- UK PM AIMS TO SERVE 3 TERMS EVEN AS MOVES AGAINST HIM GARNER MORE TRACTION

- SANCTIONS PUSH RUSSIA TO FIRST FOREIGN DEFAULT SINCE BOLSHEVIK REVOLUTION (WSJ)

- G7 OKS BAN OF RUSSIA GOLD IMPORTS, TALKING THROUGH OIL PRICE CAP MEASURE

- IRAN-U.S. NUCLEAR TALKS TO RESUME 'IN COMING DAYS', TEHRAN AND EU SAY (RTRS)

- SHANGHAI AND BEIJING OUTLINE FURTHER WIND BACK OF MOVEMENT RESTRICTIONS

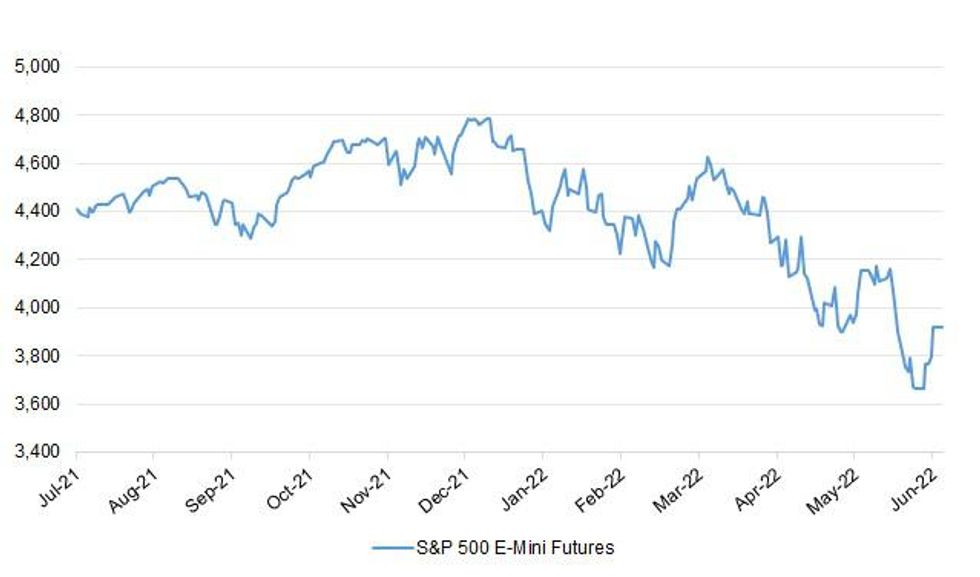

Fig. 1: S&P 500 E-Mini Futures

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Embattled UK leader Boris Johnson said he plans to stick around as prime minister for a third term until the mid-2030s, an act of defiance in the face of mounting political defeats and pressure within his own Conservative Party. (BBG)

POLITICS: Boris Johnson is facing three new threats to his leadership with MPs discussing defections, fresh letters of no confidence being sent and mutinous cabinet ministers considering whether to move against him. More than 30 MPs are understood to have submitted letters to the 1922 Committee of backbenchers demanding a confidence vote only three weeks after the last ballot, which the prime minister narrowly won. (Sunday Times)

POLITICS: Two Tory MPs who have been critical of Boris Johnson say they may stand for election to the committee which runs the party's leadership elections. (BBC)

POLITICS: Boris Johnson’s majority would be wiped out if Labour and Liberal Democrat supporters voted tactically in large numbers at the general election, new analysis shows. Almost 50 Conservative seats would be lost if opponents united in a “pincer movement”, the estimates show. (The Times)

POLITICS: Boris Johnson will delay a cabinet reshuffle until autumn after ministers warned him against destabilising his government further in the wake of last week’s two by-election defeats. (The Times)

FISCAL: British Prime Minister Boris Johnson said on Saturday that public pay could not be raised sharply, as demanded by trade unions, because it would risk fuelling a further rise in inflation. (RTRS)

FISCAL: Government plans to "level up" cities around the UK will cost billions more than thought, a think tank has said. Research by the Resolution Foundation found differences in income across the UK were "significant" and "persistent". (BBC)

