-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: No Longer Low(e)

EXECUTIVE SUMMARY

- CHINA’S LIU DISCUSSES TARIFFS WITH YELLEN AS US LOOKS TO EASE (BBG)

- BIDEN CLOSE TO ROLLBACK OF CHINA TARIFFS TO FIGHT INFLATION (BBG)

- GERMANY’S UNIPER IN BAILOUT TALKS TO PLUG $9.4 BILLION HOLE (BBG)

- RBA RAISES INTEREST RATES IN QUICKEST TIGHTENING ON RECORD (BBG)

- PBOC TO STRENGTHEN LIQUIDITY SUPERVISION, PROTECT DEPOSITORS (BBG)

- OPEC+ MUST PRODUCE MORE OIL, SAYS UK PM JOHNSON (RTRS)

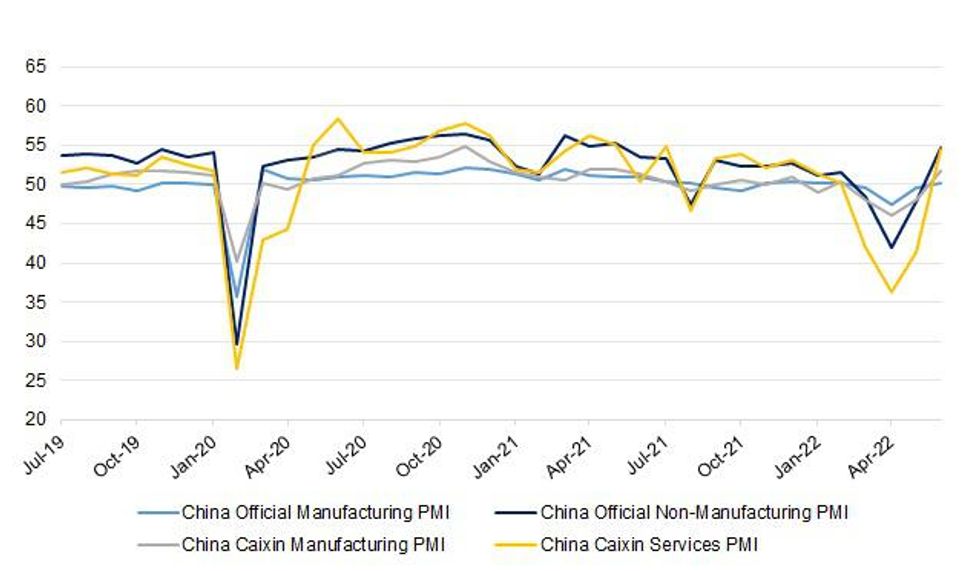

Fig. 1: China PMIs

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

SCOTLAND: The prime minister has spoken to Scotland's first minister for the first time since she outlined how she plans to hold a lawful independence referendum. Nicola Sturgeon raised the issue in a phone call with Boris Johnson. He said he would respond to her letter on an independence referendum "in due course". (BBC)

EUROPE

GERMANY: German gas giant Uniper SE is in talks with the government over a potential bailout package of as much as 9 billion euros, ($9.4 billion) according to a person familiar with the situation. The government is looking at applying a set of measures, including loans, taking an equity stake and also passing part of the surge in costs onto customers, said two people familiar with the talks. (BBG)

FRANCE: French Prime Minister Elisabeth Borne will not hold a confidence vote at the National Assembly, underscoring a failure to build a coalition after President Emmanuel Macron lost his outright majority in elections last month. The French leader’s centrist party will instead seek to legislate by building ad-hoc alliances with opposition groups, government spokesman Olivier Veran said after the first meeting of a reshuffled cabinet. (BBG)

IRELAND: Ireland's finance minister said he expects inflation to average between 7% and 8% for 2022 as a whole, higher than the 6.2% his department forecast three months ago. (RTRS)

IRELAND: Ireland collected 25% more tax in the first half of the year than the same period in 2021 following another bumper month for corporate and income tax receipts that widened the rolling budget surplus, the finance ministry said on Monday. (RTRS)

