-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Firmer Equities Applies Light Pressure To USD

- Samsung's quarterly earnings report and China's move to support auto consumption allowed equities to tick higher overnight.

- The bid in equities weighed on the USD.

- The continuation of UK political drama will provide further interest in the London session, with Boris Johnson still determined to stay on despite facing mounting pressure to quit. Elsewhere, German industrial output as well as U.S. trade balance & jobless claims will print today, with comments coming up from a slew of Fed, ECB & BoE members.

US TSYS: Richer, But Off Best Levels

Tsys initially edged higher in Asia-Pac hours but deal off their best levels as we move toward European trade, with TYU2 -0-02 at 118-31+, 0-05+ shy of session highs at typing. Cash Tsys run little changed to 4bp richer across the curve, bull steepening.

- Cross-asset moves came to the fore overnight, negating some of the early Asia bid in Tsys, after regional participants were initially willing to buy into Wednesday’s cheapening.

- Note there has been a distinct lack of notable macro headline flow, with e-minis (as the wider tech sector benefitted from Samsung’s quarterly earnings release) and major crude benchmarks rebounding from below neutral levels.

- Overnight flow was headlined buy a block buyer of FVU2 112.25 puts (+5.0K), which was hedged via a block buy of TUU2 futures (+2.5K).

- A quick reminder that a lack of dovish surprises in the minutes of the latest FOMC decision allowed Tsys to extend to fresh session cheaps into Wednesday’s close, with block sales in TU futures facilitating further curve flattening just ahead of the bell.

- Thursday’s NY docket is headlined by Fedspeak from Governor Waller & St. Louis Fed President Bullard (’22 voter), in addition to the release of the weekly jobless claims and monthly challenger jobs cuts data.

JGBS: Reception Of 30-Year Supply Results In Light Flattening

JGB outperformed wider core FI markets during the Tokyo afternoon aided by a solid enough round of 30-Year JGB supply. That leaves Futures +10, a touch shy of best levels, with the contract sticking comfortably within the confines of the range established in the overnight session. Cash JGBs are little changed to 1.0bp richer across the curve.

- In terms of auction specifics, the low price came in above broader dealer expectations, while the price tail held steady when compared to the previous auction as the cover ratio (3.245x) came in virtually in line with the six-auction average (3.239x). Lifer demand, stemming from a steep JGB curve, market vol. and elevated FX-hedging costs likely allowed the low price to top wider expectations, while impaired market functioning (albeit off of extremes) and the same general market vol. likely prevented broader participation.

- BBG’s latest BoJ sources piece noted that the BoJ is fully committed to its easing stance, while noting that it is set to adjust its forecast for CPI in the current FY to 2% or more (the latest sources piece to suggest such a move) in addition to considering an upward revision to its CPI forecast for next FY. The piece also suggested that the Bank will consider marking down its economic growth forecast for the current FY.

- Note that Tokyo’s local government has started to discuss the possibility of deploying fresh COVID curbs in the city, although Japanese Deputy Chief Cabinet Secretary Kihara has noted that the national government is not considering deploying COVID restrictions at present, with flexible measures to be deployed as necessary.

- Household spending & BoP data headline the domestic docket on Friday.

AUSSIE BONDS: A Two-Way Session

Aussie bonds have pulled away from best levels, leaving cash ACGBS 6-8bp cheaper across the curve, with the 10- to 12-Year zone leading the way lower. YM and XM are -6.0 and -8.5, respectively, with the former operating off of early session lows, while the latter had had a look through its early Sydney base but has failed to meaningfully pierce it so far. Wider EFPs suggest payside flow in swaps has also aided the cheapening. Bills run 4 to 13 ticks cheaper through the reds, bear steepening.

- A delayed reaction to the record Australian trade surplus (on the back of above-expectations exports and imports) also fed into the move away from richest levels of the day.

- Friday will see A$700mn of the 0.25% 21 November ‘24 Bond on offer and the release of the weekly AOFM issuance slate.