INFLATION: Voters are turning on the Government and Bank of England over the cost of living crisis, with almost one in three saying excessive public spending is “significantly” to blame for high inflation, according to a poll. (Telegraph)

ECONOMY: The UK economy is at significant risk of entering a “mild recession” next year as soaring inflation takes its toll, according to KPMG. (The Times)

BREXIT: A move by the British government to rip up post-Brexit trade arrangements in Northern Ireland is "illegal and unrealistic", the European Union's ambassador to the UK has warned. (Sky)

BREXIT: Brussels is taking advantage of Boris Johnson’s leadership woes by refusing Brexit concessions, sources say. (Telegraph)

EUROPE

ECB: Dutch Prime Minister Mark Rutte said Italy should take charge of managing the cost of its government debt in financial markets. “In the division of labor of the monetary system and bringing down the spread, the country has to make sure the fundamentals are alright,” Rutte said in an interview in Brussels after a European Union summit. (BBG)

FRANCE: French President Emmanuel Macron, whose party lost its outright majority in the lower house of Parliament a week ago, asked Prime Minister Elisabeth Borne to form a new cabinet by early July and sound out lawmakers from other parties about reforming the country. (BBG)

FRANCE: Individual consumers and companies need to "immediately" limit their energy consumption in order to be better equipped this winter to deal with a looming energy crisis, the heads of French energy giants Engie, EDF and TotalEnergies said in the French weekly paper Journal du Dimanche on Sunday. (RTRS)

SPAIN: Spain plans to hand out an extra 9 billion euros ($9.5 billion) in new tax breaks and direct aid to soften the impact of soaring prices threatening the euro area’s fourth-largest economy. (BBG)

U.S.

FED: San Francisco Federal Reserve President Mary Daly on Friday became the latest central bank VIP to signal she would support another big increase in interest rates in July in an effort to slow runaway U.S inflation. But she also said the central bank wants to avoid crippling the economy in the process. At a conference in California, Daly indicated a second straight 3/4-point increase in the Fed’s benchmark short-term interest rate might be needed to help get inflation under control more quickly. (MarketWatch)

ECONOMY: The Fed’s plan of quickly getting its benchmark rate to 3.5% to 4% “should create an upfront tightening of financial conditions which will quickly bring inflation back to target,” Managing Director Kristalina Georgieva told reporters following the release of the concluding statement on its article IV consultation, the IMF’s assessment of countries’ economic and financial developments following meetings with lawmakers and public officials. Based on the policy path outlined at the June Federal Open Market Committee meeting, and an expected reduction in the fiscal deficit, the IMF expects the US economy will slow, Georgieva said. (BBG)

FISCAL/INFLATION/ENERGY: California families would get as much as $1,050 to offset rising gas prices and inflation under a tentative agreement between Gov. Gavin Newsom and Democrats in the Legislature. (BBG)

RATINGS: Sovereign credit rating reviews of note from after hours on Friday included:

- Moody's affirmed {US} the United States of America at Aaa; outlook stable

OTHER

CENTRAL BANKS: Central banks around the world must act decisively to rein in inflation and avoid the global economy getting slammed by high prices and low growth, the Bank for International Settlements warned on Sunday. (POLITICO)

U.S./CHINA/TAIWAN: China’s military said the recent fly-through of a US maritime plane in the Taiwan Strait deliberately disrupted regional situation and endangered peace and stability. Colonel Shi Yi, spokesman for the Eastern Theatre Command of the People’s Liberation Army (PLA), said the Chinese military had organised air and ground forces to monitor the US aircraft’s operation, which took place on Friday. He added that the Chinese firmly opposed the actions by the United States and that their troops remained on high alert. (SCMP)

U.S./CHINA/TAIWAN: Taiwan and the United States will hold trade talks on Monday under a newly agreed framework, the office of the U.S. Trade Representative said. Deputy U.S. Trade Representative Sarah Bianchi will meet the island's top trade negotiator, John Deng, to discuss an initiative on 21st-century trade, her office said, without providing details. The initiative was unveiled this month, just days after the Biden administration excluded the Chinese-claimed island from its Asia-focused economic plan designed to counter China's growing influence, the Indo-Pacific Economic Framework, or IPEF. (RTRS)

