-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China COVID Worry & European Gas Fears Drive Sentiment

EXECUTIVE SUMMARY

- BIDEN YET TO DECIDE ON TARIFFS, CALL WITH XI LIKELY IN COMING WEEKS

- FRANCE’S LE MAIRE: TOTAL RUSSIAN GAS CUTOFF IS ‘MOST LIKELY’ SCENARIO (POLITICO)

- CANADA TO RETURN REPAIRED NORD STREAM 1 TURBINE, EXPAND SANCTIONS ON RUSSIA (RTRS)

- ECB’S HOLZMANN FORESEES STEEP RATE HIKES TO STEM FAST INFLATION (BBG)

- ‘STRONG’ ECB CRISIS TOOL COULD STAY ON SHELF, STOURNARAS SAYS (BBG)

- TAX PROPOSALS AT CENTRE OF RACE TO BECOME UK PM AS TORY RUNNING LIST SWELLS

- JAPAN’S LDP TIGHTENS GRIP ON UPPER HOUSE IN ELECTIONS

- COVID WORRIES AND FINES FOR BIG TECH WEIGHS ON CHINESE EQUITIES

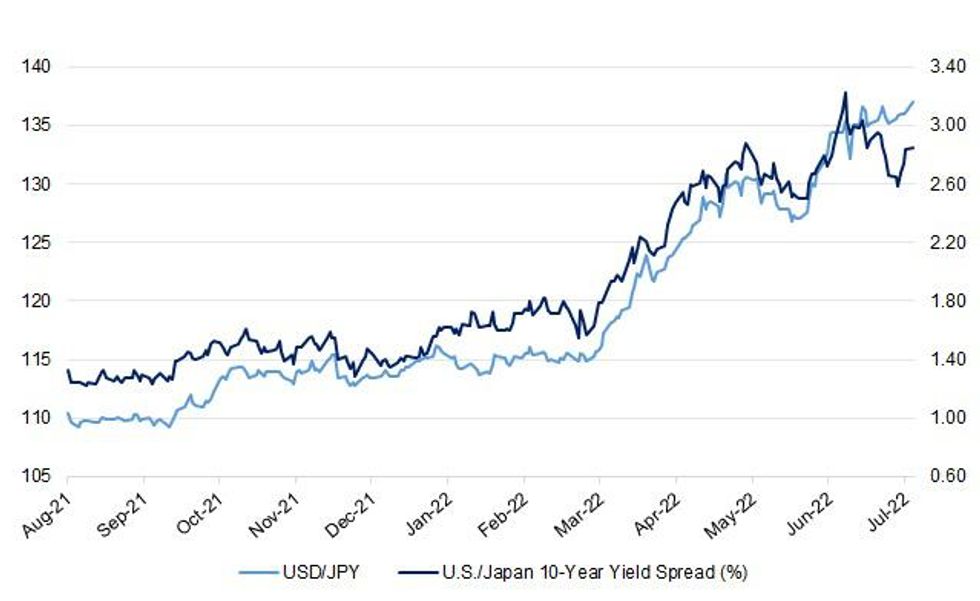

Fig. 1: USD/JPY Vs. U.S./Japan 10-Year Yield Spread

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Boris Johnson's long goodbye as prime minister will be over in eight weeks, senior Tory grandees have told Sky News. (Sky)

POLITICS: Only four Tory party leadership candidates are expected to remain by the end of next week under an accelerated timetable being drawn up by the 1922 Committee of backbenchers. (The Times)

POLITICS: One of the leading contenders to succeed Boris Johnson as prime minister has said he will not stand in the forthcoming leadership contest, as other Conservative MPs prepare to launch their campaigns. Defence secretary Ben Wallace was the favourite among the Tory grassroots, with a net approval rating of +86 among party members according to the ConservativeHome website. He was also a favourite in several bookmakers’ odds. (FT)

POLITICS: Within hours of launching bids for the Conservative party leadership after Boris Johnson’s resignation, some candidates pledged sweeping tax cuts that threaten to leave a black hole in the UK’s finances. (FT)