IRELAND: Ireland could run a budget surplus of up to 0.5% of gross domestic product for 2022, the finance ministry said on Monday, releasing parameters for the 2023 budget that will permit significantly higher spending. (RTRS)

OTHER

GLOBAL TRADE: Ukraine is working with UN and Turkey to make sure that “civilized countries” don’t take its grain illegally exported by Russia, Volodymyr Zelenskiy said during a meeting wtih Sweden’s Prime Minister Magdalena Andersson in Kyiv. (BBG)

GLOBAL TRADE: American and Asian chipmakers are warning that they will have to delay or scale back investment in the U.S. due to Washington's continued failure to fund the $52 billion CHIPS Act aimed at boosting the domestic semiconductor industry. (Nikkei)

GLOBAL TRADE: Japanese chemicals supplier Showa Denko K.K. expects to further raise prices and cut back unprofitable product lines as it grapples with a barrage of economic challenges confronting the $550 billion semiconductor industry. That’s on top of at least a dozen hikes already this year, reflecting Covid-19 supply snarls, surging energy costs from the Ukraine war and the yen’s dramatic weakening, Chief Financial Officer Hideki Somemiya told Bloomberg News in an interview. The situation is unlikely to significantly improve until at least 2023, he added. (BBG)

U.S./CHINA: China’s Vice Premier Liu He discussed US economic sanctions and tariffs in a call with Treasury Secretary Janet Yellen amid reports the Biden administration is close to rolling back some trade levies. The lifting of tariffs and sanctions and the fair treatment of Chinese enterprises are areas of great interest to China, Liu said in the video call with Yellen on Tuesday, according to a statement from China’s Ministry of Commerce. (BBG)

U.S./CHINA: President Joe Biden may announce as soon as this week a rollback of some US tariffs on Chinese consumer goods -- as well as a new probe into industrial subsidies that could lead to more duties in strategic areas like technology. Biden has not yet made a final decision, and the timing could slip, according to people familiar with the deliberations, who asked not to be identified without permission to discuss private conversations. (BBG)

BOJ: Japan’s inflation will be stronger and will last for longer than the Bank of Japan expects now, making an upward revision of its price outlook likely later this month, according to a former chief economist at the bank. “Inflation is going to clearly top 2% this year,” said Seisaku Kameda, who led the compilation of the most recent quarterly forecast in April. “The rapid weakening of the yen is obviously a huge factor.” (BBG)

JAPAN: Japan has been left with unspent budget totalling 22.4 trillion yen ($161.41 billion) from the last fiscal year, a draft seen by Reuters showed on Tuesday, which analysts say may raise questions about the way stimulus measures are implemented. The excess amount in the budget for the fiscal 2021 came on top of some 30 trillion yen that was carried over from the previous fiscal year, the draft showed. In addition, an precedented amount of 6.3 trillion yen from the last fiscal year's budget ended up being "unneeded," it showed. (RTRS)

JAPAN: Separately, Suzuki says that elections tend to encourage talk on spending, but debating fiscal health remains important, responding to a question about the upcoming upper house vote on July 10. Sales tax shouldn’t be cut as it funds social security. (BBG)

NEW ZEALAND: New Zealand Treasury publishes financial statements for 11 months ended May 31. Operating deficit before gains, losses is NZ$7.6b. Deficit is NZ$5.5b narrower than projected in the May budget. Core tax revenue NZ$2.9b more than projected. The key drivers were positive variances in corporate tax, net other individuals’ tax and source deductions. (BBG)

BOK: Bank of Korea expects high inflation to continue for a while as power and gas prices have risen and demand-side inflation pressure is increasing on eased social distancing rules, the central bank says in a statement. Tight crude oil situation won’t be eased in short term while grain prices will remain high. Trend of rising personal service price may expand for considerable time. (BBG)

SOUTH KOREA: South Korea President Yoon Suk-yeol on Tuesday said the government will aggressively cut expenditure and sell assets at public enterprises to better allocate public spending for growing welfare demand. Speaking at a policy meeting, Yoon said he will preside over a meeting on the economy every week to address "pressing" issues including reform of public enterprises, soaring consumer inflation at a 24-year high and rising energy costs. (RTRS)