GEOPOLITICS: Turkish President Tayyip Erdogan will attend a round of talks with the leaders of Sweden and Finland, as well as NATO on Tuesday ahead of the summit in Madrid, Turkish presidential spokesman Ibrahim Kalin said on Sunday. (RTRS)

BOJ: Many Bank of Japan (BOJ) policymakers saw stronger wage growth as key to sustaining the bank's 2% inflation goal, according to a summary of opinions expressed at a June meeting, underscoring their resolve to maintain ultra-low interest rates. (RTRS)

JAPAN: Tokyo’s power reserves are now forecast to be above the minimum level required for grid stability after Japanese utilities were ordered Monday to send supply to the region, the Organization for Cross-regional Coordination of Transmission Operators said. Reserves will be above key 3% level for the 5pm-5:30pm period, having earlier been expected to fall to almost 0%. OCCTO, Japan’s electricity network coordinator, ordered 4 regional utilities to supply Tokyo Electric Power with up to 912.1MW Monday, in order to avoid a shortage. (BBG)

AUSTRALIA: Treasurer Jim Chalmers has foreshadowed dire increases to inflation and warned the cost of living crisis in Australia will get “worse before it gets better”. Dr Chalmers said the Albanese Government needed to grapple with inflation as part of its pursuit for real wage growth. The Treasurer said he would make a detailed economic statement when Parliament reopens in July and flagged that inflation would continue to rise from the 5.1 per cent headline rate revealed in March. (Sky News)

RBA: Federal Treasurer Jim Chalmers has thrown his support behind calls for the Reserve Bank (RBA) board to be more representative of the broader Australian community, following scathing criticism that it is out of touch with workers demanding wage increases. (ABC News)

SOUTH KOREA: South Korea's consumer inflation is expected to exceed 6% as early as June, or possibly in July or August, the finance minister said on Sunday. South Korea's consumer inflation in May rose to 5.4%, its highest in 14 years. (RTRS)

HONG KONG: Hong Kong’s government decided to extendthe existing social distancing measures for 14 days with effect from June 30 as the coming cycle of Covid rules will span to the next government term, according to a statement. This includes continuing to require all patrons of bars, pubs, clubs and nightclubs to undergo a test and obtain a negative result before entering the relevant premises. Current measures will be effective until July 13. (BBG)

CANADA: Finance Minister Chrystia Freeland says she must strike a balance between helping Canadians suffering from the effects of inflation and pursuing a policy of fiscal restraint — or risk making the cost of living problem worse. (CBC)

TURKEY: The Turkish BDDK banking watchdog has imposed restrictions on extending lira loans to companies with high levels of forex assets in a step to strengthen financial stability, state-owned Anadolu news agency reported on Friday. (RTRS)

BRAZIL: The incoming chief executive of Brazil's state-run oil company Petrobras told a corporate committee he has not received any guidance from the government on changing the firm's fuel pricing policy, a document showed on Saturday. (RTRS)

RUSSIA: The mayor of Sievierodonetsk said Russian forces had fully occupied the strategic frontline city in eastern Ukraine after weeks of fighting and bombardment. "The city is now under the full occupation of Russia. They are trying to establish their own order, as far as I know they have appointed some kind of commandant," Mayor Oleksandr Stryuk said on national television. (RTRS)

RUSSIA: The latest missile strikes by Russia on Kyiv show that international sanctions should be more aggressive and include an EU embargo on Russian gas, the Ukraine president's chief of staff said on Sunday. "The G7 summit should respond to Russian strikes on Kyiv," said Andriy Yermak, head of the president's office. "The sanctions should be more aggressive. An embargo on gold exports is good, but a gas embargo is needed in the new EU sanctions package," he said on the Telegram app. (RTRS)

RUSSIA: Other countries should demand that Russia demilitarize its western part as a condition for any talks on renewing prewar relations, Ukrainian Defense Minister Oleksiy Reznikov said on Facebook. Demilitarizing the European part of Russia is a long-term response, while strengthening sanctions on Russia and deploying air and missile defense systems in Ukraine should come first, he said. (BBG)