FISCAL: Boris Johnson is expected to risk a summer of discontent next week by announcing below-inflation pay rises for millions of public sector workers. (The Times)

INFLATION: Two-thirds of business leaders expect rapid UK price rises to persist longer than the Bank of England hopes, with most not expecting inflation to peak until spring of next year. The views from a June survey of the Institute of Directors’ (IoD) membership suggest that companies are planning to raise their prices in moves that are likely to embed high inflation more deeply in the UK economy. (FT)

EUROPE

ECB: The European Central Bank should increase interest rates by as much as 125 basis points by September if the inflation outlook doesn’t improve, according to Governing Council member Robert Holzmann.An initial July hike should be 50 basis points and an even larger move should be considered in September to pro-actively steer the economy toward calmer waters, Holzmann told the Kronen Zeitung newspaper in an interview published Saturday. (BBG)

ECB: European Central Bank Governing Councilmember Yannis Stournaras said a new tool to keep debt-market turmoil at bay as interest rates rise may not need to be used if it’s powerful enough to persuade investors not to test it. (BBG)

ECONOMY: The risk of a euro-area recession is growing as the likelihood of natural gas shortages rises and inflation remains at record levels, according to economists polled by Bloomberg. The probability of an economic contraction has increased to 45% from 30% in the previous survey and 20% before Russia invaded Ukraine. Germany, one of the most-vulnerable members of the currency bloc to cutbacks in Russian energy flows, is more likely than not to see economic output shrink. (BBG)

GERMANY: A dispute between Germany and Finland over the cost of rescuing gas importer Uniper flared on Saturday as its Finnish main shareholder rejected a call from a senior German minister for further help in bailing out the ailing company. (RTRS)

FRANCE: France is looking at how it could extend an energy tariff shield beyond the end of 2022 on a more targeted basis for the poorest households, French Prime Minister Elisabeth Borne said. (BBG)

RATINGS: Rating reviews of note from after hours on Friday included:

- Fitch affirmed the European Financial Stability Facility's Debt at AA

- Fitch affirmed the European Stability Mechanism at AAA; Outlook Stable

- Fitch affirmed Greece at BB; Outlook Positive

- DBRS Morningstar confirmed the Netherlands at AAA, Stable Trend

U.S.

FED: Federal Reserve Bank of New York President John Williams said officials would debate raising interest rates by either 50 basis points or 75 basis points when they meet later this month to curb surging inflation.“We are much lower -- even today, with the fed funds trading around 1.6% -- well below where we need to be by the end of the year,” he told reporters Friday after giving a speech at the University of Puerto Rico-Mayagüez. “50 or 75 is the right positioning,” in terms of the discussion at the Fed’s July 26-27 gathering, he said. (BBG)

ECONOMY: Commerce Secretary Gina Raimondo expressed empathy about the inflation concerns of everyday Americans during an appearance on NBC's "Meet the Press," but maintained that the U.S. economy is fundamentally strong. (Axios)

INFLATION: US commerce secretary Gina Raimondo conceded that removing US tariffs on Chinese goods would not ease inflation in a “very significant way”, underscoring the White House’s struggle to devise an effective plan to fight high prices. (FT)

EQUITIES: Billionaire Elon Musk wants to end his $44 billion deal to buy Twitter, according to a letter sent by a lawyer on his behalf to the company's chief legal officer Friday. But Twitter's board chair Bret Taylor said the company is still committed to closing the deal at the agreed-upon price and plans to pursue legal action to enforce the agreement. (CNBC)

RATINGS: Rating reviews of note from after hours on Friday included:

- Fitch affirmed the United States of America at AAA, outlook revised to Stable from Negative

OTHER

U.S./CHINA: President Joe Biden said his administration is still discussing possible action on US tariffs on Chinese imports, after Commerce Secretary Gina Raimondo said she expects a decision “shortly.” “No, we are having further discussions on that,” Biden told reporters in Delaware on Sunday when asked if there was a decision. (BBG)