HONG KONG: Hong Kong is very actively looking at measures to reduce inconvenience for people to travel while containing Covid-19 risks in the city, Chief Executive John Lee says at a briefing. Hong Kong must continue to keep pandemic under control to avoid overload in the hospital system. (BBG)

BOC: Investors are likely underestimating how much the Bank of Canada will raise interest rates because they are overlooking money-supply growth that is putting hidden upward pressure on inflation, according to former central bank researchers. (MNI)

ENERGY: Norwegian offshore workers will likely go on strike on Tuesday in a stoppage that will cut oil and gas output as the negotiating parties have not made progress, the union and the lobby representing oil companies said on Monday. (RTRS)

OIL: British Prime Minister Boris Johnson said on Monday OPEC+ must produce more oil to try to tackle a growing cost-of-living crisis and bring down prices. (RTRS)

OIL: Ecuador’s oil output has recovered by about 90% since a deal between the government and demonstrators ended nationwide protests late last week, with output up to 461,637 barrels per day (bpd), the ministry of mines and energy said on Monday. (RTRS)

CHINA

PBOC: The Chinese central bank won’t provide liquidity support to banks with bankruptcy risks, Sun Tianqi, head of PBOC’s financial stability bureau, writes in an article in China Finance magazine. Banks can exit the market via support of deposit insurance if acquisitions are unable to help resolve their risks; depositors’ legal interests will be fully protected. Sun also writes that China will strengthen fight against insider trading and market manipulation in the financial sector. (BBG)

FISCAL: China will set up a state infrastructure investment fund worth 500 billion yuan ($74.69 billion) to spur infrastructure spending and revive a flagging economy, two people with knowledge of the matter told Reuters on Tuesday. China will issue 2023 advance quota for local government special bonds in the fourth quarter, they added. The Ministry of Finance and the National Development and Reform Commission did not immediately respond to Reuters' requests for comment. (RTRS)

FISCAL: China's infrastructure investment growth may reach about 10% y/y in 2022 with sufficient supporting funds and projects, higher than the previous expectation of 7% and last year's 0.4% gain and drive GDP growth by around 1 percentage point, the Securities Daily reported citing Wang Qing, chief analyst at Golden Credit Rating. The newly announced CNY300 billion financial bonds to be raised by policy banks for major projects will help to accelerate the launch of major water conservancy and transportation projects in the second half of this year, the newspaper said citing analysts. By end-May, a total of CNY310.8 billion was invested in water projects, though the country plans to complete over CNY800 billion of projects throughout the year, the newspaper said. (MNI)

POLICY: China's top priority is to optimise anti-pandemic measures to keep the flow of people and logistics smooth, and increase support for private and small businesses, in particular, transportation, catering, accommodation and tourism, Guan Tao, a former official and now chief economist at BOC Securities wrote in an article published on Yicai.com. The relatively severe unemployment issue is causing an uneven and unstable economic recovery, as the surveyed unemployment rate of 31 large cities recorded over 6% for three consecutive months since March, while the youth unemployment jumped to a new high of 18.4% in May, Guan added. (MNI)

PROPERTY/CREDIT: China still requires easier policies in the second half of the year to consolidate its property market as developers are under great repayment pressures of over CNY310 billion of maturing bonds, the 21st Century Business Herald reported. Bond financing is expected to be further eased with lower costs in H2, as local authorities give clear support, including the provision of endorsement or insurance mechanisms to smoothen bond issuance especially by private developers, the newspaper said citing Yan Yuejin, director of E-house China Research and Development Institution. The maturity will peak in July with over CNY83 billion bonds maturing, followed by high amount in August and September, and possible debt defaults may increase should developers fail to roll over maturing bonds or home sales remain sluggish, the newspaper said citing a report by CRIC. (MNI)