RUSSIA: Group of Seven leaders will commit to providing indefinite support to Ukraine for its defense against Russia’s invasion, according to the text of a draft statement from their summit in Bavaria. (BBG)

RUSSIA: The Russian foreign ministry said on Friday that the decision by European Union leaders to accept Ukraine and Moldova as membership candidates would have negative consequences. "With the decision to grant Ukraine and Moldova the status of candidate countries, the European Union has confirmed that it continues to actively exploit the CIS on a geopolitical level, to use it to 'contain' Russia," ministry spokeswoman Maria Zakharova said in a statement. "They are not thinking of the negative consequences of such a step..." (RTRS)

RUSSIA: Russia was poised to default on its foreign debt for the first time since 1918, pushed into delinquency not for lack of money but because of punishing Western sanctions over its invasion of Ukraine. Russia missed payments on two foreign-currency bonds as of late Sunday, according to holders of the bonds. The day marks the expiration of a 30-day grace period since the country was due to pay the equivalent of $100 million in dollars and euros to bondholders. (WSJ)

SOUTH AFRICA: Eskom Holdings SOC Ltd. will continue power cuts until at least June 29 as worker protests that have delayed maintenance and repairs persist. In a statement, Eskom said that it’s extending the power cuts due to “unlawful and unprotected” labor action at a number of power stations. The protests have been going on since June 23. (BBG)

IRAN: Iran's indirect talks with the United States on reviving the 2015 nuclear pact will resume soon, the Iranian foreign minister said on Saturday amid a push by the European Union's top diplomat to break a months-long impasse in the negotiations. (RTRS)

IRAN: Iranian state television said Sunday that Tehran had launched a solid-fueled rocket into space, drawing a rebuke from Washington ahead of the expected resumption of stalled talks over Tehran’s tattered nuclear deal with world powers. (POLITICO)

METALS: The G7 economic powers will ban imports of Russian gold in a further tightening of the stranglehold Western nations have sought to impose in response to Russian President Vladimir Putin's brutal war in Ukraine. (POLITICO)

ENERGY: Germany is pushing for Group of Seven nations to walk back a commitment that would halt the financing of overseas fossil fuel projects by the end of the year, according to people familiar with the matter. That would be a major reversal on tackling climate change as Russia’s war in Ukraine upends access to energy supplies. (BBG)

OIL: Group of Seven nations are discussing a cap on the price of Russian oil that would work by imposing restrictions on insurance and shipping, according to people familiar with the matter. (BBG)

OIL: OPEC is set to hold an ordinary meeting on June 29 followed by a meeting of OPEC and non-OPEC members on June 30, the producer group's website showed. (RTRS)

OIL: The OPEC+ alliance of oil producers is running out of capacity to pump more crude, including its biggest member Saudi Arabia, according to Nigeria’s petroleum minister. “Some people believe the prices to be a little bit on the high side and expect us to pump a little bit more but at this moment there is really little additional capacity,” said Nigeria’s Minister of State for Petroleum Resources Timipre Sylva in a briefing with reporters Friday. “Even Saudi Arabia, Russia, of course Russia, is out of the market now more or less.” (BBG)

OIL: Ecuador President Guillermo Lasso announced Sunday the country will reduce rising fuel prices that sparked two weeks of protests, although not by as much as Indigenous groups behind the demonstrations had requested. (France 24)

CHINA

ECONOMY: Effects related to the Covid pandemic in recent months will make it challenging for China to meet its 5.5% annual growth target, a central bank adviser said, adding that pro-economy policies including special bond issuance could be on the way. (BBG)

ECONOMY: The Chinese economy may grow 1% to 2% y/y in Q2, likely bringing H1 growth to around 3%, the Securities Daily reported citing economists. This means the growth in Q3 and Q4 must reach 7% to ensure meeting the annual growth target of 5.5%, the newspaper said citing Qiu Xiaohua, chief economist of Jufeng Investment. Possible incremental policy in H2 can be the issuance of special treasury bonds or front-loading next year’s local government special bonds to help boost infrastructure investment, the newspaper said citing Zhang Jun, chief economist of Morgan Stanley Huaxin Securities. Meanwhile, the central bank can further guide down the Loan Prime Rate and keep liquidity ample to promote credit expansion, the newspaper said citing economists. (MNI)