U.S./CHINA: U.S. Secretary of State Antony Blinken said on Sunday the United States expects President Joe Biden and Chinese leader Xi Jinping will have the opportunity to speak in the weeks ahead. (RTRS)

U.S./CHINA: US Secretary of State Antony Blinken blasted Beijing over its support of Russia after more than five hours of talks with his Chinese counterpart Wang Yi at the G-20 foreign ministers meeting in Bali. Blinken said he told Wang that China wasn’t neutral on the Ukraine war because there’s no such thing as being neutral when there is a clear aggressor. (BBG)

JAPAN: Japan's ruling Liberal Democratic Party (LDP) is poised to claim a single majority in Upper House election overshadowed by the assassination of former Prime Minister Shinzo Abe, preliminary results circulated by local media outlets showed. The LDP and its junior coalition partner Komeito are expected to win at least 76 seats, exceeding the threshold of 56 seats needed for victory by a wide margin. They are also set to increase their presence in the Upper House. The atmosphere in LDP headquarters was far from victorious as the party mourned its late former leader, murdered on the campaign trail just two days before voters cast their ballots. But political analysts have doubted that "sympathy votes" were pivotal in the LDP's strong performance. The ruling coalition held a comfortable lead in pre-election opinion polling and the result falls within Yomiuri's projection from before Abe's death. The result puts Prime Minister Kishida in a comfortable position to pursue his policy agenda, including the "new capitalism" plan of promoting a more equal distribution of income. The ruling coalition controls both houses of parliament and has three years until the next election. Kishida noted that he is considering when to reshuffle his Cabinet in the wake of the poll, which local media said might happen in September. Any changes will likely reflect power dynamics within the LDP after the removal of Abe's influence on its internal politics. Questions about policy continuity will be doing the rounds at the start to the week, due to Shinzo Abe's influence on the ruling party. Market participants will interrogate the extent to which Kishida can implement his flagship policy proposals. One thing is for sure, the clear electoral result removes political uncertainty on that front, promising markets three years of relative stability. (MNI)

BOJ: Bank of Japan Governor Haruhiko Kuroda said on Monday the central bank was closely watching the impact currency moves could have on the economy, warning of "very high uncertainty" on the outlook due to rising commodity prices. "We won't hesitate to take additional monetary easing steps as necessary" with an eye on risks, Kuroda said in a speech to a quarterly meeting of the central bank's branch managers. Kuroda also repeated the BOJ's policy guidance that the bank expects short- and long-term interest rate targets to "move at current or lower levels." (RTRS)

RBNZ: The widely held view amongst the Shadow Board is that the Reserve Bank of New Zealand should increase the Official Cash Rate (OCR) by 50bp at the upcoming meeting in July. (NZIER)

RBNZ: A 50 basis point hike in official interest rates in New Zealand this week was the “sensible middle ground” for the central bank, a former RBNZ official has told MNI. (MNI)

BOK: South Korea's central bank will deliver its first-ever 50 basis point rate rise to 2.25% on Wednesday, turning up the heat on a rate-hiking campaign as inflation tops a 24-year high and has yet to peak, a Reuters poll showed on Monday. (RTRS)

NORTH KOREA: South Korea's military said on Sunday it had detected the trajectories of what appeared to be shots fired by North Korea, possibly from multiple rocket launchers (MLRs). (RTRS)

TURKEY/RATINGS: Rating reviews of note from after hours on Friday included:

- Fitch downgraded Turkey to B, Outlook Negative

MEXICO: U.S. Trade Representative Katherine Tai said on Friday she will continue to raise U.S. concerns with Mexican counterparts about Mexico's state-centered energy policies and will consider all options to resolve those concerns. (RTRS)

MEXICO/RATINGS: Rating reviews of note from after hours on Friday included:

- Moody's downgraded Mexico to Baa2, Outlook Stable

RUSSIA: Comments by Russian-backed occupation authorities that the Kharkiv region is an “inalienable part of Russian land” suggest Moscow intends to annex part or all of the area, which includes Ukraine’s second largest city, said analysts at the Institute for the Study of War. (BBG)