OVERNIGHT DATA

CHINA JUN CAIXIN SERVICES PMI 54.5; MEDIAN 49.6; MAY 41.4

CHINA JUN CAIXIN COMPOSITE PMI 55.3; MAY 42.2

Chinese services companies registered a steep increase in business activity during June, according to latest PMI data, as the domestic COVID-19 situation improved and containment measures were loosened. New orders also returned to growth, rising modestly overall, while the downturn in foreign client demand softened notably. Firms trimmed their staffing levels at a softer pace, while backlogs of work rose only slightly. June saw a sustained slowdown in the rate of input price inflation, with costs rising only slightly. At the same time, efforts to attract new work led to only a marginal increase in prices charged. (S&P Global)

JAPAN JUN, F JIBUN BANK SERVICES PMI 54.0; FLASH 54.2

JAPAN JUN, F JIBUN BANK COMPOSITE PMI 53.0; FLASH 53.2

Japanese service sector firms reported a solid increase in activity that was the quickest in over eight-and-a-half years at the end of the second quarter as remaining domestic COVID-19 restrictions were lifted. At the same time, new business inflows also increased at a strong pace. (S&P Global)

JAPAN MAY LABOUR CASH EARNINGS +1.0%% Y/Y; MEDIAN +1.5%; APR +1.3%

JAPAN MAY REAL CASH EARNINGS -1.8% Y/Y; MEDIAN -1.6%; APR -1.7%

AUSTRALIA JUN, F S&P GLOBAL SERVICES PMI 52.6; FLASH 52.6

AUSTRALIA JUN, F S&P GLOBAL COMPOSITE PMI 52.6; FLASH 52.6

The continued easing of COVID-19 containment measures and the recent reopening of international borders helped to support a further expansion of Australia’s service sector in June, according to S&P Global PMI data, with business activity rising for the fifth month in a row. Both demand and output continued to increase, albeit at softer rates, and employment levels rose at the fastest pace in a year. That said, surveyed firms commented that higher interest rates have weakened service sector growth and weighed on the strength of demand conditions. Significant price pressures persisted in June, with firms continuing to share part of their cost burdens with customers in the form of higher fees. (S&P Global)

AUSTRALIA ROY MORGAN WEEKLY CONSUMER CONFIDENCE 83.7; PREV 84.7

Consumer confidence decreased 1.2% last week, driven by a 4ppt increase in the number of respondents who think it is a ‘bad time to buy’ a major household item. A possible reason for this could be the conclusion of End of Financial Year sales. Expectations of a further increase in the interest rate by the RBA at its meeting today could be another reason behind the dampened sentiment. Household inflation expectations rose 0.2ppt to 5.9% last week, exactly reversing its fall the week before. (ANZ)

NEW ZEALAND JUN ANZ COMMODITY PRICES +0.4% M/M; MAY -2.8%

NEW ZEALAND NZIER QUARTERLY BUSINESS OPINION SURVEY

The latest NZIER Quarterly Survey of Business Opinion (QSBO) shows that businesses are feeling more downbeat in the June quarter, with business confidence at its weakest level since March 2020. Economic activity in the March quarter had been negatively affected by the acceleration in COVID-19 cases as people stayed at home either as a result of self-isolation or infection. For the June quarter, firms saw activity in their own business remaining subdued. Besides the continued uncertainty over the COVID-19 outbreak, businesses are also grappling with the intensification of cost pressures and higher interest rates. (NZIER)

SOUTH KOREA JUN CPI +6.0% Y/Y; MEDIAN +5.9%; MAY +5.4%

SOUTH KOREA JUN CPI +0.6% M/M; MEDIAN +0.5%; MAY +0.7%

SOUTH KOREA JUN CORE CPI +4.4% Y/Y; MEDIAN +4.2%; MAY +4.1%

CHINA MARKETS

PBOC NET DRAINS CNY107 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY3 billion via 7-day reverse repos with the rate unchanged at 2.10% on Tuesday. The operation has led to a net drain of CNY107 billion after offsetting the maturity of CNY110 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8157% at 09:25 am local time from the close of 1.5763% on Monday.

- The CFETS-NEX money-market sentiment index closed at 46 on Monday vs 43 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.6986 TUES VS 6.7071

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7986 on Tuesday, compared with 6.7071 set on Monday.