ECONOMY: China’s economy showed some improvement in June as Covid restrictions were gradually eased, although the recovery remains muted. That’s the outlook based on Bloomberg’s aggregate index of eight early indicators for this month. The overall gauge returned to the neutral level after deteriorating for two straight months. Economic activity picked up in June after financial hub Shanghai lifted its lockdown, allowing businesses to restart and most residents to leave their homes. However, the housing sector continued to be a drag on the economy. Property sales declined in the first three weeks of June in the top four cities in China, even though sales in Shanghai last week had mostly recovered to the level before the lockdown. (BBG)

FISCAL: China’s capital city is offering subsidies for purchases of new-energy vehicles to replace old cars, the latest attempt by local authorities to boost consumption in a slowing economy. The financial aid provided by the city of Beijing ranges from 8,000 yuan ($1,196) to 10,000 yuan for qualified buyers who scrap or resell cars owned for more than a year, among other conditions, the local commerce bureau said in a statement Sunday. (BBG)

PBOC: China's central bank said on Saturday it had signed an agreement with the Bank for International Settlements to establish a Renminbi Liquidity Arrangement (RMBLA) that will provide support to participating central banks in times of market fluctuations. (RTRS)

YUAN: China should keep yuan flexibility to help ease outflow pressures and facilitate the balancing of cross-border capital flows, wrote Guan Tao, former forex official and chief economist at BOC Securities in a blog post. The net outflows under the stock and bond connect schemes totaled CNY132.4 billion in May, rising 19.4% m/m, but the deficit under securities investment only decreased 5.9% m/m due to a 4.2% depreciation in the yuan against the U.S. dollar, Guan said. Foreign investors are worrying about the "non-tradable" risk that may be induced by a rigid exchange rate, instead of the rise and fall in the currency, Guan added. (MNI)

YUAN: China plans to extend the yuan’s trading hours as it seeks to increase global investor participation in onshore currency trading as part of its internationalization push. Regulators led by the People’s Bank of China have told some banks to prepare for an extension of onshore yuan trading hours, according to people familiar with the matter, who asked not to be identified discussing private information. The trading will close at 3 a.m. the next day, instead of the 11:30 p.m. local time, the people said. It’s not known when the change would be effective. (BBG)

CORONAVIRUS: Beijing will allow schools to resume in-class teaching as early as Monday, removing one the last major curbs in the capital as the outbreak of Covid-19’s omicron variant finally comes under control. (BBG)

CORONAVIRUS: Shanghai on Saturday announced it has won the battle against the latest round of COVID-19 outbreak, a confirmation of the correct decisions and plans made by the Communist Party of China (CPC) Central Committee, as well as unity and painstaking efforts by people across the country. (Global Times)

CORONAVIRUS: Shanghai will gradually resume dining-in at restaurants from June 29 in low-risk areas and areas without any community-level spread of COVID-19 during the previous week, a Shanghai government official said on Sunday. (RTRS)

PROPERTY: China Evergrande Group faces a winding-up lawsuit in Hong Kong, according to a court website. The petition was filed by Top Shine Global Limited of Intershore Consult (Samoa) Ltd. A hearing in the high court is set for Aug. 31, the website showed on Monday. (BBG)

CHINA MARKETS

PBOC INJECTS NET CNY90 BILLION VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY100 billion via 7-day reverse repos with the rate unchanged at 2.1% on Monday. This led to a net injection of CNY90 billion after offsetting the maturing CNY10 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity stable at the end of mid-year, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions

- (DR007) rose to 1.8792% at 9:50 am local time from the close of 1.7978% on Friday.

- The CFETS-NEX money-market sentiment index closed at 47 on Friday vs 49 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.6850 MON VS 6.7000

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.6850 on Monday, compared with 6.7000 set on Friday.