RUSSIA: Russian inflation decelerated to the slowest since February, when the invasion of Ukraine prompted sanctions that disrupted imports and briefly caused shortages, as a deepening economic contraction and gains in the ruble choke off price growth. (BBG)

RUSSIA: Citigroup was forced to update disclosures related to its exposure to Russia after being pressed by the US securities regulator, according to correspondence published on Friday, the latest example of the bank coming under pressure to improve risk management and compliance. (FT)

RUSSIA: Forty-seven of the world’s top 200 companies are at risk of having their assets expropriated by the Kremlin, according to an agency set up to monitor businesses still operating in Russia. (The Times)

SOUTH AFRICA/RATINGS: It may be too soon to talk about a South African rating upgrade. While Fitch affirmed its stable outlook and rating assessment on Thursday, and S&P Global Ratings unexpectedly revised its outlook on the country’s debt to positive, from stable, in May, South Africa’s position remains challenging. (BBG)

IRAN: Iran has escalated its uranium enrichment further with the use of advanced machines at its underground Fordow plant in a setup that can more easily change between enrichment levels, the U.N. atomic watchdog said in a report on Saturday seen by Reuters. (RTRS)

MIDDLE EAST: The Biden administration is discussing the possible lifting of its ban on U.S. sales of offensive weapons to Saudi Arabia, but any final decision is expected to hinge on whether Riyadh makes progress toward ending the war in neighboring Yemen, according to four people familiar with the matter. (RTRS)

ENERGY: Canada will return a repaired Russian turbine to Germany needed for maintenance on the Nord Stream 1 gas pipeline, Canada's minister of natural resources said in a statement on Saturday. (RTRS)

ENERGY: French Economy and Finance Minister Bruno Le Maire today warned there is a strong chance that Moscow will totally halt gas supplies to Europe. (POLITICO)

OIL: Oil refining company and labor union representatives pressed the U.S. Environmental Protection Agency at a virtual meeting last week to lower costs of the nation's biofuel blending program when it resets the policy next year, according to sources familiar with the call. (RTRS)

CHINA

ECONOMY: Premier Li Urges Localities To Stabilize Growth-Xinhua Local governments should efficiently coordinate pandemic controls and economic and social development, and implement pro-growth policies to consolidate the economic recovery, said Premier Li Keqiang during his visit to Fujian province, Xinhua News Agency reported on Sunday. It is necessary to ensure the smooth flow of logistics in ports, avoid the backlog of goods, in order to reduce the cost of enterprises, said Li, adding that 70% of the country’s industrial output cannot be separated from imports. (MNI)

PBOC: China’s rising consumer inflation is moderate and controllable so the PBOC doesn’t face any constraints in setting monetary policy yet, the Shanghai Securities News reported, citing analysts. (BBG)

PBOC: China's monetary policy should remain flexible and save ammunition as the country may suffer imported inflation in the medium term, and any easing via big rate cuts and liquidity injections should be cautious, said Hu Xiaolian, former official of the People’s Bank of China said on Saturday in Caixin Summer Summit. China needs to guide markets to prevent any “self-reinforcement” of inflation expectations, said Hu, now head of Export-import Bank of China. Inflation is still a key factor impacting market expectations and potential recessions abroad will also hurt China’s confidence, she said. (MNI)

FISCAL: China can consider increasing its budget deficit to provide more support for small businesses battered by Covid outbreaks and weak consumption, Lou Jiwei, a former finance minister suggested on Saturday. (BBG)

BANKS/CREDIT: An official at China’s banking and insurance regulator said authorities will use policy tools “flexibly and precisely” at proper times to stabilize the economy, while banks and insurers will “go all out” to bolster funding. (BBG)