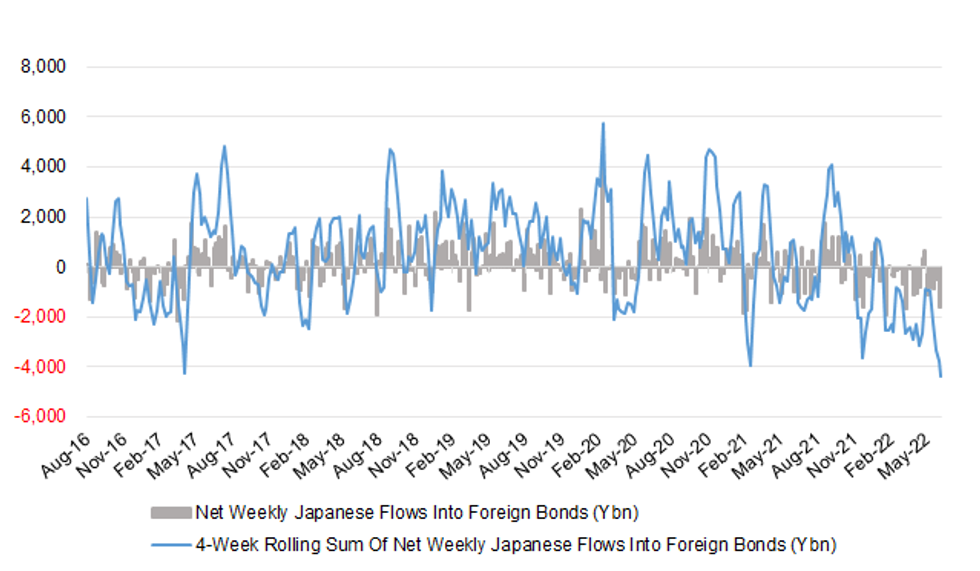

JAPAN: Japan Continued To Shed Foreign Bonds Last Week

The latest round of weekly international security flow data revealed that Japanese investors shed over Y1tn in foreign bonds for a second consecutive week, with the 4-week rolling sum of the measure cratering to fresh multi-year lows as Japanese investors likely used the latest leg of the rally in core government bond markets to shed existing longs. This represented the sixth consecutive week of net sales of foreign bonds on the part of Japanese investors.

- Elsewhere, foreign investors were net buyers of Japanese bonds for a second consecutive week. A reminder that this comes after the record weekly net selling observed two weeks prior, when offshore tested the BoJ’s resolve re: its YCC settings, so this likely represents continued short covering.

- Elsewhere, Japanese investors lodged the largest weekly round of net purchases of foreign equities seen since December, while foreign investors sold Japanese equities for a third straight week.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -1415.4 | -1599.3 | -4365.6 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 1191.7 | 51.4 | 1115.7 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 330.5 | 666.9 | -4916.8 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -490.4 | -419.1 | -1645.8 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

FOREX: Turnaround In Risk Reduces Demand For Safe Havens

The greenback lost its allure alongside other traditional safe haven currencies (JPY, CHF) as U.S. e-mini futures made their way back into positive territory and yesterday's risk aversion fizzled away.

- Tech names led gains in the equity space after Samsung reported a larger than expected jump in revenue, lending support to the shares of regional chipmakers and the wider risk sentiment.

- U.S. Tsy yields declined across the curve, with the 2-/10-Year sector moving off yesterday's flats (albeit it remains in inverted territory). The dollar index (BBDXY) pulled back from cyclical highs printed Wednesday.

- USD/JPY gave away its initial gains, with sales emerging into the Tokyo fix. Still, the yen was among the worst G10 performers amid reduced demand for safe havens.

- Antipodean FX paced gains in G10 FX space on better market mood, with BBG trader sources flagging a short squeeze on leveraged buying. Both AUD/USD and NZD/USD struggled to rip through yesterday's ceilings.

- Sterling remained vulnerable to the fallout from the Whitehall revolt, which extended into early Asia hours, as a flurry of resignations from UK ministers and government aides continued and the choir of voices calling for PM Johnson's resignation kept growing louder.