OVERNIGHT DATA

CHINA MAY INDUSTRIAL PROFITS -6.5% Y/Y; APR -8.5%

CHINA MAY INDUSTRIAL PROFITS YTD +1.0% Y/Y; APR +3.5%

JAPAN APR, F LEADING INDEX CI 102.9; FLASH 102.9

JAPAN APR, F COINCIDENT INDEX 96.8; FLASH 96.8

MARKETS

SNAPSHOT: China Continues To Roll Back COVID Restrictions, While Russia Defaults

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 384.54 points at 26877.28

- ASX 200 up 129.303 points at 6708

- Shanghai Comp. up 29.414 points at 3379.161

- JGB 10-Yr future down 25 ticks at 148.52, yield up 0.5bp at 0.235%

- Aussie 10-Yr future down 2.5 ticks at 96.19, yield up 2.1bp at 3.740%

- U.S. 10-Yr future -0-06 at 117-05, yield up 2.25bp at 3.153%

- WTI crude down $0.01 at $107.62, Gold up $8.08 at $1834.98

- USD/JPY down 49 pips at Y134.73

- FED’S DALY BACKS 75BP HIKE IN JULY

- DUTCH PREMIER SAYS IT’S UP TO ITALY TO CONTAIN BOND SPREADS (BBG)

- UK PM AIMS TO SERVE 3 TERMS EVEN AS MOVES AGAINST HIM GARNER MORE TRACTION

- SANCTIONS PUSH RUSSIA TO FIRST FOREIGN DEFAULT SINCE BOLSHEVIK REVOLUTION (WSJ)

- G7 OKS BAN OF RUSSIA GOLD IMPORTS, TALKING THROUGH OIL PRICE CAP MEASURE

- IRAN-U.S. NUCLEAR TALKS TO RESUME 'IN COMING DAYS', TEHRAN AND EU SAY (RTRS)

- SHANGHAI AND BEIJING OUTLINE FURTHER WIND BACK OF MOVEMENT RESTRICTIONS

US TSYS: Pickup In Equities Weighs On Tsys

TYU2 took out Friday’s low in overnight trade, with the contract last dealing -0-07 at 117-04, 0-01+ off the base of its overnight range, on sub-standard volume of ~63K lots. Meanwhile, cash Tsys run 0.5-4.0bp cheaper as the curve bear steepens.

- Firmer equities and a rally in the major Asia-Pac equity indices allowed the Tsy space to cheapen in overnight dealing, after a lacklustre round of early trade. The Chinese COVID situation and the impending resumption of indirect U.S.-Iran nuclear talks were positives for wider sentiment (with a strong lead from Friday’s Wall St. session also supporting), while the ongoing G7 gathering presents continued headline risk as the respective leaders discuss a potential oil price cap for Russian crude. This comes after the group agreed on ban on fresh Russian gold imports, while Russia has seemingly been forced to default on payments surrounding two foreign-currency denominated bonds. Note that e-minis and oil more than reversed early losses as regional equity benchmarks rallied.

- A block buyer in FVU2 (+2.0K) headlined on the flow side during Asia-Pac hours.

- Looking ahead, the NY session will see the release of prelim. durable goods data, pending home sales and the latest Dallas Fed m’fing activity reading, in addition to 2- & 5-Year Tsy supply (owing to the holiday-shortened week).

JGBS: Bearish Steepening Seen

The weakness in JGB futures has extended through the afternoon, after the impetus from Friday’s cheapening in U.S. Tsys, coupled with a rally in domestic equities and a lack of a meaningful richening in core global FI markets allowed JGB futures to soften in the first half of Tokyo trade. An extension lower in wider core global FI markets has allowed the move in futures to accelerate during the Tokyo afternoon, with the contract last -21, a little above worst levels of the session. Cash JGBs run 0.5-4.0bp cheaper across the curve, with bear steepening in play. The summary of opinions from the BoJ’s latest monetary policy decision offered little in the way of actionable headline flow, while domestic news flow focused on supply/demand imbalances in the energy space. Looking head, 2-Year JGB supply headlines domestic matters on Tuesday.