BANKS/CREDIT: The scale of new yuan loans and aggregate finance in June may be higher than the levels of May and a year earlier as financing demand improved with the economy recovering, the China Securities Journal reported on the front page on Monday. June new loans may exceed May’s CNY1.89 trillion and last June’s CNY2.12 trillion, as June is traditionally a big month for new loans. A pickup in home sales in 30 major cities and auto consumption would help drive certain credit demand, the newspaper said citing analysts. Aggregate finance may be significantly higher than May’s CNY2.79 trillion and last June’s CNY3.67 trillion mainly due to the accelerated issuance of local government bonds, the Journal said citing analysts. M2 would maintain rapid double-digit growth in June, the newspaper said. China is set to release its June financial data this week. (MNI)

CORONAVIRUS: Shanghai reported its first case of the new BA.5 sub-variant of Omicron on Sunday, after the highly infectious sub-variant was found in Xi'an and Beijing city last week, the 21st Century Business Herald reported citing the Shanghai’s health commission. The city added one high-risk area and 38 medium-risk areas on Sunday after more than 200 local positive cases were reported from July 3-9, the newspaper said. Another mega-city, Guangzhou, quickly carried out massive nucleic acid testing in five districts on Sunday, while Lanzhou, the largest city of Gansu province in Northwest China ordered one-week temporary control measures in four districts including home office and suspending offline entertainment and dine-in services starting Monday, the newspaper said. (MNI)

CORONAVIRUS: Macau will shut almost all business premises including casinos for a week from Monday as a Covid-19 outbreak in the gambling hub showed few signs of abating. Essential services such as water and gas utilities as well as businesses including supermarkets, pharmacies and hotels will remain open, according to a government announcement Saturday. (BBG)

PROPERTY/CREDIT: China Evergrande's bondholders rejected a proposal to postpone payment for a 4.5 billion yuan ($671.04 million) bond, the company said in a statement on Monday. It said it is in talks with bondholders to reach an acceptable agreement as soon as possible, its statement to the Shenzhen Stock Exchange showed. (RTRS)

PROPERTY/CREDIT: Chinese property developer Ronshine China Holdings Ltd (3301.HK) has not made interest payments on its June 2023 and December 2023 notes, totalling $27.9 million, in the latest blow to China's embattled property market. (RTRS)

EQUITIES: China’s antitrust watchdog fined companies including Alibaba Group Holding Ltd. and Tencent Holdings Ltd. for not properly reporting past transactions, according to a statement Sunday from the State Administration for Market Regulation. (BBG)

CHINA MARKETS

PBOC SETS YUAN CENTRAL PARITY AT 6.6960 MON VS 6.7098 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.6960 on Monday, compared with 6.7098 set on Friday.

PBOC INJECTS CNY3 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY3 billion via 7-day reverse repos with the rate unchanged at 2.1% on Monday. This keeps the liquidity unchanged after offsetting the maturity of CNY3 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8505% at 9:29 am local time from the close of 1.5542% on Friday.

- The CFETS-NEX money-market sentiment index closed at 44 on Friday vs 45 on Thursday