- The continuation of UK political drama will provide further interest in the London session, with Boris Johnson still determined to stay on despite facing mounting pressure to quit.

- Elsewhere, German industrial output as well as U.S. trade balance & jobless claims will print today, with comments coming up from a slew of Fed, ECB & BoE members.

FX OPTIONS: Expiries for Jul07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0100(E1bln), $1.0215-25(E1.2bln), $1.0275(E830mln), $1.0290-00(E1.1bln), $1.0325(E578mln), $1.0345-55(E1.1bln)

- USD/JPY: Y135.00($957mln), Y136.00-20($1.2bln), Y137.00($760mln)

- GBP/USD: $1.2000(Gbp850mln)

- NZD/USD: $0.6270-80(N$680mln)

- USD/CAD: C$1.3000($651mln)

- USD/CNY: Cny6.7000($985mln)

ASIA FX: Won Stands Out In Mixed Asia Session

Market mood improved as Samsung reported a firmer than expected jump in revenue, which helped allay some of the worst recessionary fears. Meanwhile, a decline in U.S. Tsy yields sapped strength from the greenback, albeit not all Asia EM currencies managed to eke out gains.

- CNH: Offshore yuan caught a bid in line with regional trend, spot USD/CNH sank through yesterday's lows. The pair is poised to snap a two-day winning streak, despite a slightly weaker than expected (17-pip deviation) PBOC fix & worrying COVID-19 headlines out of China.

- KRW: The won outperformed as a 21% jump in Samsung's Q2 sales outweighed a miss in operating profit. The move higher in KRW may have been facilitated by South Korea's BoP current account balanced, which flipped into a surplus of $3.8599bn in May from a deficit of $79.3mn in April. Spot USD/KRW moved away from recent cyclical highs lodged Wednesday.

- MYR: The ringgit fell to its worst levels in more than two years as participants parsed Wednesday's decision from Bank Negara Malaysia to hike the main policy rate by 25bp, which was expected by most analysts. The Bank reaffirmed its intention to tighten monetary policy gradually.

- THB: The embrace of gradualism was evident in latest comments from BoT Asst Gov Piti, who called for caution in normalising monetary policy ("you need to reach takeoff velocity"). His comments appeared to weigh on the baht in early trade, sending it to six-year lows, but this initial weakness moderated as the session progressed.

- PHP: The peso was among the poorest performers in the region, with spot USD/PHP printing new 17-year highs. The pair was supported by Wednesday's remarks from FinSec Diokno, who revealed that the 2022 growth outlook for the Philippines may be worse than previously expected.

- INR: The rupee found poise following Wednesday's late-doors announcement from the RBI on a raft of measures to support the embattled currency. Spot USD/INR eased off near record highs.

EQUITIES: Mostly Higher In Asia; Samsung Revenue Beat Lifts Sentiment

Most major Asia-Pac equity indices are higher at typing, tracking a positive lead from Wall St. Asian chipmakers and tech names outperformed, riding on tailwinds from Samsung’s better-than-expected revenue.

- The Taiwanese Taiex outperformed, sitting 2.3% better off on gains in index heavyweight and chipmaker TSMC (+4.7%, comprises >25% of index), while smaller rival United Microelectronics Corp. (+6.9%) caught a bid as well.

- The KOSPI sits 2.0% firmer at typing after extending opening gains, on track for its second daily higher close in seven sessions. Large-caps, tech, and automobile-related names lead the way higher, making up for lacklustre performance from financials and telecom stocks.

- The Hang Seng deals 0.4% softer at typing, off worst levels after opening in the red. Broader sentiment was sapped by COVID-related worry in China, with limited debate re: the release of Chinese quarterly GDP data next week doing the rounds (a BBG report has pointed to a decline on the back of high-frequency data). The Hang Seng Tech Index sits 1.0% worse off, bucking the region wide bid in tech names.