MARKETS

SNAPSHOT: No Longer Low(e)

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 263.85 points at 26414.54

- ASX 200 up 34.83 points at 6647.40

- Shanghai Comp. down 8.424 points at 3397.003

- JGB 10-Yr future down 6 ticks at 148.9, yield down 0.8bp at 0.221%

- Aussie 10-Yr future down 0.5 ticks at 96.380, yield up 1bp at 3.57%

- U.S. 10-Yr future down 0-09+ ticks at 118-31, yield up 6.61bp at 2.9464%

- WTI crude up $1.91 at $110.34, Gold down $5.54 at $1811.01

- USD/JPY up 61 pips at Y136.23

- CHINA’S LIU DISCUSSES TARIFFS WITH YELLEN AS US LOOKS TO EASE (BBG)

- BIDEN CLOSE TO ROLLBACK OF CHINA TARIFFS TO FIGHT INFLATION (BBG)

- GERMANY’S UNIPER IN BAILOUT TALKS TO PLUG $9.4 BILLION HOLE (BBG)

- RBA RAISES INTEREST RATES IN QUICKEST TIGHTENING ON RECORD (BBG)

- PBOC TO STRENGTHEN LIQUIDITY SUPERVISION, PROTECT DEPOSITORS (BBG)

- OPEC+ MUST PRODUCE MORE OIL, SAYS UK PM JOHNSON (RTRS)

US TSYS: Bear Flattening But Off Cheaps

TYU2 operates comfortably off of worst levels of the Asia session on a combination of post-RBA ACGB spill over, e-minis moving back from highs, Chinese equities pushing lower on the day, crude operating back from best levels and no real progress observed in the latest phone call between senior U.S. & Chinese policymakers (after a knee jerk risk-on move was seen on the back of confirmation that the phone call between Yellen & Liu He took place). That leaves the contract -0-11 at 118-29+, 0-06+ off the base of its 0-16+ overnight range on volume of ~115K during Asia hours. Meanwhile, cash Tsys run 7-11bp cheaper across the curve, bear flattening, with some catch up to Monday’s cheapening in the core EGB & Gilt space observed as cash markets re-opened after the Independence Day holiday.

- Overnight flow was headlined by a 7.5K block sale of the TYQ2 119.50/118.00 put spread, which saw a slightly overweighted delta hedge via TY futures (-2K).

- Tuesday’s domestic docket will be headlined by factory orders and final durable goods data.

JGBS: 10-Year Supply Goes Well, Swap Flows Aid Curve Steepening

JGB futures have stuck to a much tighter range than their global peers, operating -8 ahead of the Tokyo close, largely in line with late overnight session levels.

- 10s outperformed on the curve all day, even ahead of today’s 10-Year JGB auction, representing the only point on the cash JGB curve that is firmer (to the tune of ~1bp), while the remaining benchmarks run little changed to 3.5bp cheaper, with the super-long end leading the weakness, once again aided by payside swap flow as 20+-Year swap spreads widen.

- In terms of auction specifics, 10-Year supply went well, with the low price matching wider expectations (as proxied by the BBG dealer poll), as the tail held narrow and the cover ratio moved further above the 6-auction average. As we flagged in our preview, the BoJ’s defence of its YCC parameters and the short base of the international investor sphere likely provided 2 major sources of demand.

- Slightly softer than expected domestic wage data failed to impact the space.

- In domestic news, former BoJ chief economist Seisaku Kameda suggested that inflationary impulses will be stronger and longer lasting than the BoJ currently envisages, which will likely result in a markup of its inflation expectations when it convenes later this month.

- BoJ Rinban operations headline domestic matters tomorrow.