OVERNIGHT DATA

CHINA JUN CPI +2.5% Y/Y; MEDIAN +2.4%; MAY +2.1%

CHINA JUN PPI +6.1% Y/Y; MEDIAN +6.0%; MAY +6.4%

JAPAN JUN M2 MONEY STOCK +3.3% Y/Y; MEDIAN +3.1%; MAY +3.1%

JAPAN JUN M3 MONEY STOCK +3.0% Y/Y; MEDIAN +2.8%; MAY +2.9%

JAPAN MAY CORE MACHINE ORDERS -5.6% M/M; MEDIAN -5.5%; APR +10.8%

JAPAN MAY CORE MACHINE ORDERS +7.4% Y/Y; MEDIAN +5.6%; APR +19.0%

NEW ZEALAND JUN RETAIL CARD SPENDING +0.1% M/M; MAY +1.8%

NEW ZEALAND JUN TOTAL CARD SPENDING +0.1% M/M; MAY +1.4%

SOUTH KOREA 1-10 JUL TRADE BALANCE -$5.53 BLN

SOUTH KOREA 1-10 JUL EXPORTS +4.7% Y/Y

SOUTH KOREA 1-10 JUL IMPORTS +14.1% Y/Y

SOUTH KOREA 1-10 JUL AVG EXPORTS PER WORKING DAY +19.7% Y/Y

MARKETS

SNAPSHOT: China COVID Worry & European Gas Fears Drive Sentiment

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 335.12 points at 26854.25

- ASX 200 down 67.909 points at 6610.1

- Shanghai Comp. down 48.849 points at 3307.229

- JGB 10-Yr future down 30 ticks at 148.94, yield down 0bp at 0.244%

- Aussie 10-Yr future down 5.5 ticks at 96.420, yield up 5.6bp at 3.535%

- U.S. 10-Yr future +0-02 at 117-22, yield up 0.75bp at 3.088%

- WTI crude down $0.84 at $103.95, Gold down $0.59 at $1741.81

- USD/JPY up 85 pips at Y136.95

- BIDEN YET TO DECIDE ON TARIFFS, CALL WITH XI LIKELY IN COMING WEEKS

- FRANCE’S LE MAIRE: TOTAL RUSSIAN GAS CUTOFF IS ‘MOST LIKELY’ SCENARIO (POLITICO)

- CANADA TO RETURN REPAIRED NORD STREAM 1 TURBINE, EXPAND SANCTIONS ON RUSSIA (RTRS)

- ECB’S HOLZMANN FORESEES STEEP RATE HIKES TO STEM FAST INFLATION (BBG)

- ‘STRONG’ ECB CRISIS TOOL COULD STAY ON SHELF, STOURNARAS SAYS (BBG)

- TAX PROPOSALS AT CENTRE OF RACE TO BECOME UK PM AS TORY RUNNING LIST SWELLS

- JAPAN’S LDP TIGHTENS GRIP ON UPPER HOUSE IN ELECTIONS

- COVID WORRIES AND FINES FOR BIG TECH WEIGHS ON CHINESE EQUITIES

US TSYS: Tight Ranges In Play In Asia, Chinese Equity Weakness Limits Losses

The previously outlined weakness in Chinese equities (based on COVID worry and fines for big tech names), which weighed on broader risk appetite, allowed Tsys to tick away from worst levels of the session, after early Asia-Pac trade saw regional participants undertake some light selling as they reacted to Friday’s post NFP front end-led cheapening. TYU2 last deals +0-02 at 117-22, just off the peak of its very tight 0-04 Asia range, with a lack of fresh headline flow since the Asia re-open and diminished liquidity on the back of a holiday in Singapore hampering activity (TYU2 operates on ~60K lots in volume terms). Cash Tsys run little changed to 1bp cheaper across the curve at typing.

- Note that the US contract was the only major Tsy futures contract to show through its Friday low in overnight dealing (albeit only marginally, with the move short-lived).

- Monday’s NY docket includes another appearance from NY Fed President Williams (with the address set to focus on the LIBOR transition) and 3-Year Tsy supply. The European gas situation will also be eyed, with the annual maintenance period of the Nord Stream pipeline getting underway today.

JGBS: Cheaper On Local Political Matters, But Off Worst Levels

JGB futures moved lower during the Tokyo morning, with domestic equities pushing higher in the wake of Japan’s ruling coalition tightening its grip on power in the weekend’s upper house elections, which will allow PM Kishida to continue to push forward his idea of modern capitalism, while participants also continue to speculate on the future shape of Japanese defence and monetary policy. Press reports noted that Kishida is set to conduct a cabinet reshuffle in August or September, with subsequent comments from Kishida pointing to a reshuffle that will focus on party unity. He also noted that there will be lively debate on constitutional changes in the Autumn, while flagging imminent talks on fiscal measures to combat inflation (which will seemingly be based on “flexible” use of the country’s budget reserves).

- This mix of domestic political matters, coupled with wider weakness in global core fixed income markets in the wake of Friday’s U.S. NFP print, has allowed the space to cheapen.