AUSSIE BONDS: Cheaper As Tsys Soften

Aussie bonds have cheapened further on the back of a move lower in U.S. Tsys, leaving YM and XM 5.0 and 4.0 weaker, respectively, operating below their respective overnight session lows. The ACGB cash curve has bear steepened, with the major benchmarks running 5.0bp to 9.5bp cheaper across the curve as the long end leads the way lower, while bills have held on to earlier losses, last trading -4 to -6 through the reds.

- The latest round of ACGB Jun-51 supply was absorbed relatively smoothly, with the previously-flagged upsizing in supply accounting for the softer cover ratio (1.55x vs. 2.56x prev.). Pricing ultimately remained firm, with the weighted average yield printing 0.72bp through the prevailing mids (per Yieldbroker).

- There was little in the way of major news flow to digest after the Sydney open. A quick reminder that weekend news flow saw Australian Treasurer Chalmers stress that the cost of living crisis will get worse, while he suggested that the recent RBA communique re: inflation hitting the 7% level before the end of the year was in the right ballpark. Chalmers also seemed to support calls for the RBA board to be more representative of the wider Australian community.

- STIR markets continue to price in ~44bp of tightening for the July meeting, little changed on the day, with a cumulative ~240bp of tightening priced in for calendar ‘22.

- The local economic data docket is virtually empty tomorrow (weekly ANZ-Roy Morgan consumer confidence data is due), with retail sales expected to provide the first point of interest later this week on Wednesday.

AUSSIE BONDS: The AOFM sells A$600mn of the 1.75% 21 Jun ‘51 Bond, issue #TB162:

The Australian Office of Financial Management (AOFM) sells A$600mn of the 1.75% 21 Jun ‘51 Bond, issue #TB162:

- Average Yield: 3.3850% (prev. 3.7995%)

- High Yield: 3.8450% (prev. 3.8025%)

- Bid/Cover: 1.5533x (prev. 2.5567x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield: 38.2% (prev. 73.5%)

- Bidders 60 (prev. 49), successful 36 (prev. 21), allocated in full 31 (prev. 13)

EQUITIES: Strong Start To The Week; Chinese And Hong Kong Stocks Extend Outperformance

Virtually all Asia-Pac equity indices are higher at typing, following a strongly positive lead from Wall St. The MSCI Asia-Pacific Index is on track for a third consecutive day of gains, with Chinese and Hong Kong equities leading the bid.

- The Hang Seng leads regional peers, dealing 3.2% firmer at typing, operating around fresh 12-week highs. Optimism surrounding China’s economic recovery from pandemic control measures is evident, with Shanghai’s leader declaring victory over COVID on Sunday as the city continues to ease measures laid down since March ‘22. Broad gains were observed across virtually every sub-index while China-based tech leads the bid, seeing the Hang Seng Tech Index sit 5.7% better off at typing.

- The Nikkei 225 trades 1.3% higher after opening in the green, shrugging off the latest round of JPY strength to hit fresh one-week highs at writing. Large-caps and commodity-related equities lead the bid, with electricity/utility stocks such as Tokyo Electric Power Company (+7.6%) outperforming after the government issued a power crunch advisory on Monday, raising expectations for higher power prices and corporate profits.

- The ASX200 sits 2.0% better off at writing, on track for a third straight session of gains, and its best daily performance since mid-May. Commodity and tech-related equities lead the bid with the S&P/ASX All Technology Index trading 2.9% higher, while the major miners and ‘Big 4’ Australian banks received strong bids as well.

- U.S. e-minis sit 0.1% to 0.5% firmer at typing, reversing earlier losses. NASDAQ contracts lead gains heading into European hours, tracking outperformance in high-beta names during the Asian session.

OIL: Turning Bid; Chinese Demand On The Rise

WTI and Brent deal ~+$0.40 higher apiece at typing, operating within ~$1.00 of their respective best levels made on Friday. Both benchmarks have reversed losses near the open, with little by way of major, related headline drivers to explain the bid.

- Looking to China, a broad BBG analysis of early economic indicators has pointed to a limited improvement in China’s economy for June, centred around manufacturing and export-oriented industries.