- The ASX200 deals 0.4% firmer at typing, with a rebound in major miners (after Wednesday’s steep losses) countering shallow losses across energy and utility equities amidst the recent downtick in major crude benchmarks.

- U.S. e-mini equity index futures sit 0.1% to 0.2% firmer at typing, having struggled to make meaningful headway above neutral levels throughout the session after reversing an earlier decline.

GOLD: A Little Above Wednesday’s Nine-Month Lows

Gold is little changed at typing to print $1,739/oz, operating within a tight ~$6 trading range in Asia. The precious metal sits a little above Wednesday’s nine-month lows ($1,732.3/oz), with wider worry re: central bank rate hikes remaining in focus.

- To recap, gold continued its descent on Wed, closing $16/oz lower for a third consecutive daily loss. The move lower was facilitated by a continued rise in the USD (with the DXY notching a fresh 20-year high above the 107.00 handle), adding to downward pressure from an uptick in U.S. real yields.

- Precious metals (silver and platinum) have followed gold lower in recent sessions, with a strengthening Dollar and debate re: Fed hiking and to fight inflation evidently weighing on non-yielding metals.

- From a technical perspective, conditions remain bearish for gold after a break of key short-term support and bear trigger at $1,787.0/oz (May 16 low). Initial support at $1,753.1/oz (Dec 15 ‘21 low) has also been broken, exposing support at $1,721.7/oz (Sep 29 ‘21 low), while a break of that level will expose further support at $1,706.3/oz (1.618 proj of the Mar 8-29-Apr 18 price swing).

OIL: Back From Lows; Shanghai Sees Doubling Of COVID Cases As Mass Testing Continues

WTI and Brent are virtually unchanged at typing, with the latter returning from three-month lows earlier in the session. Both benchmarks operate around the bottom end of their respective ranges on Wed as worry re: weaker energy demand forecasts remain elevated, particularly on China’s COVID outbreak (with focus on Shanghai) and ongoing debate re: recessionary risks in the U.S. and Europe.

- To recap, both benchmarks closed $1-2 lower on Wed, hitting three-month lows in the process after extending Tuesday’s steep sell-off (WTI and Brent closed ~$9-10 lower then).

- Looking to China, lockdown fears have edged higher as fresh daily cases in Shanghai for Wed rose to 54 from 24 for Tue, the highest since May 29 (67 cases), although only two cases were found outside quarantine. More cases are expected to be reported as authorities wrap up three-days of mass testing in 12 of the city’s 16 districts.

- Elsewhere, Brent’s prompt spread remains elevated, printing ~$3.55 at typing, pointing to well-documented, persistent tightness in the near-term supply outlook for crude.

- The latest round of API inventory estimates crossed late on Wed, with reports pointing to a relatively large, surprise build in crude stockpiles, effectively negating the drawdown reported in the week prior. Gasoline and distillate inventories declined, while Cushing hub stocks rose.

- Looking ahead, EIA inventory data is due later on Thursday, with WSJ median estimates calling for a ~1.2mn bbl drawdown in crude stockpiles.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/07/2022 | 0545/0745 | ** |  | CH | unemployment |

| 07/07/2022 | 0600/0800 | ** |  | DE | Industrial Production |

| 07/07/2022 | 0600/0800 | ** |  | NO | Norway GDP |

| 07/07/2022 | 0945/1145 |  | EU | ECB Lane on Green Transition at OECD Forum | |

| 07/07/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 07/07/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 07/07/2022 | 1300/1400 |  | UK | BOE Mann Speaks at LC-MA Forum | |

| 07/07/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 07/07/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 07/07/2022 | 1500/1100 | ** |  | US | DOE weekly crude oil stocks |

| 07/07/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 07/07/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 07/07/2022 | 1605/1705 |  | UK | BOE Pill Speaks at Sheffield Hallam University | |

| 07/07/2022 | 1700/1300 |  | US | Fed Governor Christopher Waller | |

| 07/07/2022 | 1700/1300 |  | US | St. Louis Fed's James Bullard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.