- Elsewhere, comments from BoJ Governor Kuroda reaffirmed the Bank’s stance, while the latest Sakura report saw the BoJ upgrade its assessment of 9 areas of the country, while the other 2 saw their assessment remain as was.

- Futures last deal -28, off worst levels of the session as the wider equity sphere comes under some pressure (although the Nikkei 225 outperforms post-elections, last +1.2%, albeit shy of best levels). Cash JGBs are little changed to ~4bp cheaper across the curve, bear steepening (although 7s were softer than directly surrounding lines on the weakness in futures). Note that the 10-Year JGB yield was limited by the upper boundary of the BoJ’s permitted -/+0.25% trading band during the Tokyo morning. Swaps out to 10s were generally wider on the day (excluding 7s given the futures-related weakness), while 20+-Year swap spreads were narrower on the day.

- Looking ahead, PPI data and 5-Year JGB supply headline Tuesday’s domestic docket.

AUSSIE BONDS: Tracking Tsys In Muted Start To The Week

Aussie bond futures followed a similar patten to U.S. Tsys, initially shifting lower at the re-open as Sydney participants reacted to the post-NFP gyrations that were led by weakness in U.S. Tsys, although both YM & XM failed to break below their respective overnight session bases. The contracts then backed away from worst levels on the previously alluded to weakness in Chinese equities, with little In the way of domestic catalysts to trade off. YM sits -4.0 & XM -5.5 at typing, with tight ranges in play, while cash ACGBs sit 4-6bp cheaper across the curve after some catchup to overnight moves. EFPs have continued their recent march wider, to the tune of 3.5bp in both the 3- & 10-Year metrics. Bills run 6-10bp cheaper through the reds. Note that participants are also on the lookout for the launch and pricing of SAFA’s May ’36 tap, which will come at some point this week, per after-market guidance on Friday. Looking ahead, the NAB business survey, Westpac consumer confidence reading and CBA household spending data headline domestic matters on Tuesday.

EQUITIES: China COVID & Fines At Centre Of Risk-Negative Feel, Japan Bucks Trend

Worries from several areas weighed on most of the major equity benchmarks that were open for dealing during Asia-Pac hours.

- Chinese COVID fear (centring on Shanghai detecting the BA.5 variant for the first time & Macau shuttering most of its businesses for a week) coupled with a fresh round of fines for some of the tech giants (Alibaba & Tencent) meant that Chinese & Hong Kong equities underperformed the wider equity space, with the Hang Seng Tech index trading the best part of 4% softer at typing, while the benchmark CSI 300 sits ~2% worse off. Travel-related names and casinos struggled, as you would expect when assessing the aforementioned news flow.

- Worries surrounding the European gas supply saga continue to feed into the risk-negative narrative (even with Canada returning a repaired Nord Stream turbine back to Germany), while Tesla CEO Musk’s attempt to pull out of a takeover of Twitter applied further pressure to the space. The S&P 500 contract last deals 0.6% softer on the day.

- Japan was the exception to the broader rule, with the reaction to the country’s ruling coalition extending its grip on power via the latest round of upper house elections initially generating a positive market reaction, before the wider spread risk aversion pulled Japanese equities back from best levels (Nikkei 225 +0.9% at typing).

GOLD: Outperforming Other Commodities

Gold has spent the start of this week respecting recent ranges. Dips below $1740 have been supported, but we haven't been able to muster a re-test above $1745. We last tracked just under $1742

- In terms of cross asset drivers today, a firmer USD has helped cap any upside impetus for gold. The DXY is back above 107.30, +0.30% on closing levels from the end of last week.

- US yield momentum has stayed positive, but there hasn't been a great deal of follow through, with the 2yr yield up less than +1bp at this stage to 3.11%, following a strong bounce during Friday’s domestic US session.

- The trend last week was for higher US real yields, as Fed rhetoric remained hawkish and US NFP data painted to a strong labor market picture on Friday. The US 10yr real yield ended last week at +72bps. Arguably though golds dip through $1750, from earlier last week, had already arguably discounted such a move.