- Keeping within China, electricity demand across the country is continuing to rise amidst an ongoing heat wave in at least 12 of the country’s 31 provinces and regions, adding to additional demand from the return of COVID-restricted industrial output.

- Top African oil producer Nigeria has pledged to meet OPEC+ production quotas by end-August, effectively representing a ~300K-500K bpd increase from current levels as per previous survey estimates and source reports.

- Ecuador has warned that the country’s ~500K bpd output (as of levels around May ‘22) is in danger of halting “in less than 48 hours” due to ongoing anti-government protests. Ecuadorian President Lasso has just announced the deployment of police and army resources to restore order, with the situation continuing to play out at typing.

GOLD: Light Bid On G7 Import Ban; Remains Unchanged For June

Gold sits ~$8/oz better off to print ~$1,835/oz at typing, operating just below session highs after paring opening gains.

- The move higher was facilitated by the G7 announcing intent to unveil an import ban on newly mined/refined Russian gold later this Tuesday, formally cutting supplies from the world’s second-largest gold producer. ~90% of all Russian gold went to G7 countries in ‘20.

- Moves in bullion were likely muted as Russian gold exports have been facing difficulties since Q2 ‘22 after the initial round of sanctions from the West, with trade data pointing to Russian exports of gold to the UK hitting 73kg in April (particularly after moves such as the London Bullion Market Association’s suspension of deliveries from Russian refineries in March).

- To recap Friday’s price action, gold closed ~$4/oz higher on Friday, with a downtick in U.S. real yields and the USD (DXY) providing support for the space. Bullion ultimately sits virtually unchanged in June however, with few drivers observed apart from ongoing debate re: a Fed-led economic slowdown.

- Bullion also sits comfortably off its mid-June lows ($1,805.2/oz on Jun 14), with U.S. real yields broadly backing away from cycle highs made then, while the USD (DXY) notched its first weekly loss in four weeks on Friday.

- From a technical perspective, previously outlined support and resistance levels remain intact at $1,787.0/oz (May 16 low) and $1,889.1/oz (trendline resistance from Mar 8 high) respectively.

FOREX: Yen Holds Lead As Rebound In E-Minis Fails To Spark Risk Recovery In G10 FX Space

Friday's recovery in risk appetite proved fragile as the Antipodeans paced losses while the yen outperformed. A turnaround in U.S. e-mini futures failed to entail a reversal of initial risk-off moves in G10 FX space.

- The summary of opinions from the BoJ's most recent monetary policy meeting, which echoed the Board's familiar train of thought re: inflation. One member said the Bank should pay "due attention" to FX market developments.

- USD/JPY 1-month risk reversal continued to lose altitude, declining for the fifth consecutive day, with bearish sentiment among options traders still firming.

- Regional risk barometer AUD/JPY was the big mover at the start to the week, virtually unwinding its advance from the prior trading day. Its 1-week implied volatility fell to the lowest point since Jun 2.

- Antipodean cross AUD/NZD shed a handful of pips despite a degree of tightening in AU/NZ 2-Year swap spread. Financial markets in New Zealand re-opened after a long weekend.

- A rebound in crude oil prices allowed the loonie to recover, even as the Antipodeans continued to lag.

- The U.S. dollar index (BBDXY) remained heavy, touching its lowest levels since Jun 16.

- Looking ahead, the U.S. will report pending home sales & flash durable goods orders today. Comments are due from ECB's Lagarde & Villeroy.

FOREX OPTIONS: Expiries for Jun27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0445-55(E1.5bln)

- USD/JPY: Y135.00($603mln), Y137.00($550mln)

- USD/CAD: C$1.2920($835mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/06/2022 | 0700/0900 | ** |  | ES | PPI |

| 27/06/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 27/06/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 27/06/2022 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 27/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 27/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 27/06/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 27/06/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 27/06/2022 | 1830/2030 |  | EU | ECB Lagarde Opens ECB Forum | |

| 27/06/2022 | 1900/2100 |  | EU | ECB Schnabel on Financial Stability at ECB Forum | |

| 27/06/2022 | 2230/1830 |  | US | New York Fed President John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.