JGBS AUCTION: The Japanese MOF sells Y2.1822tn 10-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.1822tn 10-Year JGBs:

- Average Yield: 0.248% (prev. 0.239%)

- Average Price: 99.53 (prev. 99.62)

- High Yield: 0.250% (prev. 0.241%)

- Low Price: 99.51(prev. 99.60)

- % Allotted At High Yield: 26.6152% (prev. 7.2951%)

- Bid/Cover: 5.046x (prev. 4.860x)

AUSSIE BONDS: Further Support As RBA Removes Reference To Low Level Of Rates

Aussie bonds have extended their move away from session lows in the wake of the latest RBA decision after the Bank delivered the expected 50bp rate hike, reaffirmed its previous guidance re: further normalisation in the months ahead, but removed the reference to interest rates being at low levels, while explicitly noting that higher interest rates are impacting household spending. The Bank still feels that the strong domestic economy will provide it with a base to tighten further, but there was a slightly more cautious feel to the post meeting statement given the above tweaks. Well-defined global risks were once again highlighted in the statement. We would suggest that a combination of the U.S. Federal Reserve decision i.e. the magnitude of the hike deployed by the Fed & the domestic Q2 CPI print will figure heavily in the Bank’s August deliberations (when it is set to debate implementing a 25 or 50bp hike).

- Note that the space was already moving away from its early Sydney troughs, tracking the beat of the wider core global FI space. The initial move away from lows came with e-minis moving back from highs, Chinese equities pushing lower on the day, crude back from best levels and no real progress observed in the latest phone call between senior U.S. & Chinese policymakers (after a knee jerk risk-on move was seen on the back of confirmation that the phone call between Yellen & Liu He took place).

- That leaves YM -3.5 and XM -1.5 at typing, at little shy of their respective post-RBA peaks, while the longer end of the cash curve is ~1.5bp cheaper on the day, with a fairly parallel shift observed in the 7+-Year zone. Bills run flat to -4 through the reds, bear flattening.

- Tomorrow’s domestic docket is headlined by A$800mn of ACGB Apr-33 supply.

EQUITIES: Mostly Higher In Asia; Initial Lift From U.S.-China Tariff Optimism Wanes

Major Asia-Pac equity indices are mostly higher at typing, tracking a positive lead from Wall St. Asian equity indices are nonetheless mostly off of their best levels for the session, with major Chinese stock index benchmarks sitting below neutral levels after opening higher.

- The CSI300 sits 0.4% worse off at typing after reversing opening gains, whipping between +0.8% and -1.2% across the Asian session. Shallow gains observed in energy and materials equities were countered by weakness in consumer staples and consumer discretionary stocks, while travel-related equities underperformed, led lower by China Tourism Group Duty Free (-2.3%) amidst the ongoing COVID outbreak in the country’s east.

- The Hang Seng Index sits 0.6% firmer at typing, paring gains after opening higher. The early bid was initially driven by optimism surrounding the U.S. potentially lifting tariffs on Chinese goods in the wake of a WSJ source report and a Liu-Yellen video call, with the impetus fading later into the session. A better than expected Caixin services PMI print (54.5 vs 49.6 BBG median) did little to aid equities, with both the HSI and CSI300 trading lower since then.

- The ASX200 trades 0.6% higher at writing, hitting fresh session highs in the wake of the RBA decision to hike rates by 50bp. The late rally was aided by outperformance in tech names (S&P/ASX All Tech Index: +2.0%) and a recovery in the financials sub-index, which erased earlier losses of as low as 0.8% after the RBA decision.

- U.S. e-mini equity index futures deal 0.3% to 0.5% firmer at typing, paring an earlier bid that saw NASDAQ contracts trade as much as 1.0% firmer near the beginning of the Asian session.

OIL: Back From Best Levels; $110 Test Eyed For WTI

WTI is ~+$1.80 (owing to having no settlement on Monday due to the U.S. Independence Day holiday) and Brent is virtually unchanged at typing, with the former backing away from one-week highs made earlier in the session, operating a shade above $110 at typing.

- Brent’s prompt spread has risen above $4 at typing, pointing to still-intensifying backwardation in oil markets amidst elevated worry re: tightness in global crude supplies.

- Previously-flagged strikes in Norway’s O&G sector will begin today. While earlier RTRS reports have estimated crude output to decline by ~130K bpd, the offshore managers' union Lederne expanded their demands on Monday, with closures at three more facilities scheduled for Jun 9 (estimated additional ~160K reduction in crude output).