- Equity sentiment is more supportive for the precious metal, with falls in China related bourses, on renewed Covid concerns evident. This has also weighed on US equity futures, which are now comfortably in the red.

- Such a backdrop has likely helped gold outperform other commodities on the day, with oil, copper and iron ore lower on demand concerns.

OIL: Dips On Demand Concerns

Brent crude has started the week modestly lower, back to the low $106/bbl region (-0.5% on the day), after ending last week at $107/bbl. WTI is also weaker, now back to $104/bbl. The tug of war between supply and demand factors driving sentiment continues. Weekend Covid developments in China add downside risks to the demand outlook, which explains most of today's move.

- Rising covid cases in Shanghai, including the discovery of the BA.5 variant and mass testing this week is raising concerns around the demand outlook for broader commodities. Fresh lockdowns are also taking place in Haikou, the capital of Hainan and Macau.

- Elsewhere the focus will be on US President Biden's visit to Saudi Arabia this week. However, there is little optimism that much supply relief will be forth coming as spare capacity in the country and OPEC+ more broadly is reportedly fairly limited.

- Domestic gas prices in the US have been trending the right way for the administration, although it remains to be seen how much further downside materialises. Domestic supply remains tight in the US.

- Last week spec positions in both the gasoline and crude oil market were cut. For ICE Brent we are now back to a 20 month low at +143k. The US rig count also edged up by 2 last week.

- In the EU, Canada will return a repaired Russian turbine to Germany needed for the Nord Stream 1 gas pipeline according to a Reuters report.

FOREX: Wider Aversion To Risk Underpins USD Outperformance, Yen Fails To Benefit

The overhang from expectation-beating NFP report released out of the U.S. in local hours Friday supported the greenback at the start to the week, with participants converting data signals into hawkish Fed bets ahead of this week's CPI figures. Headwinds for the equity space nudged investors towards safer assets, amplifying appetite for the U.S. dollar.

- Offshore yuan went offered, testing the prior trading day's lows against the dollar, as China COVID-19 worry lingered, while local antitrust regulator took action against Alibaba & Tencent. Shanghai outbreak continued to spread, while Macau shut almost all of local business premises.

- The yen failed to benefit from cautious mood music as BoJ Gov Kuroda stuck with his usual lines on monetary policy despite speculation that the death of ex-PM Abe might undermine political support for the Bank's ultra-loose stance in the longer term.

- On top of that, a strong mandate handed to the ruling LDP-Komeito coalition in this weekend's Upper House election has been interpreted as a promise of stabilisation in domestic politics, allowing Japanese equities to outperform.

- Demand for USD/JPY emerged after the Tokyo fix, driving the pair above its recent cyclical high (Y137.00) and to its best levels since 1998, with the yen landing at the bottom of the G10 pile. USD/JPY 1-month risk reversal climbed to a fresh monthly high.

- Risk-off price action was evident across European FX space. Recessionary fears were fuelled by the prospect of continued weaponization of gas supplies by Russia.

- Focus turns to Norwegian CPI and a handful of second-tier releases from across the Eurozone, while ECB's Nagel is due to speak.

FOREX OPTIONS: Expiries for Jul11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0050(E897mln), $1.0225(E559mln), $1.0250(E1.3bln), $1.0300(E1.2bln), $1.0400(E1.0bln)

- USD/JPY: Y133.50($1.6bln), Y136.50($855mln)

- AUD/USD: $0.6250(A$1.0bln)

- USD/CNY: Cny6.5484($1.4bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/07/2022 | 0600/0800 | * |  | NO | CPI |

| 11/07/2022 | 0800/1000 | * |  | IT | Retail Sales |

| 11/07/2022 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 11/07/2022 | 1415/1515 |  | UK | BOE Bailey Treasury Select Committee on FS Report | |

| 11/07/2022 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 11/07/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 11/07/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 11/07/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 11/07/2022 | 1800/1400 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.