- Elsewhere, Ecuador has announced that crude production is back above 90% of pre-shutdown levels, at ~462K bpd.

- Turning to China, while the eastern province of Anhui (current outbreak epicentre) reported fewer fresh COVID cases for Monday, daily case counts have continued to tick a little higher across the rest of the economically important Yangtze Delta region, particularly in Jiangsu province (bordering Shanghai).

GOLD: Little Changed In Asia; $1,800/oz Remains In Focus

Gold prints $1,811/oz at typing, sitting a little below best levels of the session. The precious metal operates within the upper end of Monday’s trading range at typing, with an uptick in nominal U.S. Tsy yields possibly putting a cap on the space.

- Gold was little changed on headlines pointing to a call between Chinese Vice Premier Liu He and U.S. Treasury Sec. Yellen earlier in the session, with reports highlighting that the pair had discussed U.S. tariffs on Chinese consumer goods (among a wide range of other matters). A note that the call comes after a previously-flagged WSJ source report on Monday said that a lifting of tariffs could come as soon as this week, pointing to the potential for an easing in U.S. inflation.

- Nominal U.S. Tsy yields have pushed higher on the news, and broadly sit around the upper end of their pre-Independence Day ranges at typing.

- From a technical perspective, gold sits between support at $1,784.6/oz (Jul 1 low), and resistance at ~$1,830.5/oz (20-Day EMA).

FOREX: JPY Weakens As Yields Rebound, A$ Lower Post RBA

The USD DXY index is holding comfortably above 105, largely thanks to higher USD/JPY levels as yields rebound. AUD/USD has fallen post the RBA statement, while most other currencies are slightly firmer against the USD.

- USD/JPY has been supported by a rebound in US Cash Tsy yields, as these markets re-opened, with the 2yr back up to 2.94%, nearly +11bps on the day. This follows a strong bounce overnight in EU markets. USD/JPY reached close to 136.40, but is back to 136.25, +0.45% for the session.

- The RBA raised the cash rate by 50bps to 1.35%, as widely expected. AUD/USD dipped post the RBA announcement as the central bank sounded more cautious on the outlook and removed a reference to rates being low in the accompanying statement. We dipped to the low 0.6850 region before sentiment stabilized. Earlier highs were at 0.6895.

- Elsewhere, much of the focus has been US-China talks and the potential for tariff relief, although nothing concrete has emerged yet. China equities couldn't rise though, despite this news and a strong upside beat on the China Caixin services PMI (54.5 versus 49.6 expected). USD/CNH has remained range bound, last at 6.6925.

- US equity futures are tracking higher, although are well down on earlier session highs. This has helped JPY underperform at the margin, particularly on a cross basis.

- Other pairs are sticking to recent ranges. EUR/USD is holding above 1.0430, while NZD/USD is around 0.6210, largely ignoring a poor Q2 NZIER business survey.

FX OPTIONS: Expiries for Jul05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0450-70(E981mln), $1.0500-05(E596mln), $1.0600(E508mln)

- USD/JPY: Y137.00($1.7bln), Y139.00($2.2bln)

- EUR/GBP: Gbp0.8670-85(E1.5bln), Gbp0.8850(E1.1bln)

- EUR/JPY: Y144.00(E1.6bln), Y146.00(E1.6bln)

- USD/CAD: C$1.2900($675mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/07/2022 | 0645/0845 | * |  | FR | Industrial Production |

| 05/07/2022 | 0715/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 05/07/2022 | 0745/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 05/07/2022 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/07/2022 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/07/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/07/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 05/07/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 05/07/2022 | 0930/1030 |  | UK | BOE Financial Stability Report | |

| 05/07/2022 | 1230/0830 | * |  | CA | Building Permits |

| 05/07/2022 | 1400/1000 | ** |  | US | Factory new orders |

| 05/07/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 05/07/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 05/07/2022 | 1630/1730 |  | UK | BOE Tenreyro Panels Qatar Centre Conference |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.